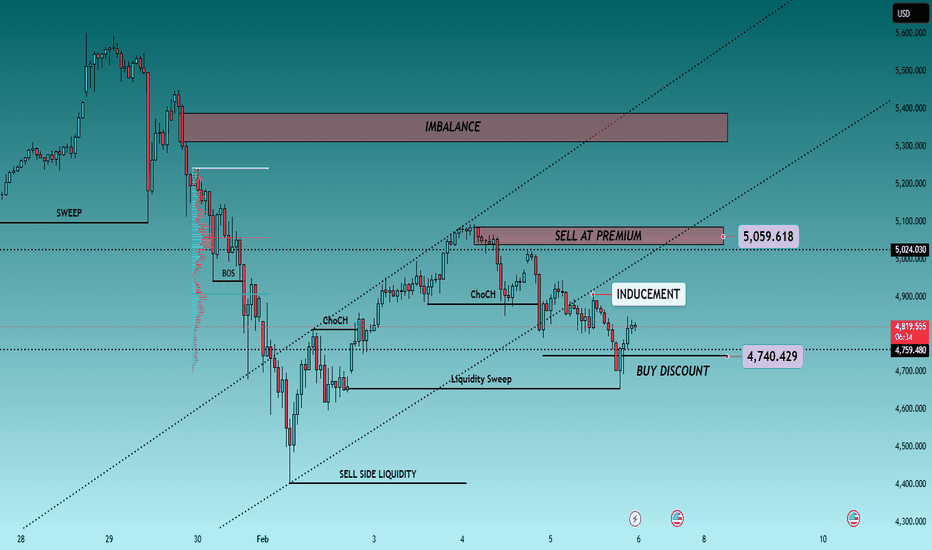

Gold trades cautiously as strong dollar impacts market.🟡 XAUUSD – Intraday Smart Money Trading Plan (H1)

📈 Market Environment

Gold remains highly reactive today as traders digest ongoing USD volatility driven by U.S. rate expectations and political headlines, keeping safe-haven flows unstable. Instead of clean trends, price action continues to favor range manipulation and liquidity-driven moves.

This backdrop supports a Smart Money environment where institutions engineer price into key extremes to trap late buyers and sellers before the real move unfolds.

🔎 Smart Money Technical Outlook

Current Condition:

Price is trading within a rising internal channel, respecting higher-lows while repeatedly reacting at premium and discount extremes. Recent moves show corrective pullbacks, not impulsive trend continuation.

SMC Bias:

➡️ Sell at premium

➡️ Buy only at deep discount

➡️ Entries only after structure confirmation

Key Observations:

• Prior buy-side liquidity already tapped

• Multiple CHoCH signals confirm rotational flow

• Price respecting internal trendlines

• Discount aligns with bullish order block

• Premium capped near previous target & imbalance

💧 Liquidity Zones & Key Levels

🔴 SELL ZONE: 5,100 – 5,102

🛑 Stop Loss: 5,110

🟢 BUY ZONE: 4,722 – 4,720

🛑 Stop Loss: 4,712

🧠 Institutional Playbook

Inducement → Liquidity sweep → CHoCH / MSS → BOS → displacement → OB entry → expansion

🔴 SELL Setup — Premium Distribution

Sell Area: 5,100 – 5,102

Execution Criteria:

Price reaches premium within channel

News-driven push into prior target zone

Bearish CHoCH / MSS on M5–M15

Clear downside BOS

Entry from bearish OB or FVG

Targets:

• 5,020 — first reaction

• 4,950 — mid-range liquidity

• Trail if downside displacement expands

🟢 BUY Setup — Discount Accumulation

Buy Area: 4,722 – 4,720

Execution Criteria:

Sweep of sell-side liquidity

Deep discount relative to range

Bullish CHoCH / MSS on LTF

Strong bullish displacement

Entry from refined bullish OB

Targets:

• 4,850 — internal reaction

• 4,980 — liquidity magnet

• 5,100 — previous high if expansion continues

⚠️ Risk Management Notes

• Expect fake breakouts during headlines

• No confirmation = no trade

• Reduce risk during news spikes

• Let structure lead, not emotion

📍 Final Takeaway

Gold is not trending — it’s being engineered.

Sell strength at premium.

Buy weakness only at deep discount.

📌 @Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

Metals

Gold Trades the Extremes as News Fuels Liquidity Games🟡 XAUUSD – Intraday Smart Money Plan (H1)

📈 Market Context

Gold remains highly sensitive today as markets react to President Trump’s announcement, keeping USD flows unstable and risk sentiment mixed. This environment favors liquidity engineering, not trend chasing. Institutions are exploiting news-driven emotions to distribute at premium and accumulate at discount.

With volatility elevated, expect false breaks, inducements, and stop hunts around key levels rather than clean directional moves.

🔎 Smart Money Technical Read

Current State:

Price is trading inside a managed range after a buy-side liquidity grab. Intraday structure shows distribution from premium, while downside moves are corrective rather than impulsive.

Core Idea:

Let price come to Smart Money — sell premium or buy deep discount only after confirmation.

