Shivalik Bimetal Controls Breaks Out Flag & Pole Pattern NSE:SBCL Breaks Out: Flag Pattern Signals Bullish Momentum in Speciality Metals Space

Price Action Analysis:

- Current Price: ₹526.40 (as of June 26, 2025)

- Daily Gain: +29.05 (+5.84%)

- 52-Week High: ₹639.75

- 52-Week Low: ₹342.00

- Trading Volume: 306.84K (compared to 20-day average of 81.39K)

Volume Spread Analysis:

- Breakout Volume: 306.84K (nearly 4x the 20-day average)

- Volume Confirmation: Strong volume surge supports genuine breakout

- Volume Pattern: Declining volume during flag formation, followed by expansion on breakout

Base Formation:

- Consolidation Base: Formed between April-May 2025 around ₹400-450 levels

- Duration: Approximately 6-8 weeks of sideways movement

- Characteristics: Healthy consolidation after initial rally from ₹375 lows

Chart Pattern Analysis:

- Primary Pattern: Bull Flag & Pole Breakout

- Flag Formation: Formed between May and June 2025 in the ₹475-500 range

- Pole Height: Approximately ₹125 (from ₹375 to ₹500)

- Breakout Confirmation: Stock broke above ₹500 resistance with strong volume

- Target Projection: ₹625-650 based on flag pole measurement

Key Technical Levels:

Support Levels:

- Immediate Support: ₹500 (previous resistance turned support)

- Secondary Support: ₹475 (flag pattern lower boundary)

- Major Support: ₹400 (psychological level and previous consolidation zone)

Resistance Levels:

- Immediate Resistance: ₹550-560 (short-term target)

- Major Resistance: ₹625-650 (flag pattern target)

- All-Time High: ₹639.75 (to be watched closely)

Trade Setup Analysis:

Long Position Setup:

- Entry Strategy: Breakout above ₹500 with volume confirmation

- Risk-Reward Ratio: 1:3 (favourable setup)

- Time Horizon: 3-6 months for target achievement

- Pattern Reliability: High (bull flag patterns have 70%+ success rate)

Entry Levels:

- Aggressive Entry: ₹526-530 (current market price)

- Conservative Entry: ₹510-515 (on pullback to breakout level)

- Accumulation Zone: ₹500-520 (for larger positions)

Exit Levels:

- Target 1: ₹580-590 (intermediate target - 15% upside)

- Target 2: ₹625-640 (pattern target - 22-25% upside)

- Final Target: ₹650-670 (extended target based on momentum)

Stop-Loss Strategy:

- Initial Stop-Loss: ₹475 (below flag pattern support)

- Trailing Stop: Implement an 8-10% trailing stop after 15% gains

- Conservative Stop: ₹490 (closer stop for risk-averse traders)

Position Sizing Recommendations:

- Conservative Allocation: 2-3% of portfolio

- Moderate Allocation: 4-5% of portfolio

- Aggressive Allocation: 6-8% of portfolio (for high-risk tolerance)

Risk Management Framework:

Risk Assessment:

- Pattern Risk: 25-30% (typical bull flag failure rate)

- Market Risk: Consider broader market conditions

- Sector Risk: Speciality metals and electronics component sector exposure

- Liquidity Risk: Moderate (average daily volume of 81.39K)

Risk Mitigation Strategies:

- Diversification across multiple positions

- Gradual position building rather than lump sum entry

- Regular monitoring of volume and price action

- Adherence to predetermined stop-loss levels

- Profit booking at intermediate targets

Money Management Rules:

- Maximum loss per trade: 2-3% of portfolio

- Position sizing based on stop-loss distance

- Avoid averaging down on losing positions

- Scale out profits at predetermined levels

Fundamental Backdrop:

Company Overview:

- Business Focus: Manufacturing and sales of Thermostatic Bimetal/Trimetal strips, Current Sense Metal Strip Shunts/Resistors, and electron beam welded products

- Operating Since: Commercial production since October 1986

- Headquarters: New Delhi, India

Financial Performance:

- Market Capitalization: ₹3,027 crores

- Annual Revenue: ₹508.35 crores (TTM)

- Pre-tax Margin: 20% (considered great)

- Return on Equity: 20.6% (exceptional performance)

- Debt-to-Equity: 0.08 (healthy balance sheet)

Recent Quarterly Results:

- Q4 FY2025 Revenue: ₹132 crores

- Q4 FY2025 Net Profit: ₹21 crores

- Q3 FY2025 Net Profit Growth: 7.55% YoY to ₹18 crores

Promoter Holding Concerns:

- Current Promoter Holding: 33.18% (considered low)

- 3-Year Trend: Decreased by 27.4% over the last 3 years

Sectoral Analysis:

Industry Positioning:

- Sector: Speciality Metals and Electronic Components

- Niche Market: Thermostatic bimetal strips for temperature control applications

- End Markets: Electronics, automotive, appliances, and industrial equipment

- Market Position: Established player with specialized manufacturing capabilities

Sector Outlook:

- Growing demand for temperature control solutions in electronics

- Increasing automation in the automotive and industrial sectors

- Focus on energy efficiency, driving demand for precision components

- Import substitution opportunities in specialised metal products

Competitive Advantages:

- Financial Stability: Appears financially stable compared to competitors

- Specialized manufacturing expertise in electron beam welding

- Established customer relationships since 1986

- Low debt levels provide financial flexibility

Technical Indicators Summary:

Momentum Indicators:

- RSI: In overbought territory post-breakout (monitor for divergence)

- MACD: Bullish crossover expected on breakout

- Volume: Strong confirmation of breakout validity

Trend Indicators:

- Moving Averages: Stock trading above key moving averages

- Trend Direction: Bullish short to medium term

- Support Levels: Well-defined support structure

Risk Indicators:

- Volatility: Moderate to high given recent breakout

- Liquidity: Adequate for position sizes recommended

- Market Correlation: Monitor broader market trends

My Take:

The technical setup for NSE:SBCL presents a compelling bull flag breakout opportunity with strong volume confirmation. The pattern projects targets of ₹625-650, representing potential upside of 22-25% from current levels. However, the declining promoter holding and moderate liquidity require careful position sizing and risk management.

Recommended approach is to enter on any pullback to ₹510-515 levels with a stop-loss at ₹475, targeting ₹580-590 for the first leg of the move. The company's strong financial metrics and niche market positioning support the technical breakout, making this an attractive medium-term opportunity for technically oriented investors.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

Search in ideas for "INDICATORS"

NIFTY : The tentative stage of a market melt-up stage in PROB#2NIFTY Projection Case Study:

Probability #2

Target Levels & Tentative Timings are marked in chart

In order to navigate the current market uncertainties effectively, it is crucial to grasp the specific stage of the market melt-up. Recognizing whether the market is in the early uptrend, an acceleration phase, or exhibiting signs of overbought conditions provides valuable insights for strategic decision-making. Acknowledging the risks associated with melt-ups, such as overvaluation and herding behavior, enables us to implement sound risk management practices. Similarly, being attuned to the potential dangers of a market melt-down, including fast declines and panic selling, empowers us to make informed decisions in this dynamic and ever-changing market environment.

A market melt-up typically occurs during the late stages of a bull market when investors rush to buy stocks, driving prices sharply higher. It is characterized by a sudden and intense upward momentum fueled by FOMO (fear of missing out). Melt-ups often precede market corrections or downturns, so caution is advised when witnessing extreme bullish behavior.

The exact timing of a market melt-up in NIFTY happened between 2003 to 2008. The rapid and excessive increase in asset prices driven by speculative buying and fear of missing out resulted in the 2008 financial crisis was marked by a severe downturn, triggered primarily by the collapse of the subprime mortgage market in the United States.

The duration of a melt-up can vary, and there is no fixed timeline for how long it lasts. Melt-ups are characterized by a rapid and intense upward movement in prices, often driven by speculative and fear-of-missing-out (FOMO) behavior among investors. The duration can be influenced by various technical factors, including market conditions, economic indicators, and global events.

In some cases, a melt-up can be relatively short-lived, with prices soaring over a few weeks or months before experiencing a correction. However, in other instances, a melt-up might extend for a more prolonged period if the speculative frenzy and optimistic sentiment persist even for several months or even years.

