SRF on the Edge of a Sharp BreakoutSRF seems to have finished its ABC correction near the 2770–2800 support zone, and the price has bounced back above 2859 , which now acts as a short-term trigger. If the stock stays above this level, it can move toward 3000 first, then 3160 , and possibly 3200 . The chart shows buyers gradually taking control again after the correction, but the outlook stays positive only as long as price holds above the support region.

Stay Tuned!

@Money_Dictators

Nsetips

JIOFIN Setting Up for the Next Big Breakout!JIOFIN Daily chart

Possible short-term dip toward 285 - 290.

Long-term Levels: 335, 368, and 342.

Overall Trend: Bullish

Short-term trend: Bearish

JIOFIN is ready for the final upsurge as the correction ends at wave (C). A major A-B-C correction of the primary degree is clearly visible on the daily timeframe chart. Upon closer examination, it appears that the JIOFIN is currently in wave (Y) of wave 4. After completion of the wave 4 structure, stock will set for the wave 4 for the given long-term levels.

Stay tuned!

@Money_Dictators

Thanks :)

NSE IOC – Approaching a Key Demand ZoneTimeframe: Daily

After reaching a high of 196.8, the price has declined by over 39% in 13 weeks. It is currently trading below the 50/100 EMA band, with ATR at 3.68 and ADX at 26.02 . According to the Elliott Wave projection, the peak of 196.80 can be identified as a wave ((3)). The security is currently undergoing the formation of a corrective wave (4).

Wave (B) formed at 185.97 , while wave 4 of wave (C) was completed at 145.10 . NSE IOC is now setting up for the final wave 5 of wave (C).

Two key Fibonacci relationships help estimate the end of the correction:

1.618 Fibonacci extension of wave (A) at 106.54 (for wave C)

0.618 Fibonacci extension of wave 1 at 115.52 (for wave 5)

The price is expected to settle between 115 and 105 , which serves as a key demand zone for buyers. If the price breaks out and sustains above 129.75, traders can target the following levels: 139 – 156 – 172+.

we will update further information soon.

NSE GLAND: A Critical Resistance Zone That Could Shift the TrendTimeframe: Daily

In NSE GLAND, the price has respected the channel in three distinct moves, indicating a potential 3-wave correction setup. Currently, it is trading below the 50 and 100 EMA, with ATR at 55.96 and ADX at 42.07 .

After reaching a high of 2220 , the price declined and formed a corrective structure. Wave (A) completed at 1585.7 , followed by wave (B) at 1964 . Presently, wave 4 of wave (C) is in formation. The 1545-1585 zone serves as a strong resistance, where a decisive breakout could shift the trend. However, the price still needs to reach 1328 to complete a 100% extension of wave A, making wave C = wave A at 1328 . A strong throw-under could enhance the probability of revisiting levels near wave (B).

We will update further information soon.

Is Tata Motors Ready for a Bullish Reversal?Timeframe: Daily

Tata Motors (NSE) has been in an expanded flat correction pattern for the past 11 months. In this pattern, the highest high (HH) was 1179, and the lowest low (LL) was 683.2. Currently, the price is trading below the 200, 100, and 50 EMA levels, indicating a bearish trend.

In this expanded flat correction:

Wave (A) completed at 855.4,

Wave (B) peaked at 1179,

Sub-wave 4 of Wave (C) touched 786.65,

Sub-wave 5 is now unfolding.

Once Wave 5 is completed, traders can look for buying opportunities with target levels at 799 – 951 – 1050+. First, it’s crucial to identify the end of Wave (C) to confirm the correction’s completion and a bullish reversal.

Projecting ending point of wave (C):

Wave (C) may end at 2.618% of Wave (A) around 628.7.

Wave 5 has multiple potential targets/support levels:

0.618 extension of Wave 1 at 526,

0.382 extension of Wave 1 at 628,

1.618 reverse Fibonacci of Wave 4 at 657,

2.618 reverse Fibonacci of Wave 4 at 562.

