Gold dives toward 3,320 as Fed decision loomsHello everyone, what are your thoughts on gold prices?

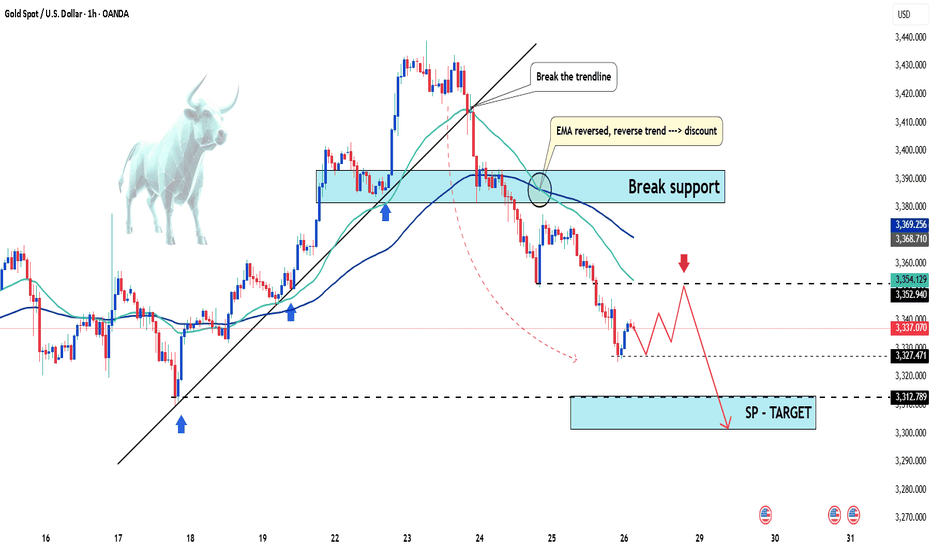

Gold's decline is accelerating, dragging the precious metal down toward the 3,320 USD mark. A stronger U.S. dollar and further developments on the trade front following the U.S.-EU agreement have significantly impacted demand for safe-haven assets.

From a technical perspective, the break below the rising price channel could mark the beginning of a deeper correction. Oscillators on the chart have just started turning negative, suggesting that the path of least resistance for gold is now downward.

Looking ahead, Wednesday’s key FOMC decision—along with the accompanying policy statement and Powell’s press conference—will be closely scrutinized for clues on the Fed’s interest rate cut roadmap.

Additionally, investors will face several important U.S. macroeconomic data releases this week, which will play a vital role in shaping the USD’s trajectory and provide new momentum for XAUUSD.

What do you think about the precious metal? Share your thoughts below!

M-forex

Gold plunges as Fed stays firm, war fails to boost XAUUSD is showing clear signs of weakness after peaking at 3,375 and consistently forming lower highs. On the H2 chart, the price action confirms a completed distribution pattern and is now consolidating ahead of a potential breakdown below 3,283.

News highlights:

The US ADP and GDP reports exceeded expectations, strengthening the case for the Fed to keep interest rates higher for longer – putting significant pressure on gold.

Although the JOLTS job openings dipped slightly, the figure remains above 7 million, offering little support for gold recovery.

Conflict news between Thailand and Cambodia might offer some support, but the impact is limited due to the small regional scale.

Trading strategy: Prioritize SELL if price pulls back to 3,339 and fails to hold. The next target is around 3,252.

The main trend remains bearish unless XAUUSD breaks above 3,360.

Do you think XAUUSD will break the bottom this week?

EUR/USD Under Pressure : Sell or Buy ? The EUR/USD pair remains under mild bearish pressure, hovering around the 1.1700 mark and extending its Thursday downtrend. Meanwhile, the US Dollar (USD) stays firm despite growing optimism over improving US-China relations. However, the ongoing tension between Trump and Powell continues to capture market attention.

In response to these developments, EUR/USD has stalled its previous rally. On the chart, the pair is forming a series of lower highs, moving within a narrowing wedge pattern. The 1.1600 level now emerges as the critical battleground between bulls and bears.

Do you think EUR/USD can successfully defend this support zone? Let us know your thoughts!

Gold, Silver & Commodity Trading (MCX)What is MCX (Multi Commodity Exchange)?

The Multi Commodity Exchange of India Ltd. (MCX) is a government-regulated commodity derivatives exchange, launched in 2003. It is regulated by SEBI (Securities and Exchange Board of India) and allows traders to buy and sell commodity futures contracts across various categories like:

Bullion: Gold, Silver

Energy: Crude oil, Natural gas

Base Metals: Copper, Zinc, Lead, Aluminum, Nickel

Agricultural commodities: Cotton, Cardamom, Mentha Oil

MCX operates similarly to stock exchanges like NSE or BSE but deals in commodity contracts rather than equities.

Factors That Influence Gold & Silver Prices

Understanding price drivers helps traders anticipate market movement:

🏦 1. Global Economic Conditions

Inflation

Recession fears

GDP data

🪙 2. Currency Movements

Gold is priced in USD globally. The USD-INR exchange rate significantly impacts domestic prices.

📉 3. Interest Rates

Rising interest rates make non-yielding assets like gold less attractive, pushing prices lower, and vice versa.

💥 4. Geopolitical Tensions

War, political instability, or crisis (Middle East conflict, Ukraine war, etc.) often boost gold/silver prices.

🛢️ 5. Crude Oil Prices

High oil prices can lead to inflation, making gold more attractive as a hedge.

💼 6. Central Bank Policies

Actions by RBI or Federal Reserve (US) in terms of gold reserves, rate hikes, or monetary policy changes affect sentiment.

