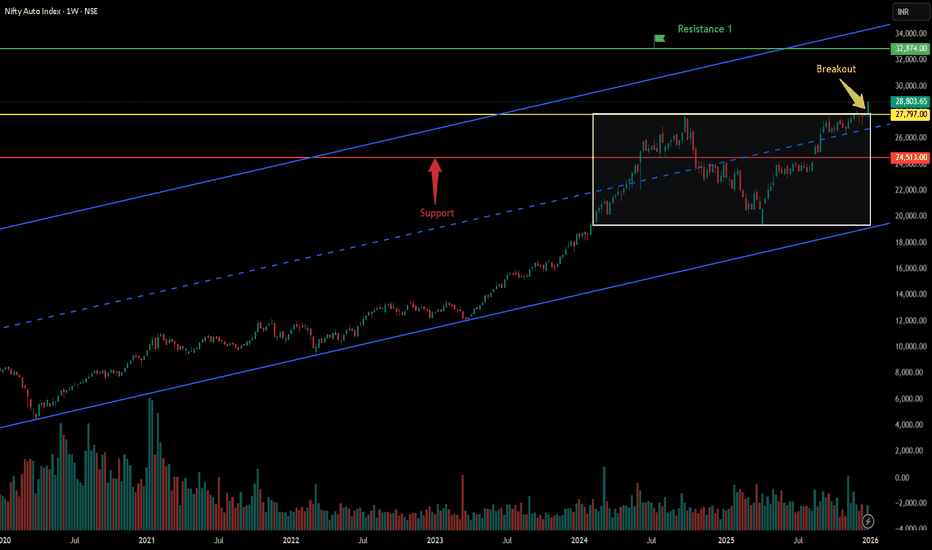

Breakout in Nifty Auto...Chart is self explanatory. Levels of breakout, possible up-moves (where index may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Niftyauto

Automotive Axles - ATH Breakout - Investment Ideas#Automotive Axles Limited - Technical Analysis

Current Price: 1,790.80

#Breakout & Retest = Opportunity

#Technical Setup

Strategy: Swing to Short Term Trade

✅ **ATH Breakout + Retest** - Successfully retested breakout zone

✅ **Higher High Formation** - Clear uptrend structure

✅ **EMAs Sorted** - Bullish alignment confirmed

✅ **Trendline Breakout** - Long-term resistance conquered

#Key Levels

Support: 1,520 (Tight SL) | 1,504 (Major support)

Swing Targets:

- T1: 2,078

- T2: 2,189

- T3: 2,284

Short-Term Targets:

- T1: 2,546

- T2: 2,800

- T3: 2,933

- Grand T4: 3,125

#tradesetup

Entry: Current levels (1,790 - 1,800)

Stop Loss: 1,520 (daily closing basis)

Risk-Reward: 1:3+ (excellent)

Timeframe: 2-6 months

Disclaimer: For educational purposes only. Not investment advice. Trading involves substantial risk. Consult a SEBI-registered financial advisor before making investment decisions. Past performance doesn't guarantee future results.

#AutomotiveAxles #SwingTrading #BreakoutTrading #TechnicalAnalysis #NSE #AutoStocks #ShortTermTrading #StockMarket #ATHBreakout #IndianStocks

Bullish Setup in Tata Motors on 1M TFHello Everyone,

Here I have analysed the Tata Motors chart and it looks bullish for long term.

It has took Support on previous strong support.

And that zone is also 0.50 fibonacci level which is an healthly retracement considered in price action analysis.

Stock has also given breakout recently which looks good on 1W Timeframe.

So this stock looks good on 1M and 1W TF, hence this can be considered as bullish setup.

Disclaimer: This is just an a price action analysis of stock Tata Motors. Don't consider this as an stock tip or advice. Invest/Trade at your own risk.

Bearish Engulfing in Maruti: Bounce or Selloff Ahead ?What happened today

The daily candle is a strong bearish engulfing—today’s real body fully engulfed yesterday’s real body. That shows aggressive supply stepping in and a potential short-term reversal after the prior advance.

Today’s high ₹15,250 is your invalidation: as long as the price stays below this, the bearish setup remains active.

