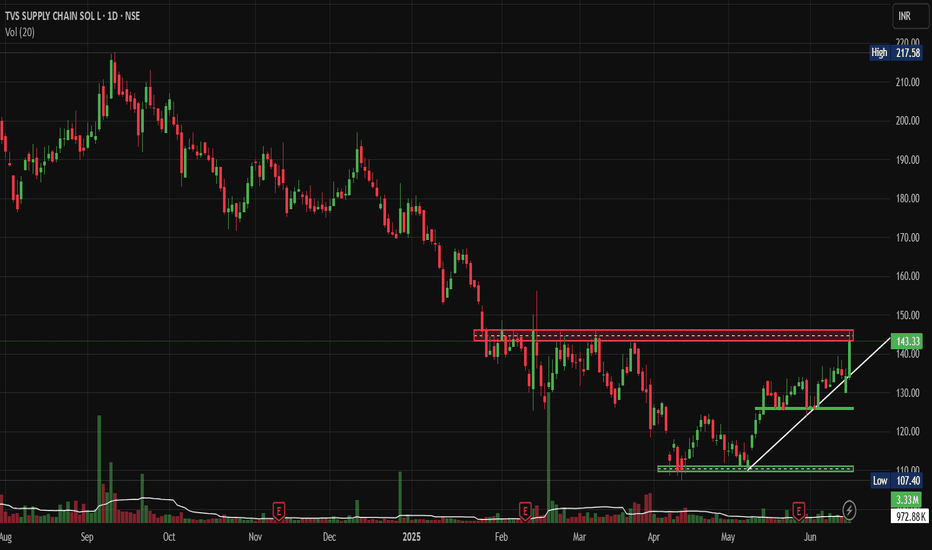

TVS Supply Chain: BO attempt after 6 Month Consolidation.This Supply Chain Giant is attempting to break out. After 6 Months of Consolidation - Is it Time to Load Up? Let's analyse today's Idea.

Price Action Analysis:

Current Market Structure:

• Stock is currently trading at ₹143.33, showing a strong +6.83% gain

• Price has broken above a key resistance zone around the ₹140 level

• Clear uptrend formation with a higher highs and higher lows pattern emerging

• Recent breakout attempt from a prolonged consolidation phase

Historical Price Movement:

• Stock witnessed a sharp decline from highs of ₹217+ in late 2024 to lows around ₹107

• Extended consolidation phase from February to May 2025 between ₹110-145 levels

• Current breakout attempt suggests potential trend reversal from bearish to bullish

Volume Spread Analysis:

Volume Characteristics:

• Significant volume spike visible during the recent breakout session

• Volume of 3.33M is substantially higher than the 20-day average of 972.88K

• Volume confirmation supporting the price breakout attempt above resistance

• Previous volume spikes coincided with major price movements

Volume Price Relationship:

• Healthy volume-price relationship during the current upward move

• Relatively lower volumes accompanied earlier decline phases

• Current breakout attempt volume suggests institutional participation

Key Technical Levels:

Support Levels:

• Primary Support: ₹130-132 (previous resistance turned support)

• Secondary Support: ₹120-125 (consolidation zone low)

• Major Support: ₹110-115 (multi-month consolidation bottom)

Resistance Levels:

• Immediate Resistance: ₹150-155 (psychological level)

• Medium-term Resistance: ₹165-170 (previous swing high)

• Major Resistance: ₹185-190 (Fibonacci retracement level)

Base Formation:

• Rectangle consolidation pattern formed between ₹110-145 levels

• Base duration: Approximately 4-5 months (February to May 2025)

• Breakout from this base suggests potential for sustained upward movement

Technical Patterns:

Primary Patterns:

• Rectangle/Box pattern completion with upward breakout attempt

• Potential inverse head and shoulders pattern on a longer timeframe

• Ascending triangle formation in recent weeks before the breakout

Trend Analysis:

• Short-term trend: Bullish (breakout confirmed)

• Medium-term trend: Transitioning from bearish to bullish

• Long-term trend: Still in recovery phase from major decline

Trade Setup and Strategy:

Entry Strategy:

• Aggressive Entry: ₹143-145 (current levels on any minor pullback)

• Conservative Entry: ₹135-138 (on retest of breakout level)

• Volume confirmation is required for any entry

Position Sizing:

• Risk 1-2% of portfolio capital on this trade

• Position size calculation: Portfolio Value × Risk % ÷ Stop Loss Distance

• Example: For ₹1,00,000 portfolio with 2% risk = ₹2,000 risk capital

Risk-Reward Calculation:

