Gold (XAU/USD) – Possible Reversal from Resistance XAU/USD (Gold Spot vs. U.S. Dollar) on the 1-day timeframe and shows an ascending channel with key price levels and technical annotations.

Key Observations:

Trend Direction:

The price has been in a strong uptrend since late 2024.

It is currently near the upper boundary of the ascending channel.

Liquidity & Market Structure:

INT.LQ (Internal Liquidity): This suggests an area where liquidity is expected to be taken before a potential move.

MB Unfilled (Market Balances Unfilled): These indicate inefficiencies in price movement that the market may revisit.

Projected Price Action:

The chart shows a potential short-term pullback from the upper boundary.

Expected retracement towards the "fair value range" around $2,800–$2,850.

If this scenario plays out, it would align with price rebalancing and a healthier uptrend continuation.

Key Levels:

Resistance: Around $3,050, which aligns with the upper trendline.

Support Zones: Around $2,950 and deeper at $2,800.

Potential Trading Strategy:

Bearish Case: If rejection occurs at $3,050, short opportunities could exist targeting $2,900–$2,850.

Bullish Case: If price retraces and finds strong support in the fair value range, it could resume its uptrend.

Metals

XAU/USD Analysis: Bearish Pullback Towards $3,000 SupportXAU/USD (Gold Spot vs. U.S. Dollar) Technical Analysis - 1H Chart

1. Price Action & Trend Analysis

The market has been in a strong uptrend, characterized by higher highs and higher lows.

Recently, the price faced resistance near the $3,040 level, leading to a rejection.

A pullback is currently in progress, suggesting a possible retracement to a demand zone.

2. Key Levels

Resistance Zone (Supply Zone): Around $3,040 - $3,045 where price has been rejected multiple times.

Support Zone (Demand Zone): Around $3,000 - $3,005, a previous accumulation area.

Current Price: $3,023.695

3. Market Structure & Expected Move

The price tested the resistance zone, failed to break above, and is now reacting downward.

A bearish projection (as shown in the chart) suggests a potential move toward the $3,000 - $3,005 support zone.

If the price reaches this level and finds buying pressure, we could see a reversal or continuation of the uptrend.

4. Indicators & Confluence Factors

Support-Resistance Flip: The previous support at $3,000 could act as a strong support again.

Bearish Momentum: Short-term price action suggests sellers are gaining control after rejection at resistance.

Liquidity Zones: The highlighted purple zones represent institutional order blocks where significant buy/sell orders exist.

5. Trading Plan & Strategy

Bearish Scenario: If price breaks below $3,000, we could see further downside pressure.

Bullish Scenario: A bounce from $3,000 could provide buying opportunities for another attempt at breaking $3,040.

6. Conclusion

The market is currently retracing from resistance, and a short-term bearish move is expected toward $3,000.

Traders should watch for price reaction at $3,000 to determine if it holds as support or breaks for further downside.

xau/usd short now Hello! Here is an effective strategy for short selling in gold (XAUUSD), including entry price, exit price, and stop loss. This strategy is designed for today's intraday trading, so that you can take advantage of the market dip.

Entry, Exit, and Stop Loss for Short Selling

Entry Price (Sell Level):

When gold is between 3037-3039, short sell (i.e. sell).

Example: If gold is at 3038, then sell here.

Stop Loss:

Place a stop loss at 3042. If gold moves above this level, close the position to minimize losses.

Example: Sold at 3038 and gold moves up to 3042, then close the position to avoid losses.

Exit Price (Profit Target):

Close your position gradually and take profit at the following levels:

1st Target: 3034

2nd Target: 3025

3rd Target: 3015

4th Target: 3005

Example: If gold falls to 3034, take some profit; If it falls to 3025, take more profit.

Strategy Summary

Entry Price: 3037-3039

Stop Loss: 3042

Exit Price: 3034, 3025, 3015, 3005

This strategy will help you profit from the fall in gold prices. Watch the market carefully and do not risk more than 1-2% of your capital. Good luck!