What confirms the signal tomorrow

A follow-through (confirmation) candle that closes below today’s low and ideally on above-average volume.

Bonus confirmation if intraday retests of the engulfing body’s mid-point get sold into (upper wicks, weak closes).

Downside roadmap if confirmed

A confirmed breakdown increases odds of a slide toward ₹13,600 (prior demand/congestion) and then ₹13,000 (major psychological level / deeper demand).

Momentum often accelerates after an engulfing + follow-through combo; expect lower highs, weak bounces, and moving-average rollovers on shorter timeframes.

Risk management / trade plan (discipline first)

Trigger: Consider shorts only after confirmation—i.e., sustained trade below today’s low; avoid pre-empting if price gaps up and holds.

Stop: Above ₹15,250 (setup invalidation) or above the confirmation candle’s high if that’s tighter and still logical.

Targets: T1 ₹13,600, T2 ₹13,000; trail stops on lower highs to lock gains.

Avoid traps: A close back inside/above half of today’s body without follow-through weakens the signal; a decisive close above ₹15,250 invalidates the view.

Bottom line

Bearish engulfing sets the stage; a confirmation candle tomorrow is key. If it comes, ₹13,600 → ₹13,000 opens up. If not—and especially if ₹15,250 is reclaimed—the bearish thesis is off.

Nifty Auto Sector : A possible talk of the Town.The much talked sector of the Indian stock market is Automobile sector after the government slashed the GST rate from 28% to 18% for small cars and trimming effective tax on large engine SUVs.

Major gainer from the GST rate cuts were the companies dealing in passenger vehicles i.e. 4-wheeler & 2-wheeler.

1. Impact of rate cuts on Passenger Vehicles (2-wheelers)

a. Lower Price : India is a price sensitive market and the price cut will significantly boost the volumes as the entry level bikes and scooters will become affordable, a potential boost to the rural demand after a good monsoon this year.

b. Stock Makret reaction : HeroMoto Corp, Bajaj Auto and TVS Motors are the major beneficial of the GST reform. Analysts project mid to high sales growth in the 2-wheeler companies over the coming quarters as the sector will recover from the sluggish growth due to high inflation rate post-COVID .

c. Margin Expansion : Companies may pass most of the benefits to the consumers but could allow retention of a portion of the benefits, leading to improved Operating margins. Both demand boost and margin gains can be seen in premium models like Bajaj Pulsar, TVS Apache, Royal Enfield (Eicher Motors).

d. Impact on EV : EV scooters (Ola Electric, Ather, TVS iQube, Bajaj Chetak) already benefit from FAME-II subsidies. Now, with ICE two-wheelers getting cheaper, EV makers might face tighter price competition, but overall demand expansion will grow the entire category.

2. Impact of rate cuts on Passenger Vehicles (4-wheelers)

a. Price reduction fuels demand : GST cut on small cars, SUVs and large cars will reduce effective rate from 50%+ to around 40% making cars more affordable across segments, stimulating demand from middle class families as well as premium buyers.

b. Passenger Vehicles Boost : Maruti suzuki (small cars leader) is the biggest beneficiary as price sensitive buyers will return to showrooms. While M&M and Tata motors benefits from the SUVs, which remain the fastest growing category.

c. EV Four-Wheelers : GST cut makes ICE vehicles cheaper, but EVs (already taxed at just 5% GST) remain far cheaper on tax. Beneficiaries: Tata Motors (Nexon EV, Tigor EV), M&M (XUV400 EV, BE 6E, XEV 9E), Maruti (upcoming EVs).