EURUSD – Bullish momentum fades, signs of a reversal emergeEURUSD is approaching the key resistance zone at 1.1780, a level that has been rejected multiple times in the past. On the H4 chart, the pair remains firmly within a descending channel since early July, with several FVG zones stacked above—indicating growing selling pressure. The recent upside momentum is clearly weakening, raising the risk of a deeper pullback.

Market context:

– The US dollar continues to gain support from strong economic data, while the Eurozone lacks clear signs of recovery.

– Traders are holding their breath ahead of upcoming Eurozone inflation data and the US PCE report—events that could trigger significant moves.

Trade setup: If EURUSD fails to break above 1.1780, a drop toward the 1.1610 support zone becomes increasingly likely.

XAUUSD – final bounce before the drop?Gold is trapped in a sideways box, and the bounce from the $3,330 zone looks like nothing more than a technical reaction – with no strong buying momentum. The dense cluster of FVGs signals that selling pressure hasn’t been fully absorbed yet.

Fresh data from the U.S. strengthens the bearish case: jobless claims have hit a 3-month low, indicating a resilient labor market. This paves the way for the Fed to keep rates steady at 4.25–4.50%. Meanwhile, Trump’s tariff policies are stoking inflation risks.

If gold fails to break above $3,437 in the next few sessions, sellers may step in aggressively. In that case, the next target could be $3,280.

Latest Gold Price Update TodayIn the most recent trading session, global gold prices dropped over 31 USD per ounce, closing at 3,337 USD. This sharp decline follows a three-day rally and reflects profit-taking by investors and a shift in capital flow.

Newly released economic indicators show that the U.S. labor market remains strong, with jobless claims falling for the sixth consecutive week — the longest streak since 2022. This helped the U.S. dollar rebound slightly, putting pressure on gold, a non-yielding asset.

At the same time, investor sentiment has tilted toward riskier assets like equities, as trade talks between the U.S., EU, and Japan show positive progress. Stock markets in the U.S. and Europe surged, drawing capital away from gold.

Although expectations remain for a potential Fed rate cut in September, gold faces short-term headwinds. The 3,300 USD zone is now a key level to watch. Traders should look for reversal signals and volume confirmation before considering long entries.

Personal view: USD strength, rising stock markets, and profit-taking are creating a short-term correction for gold. However, in the longer term, there is still upside potential if the Fed signals a policy shift in the coming months.

And you — what’s your take on gold prices today?

Technical Analysis Mastery🧠 What is Technical Analysis?

Technical Analysis (TA) is the skill of analyzing price charts and patterns to predict future movements of stocks, indices, commodities, forex, or cryptocurrencies. It’s like reading the mood and psychology of the market by observing price and volume.

Instead of studying company balance sheets or industry trends (that’s fundamental analysis), technical analysis assumes that everything important is already reflected in the price. It’s used by intraday traders, swing traders, and even investors to make smarter entries and exits.

📚 The Core Principle of Technical Analysis

There are three main beliefs that form the base of technical analysis:

Price Discounts Everything

All news, emotions, expectations, and fundamentals are already priced into the chart. So, instead of worrying about inflation or earnings, a technical analyst looks at price action.

Price Moves in Trends

Markets don’t move randomly. They trend – either up, down, or sideways. TA helps you identify the direction of the trend and when it might be changing.

History Repeats Itself

Market behavior is repetitive because human psychology is repetitive. Fear and greed create familiar patterns. Candlestick patterns, chart patterns, and indicators are all built on this belief.

🧭 Types of Market Trends

To master technical analysis, you need to understand trends first:

📈 Uptrend (Bullish): Higher highs and higher lows.

📉 Downtrend (Bearish): Lower highs and lower lows.

➡️ Sideways (Range-bound): Price moves within a horizontal range.

Your first job as a technical analyst is to identify the current trend. Once you know this, your job becomes easier:

Buy in an uptrend, sell in a downtrend, stay cautious in a sideways market.

📊 Reading Price Charts (The Visual Language)

The chart is your battlefield. Let’s break down the types:

1. Line Chart

Shows the closing price over time.

Clean and simple, but lacks detail.

2. Bar Chart

Shows open, high, low, close (OHLC).

More informative than a line chart.

3. Candlestick Chart (Most Popular)

Shows OHLC in a visually rich format.

Green (or white) candles = price went up.

Red (or black) candles = price went down.

Candlesticks reveal trader emotions and help spot patterns like Doji, Hammer, Engulfing, etc.

🔍 Support & Resistance – The Foundation

Support = A price level where demand is strong enough to stop the price from falling further.

Resistance = A level where selling pressure prevents the price from rising.

Imagine support as a floor and resistance as a ceiling. Once broken, these levels often flip roles (old resistance becomes new support).

Example:

If Nifty keeps bouncing back from 21,000 – it’s a support zone.

If it keeps failing near 22,000 – that’s resistance.

✍️ Chart Patterns – Visual Clues to Price Moves

Chart patterns are shapes formed by price on a chart, often signaling upcoming moves.

✅ Continuation Patterns

Price will likely continue in the same direction.

🔺 Flag & Pennant

🔻 Triangle (Symmetrical, Ascending, Descending)

📦 Rectangle

🔄 Reversal Patterns

Suggests trend may reverse.

👨🦲 Head and Shoulders

🧍♂️ Double Top / Bottom

🛑 Rounding Top / Bottom

These patterns help you plan trades with entry, stop loss, and target.

🧠 Candlestick Patterns – Market Psychology in Action

Candlestick patterns show short-term momentum and emotion.

🔥 Bullish Candles

Hammer: Long wick at bottom – buyers stepping in.

Bullish Engulfing: Green candle swallows previous red one.

Morning Star: A 3-candle reversal pattern.

🧊 Bearish Candles

Shooting Star: Long wick at top – sellers taking over.

