The Cup & Handle breakoutCup and Handle Pattern Analysis

Cup Formation:

From March to July, the stock declined and then gradually recovered, forming a “U”-shaped bottom.

This is the Cup part.

Volume behavior shows contraction and then expansion, which supports the pattern.

Handle Formation:

From late July to early August, the stock consolidated slightly sideways/downward.

This formed the Handle, which is typically a short retracement before breakout.

Breakout:

Now the stock has given a bullish breakout around ₹1900 – ₹1920 with strong momentum.

Indicators:

RSI above 60 (bullish strength)

MACD positive crossover

Volume spike → confirms breakout

Search in ideas for "INDICATORS"

BTC/USDT: Bullish Momentum and Key Support LevelsUptrend Channel: The price is trading within an ascending channel, denoted by two parallel black trendlines. This suggests a bullish trend is in play.

Support and Resistance:

A significant support zone is identified between approximately 112,000 and 114,000 USDT.

A weak supply zone is marked around 118,000 USDT. The price has recently tested this area and found some support.

A strong resistance level is visible at approximately 124,564.86 USDT.

Indicators:

Ichimoku Cloud (9, 26, 52, 26): The price is currently trading above the cloud, indicating a bullish sentiment. The cloud itself appears to be thin and slightly bullish, suggesting potential for continued upward movement.

RSI Strategy (14, 30, 70): The Relative Strength Index (RSI) is used as a strategy, with a "RSILE" signal (likely "RSI Low Entry") marked with a "+2" and a red arrow, suggesting a potential buy signal near the support zone in early August. A "-2" signal is marked near the top of the channel, indicating a potential overbought condition or reversal signal.

Price Action and Projections:

The price recently experienced a sharp decline from the upper trendline, indicating profit-taking or resistance at that level.

The price is currently near the lower trendline and the "weak supply zone," which appears to be acting as support.

A potential future price path is drawn with a blue arrow, suggesting that the price may consolidate or bounce off the current support area and move higher towards the upper boundary of the channel.

Another potential path is drawn with a red arrow, showing a possible further drop towards the lower trendline before a bounce.

XAU/USD Bullish Bounce from Demand Zone !Gold (XAU/USD) on the 4H chart is showing a potential bullish reversal setup. Price has pulled back into a Fair Value Gap (FVG) and high supply/demand zone near 3,329–3,315, aligning with the 0.382–0.5 Fibonacci retracement.

Key Points:

Support Zone: 3,329–3,315 (demand + FVG).

Bullish Rejection Expected: Price may bounce from this zone, targeting upper resistance levels.

Upside Targets:

TP1: 3,356

TP2: 3,375

TP3: 3,440–3,459 (major resistance)

Invalidation: A daily close below 3,315 could open room for deeper downside toward 3,278–3,245.

Indicators: EMA(9) and Ichimoku showing potential for trend resumption if price closes above 3,362.

Overall, the chart suggests a buy setup on bullish confirmation, aiming for the 3,375–3,459 zone.

“AVALON Technologies: Strong Bullish Base Pattern with Breakout Technical Analysis Overview:

AVALON is currently displaying a classic base formation pattern on the daily chart, which is a bullish continuation signal following the strong uptrend from earlier lows.

Key Observations:

• Current Price: ₹895.70 (as of recent data)

• Pattern: Clean base formation around the ₹780-800 support zone

• Volume: Consolidation phase with declining volume, typical of healthy basing patterns

• Technical Indicators: Strong Buy signal from moving averages (12 buy vs 0 sell signals)

• RSI: 56.04 - indicating bullish momentum without being overbought

Base Formation Analysis:

The stock has been consolidating in a tight range after the significant rally, forming what technical analysts call a “flat base pattern”. This is a second-stage consolidation that typically provides another buying opportunity before the next leg up.

Key Levels to Watch:

• Resistance: ₹900-920 zone (recent highs)

• Support: ₹780-800 (base formation low)

• Breakout Target: Above ₹920 could trigger next bullish move

Trading Strategy:

• Entry: On breakout above ₹900-920 with volume confirmation

• Stop Loss: Below ₹780 (base support)

• Target: ₹1000+ based on base depth projection

Risk Management:

The tight consolidation range offers an excellent risk-reward ratio for position traders. The narrow base formation suggests strong underlying demand.

Fundamental Backdrop:

AVALON Technologies shows strong financial metrics with consistent growth, supporting the technical setup.

Disclaimer: This is for educational purposes only. Always do your own research and manage risk appropriately.

CUMMINS: Cup Pattern Breakout | Supply Zone Test & Strong ResultCUMMINS is showing a classic cup pattern, with price rallying into supply zone resistance at ₹3,893–₹3,900. Momentum remains strong, supported by positive recent results and robust technical signals.

Chart Highlights

• Pattern: Cup formation, price testing supply zone.

• Trend: Strong bullish, with medium volatility.

• Indicators:

• RSI: 72.3 (Overbought/Sell signal)

• MACD: 71.04/62.01 (Buy)

• ADX: 31.2 (Buy)

Price Levels

• Resistance (Supply Zone): ₹3,893–₹3,900

• Current Price: ₹3,806.90

• Support: ~₹3,700 (recent breakout)

Brief Result for This Quarter (Jun-25)

• EPS: 21.8 (+32% YoY)

• Sales: ₹2,906.8Cr (+26% YoY)

Strong quarterly growth shown in both earnings and revenue, supporting bullish momentum.

Action Plan

• Watch for a decisive breakout above ₹3,900 for fresh longs.

• Look for reversal signals near supply zone for short-term correction.

• Maintain tight risk management as price tests major resistance.

Summary:

Strong technical setup meets solid fundamentals. Potential for new highs if supply zone breaks, but cautious near resistance.

Zinka Logistics Sol Ltd : Daily Chart Breakout from Darvas BoxThis chart shows the daily price action of Zinka Logistics Sol Ltd (NSE) with a focus on recent technical developments:

• Darvas Box Pattern: For several months, the stock price traded sideways within a well-marked “Darvas Box” range, approximately between ₹400 and ₹549.30. This represents a consolidation phase where the stock found both support and resistance within this zone.

• All-Time High Resistance: The yellow dashed line at ₹549.30 marks the previous all-time high (ATH) level, acting as a critical resistance point.

• Breakout and Volume Surge: On the latest trading day, the stock price sharply broke above the ATH resistance, closing at ₹561.25—a gain of 15.66%. This move was supported by a significant spike in trading volume, as shown at the bottom of the chart, which reinforces the breakout’s strength.

• Bullish Signal: Such a breakout from a long consolidation within a Darvas Box, particularly on elevated volume, is typically interpreted by traders as a strong bullish signal, suggesting the start of an upward trend.

• Indicators: The chart also includes a moving average line (light blue) that underscores recent momentum and trend direction.

ASIAN PAINTS LTD – Technical Analysis________________________________________

🧠 ASIAN PAINTS LTD – Technical Analysis

Ticker: NSE:ASIANPAINT | Sector: Decorative & Industrial Coatings

CMP: 2,491 ▲ (+1.9%)

Chart Pattern: Symmetrical Triangle Breakout

Technical View: ⭐⭐⭐⭐ (Neutral-to-Positive Setup – Educational Purposes Only)

________________________________________

📈 Technical Overview (For Educational & Informational Purposes Only)

🔹 Pattern Observed:

Price action indicates a breakout from a symmetrical triangle pattern on the daily timeframe – a structure often linked to volatility contraction and potential directional movement. The stock breached the upper trendline near 2,467 with an uptick in volume, indicating possible buyer interest.