It's important to note that while melt-ups can result in significant gains, they often precede market corrections or downturns. Investors & traders should exercise caution and be aware of the potential risks associated with the unsustainable nature of extreme upward movements in asset prices. Monitoring market conditions using potential technical indicators and navigating using geometric analysis can help traders & investors make well-informed decisions during such periods.

In technical analysis, a melt-up is often characterized by rapid and aggressive upward price movements. Here are some technical indicators and patterns that might be associated with a typical melt-up:

Sharp Price Spikes: Look for sudden and substantial increases in the price of the asset, often accompanied by high trading volumes. This indicates strong buying interest.

Breakouts and Gaps: Melt-ups may involve breakouts above key resistance levels and price gaps as buyers enthusiastically enter the market, pushing prices higher without waiting for traditional technical levels.

Overbought Conditions: Indicators and oscillators to identify overbought conditions. Extremely high values can indicate that the market is overextended and vice versa.

Parabolic Moves: A parabolic price pattern, where the price accelerates upward in a steep curve, is often associated with a melt-up. This can be identified on a price chart.

FOMO Behavior: Market sentiment plays a crucial role in a melt-up. Watch for signs of Fear of Missing Out (FOMO) behavior among investors, which can contribute to an unsustainable rally.

Low Volatility Pullbacks: During a melt-up, pullbacks might be short-lived and characterized by low volatility. Buyers may quickly step in to take advantage of any dips.

It's important to note that while these indicators may suggest a melt-up, market dynamics can change, and there's always a level of unpredictability.

Risk management and staying informed about broader market conditions are crucial when navigating such extreme scenarios.

Melt-Up Factors observed in Technical Analysis:

Strong Momentum Indicators:

Bullish momentum, as indicated by rising indicators & oscillators having positive readings, can attract more buyers, fueling a melt-up.

Breakout Patterns:

Identification of bullish chart patterns like breakouts or continuation patterns may signal a strong upward move and contribute to a melt-up scenario.

Volume Surge:

High trading volumes accompanying the uptrend suggest increased participation and confidence among investors, reinforcing the melt-up trend.

Supportive Trendlines:

Upward-sloping trendlines provide a visual representation of the bullish trend, and their support can encourage further buying interest.

Liquidity Influx:

Positive market sentiment and an influx of liquidity, possibly driven by accommodative monetary policies, can contribute to a melt-up by facilitating higher valuations. Optimistic Market Psychology:

Positive news, economic indicators, or corporate earnings can create a bullish psychological environment, encouraging traders to adopt a buy-and-hold mentality.

Melt-Down Factors observed in Technical Analysis:

Divergence in Momentum Indicators:

Negative divergences in momentum indicators & oscillators can signal weakening upward momentum, potentially indicating an impending melt-down.

Bearish Reversal Patterns:

Recognition of bearish chart patterns, such as head and shoulders or double tops, can suggest a potential reversal in the trend, leading to a melt-down.

Increasing Selling Volumes:

A surge in selling volumes during a downtrend reflects strong selling pressure, exacerbating the downward movement and contributing to a melt-down.

Violation of Support Levels:

Breaking below key support levels or trendlines may trigger stop-loss orders and further selling, accelerating the melt-down process.

Market Sentiment Shifts:

Negative news, economic downturns, or geopolitical uncertainties can shift market sentiment, prompting investors to exit positions and contribute to a melt-down.

Liquidity Drying Up:

Reduced liquidity in the market, possibly due to risk aversion or tightening monetary policies, can exacerbate price declines during a melt-down.

Analyzing these technical factors provides insights into the dynamics of market movements, helping traders and investors navigate both bullish and bearish scenarios.

Stages of Melt-Up Using Technical Analysis:

Early Uptrend Recognition:

Identification of the initial signs of a bullish trend through technical indicators like moving averages, positive momentum, and breakout patterns.

Acceleration Phase:

Confirmation of the uptrend with strong momentum indicators, increasing trading volumes, and the development of bullish chart patterns, leading to an acceleration of price gains.

Overbought Conditions:

Recognition of overbought conditions using indicators, suggesting that the market may be reaching an unsustainable level of buying activity.

FOMO and Speculative Buying:

Increased speculation and FOMO behavior among investors, as indicated by rapid price increases, a surge in retail trading activity, and a shift towards riskier assets.

Parabolic Price Movement:

Observation of parabolic price movement, characterized by steep and unsustainable upward curves on charts, signaling an intensified phase of the melt-up.

Market Exuberance:

High levels of market exuberance and positive sentiment, possibly fueled by media coverage and optimistic economic outlooks, contributing to a euphoric atmosphere.

Stages of Melt-Down Using Technical Analysis:

Early Signs of Weakness:

Identification of initial signs of weakness in the uptrend, including negative divergences in momentum indicators, bearish reversal patterns, or a failure to sustain higher highs.

Loss of Key Support:

Breaking below key support levels or trendlines, triggering concerns among technical analysts about a potential shift in the trend.

Increased Selling Pressure:

Surge in selling volumes accompanied by downward price movements, signaling increased selling pressure and a potential acceleration of the melt-down.

Bearish Chart Patterns Confirmation:

Confirmation of bearish chart patterns, such as head and shoulders or double tops, supporting the case for a sustained downtrend.

Fear and Panic Selling:

Elevated fear and panic selling as investors rush to exit positions, exacerbating the downward pressure on prices.

Breakdown of Critical Levels:

Breaking through critical support levels, possibly triggering algorithmic trading strategies and stop-loss orders, intensifying the melt-down.

Understanding these stages using technical analysis can help traders and investors make informed decisions and implement risk management strategies during both melt-up and melt-down scenarios.

Risk and Dangers of a Market Melt-Up:

Overvaluation:

Melt-ups can lead to overvaluation, where asset prices detach from underlying fundamentals. This poses a risk of substantial losses when the market corrects.

Herding Behavior:

Investors may engage in herding behavior during a melt-up, following the crowd without considering fundamentals, increasing the risk of a sharp reversal.

Sudden Corrections:

Melt-ups are often followed by sudden corrections or market downturns. Investors entering late in the rally may face significant losses if they don't exit positions in time.

Excessive Risk-Taking:

The euphoria of a melt-up can lead to excessive risk-taking and leveraged positions, increasing vulnerability to market volatility.

Risk and Dangers of a Market Melt-Down:

Fast and Sharp Declines:

Melt-downs are characterized by fast and sharp declines in prices, catching investors off guard and resulting in substantial portfolio losses.

Panic Selling:

Fear and panic selling during a melt-down can exacerbate the decline, causing a cascading effect as more investors rush to liquidate positions.

Liquidity Issues:

Melt-downs may lead to liquidity issues, making it challenging for investors to exit positions at desired prices, amplifying losses.

Financial System Stress:

Severe market downturns can stress the financial system, potentially leading to disruptions in banking and other financial institutions.

Economic Impact:

Market melt-downs can have broader economic consequences, affecting consumer confidence, business investments, and overall economic stability.

A market melt-up poses risks as it can lead to overvaluation, herding behavior, and sudden corrections. Investors might be drawn into a euphoric buying frenzy, neglecting underlying fundamentals and taking excessive risks.

The danger lies in the potential for significant losses when the market corrects, catching latecomers off guard. Conversely, a market melt-down carries the risk of fast and sharp declines, triggering panic selling and liquidity issues. The rapid deterioration can stress the financial system, impacting not just investors but also having broader economic consequences. Both scenarios require vigilant risk management, strategic decision-making, and adaptability to navigate the inherent dangers associated with extreme market movements.

Using Technical Analysis to Mitigate Risks:

Risk Management:

Set clear risk management strategies, including stop-loss orders and position sizing, to protect against significant losses.

Diversification:

Diversify your portfolio across different asset classes to spread risk and reduce the impact of a severe market event.

Stay Informed:

Regularly monitor technical indicators, trend reversals, and market sentiment to stay informed about potential shifts in market conditions.

Avoid Chasing Trends:

Avoid chasing trends during melt-ups and practice disciplined investing to mitigate the risk of entering the market at unsustainable levels.

Adaptability:

Be adaptable and ready to adjust your investment strategy based on changing technical signals and market dynamics.

While technical analysis can provide valuable insights, it's essential to combine it with a holistic approach to risk management and a thorough understanding of market dynamics to navigate the challenges associated with both melt-ups and melt-downs.

