IS ITC READY TO MOVE UP OR GOING RANGE BOUND SEE YOURSELF !!Hi Traders,

1. In last week's post, I mentioned in the trade plan next week is quoting for your consideration. " if the price takes out a yellow line with the above-mentioned condition then the trend will change to upside." See in the last post I showed you two patterns circled in white and red. The white one evening star and red one dark cloud on the same white resistance. Since I wrote dark]]k cloud is not activated till yet. If the activated price will move down. You can see this pattern not activated and the yellow support line provides the good support and price moved up. My followers Have you ever thought about why I provide perfect support and conditions? Why price reacts to these markings. Why I do not make these support resistance up and down? More than 175 + post authenticate the above-mentioned questions. Since new readers can not think about this but you all have been watching since I started two publish my ideas.

2. In every post, I mention conditions and how accurately all work. This is a matter of deep thinking. for new readers, I write taken out conditions. And set last week's posted chart for your comparison of my statements for better understanding. Taken out condition works in the two-time frame combination for daily( 4 hr + 1 day) analysis. Similarly, work for lower time frames is also a two-time frame combination. For intraday trades 1 hr with 15 min. For taken out condition price has to complete in both time frames. Aggressive traders can take that side position in a lower time frame with the stop loss of breached candle low. In both the time frames given line is breached by a candle that candle high is to be breached by next candle and close should be above the previously breached candle. This is how taken out condition is being implemented.

3. In the current fig, I made two red dotted lines you need to understand these conditions for further trades. To move up price has to take out upper red dotted line in 4-hour time frame and next day closing has to be above last day closing. If this is not satisfied then chances of price to be range-bound in these two dotted lines.

4. On the contrary, If the price takes out a lower yellow line in a 4-hour time frame and the next day closing is below the previous close then the trend will change to the downside.

5. On the upside, the white dotted line will be the target. since the candlestick formation is negated by price so It should achieve the white dotted line as a target. The rest price will decide.

YOGESH VATS

Disclaimer:- All trading positions should be taken from consulting your financial planner. This study is for educational purposes only.

ITC

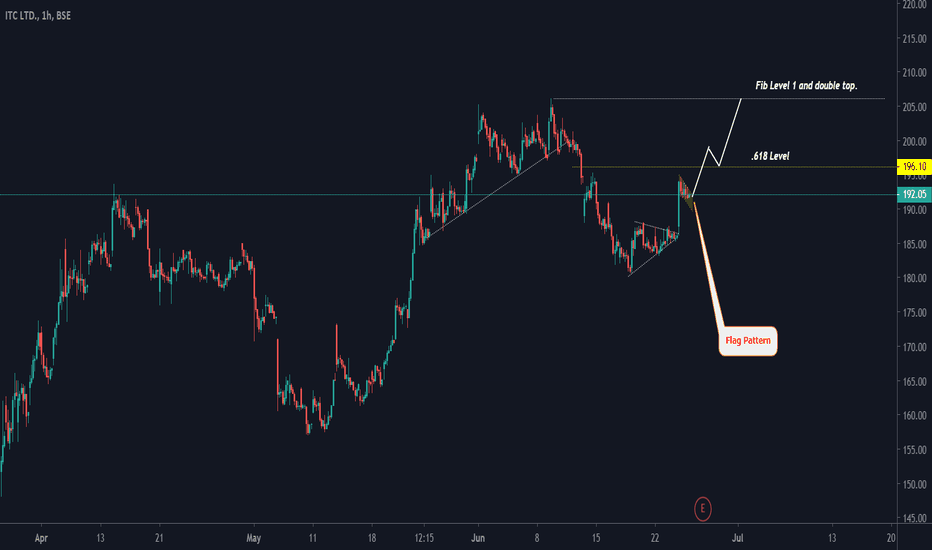

ITC - Short after the initial upswingITC, as predicted in the last 2 posts on ITC (linked below) is trading in a value area.

Today, it made a huge bullish marubuzo traversing the range of value area and closed just below the resistance of 203.

However it did so with lot less volume when compared with its past breakout; which is primarily why I don't see it sustaining the bullish behaviour.

The effects of Earning Release are already history, however a pending Dividend declaration may drive the stock upwards.

206 is the key level to watch out for that to happen. Also look out for volumes in play.

The stock may see some upward movement before commencing its downward journey.

Short below 203 for Targets of 200, 197 and 194.

If it sustains 206 with high volumes - Buy 205CE or 210CE July options and sit back relax, buy some sunfeast biscuits (please do not smoke!) & wait for it to make new highs.

In case of gap openings; follow ORB on 15 min candle.

Wait for the results for trading on MondayITC as forecasted in my previous cup breakout analysis is in a historical price value area between 194 and 203.

Depending on how the results are vis-a-vis expectations of the market movers (MF, banks, investors); the breakout may happen in either direction or a side-ways movement.

For breakout up; wait for a close above 206

Fore breakout below; wait for a close below 190.

The value area is open for scalping.

ITC will go down ? What are the reasons ?Disclaimer

-----------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. Consult your financial adviser before any decision. This is only for education purpose.

ITC 4H Chart : Dark cloud cover already activated, see the following chart

IS ITC READY TO CHANGE ITS UP DIRECTION TO DOWN SEE YOURSELF !!Hi Traders & Investors,

ITC ANALYSIS

Almost a few weeks ago, I posted my analysis on ITC where I mentioned two conditions is quoting for your consideration " If this is taken out on a 2hr time frame then the structure will change and the price will move down further. On the contrary, If the price consolidates or not taken out then uptrend will resume." You can see price did not break blue color line ( in previous fig it was slightly down but here I moved a little bit up.). Basically I was expecting the uptrend that is why I wrote trend will resume. Though I showed an evening star pattern in a white circle that got activated at that time. so that effect was assumed to take price near the blue zone. Had I got time last week to update then you would have got upward information too? Showing the last chart to understand the better view of the picture with the latest one.

Trade plan for next week.

1. See a white color circle showing an evening star pattern on the blue and white upper zone. Today trading the price made a dark cloud circled in red on the same tested zone. This shows that it is tough for the price to break this upper zone upside. Though this pattern is not activated till yet. But hope to get activated soon.

2. A red color zone is in fig to go further down this is the second condition to take it out on 2 hr time frame.

3. If price takes support at the blue down line Then a pullback can be seen to the yellow upper line. So be careful at this point. Yellow resistance line should be used to sell the stock only when this line is not taken out on 2 hr time frame. keeping a stop loss at the high of the breached candle of the yellow line.

4. On the contrary, if the price takes out a yellow line with the above-mentioned condition then the trend will change to upside.

5. On taking the blue line out on a 2hrs time frame you will see the price moving to the white red lower zone.

To understand the taken-out condition I provide the detail in one of my posts. Attaching with this blog.

YOGESH VATS

Disclaimer:- I do not suggest any buying or selling in the real market better to consult your financial advisor. This work is purely for educational purposes.