Structure Observations:

• Buy-side liquidity already delivered

• Multiple CHoCH signals confirm corrective flow

• Price respecting descending internal channel

• Discount aligns with prior sell-side liquidity

• Premium capped by institutional supply & imbalance

Liquidity Zones & Key Levels

• 🔴 SELL GOLD: 5,020 – 5,060

• 🟢 BUY GOLD: 4,720 – 4,760

🧠 Institutional Expectation

Inducement → Liquidity sweep → CHoCH / MSS → BOS → displacement → OB / FVG entry → expansion

🔴 SELL Scenario — Premium Distribution

Sell Zone: 5,020 – 5,060

Conditions:

✔ Price taps premium / prior sell-high

✔ News-driven push into resistance

✔ Bearish CHoCH or MSS on M5–M15

✔ Downside BOS confirms intent

✔ Entry via bearish OB or FVG

Targets:

• 4,950 — internal reaction

• 4,820 — range low

• Trail if momentum expands

🟢 BUY Scenario — Discount Accumulation

Buy Zone: 4,720 – 4,760

Conditions:

✔ Sweep below sell-side liquidity

✔ Discount relative to HTF range

✔ Bullish CHoCH / MSS on LTF

✔ Strong displacement confirms buyers

✔ Entry from refined bullish OB

Targets:

• 4,850 — first reaction

• 4,980 — internal liquidity

• 5,050+ — if expansion resumes

⚠️ Risk Notes

• Expect fake breakouts during headlines

• No trade without structure confirmation

• Reduce size near news spikes

• Patience > prediction

📍 Summary

Gold is a Smart Money range play today:

• Sell strength at premium

• Buy weakness only at deep discount

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

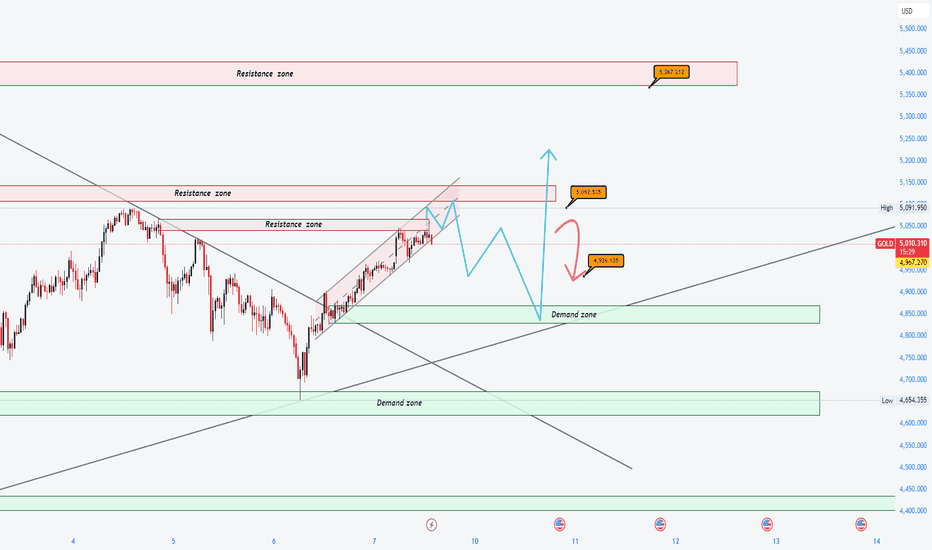

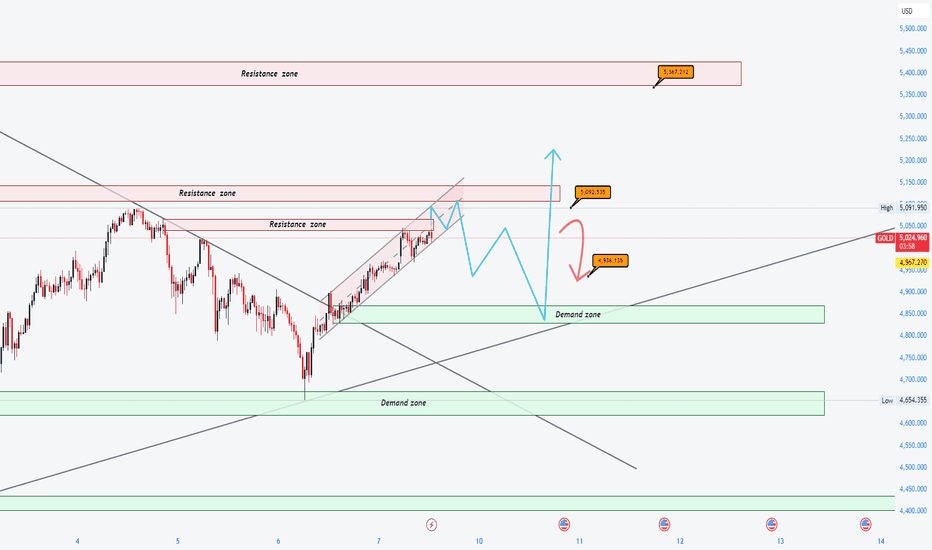

GOLD before Non-Farm: Sideways or a Trap?🌍 Macro Background

Continuing to monitor U.S. – Iran tensions and whether escalation occurs.

Japan: maintaining a weak JPY → USD remains supported.

A heavy news week ahead:

FED speeches (today)

Labor market data

Inflation data later this week

👉 Market sentiment remains cautious, waiting for a clearer directional catalyst.

📈 Trend & Structure

Overall price structure remains unchanged: Gold is in the final phase of a corrective rebound.

Upside momentum still exists, but limited, while reversal risk is increasing.

Price is consolidating near resistance → sideways conditions are favored.