🔹 Supporting Indicators:

— MACD: Bullish crossover

— 200 EMA: Price reclaimed above the long-term average

— RSI: Reading near 66, indicating strengthening momentum

— Bollinger Bands: Price broke above upper band + BB squeeze

— SuperTrend: Bullish

— Open = Low: Potential buyer strength

🔹 Volume Context:

Volume during the breakout session was ~2.02M – higher than average, suggesting institutional participation or increased trader interest.

________________________________________

🔼 Resistance Levels (Reference Zones)

R1: 2,518

R2: 2,545

R3: 2,583

🔽 Support Levels (Reference Zones)

S1: 2,452

S2: 2,413

S3: 2,387

________________________________________

📰 News Summary & Sentiment Context (Neutral View)

📌 Earnings:

Q1 FY26 PAT declined ~6% YoY to 1,100 Cr. Revenue slightly lower YoY but largely in-line with expectations. Decorative segment volume grew ~4%, which helped cushion margin pressures.

📌 Demand Trends:

Urban & project-led demand showing signs of recovery. Rural demand is stable. Some macroeconomic caution warranted due to external factors (e.g., job market uncertainties).

📌 Regulatory Update:

The CCI has initiated a probe on alleged market dominance following a complaint. The company has contested the investigation citing procedural inconsistencies.

📌 Market Mood:

Despite regulatory concerns, post-earnings sentiment appears improved. The stock has risen ~5.2% YTD and has been among recent Nifty outperformers.

________________________________________

📚 Educational Insight for Traders & Learners

The symmetrical triangle is a common consolidation pattern formed by converging trendlines. It reflects a balance of power between buyers and sellers. A breakout (especially with volume) can signify renewed directional bias.

In this case, the stock broke out above the resistance trendline, backed by volume and confirmation from technical tools (RSI > 60, MACD, BB squeeze, etc.).

Such breakouts are monitored by traders for swing or positional opportunities, provided risk is managed and external catalysts (like earnings and macro sentiment) are factored in.

✅ Key Reminder: Technical setups should be combined with proper position sizing, exit plans, and broader market context.

________________________________________

🔍 Trade Setup (For Educational Simulation Only)

Trade Details

🔹 Long Entry: ₹2,505.60

🔹 Stop Loss (SL): ₹2,406.55

🔹 Risk-Reward Ratio: 1:1 | 1:2+

Pullback Trade Setup (Optional Re-Entry)

📍 Pullback Entry Zone: ₹2,491.20 – ₹2,505.60

📍 Protective Stop Zone: ₹2,465.87 – ₹2,453.60

📍 Risk-Reward Range: 1:1 | 1:2+

________________________________________

⚠️ Disclaimer (Please Read Carefully):

This content is shared strictly for educational and research purposes only.

I am not a SEBI-registered investment advisor, and no buy or sell recommendations are being made.

All views expressed are based on personal market analysis and experience. They are not intended as financial advice.

Trading — especially in derivatives like options — involves significant financial risk. Losses can exceed your initial investment.

👉 Always do your own research and consult a certified SEBI-registered advisor before making any investment or trading decisions.

👉 Use proper risk management and only trade with capital you can afford to lose.

The author assumes no responsibility or liability for any trading losses incurred from acting on this content.

By engaging with this material, you agree to these terms.

________________________________________

💬 Found this helpful?

Drop your thoughts, questions, or insights in the comments below ⬇️ — let’s learn together!

🔁 Share this post with your trading friends and community — help them discover clean charts, structured setups, and zone-based learning.

✅ Follow simpletradewithpatience for clear setups, educational content, and a no-nonsense approach to price action, supply-demand zones, and risk-managed trades.

🚀 Trade with patience. Trust your charts. Stay clear-headed.

Because the goal is not just to trade — it's to trade better.

Be Self-Reliant | Trade with Patience | Learn with Charts & Zones 📊

[LONG] BTCUSDT - Wave 5 Elliott Wave forecast 🧠 Technical Analysis Summary (Elliott Wave Perspective)

✅ Pattern Structure Observed:

Wave 1–2–3–4 appears to be complete or nearly complete.

The current price action suggests we are potentially entering Wave 5, following a successful Wave 4 correction.

The chart shows:

A bullish flag/channel breakout.

A well-respected parallel rising channel, hinting Wave 5 is forming.

EMA support (purple line) is holding.

Volume remains relatively low but stable.

📈 Wave 5 Forecast:

Target: Near 136,824 (as marked on your Fibonacci level 1), aligning with the upper boundary of the channel.

Launch Zone: Around 112,060, where Wave 4 likely ended (Fibonacci 0).

Price Projection: Wave 5 can reach or slightly overshoot the upper resistance of the yellow rising wedge.

🧭 Indicators:

Volume: No large spike yet — if a breakout begins, look for a confirming volume surge.

RSI (bottom indicator): Currently neutral. No extreme overbought/oversold — leaves room for upward movement.

🧮 Elliott Wave Count (Annotated):

Wave 1: Start of May to mid-May

Wave 2: Mid-May to late May pullback

Wave 3: June rally into mid-July

Wave 4: Late July correction (falling wedge/bull flag)

Wave 5: Aug–Sep potential move up, projected in red arrow

🔔 Things to Watch:

Break above the mini wedge (Wave 4 flag) is critical.

RSI divergence near the top of Wave 5 could signal exhaustion.

Volume confirmation will help validate a true breakout.

Channel support/resistance should be monitored closely for invalidation.

Nifty Trading Strategy for 06tth August 2025📊 Nifty Intraday Trading Strategy (15-Min Candle)

🟢 Buy Setup (Long Trade)

✅ Entry Condition:

Watch the 15-min candle near 24,740.

Enter Buy if the candle closes above 24,740 and the next candle breaks the high.

Confirm with volume spike or strong bullish candle.

🎯 Targets:

Target 1: 24,770 (💰 Book partial profit)

Target 2: 24,800 (💰 Major target)

Target 3: 24,830 (💰 Extended target)

🛡 Stop-Loss:

Initial stop-loss: Below 24,710

Trail stop-loss to cost after Target 1 hits.

📌 Notes for Buy Trade:

Enter only if momentum is strong (green candle body > 60% of full range).

Avoid entry if RSI < 50 or market is sideways.

Risk-Reward Ratio: Minimum 1:2 before entering.

🔻 Sell Setup (Short Trade)

✅ Entry Condition:

Watch the 15-min candle near 24,590.

Enter Sell if the candle closes below 24,590 and the next candle breaks the low.

Confirm with volume on the downside or bearish candle formation.

🎯 Targets:

Target 1: 24,561 (💰 Quick scalp)

Target 2: 24,531 (💰 Major target)

Target 3: 24,501 (💰 Extended target)

🛡 Stop-Loss:

Initial stop-loss: Above 24,620

Trail stop-loss to cost after Target 1 hits.

📌 Notes for Sell Trade:

Enter only if momentum is strong (red candle body > 60% of full range).

Avoid entry if RSI > 50 or market is sideways.

Risk-Reward Ratio: Minimum 1:2 before entering.

⚡ Pro Tips for Intraday Trading

⏰ Timing Matters:

Best entries are between 9:30 AM – 11:30 AM or 1:30 PM – 2:30 PM.