Bearish Engulfing: Red candle engulfs previous green one.

Evening Star: Opposite of Morning Star.

Candlestick mastery = understanding buyer vs seller fight in every candle.

🧰 Indicators & Oscillators – Your Technical Tools

Indicators are formulas applied to price data to give more insight.

🛣️ Trend Indicators

Moving Averages (MA):

SMA: Simple Moving Average.

EMA: Exponential (gives more weight to recent price).

Used to identify and confirm trends.

MACD (Moving Average Convergence Divergence):

Measures momentum and crossover signals.

Parabolic SAR:

Gives entry/exit dots on chart.

📉 Momentum Indicators (Oscillators)

RSI (Relative Strength Index):

Measures overbought (>70) or oversold (<30).

Stochastic Oscillator:

Shows momentum, good for spotting reversal zones.

CCI (Commodity Channel Index):

Helps detect cyclical trends.

These are tools to confirm what you see on price action – never trade based on indicators alone.

🧪 Volume – The Fuel Behind Moves

Volume tells you how strong or weak a price move is.

Rising volume + rising price = strong uptrend.

Low volume + breakout = fakeout risk.

Volume spike at support/resistance = possible reversal or breakout.

Smart traders always watch volume with price action. It shows institutional interest.

🧱 Building a Trading Setup (Strategy Framework)

A solid technical trading setup has:

Market Context (Trend, Sentiment)

Entry Trigger (Pattern, Indicator, Breakout)

Stop Loss Level (Support/Resistance, ATR, Swing High/Low)

Target (Risk:Reward ratio, Resistance/Support, Fibonacci)

Volume Confirmation

Risk Management Plan

🧠 Psychological Mastery in TA

Even the best technical setup can fail without the right mindset.

Stick to Plan: Don’t react emotionally.

Accept Losses: TA gives probabilities, not guarantees.

Avoid Overtrading: Quality > Quantity.

Backtest Your Strategies: Practice builds confidence.

Mastering TA is not just about charts – it’s about mastering yourself.

🧪 Advanced Concepts in Technical Analysis

Once you’re comfortable with the basics, explore:

🔁 Fibonacci Retracement & Extensions

📏 Average True Range (ATR) for volatility

📈 Ichimoku Cloud for trend + momentum

🔎 Multi-Time Frame Analysis

🔄 Divergence (RSI/Price divergence for reversal signals)

These tools help fine-tune entries and exits.

🧩 Common Mistakes in Technical Analysis

Avoid these traps:

Trading every breakout – wait for confirmation.

Ignoring the trend – don’t go against it.

Using too many indicators – analysis paralysis.

Revenge trading – leads to big losses.

Disrespecting stop loss – small loss can become disaster.

✅ How to Master Technical Analysis?

Learn from real charts – theory alone won’t help.

Practice Daily – track 1-2 instruments closely.

Journal Your Trades – analyze what worked/failed.

Backtest Setups – check success over historical data.

Follow Experts – learn from professional TA traders.

Join Communities – share and get feedback.

Consistency is the key to mastery. 📈

🧠 Final Thoughts: Why Technical Analysis Works

Because humans behave in predictable patterns, and TA captures those behaviors in charts. Whether it’s fear of missing out or panic selling, the psychology leaves footprints on price action.

You don’t need to predict the future. You need to react smartly to what the chart is telling you.

Mastering technical analysis takes time, patience, and lots of screen time – but once you get it, it becomes a powerful edge in the market.

Options Trading Strategies📌 What Are Options in Trading?

Before we get into strategies, let’s understand what options actually are.

In the simplest form, options are contracts that give a trader the right, but not the obligation, to buy or sell an asset (like a stock, index, or commodity) at a specific price before or on a specific date.

There are two main types of options:

Call Option – Gives you the right to buy something at a set price.

Put Option – Gives you the right to sell something at a set price.

These tools can be used to hedge, speculate, or generate income. Now that you know what options are, let’s go deeper into strategies.

🎯 Why Use Options Strategies?

Options trading is not just about buying Calls and Puts randomly. It’s about smart combinations and planned risk management. With the right strategies, you can:

Profit in up, down, or sideways markets

Limit your losses

Leverage small capital

Hedge your stock or portfolio

Earn regular income

Let’s now dive into some popular options trading strategies—from basic to advanced—with examples.

✅ 1. Covered Call Strategy

💡 Use When: You own a stock and expect neutral or slightly bullish movement.

You own shares of a stock and you sell a Call Option on the same stock. You receive a premium from selling the Call, which gives you extra income even if the stock doesn’t move.

📘 Example:

You own 100 shares of Reliance at ₹2800. You sell a 2900 Call Option and receive ₹30 per share as premium.

If Reliance stays below ₹2900 – You keep your stock and the premium.

If Reliance goes above ₹2900 – Your stock gets sold (you deliver), but you still profit from stock rise + premium.

✅ Pros:

Earn extra income

Lower risk than buying naked calls

❌ Cons:

Limited upside

Need to own stock

✅ 2. Protective Put Strategy

💡 Use When: You own a stock but want to protect from downside risk.

Here, you buy a Put Option along with owning the stock. It acts like insurance – if the stock crashes, the Put will rise in value.

📘 Example:

You buy HDFC Bank shares at ₹1700 and buy a 1650 Put Option for ₹25.

If HDFC drops to ₹1600 – Your stock loses ₹100, but your Put may gain ₹50–₹75.

If HDFC goes up – You lose only the premium ₹25.

✅ Pros:

Protects your portfolio

Peace of mind in volatile markets

❌ Cons:

You pay a premium (like insurance)

Can eat into profits

✅ 3. Bull Call Spread

💡 Use When: You are moderately bullish on a stock.