🔴 Resistance – 🟢 Support

🔴 Resistance: 5,050 – 5,100

🟢 Near support: 4,980 – 4,950

🟢 Additional support: 4,930 – 4,936

🟢 Deeper support: 4,880 – 4,850

📊 Trading Scenarios

✅ Primary scenario (higher probability): Sideways – range trading

Sell reactions around 5,050

Condition: rejection candles / bearish confirmation

Buy technical pullbacks at support zones

Focus on M15 – H1, quick and disciplined trades.

⚠️ Alternative scenario (lower probability): Bullish breakout

Mandatory condition: H1 close clearly above 5,100

Only then consider buying the breakout.

🧠 Risk Management

Avoid holding large positions during:

FED speeches

Labor market & inflation releases

No FOMO — wait for candle confirmation.

XAGUSD 1H Bearish Trendline Rejection📉 Market Structure

Primary trend: Bearish

Price is making lower highs & lower lows

Clear descending channel visible

The recent rally looks like a corrective pullback, not a trend reversal

🔴 Key Rejection Zone

Resistance: 83.50 – 84.20

Price has been rejected exactly at the descending trendline

Bearish reaction candle + arrow confirms seller dominance

📊Pattern Insight

Structure resembles a bear flag / falling channel

Impulse down → consolidation → rejection → continuation expected

Trendline break did NOT happen → bearish continuation favored

❌ Invalidation

Hourly close above 85.00 setup

Clean breakout + hold above descending trendline→ would delay or invalidate bearish setup

GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined

GOLD before US Jobs & Inflation Data: Key Scenarios?🌍 Macro Context & Market Expectations

This week, the market is closely focused on:

US employment data

US inflation data (CPI / PCE)

Additionally, traders are monitoring:

Developments in US–Iran negotiations

US Supreme Court rulings related to trade tariffs

→ These factors may amplify short-term volatility, especially around key technical levels.

📈 Trend & Market Structure

Medium-term trend: BULLISH

Price has rebounded strongly from the ~4,700 low to around 5,04x

Last week printed a bullish Hammer candle, confirming long-term buying interest

On the H12 timeframe, the A–B–C corrective structure is not yet complete

Short term: price is consolidating within a tightening range, waiting for a clear breakout

🔑 Key Price Levels

🟢 Support:

5,000 | 4,950 | 4,930 | 4,850 | 4,700 | 4,650

🔴 Resistance:

5,050 | 5,095 | 5,100 | 5,110 | 5,200 | 5,300

🎯 Primary Scenarios

✅ Bullish continuation

Price holds above 4,930 and breaks decisively above 5,050

→ Potential upside toward 5,095 – 5,100, and further to 5,200 – 5,300

❌ Failed breakout / Pullback

Price fails to clear 5,050 and closes below 4,930

→ Likely correction toward 4,850, with deeper pullback to 4,700 – 4,650

🧭 Trading Strategy

Prioritize buy-the-dip opportunities in line with the trend

Avoid counter-trend shorts unless clear reversal signals appear at resistance

Stay patient and avoid FOMO — only trade when risk–reward is clearly defined

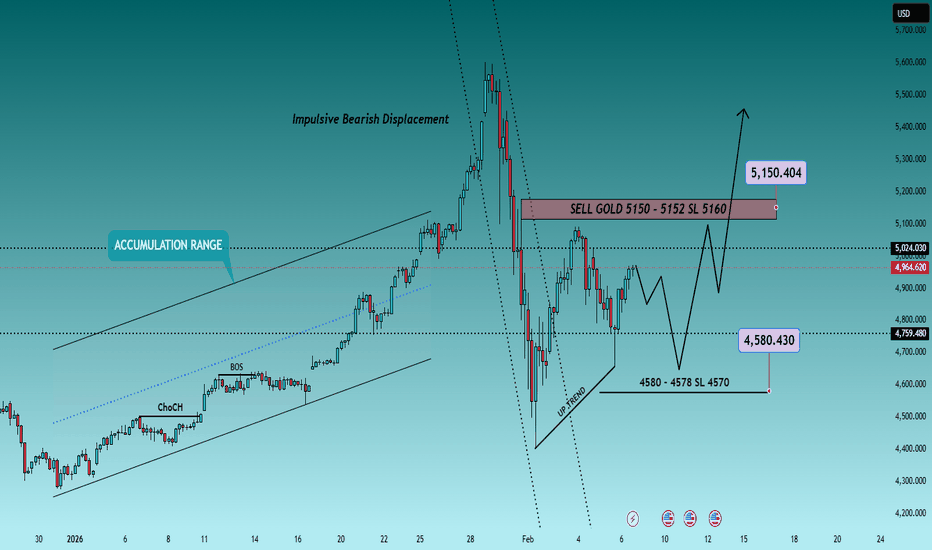

Gold at highs; CPI, Fed bets impact liquidity.🟡 XAUUSD — Weekly Smart Money Plan (SMC)

📈 Market Context

Gold enters the new week in a liquidity-driven environment as traders react to hot U.S. CPI expectations, shifting Fed rate-cut odds, and volatile U.S. yields. News is fueling emotion and stop runs, not clean trends. This is prime conditions for Smart Money to distribute at premium and accumulate at discount.

Expect headline spikes, false breakouts, and engineered moves around key weekly levels.

Smart Money Technical Read

Current State:

After an impulsive bearish displacement from highs, price is now rotating inside a managed weekly range. Upside moves look corrective, while sell-offs are sharp and efficient — a classic sign of institutional control.

Core Bias:

Sell premium / Buy deep discount only after structure confirmation.

No chasing. Let price come to Smart Money levels.

