Search in ideas for "tata motors"

Tata Motors - The Hero Of EV India's EV Story 🚗🔌 Transitioning to Electric Vehicles (EVs) is a top priority for India. 🇮🇳 With ambitious goals set by the government, EVs are expected to make up 25% of two-wheeler sales and 15% of passenger vehicle sales by 2030.

💡 According to ICRA, this shift presents a huge opportunity for auto component suppliers. Market potential for EV components is projected to exceed Rs 1 lakh crore for e-2Ws and Rs 50,000 crore for e-PVs by 2030.

🔋 However, several factors need addressing for rapid adoption. This includes expanding charging infrastructure and service centers to boost consumer confidence in EVs. Challenges like insurance coverage and resale value also need resolution, especially for passenger vehicles.

📈 January's e-PV retail sales data show promising signs with a 13% month-on-month rise and a staggering 137% year-on-year increase. Yet, e-2W sales saw a robust 54% year-on-year growth but a decline in month-on-month sales.

💰 Vehicle pricing is crucial for customer acceptance. Tata Motors' recent price drop in e-PVs could be a game-changer, potentially spurring adoption. While some speculate weaker demand, Tata Motors attributes it to passing on cost reductions to customers to aid in purchase decisions.

#EVs #India #Sustainability #ElectricVehicles

Tata Motors indicated bullishnessHi folks,

Tata Motors currently is about to face some minor resistance as it is getting approached towards the mid-channel line.

Tata Motors is heading towards a great future.

Disc: I am already invested in this stock from 490.

Patterns look like head and shoulder but volume is not good at the time of breakout.

SL is a must.. just a reminder.

Supply Zone Breakout in Tata Motors (D)Tata Motors has finally broken the previous supply zone of 460-475. With stock approaching all-time high levels looks very bullish. We can buy at the current price with SL@ 425. Possible targets are mentioned on the chart.

Tata motors is one of the fundamentally strong companies which is a leading global automobile manufacturer. It is a formidable player in the CV segment in India and offers a broad portfolio of automotive products including trucks, buses, coaches and defense vehicles. It is the leading player in the CV segment, with a market share of 43.0% during FY20.

This is not a trade recommendation, Do your own analysis before investing.

Do share your views on this.

Tata Motors - Long OpportunityLong Opportunity -

Tata Motors has announced about their new cars, are going to be introduced in Indian Market. This may strengthen Tata Motors' position in the auto sector as well as in the stock market. It will be a good buying opportunity for the short term and for intraday too. For intraday 434 level is important and for the Short term, the 437 level is important, if it crosses this level, it will give a good target.

Happy Trading!

Tata Motors Triangle Patterns : Is it ready to make new high ?Hello all, Tata motors chart patterns are in triangluar form, if we see some previous days candle on daily time frame. if it comes out of the box, will this stock be able to make new high ? it may be possible. It has huge potential to move up. Keep in touch with this stock and examine this triangular patterns breakout .

Note : Given thought is personal and just for learning purpose only.

tata motors forming W patternThe sales of tata motors increased rapidly. now tata motors are at second position in sales in india . also at technical level there is W pattern formation happening in daily chart. If price brakes above 500 level and retest again then strong bullish candle at retest level should be buying opportunity.

TATA MOTORS POSSIBLE DESCENDING TRIANGLE BREAKDOWN???SUMMARY:-

*stock is constantly rejecting its 20-ema

*upon that the stock is seeing rejection from its bearish trendline

*on the downside there is a visible support at 445 level

*twice market bounced from 445 and moved higher

*if we notice the bounce is getting weaker and weaker creating lower high each time

*this clearly marks an example of descending triangle pattern

*so there is a huge risk reward trade in tata motors available

*one can go short now with a stop above 20-ema and bearish trendline on closing basis

TATA MOTORS JAN FUT

SHORT@471

STOP@479

TARGET@461-455-449

(IF A CLOSE BELOW 445-440 IS ACHEIVED ON CLOSING BASIS THEN STAY SHORT FOR 410-415 LEVELS)

NOTE

*once in profit and first target is achieved

*trail your trade to short price so it becomes no profit no loss trade

*do not overtrade

*for more index and stock updates check the link in the signature box below

👇👇👇👇👇👇👇👇👇

Tata Motors (Tatamotors) : Driving in to the future...Last week, Tata Motors violated the 20 day EMA. Today, after breaching the 50 day EMA, the stock price rebounded and closed the day above it.