XAU#25: Is the correction over? What's next?Prices OANDA:XAUUSD stabilized around $3,022/ounce after a slight decline two days ago, reflecting strong safe-haven demand due to economic and geopolitical uncertainty. So is this correction over? Let's look at the next plan FOREXCOM:XAUUSD :

1️⃣ **Fundamental analysis:**

📊 Risks of economic recession and war conflict still exist:

🔹The Trump administration's reciprocal tariff policy may be more moderate than expected, reducing concerns about trade conflicts, but Wall Street is still betting on a 50% chance of a US recession due to slow currency circulation. This is one of the factors supporting Gold's rise

🔹 Risks from the Middle East and Ukraine are still unknown. Negotiations are still reaching certain agreements, but the impact on market confidence is insignificant. The fear psychology is still pushing money into Gold as a safe haven asset.

2️⃣ **Technical analysis:**

🔹 **D Frame**: The uptrend remains unchanged. Closing the session last Friday with a bearish candle is considered a profit-taking move after a series of days of gold price increase.

🔹 **H4 Frame**: The 3000 area is playing an effective support role when the price bounces back. However, the correction wave has not shown any signs of ending.

🔹 **H1 Frame**: The bearish price structure is very clear. If the 301x area is still held, the price may seek the resistance zones above to confirm the price reaction.

3️⃣ **Trading plan:*

✅ From the basic information to the reflected horizontal line, it can be seen that at the present time, the price can still continue to decrease. However, there are certain risks when FOMO establishes a SELL position in the current area. The price may not drop deeply to the lower area immediately but will sweep SL at both ends. We can wait for the price reaction in the upper resistance area to find a safer position.

💪 **Wishing you success in achieving profits!**

Gold Next Move: 3000 Loading... Key Observations to Current Price Action:

- Recent price action shows a strong impulsive move up from the green support zone (2770-90)

- The current structure suggests that we're potentially entering a corrective phase followed by continuation of the bullish trend as marked with black arrows.

- The green zone that I marked on chart can act as an institutional support level or "fair value zone" where significant trading activity has occurred,The recent breakout above this level with strong momentum suggests institutional buying pressure

- The anticipated pullback could represent a potential "discount" zone where smart money might accumulate or re enter.

The pullback, if it materializes, should ideally hold above the green support zone to maintain bullish market structure.

The overall price action still showing a bullish bias with a potential short-term correction before continuing higher. The green zone will be crucial for maintaining this bullish scenario.

I am still holding buy trade on Gold and Silver and will add more if I see confirmation from lower area (Marked in Red circle) for the target of 3000.

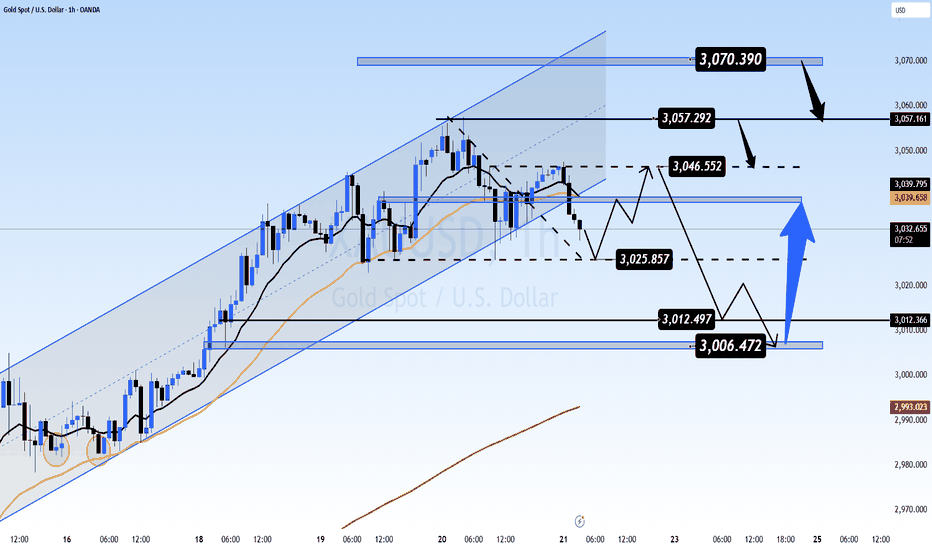

Gold Analysis -MMF- Profit-Taking Signals Opportunity🚀 Critical Levels Today! 📊

✅ Yesterday’s Recap: Our previous analysis hit around 90% accuracy 🎯, with gold responding perfectly at historical highs, prompting traders to book profits early in the European session. The bearish momentum is continuing into today's Asian session. 📉