You buy a Call Option at a lower strike and sell another Call Option at a higher strike (same expiry). This reduces your cost and risk.

📘 Example:

Buy Nifty 22500 Call at ₹100

Sell Nifty 23000 Call at ₹50

Your net cost = ₹50

Max profit = ₹500 (if Nifty ends above 23000)

✅ Pros:

Lower cost than naked Call

Defined risk and reward

❌ Cons:

Limited profit potential

✅ 4. Bear Put Spread

💡 Use When: You are moderately bearish.

You buy a Put at higher strike and sell another Put at lower strike. This is just like Bull Call, but for falling markets.

📘 Example:

Buy Bank Nifty 50000 Put at ₹120

Sell 49500 Put at ₹60

Net Cost = ₹60

Max Profit = ₹500

✅ Pros:

Risk-managed way to profit in downtrend

❌ Cons:

Limited profits if market crashes heavily

✅ 5. Iron Condor

💡 Use When: You expect the market to stay sideways or within a range.

It’s a neutral strategy involving four options:

Sell 1 lower Put, Buy 1 far lower Put

Sell 1 upper Call, Buy 1 far upper Call

📘 Example:

Sell 22500 Put

Buy 22200 Put

Sell 23000 Call

Buy 23300 Call

You receive a net premium. If the index stays between 22500–23000, you make full profit.

✅ Pros:

Profits in range-bound market

Low risk, fixed reward

❌ Cons:

Requires margin

Complicated setup

✅ 6. Straddle Strategy

💡 Use When: You expect a big move in either direction, but not sure which.

Buy both a Call and a Put at the same strike price and expiry. One side will definitely move.

📘 Example:

Buy Nifty 23000 Call at ₹80

Buy Nifty 23000 Put at ₹90

Total cost = ₹170

If Nifty makes a big move (up or down), one side can explode in value.

✅ Pros:

Unlimited potential if market breaks out

Great for news events

❌ Cons:

Expensive to enter

Needs big movement to profit

✅ 7. Strangle Strategy

💡 Use When: You expect a big move, but want to reduce cost compared to straddle.

Buy an Out-of-the-Money Call and Put.

📘 Example:

Buy Nifty 23200 Call at ₹40

Buy Nifty 22800 Put at ₹50

Total cost = ₹90

You still profit from big movement, but cheaper than a straddle.

✅ Pros:

Lower cost

Profits from big moves

❌ Cons:

Requires even larger movement than straddle

✅ 8. Short Straddle (for experts)

💡 Use When: You think the market will stay flat (low volatility).

Sell a Call and a Put at the same strike. You earn double premium.

⚠️ Risk: Unlimited risk if market moves too much!

This strategy is not for beginners. You need tight stop losses or hedges.

🔐 Risk Management Is Key

No matter which strategy you use:

Always define your maximum risk and reward.

Avoid taking naked positions without hedging.

Use stop losses and trailing SLs.

Don’t bet your whole capital – use position sizing.

Avoid trading right before major events unless you understand the risks.

Strangle

🤔 Real-Life Example (Simple Breakdown)

Let’s say the market is range-bound and Nifty is stuck between 22500–23000 for weeks. You can go with an Iron Condor:

Sell 22500 Put at ₹80

Buy 22200 Put at ₹40

Sell 23000 Call at ₹70

Buy 23300 Call at ₹35

Net Premium = ₹75

If Nifty expires between 22500–23000, you get full ₹75 profit per lot. If it breaks the range, losses are capped due to hedges.

💬 Final Thoughts

Options trading strategies are like different weapons in your trading arsenal. But using them without understanding or discipline is dangerous. Always know:

What is your market view?

What is your max risk?

How will you manage losses?

The smartest traders don’t gamble—they plan. They treat options like a business, not a lottery ticket.

So whether you’re trading with ₹5000 or ₹5 lakhs, always use a strategy with:

✔ Proper Risk-Reward

✔ Defined Exit Plan

✔ Strong Logic (not emotion)

Intraday Breakouts & FakeoutsIntroduction

If you’ve been trading for any length of time, you've probably heard of the term “breakout”. It sounds exciting—and it is. A breakout can be the start of a big move and massive profits. But what’s less talked about (yet very common) is the “fakeout”—a breakout that doesn’t hold and traps traders on the wrong side.

In the world of intraday trading, understanding breakouts and fakeouts is critical. Many traders lose money not because they don’t spot the breakout, but because they get caught in fakeouts. In this guide, we’re going to deeply understand what breakouts are, how fakeouts trick traders, and how you can trade both effectively.

Let’s dive in.

Part 1: What is a Breakout in Intraday Trading?

In simple words, a breakout happens when the price of a stock or asset moves outside a defined support or resistance level with increased volume.

Imagine the price is stuck between ₹100 (support) and ₹110 (resistance). It keeps bouncing in this range for hours. If suddenly, the price jumps above ₹110, that’s a breakout to the upside. If it drops below ₹100, that’s a breakdown (downward breakout).

Types of Breakouts

Price Breakout

Breaks key support/resistance levels.

Can happen on charts like 5-min, 15-min, or hourly.

Example: Nifty breaking above the day’s high at 10:30 AM with a strong green candle.

Volume Breakout

Price breaks with strong volume. Volume confirms that the breakout is real.

No volume = high risk of fakeout.

Time-Based Breakout

Usually happens during market opening (9:15-10:00 AM) or after lunch session (1:30-2:30 PM).

Institutions are active during these times.

Why Do Breakouts Happen?

A breakout indicates fresh buying or selling interest.

It reflects market consensus that price is ready to move beyond its old limits.

Often driven by news, earnings, or technical pressure (like stop-loss hunting).

Part 2: What is a Fakeout?

A fakeout (fake breakout) occurs when:

Price appears to break a level.