Disclaimer:

The information provided in the technical analysis charts published on this TradingView account is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading strategies.

Trading and investing in financial markets involve risk, and past performance is not indicative of future results. The charts and analysis presented here may not guarantee accuracy or completeness, and users are encouraged to conduct their own research and seek professional advice before making any investment decisions.

The author of these charts is not responsible for any losses, damages, or other liabilities arising from the use of the information presented. Users should be aware of the inherent risks associated with trading and carefully consider their financial situation and risk tolerance before engaging in any trading activities.

By accessing and using the information provided in these charts, users acknowledge and agree to the terms of this disclaimer.

NIFTY : The tentative stage of a market melt-up stage in PROB#1NIFTY Projection Case Study:

Probability #1

Target Levels & Tentative Timings are marked in chart

In order to navigate the current market uncertainties effectively, it is crucial to grasp the specific stage of the market melt-up. Recognizing whether the market is in the early uptrend, an acceleration phase, or exhibiting signs of overbought conditions provides valuable insights for strategic decision-making. Acknowledging the risks associated with melt-ups, such as overvaluation and herding behavior, enables us to implement sound risk management practices. Similarly, being attuned to the potential dangers of a market melt-down, including fast declines and panic selling, empowers us to make informed decisions in this dynamic and ever-changing market environment.

A market melt-up typically occurs during the late stages of a bull market when investors rush to buy stocks, driving prices sharply higher. It is characterized by a sudden and intense upward momentum fueled by FOMO (fear of missing out). Melt-ups often precede market corrections or downturns, so caution is advised when witnessing extreme bullish behavior.

The exact timing of a market melt-up in NIFTY happened between 2003 to 2008. The rapid and excessive increase in asset prices driven by speculative buying and fear of missing out resulted in the 2008 financial crisis was marked by a severe downturn, triggered primarily by the collapse of the subprime mortgage market in the United States.

The duration of a melt-up can vary, and there is no fixed timeline for how long it lasts. Melt-ups are characterized by a rapid and intense upward movement in prices, often driven by speculative and fear-of-missing-out (FOMO) behavior among investors. The duration can be influenced by various technical factors, including market conditions, economic indicators, and global events.

In some cases, a melt-up can be relatively short-lived, with prices soaring over a few weeks or months before experiencing a correction. However, in other instances, a melt-up might extend for a more prolonged period if the speculative frenzy and optimistic sentiment persist even for several months or even years.

It's important to note that while melt-ups can result in significant gains, they often precede market corrections or downturns. Investors & traders should exercise caution and be aware of the potential risks associated with the unsustainable nature of extreme upward movements in asset prices. Monitoring market conditions using potential technical indicators and navigating using geometric analysis can help traders & investors make well-informed decisions during such periods.

In technical analysis, a melt-up is often characterized by rapid and aggressive upward price movements. Here are some technical indicators and patterns that might be associated with a typical melt-up:

Sharp Price Spikes: Look for sudden and substantial increases in the price of the asset, often accompanied by high trading volumes. This indicates strong buying interest.

Breakouts and Gaps: Melt-ups may involve breakouts above key resistance levels and price gaps as buyers enthusiastically enter the market, pushing prices higher without waiting for traditional technical levels.

Overbought Conditions: Indicators and oscillators to identify overbought conditions. Extremely high values can indicate that the market is overextended and vice versa.

Parabolic Moves: A parabolic price pattern, where the price accelerates upward in a steep curve, is often associated with a melt-up. This can be identified on a price chart.

FOMO Behavior: Market sentiment plays a crucial role in a melt-up. Watch for signs of Fear of Missing Out (FOMO) behavior among investors, which can contribute to an unsustainable rally.

Low Volatility Pullbacks: During a melt-up, pullbacks might be short-lived and characterized by low volatility. Buyers may quickly step in to take advantage of any dips.

It's important to note that while these indicators may suggest a melt-up, market dynamics can change, and there's always a level of unpredictability.

Risk management and staying informed about broader market conditions are crucial when navigating such extreme scenarios.

Melt-Up Factors observed in Technical Analysis:

Strong Momentum Indicators:

Bullish momentum, as indicated by rising indicators & oscillators having positive readings, can attract more buyers, fueling a melt-up.

Breakout Patterns:

Identification of bullish chart patterns like breakouts or continuation patterns may signal a strong upward move and contribute to a melt-up scenario.

Volume Surge:

High trading volumes accompanying the uptrend suggest increased participation and confidence among investors, reinforcing the melt-up trend.

Supportive Trendlines:

Upward-sloping trendlines provide a visual representation of the bullish trend, and their support can encourage further buying interest.

Liquidity Influx:

Positive market sentiment and an influx of liquidity, possibly driven by accommodative monetary policies, can contribute to a melt-up by facilitating higher valuations. Optimistic Market Psychology:

Positive news, economic indicators, or corporate earnings can create a bullish psychological environment, encouraging traders to adopt a buy-and-hold mentality.

Melt-Down Factors observed in Technical Analysis:

Divergence in Momentum Indicators:

Negative divergences in momentum indicators & oscillators can signal weakening upward momentum, potentially indicating an impending melt-down.

Bearish Reversal Patterns:

Recognition of bearish chart patterns, such as head and shoulders or double tops, can suggest a potential reversal in the trend, leading to a melt-down.

Increasing Selling Volumes:

A surge in selling volumes during a downtrend reflects strong selling pressure, exacerbating the downward movement and contributing to a melt-down.

Violation of Support Levels:

Breaking below key support levels or trendlines may trigger stop-loss orders and further selling, accelerating the melt-down process.

Market Sentiment Shifts:

Negative news, economic downturns, or geopolitical uncertainties can shift market sentiment, prompting investors to exit positions and contribute to a melt-down.

Liquidity Drying Up:

Reduced liquidity in the market, possibly due to risk aversion or tightening monetary policies, can exacerbate price declines during a melt-down.

Analyzing these technical factors provides insights into the dynamics of market movements, helping traders and investors navigate both bullish and bearish scenarios.

Stages of Melt-Up Using Technical Analysis:

Early Uptrend Recognition:

Identification of the initial signs of a bullish trend through technical indicators like moving averages, positive momentum, and breakout patterns.

Acceleration Phase:

Confirmation of the uptrend with strong momentum indicators, increasing trading volumes, and the development of bullish chart patterns, leading to an acceleration of price gains.

Overbought Conditions:

Recognition of overbought conditions using indicators, suggesting that the market may be reaching an unsustainable level of buying activity.

FOMO and Speculative Buying:

Increased speculation and FOMO behavior among investors, as indicated by rapid price increases, a surge in retail trading activity, and a shift towards riskier assets.

Parabolic Price Movement:

Observation of parabolic price movement, characterized by steep and unsustainable upward curves on charts, signaling an intensified phase of the melt-up.

Market Exuberance:

High levels of market exuberance and positive sentiment, possibly fueled by media coverage and optimistic economic outlooks, contributing to a euphoric atmosphere.

Stages of Melt-Down Using Technical Analysis:

Early Signs of Weakness:

Identification of initial signs of weakness in the uptrend, including negative divergences in momentum indicators, bearish reversal patterns, or a failure to sustain higher highs.

Loss of Key Support:

Breaking below key support levels or trendlines, triggering concerns among technical analysts about a potential shift in the trend.

Increased Selling Pressure:

Surge in selling volumes accompanied by downward price movements, signaling increased selling pressure and a potential acceleration of the melt-down.

Bearish Chart Patterns Confirmation:

Confirmation of bearish chart patterns, such as head and shoulders or double tops, supporting the case for a sustained downtrend.

Fear and Panic Selling:

Elevated fear and panic selling as investors rush to exit positions, exacerbating the downward pressure on prices.

Breakdown of Critical Levels:

Breaking through critical support levels, possibly triggering algorithmic trading strategies and stop-loss orders, intensifying the melt-down.

Understanding these stages using technical analysis can help traders and investors make informed decisions and implement risk management strategies during both melt-up and melt-down scenarios.

Risk and Dangers of a Market Melt-Up:

Overvaluation:

Melt-ups can lead to overvaluation, where asset prices detach from underlying fundamentals. This poses a risk of substantial losses when the market corrects.

Herding Behavior:

Investors may engage in herding behavior during a melt-up, following the crowd without considering fundamentals, increasing the risk of a sharp reversal.