📌 Market Sentiment:

Profit-taking is the primary driver at these historic highs. Investors are carefully eyeing lower liquidity zones for re-entry, positioning themselves strategically for future gains as global economies lean towards rate-cut cycles and an era of cheaper money. Historically, such cycles strongly favor gold prices. 🌟💰

📌 Technical View:

Technical signals align closely with fundamentals: reversal signals at recent highs are mild, suggesting cautious profit-taking rather than aggressive short-selling. Gold traders are merely scouting temporary peaks cautiously, not heavily bearish yet. ⚠️🔍

📉 Critical Levels:

🛑 Resistance: 3038 | 3046 | 3056 | 3070

🟢 Support: 3030 | 3025 | 3014 | 3005

Currently, gold has broken the bullish H1 channel, testing immediate support at 3025. A strong breakdown below this level could trigger deeper bearish moves, especially today—Friday volatility could drive intense movements targeting lower liquidity zones. 🔻🔥

🎯 Strategic Trading Zones:

🚨 BUY ZONE: 📈

Entry: 3006 - 3004

Stop Loss (SL): 3000 🛡️

Take Profit (TP): 3010 | 3015 | 3020 | 3025 | 3030 🎯

🚨 SELL ZONE: 📉

Entry: 3056 - 3058

Stop Loss (SL): 3062 🛡️

Take Profit (TP): 3052 | 3048 | 3044 | 3040 | 3035 | 3030 🎯

⚡ Today’s Action Plan:

Focus closely on Asian & European sessions. Updates will be provided ahead of the US session, anticipating high volatility and profit-booking activities. Stay disciplined, strictly adhere to your TP & SL to protect your account! 🙌💼

Gold short-term analysis and buying planJudging from the current market situation, short-term bulls continue to take the initiative, which will undoubtedly increase the probability of gold prices hitting the 3070-3080 area, but we also need to be prepared for high-level bulls to leave the market and make profits, and be prepared for the trend to change.

Today, Friday, since the market is still in the trend bullish structure channel, coupled with yesterday's bottoming and rebounding trend, we need to pay attention to Friday's re-high action. Trading ideas: Buy at a low position during the intraday correction, and sell after the historical high or new high is under pressure. It is planned to trade in the 3030-3060 range.

For intraday operations, it is recommended to buy on pullbacks without buying at high positions. For the support below, pay attention to the 3030-3032 area. As long as the price can keep running above, the probability of seeing the 3050-3060 area during the day is very high. On the contrary, if the support breaks down, it will most likely test the 3023 area. As for the resistance, pay attention to the 3060 area. It is expected that the possibility of a breakthrough today is very small. However, considering that the current support has moved up, it is only recommended to participate in the sale when the price approaches 3055 for the first time.

Key points:

First support: 3040, second support: 3032, third support: 3023

First resistance: 3054, second resistance: 3060, third resistance: 3077

Operation ideas:

Buy: 3031-3035, SL: 3022, TP: 3050-3060;

Sell: 3055-3057, SL: 3066, TP: 3020-3030;

More signals will be updated in the VIP group

Gold PA on week close : Profit-Taking or Trend Reversal? Gold is currently showing signs of a pullback after its strong bullish run, trading at 3,031.975 . This consolidation was anticipated in yesterday's update as a "healthy pause" following the impressive momentum .

Current current PA Status:

- Gold has pulled back from recent highs and is currently trading below the R2 resistance level (3,046.317)

- Price action is showing some selling pause in rally but remains within the projected consolidation range (3,030-3,060) that shared yesterday

- The higher high (HH) structure on the daily timeframe remains intact despite yesterday's pullback

Technical Observations

- The pullback is occurring exactly as predicted in yesterday's secondary scenario

- Current price action suggests profit-taking after reaching near the R2 level

- Gold is still trading well above the psychological 3,000 support level

- The pullback appears orderly rather than panic-driven

Updated Projections

**Primary Scenario (Bullish After Consolidation)**

- Current pullback represents normal profit-taking after the strong upward move

- Support around 3,000 should hold if bullish momentum remains intact or price need to break above yesterady high to see continuation.