📊 Confirm With Indicators:

EMA 20/50 Crossover, VWAP, and RSI (45-60 range) can help filter false signals.

💹 Position Sizing:

Never risk more than 1-2% of your capital on a single trade.

❌ Avoid Overtrading:

1–2 high-quality trades per day are enough for consistency.

📢 Disclaimer

I am not SEBI registered.

This content is for educational purposes only, not investment advice.

Stock market trading is risky; you may lose capital.

Please consult a financial advisor before trading.

Trade at your own risk & use proper risk management.

Volume & Round Number Confluence ZonesThis chart highlights key price areas using two important indicators:

🔹 Volume – Helps identify high-activity zones where buyers and sellers are most engaged. Spikes in volume often signal strong interest or potential reversals.

🔹 Round Numbers – Psychological levels (e.g., 100, 500, 1000) where price tends to react due to trader bias. These act as natural support/resistance zones.

📊 Use Case:

Look for volume spikes near round numbers to find high-probability reversal or breakout setups.

Combine this with price action for better entry/exit signals.

🧠 Tip: Round number zones with strong volume support often act as key levels during trend continuation or reversal.

ETHUSD Trade Setup from Support Zone Toward $3,940ETH/USD (Coinbase)

Timeframe: 2-hour

Current Price: ~$3,485.73

Indicators:

Red Line: Likely a short-term moving average (e.g., 20 EMA)

Blue Line: Longer-term moving average (e.g., 50 or 100 EMA)

Pattern: A pullback toward previous support after a significant rally

✅ Trade Setup Details

Entry Point: ~$3,485.34

This level aligns with prior consolidation and support zone (yellow highlighted area)

Stop Loss: ~$3,369.61

Placed below the support block to allow room for volatility

Target Point: ~$3,940.56

A retest of previous swing highs

✅ Risk/Reward

Potential Upside: ~13.96% move (approx. +$482)

Risk: About $115 per ETH

Reward/Risk Ratio: ~4:1

Favorable, as rewards significantly exceed the risk

✅ Technical Context

Price Action:

Recent downward retracement after peaking near $3,940

Testing a major support (highlighted in yellow)

If this support holds, there is potential for a reversal rally toward target

Moving Averages:

Price is near/below the red short-term moving average, signaling recent bearish momentum

A bounce from this zone could confirm a higher low formation

Key Confirmation:

Strong bullish candle or rejection wick from the support zone would strengthen the long bias

✅ Summary of the Setup

This chart outlines a long trade opportunity:

Entry near: $3,485

Stop below: $3,369

Target: ~$3,940

Rationale: Buying into a well-established support zone anticipating a rebound to retest prior highs.

If you’d like, I can help you:

Assess alternative targets

Discuss scaling entries

Review other timeframes for confluence

JIO FIN SERVICES LTD (NSE: JIOFIN) – Daily Chart AnalysisThis daily chart of JIO FIN SERVICES LTD highlights the latest technical structure with a strong bullish trend. Key zones are marked:

• Supply Zones at 345–368 and 398–425 levels, where selling interest may emerge.

• Demand Zone at 285–310 levels, a potential support area.

• Fibonacci Levels: Price currently testing the 0.618 retracement at 345.40; next resistance at 0.786 (362.85).

• 50 EMA Pullback: Recent bounce from the 50 EMA, signaling buyer strength and a continuation potential.

• Key Resistance: 345–366 range is reinforced as a critical barrier.

• Indicators: RSI at 62, MACD and ADX neutral, volatility modest, trend marked “Strong Bullish.”

Watch for price action around supply/resistance zones and sustainability above 50 EMA for trend continuation or reversal signals. Suitable for short-term swing and positional traders watching breakout or pullback opportunities.

nifty overview for short termCertainly! Here's a **detailed and polished rewrite** of a **short-term Nifty 50 overview**:

---

### **Nifty 50 – Short-Term Outlook**

#### **Current Market Sentiment:**

The Nifty 50 index is showing a **consolidation phase** in the short term, as traders assess global cues, earnings results, and macroeconomic data. While overall sentiment remains cautiously optimistic, near-term direction will largely depend on institutional flows and external triggers.

#### **Key Levels to Watch:**

* **Immediate Resistance:** 23,250 – 23,400

* This zone has been tested multiple times, and a **decisive breakout** above this level could signal fresh upward momentum.

* If breached, the next upside target could be in the range of **23,600 – 23,800**.

* **Immediate Support:** 22,850 – 23,000

* This zone has acted as a strong base in recent sessions.

* A breakdown below this level may lead to a short-term correction toward **22,600 – 22,500**.

#### **Technical Indicators:**

* **Momentum Oscillators** like RSI and MACD are currently in **neutral to slightly bullish territory**, suggesting consolidation with a slight upward bias.

* **Moving Averages:** Nifty is trading above its **20-day and 50-day moving averages**, indicating an overall bullish trend remains intact in the medium term, despite near-term pauses.

#### **Market Drivers:**

* **Earnings Season:** Volatility may persist as companies report quarterly numbers. Positive surprises can boost sentiment, while weak results may trigger profit booking.

* **Global Cues:** Movements in the US markets, crude oil prices, and geopolitical developments are likely to influence short-term trends.

* **FII/DII Activity:** Net buying by domestic institutions is providing support, while foreign flows remain mixed.

#### **Strategy for Traders:**

* **Bullish Bias:** As long as Nifty holds above 22,850, traders may consider buying on dips with tight stop-losses.

* **Breakout Traders:** A sustained move above 23,400 can open up short-term targets toward 23,600 and beyond.

* **Risk Management:** Keep strict stop-losses, as false breakouts or sudden reversals remain possible in a range-bound market.

---

### **Conclusion:**

In the short term, **Nifty remains in a consolidation-to-positive zone**, with **key support at 22,850** and **resistance near 23,400**. A breakout or breakdown from this range will likely determine the next directional move. Traders should remain cautious but opportunistic, adapting to quick shifts in momentum.

---

Vimata Labs - Stock Analysis Overview TGT 755Vimata Labs - Stock Analysis Overview

Current Market Price (CMP): ₹691

Target Price (TGT): ₹755

Support Level: ₹585

Key Insights:

Current Market Price (CMP): ₹691

As of the latest market update, Vimata Labs is trading at ₹691. This price represents the current valuation of the stock in the market.

Volatility Factor: At this price point, the stock has experienced some fluctuations, but it remains within an acceptable range for most investors.

Target Price (TGT): ₹755

The target price of ₹755 suggests a potential upside of about 9.2% from the current CMP.

This target price is often set by analysts based on projected growth, future performance, and market sentiment.

Why ₹755? This price is based on several factors such as:

Strong Fundamentals: Solid revenue growth, effective cost management, and consistent performance.

Positive Market Sentiment: Expectations that the stock will perform well due to strong product or service offerings, market conditions, or favorable industry trends.

Technical Indicators: Breakout signals or upward momentum patterns.

Support Level: ₹585

Support level refers to the price point where the stock has consistently found buying interest in the past, preventing it from falling further.

₹585 is the level at which the stock is expected to face a strong buying interest if the price falls to this point.

If the price dips to ₹585, it could be seen as a buying opportunity, as the support level acts as a cushion for the stock price.

Risk Mitigation: Investors can consider ₹585 as the threshold for stopping losses if the stock doesn’t show signs of recovery above this level.

