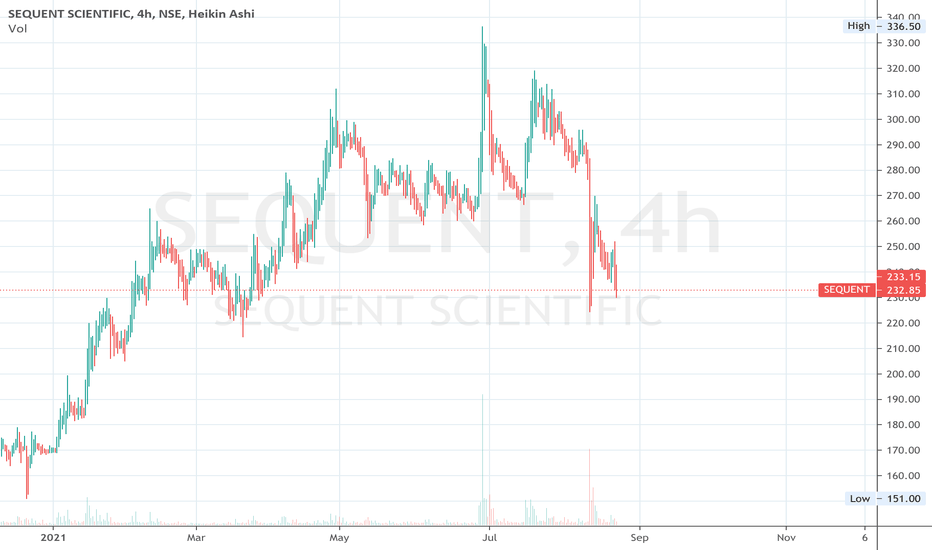

Long Sequent ScientificSequent Scientific

NSE:SEQUENT

Cmp - 232

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 500

T2 - Open, Review at 500

Expected Holding Period - 12 months or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Investmentidea

Long Greenply IndustriesGreenply Industries

NSE:GREENPLY

Cmp - 172

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 300

T2 - Open, Review at 300

Expected Holding Period - 18 months or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Long Tata Steel BSLTata Steel BSL

NSE:TATASTLBSL

Cmp - 93

Stop - Nil, Add more on relevant dips

Expectation -

T1 - 450

T2 - Open, Review at 450

Expected Holding Period - 2 years or earlier for T1

Technicals - ✅

Fundamentals - ✅

View:- Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Long RaymondRaymond Ltd

Cmp - 413

Stop - Nil

Expectation -

T1 - 1200

T2 - Open, Review at 1200

Expected Holding Period - 2 years or earlier for T1

View:- Positional/Investment

Can go for SEP mode

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

Investment Idea || Larsen & Toubro LtdWeekly Investment Idea | Large Cap Stock | Larsen & Toubro Ltd #LT

1) Good weekly close.

2) Inverted Head & Shoulder Breakout.

3) No near term resistance. ATH.

Free Tip #Calculation of Target in INHS type of breakouts:

Target = R1 + (R1-S1) = 1600 + (1600-765) = 2435.

Note: Above values are approx. values. Please refer chart.

Investment Idea || BOROSIL RENEWABLESTechnically:

1. Weekly resistance breakout with good volumes during Dec,2020 week.

2. After seven months of consolidation poised well for another breakout.

3. Good Price-Volume action.

4. Technically, next stop around 530.

Fundamentally:

1. Sustainable business.

2. Healthy Quarterly/Yearly results.

3. Almost a Debt free company.

Potential Multibagger in coming years.

Multi Year Breakout Expected - Cup and Handle PatternPositional and Investment Pick !!

The Company is to post its result today for the June Quarter. Expecting good numbers form the company.

Risky Traders can take position and Safe Traders can take position after results.

Note - I myself added today at 359.

Oriental Aromatics - Positional TradingI have based my analysis primarily on Stan Weinstein's methodology with some variations. Price structure, 30 Weekly MA, Relative Strength and Volume are key elements of Stan Weinstein's framework. I have added the Delivery percentage (not to be confused with Delivery Volumes) of last two days and the average of the previous week and RSI indicator to get a further confirmation of momentum.

The timeframe that I have referred to is Weekly which is suitable for slightly longer duration of trading or even investment. The advantage is analysis can be done post market hours and the weekly timeframe ensures lower price whipsaws.

Entry strategy- Once the conditions are met on Weekly timeframe, I stagger my entry to 20-25% at the breakout weekly candle and then enter the balance 75% on retracement. Stan Weinstein advises staying with trend so long as the upward trend continues and 30WMA is not breached. Since Nifty 50 is near ATH, I do a slight modification for Exit- if stock decisively closes below 50 DMA, I exit 50% and if it breaches the nearest swing low, I make a total exit. It is important to protect capital and hence risk management is key to grow account size.

About the company- Oriental Aromatics is engaged in the Business of manufacturing Fine chemicals i.e. camphor, perfumery & specialty aroma chemicals, fragrances and flavours. Company is one of only ten completely integrated flavour, fragrance and aroma chemical manufacturing companies in the world. Source: Screener.in

CMP INR 925

RoE 20.2

Debt 0.14

Equity Capital INR 16 CR

PAT INR 114 CR

Promoter Holding 74%

5 year Sales CAGR 15%

5 year PAT CAGR 36%

Operating Margin 22%

Disclosure: Not an investment or trading buy/sell advice. This is for learning purposes and exchange of knowledge. Figures mentioned above rounded off.

Long 63 Moons...5X and more63 Moons

NSE:63MOONS

Cmp - 111

Stop - 80 on WCB

Expectation -

T1 - 500

T2 - 1250, Review at 500

Expected Holding Period - 240 trading days or earlier for T1

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

LT approaching a crucial resistanceStock of L&T is forming an Inverted Head & shoulders in weekly Time frame with the zone of 1580-1600 as the neck line.

One can go long ONLY if there is a weekly closing above 1600 for minimum target of 1900 with SL as 1450 DCB.

On daily TF too, the stock is making an IVHS at the same level which can be a congruence to the analysis.

This is just for educational purposes. Hope you find this analysis interesting!

Long Raj TV...3X in sightRaj TV

Cmp - 52

Stop - 35 on DCB

Expectation -

T1 - 85

T2 - 165, Review at 165

Expected Holding Period - 60 trading days or earlier for T1

View:- Positional/Investment

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing

INVESTMENT PICK: BOROSIL RENEWABLESIt is engaged in manufacturing extra clear patterned glass and Low Iron Solar Glass for application in Photovoltaic panels, Flat plate collectors, and Greenhouses.

This company is future-proof as it operates in the domain of renewable energy. And the increasing interest of institutions and investors towards non-financial factors (Example. ESG) while making investments for their long-term portfolio is also increasing.

Considering the technical aspect, after an excellent rally, followed by a consolidation, it is set on the trajectory to move on the upside again.

CMP= 287.95

KRBL | Investment opportunity - Potential for 3-4 timesKRBL | Investment opportunity - Potential for 3-4 time as per current price action setup.

Simple breakout above the trendline.

Price action and RSI momentum both have big room to go.

CMP : 293

Target : 660, 1056

P.S : Not a trading scipt for short term.