- Once consolidation completes, gold likely resumes its upward trajectory toward R3 (3,136.323) as I am still execting one more week of strenth as per daily cycle timing.

Secondary Scenario (Correction)

- If today's close remains weak, we could see further pullback toward the 3,000 psychological level

- A break below 3,000 would suggest a deeper correction toward R1 (2,952.228)

Key Levels to Monitor

- Immediate resistance: R2 (3,046.317)

- Current support: 3,030 and then 3000 area

- Critical support: 3,000 psychological level and previous week low

Today's price action confirms yesterday's analysis about potential consolidation. Wait for today's closing price to determine if this is merely a pause in the bullish trend or the beginning of a deeper correction. The overall trend remains bullish as long as the price stays above 3,000 and the HH structure on the daily timeframe remains intact.

GOLD TRDAING POINT UPDTAE > READ THE CHAPTIAN Buddy'S dear friend

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 list time post signals 💯 reached target point 3059. ). Analysis update on gold. Gold look 👀 patterns chart 📉 sellers recover and strong 💪. 30M time frame 🖼️ looking short trend 📉 target 🎯 point 3001 that entry buying said good luck 💯

Key Resistance level 3042 + 3046

Key Support level 3006 - 3001

Mr SMC Trading point

Palee support boost 🚀 analysis follow)

GOLD TRADING POINT UPDATE >READ THE CHPTAIAN Buddy'S dear friend

SMC Trading Signals Update 🗾 Update Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders. ) a little. Analysis setup for buying said FVG level support level 🎚️. Fisrt entry 3037 + 3060 next entry level support level 3025. Target point 3060 ) that is rejected point below 👇 trend 📉 update you next analysis) good luck 💯💯🤞

Key Resistance level 3055+ 3060

Key Support 3025 - 3019

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

Gold (XAUUSD) Going Parabolic ?The chart suggests that Gold (XAUUSD) has been rising steadily in the past year.

Gold in general acts as hedge against inflation and uncertainty.

There can be further upthrust due to some catalyst. In general one should not short a parabolic move prematurely as it can keep moving upwards. Only with defined signals one must try that. Shorting in general is very difficult. Nevertheless if one wants to trade a parabolic move, they can long it with a small position so that the risk reward is great. Commit only that much which you are ready to lose with appropriate stop loss.

What effects the price of Gold in general -

1. Geopolitical events - e.g.

Ukraine War

Gaza War

Tariff Wars

2. Dollar Index - Post election DXY rose steadily causing selloff in emerging markets. Though Gold fell initially but it steadied and started moving upwards later. Since gold correlates negatively in general with DXY, it's important to keep a tab on it.

3. Demand and supply of physical gold.

Buying and selling by Central Banks around the world

Mining output

Demand by consumers

4. Monetary policies of Central Banks of USA, China, Japan etc

5. Trading in derivatives

PS - This is not an exhaustive list of course.

So in order to understand and speculate on Gold one must have an updated macro view and chart reading capacity.

Trade Safe

Gold short-term analysisTechnically, the daily gold line continues to maintain its strength, setting a new record high. The daily chart maintains a bullish trend structure, and the price continues to run in the trend. At present, the MA10/7-day moving average continues to open and move up to 2977/3007, and the price runs along the upper track of the Bollinger Band. The RSI indicator stands above the 70 value and is close to the 80 value.

The short-term four-hour chart also keeps the price running on the upper track of the Bollinger Band, the moving average opens upward, and the price continues the MA10-day moving average and stops moving up to set a new record high. However, it should be noted that the RSI indicator has reached the 80 value, and there will be profit-taking today and tomorrow. The trading idea of gold today is still mainly to buy at low positions, and sell according to market conditions after the historical high.