Structure Notes:

• HTF buy-side liquidity already swept

• Bearish displacement signals distribution

• Internal rallies show weak follow-through

• Discount aligns with prior sell-side liquidity

• Premium capped by HTF supply zone

Liquidity Zones & Key Weekly Levels

🔴 SELL GOLD: 5150 – 5152 SL: 5160

🟢 BUY GOLD: 4580 – 4578 SL: 4570

🔴 SELL Scenario — Weekly Premium Distribution

Conditions:

✔ Price spikes into 5150–5152 on news or USD weakness

✔ Buy-side liquidity sweep above recent highs

✔ Bearish CHoCH / MSS on H1–M15

✔ Downside BOS confirms institutional intent

✔ Entry via bearish OB or FVG

Targets:

• 5020 — internal reaction

• 4800 — mid-range liquidity

• 4600s — weekly discount expansion

🟢 BUY Scenario — Weekly Discount Accumulation

Conditions:

✔ Sell-side liquidity sweep below 4580

✔ Deep discount vs weekly range

✔ Bullish CHoCH / MSS on LTF

✔ Strong bullish displacement

✔ Entry from refined bullish OB

Targets:

• 4750 — first reaction

• 4950 — internal liquidity

• 5100+ — if weekly expansion resumes

Institutional Playbook

Inducement → Liquidity Sweep → CHoCH/MSS → BOS → Displacement → OB/FVG → Expansion

Risk Notes

• Expect fake moves during CPI & Fed headlines

• No structure = no trade

• Reduce risk during news spikes

• Patience beats prediction

📍 Weekly Summary

Gold is a Smart Money range game this week:

• Sell strength at premium (5150s)

• Buy weakness only at deep discount (4580s)

Trade levels. Respect structure. Let liquidity do the work.

📌 Follow @Ryan_TitanTrader for Smart Money gold breakdowns.

Gold Faces Strong Selling PressureGold came under heavy selling pressure after failing to break above the 5,100 USD level overnight and subsequently falling below 4,900 USD during today’s trading session.

The US dollar climbed to its highest level in two weeks and appears to be extending its recent solid recovery from a four-year low, which is adding notable downside pressure to the precious metal.

In addition, the current corrective move is still struggling, as price remains below the trendline. As long as this trendline—and more importantly the recent high at 5,100 USD—is not convincingly broken, the path of least resistance remains to the downside.

What’s your view? How do you see the next move for OANDA:XAUUSD ?

Silver’s Breakdown Points to Much Lower LevelsSilver’s recent price action is not showing signs of strength or accumulation.

Instead, it reflects a clean structural breakdown followed by weak, corrective consolidation — the kind of behavior that usually precedes another leg lower.

After losing the key $84 level, silver didn’t stabilize or reclaim lost territory. It simply drifted into a lower range, suggesting that the move down was not just a temporary flush, but the start of a broader repricing phase.

What the market is doing now looks less like accumulation and more like post-breakdown exhaustion.

The $84 zone: where structure changed

The $84 area was a major structural level.

It acted as a balance zone where price previously found support and built value.

Once that level broke:

Buyers lost control of the structure

The market shifted from balance to imbalance

Liquidity started moving downward

Strong markets defend key levels.

Weak markets lose them and never look back.

So far, silver is behaving like the latter.

The inability to reclaim $84 suggests that the market is now operating in a lower value regime, where rallies are likely to be sold into, not chased higher.

Current price action: drift, not recovery

After the sharp drop, price entered a sideways range. But this range lacks the characteristics of real accumulation.

There is:

No strong impulsive buying

No reclaim of broken structure

No sustained upward expansion

Instead, the market is:

Printing lower highs

Moving sideways to slightly down

Showing reactive buying, not aggressive accumulation

This type of behavior is typical in markets that are pausing before the next leg lower.

The downside path: where liquidity sits

Below the current price, multiple untested liquidity zones remain.

These areas represent prior consolidation, psychological levels, and structural supports.

First major target: $56.52

This is the nearest meaningful support zone.

It represents:

A prior demand area

A structural pause in the previous trend

A natural magnet after the $84 breakdown

A move to this level would be a logical continuation, not a panic move.

Secondary target: $49.78

If $56 fails to hold, the next liquidity pocket sits near $49.78.

This level aligns with:

Deeper structural support

A prior consolidation region

A zone where longer-term buyers may begin to re-enter

This would represent a full structural correction from the $84 breakdown.

Deeper flush zones: $44.13 → $37.48 → $34.82

If the market enters a true risk-off phase or broad commodity weakness:

$44 becomes the next major structural test

$37 acts as a deeper psychological and technical level

$34 represents a full-cycle liquidity reset zone

These levels are where:

Long-term positioning resets

Weak hands are fully cleared out

Real accumulation could begin

Why the bearish scenario makes structural sense

Several factors support the downside path:

1) Clean structural breakdown

The loss of $84 shifted the entire market regime.

2) Lack of impulsive recovery

Strong markets bounce fast. Weak markets drift.

3) Overhead supply above current price

Every rally now runs into trapped longs from higher levels.

4) Untested liquidity below

Multiple clean targets sit beneath the current range.

Markets naturally move toward unfilled liquidity zones.

The likely sequence from here

The higher-probability path:

Continued sideways-to-lower drift below $84

Gradual breakdown of the current range

First major test around $56.52

If that fails, extension toward $49.78

Deeper flush possible toward $44 → $37 → $34 zones

Real accumulation is more likely after these levels are tested, not at current prices.