Sudden Corrections:

Melt-ups are often followed by sudden corrections or market downturns. Investors entering late in the rally may face significant losses if they don't exit positions in time.

Excessive Risk-Taking:

The euphoria of a melt-up can lead to excessive risk-taking and leveraged positions, increasing vulnerability to market volatility.

Risk and Dangers of a Market Melt-Down:

Fast and Sharp Declines:

Melt-downs are characterized by fast and sharp declines in prices, catching investors off guard and resulting in substantial portfolio losses.

Panic Selling:

Fear and panic selling during a melt-down can exacerbate the decline, causing a cascading effect as more investors rush to liquidate positions.

Liquidity Issues:

Melt-downs may lead to liquidity issues, making it challenging for investors to exit positions at desired prices, amplifying losses.

Financial System Stress:

Severe market downturns can stress the financial system, potentially leading to disruptions in banking and other financial institutions.

Economic Impact:

Market melt-downs can have broader economic consequences, affecting consumer confidence, business investments, and overall economic stability.

A market melt-up poses risks as it can lead to overvaluation, herding behavior, and sudden corrections. Investors might be drawn into a euphoric buying frenzy, neglecting underlying fundamentals and taking excessive risks.

The danger lies in the potential for significant losses when the market corrects, catching latecomers off guard. Conversely, a market melt-down carries the risk of fast and sharp declines, triggering panic selling and liquidity issues. The rapid deterioration can stress the financial system, impacting not just investors but also having broader economic consequences. Both scenarios require vigilant risk management, strategic decision-making, and adaptability to navigate the inherent dangers associated with extreme market movements.

Using Technical Analysis to Mitigate Risks:

Risk Management:

Set clear risk management strategies, including stop-loss orders and position sizing, to protect against significant losses.

Diversification:

Diversify your portfolio across different asset classes to spread risk and reduce the impact of a severe market event.

Stay Informed:

Regularly monitor technical indicators, trend reversals, and market sentiment to stay informed about potential shifts in market conditions.

Avoid Chasing Trends:

Avoid chasing trends during melt-ups and practice disciplined investing to mitigate the risk of entering the market at unsustainable levels.

Adaptability:

Be adaptable and ready to adjust your investment strategy based on changing technical signals and market dynamics.

While technical analysis can provide valuable insights, it's essential to combine it with a holistic approach to risk management and a thorough understanding of market dynamics to navigate the challenges associated with both melt-ups and melt-downs.

Disclaimer:

The information provided in the technical analysis charts published on this TradingView account is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading strategies.

Trading and investing in financial markets involve risk, and past performance is not indicative of future results. The charts and analysis presented here may not guarantee accuracy or completeness, and users are encouraged to conduct their own research and seek professional advice before making any investment decisions.

The author of these charts is not responsible for any losses, damages, or other liabilities arising from the use of the information presented. Users should be aware of the inherent risks associated with trading and carefully consider their financial situation and risk tolerance before engaging in any trading activities.

By accessing and using the information provided in these charts, users acknowledge and agree to the terms of this disclaimer.

Study & Analysis: Bullish Setup in SJVN (NSE)SJVN Ltd. is showing signs of a potential bullish reversal after taking support at the lower boundary of an ascending channel. The stock has formed a consistent pattern of higher lows and is currently trading at ₹94.55 with increasing volume and positive momentum on key indicators.

✅ Key Technical Highlights:

📈 Chart Pattern:

Trading within a well-defined ascending channel.

Recently bounced off the channel support line (third touch confirmation).

Next resistance zone lies near ₹101.67, which aligns with the upper trendline and horizontal supply zone.

📊 Indicators:

RSI Divergence: Bullish divergence seen — RSI made a higher low while price made a lower low, signaling potential reversal.

MACD Bullish Crossover: MACD line has crossed above the signal line near oversold levels — historically a strong bullish sign.

Volume: Notable volume spike observed at support — indicating accumulation.

📏 Risk-Reward Zone (For Study Purposes Only):

Entry Zone: ₹93–₹95

Target: ₹101–₹102

Stop Loss: Below ₹91.97

⚠️ Note:

This post is purely for educational and analysis purposes only. It is not a recommendation to buy or sell any security. Always do your own research or consult a qualified advisor before making investment decisions.

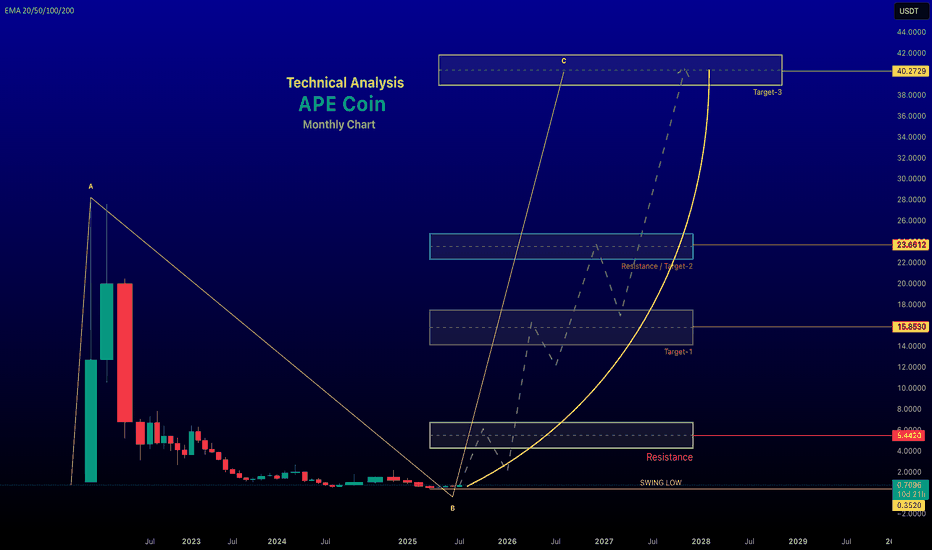

renderwithme || Ape Technical Analysis for 2025ApeCoin (APE) AnalysisApeCoin (APE) is an ERC-20 governance and utility token tied to the Bored Ape Yacht Club (BAYC) ecosystem by Yuga Labs, designed to empower decentralized community building in Web3. Below is a comprehensive analysis of ApeCoin, covering its current market performance, technical indicators, price predictions, and fundamental factors, based on available data.

Historical Price Trends: All-Time High: $27.79 on April 28, 2022, reflecting a -98% decline to current levels.

All-Time Low: $0.349 on April 7, 2025, with the current price up approximately 93.31% from this low.

Recent Performance: Over the past week, APE has risen by 9.17%-37.09%, and over the past month, it has increased by 0.45%-58.16%. However, it has declined by -15.88% to -44.50% over the past year, indicating significant volatility and a bearish long-term trend.

Trading Volume: The 24-hour trading volume is approximately $30.92M-$61.61M, with a 7-day average of $32.61M and a 30-day average of $25.38M. This suggests moderate trading activity, with recent spikes potentially tied to ecosystem developments.

Technical AnalysisCurrent Signals: Short-Term (Daily/4-Hour): Technical indicators show a "Strong Buy" signal on 4-hour and daily charts, suggesting short-term bullish momentum. This is supported by a recent breakout above a key resistance at $0.63 and a potential retest of higher levels like $0.74 or $1.00.

Weekly/Monthly: The weekly chart shows a neutral signal, while the monthly chart indicates a "Sell" trend, reflecting longer-term bearish pressure.

Chart Patterns:A falling wedge pattern has formed on the daily chart, which could signal a bullish reversal if buying pressure increases, potentially pushing APE toward $0.80-$2.00. However, failure to sustain momentum could lead to a drop to $0.22-$0.42.

The price has broken key resistance levels (e.g., $0.63) and trendlines, with some analysts noting a "flag" pattern breakout, indicating potential for further upside if the trend holds.

Key Indicators:Moving Averages: Most moving averages suggest a "Strong Sell" on longer timeframes, indicating bearish momentum over months.

Oscillators: Neutral, with no clear overbought or oversold conditions, suggesting indecision between buyers and sellers.

Fibonacci Levels: APE is currently trading between 0.236 and 0.382 Fibonacci retracement levels, with resistance around $0.60-$1.00.