CIPLA: Darvas Box Breakout Post Results ReactionNSE:CIPLA Darvas Box Breakout Post Q1 FY 26 Results Reaction: Why This Pharma Giant Could Be Your Next Big Winner Let's Analyze

Price Action:

Price Movement Characteristics:

- Volatility: Compressed volatility within the Darvas Box range

- Price Swings: Controlled swings between ₹1,480-1,532.50 boundaries

- Breakout Attempts: Multiple tests of upper resistance without sustained follow-through

- Support Tests: Clean bounces from the lower boundary showing strong institutional support

Volume Spread Analysis

- Current Volume: 5.23M (above 20-day average)

- Volume Pattern: Declining during consolidation (bullish accumulation sign)

- Volume Spike Required: Need 1.5x average volume for breakout confirmation

- Volume Trend: Steady participation without panic selling

Market Structure Analysis:

- Higher Lows Formation: Gradual increase in swing lows within the consolidation

- Lower Highs Compression: Resistance level holding firm, creating compression

- Price Coiling: Decreasing range suggesting energy buildup for directional move

- Time Compression: Extended sideways movement indicating a major move is pending

Chart Pattern Recognition:

- Primary Pattern: Darvas Box Formation (clearly marked on the chart)

- Box Range: ₹1,480 - ₹1,532.50 consolidation zone

- Pattern Duration: Approximately 3-4 months of sideways consolidation

- Volume Context: Declining volume during the consolidation phase, typical of accumulation

Candlestick Pattern Analysis:

- Recent Candles Formation: Doji and small-bodied candles indicating indecision at resistance

- Candle Bodies: Predominantly small bodies suggesting balanced buying/selling pressure

- Wicks Analysis: Upper wicks at resistance showing selling pressure, lower wicks showing support

- Colour Distribution: Mixed red/green candles within the box showing consolidation

Key Support and Resistance Levels:

- Immediate Support: ₹1,480 (Darvas Box lower boundary)

- Strong Support: ₹1,420 (previous swing low)

- Critical Support: ₹1,335 (yearly low)

- Immediate Resistance: ₹1,532.50 (Darvas Box upper boundary)

- Target Resistance: ₹1,600-1,620 (measured move projection)

- Ultimate Target: ₹1,700+ (analyst consensus target)

Base Formation:

- Base Type: Rectangular consolidation/Darvas Box

- Base Duration: 3-4 months (adequate for institutional accumulation)

- Base Tightness: Well-defined boundaries showing controlled supply

- Breakout Confirmation: Price action at upper boundary with volume expansion needed

Trend Analysis:

- Short-term Trend: Sideways consolidation

- Medium-term Trend: Neutral to slightly bullish

- Long-term Trend: Recovery phase from 2024 lows

Momentum Indicators:

- Current Momentum: Building up for potential breakout

- Price Position: Near upper boundary of consolidation range

- Market Structure: Higher lows formation within the box

Trade Setup Strategy:

Entry Strategy:

- Primary Entry: Breakout above ₹1,535 with volume confirmation

- Secondary Entry: Retest of breakout level around ₹1,520-1,525

- Conservative Entry: Support bounce from ₹1,485-1,490

Target Levels:

- Target 1: ₹1,580 (initial resistance)

- Target 2: ₹1,620 (measured move from box height)

- Target 3: ₹1,700 (analyst target consensus)

- Long-term Target: ₹1,800+ (bull case scenario)

Stop-Loss Levels:

- Aggressive: ₹1,470 (below box support)

- Conservative: ₹1,450 (below key support zone)

- Risk Management: ₹1,420 (major support failure)

Position Sizing Guidelines:

- High Conviction: 2-3% of portfolio (on confirmed breakout)

- Medium Conviction: 1-2% of portfolio (on retest entry)

- Conservative: 0.5-1% of portfolio (support bounce play)

- Maximum Risk per Trade: Not more than 1% of total capital

Risk Management Framework:

- Risk-Reward Ratio: Minimum 1:2 for all entries

- Position Scaling: Add on strength after initial 5% move

- Profit Booking: Book 30% at Target 1, 40% at Target 2, trail rest

- Stop-Loss Management: Trail stop to breakeven after 7-8% profit

Sectoral and Fundamental Backdrop:

Pharmaceutical Sector Outlook:

- Market Size: The Indian pharma market is expected to reach US$18.8 billion by 2028 at an 8% CAGR

- Global Position: 500 facilities approved by the US FDA, the highest number outside the US

- Growth Drivers: Speedy introduction of generic drugs and focus on rural health programmes

CIPLA Fundamental Strengths:

- Market Capitalization: ₹1,23,842 Crore

- Performance: ₹27,548 Cr revenue with ₹5,269 Cr profit

Key Fundamental Concerns:

- Growth Rate: Poor sales growth of 10% over the past five years

- Promoter Holding: Decreased by 4.42% over the last 3 years, currently at 29.19%

Industry Catalysts:

- FDA Approvals: India has received 6,316 USFDA approvals for formulation plants

- Global Market Share: India supplies 40 per cent of generic drugs globally

- Export Potential: Strong positioning as a global generic supplier

Risk Assessment:

Technical Risks:

- Pattern Failure: Box breakdown below ₹1,470 would negate the bullish thesis

- Volume Concerns: Breakout without volume confirmation could lead to a false move

- Market Sentiment: Broader market correction could impact individual stock performance

Fundamental Risks:

- Regulatory Changes: FDA compliance issues or policy changes

- Competition: Intense pricing pressure in the generic segment

- Currency Risk: Rupee fluctuation impact on export revenues

Market Risks:

- Sector Rotation: Money flow away from the pharma sector

- Global Slowdown: Impact on export-dependent business model

- Geopolitical Factors: Trade tensions affecting pharmaceutical exports

My Take:

Trading/Investment Thesis:

The Darvas Box pattern on NSE:CIPLA represents a classic accumulation phase, characterised by institutional buying at lower levels. The pharmaceutical sector's strong fundamentals, combined with CIPLA's established market position, create a favourable environment for a potential breakout.

My Action Plan:

- Watch for breakout above ₹1,535 with 1.5x volume

- Enter in phases rather than a lump-sum investment

- Maintain strict stop-loss discipline

- Book profits in tranches as targets are achieved

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

RAIN: Breaks Out of Rising Wedge Pattern Signals Fresh UptrendNSE:RAIN Breaks Out: Rising Wedge Pattern Signals Potential Bullish Run to 180+ Levels

Signals Fresh Uptrend After Months of Consolidation

Price Action:

- NSE:RAIN has been trading within a well-defined rising wedge pattern since March 2025

- The stock has recently broken out above the upper trendline of the wedge at approximately 160 levels

- Current price of 160.74 represents a significant move above the key resistance zone

- The breakout is accompanied by increased volume, suggesting genuine buying interest

Volume Spread Analysis:

• Volume breakout accompanied the wedge pattern breakout

• Higher volumes during up moves compared to down moves indicate bullish participation

• Volume spike visible during the recent breakout at 160+ levels

• Average volume of 972K around today, 3.59M shares with recent surge to higher levels

Base Formation and Accumulation Zone:

• The stock established a strong base between 117-125 levels from March to July 2025

• Multiple retests of the 117 support level showed strong buying interest

• Base formation lasted approximately 4 months, indicating thorough accumulation

• Volume during base formation remained relatively stable with occasional spikes

Key Support and Resistance Levels:

• Primary Support: 117.06 (marked as swing low and base support)

• Secondary Support: 140-145 zone (previous resistance turned support)

• Immediate Resistance: 165-170 zone (next major hurdle)

• Target Resistance: 180-185 zone (measured move target)

• 52-week High: 197.00 (ultimate resistance level)

Technical Patterns:

Rising Wedge Breakout Pattern:

• Clear rising wedge pattern formed over 4-5 months

• Lower highs and higher lows converged into a wedge formation

• Breakout occurred at 160+ levels with strong volume confirmation

• Pattern suggests continuation of the broader uptrend

Trend Analysis:

• Long-term trend: Bullish (higher highs and higher lows since March 2025)

• Medium-term trend: Bullish breakout from consolidation

• Short-term trend: Strong bullish momentum post-breakout

• Moving averages alignment suggests sustained upward momentum

Chart Patterns and Indicators:

• Cup and handle formation visible in the broader timeframe

• Multiple flag patterns during the consolidation phase

• Price above all key moving averages, indicating bullish sentiment

Trade Setup and Strategy:

Entry Levels:

• Aggressive Entry: 155-160 levels (on any minor pullback)

• Conservative Entry: 145-150 levels (on deeper retracement to support)

• Breakout Entry: Above 165 levels with volume confirmation

• averaging between 150-160 for position building

Exit Levels and Targets:

• Target 1: 180-185 levels (initial profit booking - 15-20% upside)

• Target 2: 195-200 levels (testing previous highs - 25-30% upside)

• Target 3: 220-230 levels (extended target - 40-45% upside)

• Swing high exit: Trail stops below key support levels

Stop-Loss Strategy:

• Initial Stop-Loss: Below 140 levels (10-12% risk from current levels)

• Trailing Stop-Loss: Below 150 levels once 180 is achieved

• Pattern Stop-Loss: Below the wedge support around 145 levels

• Time-based stop: Exit if no progress in 2-3 months

Position Sizing and Risk Management:

• Maximum position size: 2-3% of total portfolio

• Risk per trade: Not more than 1% of portfolio value

• Scale in approach: 50% at entry, 30% on dip, 20% on breakout confirmation

• Maintain a risk-reward ratio of a minimum of 1:3

Sectoral and Fundamental Backdrop:

Company Overview:

• NSE:RAIN is one of the world's largest producers of calcined petroleum coke, coal tar pitch and other high-quality basic and speciality chemicals

• Market Cap: 5,405 Crore with Revenue: 15,472 Cr

• Promoter Holding: 41.2% indicating stable management control

Financial Health Assessment:

• The company has a low interest coverage ratio, which poses some financial risk

• Net Profit: ₹-115.10Cr as on March 2025 (Q4 FY25) showing current losses

• The company has delivered a poor sales growth of 4.46% over the past five years

• Recent debt reduction efforts as management focuses on prepaying obligations

Business Segments Performance:

• Carbon Business: Environment-friendly and energy-efficient practices have made RAIN's carbon business highly profitable and sustainable

• The carbon business co-generates energy at six calcined petroleum coke plants with a combined power-generation capacity of approximately 135 MW

• The speciality chemicals segment is showing resilience despite market challenges

Sector Outlook and Industry Trends:

• In 2025, the industry is expected to continue its recovery, adjusting to new market drivers while balancing short- and long-term goals

• Chemical industry focusing on decarbonization and innovation initiatives

• India Ratings affirms Rain Industries' credit rating at IND A/Stable with stable outlook and improved operational outlook

Key Risk Factors:

• Cyclical nature of the chemical industry affecting margins

• High debt levels and interest coverage concerns

• Global economic slowdown has an impact on demand

• Raw material price volatility

• Environmental regulations affecting operations

Positive Catalysts

• Debt reduction strategy showing management commitment

• Stable credit rating with improved operational outlook

• Strong technical breakout indicating renewed investor interest

• Global chemical industry recovery supporting sector sentiment

• Energy co-generation capabilities providing cost advantages

Risk Assessment and Monitoring:

Key Levels to Watch:

• Break below 145: Bearish signal, consider exit

• Sustain above 165: Bullish confirmation for higher targets

• Volume patterns: Declining volume on up moves would be concerning

• Sector rotation: Monitor chemical sector performance relative to the broader market

Regular Review Parameters:

• Weekly closing above key moving averages

• Monthly volume trends and institutional participation

• Quarterly earnings performance and guidance

• Industry developments and regulatory changes

• Management commentary on debt reduction progress

Exit Triggers:

• Fundamental deterioration in business metrics

• Break of key technical support levels

• Adverse sector developments

• Better opportunities in other stocks/sectors

• Achievement of target levels with profit booking

My Take:

NSE:RAIN presents a technically attractive setup with the rising wedge breakout, but investors should be cautious about the fundamental challenges. The trade setup offers good risk-reward ratios for short to medium-term positions, while long-term investors should wait for clearer signs of fundamental improvement.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Gold Faces Critical Turning Point – Wave 5 May Have ToppedGold Faces Critical Turning Point – Wave 5 May Have Topped

During today’s Asian session, gold reached the 1.272 Fibonacci extension level, matching with a major H4 resistance zone. This move also aligns with the fifth wave of Elliott Theory, and I believe this could be the potential end of the current bullish cycle, especially around the 3439 region.

📊 Technical Perspective

Right now, divergence has formed between price action and indicators:

Price is rising,

But volume is falling and RSI is not confirming the breakout.

This divergence strongly suggests that the 5th wave might be completed, and a correction may soon follow.

🎯 Trade Plan for Today

🔹 Buy Zones (trend-aligned):

Fast Buy Entry:

▶️ Entry: 3396 – 3398

▶️ SL: 3391

▶️ TP: 3400 – 3412 – 3425

Primary Buy Zone:

▶️ Entry: 3350 – 3352

▶️ SL: 3345

▶️ TP: 3375 – 3400 – 3435 – 3477

Note for Intraday Traders:

🔸 Look for scalping chances around 3375 – 3377.

🔻 Sell Zones (only with confirmation):

Sell Zone 1:

▶️ Entry: 3452 – 3454

▶️ SL: 3459

▶️ TP: 3440 – 3425 – 3390

Sell Zone 2:

▶️ Entry: 3475 – 3477

▶️ SL: 3482

▶️ TP: 3460 – 3455 – 3440 – 3425

✅ Continue to prioritise trend-friendly buy setups. Wait for reversal confirmation before initiating any sell trades.

📌 Stay tuned for real-time analysis, trade-ready setups and daily gold market insights.

#XAUUSD #GoldIndia #GoldTechnicalAnalysis #ElliottWaveTheory #ForexIndia #IntradayTrading #VolumeDivergence #ScalpingIndia #TradingViewIN #FibonacciStrategy #LiveTradingIndia

ELGIEQUIP: Breaks Out of its Ascending Triangle PatternNSE:ELGIEQUIP Breaks Out of its Ascending Triangle Pattern: This Industrial Giant Could Be Your Next Multi-Bagger as Manufacturing Boom Accelerates

Price Action:

- Current Price: ₹589.75 (as of chart date)

- 52-Week High: ₹752.95

- 52-Week Low: ₹401.00

- Daily Change: +₹35.95 (+6.41%)

- Market Cap: ₹18,703 Cr.