Traders jump in expecting a big move.

But price immediately reverses and traps them.

Fakeouts are deliberate traps—usually set by big players (institutions, smart money) to grab liquidity.

Retail traders often become the liquidity providers for institutions.

Why Do Fakeouts Happen?

Institutions want to fill large orders.

They push prices above resistance to trigger buy orders and stop-losses of short sellers.

Then they reverse the move, causing panic.

End result: Retail traders are left holding losses.

Part 3: Intraday Breakout Trading Strategies

Let’s look at some practical breakout strategies for intraday traders.

1. Opening Range Breakout (ORB)

Define the first 15–30 minutes range after market opens.

Place buy order above the high and sell order below the low.

Wait for confirmation candle and volume spike.

Common in indices like Nifty, Bank Nifty.

Tip: Always avoid trading in sideways markets using ORB. Use it when there’s strong news or momentum.

2. Flag or Pennant Breakout

Price consolidates in a tight flag or triangle after a sharp move.

Breakout of the pattern gives second entry into the trend.

Ideal for stocks showing momentum (e.g., high volume gainers).

3. Break and Retest Strategy

Wait for price to break a level.

Let it come back and retest the breakout point.

If retest holds and reverses in the breakout direction → enter.

Safer than blind breakout entries.

4. Trendline or Channel Breakout

Draw intraday trendlines on 5-min or 15-min chart.

Break of the trendline with good volume = possible entry.

Works well when the price breaks a descending or ascending channel.

Part 4: How to Avoid Fakeouts

Let’s be honest—you can’t avoid fakeouts 100%. But you can reduce them by being smart:

✅ Wait for Confirmation

Don’t enter on the first candle.

Wait for a closing candle above/below the breakout zone.

✅ Use Volume

No volume = No trade.

Use volume bars to check if breakout is real.

✅ Check Higher Time Frame

If 5-min shows breakout, check 15-min or hourly chart.

Are those timeframes supporting the move?

✅ Avoid Trading in Newsless/Sideways Markets

Breakouts in a consolidating or low-volume market are usually traps.

✅ Don’t Chase Breakouts

If price already moved too far from level, skip it.

Chasing leads to bad entries and panic exits.

Part 5: Stop Loss & Risk Management

Even the best setups fail. So risk management is king.

🔹 Where to Place Stop Loss?

Just below breakout candle (for long).

Just above breakdown candle (for short).

Or below the last swing low/high.

Example:

If a stock breaks out at ₹210 and breakout candle low is ₹205, place SL at ₹204.50.

🔹 How Much to Risk?

Risk only 1–2% of your total capital per trade.

Never add to a losing breakout trade.

Use position sizing wisely.

Part 6: Mindset – Stay Neutral, Not Emotional

Fakeouts hurt more mentally than financially.

After 2–3 fakeouts, you may start doubting every breakout.

The key is to follow a process, not feelings.

Keep notes of what works and what doesn’t. Learn from each setup.

Part 7: Bonus – Common Breakout Traps

Breakout Without Volume

Looks tempting, but lacks power.

Almost always fails.

Midday Breakout in Low Volatility

Low chance of success unless news-driven.

Breakouts Near Big Events (like Fed meetings, RBI policy)

Markets often reverse after whipsawing.

Extended Breakouts (after 4-5 green candles in a row)

Usually too late to enter.

Conclusion

Trading intraday breakouts and avoiding fakeouts is both art and science.

Yes, it’s risky. Yes, it’s fast. But with the right knowledge, experience, and discipline, you can turn it into a powerful edge.

To succeed:

Focus on volume, price action, and context.

Have patience to wait for the right setup.

And most importantly, protect your capital using risk management.

Breakouts can give you explosive gains—but only if you avoid the traps that come with them. So stay sharp, stay calm, and trade with a plan.

BTCUSD 1D TimeframeBitcoin is trading near $117,800 – $118,400

It’s in a sideways consolidation zone after a strong uptrend

📊 Technical Summary

📈 Trend Direction:

Primary Trend: Bullish (long-term)

Short-Term Trend: Sideways to slightly bullish

Structure: Higher highs and higher lows still intact

🔍 Key Support & Resistance Levels

🟢 Support Zones:

$117,000 — Immediate support zone

$115,000 — Minor demand zone

$112,000 — Key swing low support

$108,000 – $110,000 — Strong base if correction deepens

🔴 Resistance Zones:

$119,000 — Current price ceiling

$121,000 — Breakout target

$123,000 – $125,000 — All-time high resistance area

🧠 Indicators Overview

📌 RSI (Relative Strength Index):

Around 58–60

Shows moderate bullishness — not overbought

📌 MACD (Moving Average Convergence Divergence):

MACD line above signal line, but momentum is weakening

Indicates potential slowing of bullish push

📌 Moving Averages:

20-day EMA: Below price — short-term support

50-day EMA: Also below — confirms mid-term uptrend

200-day EMA: Far below — strong long-term bullish signal

🕯️ Candlestick Behavior

Recent candles are small-bodied: suggests indecision

Wicks both sides: market waiting for next trigger

No bearish reversal patterns visible yet

SENSEX 1D TimeframeClosing Value: ₹81,463.09

Day Change: ▼ 721.08 points (−0.88%)

Opening Level: ₹82,065.76

Day's High: ₹82,069.51

Day's Low: ₹81,397.69

Intraday Range: ~₹672 points swing

🧭 Market Context

Sensex fell nearly 1% in a single session, indicating a short-term pullback or profit-booking.

The fall was led by major banking, IT, and financial stocks.

Broader market sentiment turned cautious amid weak domestic cues and global uncertainty.

Several heavyweight stocks saw sharp declines, with a few dropping more than 5% in a single day.