• Risk-Reward Ratio: Minimum 1:2 preferred

• Expected risk per share: ₹15-20 based on stop loss placement

• Potential reward: ₹30-40 per share to the first target

Exit Strategy:

Profit Targets:

• Target 1: ₹165-170 (15-20% upside) - Book 40% position

• Target 2: ₹185-190 (30-35% upside) - Book 40% position

• Target 3: ₹200+ (40 %+ upside) - Trail remaining 20% position

Stop Loss Levels:

• Initial Stop Loss: ₹125-128 (below consolidation support)

• Trailing Stop: Move to breakeven once Target 1 is achieved

• Final Trail: Use 10-day EMA or ₹10-15 trailing stop

Risk Management Framework:

Risk Control Measures:

• Maximum loss per trade: 2% of total capital

• Position sizing based on stop loss distance

• No averaging down if the trade goes against the initial thesis

• Exit if the technical structure breaks down

Portfolio Allocation:

• Maximum exposure to single stock: 5-8% of portfolio

• Sector allocation limit: 15-20% to logistics/supply chain

• Maintain diversification across market caps and sectors

Sectoral Analysis:

Logistics and Supply Chain Sector:

• The sector has shown resilience post-pandemic disruptions

• Growing e-commerce and digitalization are driving demand

• Government infrastructure push benefiting logistics companies

• Increasing focus on supply chain optimization across industries

Sector Positioning:

• NSE:TVSSCS is positioned in the growing third-party logistics market

• Beneficiary of Make in India and manufacturing growth

• Automotive sector recovery supporting the company's core business

Fundamental Backdrop:

Business Overview:

• Leading third-party logistics and supply chain solutions provider

• Strong presence in automotive, consumer goods, and industrial sectors

• Integrated service offerings including warehousing, transportation, and value-added services

Growth Drivers:

• Expansion in new geographies and service offerings

• Technology-driven efficiency improvements

• Growing outsourcing trend in supply chain management

• Recovery in the automotive sector supporting traditional business

Market Outlook and Catalysts:

Positive Catalysts:

• New client acquisitions and contract wins

• Capacity expansion announcements

• Favourable government policies for the logistics sector

Risk Factors:

• Economic slowdown affecting industrial demand

• Fuel price volatility is impacting transportation costs

• Competitive pricing pressure in the logistics industry

• Global supply chain disruptions

My Take:

TVS Supply Chain Solutions presents a compelling technical setup with the recent breakout attempt from a multi-month consolidation. The combination of strong volume confirmation, supportive sectoral trends, and improving fundamental backdrop makes this an attractive opportunity for Short to medium-term investors. However, proper risk management and position sizing remain crucial for the successful execution of this trade setup.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Rectanglepattern

Venus Pipes Explodes 12% Breaking Out of 6-Month BaseNSE:VENUSPIPES Explodes 12%: Breaking Out of 6-Month Base Could Target ₹1,600 as it made a Beautiful Chart Structure Just Before Q4 FY25 Results.

Price Action Analysis

NSE:VENUSPIPES is experiencing a significant breakout moment, currently trading at ₹1,452.00 with an impressive 12.37% gain (₹159.80). The stock has decisively broken above a critical resistance zone around ₹1,400-1,420 after consolidating in a well-defined base for nearly six months. This breakout comes with strong momentum and represents a potential shift from accumulation to the markup phase.

Volume Analysis:

Volume is exceptionally strong at 626.33K shares compared to the average of 85.02K - nearly 7.5x times normal volume. This massive surge in participation validates the breakout and suggests institutional buying interest. The volume spike coinciding with the price breakout is a textbook confirmation signal that significantly increases the probability of continuation.

Key Support & Resistance Levels:

- Newly Broken Resistance: ₹1,400-1,420 zone (now potential support)

- Next Major Resistance: ₹1,500-1,520 (psychological level and previous resistance)

- Ultimate Target Resistance: ₹1,900-1,950 (red horizontal line - major resistance from earlier highs)

- Strong Base Support: ₹1,100-1,150 zone (multiple green arrows showing successful tests)

- Immediate Support: ₹1,380-1,400 (previous resistance becomes support)

Technical Patterns:

1. Rectangle Breakout: Clean break above the 6-month consolidation range (₹1,100-1,420)

2. Multiple Bottom Formation: Several tests of the ₹1,100-1,150 support zone (marked with green arrows)

3. Ascending Triangle: Recent price action shows higher lows approaching the ₹1,420 resistance

4. Volume Breakout Pattern: Classic high-volume breakout from a prolonged base

Trade Setup - Breakout Continuation

Primary Entry Strategy:

- Entry Point: ₹1,440-1,460 (current levels or minor pullback)

- Aggressive Entry: ₹1,420-1,430 (on any retest of breakout level)

Target Levels:

- First Target: ₹1,520-1,540 (psychological resistance and measured move)

- Second Target: ₹1,650-1,680 (extension target based on base width)

- Ultimate Target: ₹1,800-1,850 (major resistance zone approach)

Risk Management:

- Stop Loss: ₹1,350 (below the breakout zone and recent support)

- Tight Stop: ₹1,390 for short-term traders

- Position Size: Maximum 2-3% of portfolio at risk

Alternative Setup - Conservative Approach

For risk-averse traders:

- Entry: ₹1,480-1,500 (after clearing first resistance convincingly)

- Stop Loss: ₹1,420 (below confirmed breakout level)

- Targets: ₹1,600, ₹1,750

Pattern Analysis:

The stock has formed a solid 6-month base between ₹1,100-1,420, allowing for significant accumulation. The multiple tests of support around ₹1,100-1,150 (green arrows) demonstrate strong buying interest at lower levels. The recent ascending triangle formation within the larger rectangle pattern suggests building momentum that has now been released.

Risk-Reward Assessment:

- Primary Setup R:R: 1:2.8 (Entry ₹1,450, Stop ₹1,350, Target ₹1,730)

- Breakout Target: Rectangle pattern suggests potential for 25-30% move

- Failure Risk: Breakdown below ₹1,380 would invalidate the bullish setup

Key Technical Factors:

The convergence of multiple bullish signals - rectangle breakout, volume confirmation, successful base building, and momentum surge - creates a high-probability setup. The stock has spent considerable time building this base, and the breakout with such strong volume suggests genuine institutional participation rather than retail speculation.

Trading Strategy:

Traders should look for any minor pullbacks to the ₹1,420-1,440 zone as ideal entry opportunities. The key is to ensure the breakout level holds as support. A sustained move above ₹1,500 would confirm the pattern and likely attract momentum buying, potentially accelerating the move toward the ₹1,650-1,700 zone.

Monitor for any evening star or shooting star patterns at resistance levels, which could signal temporary exhaustion and provide profit-taking opportunities.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Advanced Enzymes: Fresh Breakout Above Key ResistanceNSE:ADVENZYMES Made a Beautiful Chart Structure, Gave Fresh Breakout Above Key Resistance, Could Now Trigger 20% Rally - Time to Buy the Dip?

Pattern Recognition and Base Formation:

NSE:ADVENZYMES has been consolidating in a well-defined rectangular trading range for the past 3-4 months, oscillating between ₹260-305 levels. This sideways consolidation represents a healthy digestion phase after the stock's earlier decline from highs around ₹350.

The most recent price action shows a decisive breakout above the ₹305 resistance level on strong volume expansion, suggesting institutional participation and potential trend reversal. The stock appears to be forming a classic "rectangle breakout" pattern, which typically signals continuation of the prevailing trend or reversal from consolidation.

Key Technical Levels Analysis:

Key Support Levels:

- Immediate Support: ₹285-290 (recent breakout zone, now expected to act as support)

- Major Support: ₹270-275 (mid-range consolidation area with multiple touches)

- Critical Support: ₹260-265 (lower boundary of the rectangle pattern)

- Ultimate Floor: ₹257.90 (52-week low and absolute support)

Key Resistance Levels:

- Immediate Resistance: ₹315-320 (psychological round number resistance)

- Next Target: ₹330-335 (halfway to previous highs)

- Major Target: ₹350 (previous high retest)

- Extension Target: ₹365-370 (measured move from rectangle pattern)

Volume Spread Analysis:

Today's volume surge to 776.33K shares represents nearly 5x the average daily volume of 162.61K, indicating significant institutional interest. This volume expansion accompanying the breakout is a critical confirmation signal that validates the technical setup.

The volume pattern during the consolidation phase showed typical accumulation characteristics - higher volume during declines and moderate volume during bounces, until today's breakout, which shows strong participation.

Technical Pattern Assessment:

Primary Pattern: Rectangle/Trading Range Breakout

- Formation Period: February 2025 - May 2025

- Range: ₹260-305 (approximately ₹45 range)

- Breakout Level: ₹305 (achieved with volume confirmation)

- Measured Target: ₹350+ (adding range height to breakout point)

The pattern shows multiple tests of both support and resistance levels, indicating a mature base formation with strong hands accumulating positions during weakness.

