Macd-v

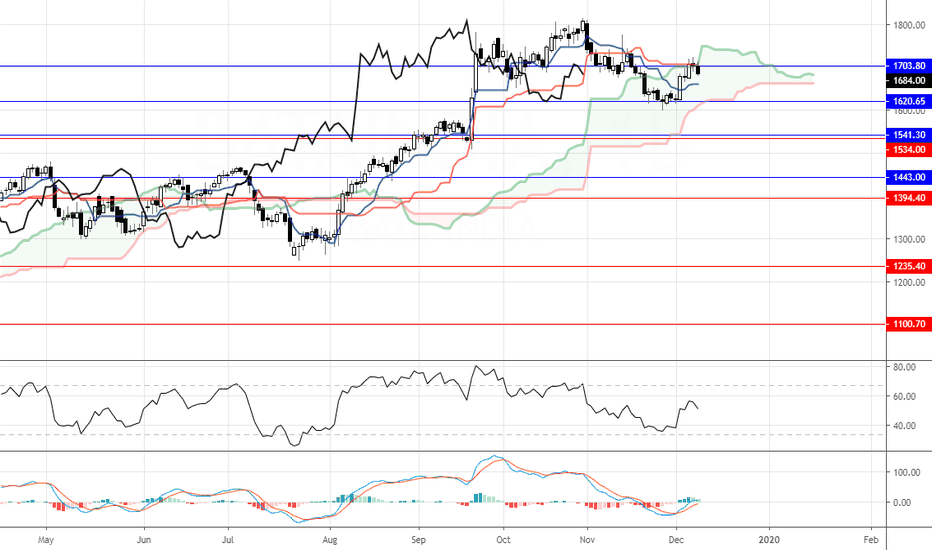

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

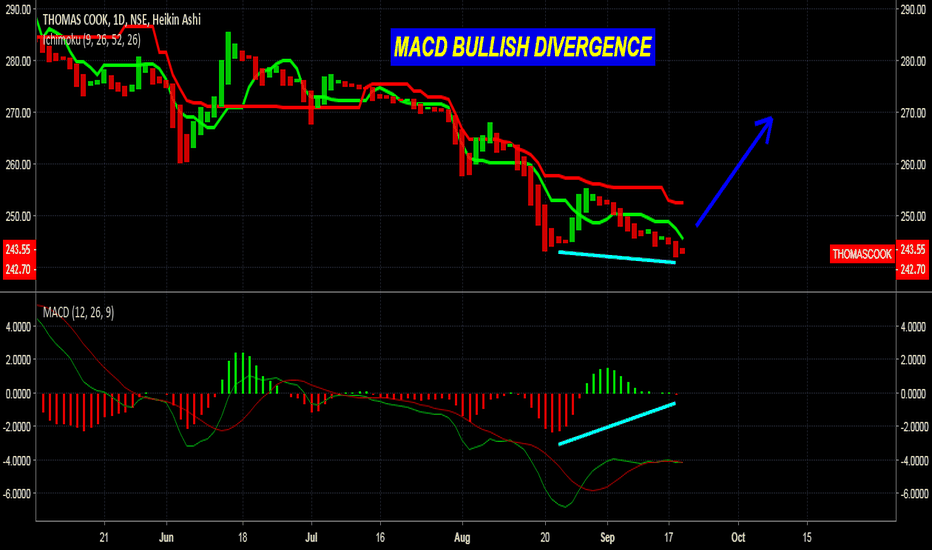

Titan Bearish Divergence on 4h ChartTitan Chart shows Bearish Divergence on RSI, Stoch RSI and Momentum too.

A pull Back is possible but overall Stock looks bullish for longer term.

Bearish Divergence + Price approaching Resistance may bring the Price Down.

If setup fails and breaks 910, Wait and buy the retest of 900 areas in next couple of days.