Sentiment: The Fear & Greed Index for APE stands at 66 (Greed zone), indicating positive investor sentiment, which could signal a buying opportunity for some or a potential sell-off if greed peaks.

Price PredictionsShort-Term (2025):Bearish forecasts suggest APE could drop to $0.22-$0.42 due to consolidation or lack of buying pressure.

Bullish scenarios predict a range of $0.80-$2.00, especially if an altcoin season emerges or ecosystem developments drive demand.

Medium-Term (2026-2027):Bullish predictions estimate APE reaching $2.50-$3.84 in 2026 and potentially higher in 2027 if the crypto market sees broader growth.

Conservative estimates suggest a trading range of $0.41-$0.94, reflecting continued volatility.

Long-Term (2030-2050):Optimistic forecasts project APE reaching $29.55-$40.15 by end of 2026, driven by potential growth in the Web3 and metaverse sectors.

Extremely bullish (but speculative) predictions for 2050 suggest prices as high as $1,050-$1,184, though these are highly uncertain due to the hype-driven nature of APE’s ecosystem.

More conservative outlooks predict modest growth to $0.73-$1.10 by 2030, contingent on sustained ecosystem adoption.

Fundamental AnalysisEcosystem and Use Case:Governance: APE is the governance token for the ApeCoin DAO, allowing holders to vote on fund allocation, partnerships, and ecosystem development. 62% of the token supply is allocated to the Ecosystem Fund to support community-driven initiatives.

Utility: APE serves as a currency for transactions within the ecosystem, providing access to exclusive games, merchandise, events, and services. It also incentivizes third-party developers to integrate APE into Web3 projects, such as Animoca Brands’ Benji Bananas.

ApeChain: The launch of Yuga Labs’ ApeChain Layer-3 platform in October 2024 briefly boosted APE’s price, but the token fell out of the top 100 cryptos by market cap in December 2024, reflecting waning momentum.

Community and Adoption:The BAYC ecosystem, backed by high-profile endorsements (e.g., Justin Bieber, Paris Hilton), remains a key driver of APE’s relevance. However, declining NFT popularity since 2021 has reduced hype, impacting APE’s value.

The ApeCoin DAO’s governance structure, including the APE Foundation and its Board, aims to foster decentralized decision-making but has faced criticism for inefficiencies and lack of community engagement.

Strengths:Strong brand association with BAYC, a leading NFT project.

Fixed supply of 1 billion tokens, preventing inflation.

Integration into Web3 projects like the Otherside metaverse and gaming ecosystems.

Weaknesses:Heavy reliance on NFT hype, which has significantly declined.

Volatility tied to market sentiment and ecosystem developments.

Criticism of the DAO’s treasury spending on “nonsense” projects, raising concerns about governance efficiency.

Opportunities:Growth in Web3 and metaverse adoption could drive demand for APE.

Partnerships with platforms like Animoca Brands and potential new use cases in DeFi or e-commerce.

Threats:Regulatory risks affecting cryptocurrencies and NFTs.

Competition from other governance and utility tokens.

Potential for further price declines if NFT market sentiment remains bearish.

Investment Advice: Always conduct thorough research and consult a financial advisor before investing, as cryptocurrencies carry significant risks.

BIRLANU technical analysisBirlaNu Ltd is listed on the NSE with a current price of INR 2,067.80. The company operates as a diversified conglomerate with interests spanning textiles, cement, financial services, and telecommunications.

Key Levels

Support Level: INR 1853

Swing Level: INR 3494

Possible Upside Levels: INR 5461, INR 6509, INR 7844

Technical Indicators:

RSI (Relative Strength Index): Currently at 39.84, indicating that the stock is approaching oversold territory, which could suggest a potential buying opportunity if the trend reverses.

Volume: The trading volume stands at 120.15K, reflecting significant investor activity. Higher volume often signals stronger market interest and can precede price movements.

Sector and Market Context:

BirlaNu Ltd operates across multiple sectors, including financial services, telecommunications, cement, and textiles, leveraging its diversified presence to mitigate sector-specific risks. The financial services division benefits from India's growing digital adoption, though regulatory changes and interest rate fluctuations remain key considerations. In telecommunications, competitive pricing and 5G expansion drive growth, but high capital expenditure and policy shifts could impact profitability. Meanwhile, cement and textiles are supported by infrastructure demand and strong exports, though global economic conditions and raw material costs influence margins. The broader Indian market has shown resilience despite global volatility, with domestic consumption and policy support acting as stabilizing factors. Given BirlaNu’s exposure across industries, its stock performance is shaped by sector-specific developments, macroeconomic trends, and investor sentiment.

Risk Considerations:

Market Volatility: Fluctuations in the broader market can influence the stock’s price.

Sector-Specific Risks: Regulatory changes, economic downturns, or adverse events in any of the company’s operating sectors may affect performance.

Company-Specific Risks: Operational challenges, management decisions, or financial health concerns within BirlaNu Ltd could impact stock valuation.

Analysis Summary:

BirlaNu Ltd presents potential growth opportunities due to its diversified business model and current technical indicators. The RSI suggests the stock is nearing oversold conditions, which might indicate a reversal. The volume reflects strong investor interest, a positive sign for future price movements. However, investors should remain cautious of market volatility and sector-specific risks. Monitoring key levels and broader market trends will be essential for making informed decisions.

ZINKA LOGISTICS technical analysis**Technical Analysis Report**

**Stock Overview:**

Zinka Logistics Solutions Ltd. (NSE: ZINKA) is currently priced at INR 400.35. The company specializes in logistics and supply chain solutions, offering services such as transportation, warehousing, and distribution.

**Key Levels:**

- Support Level: INR 313.05

- Upside Swing Zone: INR 412.10

- Possible Upside Levels: INR 513.30, INR 564.10, INR 628.80

**Technical Indicators:**

- **RSI (Relative Strength Index):** The RSI is at 58.54, indicating a neutral position where the stock is neither overbought nor oversold. RSI measures the speed and change of price movements, helping identify potential trend reversals.

- **Volume:** The weekly trading volume stands at 380.74K, reflecting moderate activity. Volume is a key indicator of the strength behind price movements, with higher volumes often signaling stronger trends.

**Sector and Market Context:**

Zinka Logistics Solutions Ltd. operates within the logistics and supply chain sector, which has been experiencing growth due to the rise of e-commerce and the increasing need for efficient transportation and distribution services. The sector has shown resilience, supported by technological advancements and streamlined operations. However, broader market trends, including economic fluctuations and consumer demand, play a significant role in shaping the stock's trajectory.

**Risk Considerations:**

- **Market Volatility:** Broader market fluctuations could impact investor sentiment and stock prices.

- **Economic Conditions:** Factors such as inflation, interest rates, and GDP growth may influence the logistics sector's performance.

- **Industry Competition:** The company faces challenges from competitors in maintaining market share and profitability.

- **Regulatory Changes:** Any shifts in transportation or warehousing regulations could affect operational efficiency and financial outcomes.

**Analysis Summary:**

Zinka Logistics Solutions Ltd. demonstrates potential for upward movement based on its key levels and technical indicators. The RSI suggests a stable position, while moderate volume indicates consistent trading interest. The stock's performance aligns with the logistics sector's growth trends, but investors should remain cautious about external risks such as market volatility and regulatory changes. Conducting further research and monitoring sector developments is advisable before making investment decisions.

This analysis provides a comprehensive overview while maintaining a balanced perspective. Let me know if you'd like to refine or expand on any section!

ready for cheers RADICO KHAITANStock Overview:

Stock Name: Radico Khaitan Ltd, Exchange: NSE

Company Business Profile: Radico Khaitan Ltd is a leading Indian company specializing in the manufacturing and distribution of alcoholic beverages, including spirits and liquors.

Key Levels:

Support (Yellow Zone): ₹1,688.35 - ₹1,891.25

Swing Zone (Green Zone): ₹2,032.45 - ₹2,148.10

Technical Indicators:

RSI (Relative Strength Index): Currently at 53.69, indicating neutral momentum. RSI values above 70 suggest overbought conditions, while below 30 indicate oversold conditions.

Volume: 410.85K shares traded, reflecting moderate activity. Higher volume often signals increased interest in the stock.

MA (Moving Averages): The stock price is above the 200-day moving average (₹1,437.52), suggesting a long-term uptrend.