Trade Setup:

Setup Classification: Breakout Play with Volume Confirmation

Entry Strategies:

- Aggressive Entry: ₹300-305 (current levels on any minor pullback)

- Conservative Entry: ₹285-290 (on retest of breakout level for better risk-reward)

- Value Entry: ₹275-280 (if deeper pullback occurs, though less likely given volume surge)

Position Sizing:

- Initial Allocation: 1-2% of portfolio (given setup quality and volume confirmation)

- Scaling Strategy: Add on pullbacks to support levels

Profit Taking Approach:

- Target 1: ₹325-330 (6-8% upside) - Book 30% of position

- Target 2: ₹345-350 (12-15% upside) - Book 40% of position

- Target 3: ₹365-370 (18-20% upside) - Hold remaining 30% for potential extension

Risk Management Framework:

- Tight Stop: ₹295 (3-4% downside for short-term traders)

- Swing Stop: ₹285 (7-8% downside for position traders)

- Pattern Stop: ₹275 (10% downside - invalidates bullish setup if breached)

Sectoral and Fundamental Backdrop:

NSE:ADVENZYMES operates in the speciality chemicals and biotechnology space, focusing on enzyme manufacturing for various industrial applications. The sector dynamics are currently favourable due to:

Industry Tailwinds:

- Growing demand for sustainable and eco-friendly industrial processes

- Increasing adoption of enzyme-based solutions in food processing, textiles, and pharmaceuticals

- Government push for bio-based manufacturing and green chemistry initiatives

- Rising exports of speciality chemicals from India

Company Specific Factors:

- Strong research and development capabilities in enzyme technology

- Diversified application portfolio reducing single-sector dependency

- Established client relationships in domestic and international markets

- Beneficiary of the "Make in India" initiative in speciality chemicals

Fundamental Support:

- Consistent revenue growth trajectory in recent quarters

- Improving operating margins due to product mix optimization

- Strong balance sheet with manageable debt levels

- Increasing focus on value-added enzyme products

Risk Assessment:

Bullish Catalysts:

- Volume-confirmed breakout from 3-month consolidation

- Strong sectoral tailwinds supporting long-term growth

- Technical pattern completion with clear target levels

- Established support base providing downside protection

Risk Factors:

- Broader market volatility could impact momentum stocks

- The speciality chemicals sector's sensitivity to raw material costs

- Global economic slowdown affecting industrial demand

- Competition from larger multinational enzyme manufacturers

My Take and Recommendation:

NSE:ADVENZYMES presents a compelling technical setup with the stock breaking out of a well-established 3-month trading range on exceptional volume. The combination of strong technical patterns, sectoral tailwinds, and reasonable fundamental backdrop creates an attractive risk-adjusted opportunity.

The immediate focus should be on the stock's ability to sustain above the ₹305 breakout level and build momentum toward the ₹325-330 resistance zone. Any pullback to the ₹285-290 area would offer an excellent secondary entry point with improved risk-reward parameters.

Given the volume confirmation and sector dynamics, the stock appears positioned for a potential move toward its previous highs around ₹350, representing approximately 15% upside from current levels. However, traders should maintain disciplined risk management and respect the established support levels to protect capital in case of adverse market conditions.

The next few trading sessions will be crucial to determine whether this breakout has the sustainability to trigger the next leg of the rally or if it represents a false breakout requiring reassessment of the bullish thesis.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Shaily Eng Plastics Makes a Power MoveNSE:SHAILY Makes a Power Move on Hourly Charts after Q4 Results.

Price Action Analysis:

The stock is currently trading at ₹1,811.20. After consolidating near the ₹1,650-1,680 support zone for several days, SHAILY has broken out strongly to the upside, reclaiming previous highs near ₹1,820. The price action shows a series of higher lows since the early May bottom, indicating increasing bullish momentum.

Volume Analysis:

Volume has been healthy at 46.63K shares, significantly above the 30.96K average volume. This confirms genuine buying interest supporting the recent breakout. The volume spikes align with key price movements, particularly during the recent bullish moves, which validates the strength of the current uptrend.