We will update further information soon.

TATACONSUM: Upcoming Price Surge Projection

Timeframe: 4h

NSE TATACONSUM has formed a correction on the 4-hour timeframe chart. A closer look at wave A reveals it consists of three distinct waves, indicating it can't be labeled as an impulse. The security has broken below the 50, 100, and 200 EMA, with the Average True Range (ATR) at 15 .

Currently, the price is developing wave (iv) of wave C within wave (B). Wave (B) has already reached 100% of wave A, and with bullish sentiment, the price could surge from this point. However, we need confirmation through a breakout of the sub-structure. After wave (B) is completed, traders can use wave (iv) as an entry point to confirm a long setup. Fibonacci clusters indicate potential levels at 1189 - 1246 - 1296. Risky traders entering right after the completion should confirm their position with a lower high.

We will provide further updates soon.

- KP (Trade Technique)

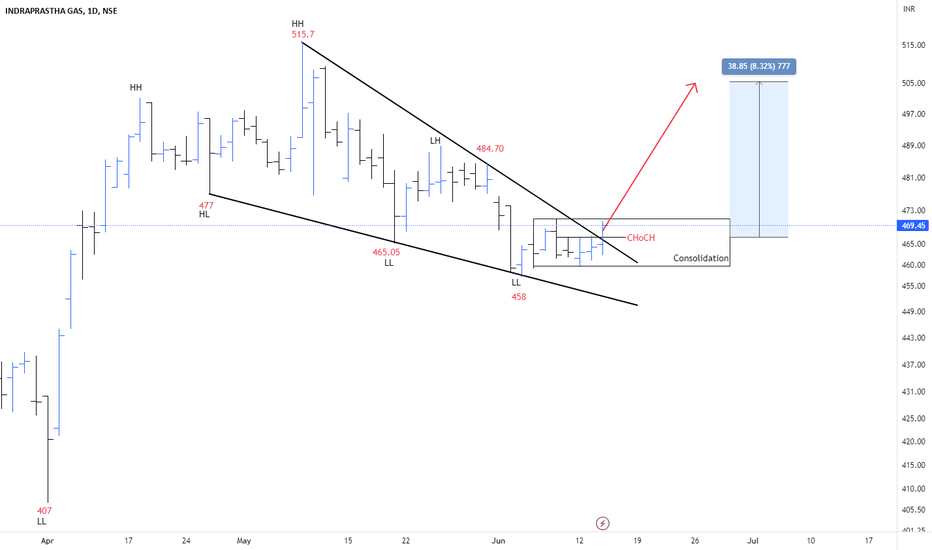

IGL: Bullish Falling Wedge Pattern IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs.

The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 .

Buyers have to break and stay above 504 to increase demand pressure.

Note: Do your own research / discuss it with your advisor

NSE 3MINDIA – ELLIOTT WAVE ANALYSISTimeframe: Daily

3M India has given a good move after 100% extension of wave A. Note wave A = B is at 21368.9 . Price entered into the corrective channel, which signals an impending bullish move. 22292 is a pivot level for 3MINDIA.

Wave C is the ending point of the correction, and traders can trade for the following targets: 22564 – 22850 – 23282 . There will be an extension of the target after the breakout of wave (B).

I will update further information soon.

NSE PEL: Watch-Out For Cup And Handle BreakoutPrice has been trading in the long-term channels for more than 16 months. After making a low of 785 , prices started rising to the upper band of the parallel channel. Currently, prices are trading above 100 EMA .

PEL has formed a value area with a cup and handle pattern. The neckline of the cup and handle pattern is also the upper band of the value area at 915 .

ABCAPITAL Elliott Wave StudyTF - Monthly -

Aditya Birla capital had broken out descending trendline at 80 . But, due to supply pressure, it couldn't make a new high again. It ends up making the same high(double top).