Sector and Market Context: Radico Khaitan Ltd operates within the alcoholic beverages sector, which is influenced by regulatory changes, consumer trends, and economic conditions. The sector shows resilience, and the stock's position above its long-term moving average aligns with the broader bullish market sentiment.

Risk Considerations: Potential risks include regulatory changes impacting the alcoholic beverages industry, fluctuations in raw material costs, and shifts in consumer preferences. Broader market conditions, such as economic downturns or geopolitical events, could also affect the stock's performance.

Analysis Summary: Radico Khaitan Ltd demonstrates a strong upward trend, supported by key technical levels and indicators. While the long-term outlook appears positive, investors should remain cautious of potential risks and market conditions. This analysis is for informational purposes only and does not constitute investment advice.

EpackLet's analyze **Epack Polymers Ltd. (EPACK)** from both a **fundamental** and **technical** perspective.

### **Fundamental Analysis of Epack Polymers Ltd. (EPACK)**

#### **Overview of Epack Polymers Ltd.**

- **Sector:** Materials, Plastics

- **Industry:** Packaging, Polymers & Plastic Products

- **Founded:** 2006

- **Headquarters:** Delhi, India

- **Market Cap:** Approx. ₹500-600 crore (as per the latest data)

**Epack Polymers Ltd.** is a company primarily engaged in the **manufacturing of polymer products**, particularly **polyethylene films** and **flexible packaging materials**. The company caters to a variety of industries, including **food packaging, pharmaceuticals, retail, agriculture**, and **consumer goods**. Epack’s product portfolio includes **laminated films, pouches, and rolls** used extensively in the packaging sector.

Key areas of Epack’s operations include:

- **Flexible Packaging:** The company provides a wide range of packaging solutions for food, beverages, and other consumer goods.

- **Custom Packaging Solutions:** Epack manufactures packaging products tailored to specific industry needs, such as pharmaceuticals, dairy, and personal care.

- **Sustainability Focus:** The company is gradually integrating sustainable practices in its operations, including eco-friendly packaging solutions.

#### **Key Financials (Latest Report)**

- **Revenue Growth:** Epack has demonstrated steady revenue growth over the years, driven by the demand for packaging products in India, especially in sectors such as food, pharmaceuticals, and agriculture.

- **Profitability:** The company maintains healthy profit margins in the packaging industry, although it faces some pressure due to fluctuating raw material costs, such as the prices of polyethylene and other polymers.

- **Debt Levels:** Epack’s debt levels are generally moderate, with manageable leverage in relation to its earnings and cash flows. The company focuses on maintaining operational efficiency.

- **Cash Flow & Dividend Yield:** The company has been able to generate strong operational cash flows, which it reinvests into expanding production capacity and improving infrastructure.

#### **Valuation Ratios**

- **P/E Ratio:** Epack’s price-to-earnings (P/E) ratio may be on the higher side, reflecting growth expectations in the packaging sector. However, it’s important to compare this ratio with other companies in the packaging industry to determine if it’s overvalued or fairly priced.

- **P/B Ratio:** The P/B ratio is relatively moderate, indicating that the stock is reasonably priced in terms of book value, although it can vary depending on market sentiment.

- **Dividend Yield:** Epack is focused on growth, and while it does not have a high dividend yield, it is investing its earnings into capacity expansion and infrastructure.

#### **Industry & Macro Trends**

- **Packaging Demand:** The packaging industry in India is expected to grow rapidly, driven by increasing consumer demand in retail, food & beverages, and pharmaceutical sectors. Epack is well-positioned to capture this growth due to its diverse product offerings.

- **Sustainability Trends:** With the rising global focus on environmental sustainability, companies in the packaging industry, including Epack, are transitioning toward more eco-friendly packaging solutions. This could present both challenges and opportunities as the industry evolves.

- **Regulations:** The Indian government’s focus on packaging waste and regulations around plastic usage may impact the company’s operations. However, as the company adapts to environmental concerns by shifting toward sustainable solutions, it may continue to tap into the growing demand for green products.

- **Raw Material Prices:** The prices of polymers, including polyethylene, are volatile and can impact margins. Any fluctuations in crude oil prices can affect raw material costs, which would impact profitability.

---

### **Technical Analysis of Epack Polymers Ltd. (EPACK)**

Now, let's look at the **technical outlook** for Epack Polymers Ltd. (EPACK), analyzing key support and resistance levels, moving averages, and momentum indicators.

#### **Price Action:**

- **Current Price:** Epack has shown a positive price trend in recent times, benefiting from increased demand in the packaging sector, especially in the food and pharmaceutical segments.

#### **Key Levels:**

- **Support Levels:**

- **₹170-₹175:** This level has acted as a key support area for Epack in the past. A pullback toward this range could present a potential buying opportunity if the stock shows signs of stabilization.

- **₹160:** This is another key support level, which could act as a fallback in case of a more significant correction.

- **Resistance Levels:**

- **₹200-₹210:** The stock has faced resistance near this level in recent trading. A break above this resistance with strong volume could signal a potential upward trend.

- **₹220:** This level marks a strong resistance and psychological barrier for the stock, above which there could be further bullish momentum.

#### **Moving Averages:**

- **50-Day Moving Average (50-MA):** If Epack is trading above its 50-day moving average, this indicates short-term bullish momentum. A cross below this moving average could suggest weakening trend and bearish sentiment.

- **200-Day Moving Average (200-MA):** The 200-day moving average is a critical indicator for long-term trends. A stock trading above the 200-day MA signals that the broader trend is bullish. However, if it starts trading below this level, it may indicate a shift in trend.

#### **Momentum Indicators:**

- **RSI (Relative Strength Index):**

- If RSI is above 70, the stock may be in an overbought territory, signaling a potential pullback.

- If RSI is below 30, it indicates the stock might be oversold, suggesting that a reversal could be coming.

- **MACD (Moving Average Convergence Divergence):**

- A **bullish MACD crossover** (when the MACD line crosses above the signal line) could signal strong buying momentum.

- A **bearish MACD crossover** (when the MACD line crosses below the signal line) would indicate weakening momentum, signaling potential downside risk.

#### **Volume Analysis:**

- **Volume Trends:** Increasing volume alongside upward price movements generally confirms the strength of the trend. If the stock faces resistance with high volume, it suggests that the selling pressure may overcome the buying pressure.

- **Volume Spikes:** Pay attention to volume spikes near key resistance levels like ₹200-₹210 or ₹220, as these could indicate either strong buying momentum or the beginning of a trend reversal.

---

### **Conclusion:**

- **Fundamental Strengths:**

- **Epack Polymers Ltd.** has a strong position in the **flexible packaging** industry, benefiting from consistent demand in food, pharmaceuticals, and consumer goods sectors.

- The company has demonstrated steady revenue growth and maintains strong profitability, with a focus on reinvesting in growth and capacity expansion.

- While the packaging sector faces challenges related to raw material price fluctuations and sustainability trends, Epack is adapting to these changes by incorporating eco-friendly packaging solutions.

- **Technical Outlook:**

- **Support levels:** ₹170-₹175 (primary), ₹160 (secondary).

- **Resistance levels:** ₹200-₹210 (primary), ₹220 (psychological resistance).

- The stock is likely to continue benefiting from demand in the packaging sector, and a breakout above resistance levels could signal a further bullish trend.

#### **Risks to Consider:**

- **Raw Material Price Fluctuations:** The cost of polyethylene and other polymers is volatile, and sudden increases could squeeze margins.

- **Regulatory Risks:** Changes in government policies regarding packaging, plastic use, and environmental regulations could impact Epack’s operations and product offerings.

- **Market Competition:** The packaging industry is highly competitive, with several established players vying for market share. Epack must continue innovating and adapting to industry trends to maintain its growth trajectory.

---

**Disclaimer:**

The information provided is for educational purposes only and should not be construed as financial or investment advice. I am not a SEBI-registered advisor, and this analysis is not a recommendation to buy, sell, or hold any securities. Accuracy and timeliness of the data cannot be guaranteed. Always conduct your own research or consult with a professional before making investment decisions. I do not take responsibility for any losses incurred.

NationAlumLet's analyze **National Aluminium Company Ltd. (NALCO)** from both a **fundamental** and **technical** perspective.