3. Stocks and their YTD Returns

a. Hero Moto Corp (29.23%) : Dealing in 2-wheelers, the stock has giving good return and remain a hot stock as it had acquired 32.5% in Euler Motors, signaling entry into Electric 3-wheeler segment.

b. Bajaj Auto (4.18%) : Stock has delivered a Net profit of Rs. 2049 Crore (up~ 5.8%) while declaring a dividend too. The company has faces a potential "zero month" in August for EVs due to rare-earth magnet supply issues from China. Some brokerages remain neutral suggesting the stock is fully valued in the short term.

c. TVS Motors (46.78%) : Companies EV Expansion and its iQube saw 44% YoY growth. Company plans launching new EV Scooters and EV 3-wheelers.

d. Eicher Motors (36.47%) : Royal enfield recorded its highest quarter sale (~2.8 lakh units) and crossed 1 Million sales in FY25. Though, company will not be relaxed by the GST rate cuts as the premium Bikes (over 350 cc) will now be taxed 40% up from ~31%. Stock is creating new ATH high on the prospect of the Commercial vehicles as reduction of auto components costs by 7-8%. Better margins, improved volumes and healthy ROI in coming quarter, reinforces its growth outlook.

e. Maruti Suzuki (37%) : Maruti is the leading small car producers and will be the leading beneficial of the GST rate cut on small cars. The entry in the EV will also improve the company's portfolio and the upcoming festive season seeing the discounted rate of the GST may help boost the sales.

f. Tata Motors (-6.55%) : Company's outlook is mixed to cautiously optimistic, growth drivers include EV adoption and strong demand on the upcoming car models. Most analysts project modest upside in single digits.

g. Mahindra & Mahindra (19%) : Most beneficial of the GST rate as uniform rate of 40% across all SUVs, 18% on the small cars, 5% GST on tractor segment. The company has demonstrated impressive EV segment growth. The favorable GST reform, pent-up demand and strong booking will help company in good quarter numbers.

Indian Auto sector can be seen as a good sector to invest in for the upcoming quarter considering GST rate cuts, festive season demand and EV adoption.

Swing/Positional Trade Idea: Jamna Auto (NSE: JAMNAAUTO)Pattern Alert: Rounding Bottom Nears Breakout!

📈 Technical Setup

Daily Chart Pattern: Price is completing a multi-month rounding bottom (bullish reversal pattern), signaling accumulation.

Current Price: Consolidating near ₹88.80, approaching the crucial breakout zone of ₹94.25–95.60.

Confirmation Trigger: A decisive close above ₹95.60 on rising volume validates the breakout.

🎯 Trade Strategy

Entry: Buy on breakout confirmation above ₹95.60 (close basis).

Stop Loss: ₹86.36 (below the recent swing low & pattern support).

Targets:

T1: ₹106 (+11% from breakout)

T2: ₹113 (+18%)

T3: ₹123 (+29%)

T4: ₹133 (+39%)

Final Target: ₹149 (all-time high, +56%)

Risk-Reward: 1:5+ (based on SL to T1).

⚠️ Key Notes

Patience Required: This is a positional trade with a 3–6 month horizon. Hold through minor pullbacks.

Volume Confirmation: Breakout must be backed by +50% above average volume for conviction.

💡 Why This Works

Rounding bottoms indicate long-term trend reversal with high follow-through probability.

Targets align with Fibonacci extensions & prior swing highs.

Low-risk entry: Tight SL (8% risk) for asymmetric upside.

Trade smart. Track volume. Patience pays!

🔥 Like this idea? Hit "Boost" to increase visibility!

-------------------------------------------------------------------------------------------------------------

📜 GENERAL DISCLAIMER

This analysis is for educational purposes only and does not constitute financial advice, a recommendation, or an offer to buy/sell securities. Trading involves substantial risk of loss and is not suitable for every investor.

❗ KEY RISK ACKNOWLEDGMENTS

Not Personalized Advice: This idea is based on technical analysis and may not align with your risk profile, capital, or goals.

Past Performance ≠ Future Results: Patterns may fail due to market volatility, news, or sector weakness.

Capital Risk: You may lose all or more than your initial investment. Use only risk capital.

Stop Loss Execution: SL orders may trigger below ₹86.36 during gaps or low liquidity.

Holding Period: Positional trades require monitoring. Unforeseen events (earnings, regulations, global shocks) could invalidate the setup.

Bias Alert: This is a bullish bias idea. Always assess bearish scenarios.

🔍 Verify Independently

Cross-verify with fundamentals (debt, earnings, management).

Check broader market trends (Nifty Auto, Nifty 500).