Bottom line

Silver is not showing signs of a bottom.

It’s showing signs of a market adjusting to a lower price regime.

The $84 breakdown changed the structure.

Since then, price has only drifted — not recovered.

That usually means the move isn’t over.

The structure currently favors:

First major downside target: $56.52

Secondary level: $49.78

Deeper reset zones: $44 → $37 → $34

This isn’t a base in silver.

It’s a pause before the next move.

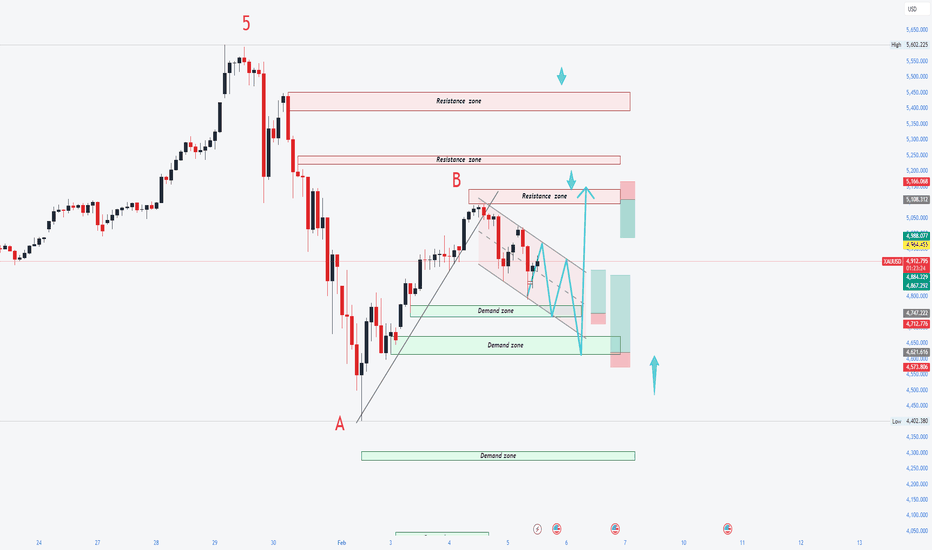

Chumtrades XAUUSD Has Wave B finished?GOLD – DAILY PLAN

Has Wave B finished?

→ No confirmation yet.

Macro & Market Sentiment

US–Iran negotiations have been cancelled. Geopolitical risks remain, but not strong enough to trigger a new bullish wave.

Gold experienced a relatively calm trading session, failed to break above the key level around 5,100, and saw a moderate pullback during the US session.

The Daily candle formed a Spinning Top, indicating market indecision and consolidation, with a lack of momentum for a breakout.

👉 Macro factors are supporting prices, but not pushing the market into an immediate uptrend.

Technical Structure & Outlook

Price is still moving within a descending price channel.

On the H1 timeframe, price has broken above the 4,888 key level, showing a technical rebound.

However, the higher timeframe structure remains bearish, with no confirmed trend reversal.

→ Therefore, current rebounds are considered pullbacks within a downtrend.

Key Levels

Support: 4,810 | 4,830 | 4,700–4,750 | 4,650–4,624

Resistance: 4,950–5,000 | 5,100

Trading Scenarios

Primary strategy: Sell the rallies within the descending channel.

Look for SELL setups near resistance zones, targeting lower lows.

Momentum SELL may be considered if price clearly breaks below 4,882–4,890, with confirmation on H2 or H4, targeting around 4,810.

No BUY positions while price remains inside the descending channel.

👉 Only if price breaks and holds above 5,100, will we start reassessing a trend-following BUY scenario.

👉 Deeper pullbacks are viewed as potential zones for swing BUY opportunities, not short-term buys at this stage.

Note: The market is in a “confidence-testing” phase. Focus on zone-based trading, trend alignment, reduced position size, and avoid FOMO.

What’s Next for Gold?Gold’s sharp rebound from the recent lows has reignited calls for an immediate continuation toward new highs. But the structure tells a more nuanced story.

The rally so far looks less like fresh upside momentum and more like a classic relief move after forced liquidation.

The recent selloff flushed leverage aggressively. Stops were triggered, weak hands exited, and positioning reset fast. What followed wasn’t accumulation — it was short-covering and mean reversion.

This matters because markets that truly want to trend higher don’t need to retrace this violently first.

The key zone: supply above, not support below

Gold is now approaching a well-defined supply band, roughly around the 5,250–5,300 region.

This zone is important for three reasons:

It was a prior distribution area before the breakdown

It aligns with VWAP / value rejection from the last impulse down

It represents the level where trapped longs may look to exit breakeven

In other words, this is where selling interest naturally returns, not where new longs should feel comfortable.

If Gold were truly in a strong continuation phase, it would have:

Built a base

Absorbed supply

Then expanded higher

Instead, price is walking straight back into overhead resistance.

Liquidity behavior doesn’t confirm strength

Despite the bounce, liquidity behavior remains defensive.

• Rallies are corrective, not impulsive

• Volume expands on down moves, not up moves

• Buyers are reactive, sellers are proactive

This is typical of a market inside a larger corrective phase, not the start of a fresh leg higher.

Gold often rallies hardest after fear peaks — but it doesn’t trend sustainably until supply is fully absorbed. That process takes time.

Macro tailwinds aren’t immediate triggers

Yes, long-term macro drivers for gold remain intact.

But markets don’t move on narratives alone — they move on timing and positioning.