### **Fundamental Analysis of National Aluminium Company Ltd. (NALCO)**

#### **Overview of National Aluminium Company Ltd. (NALCO)**

- **Sector:** Metals

- **Industry:** Aluminium and Metal Products

- **Founded:** 1981

- **Headquarters:** Bhubaneswar, Odisha, India

- **Market Cap:** Approx. ₹25,000 crore (as per the latest data)

**National Aluminium Company Ltd. (NALCO)** is one of the largest integrated aluminium producers in India. The company operates in the production of **bauxite, alumina**, and **aluminium** products. NALCO is a Government of India Enterprise, and it is one of the top players in the aluminium industry in India, with a well-established production capacity.

NALCO's operations span:

- **Bauxite Mining:** The company has one of the largest bauxite reserves in the world.

- **Alumina Refining:** NALCO operates one of the largest alumina refineries in the country.

- **Aluminium Production:** It manufactures primary aluminium and downstream products, such as billets, wire rods, and rolled products.

#### **Key Financials (Latest Report)**

- **Revenue Growth:** NALCO has demonstrated consistent revenue growth over the years, supported by increasing demand for aluminium across various sectors, including automotive, infrastructure, and construction.

- **Profitability:** NALCO’s profit margins are relatively healthy, benefiting from its integrated operations (from mining to aluminium production). However, the company’s margins can fluctuate based on global aluminium prices and raw material costs.

- **Debt Levels:** NALCO has historically maintained low to moderate levels of debt, which provides it financial stability. The company has strong cash flows to support its operations and debt servicing.

- **Cash Flow & Dividend Yield:** The company generates healthy operational cash flows and has a strong dividend track record. The government ownership aspect means the company is committed to maintaining a regular dividend payout.

#### **Valuation Ratios**

- **P/E Ratio:** NALCO’s P/E ratio is generally in line with the metals sector, reflecting its stable earnings and government backing. Being a public sector enterprise, its valuation tends to be slightly lower compared to privately held counterparts.

- **P/B Ratio:** The P/B ratio of NALCO is moderate, reflecting its robust balance sheet, driven by a solid asset base in bauxite reserves and aluminium production.

- **Dividend Yield:** NALCO is known for its strong dividend payouts, with the dividend yield being attractive to investors seeking steady income alongside capital appreciation.

#### **Industry & Macro Trends**

- **Aluminium Demand:** The demand for aluminium is driven by sectors like automotive, construction, packaging, and electrical industries. With rising global demand for lightweight materials and sustainable products, NALCO stands to benefit from growth in these sectors.

- **Commodity Prices:** The prices of aluminium and bauxite can fluctuate based on global supply-demand dynamics, and NALCO’s margins are sensitive to commodity price movements. Any significant drop in aluminium prices may affect profitability in the short term.

- **Government Policies:** NALCO, being a state-owned enterprise, is subject to Indian government policies related to subsidies, regulations, and pricing controls. Government initiatives to boost the domestic manufacturing of aluminium products could support demand.

- **Global Competition:** NALCO competes with other large aluminium producers like **Hindalco Industries**, **Vedanta Limited**, and global players like **China’s Chalco**. The competition also includes regional producers of bauxite and alumina.

---

### **Technical Analysis of National Aluminium Company Ltd. (NALCO)**

Let's look at the **technical outlook** of NALCO, focusing on key support and resistance levels, moving averages, and momentum indicators.

#### **Price Action:**

- **Current Price:** NALCO’s stock tends to follow global trends in aluminium and metal prices. It has shown long-term uptrends during periods of rising commodity prices and pullbacks during market corrections.

#### **Key Levels:**

- **Support Levels:**

- **₹75-₹80:** This level has served as a strong support zone for NALCO in the past. A pullback towards this range could present a potential buying opportunity if the stock shows signs of stabilizing.

- **₹70:** This is a secondary support level in case of a more significant correction in the stock.

- **Resistance Levels:**

- **₹90-₹95:** This is a significant resistance zone. If NALCO breaks above this level with strong volume, it could signal a potential uptrend and more upside.

- **₹100:** This is a psychological resistance level, and a breakout above ₹100 could signal a potential rally.

#### **Moving Averages:**

- **50-Day Moving Average (50-MA):** If the stock is trading above the 50-day moving average, it indicates a short-term uptrend. A break below this level could suggest short-term bearishness.

- **200-Day Moving Average (200-MA):** The 200-day moving average is a key indicator of the long-term trend. NALCO is considered in a bullish phase if trading above the 200-MA, but below it could indicate a long-term downtrend.

#### **Momentum Indicators:**

- **RSI (Relative Strength Index):**

- An RSI above 70 indicates that NALCO may be overbought, and a pullback could be imminent.

- An RSI below 30 suggests that the stock may be oversold and could be due for a potential reversal or recovery.

- **MACD (Moving Average Convergence Divergence):**

- A positive MACD crossover (MACD line crossing above the signal line) would indicate bullish momentum.

- A negative MACD crossover would suggest a weakening trend or potential bearishness.

#### **Volume Analysis:**

- **Volume Trends:** Rising volume accompanying price increases can confirm the strength of an uptrend, while increasing volume during price declines could indicate strong selling interest.

- **Volume Spikes:** Watch for volume spikes near key levels such as ₹90-₹95 or ₹100. A breakout or breakdown accompanied by high volume often signifies the beginning of a new trend.

---

### **Conclusion:**

- **Fundamental Strengths:**

- NALCO has strong fundamentals with a focus on integrated aluminium production, a solid balance sheet, and a consistent record of profitability.

- As a state-owned entity, it enjoys stability and government backing but may face limitations in terms of strategic flexibility.

- The company benefits from strong demand in the aluminium sector, supported by growth in infrastructure, automotive, and electrical industries.

- **Technical Outlook:**

- **Support levels:** ₹75-₹80 (primary), ₹70 (secondary).

- **Resistance levels:** ₹90-₹95 (primary), ₹100 (psychological resistance).

- NALCO's stock is likely to follow the broader trends in the metals sector. A breakout above resistance levels can signal an upward trend, while a break below support levels may signal a deeper correction.

#### **Risks to Consider:**

- **Commodity Price Fluctuations:** NALCO’s margins are highly dependent on aluminium and bauxite prices, and any significant price volatility could impact profitability.

- **Regulatory Risks:** Changes in government policies related to aluminium pricing or subsidies could influence the company's earnings and cash flows.

- **Global Competition:** NALCO faces competition from other domestic and international aluminium producers, which may affect market share and pricing power.

---

**Disclaimer:**

The information provided is for educational purposes only and should not be construed as financial or investment advice. I am not a SEBI-registered advisor, and this analysis is not a recommendation to buy, sell, or hold any securities. Accuracy and timeliness of the data cannot be guaranteed. Always conduct your own research or consult with a professional before making investment decisions. I do not take responsibility for any losses incurred.

Garware Hi-Tech Films Ltd.Let's dive into the analysis of **Garware Hi-Tech Films Ltd.** (GHFL).

### **Fundamental Analysis**

#### **Overview of Garware Hi-Tech Films Ltd.**

- **Sector:** Materials

- **Industry:** Specialty Chemicals/Films Manufacturing

- **Market Cap:** Approx. ₹7,000 crore (as of the latest data)

- **Headquarters:** Mumbai, India

Garware Hi-Tech Films is a leading manufacturer of polyester films in India and offers a wide range of products, including films for packaging, electrical insulation, and solar applications. The company primarily focuses on the production of high-performance films.

#### **Key Financials (Latest Report)**

- **Revenue Growth:** The company has shown consistent growth in its revenue streams over the last few years, driven by strong demand in sectors like packaging, automotive, and solar energy.

- **Profitability:** Garware Hi-Tech Films typically reports solid operating margins, benefitting from its strong product offerings and technical expertise in high-value applications.

- **Debt Levels:** The company is in a relatively low-debt position, which is beneficial for its financial health, reducing the risk associated with interest rate fluctuations.

- **Dividends:** Garware Hi-Tech Films has a track record of paying consistent dividends, which may be appealing to income-focused investors.

#### **Valuation Ratios**

- **P/E Ratio:** As a growth stock in a niche industry, Garware might exhibit a higher P/E ratio compared to broader market averages, reflecting its growth potential.

- **P/B Ratio:** A measure of how the market values the company’s net assets.