Support & Resistance Levels:

- Key Resistance: ₹1,835-1,850 zone (previous high)

- Immediate Breakout Level: ₹1,820 (now acting as support)

- Major Support: ₹1,650-1,680 zone (multiple tests with green arrows)

- Base Formation: A solid base was formed between ₹1,650-1,680 after the pullback from April highs

Technical Patterns:

1. Rectangle Pattern: The stock formed a rectangular consolidation pattern between mid-April and mid-May (₹1,650-1,680 range)

2. Triple Bottom: Three distinct touches at the ₹1,650-1,680 support zone (marked with green arrows)

3. Bull Flag: The recent consolidation after the strong upward move from early May represents a bull flag pattern that has now resolved to the upside

Trade Setup:

- Entry Point: ₹1,815-1,820 on a pullback to the breakout level

- Stop Loss: ₹1,765 (below the recent swing low)

- First Target: ₹1,850 (previous resistance)

- Second Target: ₹1,920 (measured move from the rectangle pattern)

- Final Target: ₹2,000 (psychological level and potential measured move target)

Risk Management:

- Position sizing: Limit exposure to 2-3% of trading capital

- Risk-Reward Ratio: Approximately 1:1.5 based on the stop loss and the second target

- Trailing stop: Move stop loss to breakeven after the price reaches the first target

NSE:SHAILY showed exceptional technical strength with the recent breakout above resistance after forming a solid base. The increased volume confirms buyer interest, and the prior triple bottom pattern adds confidence to the bullish outlook. Traders should watch for the continuation of the breakout with the mentioned targets, while protecting capital with the defined stop loss.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Honasa Consumer - Breakout Brewing After 6-Month Base Formation NSE:HONASA : Breakout Brewing After 6-Month Base Formation - Is This the Perfect Entry Point?

After Q4 FY25 Results, Jefferies Adjusts Price Target to ₹400 From ₹320, Keeps at Buy. They target double-digit revenue growth on retail push, also eyeing Mamaearth revival, thus qualify for my Chart of the Week idea.

Base Formation & Pattern Recognition:

NSE:HONASA has carved out a compelling 6-month consolidation base between November 2024 and May 2025, with the stock oscillating between ₹197-280 range. This extended sideways movement represents a classic accumulation phase, where smart money has likely been building positions while retail investors remained on the sidelines.

The most recent price action shows a powerful breakout above the ₹280 resistance level, accompanied by explosive volume expansion - a textbook technical setup that often precedes sustained upward moves.

Key Technical Levels:

Key Support Levels:

- Primary Support: ₹280 (former resistance, now support)

- Secondary Support: ₹240-250 (mid-range consolidation zone)

- Major Support: ₹197 (base low and critical floor)

Key Resistance Levels:

- Immediate Resistance: ₹350-360 (psychological round number)

- Next Target: ₹400 (measured move from base breakout)

- Long-term Target: ₹472 (0.786 Fibonacci extension visible on chart)

Volume Analysis:

The standout feature is the dramatic volume surge accompanying today's breakout - nearly 5x the average weekly volume at 26.41M shares. This volume expansion validates the breakout and suggests institutional participation rather than retail-driven momentum.

The volume pattern during the 6-month base shows periodic spikes at key support levels, indicating accumulation by informed participants during weakness.

Technical Pattern:

The chart displays a Rectangle/Trading Range pattern that has resolved to the upside. The measured move target from this pattern projects to approximately ₹400, representing the height of the rectangle (₹280-₹197 = ₹83) added to the breakout point.

Trade Setup:

Setup Type: Breakout Play with Volume Confirmation

Entry Strategy:

- Aggressive Entry: ₹325-330 (current levels on any minor pullback)

- Conservative Entry: ₹285-290 (on retest of breakout level)

Position Sizing: Use 1-2% portfolio risk given the setup quality

Exit Strategy:

- Target 1: ₹360 (9-10% upside) - Book 30% position

- Target 2: ₹400 (20% + upside) - Book another 40% position

- Target 3: ₹450-470 (35-40% upside) - Ride remaining position

Stop Loss:

- Tight Stop: ₹310 (6% downside protection)

- Wider Stop: ₹275 (below breakout level for swing traders)

Risk Assessment:

Bullish Factors:

- Clean 6-month base formation

- Volume-confirmed breakout

- Multiple support levels established

- Strong sector tailwinds in the consumer space

Risk Factors:

- Broader market volatility could impact momentum

- Profit-booking likely near psychological levels

- Need to hold above ₹280 to maintain bullish structure

Bottom Line:

Honasa Consumer presents a high-probability technical setup with the stock breaking out of a well-defined 6-month accumulation base on strong volume. The risk-reward profile favours the bulls, with clearly defined support levels for stop placement and multiple upside targets for profit-taking.