Key points:

First support: 3044, second support: 3038, third support: 3023

First resistance: 3057, second resistance: 3068, third resistance: 3078

Operation ideas:

Buy: 3043-3046, SL: 3032, TP: 3060-3070;

Sell: 3073-3075, SL: 3084, TP: 3060-3050;

GOLD (XAU/USD) Trading Plan: Will Gold Break $3100? 🚀Published by MMFlowTrading on March 20, 2025

Overview 📊

Gold (XAU/USD) is in a strong uptrend on the H1 timeframe, with price action moving within a clear ascending channel 📈. The recent breakout above the $3000 psychological level signals robust bullish momentum 💪. However, key resistance levels are approaching, and upcoming economic events might influence the next move. Let’s dive into the technical and fundamental factors to craft today’s trading plan! 🧠

Technical Analysis 🔍

Ascending Channel:

Gold is trading within a well-defined ascending channel (highlighted in orange on the chart) 📉📈. The price has respected both the upper and lower boundaries, indicating a healthy uptrend. Currently, the price is near the upper channel resistance at $3070.612 🚧.

Key Resistance Levels (VPOC High):

The nearest resistance is at $3070.612, a high-volume node (VPOC) where sellers might step in 🛑.

If this level is broken, the next targets are $3081.053 and $3097.774, with a potential push toward the psychological $3100 mark 🎯.

Key Support Levels:

The closest support is at $3031.774, aligning with the lower channel boundary and a previous VPOC level 🛡.

A deeper pullback could test $3024.254 or even $3017.197, where buyers previously stepped in (marked by yellow circles on the chart) 📍.

Additional Key Levels:

Resistance: $3054 - $3061 - $3070 🚧

Support: $3044 - $3038 - $3031 - $3026 🛡

Fundamental Analysis 🌍

US Dollar Strength:

Gold has an inverse relationship with the USD 💱. On March 20, 2025, the market is awaiting the US Jobless Claims data and Fed speeches, which could impact the USD 📅. If the data indicates a weaker US economy, the USD might weaken, supporting Gold’s rally toward $3100 🚀.

Geopolitical Tensions:

Ongoing global uncertainties (e.g., Middle East tensions, US-China trade talks) continue to drive demand for safe-haven assets like Gold 🛡. This fundamental factor supports the bullish bias in the short term.

Interest Rates:

The Fed’s recent dovish stance on interest rates (as of early 2025) has reduced the opportunity cost of holding Gold, further fueling its uptrend 📉.

Trading Plan 📝

Buy Setup (BUY ZONE: $3032 - $3030) 🟢

Stop Loss (SL): $3026 ⛔️.

Take Profit (TP): $3038 - $3042 - $3046 - $3050 - $3060

Sell Setup (SELL ZONE: $3069 - $3071) 🔴

⛔️Stop Loss (SL): $3075

Take Profit (TP): $3065 - $3060 - $3055 - $3050

Market Note ⚠️

The market has been hitting all-time highs (ATH) after the FOMC storm early this morning 🌪. Traders, please stay cautious and strictly follow your TP/SL to keep your accounts safe! 🛡💡

Conclusion 🏁

Gold is at a critical juncture near $3070. A breakout above this level could pave the way to $3100, driven by strong technicals and supportive fundamentals 🚀. Alternatively, a rejection might lead to a pullback to the $3032 - $3030 buy zone. Stay disciplined and trade smart! 💪

What do you think about this setup? Drop your thoughts in the comments below! 👇 For more daily trading ideas, follow me on TradingView

Gold Price Action Analysis - March 20, 2025Gold Price Action Analysis - March 20, 2025

Current Market Status

- Gold is currently trading at 3,050.055,

- Successfully conquered the R2 resistance level (3,046.317)

- Showing strong momentum with minimal retracement or consolidation

- Psychological level of 3,000 has been comfortably established as support

Technical Observations

- The price is following almost exactly the projected path that I shared on Monday (blue arrow)

- Minimal upper wicks on recent candles indicate buyers are maintaining control

- Volume appears to be supporting the move higher

- No divergence signals on the daily timeframe indicating weakness

Updated Projections

Primary Scenario (Continued Bullish Momentum)

- Having broken through R2 (3,046.317), gold is now likely to target R3 at 3,100

- The absence of significant profit-taking suggests potential for further upside

- Watch for a potential acceleration if momentum continues to build

Secondary Scenario (Short-term Consolidation)

