Why MSFT Could Be a Smart Pick in 2025?MSFT has bullish signals from the multiple moving averages, RSI and volume analysis. However, wave principle asks evidence from the buyers. The wave count suggests that the corrective wave (B) is ongoing, and bears will control the final wave of the primary wave 3.

Wave C will start falling nearby the supply zone and high of the 2nd wave of wave intermediate wave A. Wave C can fall up to 476 which will be the strength for wave primary wave 5. As per the chart, breakout above 540 will be a good signal for bulls to take charge back.

Zones:

Supply zone: 538 - 528

Demand zone: 482 - 476

I will update the chart and details shortly.

Microsoft (MSFT)

Analysis of Microsoft Corp. (MSFT) Weekly ChartHistorical Trend: The chart illustrates Microsoft Corp.'s stock price on a weekly timeframe from 2022 to mid-2025. The stock showed a steady upward trend from 2022 to early 2025, reflecting strong growth driven by its dominance in software and cloud computing.

Key Levels:

Resistance: The $483.89-$477.40 range (red line) has acted as a significant resistance level. The price recently tested this zone and appears to have faced rejection.

Support Levels:

Support 1: $425.59 (green line) served as a mid-range support during recent corrections.

Support 2: $376.00 (green line) acted as a stronger support level during prior consolidations.

Major Support 3: $316.63 (green line) represents a critical long-term support zone, tested during deeper pullbacks.

Recent Price Action: After approaching the resistance at $483.89, the stock experienced a sharp decline, forming a descending pattern (blue line). This suggests a potential bearish reversal or correction following the rejection at resistance.

Projected Movement: The downward projection indicates the stock could decline toward the $316.63 major support level if the bearish momentum continues. A break below $376.00 would confirm this trend, while a bounce from $425.59 could signal a potential recovery.

Volume and Indicators: The chart includes Bollinger Bands (O475.21 H483.46 L474.08 C477.40) with a -2.44 (-0.51%) change, indicating moderate volatility. The recent drop suggests selling pressure, though specific volume data is not detailed.

Outlook: The stock is currently in a bearish phase after failing to break above $483.89. Watch for a potential test of $425.59 or $376.00 supports. A recovery above $477.40 would indicate a resumption of the bullish trend, while a drop below $316.63 could signal a deeper correction.

Market bubbles are for real !MSFT vs CAT returns after the peak of 2000’s, The Dot Com Bubble! CAT has outperformed to the date. For a rough idea MSFT has given 800% vs CAT has given 1500% since 2000’s.

This does not mean the same will happen in the next 25 years. This ratio chart of MSFT/CAT shows that market bubbles are for real, at least in this case.

CNXIT Levels // 25 MinHello Everyone 👋

Current Market Overview

Current Level: 41,089.85

Market Sentiment: The IT sector has been showing mixed signals with some volatility due to global economic factors and earnings reports.

Support Levels

40,800: This is the first major support level. If the index falls below this, it could indicate a bearish trend.

40,500: A stronger support level. Breaching this could lead to a significant downward movement.

Resistance Levels

41,300: The first resistance level. Breaking above this could signal a bullish trend.

41,600: A stronger resistance level. Surpassing this could lead to a sustained upward movement.

Indicators to Watch

Moving Averages: Keep an eye on the 50-day and 200-day moving averages for trend confirmation.

Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, while below 30 indicates oversold conditions.

MACD (Moving Average Convergence Divergence): Look for crossovers to identify potential buy or sell signals.

Recent News and Events

Earnings Reports: Recent earnings reports from major IT companies can impact the index.

Global Economic Factors: Changes in global economic policies, especially in the US and Europe, can influence the IT sector.

Trading Strategy Tips

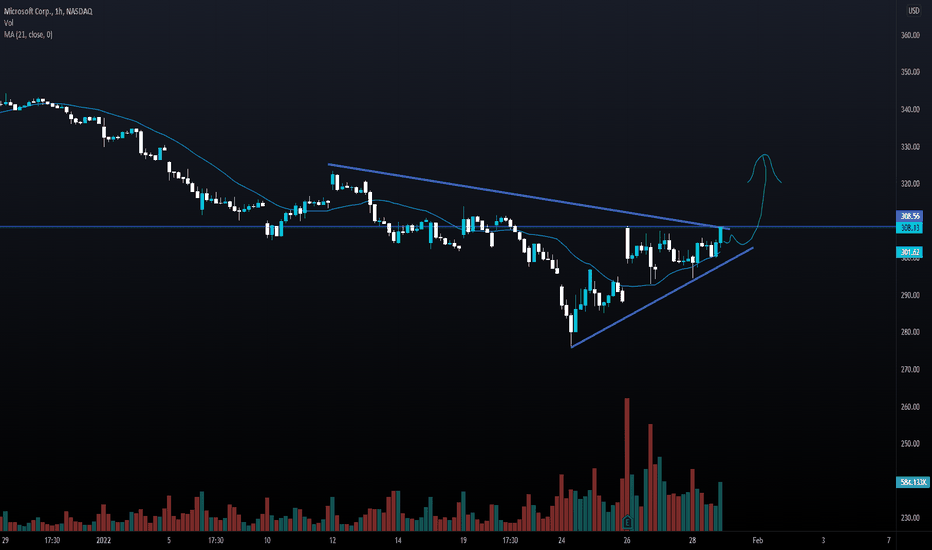

Microsoft - Blessing in disguiseLooks like it may come true wen they say Buy Fear - Sell Greed