The key now is whether the stock can sustain above the ₹280 breakout level and continue its march toward the ₹350-400 zone. Any pullback to the ₹285-290 area would offer an attractive secondary entry point for those who missed the initial breakout.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

RBL Bank Ltd- Range Breakout + Trendline Break!RBL Bank Range Breakout + Trendline Break! 💥🚀

📅 Published on: April 16, 2025

📊 Chart Insight:

RBLBANK has given a dual breakout—piercing above a long-standing descending trendline and breaking out of a rectangle consolidation zone. This combo setup indicates a potential trend reversal or continuation rally from here on.

🔍 Technical Highlights:

🔺 Pattern: Rectangle range breakout + descending trendline breakout

🟪 Consolidation Range: ₹148–₹178 (marked in purple)

📈 Breakout Candle Close: ₹181.57

📊 Volume Surge: 218.23K—strong bullish confirmation

📌 Support & Resistance Levels:

🟢 Immediate Support: ₹178 (top of the rectangle zone)

🟢 Next Strong Support: ₹164 (middle of the rectangle)

🔴 Resistance Levels to Watch:

₹188 (trendline zone retest)

₹198

₹212 (gap fill level)

📈 Trendline Analysis:

Price has broken above the major descending trendline from April 2024 highs.

This trendline had been acting as dynamic resistance and is now a potential trend shifter.

🧠 Trade Idea/Strategy:

💹 Entry: Near ₹178–₹181 (post-breakout retest ideal)

🛑 Stop-loss: Below ₹164

🎯 Targets: ₹188 ➡ ₹198 ➡ ₹212

📍 Visual Indicators Used:

✅ Rectangle drawn to capture sideways accumulation

✅ Trendline from previous highs marking resistance

✅ Volume spike indicating strong buying interest

📘 Note: Multiple timeframe confirmation is advised. Volume and structure align well with bullish bias.

🔔 Disclaimer: Educational post only. Always do your own research or consult with a SEBI-registered advisor

BALUFORGE - Is it time for the Surge? Technically, this is a continuation consolidation. Usually Wave 3 which is about to start is considered to be the longest. So fingers crossed🤞.

Balu Forge Industries Limited is a leading Indian company that manufactures crankshafts and other forged components for various industries. The company was founded in 1989 and has since expanded its operations to become a preferred supplier of crankshafts to OEMs in India and around the world.

The forging industry plays a crucial role in supporting various sectors, including:

Automotive: Forging is used to manufacture critical components such as crankshafts, gears, and axles.

Aerospace: Forging is used to manufacture lightweight, high-strength components for aircraft and spacecraft.

Energy: Forging is used to manufacture components for wind turbines, hydroelectric power plants, and nuclear power plants.

Construction: Forging is used to manufacture components for heavy machinery, such as excavators and bulldozers.

Balu Forge caters to these sectors by manufacturing a range of forged components, including crankshafts, gears, axles, and other critical components.

In terms of market position in India, Balu Forge is a leading player in the forging industry, with a strong presence in the automotive and aerospace sectors. The company has a market capitalization of around ₹8,962 crore.

Could Pokarna help you attain Nirvana ?After a long uptrend and in spite of the recent correction that we experienced this stock held its ground consolidated sideways holding on to its very strong support.

Although the targets here seem to be quite high, the overall markets are a little uncertain. Hence, we take small steps forward and then start trailing the Stoploss as and when it climbs.

Fantastic pattern and rectangle breakout seems evident. Enter only on Daily Closing Basis confirmation

ADANI ENERGY SOLUTIONS - Swing Trade Analysis - 30th July #stockADANI ENERGY SOLUTIONS (1W TF) - Swing Trade Analysis given on 30th July, 2024

Pattern: RECTANGLE BOX SETUP

- Weekly Resistance Breakout Initiated - Done ✓

- Weekly Volume Buildup at Resistance - Done ✓

- Demand Zone Retest & Consolidation (for a small SL and a better RR) - In Progress

* Disclaimer

Are you ready to get 2332% Return if yes please Read descriptionHello Everyone, i hope you all will be doing good in your trading and your life as well, i know you guy's have to read about this stock which can give 2332% returns. So i am talking about welspun corp stock which has given breakout and retested the breakout zone on monthly time frame. Well i have written many things on chart about these, but still i will explain about this stock here too, but for the levels you have to go through chart above.