- After such a strong move, an intraday pullback or consolidation may occur

- Potential consolidation range: 3,030-3,060

- This would be a healthy pause before the next leg up

- The overall bullish structure remains intact as long as price stays above 3,000

Key Levels to Monitor

- Immediate resistance: 3050-55 and 3100, then 3,136.323 (R3)

- Current support: 3,046.317 (previous R2, now potential support)

- Secondary support: 3,000 (psychological level)

- Critical support: 2,952.228 (R1)

Trade Considerations

- Overall outlook is still bullish while being cautious of potential short-term overbought conditions

- Consider partial profit-taking at 3100 0r R3 (3,136.323) if reached

- Potential dips toward 3,030-3,040 range could offer strategic entry points for traders looking to add to positions for Intra day on confirmations

Gold continues to demonstrate exceptional strength with no technical signs of weakness on higher timeframes. While an intraday pullback is possible, the primary trend remains firmly bullish.

Gold Price Analysis Update - March 18, 2025Gold continues to demonstrate exceptional bullish momentum, validating yesterday's primary scenario prediction shared here. Currently trading at 3,010.965, gold has surged past the R1 target of 2,952.228 as forecasted and is now approaching the R2 resistance level at 3,046.317.

Current Market Conditions

-Successfully sustaining on the 3,000 psychological barrier

- Trading well above the previous all-time high (2,956.73), which is now serving as strong support

- The chart shows minimal retracement following the breakout, indicating robust buying pressure

Updated Projections

1. Primary Scenario (Continued Bullish Momentum): Gold is likely to test the R2 resistance at 3,046.317 in the near term. With current momentum, a push toward R3 at 3,136.323 remains a strong possibility.

2. Secondary Scenario (Minor Consolidation): We may see brief consolidation around current levels before the next leg up. However, as long as price remains above 2,952 (R1), the bullish outlook remains intact.

Key Levels to Monitor

- Immediate resistance: 3,046.317 (R2)

- Extended target: 3,136.323 (R3)

- Support levels:$2,952.228 (R1, previous resistance now support)

Market Sentiment

The strong daily close with minimal upper wicks indicates buyers remain in control with no significant profit-taking yet. The overall trend structure remains intact with higher highs and higher lows, confirming the bullish bias.

Gold's performance likely continues to be supported by geopolitical tensions, inflation concerns, and potential monetary policy adjustments. With no technical weakness apparent on the daily timeframe, maintain bullish outllok overall.

Gold Surges Unstoppably, Hits $3,036 – What’s Next?Gold is skyrocketing without brakes, reaching $3,036, making traders as happy as a holiday, while those waiting to buy the dip... can only watch the price soar sadly. 😅

📌 The main reason?

The USD is as weak as a soggy cracker, giving gold a perfect chance to break out.

Safe-haven sentiment keeps pushing gold higher, and even traders who bought at the top still seem happy as prices show no sign of stopping!

📈 Forecast:

If gold holds above $3,020, there's a high chance it will set a new record.

And if it corrects? Just gathering momentum for another big jump!

💡 What about you? Are you already in position or still waiting and watching?

XAU/USD 1H – Bullish Continuation from Demand Zone?📊 XAU/USD (Gold) 1H Analysis – Bullish Continuation Setup

🔹 Market Structure: Gold has been in a strong uptrend, with price currently consolidating near a key demand zone.

🔹 Key Levels:

🔴 Resistance: $3,050 - $3,060 (Potential target)

🟣 Demand Zone: $3,030 - $3,035 (Support area)

🟠 Deeper Support: $3,025 (Break below weakens bullish bias)

📈 Potential Trade Setup:

1️⃣ A possible pullback into the demand zone could attract buyers.

2️⃣ Price may wick below liquidity before reversing.

3️⃣ If support holds, we anticipate a move toward $3,050+.

✅ Entry Zone: $3,030 - $3,035

🎯 Target: $3,050 - $3,060

🚨 Stop Loss: Below $3,025

⚠️ Watch for price action confirmation before entering. A strong bullish candle from support could signal entry. Let the market show its hand! 🚀✨

US Dollar Index (DXY) – Pre-FOMC Update💥 US Dollar Index (DXY) – Pre-FOMC Update: Expert Analysis and Trading Strategies 💥

In just a few hours, the Federal Reserve (Fed) will announce its interest rate decision and update its economic projections in the Summary of Economic Projections (SEP). This is a highly anticipated event that will shape trading decisions in the coming weeks. The US Dollar Index (DXY) is currently fluctuating within the 103.00 - 104.00 range, reflecting investor caution ahead of the critical updates.