Stock coming at strong Demand Zone

As it also is a Flip Zone

All the selling pressure have been absorbed can be seen

If sustains the current area may go on to touch new highs in coming days

Risk to reward most favorable at current levels

MSFT in correction mode after extended wave 3?Microsoft corporation is undergoing wave 4 correction in long term, wherein wave A is unfolding in 5 waves.

Currently wave (5) is extending and expected to tag 242 range. After this there would be a pull back and this would then named as Wave B in long term (This wave may 3 or 5 wave structure)

Lets wait and watch

Microsoft (MSFT) | The safest target to climb📍Hello traders, Microsoft in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

The general structure of this counted wave is unclear and we need more waves to detect it.

Now, according to the count, the main waves 1 and 2 have been formed and now we are inside wave 3.

This wave 3 has formed its wave 4 in such a way that it can not be said that it is complete or this ascent that we are considering is part of wave 4.

In terms of time, wave 4 is normal compared to wave 3.

We are currently waiting for an uptrend that this trend may take place before the 270 range and possibly after this price at which the correction structure will change and possibly end in a leading triangle.

If the canal roof is broken upwards, it is a confirmation to start the upward movement.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

Microsoft (MSFT) | The safest target to climb📍Hello traders, Microsoft in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

It is better for Rajab not to talk about the general nature of this wave and to explain only the counted part.

Based on the counting of the first wave 1 and 2, it has ended in a very normal state and now we are inside the third wave.

From wave 3, waves 1, 2 and 3 are completed and now wave 4 is taking place.

We thought that wave 4 was flat, but considering its current motion, which has a steep slope, this motion is part of a flat, in fact, wave a is this flat and the next ascending motion is for wave b, and this motion is done until the beginning of wave a.

We may have a descent to the previous floor before ascending.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

Microsoft (MSFT) | The safest place to buy🔥Hello traders, Microsoft in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

It is better not to talk about the general nature of this wave and only explain the counted part of the wave.

Based on the counting of the first wave 1 and 2, it has ended in a very normal state and now we are inside the third wave.

From wave 3, waves 1, 2, and 3 are completed, and now wave 4 is formed. As we previously thought, wave 4 was formed in the form of a flat, and from this flat, waves a and b are completed, and the structure of wave c is formed.

Wave c is at the end of its trend, both in terms of the number of waves and the ratio between waves a and b of the flat, as well as the ratio of the depth of this correction to wave 4, but the probability of correction to Fibo will be 0.38 and then the wave starts breaking the green circle. 5 is approved.

This analysis is also fielded if the trend moves beyond the resistance indicated by the warning sign.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

Microsoft (MSFT) | The best scenario for climbing📝Hello traders, Microsoft in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

It is better not to talk about the general nature of this wave and only explain the counting part.

Based on the counting of the first wave 1 and 2, it has ended in a very normal state and now we are inside the third wave.

From wave 3, waves 1, 2 and 3 are completed and now wave 4 is formed. We assume that wave 4 is formed in the form of a flat and from this flat 2 waves are needed to complete.

The end point of this wave, considering wave 2, which is a deep wave, can be around 0.23 and 0.38, and it is better to start the upward movement for wave 3 by hitting the trend line and breaking the upper side of the channel.

The target for Wave 3 is a multi-fibo collision.

If the warning sign is broken down, the field analysis is not done, but it returns to normal.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

Microsoft (MSFT) | The best scenario for climbing📝Hello traders, Microsoft in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

It is better not to talk about the general nature of this wave and only explain the counted part of the wave.

Based on the counting of the first wave 1 and 2, it has ended in a very normal state and now we are inside the third wave.

From wave 3, waves 1, 2, and 3 are completed, and now wave 4 is formed. We assume that wave 4 is formed in the form of a flat, and two waves are needed from this plate to complete, and the end point of this wave can be rough due to wave 2, which is deep. 0.23 and 0.38, and it is better to start the upward movement for wave 3 by hitting the trend line and breaking the upper side of the channel.

The target for Wave 3 is a multi-fibo collision.

If the warning sign fails, the field analysis will not go down, but will return to normal.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️