1st of all stock has given huge breakout after almost 16 years, and stock is sustaining above to this breakdown zone, All major indicators like, MACD AND RSI showing bullish crossover, price is above 200=DEMA, everything looks positive about this stock. So this is the best time to enter and hold for long term, now come about returns which i have mention on title, how will you get this much of returns in this stock if you invest now, 1st of all if you check major pattern on monthly chart, it is kind of triangle pattern right, in tringle pattern we always expect whatever inside higher length size will be we will expect that target for next move after breakout of triangle pattern. So if you check i have measure same length and i found stock has rallied 2332% in between, so i am expecting same. See guy's in longer term company always take some corporate action like, bonus and split so we might can see price differentiation on chart, but to calculate exact returns, you have to measure from today's date when i am publishing this post.

i hope this have been clear, one thing i have written on chart as well, i am just going to do copying and paste here as well just read this is very important:-

((Friends, if you check inside the monthly chart analysis, you will see that many types of chart patterns were formed, many trendlines and supports were found breakout or breakdowns which occurred many times, but now in the long term the stock has given all time high breakout. which Formed in 2008, my point here to tell you all this is that if you think for long term you will never care about these noises, so if the company is good we should always find opportunity to invest and whenever we have any type correction in stock, we should take as another opportunity to add more at down levels. i hope i have explain clearly about long term investing method.))

i think this is one of the best idea or method to get best appreciation in returns in long term on your stock. So i am expecting you guy's have learned these unique techniques in investing world. if you think i have really teach you something best then do not forget to hit like on this post.

NOW LET'S READ ABOUT THE COMPANY AND IT'S FUNDAMENTAL:-

WCL is one of the largest manufacturers of large diameter pipes globally. The company also manufactures BIS-certified Steel Billets, TMT (Thermo-Mechanically Treated)

Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars. The company acquired Sintex-BAPL, a market leader in water tanks and other plastic products, to expand its building materials portfolio. It has also made strategic acquisition of specified assets of ABG Shipyard.

Growth Strategy:-

The Company has been undergoing a transformation journey since past couple of

years by diversifying into related businesses that have good future growth potential. Setting up of DI Pipes facility in Anjar, Gujarat and acquisition of Sintex BAPL are a part of that strategy.

Product Portfolio:-

The product portfolio of the company comprises HSAW Pipes (Helically Welded), LSAW Pipes (Longitudinally Welded), and ERW Pipes (Electric Resistance Welded) for Onshore/Offshore Oil, Gas, and Water Transmission it also provides Coating System for anti-corrosion and Value-added Service like Double Jointing, Pipe Bending, ID Machining, etc.

In Q3FY24, Sintex finalized its foray in Plastic Pipes segments through different types of PVC Pipes including CPVC, HDPE, UPVC and OPVC.

Growth in Pipes Business:-

DI Pipes sales - 9MFY24 sales volume rose almost 10x YoY to 135 KMT. Stainless Steel Bars sales volume grew by 201% YoY to 12,294 MT while, Pipes & Tubes sales volume rose by 23% YoY to ~3,667 MT during 9MFY24.

DI Pipes in Middle East:-

In Feb,24, company is planning to set up a 150 KMTPA DI Pipes manufacturing facility in the Middle East with an investment of ~Rs. 500 crore over next 4-6 quarters. The investment will be made through a combination of debt and equity. The plant is expected to commence commercial production by H1CY25.

Market Cap

₹ 17,538 Cr.

Current Price

₹ 669

High / Low

₹ 671 / 300

Stock P/E

15.8

Book Value

₹ 215

Dividend Yield

0.75 %

ROCE

21.6 %

ROE

21.5 %

Face Value

₹ 5.00

Industry PE

19.7

Debt

₹ 1,949 Cr.

EPS

₹ 42.4

Promoter holding

50.1 %

Intrinsic Value

₹ 587

Pledged percentage

0.00 %

EVEBITDA

8.91

Change in Prom Hold

0.18 %

Profit Var 5Yrs

94.2 %

Sales growth 5Years

14.1 %

Return over 5years

37.0 %

Debt to equity

0.35

Net profit

₹ 1,136 Cr.

ROE 5Yr

14.4 %

Profit growth

656 %

Earnings yield

9.33 %

PROS:-

Company has reduced debt.

Company is expected to give good quarter

Company has delivered good profit growth of 94.2% CAGR over last 5 years

Company has been maintaining a healthy dividend payout of 34.9%

CONS:-

Stock is trading at 3.12 times its book value

Company has a low return on equity of 12.2% over last 3 years.

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.