🕵️♂️ Technical Perspective (1D Timeframe)

The daily candle likely formed a strong bearish body, signaling selling pressure.

The index is still trading well above its key moving averages (e.g., 50-day, 200-day), but this drop shows possible reversal signals.

Immediate support lies around ₹81,200–81,000, while resistance remains near the ₹82,500–83,000 zone.

🔍 Outlook Ahead

If weakness continues, the index may retest the ₹80,500–81,000 range.

A rebound above ₹82,000 with volume could reignite bullish sentiment.

Keep an eye on FII/DII flows, global indices, and upcoming earnings for direction.

BANKNIFTY 1D TimeframeClosing Price: ₹56,528.90

Opening Price: ₹57,113.90

Day High: ₹57,170.70

Day Low: ₹56,439.40

Net Change: –₹537.15 (–0.94%)

🔹 Key Price Levels

📉 Support Zones:

Support 1 (S1): ₹56,255

Support 2 (S2): ₹55,982

Support 3 (S3): ₹55,524

Fibonacci Support Zone: ₹56,260 – ₹56,430

Camarilla Support Levels: ₹56,460 / ₹56,395 / ₹56,328

📈 Resistance Zones:

Resistance 1 (R1): ₹56,987

Resistance 2 (R2): ₹57,444

Resistance 3 (R3): ₹57,718

Fibonacci Resistance Zone: ₹56,992 – ₹57,165

Camarilla Resistance Levels: ₹56,596 / ₹56,663 / ₹56,730

🔸 Pivot Point (Central Level): ₹56,713

🔹 Trend Direction (1-Day Timeframe)

📊 Short-Term Trend: Consolidating with mild bearish pressure.

📉 Price closed below pivot point (₹56,713), signaling short-term weakness.

✅ Still within bullish structure as long as it holds above ₹55,980 – ₹56,000.

🔹 Technical Indicator Snapshot

RSI: Around 58 → Still in bullish territory, but momentum cooling.

MACD: Positive crossover, but histogram flattening — sign of range or pause.

20 EMA: Near ₹57,000 → Price is currently below this level.

50 EMA: Around ₹55,500 → Still acts as major support.

Price Action: Forming inside candles → Indicates compression/indecision.

NIFTY 1D TimeframeClosing Price: ₹24,837.00

Daily Change: −0.90% (about 225 points down)

Day’s Range: ₹24,806 – ₹25,010

Volume: Moderate to slightly higher than average

Market Sentiment: Cautiously Bearish

🔍 1D Price Action Summary

The 1-day chart of Nifty shows weakness near a key resistance zone. The index has been trading in a downward-sloping range over the past few sessions. The day began with mild strength but selling pressure pushed the index down by the close.

Bearish candlestick formation with a relatively long upper wick, indicating rejection near intraday highs.

4th consecutive day of weakness, hinting at profit booking and lower highs on the chart.

The price closed near the day’s low, suggesting bearish momentum could carry into the next session.

📐 Technical Levels

✅ Support Zones

Primary Support: ₹24,800 – This level has been tested multiple times recently. A close below it could trigger further downside.

Secondary Support: ₹24,550 – Considered a swing low from earlier this month.

Major Support: ₹24,250 – The breakout level from the previous consolidation.

❌ Resistance Zones

Immediate Resistance: ₹25,050 – This was the intraday high and rejected.

Stronger Resistance: ₹25,250 – Previously a strong support zone, now turned resistance.

Major Resistance: ₹25,500 – All-time high zone; bulls will need strength to retest this.

📊 Trend Analysis

Current Trend: Short-Term Bearish

Medium-Term Trend: Neutral to Slightly Bullish

200-DMA (Daily Moving Average): Nifty is trading above the 200-DMA, keeping the long-term trend intact.

50-DMA: Price is nearing the 50-day moving average. A break below could accelerate selling pressure.

📈 Chart Patterns Observed

Head and Shoulders Pattern (Forming): The right shoulder is under formation; neckline lies near ₹24,800. Breakdown could trigger a short-term fall of 200–300 points.

Bearish Engulfing Candlestick (on the daily): Indicates aggressive seller dominance.

Lower Highs and Lower Lows: A sign of short-term downtrend.

🧠 Institutional & Retail Activity

FIIs (Foreign Institutional Investors): Net sellers over the past few sessions. Sentiment cautious due to global macro uncertainty.

DIIs (Domestic Institutions): Providing some support on dips, but not aggressively buying.

Retail Traders: More active in options and short-term plays; volatility increasing.

💡 Trading Strategy Ideas (Short-Term)

🔻 For Bears (Short-Side Traders)

Consider short positions below ₹24,800 with targets around ₹24,550–24,400.

Use strict stop-loss above ₹25,050 to manage risk.

Bearish bias valid until the price closes above ₹25,250.

🔼 For Bulls (Dip Buyers)

Watch for price action around ₹24,800–24,550 for signs of reversal.

Ideal scenario: bullish engulfing candle or bullish divergence on RSI.

Avoid aggressive buying unless the index reclaims ₹25,250.

🕯️ Candle Psychology Summary

The market opened near flat, tried to move higher, but was met with consistent selling.

This created a long upper wick – a sign that bulls lost control quickly.

The close near the low signals sellers had the upper hand all day.

🚨 Key Takeaways

Nifty is under pressure with key support at ₹24,800 in focus.

A breakdown below this level could drag the index to ₹24,550 or even lower.

Bulls must reclaim ₹25,250 to shift momentum in their favor.

RSI and MACD show weakness, but Stochastic hints a possible oversold bounce soon.

Volatility remains high; risk management is critical.

Trading Master Class With Experts🎓 Trading Master Class With Experts

Join a premium learning experience led by real market experts and institutional-level traders.