Consult a SEBI-registered advisor before acting.

⚠️ YOUR RESPONSIBILITY

You alone are accountable for trading decisions. The author/platform assumes no liability for losses.

Ashokleyland Truck and Bus loaded with BULLS ?!!Yes!!!!

Chart patterns suggest me the above titled opinion of mine.

Reasons-

1. It's moving in a Ascending channel pattern from MARCH 2020 TILL NOW

2. 3 Upside candles(3 white soldiers) in monthly timeframe(shown below) with good rise in volumes

3. In weekly time frame, Bullish Marubozu candle Breakout seen with good volumes (shown below)

4. Coming to daily time frame, Inverted h&s pattern looks visible and Breakout has happened and now retesting.(there also 3 white soldiers visible)

5. As per pattern , target is about 20% from current levels.(soon to 150 level. )

6. We can enter now with sl as daily close below 120.4, targets -130,138,144 levels

Ashokleyland looks way good for the long term investment (buy and forget) too!! !

This is just my opinion...not a tip nor advice!!!!

Happy trading!!!!

Thank you!!!!

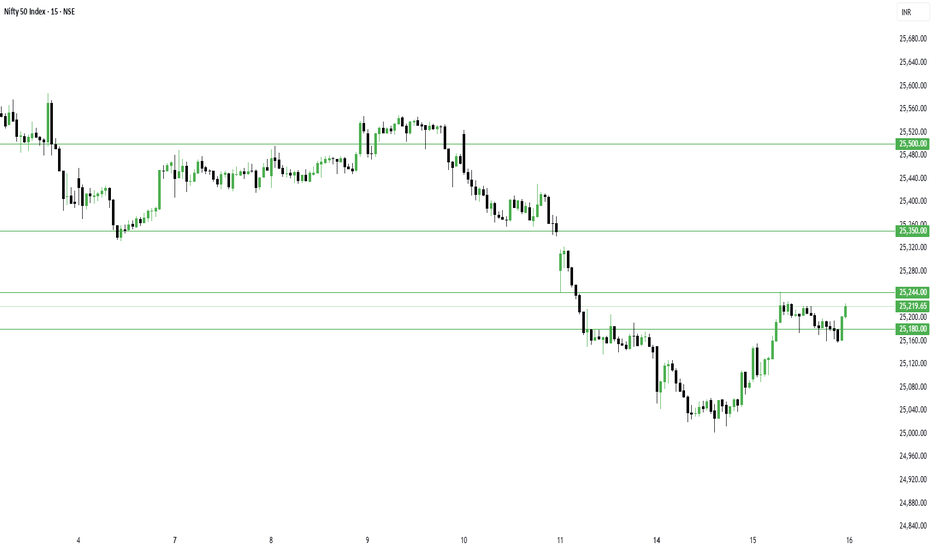

Pivot Low Formed, Follow-Up Buying Crucial – Nifty and BankniftyYesterday, i mentioned that sellers’ volume was 40 million higher than buyers, and for a new trend to emerge, today’s candle needed to absorb that supply.

And look what happened — today, buyers’ volume surpassed sellers’ by 82 million.

All the setups I traded today blasted exactly as expected:

NSE:SWARAJENG (Earnings Pivot) – +10%

NSE:SPORTKING – +5.92%

NSE:MOBIKWIK – +4.16%

For the short term, I am still holding NSE:CUPID , which has already given a 22% move in the last 3 sessions since my entry!

Now, coming to today’s market action:

NSE:NIFTY formed a Demand Candle today, and along with that, a Pivot Low has also been created.

The only missing piece is that the index hasn’t yet closed above 25200.

The message is clear — if we get follow-up buying tomorrow, the index could be ready for a fresh high.

For tomorrow:

Resistance: 25244 — once crossed, short covering can push it directly to 25350/25500.

Support: will be at 25180.

NSE:BANKNIFTY looks more positive, and this time, NSE:CNXPSUBANK could be the key driver.

For BankNifty:

- Support: 56965

- Resistance: 57260 — a close above this could trigger a move towards a new high.