Volume Spread Analysis:

Volume Profile Assessment:

- Breakout Volume: 6.8M shares (significantly above average)

- Volume Trend: Increasing volume during breakout phase

- Volume-Price Relationship: Positive correlation during an uptrend

- Distribution vs Accumulation: Clear accumulation pattern visible

Volume Indicators:

- 20-day Average Volume: 1.24M shares

- Breakout Volume Confirmation: Yes (above average volume)

- Volume Concentration: Higher volumes at support levels indicate buying interest

My Key Technical Observations:

- Stock has successfully broken out from a major ascending triangle pattern

- Strong volume confirmation on the breakout day

- Price action showing momentum acceleration after months of consolidation

- Clear trend reversal from the March 2025 lows

Pattern Recognition and Structure Analysis:

Primary Pattern: Ascending Triangle Breakout

- Formation Period: Jan 2025 to July 2025 (7 months)

- Resistance Level: ₹570-580 (horizontal resistance)

- Support Trendline: Rising from ₹401 lows in March 2025

- Breakout Confirmation: Volume spike accompanying price breakout

- Pattern Target: ₹680-700 (measuring the height of the triangle base)

Secondary Patterns:

- Double Bottom formation at ₹401 levels (March 2025)

- Flag and pennant consolidations during the uptrend

- Higher highs and higher lows structure since March 2025

Key Support and Resistance:

Key Resistance Levels:

- Immediate Resistance: ₹600-610 (psychological level)

- Major Resistance: ₹650-680 (pattern target zone)

- 52 Week High Resistance: ₹750-755 (previous swing high)

Key Support Levels:

- Immediate Support: ₹560-570 (breakout level, now support)

- Strong Support: ₹520-530 (previous consolidation zone)

- Major Support: ₹480-490 (ascending trendline support)

- Critical Support: ₹440-450 (50% retracement of current move)

Base Formation Analysis:

- Primary Base: ₹480-580 consolidation zone (7 months)

- Base Characteristics: Tight consolidation with reduced volatility

- Base Quality: High-quality base with multiple retests of support/resistance

- Accumulation Evidence: Consistent volume during the consolidation phase

Trade Setup and Entry Strategy:

Primary Trade Setup - Momentum Play:

- Entry Strategy: Buy on pullback to ₹570-575 (breakout retest)

- Alternative Entry: Current levels for aggressive traders

- Entry Rationale: Ascending triangle breakout with volume confirmation

Secondary Trade Setup - Swing Trade:

- Entry Strategy: Accumulate on dips to the ₹520-530 zone

- Entry Rationale: Strong support zone with multiple bounce history

- Time Horizon: 3-6 months

Entry Levels and Execution:

Aggressive Entry (Short-term):

- Entry Price: ₹585-590 (current market price)

- Quantity: 30% of planned position

- Rationale: Momentum continuation play

Conservative Entry (Medium-term):

- Entry Price: ₹570-575 (breakout retest)

- Quantity: 50% of the planned position

- Rationale: Better risk-reward ratio

Value Entry (Long-term):

- Entry Price: ₹520-530 (support zone)

- Quantity: 70% of planned position

- Rationale: High probability support zone

Exit Levels and Profit Targets:

Short-term Targets (1-3 months):

- Target 1: ₹620-630 (5-7% upside from current levels)

- Target 2: ₹650-660 (10-12% upside)

- Target 3: ₹680-690 (pattern target)

Medium-term Targets (3-12 months):

- Target 1: ₹700-720 (psychological resistance)

- Target 2: ₹750-760 (52 Week high retest)

- Target 3: ₹800-820 (extension target)

Exit Strategy:

- Partial Profit Taking: 25% at each target level

- Trailing Stop: Implement after reaching the first target

- Final Exit: Technical breakdown below key support

Stop-Loss Strategy:

Initial Stop-Loss Levels:

- Aggressive Traders: ₹555 (5% below entry)

- Conservative Traders: ₹530 (below support zone)

- Long-term Investors: ₹480 (below ascending trendline)

Stop-Loss Management:

- Initial Risk: 5-10% of entry price

- Trailing Strategy: Move stop-loss to breakeven after 5% profit

- Progressive Tightening: Reduce stop distance as price advances

Position Sizing and Risk Management:

Position Sizing Framework:

- Conservative Approach: 2-3% of portfolio

- Moderate Approach: 3-5% of portfolio

- Aggressive Approach: 5-7% of portfolio

Risk Management Rules:

- Maximum Risk per Trade: 2% of total capital

- Risk-Reward Ratio: Minimum 1:2 for all trades

- Portfolio Concentration: Maximum 10% in a single stock

- Sector Exposure: Maximum 20% in the capital goods sector

Capital Allocation Strategy:

- 30% on initial breakout entry

- 40% on pullback to support

- 30% reserved for additional weakness

Sectoral Backdrop:

Capital Goods Sector Overview:

- Sector Performance: Outperforming broader markets in 2025

- Government Support: PLI schemes boosting manufacturing

- Infrastructure Push: Continued focus on industrial development

- Export Opportunities: Growing global demand for Indian machinery

Industrial Compressor Market Dynamics:

- Market Size: India air compressor market valued at $1.09 billion (2023)

- Growth Projection: Expected to reach $1.64 billion by 2030

- CAGR: 5.4% growth from 2024 to 2030

- Volume Growth: From 64,000 units (2023) to 120,000 units (2030)

Manufacturing Sector Tailwinds:

- Target Achievement: Manufacturing sector expected to reach $1 trillion by 2025

- Industrial Growth: Rapid expansion in the automotive and electronics sectors

- Policy Support: Make in India and PLI schemes driving demand

- Infrastructure Development: Continued capex cycle supporting industrial equipment demand

Fundamental Backdrop:

Company Overview:

- Business: Leading manufacturer of air compressors and pneumatic tools

- Market Position: Strong presence in the industrial compressor segment

- Product Range: Oil-lubricated piston compressors, reciprocating compressors

- Employee Strength: 2,172 employees

Financial Highlights:

- Market Capitalization: ₹ 18,703 Cr.

- EPS (TTM): ₹11.05

- Book Value per Share: ₹58.90

- Price to Book Ratio: 10

- Dividend Yield: 0.37%

Recent Performance:

- Q4 FY25 Revenue: ₹ 993 crore

- Q4 FY25 Net Profit: ₹102.00 crore

- Annual Revenue (FY25): ₹3,510 crore

- Annual Net Profit (FY25): ₹350 crore

Earnings Outlook:

- Next Earnings Report: July 30, 2025 (Expected)

- Annual General Meeting: August 12, 2025 (Expected)

- Dividend Declared: ₹2.20 per share for FY25

- Management Assessment: Economic quality in terms of earnings and margins

Risk Factors and Considerations:

Technical Risks:

- False Breakout Risk: Potential failure to sustain above resistance

- Market Correlation: High correlation with broader market movements

- Sector Rotation: Risk of funds moving away from capital goods

- Volume Sustainability: Need for continued volume support

Fundamental Risks:

- Economic Slowdown: Impact on industrial capex cycles

- Competition Intensity: Pressure from domestic and international players

- Raw Material Costs: Inflation in steel and component prices

- Export Dependency: Global economic uncertainty affecting demand

Market Risks:

- Interest Rate Sensitivity: Impact of monetary policy changes

- Currency Fluctuation: Export revenue exposure to forex volatility

- Regulatory Changes: Potential policy modifications affecting industry

- Liquidity Risk: Lower institutional participation during market stress

My Take:

NSE:ELGIEQUIP presents a compelling technical setup with its successful breakout from a 7-month ascending triangle pattern. The combination of strong volume confirmation, favourable sectoral tailwinds, and robust fundamental positioning makes it an attractive investment opportunity. The stock is well-positioned to benefit from India's manufacturing sector growth and the expanding industrial compressor market.