AB CAPITAL has made a monthly consolidation range of 139 - 95

As per the monthly chart, AB CAPITAL can take support from 78.05 .

Three reasons to consider this level:

1. AB CAPITAL has given five touches to this level.

2. AB CAPITAL had taken support and broken up the trendline.

3. AB CAPITAL can retraced 61.8 % at 76.45 , which is demand zone.

If AB CAPITAL breaks down to 90 , then it will come to take support near 78.05.

TF: Daily -

AB CAPITAL has completed corrective waves A & B . Wave C of wave 4 is about to completed.

We are getting similar confirmation that if AB capital breaks down to 90.05 , we can expect a support level of 78.05 .

As per Elliott wave, wave 4 can complete near the previous 4th wave of lower degree.

Wave 4 of lower degree is a 78.50 . We got the confluence zone as 78.05 . After taking support level, AB CAPITAL will start its upward march.

I will update more information soon.

Thank you!

@Money_Dictators

BEL Has Started Wave CBEL has completed impulsive wave 5 at 258 and started declining for corrective formation.

BEL has completed corrective wave 5 of C of B at 250 . Now, BEL is forming lower degree's waves of wave C. If it sustains below 245 , BEL can fall for following support levels: 235 - 224 - 215.

Wave C can complete near 100 of wave A at 215 . It is called A=B .

I will share more information soon.

Thank you

@Money_Dictators

EWT - Is EICHERMOT Forming Wave (5) Of Its WaveCycle?Timeframe: Daily

NSE EICHER motors have accomplished the corrective wave (4) and started forming impulsive waves (5). The price is currently forming sub-waves of the impulsive waves (5).

Wave (2) was a sharp zigzag, so wave (4) formed the choppy structure triangle. Since wave (3) was an extensive wave, we cannot expect wave (5) to extend with a high probability.

Eicher motors have given a good breakout and broken out wave 2 of the triangle and impulsive wave (3). If the price sustains above 3790 , traders can trade for the following targets: 3948 -3992 - 4030+ .

I will update further information soon.

NSE Adani Ports Is Growing But The Truncation level is there Key Level: 824 & 853

Adani Port has broken down the corrective wave X and started forming an impulse wave ((5)).

Price had broken down the 8-month-old correction, and Adani Port surged rapidly. Adani Port can u-turn from 1.618% at 1049 . It is a reverse Fibonacci of wave ((4)). Currently, the price is at the 78.6 % reverse Fibonacci level at 853.

If Adani port fails to break the previous high at 901 , there will be a case of truncation. It shows that the current impulsive move has a lack of demand pressure. Then the decline will be 3x more powerful than the normal corrective wave.

Bajaj Finserv: Elliott Wave Analysis & TipsBajaj Finserv has started it's final bearish, where we have seen a speculative boom downside. After breaking 50 & 200 EMAs , it started falling for wave Z .

Traders can expect the following targets: 14631 - 14449 - 14176 . The Control line will work as a hurdle for intraday traders.

Bajaj Finserv has formed in the descending channel for more than 27 weeks . It has broken the control line's channel also. That indicates bulls are not ready to expect a falling knife.

Measurement of wave ((4)):

Wave ((4)) can accomplish 38.2% of wave ((3)) at 14000 .

Wave ((4)) can complete at the lower band of the parallel channel because the price has created a throw-out action.

Sometimes, prices do not break the low of wave ((Y)) due to less momentum and supply deficiency. And it causes orthodox bottoms.

After the completion of wave (z) of wave (4), the price will march for motive wave (5).If the price sustains above wave (X) at 17480 , Bajaj Finserv will move on for an all-time high.

Note: ending point of the corrective structure is the starting point of an impulsive phase.

I will update further information soon.

Bajaj Finserv: Short Setup For Intraday TradersAfter making a high of 17480, Bajaj Finserv has started falling.