1. Interest Rate Decision and Its Impact on DXY

The policy rate is expected to remain unchanged at 4.25% - 4.50%. However, the market is more focused on signals about future rate cuts, particularly in 2025.

Chair Jerome Powell's post-meeting speech will be the key driver. The market will closely watch for hints on monetary policy, inflation, and the US economic outlook.

If the Fed adopts a hawkish tone (indicating sustained high rates or even further hikes), the DXY could rally strongly. Conversely, a dovish signal could weaken the USD.

2. Technical Analysis of DXY

🔴 Key Support: 103.18

The DXY is currently under pressure at the 103.18 support level. A break below this level could push the index further down to 103.00 or even 102.50.

This is a crucial zone, as failure to hold here would signal continued USD weakness in the short term.

🟢 Major Resistance: 105.00 and 105.57

If the DXY rebounds from current support levels, the next challenges will be the resistance zones at 105.00 and 105.57.

The 50-day and 200-day Moving Averages (MA) on the daily chart are also key indicators to watch. A break above these MAs could reinforce the bullish trend.

📉 Short-Term Trend:

On the 4H chart, the DXY is in a downtrend, with lower highs and lower lows. However, upcoming macroeconomic factors (the rate decision and Powell’s speech) could trigger a reversal or increased volatility.

Technical indicators like the RSI and MACD are in neutral territory, suggesting the market is awaiting clearer signals.

3. Trading Strategy Before and After the FOMC Decision

🔍 Before the Fed Announcement:

Caution is key. The market may experience mild fluctuations during the wait. Traders should avoid large positions and wait for clearer signals.

Closely monitor key support and resistance levels: 103.18 (support) and 105.00 (resistance).

🔥 After the Fed Announcement:

Scenario 1: Fed Holds Rates and Signals Hawkish Tone

The DXY could rally strongly, targeting resistance levels at 105.00 and 105.57.

Strategy: Look for buy opportunities when the DXY bounces off support or breaks above resistance.

Scenario 2: Fed Signals a Dovish Tone

The DXY could drop sharply, breaking below 103.18 and heading toward 102.50.

Strategy: Look for sell opportunities when the DXY breaks support or fails to surpass resistance.

Scenario 3: Fed Holds Rates Without Clear Signals

The DXY may continue to fluctuate within the 103.00 - 104.00 range.

Strategy: Trade within the range, using identified support and resistance levels.

4. Advice for Investors and Traders

📊 Risk management: Always set appropriate stop-loss and take-profit levels to protect your capital. Post-FOMC volatility can be intense, so prepare mentally and have a solid trading plan.

📰 Stay updated: Keep a close eye on Fed updates and market reactions. Jerome Powell’s speech could create significant trading opportunities.

🛠️ Use technical tools: Combine indicators like RSI, MACD, and Fibonacci to identify precise entry points.

5. Conclusion

Tonight’s FOMC meeting will be a decisive factor for the DXY’s short-term direction. With clear support and resistance levels identified, traders should prepare their strategies to capitalize on market movements.

🚨 Stay tuned for the latest updates on TradingView to ensure you don’t miss any trading opportunities!

Wishing you successful trades and profitable outcomes! 💪💰

Kalyani Steels trendline breakout - D timeframeKalyani Steels after achieving the target of 1179.50 exited parallel channel and held support at 700 range. Bullish reversal happened at 704.20 (mar 3) and bullish reversal confirmation at 721 (mar 17). Dec 17 '24 ATH to Mar 3 '25 precisely 44.86% fall as anticipated. Now price chart in daily timeframe showing double bottom with inverted hammer (Mar 19) along with RSI double bottom breakout. Weekly chart piercing line (i think) candlestick pattern along with RSI +ve divergence.