WELCORP - CLEAN BREAKOUT OUT OF DARVAS BOXHi All,

This idea is about Welspun Corp Ltd

FUNDAMENTALS

Mkt Cap - 17161 Cr

Mkt Cap/Sales - 0.99

P/E - 15.5

P/BV - 3

FCF - 1022 Cr

D/E - 0.35

Promoter increase thr stake by 0.18%

ROE - 21%

ROCE - 21.6%

Technicals

Price has been consolidating within a range of 25% and has now given a decisive breakout above the supply zone. There was a mid resistance as well which was broken with good volumes

Hope you have a profitable trade,

Thanks,

Stock-n-Shine

Weekly Chart of MAZDOCK, Ready for breakout.Mazagon Dock Shipbuilders Ltd. is an Indian shipyard located in Mumbai, Maharashtra. The company is a public sector undertaking of the Ministry of Defence (India). Mazagon Dock builds a variety of ships, including warships, submarines, and merchant ships.

The company's stock price has been on an upward trend in recent months, due to a number of factors, including increased government spending on defense, and a growing demand for Indian-built ships. However, the stock price is also volatile, and it is important to do your own research before investing in any stock.

NLCINDIA - SWING TRADE - 3rd December #stocksNLCINDIA (1D TF)

Swing Trade Analysis given on 3rd December, 2023 (Sunday)

Pattern: RECTANGLE BOX BREAKOUT

- Volume Buildup Near Resistance - Done ✓

- Trendline Breakout - Done ✓

- Retracement + Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #nlcindia

GANDHITUBE | Weekly Chart | Rectangle Chart pattern | ATHChart analysis:

Pattern: Rectangle pattern is formed when the consolidation takes place.

Breakout: Rectangle pattern is breakout happened on 24-Jan-2024. Price might comes to 770 for re-test of the BO.

Volume: Spike in volume in BO candle indicating big players are interested.

Trade setup:

Entry price: Between 769.45 and 802.85

Stop loss: Below rectangle pattern i.e., 654.95

Target 1: 957.80

Target 2: 1260.65

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades

ADITYA BIRLA FASHION - Swing Trade Analysis - 28th Jan #stocksADITYA BIRLA FASHION (1W TF) - Swing Trade Analysis given on 28th Jan, 2024

Pattern: RECTANGLE BOX BREAKOUT

- Volume Spike at Resistance - Done ✓

- Breakout - Done ✓

- Retest & Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #ABFRL

PPL PHARMA - Swing Trade - 22nd January #stocksPPL PHARMA (1D TF) - Swing Trade Analysis given on 22nd Jan, 2024

Pattern: RECTANGLE BOX

- Volume Spike at Resistance - Done ✓

- Breakout - In Progress

- Retest & Consolidation - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #PPLPHARMA

NIFTY MEDIA Sector Analysis (1W TF) - 16th December 2023#NIFTYMEDIA Sector Analysis (1W TF)

Pattern: RECTANGLE BOX BREAKOUT

(Or Inverted HnS or Cup and Handle)

- Breakout of Neckline Resistance expected

- Wait for Breakout

#stocks #swingtrade #chartanalysis #priceaction #traderyte #india #indiagdp #StockMarketindia

NIFTY FMCG Sector Analysis (1W TF) - 16th December 2023#NIFTYFMCG Sector Analysis (1W TF)

Pattern: RECTANGLE BOX BREAKOUT

- Breakout of Resistance - Done ✓

- Retracement & Consolidation- Done ✓

- Pullback Candle - In Progress

#stocks #swingtrade #chartanalysis #priceaction #traderyte #india #indiagdp #StockMarketindia

Swing In Navin Fluorine International.About Comapany

Navin Fluorine International Ltd primarily produces refrigeration gases, inorganic fluorides, and specialty organofluorines. They also offer contract research and manufacturing services. Their portfolio consists of 50+ developed fluorinated compounds.

Fundamentals

The company is expected to have a strong quarter, and they consistently pay a healthy dividend of 19.2%.

Company has little down side as well. promoter holding is slightly lower and FII holding also decreasing a bit. But interestingly DII purchasing more and more continuously.

20.4% of ROCE seems to be much healthy.

Technical analysis.

The stock has been consolidating in range of a rectangle pattern for the past 24 months. As visible from weekly timeframe, it is making higher highs and higher lows, touching the upper level and retracing back to its support, which is making it strong consolidating zone.

We can wait for the price to fall a little almost near to the support level And then we can take position considering to the long, With a 5% stop loss, we can aim for a minimum of 25% gain.

#StockMarket #NSE #BSE #Analysis