Potential Breakout: Karnataka Bank Eyeing Upside Towards 285Details:

Asset: Karnataka Bank Limited (KTKBANK)

Breakout Level: Sustaining above 245

Potential Target: 285 and beyond

Stop Loss: Below breakout level or as per risk tolerance

Timeframe: Short to medium-term

Rationale: Karnataka Bank Limited (KTKBANK) is approaching a potential breakout level around 245. Sustaining above this level could signal a bullish sentiment shift, potentially leading to further upside momentum. If the breakout occurs and is sustained, KTKBANK could target 285 and beyond in the near future.

Market Analysis:

Technical Breakout: A sustained move above 245 would indicate a technical breakout, attracting buying interest and potentially driving the price higher.

Market Sentiment: Positive market sentiment or company-specific catalysts may be contributing to the anticipated breakout in KTKBANK.

Price Target:

The initial target for KTKBANK is set at 285, with potential for further upside depending on market dynamics and investor sentiment.

Risk Management:

It's important to implement a stop loss strategy below the breakout level to manage risk in case of unexpected price reversals.

Timeframe:

The projected target of 285 and beyond is based on a short to medium-term outlook, but actual timing may vary based on market conditions.

Risk-Reward Ratio: Consider individual risk tolerance and adjust position size accordingly to maintain a favorable risk-reward ratio.

As with any investment opportunity, conduct thorough analysis and consider factors such as market trends, company fundamentals, and risk management strategies before making trading decisions.

KTKBANK

KTKBANK - Weekly Chart Analysis, CMP-272.50After breaking the previous all time high levels (176-194) it went into another base formation of 15 weeks and 18% range. Volumes are decent.

Overall PSU Banking sector is hot and showing strength.

Now 210-218 shall act as initial support. Main support will be 176-194 which was previous resistance and now it shall act as a support. Weekly close below these levels and follow through shall invalidate our view.

327 - 509 are the levels which can be tested over the long term.

Disclaimer: This is just a study and shared here for educational purpose. It is not a buy/sell recommendation in any way. If you intend to trade this counter then do your own due diligence and trade at your own risk.

KTKBANK | Swing Trade📊 DETAILS

Sector: Bank - Private

Mkt Cap: 8,387 cr

Karnataka Bank is engaged in providing a wide range of banking & financial services involving retail, corporate banking and para-banking activities in addition to treasury and foreign exchange business.

TTM PE : 6.19 (High PE)

Sector PE : 25.76

Beta : 1.83

📚 INSIGHTS

Strong Performer

Stock with consistent financial performance, quality management, and strong technical momentum indicating good investor enthusiasm. Currently valued at Good to expensive valuation

5.78% away from 52 week high

Outperformer - Karnataka Bank up by 11.1% v/s NIFTY 50 up by 8.62% in last 1 month

📈 FINANCIALS

Piotroski Score of 7/9 indicates Strong Financials

Disclaimer: This analysis is for educational purposes only, and I'm not a SEBI registered analyst.

If you found this analysis helpful, I encourage you to like and share it. Your observations and comments are also welcomed below. Your support, likes, follows, and comments motivate me to consistently share valuable insights with you.

🔍 More Analysis & Trade Setups 🔍

For more technical analysis and trade setups, make sure to follow me on TradingView: www.tradingview.com

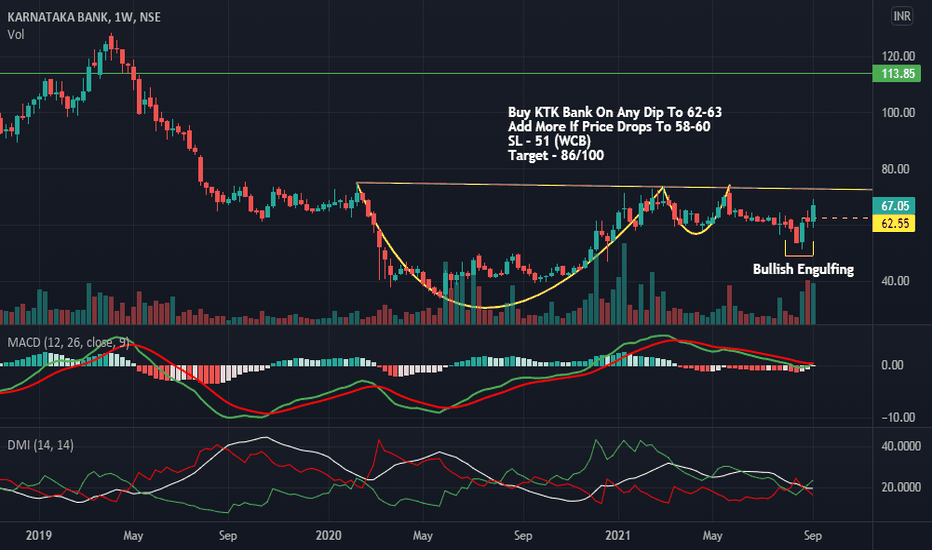

KTKBANK - Bullish Swing ReversalNSE: KTKBANK is closing with a bullish swing reversal candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 11% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Karnataka Bank - Long Setup, Move is ON...#KTKBANK trading above Resistance of 244

Next Resistance is at 375

Support is at 133

Here are previous charts:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Karnataka Bank - Long Setup, Move is ON...#KTKBANK trading above Resistance of 164

Next Resistance is at 244

Support is at 126

Here are previous charts:

Chart is self explanatory. Entry, Resistances and Support are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Karnataka Bank: Still one can enter for a long setup

KTKBank is trending up, possibly target price to hit 190.00 Still very good setup to go up once it clears the line of resistance.

Flag and Pole pattern has already given a breakout followed by two legged correction. Spike phase is still trending on daily chart.

SL can be very well placed at the pullback showed at 146.35 or more comfortable one can be at 136.

Please note that this is more of educational purpose and it's important to note that this analysis is based on technical indicators

so further research and analysis are recommended before anyone making any investment decisions.

KTKBANK - Ichimoku BreakoutStock Name - The Karnataka Bank Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 174

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, share & subscribe for daily analysis.

The Karnataka Bank LimitedKTKBANK:- breakout soon after 14 year, keep on eye.....

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

KTKBANK - Ichimoku Bullish Breakout Stock Name - The Karnataka Bank Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 113

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

YR 2022 Idea #117: Long on KTKBANKThis is a public swing trade idea and is only for Learning and observational purpose. Please understand your risk and take full responsibility of your actions. I might trail my stoploss after I get an entry but even if my original Stoploss hits, i exit the trade with pre-planned loss (risk). At target, I book usually 75% positions and trail stoploss for rest. Our objective to help anyone who wants to learn technical analysis using charts by demonstrating my real trade entries. You can post your queries in comment section here and we will try to answer them asap.

KTKBANK - Ichimoku Bullish Breakout Stock Name - The Karnataka Bank Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at CMP

and more bullishness AFTER crossing 73.

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

KTK Bank Trading in a ChannelCHART -> KTK Bank WEEKLY SETUP

As seen through charts, KTK Bank weekly chart is trading in bullish channel. Also in the upcoming budget of 2022, PSU Banks will be on radar.

One can take long term decisions by looking at this channel, while making the below trendline as weekly closing stop loss.

Disclaimer: This is for educational purpose only. This is not any recommendations. I am not SEBI registered. Please consult your financial advisor before taking any action.

Breakout in Karnataka Bank...Chart is self explanatory. Entry, Targets and Stop Loss are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.