Talking about sector rotation — in the short-term timeframe, a new sector has emerged: NSE:NIFTY_CONSR_DURBL

NSE:NIFTY_IPO stocks remain strong, and for intraday trades, NSE:CNXAUTO and NSE:NIFTY_EV stocks are at the top of the list. So if you’re planning tomorrow’s intraday trades, focus on these sectors.

That’s all for today.

Take care.

Have a profitable tomorrow.

Cummins India Ltd: Eyeing a Major BreakoutCummins India Ltd (NSE: CUMMINS) is signaling strong bullish momentum on the weekly chart with a falling wedge and bullish flag combination .

Key Insights:

Patterns: Falling wedge + bullish flag – strong continuation signals.

Current Price: ₹3,671.00 (+1.98%).

Breakout Zone: ₹3,750 (watch for a sustained move).

Targets: ₹3,929 → ₹4,169 → ₹4,500 → ₹5,600+ (bullish flag projection).

Support Levels: ₹3,422 and ₹3,251.

A breakout above ₹3,750 with volume confirmation could push prices toward ₹5,600+, aligning with the bullish flag target.

Bajaj Auto Ltd.: Descending Wedge - Breakout or Breakdown?Bajaj Auto Ltd. is currently trading within a descending wedge pattern, indicating potential consolidation or a breakout scenario. Here’s the technical breakdown:

Key Observations

Descending Wedge:

The price is narrowing, with lower highs and lows, signaling reduced selling momentum.

Support Zone:

₹8,800–₹8,900 serves as a strong support level. A breakdown below this could lead to further downside.

Resistance Levels:

₹9,262.90: Immediate resistance.

₹9,642.45 and ₹9,995.55: Higher levels to watch in case of a breakout.

Trade Outlook

Bullish View:

A breakout above the wedge’s upper trendline signals upward momentum, targeting ₹9,262 and beyond.

Bearish View:

A breakdown below ₹8,800 could push the price to ₹8,600 or ₹8,400.

Viaz Tyres Ltd: On the Verge of a Major Breakout or ReversalKey Highlights:

Resistance Zone (₹70-₹72):

The chart shows a well-defined resistance zone marked in red. This level has been tested multiple times without a breakout, making it a critical hurdle for the stock.

Ascending Trendline Support:

The blue trendline indicates a steady upward movement, with the stock consistently making higher lows. This trendline is currently acting as a strong support level, near ₹63.

Critical Support Level (₹53.90):

A red horizontal line at ₹53.90 highlights a strong support zone. If the price breaks below the ascending trendline, this level could act as the next major support.

Volume Analysis:

The stock is witnessing moderate volume near the consolidation phase, indicating indecision. A spike in volume could confirm a breakout or breakdown.

Potential Scenarios:

Bullish Outlook:

A breakout above ₹72 with strong volume could lead to a rally towards ₹85 or higher.

The ascending trendline suggests a positive bias as long as the price respects this support.

Bearish Outlook:

A breakdown below the trendline (₹63) may push the stock towards ₹53.90, the next support zone.

Failure to hold ₹53.90 could trigger further downside.

Takeaway:

The stock is currently consolidating between ₹65-₹72, forming a critical juncture for traders and investors. A breakout above resistance or breakdown below support levels will determine the next trend. Keep a close watch on volume for confirmation of the next move.

TVSMOTORReasons for considering a long position on TVS Motor:

1. Price at Support Zone: The daily horizontal support zone indicates a level where demand has historically been strong, which could push the price higher from here.

2. Above 200-Day Moving Average: Trading above this long-term moving average suggests a bullish trend, as it’s a widely-watched indicator of a stock’s overall direction.

3. Positive Relative Strength Against Nifty: Outperforming the Nifty shows that TVS Motor has stronger momentum, a good sign of investor confidence in this stock specifically.

4. Nifty Auto at Support Zone and 200-Day Moving Average: The sector’s overall strength at support, combined with it holding above the 200-day moving average, adds a supportive macro backdrop.

Waiting for confirmation with a CHOCH (Change of Character) on the 1-hour timeframe is a solid approach. Here’s a structured plan based on that:

1. Wait for CHOCH on 1-Hour: The CHOCH would confirm a potential shift in market structure, signaling the beginning of bullish momentum. This adds more reliability to the trade setup.