- **Dividend Yield:** Historically, Garware offers moderate dividends, making it attractive for long-term investors who value both growth and income.

#### **Industry & Macro Trends**

- **Packaging & Film Industry:** The demand for specialty films in packaging, automotive, and solar applications is expected to grow as industries continue to innovate. Garware is well-positioned in this growth area.

- **Solar Energy Demand:** One of the key growth drivers for Garware is the increasing demand for solar energy and the growing need for specialized films in solar panel applications.

- **Global Expansion:** Garware's ability to capture markets outside of India, especially in the developed economies, is critical to its future growth prospects.

---

### **Technical Analysis**

Let’s explore the stock’s technical position, analyzing price action, key levels, and momentum indicators.

#### **Price Action**

- **Current Price:** (Exact price will depend on real-time data)

- **Chart Patterns:** Check for any ongoing chart patterns such as triangles, rectangles, or head and shoulders. Given the sector's growth outlook, the stock might be showing bullish patterns over the medium term.

#### **Key Levels:**

- **Support Levels:**

- **₹760-₹780:** The stock has previously shown support around this zone. A price retracement towards this area might be a good entry point.

- **₹700-₹720:** If the stock breaks below ₹780, the next support zone lies here, where buyers might step in.

- **Resistance Levels:**

- **₹860-₹880:** This level has been a strong resistance zone for the stock in the past. Breaking above this could signal continued upward movement.

- **₹900-₹920:** A major psychological resistance level. If the stock crosses this barrier, it could set the stage for further bullish momentum.

#### **Moving Averages:**

- **50-Day Moving Average (50-MA):** Watch whether the stock is trading above or below its 50-day MA. If it’s trading above, this indicates a positive short-term trend.

- **200-Day Moving Average (200-MA):** A key indicator of the long-term trend. If the stock is trading above the 200-day MA, it shows a strong long-term uptrend.

#### **Momentum Indicators:**

- **RSI (Relative Strength Index):** RSI values between 70-80 indicate the stock could be in overbought territory, while below 30 suggests it might be oversold.

- **Current RSI:** A higher RSI above 70 might indicate overbought conditions, while an RSI below 30 would indicate potential opportunities for buying in the case of a correction.

- **MACD (Moving Average Convergence Divergence):**

- If the MACD line is above the signal line, it suggests bullish momentum. Conversely, if the MACD crosses below the signal line, it may indicate weakening momentum.

#### **Volume Analysis:**

- **Volume Trends:** Consistent increasing volume during an uptrend is a sign of strength in the current price movement. If volume picks up during a price decline, it might indicate more selling pressure.

- **Volume Spikes:** A sudden increase in volume can signal a potential breakout or breakdown, so watch for this closely when the price approaches key resistance or support levels.

#### **Recent Price Action and Trend:**

- **Uptrend/Downtrend:** Evaluate if Garware is in an uptrend or consolidating sideways. Generally, the stock’s performance in recent months would provide clues to whether it’s positioned for a breakout.

- **Breakouts/Breakdowns:** Watch for any significant breakouts above resistance or breakdowns below support levels. A breakout above ₹880 might indicate a bullish continuation.

---

### **Conclusion:**

- **Fundamental Strengths:**

- Garware Hi-Tech Films is a strong player in the high-performance films industry, benefitting from its niche offerings, and it's poised for growth in packaging, automotive, and solar sectors.

- The company is financially sound, with low debt and a stable track record of profitability.

- **Technical Outlook:**

- The stock is currently trading in a range, with key support levels at ₹760-₹780 and resistance at ₹860-₹880.

- A breakout above ₹880 could signify the start of a strong uptrend, while a fall below ₹760 might trigger a bearish signal.

- RSI and MACD should be monitored to assess short-term momentum, and volume trends will help confirm the strength of any movement.

---

This analysis offers a balanced view based on the available technical and fundamental data. To ensure your investment decisions align with market conditions, it’s important to monitor real-time data and market sentiment.

Disclaimer:

The information provided is for educational purposes only and should not be construed as financial or investment advice. I am not a SEBI-registered advisor, and this analysis is not a recommendation to buy, sell, or hold any securities. Accuracy and timeliness of the data cannot be guaranteed. Always conduct your own research or consult with a professional before making investment decisions. I do not take responsibility for any losses incurred.

Exicom Tele-SystemsDouble-Bottom Breakout with Bullish TechnicalExicom Tele-Systems Ltd. is showing strong technical signs of an upward movement, supported by both chart patterns and technical indicators. Here’s a detailed breakdown of the analysis:

Current Market Price (CMP): ₹356.30 (as of 6 Nov 2024).

Chart Pattern:

The stock recently confirmed a double-bottom breakout on the daily timeframe, a classic bullish reversal pattern. This breakout indicates potential upward momentum as buyers continue to accumulate near support levels.

Technical Indicators:

RSI Bullish Divergence: A positive RSI divergence on the daily timeframe suggests strengthening momentum as the RSI has turned upwards, signaling increased buying interest.

Moving Averages: The stock has closed above three key moving averages, adding further confirmation of bullish sentiment.

Shareholding Insights:

Promoter holding remains strong at 69.6%, while institutional holdings have decreased to 7.43%, as both FII and DII reduced their positions. This may indicate some caution among institutional investors but is balanced by steady promoter confidence.

News and Catalysts:

The Board of Directors will review and potentially approve the unaudited financial results for Q2 and the half-year on 13 November 2024. This upcoming announcement could serve as a key catalyst, either strengthening the current uptrend or bringing volatility.

Financial Health:

Exicom has shown a positive trend in net profit, adding support to the potential for continued growth in value.

Expected Price Movement and Targets:

Primary Resistance Target: ₹389

Secondary Target: ₹425

Timeframe: Estimated at 1-3 months based on the daily timeframe analysis.

Summary:

Exicom Tele-Systems Ltd. exhibits a bullish technical setup, with a confirmed double-bottom breakout, favorable RSI divergence, and strong moving average support. With upcoming financial announcements as a potential catalyst, the stock appears poised to test the ₹389 resistance level, with further potential to reach ₹425 over the next 1-3 months.

Disclaimer:

This analysis is for educational purposes only. Please conduct your own research or consult a financial advisor before making any investment decisions.

MOIL Ltd. (LONG SETUP)NSE:MOIL

Company Overview: MOIL Ltd

MOIL Ltd ( Manganese Ore India Limited) is a leading producer of manganese ore in India, playing a crucial role in the country's steel industry. The company has a strong market presence and operates several mines across India. MOIL's manganese ore is vital for producing ferroalloys, which are key inputs in steel production.

PE Ratio: MOIL Ltd currently has a price-to-earnings (PE) ratio of 23, which indicates that the stock is reasonably valued compared to its earnings. This ratio suggests that investors are willing to pay 23 times the company's earnings per share, which is aligned with industry averages.

Technical Analysis:

Uptrend and 200-DMA Support:

MOIL Ltd is in a strong uptrend, supported by several key technical indicators:

200-Day Moving Average (DMA) Support: The stock has consistently found support at the 200-day moving average, a crucial long-term trend indicator, which suggests that the underlying trend is bullish.

RSI in Oversold Zone: The Relative Strength Index (RSI) is currently in the oversold zone, indicating that the stock may be undervalued in the short term and could be poised for a rebound.

Investment Idea:

Buy Setup:

Entry: Consider buying in the 420-425 range. This price range provides a good entry point, especially given the support from the 200-DMA and the oversold condition on the RSI.

Stop Loss: Place a stop loss below 370 to protect against potential downside risks. This stop loss level ensures that losses are minimized if the stock breaks below key support levels.

Targets: Set multiple targets to capitalize on potential gains:

First Target: 480

Second Target: 550

Third Target: 620

Conclusion:

MOIL Ltd offers a solid investment opportunity with a combination of fundamental strength and favorable technical indicators. The stock's support from the 200-DMA and the RSI in the oversold zone suggest a potential rebound. Buying in the 420-425 range with targets at 480, 550, and 620, and a stop loss below 370, provides a balanced approach to risk and reward. Consider your risk tolerance and market conditions before making any investment decisions.

Thanks & Happy Trading

S_Rawat

Disclaimer:

This idea is shared for educational purposes and should not be interpreted as financial advice. Please conduct your own research and consider your individual financial circumstances before engaging in any trading activity.