If global liquidity remains tight or even mildly restrictive, gold doesn’t collapse — but it also doesn’t trend freely. It oscillates, frustrates, and cleans up positioning.

That’s exactly what current structure suggests.

The probable path from here

From a trader’s perspective, the higher-probability sequence is:

• Price tests the 5,250–5,300 supply zone

• Sellers re-engage into strength

• Volatility compresses or rejection appears

• Market either ranges or pulls back before the next real move

A clean break and acceptance above this zone would invalidate the view — but until then, this is resistance, not confirmation.

Bottom line

Gold’s bounce is real — but bounces are not trends.

This move looks like:

A reaction, not initiation

Short-covering, not accumulation

Repair work, not breakout

Strong markets build value below resistance.

Weak or corrective markets rush into it.

Right now, Gold is doing the latter.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Bullish Structure Rebuild as Precious Metals Surge | Lana ✨

Precious metals are back in focus as silver surges sharply, adding momentum to the broader metals complex. In this context, gold is showing signs of structure rebuilding after a healthy correction, setting the stage for potential continuation.

📈 Market Structure & Technical Context

After a strong impulsive drop, gold successfully defended the 4,420–4,450 strong support zone, where buyers stepped in decisively. Since then, price has been forming higher lows along an ascending trendline, signalling a shift from distribution into recovery.

The current price action suggests this move is corrective-to-bullish, not just a short-lived bounce.

🔍 Key Levels to Watch

Strong Support: 4,420 – 4,450

This zone remains the structural base. As long as price holds above it, bullish scenarios stay valid.

Mid Resistance / Reaction Zone: ~5,050 – 5,080

Price is currently consolidating here, absorbing supply after the rebound.

Next Resistance: ~5,135

A clean break and acceptance above this level would confirm continuation strength.

Upper Targets: ~5,300 – 5,350

Aligned with Fibonacci extensions and prior supply zones.

Higher Objective: ~5,580

Only in play if bullish momentum accelerates across the metals market.

🎯 Bullish Scenarios

If gold continues to respect the upper trendline and holds above the 5,000 psychological level:

A brief pullback into 5,000–5,050 could offer structure for continuation.

Acceptance above 5,135 opens the path toward 5,300+.

Strong momentum, supported by silver’s breakout, could extend moves toward 5,580.

Any pullbacks toward support are currently viewed as constructive corrections, not weakness.

🌍 Intermarket Insight

Silver’s sharp rally highlights renewed demand across precious metals, often acting as a leading signal for broader sector strength. This backdrop supports the idea that gold’s recent correction was a reset, not a reversal.

🧠 Lana’s View

Gold is rebuilding its bullish structure step by step. The focus is not on chasing price, but on how price reacts at key levels. As long as structure and momentum remain aligned, the broader trend stays constructive.

✨ Stay patient, respect the zones, and let the market confirm the next expansion.

XAUUSD (H3) – Liam PlanXAUUSD (H3) – Liam Plan

Safe-haven bid is back, but structure is still corrective | Trade the zones, not the headlines

Quick summary

Gold is up for a second day as US–Iran tensions revive safe-haven demand. At the same time, expectations for Fed rate cuts keep the USD on the defensive, which typically supports non-yielding assets like gold. However, with ADP and ISM Services PMI ahead, short-term volatility can spike fast — and that’s exactly where gold tends to run liquidity before choosing direction.

My approach: respect the macro tailwind, but execute based on structure.

Macro context

Gold usually benefits when:

geopolitical risk rises (risk-off flows),

rate-cut expectations increase (lower real yields),

the USD weakens or struggles to sustain a bounce.

That said, pre-data sessions often produce fake moves. The market will likely “test” both sides before committing.

Technical view (H3 – based on the chart)

Price rebounded sharply from the recent low, but the overall swing structure is still in a correction / rebalancing phase after a major impulse down.

Key zones on the chart:

Major supply / premium target: 5570 – 5580 This is the clear “sell reaction” zone if price expands higher.

Current decision area: around 5050 – 5100 Price is pushing back into a key mid-range level — where continuation must prove acceptance.

Deep demand / liquidity base: 4408, then 4329 If the market fails to hold higher supports, these are the next magnets for sell-side liquidity.

This is a classic: bounce → retest → decide environment.

Trading scenarios (Liam style: trade the level) Scenario A: Continuation bounce

If price holds above the current base and continues to reclaim levels:

Upside rotation can extend toward 5200 → 5400 → 5570–5580

Expect reactions near each resistance band, especially approaching premium.

Logic: safe-haven flows + softer USD can fuel continuation, but only if price accepts above the mid-range.

Scenario B: Rejection and rotation lower

If price fails to hold above 5050–5100 and prints rejection:

Expect a pullback back into prior demand

Deeper continuation opens toward 4408, then 4329

Logic: corrective rallies often redistribute before the next leg lower, especially around major data.

Execution notes

With ADP + ISM ahead, avoid chasing candles.

Wait for price to tag the zone and show a clear reaction.

Trade smaller if spreads widen.

My focus: If price accepts above the mid-range, I’ll respect the bounce. If it rejects, I’ll treat the move as a corrective rally and look for rotation lower. Either way, I’m trading levels — not headlines.

— Liam

SILVER1! : Volatility Contraction & Mean Reversion Analysis1. Context & Review (Linking the Past) In our previous analysis Silver Futures: Parabolic Breakdown , we correctly identified the "Bearish Liquidation" event that led to a -17% correction. As predicted, the parabolic arc was violated, and price sought liquidity lower.