This is not just theory—it's real-world strategy, live insights, and powerful execution.

🔥 What You’ll Learn:

Advanced Price Action – Master structure, trends & breakouts

Institutional Trading Tactics – Learn how the big players move

Options & Derivatives – Trade with smart setups & defined risk

Strategy Building – From scalping to swing setups

Trader Psychology – Build discipline, mindset & consistency

Risk Management – Professional capital protection strategies

💡 Why Join?

✅ Learn from real experts

✅ Get access to institutional methods

✅ Trade with confidence, clarity & control

✅ Perfect for intraday, swing, and option traders

📌 Learn. Apply. Profit.

This is your step toward trading like a pro.

Master Institutional Trading🏛️ Master Institutional Trading

Unlock the secrets of how the smart money dominates the market

Learn to think, plan, and trade like top institutions and hedge funds.

What You’ll Master:

Advanced Market Structure – Breakouts, fakeouts & liquidity grabs

Smart Money Concepts – Accumulation & distribution like a pro

Order Flow & Volume Logic – Follow the real money

Entry & Exit Precision – Based on logic, not guesswork

Institutional Risk Management – Capital protection & scaling

Trader Psychology – Discipline, patience & strategy

No more random trades. No more emotional decisions.

This is structured, high-level trading built for serious traders.

📌 Master the mindset. Read the market. Trade like institutions.

Learn Advanced Institutional Trading🏛️ Learn Advanced Institutional Trading

Step into the world of professional-level trading and master how institutions control the markets.

This advanced level dives deep into:

Market Structure Mastery – Spot trends, breakouts & manipulation zones

Smart Money Tactics – Learn how big players accumulate & distribute silently

Volume & Liquidity Zones – Trade where institutions trade

Precision-Based Entries – No noise, just logic

Risk Management Systems – Protect capital like a pro

Avoid Retail Traps – Outsmart fakeouts, stop hunts & emotional trades

Whether you're trading options, futures, or intraday levels—this training gives you the edge to follow the real money and make consistent, calculated moves.

📌 Upgrade your strategy. Trade with purpose. Win like institutions.

Institutional Intraday option Trading🏛️ Institutional Intraday Option Trading

Trade like the big players — with speed, strategy, and smart money precision.

This is high-level intraday options trading the way institutions do it — not with guesswork, but with structure, volume, and calculated risk.

🔥 What You’ll Learn:

Smart Money Concepts – Recognize institutional footprints & price manipulation

Intraday Market Structure – Breakouts, fakeouts, traps & liquidity zones

High-Volume Option Levels – Trade where institutions act

Scalp-to-Swing Entries – Fast setups with defined risk

Tight Risk Management – Stop loss placement like a pro

Time & Premium Decay Tactics – Trade with Theta on your side

💼 Perfect For:

✅ Intraday Option Traders

✅ Scalpers & Index Traders (Nifty/BankNifty )

✅ Anyone ready to follow the real momentum

📌 Fast markets need smart strategies.

Learn to dominate intraday moves with institutional logic.

Advance Option Trading⚙️ Advance Option Trading

Advance Option Trading helps you level up your skills and trade like the pros!

It’s not just about buying Calls or Puts — it's about using smart, multi-leg strategies like:

🔹 Iron Condors

🔹 Butterflies

🔹 Credit Spreads

🔹 Calendar Spreads

These strategies let you profit from:

📈 Price movement

⏳ Time decay (Theta)

🌪️ Volatility changes (Vega)

🔍 What You'll Learn:

Greeks mastery – Delta , Theta , Gamma , Vega

Risk control – Trade with limited loss & defined risk

Trade adjustments – Fix or flip trades smartly

High-probability setups – Trade based on logic, not luck

💡 Perfect For:

✅ Experienced traders

✅ Options scalpers & income seekers

✅ Anyone ready to trade like institutions

🚀 Final Thought:

Trade smarter. Risk less. Profit more.

Advance Option Trading is your path to professional-level strategies with control, clarity, and consistency.

Learn Institutional Trading🏛️ Learn Institutional Trading

Step into the world of smart money and learn how the big players trade!

Institutional Trading isn’t about following indicators—it’s about understanding market structure, liquidity, and smart money moves.

🔍 What You’ll Learn:

Market Structure – Trends, ranges, and liquidity zones

Smart Money Concepts – Accumulation , distribution , and manipulation traps

Volume & Order Flow – See what the institutions see

Precision Entries – No guessing, just calculated moves

Risk Management – Trade like a pro, protect your capital

💡 Why It Matters:

Retail traders often get trapped 🚧 by institutional strategies. When you learn how institutions think and operate, you stop reacting and start predicting market behavior.

🚀 Final Thought:

Think like a pro. Trade like an institution. 🏛️ Win with structure.

Learn Institutional Trading and transform the way you see the market—forever

Option Trading💼 Option Trading 📉📈

Leverage. Flexibility. Strategic Advantage.

Option Trading is a powerful segment of the financial markets where traders and investors use derivative contracts—known as options—to speculate, hedge, or generate income. Unlike traditional stock trading, options give you the right (but not the obligation) to buy or sell an asset at a predetermined price, within a specific time frame.

It’s a strategic tool used by everyone from retail traders to hedge funds to gain exposure with limited risk and amplified potential.

🔍 Key Concepts:

✅ Call Option – Gives the right to buy an asset at a fixed price (strike)

✅ Put Option – Gives the right to sell an asset at a fixed price

✅ Premium – The price paid to buy the option contract

✅ Strike Price – The level at which the option can be exercised

✅ Expiry Date – The date on which the contract expires

✅ In-the-Money / Out-of-the-Money – Describes the moneyness of a position relative to current price

⚙️ Why Trade Options?