GOLD EA MAN UPDATE >READ THE CHAPTIAN Key Observations:

Support Zone: The price has respected the marked support area and is showing bullish momentum.

EMA Confluence: The price is currently below the 30 EMA (red), but if it crosses above, it could signal stronger bullish momentum.

Target Point: The projection anticipates a move towards 3,052.357, possibly after a minor pullback.

If price sustains above the 30 EMA and breaks through the minor resistance, your bullish target seems achievable. Are you already in a long position, or waiting for further confirmation?

Short-term strategy before the Fed's interest rate decisionGold continued to rise yesterday, up more than 1%. This is the power of the trend. Don't guess whether it has reached the top. This is not in line with market logic, because there is no turning signal. The risk of guessing that it has reached the top is relatively high. Of course, the market is always relative. It is impossible to keep rising. It is necessary to prevent the risk of large adjustments!

Yesterday, the highest impact of the US market was 3038. There may be room for a short-term rise, but you must pay attention to the future. Going long is also a short-term profit exit. The daily and weekly lines are in an overbought divergence state. The price deviates far from the short-term moving average, and the risk of stepping back is getting bigger and bigger. Be bullish but not blind, and don't chase more. The short-term has risen three times, and the possibility of a pullback needs to be prevented later!

Pay attention to the news of the Fed's interest rate decision. There was not much risk in going long before this. It should be a strong form. Gold continued to set new highs in 1 hour, but it is obviously not appropriate to enter at a high level now. It is better to wait patiently for a decline and continue to buy. Gold focuses on the support near the starting point of 3015 and continues to go long. The market is changing rapidly. Since the gold bulls continue to be strong, gold will continue to trade with the trend.

Key points:

First support: 3023, second support: 3016, third support: 3002

First resistance: 3039, second resistance: 3048, third resistance: 3056

Operation ideas:

Buy: 3013-3015, SL: 3004, TP: 3035-3045;

Sell: 3048-3050, SL: 3059, TP: 3020-3010;

For more daily analysis, click on my avatar to view

Gold - Long Term Elliot Wave Counts - Top is near!Gold has finally started it's last leg up, 5th of 5th on Weekly.

This can go another 3-5% to 90600, 9100 or so, or maybe slightly higher, however, when it ends, we are looking for a sharp fall, as an extended 5th with short retracement in 4th doesn't end well.

Lot of people would be trapped, and when it starts breaking levels it will create double pressure from bears shorting and bulls covering longs.

I am expecting around 75k.

GOLD AWAITS FED DECISION – WILL $3,050 BE THE NEXT TARGET?📌 Market Outlook

Gold is holding steady above the $3,000 level as investors remain cautious ahead of the March 19 FOMC meeting. The Federal Reserve is expected to keep interest rates unchanged, with increasing speculation about a potential rate cut in June.

Despite last week’s price surge, gold’s short-term direction hinges on how the Fed’s economic outlook unfolds. If policymakers signal a dovish stance, we could see new highs beyond $3,050. However, any signs of persistent inflation may trigger a short-term pullback.

📊 Key Technical Analysis

🔹 Support Levels (Buy Zones)

$3,000 – The psychological level where buyers are active.

$2,985 - $2,975 – Strong liquidity zone, likely to provide support.

$2,945 - $2,950 – If tested, this could be a major reaccumulation area.

🔺 Resistance Levels (Breakout Targets)

$3,034 - $3,050 – Key resistance, breaking above could open the door for further upside.

Above $3,050, momentum could accelerate toward $3,080 - $3,100.

🎯 Trading Strategy for Today

🟢 BUY ZONE: 2986 - 2984

📍 SL: 2980

🎯 TP: 2990 - 2994 - 3000 - 3005 - 3010

🔴 SELL ZONE: 3033 - 3035

📍 SL: 3039

🎯 TP: 3028 - 3024 - 3020 - 3015 - 3010

⚠ Market Sentiment & Risk Management

Gold is currently trading in an ascending channel with high volatility expected before the Fed’s decision.

Traders should prepare for false breakouts and possible profit-taking moves around key levels.

Stick to strict TP/SL strategies to mitigate risks!

📢 What’s your outlook for gold? Will we break above $3,050 or see a dip first? Let’s discuss! 🚀🔥