2. Current Market Structure: The Snap-Back We are witnessing the aftermath. The market stabilized at the ~265k zone and is reacting with a strong +5% bounce. This aligns with standard Mean Reversion mechanics:

Oversold Conditions: The selling intensity stretched price too far from the average ("rubber band" effect).

Short Covering: Early bears are booking profits, fueling the initial bounce.

3. Technical Roadmap (The "New" Path)

The Gap Fill: The rapid drop left a liquidity void (Fair Value Gap) between 290k - 300k. Price naturally gravitates toward this magnet to "repair" inefficient price action.

The 0.382 Test: As mentioned in our previous "Dead Cat Bounce" scenario, we are watching the Fibonacci retracement levels. The current move is approaching the 0.382 resistance.

4. Technical Setup (Visible on Chart)

The "Orange Box" (Supply Zone): We have highlighted the 290k-300k zone as the "Line in the Sand."

Bullish Case: A daily close above 300k suggests this is more than just a dead cat bounce and opens the door to the Golden Pocket (0.618).

Bearish Case: Rejection at this Orange Box confirms the "Lower High" thesis, likely inviting a second leg down.

5. Volatility Analysis (TradeX View) Historical data confirms that after a >15% crash, volatility remains elevated for 2-3 weeks. We expect wide trading ranges rather than a straight V-shape recovery.

Strategy: Fade the extremes. Buy deep supports, sell the rip into resistance.

6. Conclusion The panic phase is over; the "reconstruction" phase has begun. We are currently neutral-bullish for a tactical bounce to the ~300,000 resistance area, but we remain cautious of the macro trend until that level is reclaimed.

Wave B Has Rebounded 15% Bottom Confirmed at 4,400?Wave B Has Rebounded 15% – Final Bottom or a Trap Before Wave C?

After a strong rally in yesterday’s Asian session, gold moved into consolidation during the European and US sessions, with a failed breakout late in the US session. In today’s Asian session, price broke above the 4,882–4,960 range, confirming it as a new buy-side base.

Gold has rebounded ~15% from the 4,404 area, driven by dip-buying demand and rising US–Iran geopolitical tensions, which remain a key catalyst alongside this week’s economic data.

From an Elliott Wave perspective, 4,400 marks the Wave A bottom. The market is now in a Wave B corrective rebound, with potential upside toward 5,140 – 5,200 – 5,220. Once Wave B completes, Wave C may follow, where signs of weakness and distribution will be watched to identify new swing-buy zones after the correction.

Support: 4,990–4,950 | 4,880–4,890 | 4,780–4,750 | 4,650–4,624

Resistance: 5,140 | 5,200 | 5,220

Note: Volatility remains elevated. Trade cautiously with strict risk and capital management.

IM LONG IN XAUUSD: HTF 0.5 Fibonacci Magnet in Play (4950–5000)*Gold is holding trendline support and targeting the 0.5 Fibonacci level of the higher timeframe.

What I Have Mentioned is the Clear HTF bias, defined by zone, defined reaction zone, which shows both bullish & corrective scenarios

****Strongly it educates, not hypes***

XAUUSD Price ( 4950 – 5000 ) remains the key upside zone if support continues to hold.

Market Context:

XAUUSD is currently trading around 4810, holding above a rising yellow trendline support.

Technical Confluence:

• Higher timeframe 0.5 Fibonacci retracement lies between 4950 – 5000

• This zone is marked as a major reaction area (highlighted rectangle)

• Trendline support + structure holding adds bullish probability

Price Expectation:

As long as the price respects the trendline support, gold can continue its move higher towards the 0.5 HTF Fibonacci zone.

The green and red projected paths indicate possible market reactions based on support and resistance behavior — not prediction, but preparation.

Trading Insight:

This is a buy-on-support, sell-into-resistance setup.

Strength near 4950–5000 must be watched closely for either continuation or rejection.

Let price confirm at HTF levels — patience pays more than prediction.

(XAUUSD) – Bearish Continuation From Major Supply Zone (45m)

Market Structure

Clear trend reversal from the highs → strong impulsive sell-off.

The curved marking shows a distribution/top formation, followed by aggressive downside momentum.

Overall structure is lower highs & lower lows → bears in control.

Key Zones

Resistance / Supply Zone (~4,700–4,750)

Previous support flipped into resistance.

Price has retested this zone multiple times and failed to break above → strong seller presence.

Target / Demand Zone (~4,350)

Prior demand area and liquidity pool.

Logical downside objective if resistance continues to hold.

Entry Logic (as drawn)

Short entry after rejection inside the resistance zone.

Confirmation comes from:

Weak bullish candles

Long upper wicks

Failure to reclaim the zone

Price Action Read

The small bounces are corrective pullbacks, not reversals.

Each push up is being sold → classic bearish continuation / pullback-to-supply setup.

Bias & Expectation

Bias: Bearish

Expectation:

Rejection from resistance → continuation toward 4,350 target

Invalidation if price accepts and closes above the resistance zone

Summary

This chart shows a textbook support-to-resistance flip after a strong sell-off. As long as price remains below the highlighted resistance, the path of least resistance is down, targeting the lower demand zone.

XAUUSD 15M – Bullish Reversal Setup Explained Above 4700 Level After a strong sell-off, Gold is now reacting near a high-probability demand zone.