2. Entry on Retest / FVG / IFVG:

• Retest: After the CHOCH, a retest of the breakout zone could provide an optimal entry, ensuring the breakout holds.

• Fair Value Gap (FVG): If an FVG appears within this structure, entering here could capture the shift in momentum at a lower-risk point.

• Imbalance Fair Value Gap (IFVG): An entry on an IFVG could further refine your risk-to- reward ratio, especially if market liquidity fills these gaps.

TATA MOTORSReasons to consider going long on Tata Motors:

1. Technical Support Levels: Tata Motors is positioned at a horizontal support level and a fair value gap on the daily timeframe, indicating potential for a reversal or bounce.

2. Fundamental Strength: Tata Motors is fundamentally strong, likely benefiting from a well- positioned product line, growing market share, and financial resilience.

3. Sector Support: The Nifty Auto index is also at its support level and is taking support at the 200-day moving average, which could signal broader strength for the auto sector and support upward movement for stocks like Tata Motors.

Waiting for confirmation with a CHOCH (Change of Character) on the 1-hour timeframe is a solid approach. Here’s a structured plan based on that:

1. Wait for CHOCH on 1-Hour: The CHOCH would confirm a potential shift in market structure, signaling the beginning of bullish momentum. This adds more reliability to the trade setup.

2. Entry on Retest / FVG / IFVG:

• Retest: After the CHOCH, a retest of the breakout zone could provide an optimal entry, ensuring the breakout holds.

• Fair Value Gap (FVG): If an FVG appears within this structure, entering here could capture the shift in momentum at a lower-risk point.

• Imbalance Fair Value Gap (IFVG): An entry on an IFVG could further refine your risk-to- reward ratio, especially if market liquidity fills these gaps.

M&MThese are compelling reasons to consider a long position on M&M:

* Daily Support Level: When a stock holds at a daily support level, it often signals a buying opportunity as it tends to attract buyers, limiting downside risk.

* Above 200-Day Moving Average: This is a strong indicator of an uptrend. Trading above the 200-day moving average often suggests positive sentiment and longer-term bullishness.

* Relative Strength Against Nifty: Outperforming the broader market, such as Nifty, shows investor confidence in M&M compared to other sectors, suggesting resilience and potential for further upside.

* Nifty Auto on Support: Support in the Nifty Auto index can help support M&M’s price movement since positive sentiment across the sector typically benefits individual auto stocks.

Waiting for confirmation with a CHOCH (Change of Character) on the 1-hour timeframe is a solid approach. Here’s a structured plan based on that:

* Wait for CHOCH on 1-Hour: The CHOCH would confirm a potential shift in market structure, This adds more reliability to the trade setup.

* Entry on Retest / FVG / IFVG:

• Retest: After the CHOCH, a retest of the breakout zone could provide an optimal entry, ensuring the breakout holds.

• Fair Value Gap (FVG): If an FVG appears within this structure, entering here could capture the shift in momentum at a lower-risk point.

• Imbalance Fair Value Gap (IFVG): An entry on an IFVG could further refine your risk-to- reward ratio, especially if market liquidity fills these gaps.

Sobha LtdAll important points are marked.

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞 𝐬𝐮𝐛𝐣𝐞𝐜𝐭 𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐢𝐬𝐤𝐬, 𝐫𝐞𝐚𝐝 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐜𝐚𝐫𝐞𝐟𝐮𝐥𝐥𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠. 𝐒𝐭𝐨𝐜𝐤𝐬 𝐬𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐠𝐫𝐨𝐮𝐩 𝐚𝐫𝐞 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐩𝐮𝐫𝐩𝐨𝐬𝐞. 𝐖𝐞 𝐝𝐨𝐧𝐭 𝐦𝐚𝐤𝐞 𝐚𝐧𝐲 𝐩𝐫𝐨𝐟𝐢𝐭𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐢𝐬 𝐫𝐞𝐜𝐨𝐦𝐦𝐞𝐧𝐝𝐚𝐭𝐢𝐨𝐧𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐞𝐝 𝐡𝐞𝐫𝐞 𝐚𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐨𝐟 𝐟𝐫𝐞𝐞 𝐨𝐟 𝐜𝐨𝐬𝐭.