The risk-reward profile appears favourable for both short-term momentum traders and long-term investors, with multiple entry strategies catering to different risk appetites. However, proper position sizing and disciplined stop-loss management remain crucial for the successful execution of this trade setup.

Keep in the Watchlist and DOYR.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Gold Price Forecast: Watching for a Breakout from the Triangle PDate: July 23, 2025

Instrument: Gold (XAU/USD)

Chart Type: Daily (1D)

Source: TradingView

The price of gold is currently consolidating within a symmetrical triangle pattern, suggesting a potential breakout in the coming weeks. As of July 23, gold is trading around $3,390, down by 1.21% on the day. The chart highlights key support and resistance levels, trendlines, and a possible breakout path, providing valuable insight into future price action.

Technical Overview

Pattern Forming: A symmetrical triangle formed since early April, with higher lows and lower highs converging toward an apex.

Support Levels: $3,371.36, $3,370.79, and the lower ascending trendline.

Resistance Levels: $3,395.78, $3,401.08, and the horizontal zone near $3,430.88.

Indicators:

Moving Averages (likely EMA or SMA): Price is interacting with short- and mid-term MAs.

RSI (Relative Strength Index): Currently around 56, indicating bullish momentum without being overbought.

Forecast and Price Path

The chart includes a forecasted price path (in blue) that outlines a possible movement:

A short-term dip to retest the triangle’s lower support area near $3,370.

A bounce followed by sideways consolidation within the triangle.

A bullish breakout projected around early August.

A sharp upward trajectory targeting levels above $3,500, suggesting a strong bullish continuation if the breakout occurs as expected.

Conclusion

This symmetrical triangle is a classic continuation pattern, and given the overall bullish trend from earlier this year, the market may lean toward a breakout to the upside. However, confirmation is crucial: a strong daily close above $3,430 would validate the bullish breakout, while a drop below $3,370 could invalidate this scenario and hint at further consolidation or a downside move.

Traders should watch for volume spikes and RSI behavior near the triangle's apex for clearer breakout signals. Until then, gold remains in a tightening range—preparing for its next major move.

"USD/JPY Bear Flag Breakdown Targets 146.41 Support"This is a technical analysis chart of USD/JPY (U.S. Dollar / Japanese Yen) on the 1-hour timeframe, and the idea presented suggests a bearish continuation. Let’s break it down:

---

Chart Overview

Current Price: Around 147.45

Key Levels:

Resistance: ~147.85 (highlighted rectangular zone)

Support: 146.41 (blue horizontal line, likely the target)

Indicators:

50 EMA (red line)

200 EMA (blue line)

Pattern: Bearish flag or rising wedge following a sharp downtrend (flagpole)

---

Key Observations

1. Previous Strong Drop:

Two major drops are highlighted:

First drop: -1.519 (around -1.02%)

Second expected drop: -1.472 (around -0.99%)

These drops suggest momentum is with the bears.

2. Bearish Flag/Rising Wedge Breakdown:

A consolidation in an upward sloping channel (bear flag) occurred after the initial drop.

Price has just broken below this pattern, indicating continuation of the downtrend.

3. Resistance Zone (147.65–147.85):

The price retraced into this area and got rejected.

Acts as a supply zone, confirming bearish pressure.

4. Projected Target:

Measured move suggests a fall to 146.413, aligning with prior support and the magnitude of the earlier drop.

Price action is expected to make a lower high and continue down.

5. EMAs:

The 50 EMA is crossing below the 200 EMA (bearish crossover).

Price is trading below both EMAs, confirming bearish structure.

---

Conclusion:

Bias: Bearish

Entry Idea: After breakdown of the flag/rising wedge.

Target: ~146.41

Stop-loss (implied): Likely above 147.85 resistance.

Risk-Reward: Solid, if entry was taken on flag breakdown.

This is a classic bear flag continuation pattern within a broader downtrend. The structure and confluence (resistance zone, EMA alignment, bearish pattern) support a short bias.

-

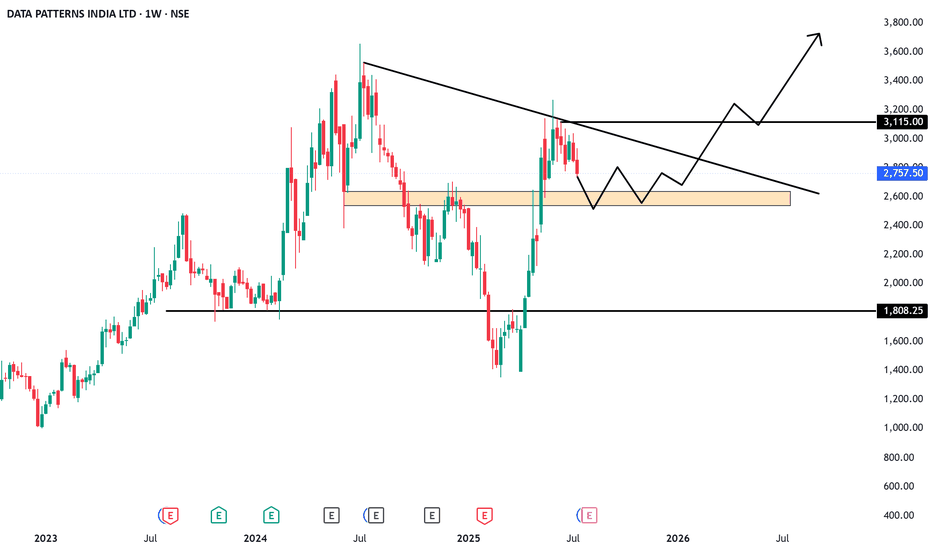

Data Patterns: Brain behind India’s missile, radar & ISRO tech.NSE:DATAPATTNS

🏢 Company Overview:

Data Patterns is a vertically integrated defense and aerospace electronics solutions provider. It designs, develops, manufactures, and tests advanced electronic systems used in:

Radar, Electronic Warfare

Avionics, Missile Systems

Satcom, Communication & Surveillance

It’s one of the few Indian defense electronics companies with end-to-end capabilities—from design to delivery.

📈 Fundamental Analysis:

✅ Key Financials (FY24-25 Estimates):

Market Cap ₹13,000+ Cr

Revenue (FY24) ₹480–500 Cr

EBITDA Margin ~38%

PAT Margin ~28–30%

ROE / ROCE 25%+ / 30%+

Debt to Equity 0 (Debt-free)

P/E Ratio ~70x (Premium)

🧩 Strengths:

Strong order book visibility with over ₹900 Cr+ backlog.

In-house R&D and full control over hardware + software.

Supplied systems to ISRO, DRDO, BEL, HAL — proven credibility.

High margin & asset-light business model.

⚠️ Risks:

Heavy dependency on government contracts (lumpy revenue).

High valuations — pricing in future growth.

Competition from global defense OEMs and local PSU giants.