Today, It has made a low of 14660 .

In 15 min timeframe, we can see a bearish butterfly pattern, which indicates a bearish trading setup for intraday traders.

Bajaj Finserv has completed its D point at 15250 . If the price sustains below 15250 , traders can expect the following targets: 15080 - 14902 - 14751.

Invalidation: Breakout D point

Thank You

Money_Dictators

BANKNIFTY Can't Wait to Fall – Even Without NIFTY’s Help Key levels: 36496 - 37060

Bank Nifty was following the uptrend channel from Dec 2020, and it had broke on 02 March '22. There's a new parallel channel unfolded.

In the last trading session, Banknifty has created a shooting star pattern. And this pattern is a single line pattern that indicates an end to the uptrend. At the same time, it is close to a parallel channel resistance line. Moreover, advance traders must look at 100 EMA on it. These signs are signaling further decline. And that could be from the parallel channel's resistance line to control price.

An uptrend possibility comes from key levels breakout. So intraday traders can use it as an invalidation level. Moreover, Banknifty prices can hike up to that level this week.

If Banknifty doesn't cross/close above the second level, you should prepare for the following targets: 36000 - 35800 - 35400 below

NSE KoltePatil Stocks Prior Uptrend ResumeNSE KoltePatil stock overwhelmed today, and it hiked +34.10 ( +12.30% ). Technically, the A B C correction of the Elliott Wave is over. We can expect impulsive moves ahead. Today's volume spike and breakout of EMA 100 indicate bulls are stepping in. The uptrend can extend up to 322 - 340 - 350+ target price for intraday traders.

Further information I will update soon.

NSE AEGISCHEM More Selling BeginsAegis Logistics is seemed bearish more. It's the top loser stock of last Friday's market session. I have drawn this chart to show a bearish area to short-term investors. Wherein AEGISCHEM can show 150 - 138 - 118 levels into that area.

Intraday traders can sell for targets of 166 - 164 levels. And if it breaks the 164 level, then be ready for a downtrend.

Will BANK NIFTY Hit 37800 Today?Bank Nifty had stuck into the descending channel (DC) from 25 Oct to 07 Dec. The upper trendline of DC has broken and started moving forward. It has filled the 25 Nov gap yesterday and marching towards the supply zone. We have chances to see 37600 – 37800+ levels today. Intraday traders can take benefit of it.

But you must note the second resistance of 36871 . It’s a barrier for buyers. If Bank Nifty remains under of it, then we may see an excess of this channel. And that will collapse the Bank Nifty prices from 36800 to 36300 – 35696 below. That’s why I have highlighted the supply zone in the above chart with a strict warning.

I have used RSI and Stoch RSI together. The Stoch RSI is indicating a downtrend ahead. But, others (MA, DMI, & RSI) are throwing positive signs. Hence, you have to focus on the second resistance line only.

Further any changes/details I will update during the market hours.

Kotak Bank Has An Explosive Rally AheadNSE Kotak Mahindra Bank has started marching upside because it has completed wave ((4)). Its fifth wave will end nearby the retracement of wave ((4)) of 161.8% and sub-wave of (4) of 161.8%. So, long-term investors may hold for the targets of 2345 - 2446 - 2536 .

At present, intraday & short-term investors can also jump on this stock. Kotak bank prices may move forward up to 1900 - 1960 - 2056 levels to hit the halfway of wave 5th. Consecutive closing above the level of 1832 is a direct buy signal.

A short reversal is expected at the last target of 2056 .

Further information I will update you soon. Stay connected!

Is zeel preparing for a bull run?ZEEL is forming 3rd impulsive wave. Wave 2 has taken a reversal from a 61.8% Fibonacci ratio.

If zeel is forming wave 3, we should at least get a 161.8% extension of wave 1.

Target 1:390

Target 2:362

Target 3:335

Invalidation: Wave 2 can never overlap the starting point of the wave.