Macrotech developers Ltd (LODHA)All important points are marked.

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞 𝐬𝐮𝐛𝐣𝐞𝐜𝐭 𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐢𝐬𝐤𝐬, 𝐫𝐞𝐚𝐝 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐜𝐚𝐫𝐞𝐟𝐮𝐥𝐥𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠. 𝐒𝐭𝐨𝐜𝐤𝐬 𝐬𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐠𝐫𝐨𝐮𝐩 𝐚𝐫𝐞 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐩𝐮𝐫𝐩𝐨𝐬𝐞. 𝐖𝐞 𝐝𝐨𝐧𝐭 𝐦𝐚𝐤𝐞 𝐚𝐧𝐲 𝐩𝐫𝐨𝐟𝐢𝐭𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐢𝐬 𝐫𝐞𝐜𝐨𝐦𝐦𝐞𝐧𝐝𝐚𝐭𝐢𝐨𝐧𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐞𝐝 𝐡𝐞𝐫𝐞 𝐚𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐨𝐟 𝐟𝐫𝐞𝐞 𝐨𝐟 𝐜𝐨𝐬𝐭.

Mahindra and Mahindra ltdAll important points are marked.

𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐢𝐧 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐢𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞 𝐬𝐮𝐛𝐣𝐞𝐜𝐭 𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐢𝐬𝐤𝐬, 𝐫𝐞𝐚𝐝 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐜𝐚𝐫𝐞𝐟𝐮𝐥𝐥𝐲 𝐛𝐞𝐟𝐨𝐫𝐞 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠. 𝐒𝐭𝐨𝐜𝐤𝐬 𝐬𝐮𝐠𝐠𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐠𝐫𝐨𝐮𝐩 𝐚𝐫𝐞 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐩𝐮𝐫𝐩𝐨𝐬𝐞. 𝐖𝐞 𝐝𝐨𝐧𝐭 𝐦𝐚𝐤𝐞 𝐚𝐧𝐲 𝐩𝐫𝐨𝐟𝐢𝐭𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐢𝐬 𝐫𝐞𝐜𝐨𝐦𝐦𝐞𝐧𝐝𝐚𝐭𝐢𝐨𝐧𝐬 𝐞𝐯𝐞𝐫𝐲𝐭𝐡𝐢𝐧𝐠 𝐬𝐡𝐚𝐫𝐞𝐝 𝐡𝐞𝐫𝐞 𝐚𝐫𝐞 𝐜𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐨𝐟 𝐟𝐫𝐞𝐞 𝐨𝐟 𝐜𝐨𝐬𝐭.

TVS SUPPLY CHAIN SOL - Swing Trade Analysis - 21st April #stocksTVS SUPPLY CHAIN SOLUTIONS (1D TF) - Swing Trade Analysis given on 21st April, 2024

Pattern: ASCENDING TRIANGLE

- Volume Buildup at Resistance - Done ✓

- Resistance Breakout - In Progress

- Demand Zone Retest & Consolidation - In Progress

* Disclaimer

#tvs #niftyauto

Eicher motors around the resistance zone (26/02/24)

The stock has taken a nice support from the weekly 20 EMA and has closed around the previous candle close.

There is a resistance zone around 3950-3985. If this resistance is clear and price sustain above the level. There will be chance of stock touch its recent high around 4160 level.

In case there is a pullback and price action near the support zone (3765-3800) shows some positivity, a nice R:R ratio trade can be captured.

Possibility of stock dropping below the support zone is quite less and if it occures, short opportunity will be there upto the next support level.

Major support zone :- 3765-3800, 3600-3625

Positional trades in the stock can be created in this week as per the trend.

On the daily charts market is consolidating and there are chance of a break out. Next thursday being the monthly expiry march expiry options can be trades.

Both side momentum is possible in the stock. Nifty Auto is trading around the ATH.

Wait for the price action on the daily charts and enter accordingly.