🔍 My Analysis & Thinking:

• Price has reached the 61.8% Fibonacci retracement of the recent major swing

• RSI (15 Min) is showing a clear bullish divergence

• Selling momentum is weakening after the big fall

• Structure suggests a potential higher low formation

📈 Trade Plan (IF–THEN Logic):

✅ IF price breaks above 4700 (yellow resistance zone)

✅ AND gives a clean retest + bullish confirmation

➡️ THEN BUY

🎯 Upside Targets:

4800 , 4900, 5000 zone (major supply & trendline confluence)

🛑 Invalidation:

Breakdown below 61.8% (4500 -4550 level ) support with strong momentum

⚠️ This is a patience trade — confirmation > prediction.

📊 KEY LEVELS TO MENTION IN CAPTION

Support Zone:

🔹 61.8% Fib – Major demand area

Breakout Level:

🟡 4700 (Yellow Rectangle)

Targets:

🎯 4800 → 4900 → 5000

Bias:

🔄 Short-term bullish after confirmation

XAUUSD 15M – Bullish Reversal Setup Explained Above 4700 Level

XAUUSD "BULLISH" BIAS IDEA.Symbol + Timeframes: XAUUSD — HTF (Daily) & ITF (H4)**

Bias: Bullish (as long as price holds above key support zone)

Structure: – Higher lows intact on HTF

– Intermediate pullbacks LIQUIDATING "fomoing" retailers.

Key Levels: – Support: – 4629.989

And if it breaks , the confluential block at - 4633.96 and marked important swing low at - 4267.383.

– Invalidation: daily candle close below 4267.383

Context: – Price reacting to confluence (fair value gap + structural support + confluential block)

– Dollar bearish pullback adds supporting context

Plan: – Look for corrective pullback to support for continuation setups at smaller timeframe to frame trades, I've marked the path

– Targets based on structural levels

This is analysis, not trade advice.

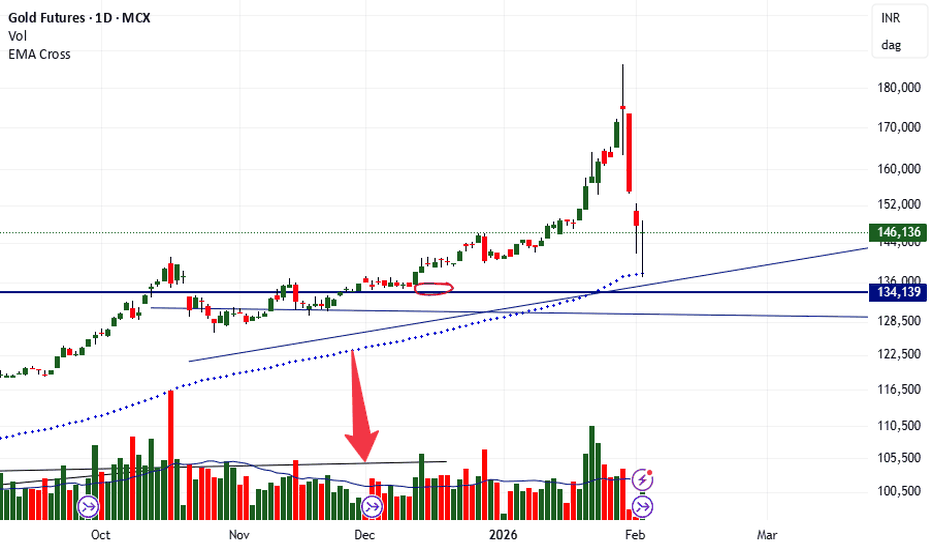

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases rarely resolve in a straight line and typically evolve into consolidation, base-building, or deeper corrective structures.

At current levels, Silver is hovering near an immediate demand zone around the 80–85 region, which now acts as a crucial decision area. This zone represents the first major area where buyers are expected to defend aggressively. The way price behaves here will define the next medium-term trend.

Scenario A – Range / Base Formation (High Probability):

The most probable outcome at this stage is sideways consolidation. After a vertical fall, markets often need time to absorb supply and rebuild demand. If Silver manages to hold above the immediate demand zone and starts forming higher lows on lower timeframes, it would indicate base formation rather than trend failure. This scenario favors range traders and patient positional participants, as price may oscillate between support and overhead resistance for several weeks or months.

Scenario B – Breakdown Continuation (Moderate Probability):

If the current support zone fails decisively with strong weekly closes below it, Silver could enter a deeper corrective phase. In such a case, price may gravitate toward the next major demand zone near 73–75, which aligns with prior consolidation and breakout structure. This move would likely be driven by broader risk-off sentiment or macro pressure rather than technical weakness alone. Traders should avoid aggressive longs if this breakdown structure develops.

Scenario C – Bullish Reclaim and Bounce (Low Probability, Needs Confirmation):

A less likely but still possible outcome is a bullish reclaim, where Silver holds current levels, absorbs selling pressure, and reclaims the 90+ zone with strong weekly confirmation. For this scenario to gain credibility, price must show acceptance above resistance with volume and structure. Until then, any bounce should be treated as reactive and corrective, not a confirmed trend reversal.

From a structural perspective, the major resistance remains far above near the 115–120 zone, which was the distribution area before the sharp reversal. This level will act as a long-term supply cap unless Silver builds a strong base over time.

In summary, Silver is no longer in a trending phase but in a transition zone. Patience is critical here. Traders should focus less on prediction and more on reaction to price behavior at key demand levels. Let structure, confirmation, and risk management guide decisions, as this phase can easily trap both early bulls and aggressive bears if approached without discipline.