📊 Technical Analysis (As of July 2025):

🧾 Price Action Summary:

CMP: ₹2,880 (Example)

52-Week Range: ₹1,650 – ₹2,980

Trend: Strong uptrend since Jan 2025

Support Zone: ₹2,550 – ₹2,650

Resistance: ₹3,000 (psychological and technical resistance)

🔍 Indicators:

200 EMA: ₹2,200 (Stock trading well above long-term average)

MACD: Positive with histogram expanding

RSI: 71 – Overbought, watch for pullbacks

Volume: Spikes near breakout levels – confirms strength

📉 Short-Term View:

Likely to consolidate near ₹2,800–₹3,000

Fresh breakout above ₹3,000 may lead to ₹3,400–₹3,600 zone

🚀 Future Growth Prospects:

🛰️ 1. Defense Capex Boom:

Indian Government’s “Atmanirbhar Bharat” push & higher defense budget directly benefits defense tech firms like Data Patterns.

🧠 2. R&D & IP-Led Growth:

Owns IP of most products – high operating leverage and export potential.

🌍 3. Export Market Entry:

Partnering with foreign OEMs; growing traction in South-East Asia, Middle East.

🛠️ 4. Order Book Strength:

High-margin orders across radar, avionics, and missile sub-systems.

Client base includes DRDO, BrahMos, BEL, ISRO, HAL – strong pipeline ahead.

📝 Conclusion:

Parameter Verdict

Fundamentals 🔵 Very Strong (Debt-free, high ROCE)

Technicals 🟢 Bullish (Watch ₹3,000 zone)

Valuation 🟡 Expensive but justified by moat

Long-Term View ✅ Positive – IP-driven defense electronics play

Short-Term View 🔄 Wait for breakout or buy on dips near ₹2,600

=====================================================

=====================================================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

MTAR Technologies: The hidden giant behind space & clean Energy NSE:MTARTECH

🏢 Company Overview:

MTAR Technologies Ltd is a precision engineering company catering to high-value, mission-critical sectors such as:

Clean Energy (Hydrogen, Nuclear, etc.)

Space & Defence

Aerospace

They manufacture critical components like fuel cells, nuclear reactor parts, aerospace engines, and satellite launch system parts.

📈 Fundamental Analysis:

✅ Key Financials (FY24-25 Estimates):

Market Cap : ₹6,500+ Cr

Revenue (FY24) : ₹650 Cr+

EBITDA Margin : ~28-30%

PAT Margin : ~15%

ROE / ROCE : 15-18% / 20%+

Debt to Equity : 0.1 (Very low)

P/E Ratio : ~45x (Premium)

🧩 Strengths:

Strong order book from ISRO, DRDO, BHEL, and international clean energy players like Bloom Energy.

Technological moat in nuclear & space-grade precision engineering.

Low debt, high return ratios—financials are robust.

Entering Hydrogen & Fuel Cell space—a big long-term catalyst.

⚠️ Risks:

Dependency on a few clients (Bloom Energy being a major one).

Volatility in clean energy adoption pace.

High valuation – priced for growth.

📊 Technical Analysis (As of July 2025):

🧾 Price Action Summary:

CMP: ₹2,050 (Example)

52-Week Range: ₹1,250 – ₹2,150

Trend: Bullish continuation from March 2025

Support Zone: ₹1,860 – ₹1,950

Resistance: ₹2,150 (all-time high breakout zone)

🔍 Indicators:

200 EMA: ₹1,620 (Stock trading well above 200 EMA)

MACD: Bullish crossover on daily chart

RSI: ~67—momentum strong but near overbought zone

Volume: Rising steadily with price—confirms strength

📉 Short-Term View:

Healthy consolidation expected around ₹2,000–₹2,150

A breakout above ₹2,150 could lead to ₹2,400–₹2,600 zone

🚀 Future Growth Prospects:

🔬 1. Clean Energy Boom:

Supplying parts to Bloom Energy (US-based Fuel Cell firm).

India’s green hydrogen policy and PLI schemes can benefit MTAR.

🛰️ 2. Space & Defense:

Increasing budgets in defense, ISRO’s new missions, and India’s entry into private space programs can drive long-term orders.

💹 3. Export Potential:

MTAR is entering global markets for nuclear and aerospace precision components.

USD-denominated revenues provide a hedge and higher margins.

🌱 4. Capex & Expansion:

New manufacturing facility in Adibatla, Telangana.

Capex being done to triple capacity in the coming 3–5 years.

📝 Conclusion:

Parameter Verdict

Fundamentals 🔵 Strong (Clean Balance Sheet, Healthy Margins)

Technicals 🟢 Bullish (But Near Resistance)

Valuation 🟡 Slightly Overvalued (but justified by growth)

Long-Term View ✅ Positive – Multiyear structural story

Short-Term View 🔄 Wait for consolidation or breakout above ₹2,150

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Tools

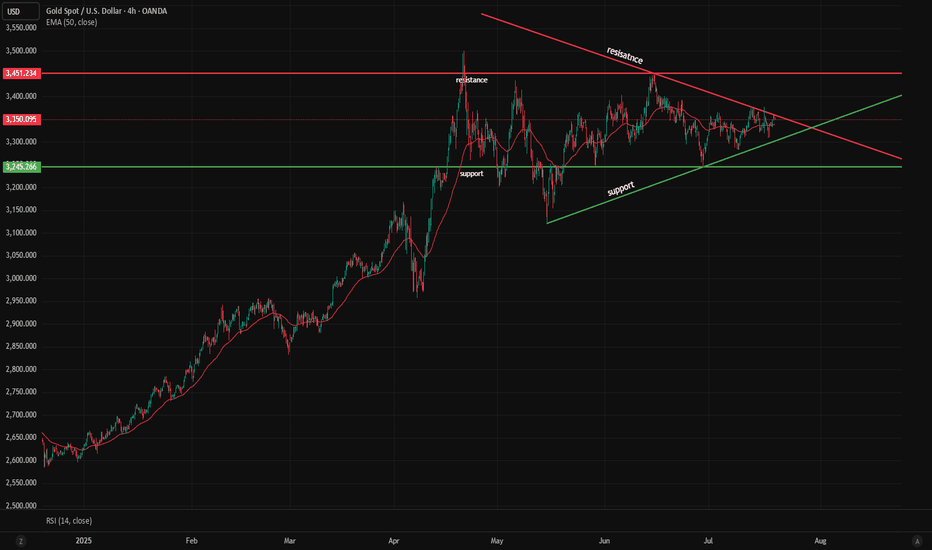

Gold (XAU/USD) – Symmetrical Triangle Formation Near Breakout ZGold is currently consolidating within a well-defined symmetrical triangle pattern on the 4-hour chart, indicating a potential breakout scenario in the near term.

Resistance Levels:

🔺 $3,350 – Immediate resistance

🔺 $3,451 – Key historical resistance

Support Levels:

🟢 $3,245 – Strong horizontal support

🟢 Rising trendline – Dynamic support

Technical Indicators:

📉 Price is hovering around the 50-period EMA (currently at $3,338), suggesting indecision.

📊 RSI at 51.24 reflects a neutral momentum, awaiting confirmation.

Key Insight:

The price is nearing the apex of the triangle, where a breakout or breakdown is likely imminent. A decisive move above resistance may trigger bullish continuation, while a drop below the rising support could open the door to further downside.

Watch for:

✅ Break and close above $3,350 (bullish confirmation)

❌ Breakdown below $3,245 (bearish confirmation)