🔹 Leverage – Control larger positions with smaller capital

🔹 Flexibility – Bullish, bearish, neutral—there’s a strategy for every view

🔹 Defined Risk – Max risk = premium paid (in buying options)

🔹 Income Generation – Sell options (covered calls, credit spreads) for passive income

🔹 Hedging – Protect existing stock positions from volatility or loss

Option trading isn’t gambling—it’s a game of precision, risk management, and market insight. To succeed, you need to master:

Ride The Big Moves🚀 Ride The Big Moves 📈

"Ride The Big Moves" is a powerful trading strategy and mindset that focuses on capturing large, high-probability market moves—rather than chasing small, uncertain fluctuations. It’s about positioning yourself with the trend, identifying institutional footprints, and holding trades with discipline and conviction for maximum reward.

This concept is rooted in smart money principles: letting your winners run, minimizing overtrading, and waiting for momentum-backed breakouts instead of guessing tops and bottoms. Whether you're trading options, stocks, or futures, the goal is simple—enter with precision, and ride the wave to its full potential.

👉 Perfect for:

✅ Swing Traders

✅ Intraday Momentum Traders

✅ Institutional-Style Traders

✅ Traders seeking fewer but higher-quality setups

🔍 Key Components:

Identifying high-volume breakout zones

Trend confirmation using price action

Entry triggers aligned with momentum shifts

Risk management for extended holds

Avoiding noise & false signals

Stop settling for crumbs — Ride The Big Moves and trade like the pros.

Options Trading vs Stock Trading👋 Introduction

If you've ever stepped into the world of the stock market, chances are you've heard about both stock trading and options trading. While they both exist under the umbrella of equity markets, they are fundamentally different beasts.

Imagine stock trading like buying a house — you own the asset. In contrast, options trading is like paying a small amount to rent the house with the option to buy it later — you get access, flexibility, and leverage, but also more complexity and risk.

In this guide, we’ll break it down in simple language, so you can understand:

What each involves

How they work

Risks vs rewards

Which one suits your trading style

📌 1. What Is Stock Trading?

Stock trading involves buying and selling shares of publicly listed companies on the stock exchange.

Example:

You buy 10 shares of TCS at ₹3,500, totaling ₹35,000. If the price rises to ₹3,800, and you sell, you make a ₹3,000 profit.

Key features:

Ownership: You become a partial owner of the company

No expiry: You can hold stocks forever

Dividends: You may earn income from dividends

Capital appreciation: Profit is made when price rises

Lower complexity: Ideal for beginners

📌 2. What Is Options Trading?

Options trading involves buying and selling contracts (not shares directly), that give you the right (but not the obligation) to buy or sell a stock at a specific price before a set date.

There are two main types of options:

Call Option: Betting that the price will go up

Put Option: Betting that the price will go down

Each contract typically covers 1 lot (e.g., 25 shares) of a stock or index.

Example:

You buy a Reliance 2800 Call Option for ₹50, and each lot = 250 shares. Your total cost = ₹12,500. If Reliance goes above ₹2800 and the premium rises to ₹100, you earn ₹12,500 profit.

Key features:

Leverage: Small capital, large exposure

Limited time: All options have expiry dates (weekly/monthly)

No ownership: You control a right, not the actual stock

Higher risk: Gains can be huge, losses can be total

Advanced strategy: Better for experienced traders

💥 3. Risk-Reward Trade-off

Stock Trading:

Lower volatility: Stock prices move gradually

Better for long-term wealth

Risk is limited to the price going down, but you still own the stock

Options Trading:

High leverage = high reward, high risk

Option premiums can decay rapidly due to time decay (theta)

Entire premium can become zero at expiry

Can be used for hedging or speculation

🧮 4. Margin & Capital Requirements

Stock Trading:

You pay the entire value of the stock upfront (unless using margin facilities)

Brokers may offer 5x margin for intraday, but that’s separate

Options Trading:

Option buyers pay only the premium

Option sellers (writers) require huge margin due to unlimited loss potential

Can start with as low as ₹500–₹5,000 per trade

🧠 5. Who Should Trade What?

You Are Prefer Stock Trading Prefer Options Trading

Beginner ✅ Yes ❌ No (unless trained)

Short-term trader ✅ Yes ✅ Yes

Investor ✅ Yes ❌ Not ideal

Hedger ❌ No ✅ Yes

Speculator ❌ Less ideal ✅ Perfect

🔁 8. Time Decay – The Invisible Killer in Options

One key concept in options is time decay (theta). As expiry nears, the premium loses value even if the stock doesn’t fall.

If you're long in options and your view is wrong or delayed, your option can become worthless.

Stock trading has no such concept — the price remains based on fundamentals and demand-supply.

🧮 6. Strategies Comparison

📈 Stock Trading:

Buy and Hold

Swing Trading

Intraday

🧩 Options Trading:

Buy Call / Buy Put (directional)

Sell Options (income)

Straddle / Strangle (neutral)

Iron Condor / Butterfly (advanced)

🧭 7. Regulatory Perspective

SEBI has increased margin requirements for option sellers due to high risk.

Recent data shows that:

90%+ retail option buyers lose money

85%+ option sellers make money, but require capital and strategy

Stock traders lose less on average, but make smaller % gains

💬 8. Psychological Factor

Stock trading is slower and requires patience

Options trading is fast, intense, and emotional — often leading to impulse trading

You must develop:

Strong discipline

Risk management

Understanding of Greeks (for options)

📚 9. Learning Curve

Area Difficulty (1 to 10)

Stock Trading 3–5

Options Trading 7–9

Options involve:

Understanding of strike prices, expiry, premium, Greeks (delta, theta, vega, gamma)

Quick decision-making under pressure

Multiple possibilities with the same price movement