As per the chart structure, 451 at 50 day EMA and 434 at Fibonacci level can act as a good support and rebound zone.

Support at around 100 day EMA and Fibonacci retracement level around 402 if it breaks 434 level.

Aggressive investors can initiate position around the 50 day EMA on rebound or else wait for the stock price to break out above 537.

I am bullish on Tata Motors on a longer time zone and am have positions and hence my views could be biased. Please do your own research as this is just an analysis and not an advisory for buy and sell.

TATA MOTORS Breaking Multi Year Support / ResistanceBuy Tata Motors above 365 and hold it till a target price of 550 - 600.

Do not buy If TATA Motors does not remain in the current Fib Retracement Levels.

Chart is simple enough to understand the strategy. Adjust your SL according to your Risk Management.

This is only from demonsration purposes and invest only after your own research.

TATA MOTORS SELL 15/3/2021 1.On 1hr time frame we can clearly see a range pattern along with a beautiful pattern i.e HEAD & SHOULDER PATTERN. The trade is bearish for tomorrow.

2. Also the Green trendline is support trendline and to break such strong supports it requires very promising pattern and head & shoulder is the one. its very rare that a head & shoulder patterns get failed.

3.If we go to 15min time frame we can see a bearish flag pattern making it confirm that on 15/3/2021 tata motors may open flat with 315 to 317 range and may trade red whole day.

4. Going to weekly time frame if we put fibonacci we can see that TATA motors is currently trading at 50% fibo retrace we means to continue an uptrend it has to give some fall to bring more buyers so that it can break fibo 50% level in long go.

5.LEVELS TO NOTE:

A. may open flat 315 to 317.

B. Targets can be set has T1=312-313,T2= 308-

306,T3=302-300

-SHIVAM MISHRA

MGB

Tata Motors Supply and Demand Zones TradingDear Traders,

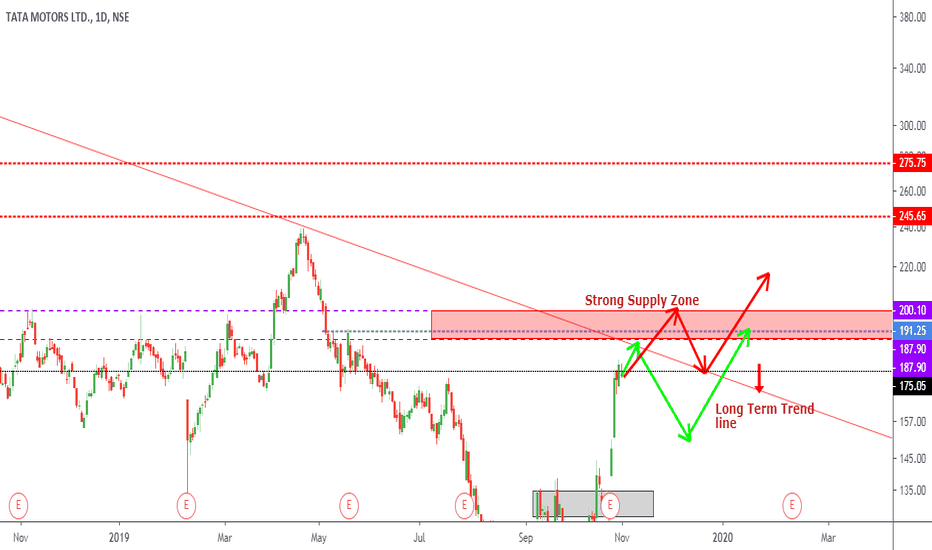

Tata motors are very close to the supply zones, I am expecting the two way track method of travelling with the price action. Either it will break the long term trend line, for me it is difficult to do because need one more better results to break the trend , but if it do so then it will take rest on the trend line for a while before it take off.

Case 2: If it resist by the trend line then we will see some correction towards the 150 Zones for buying opportunity as many of them missed the current flight, so they will get another opportunity to be on board.

I have shared my tata motors Supply and demand zone video, those who missed, please go thru the below mention link for ore clarification.

Thanks & Regards,

Deepak

Support us by Giving LIKE COMMENT SHARE for new people get rewarded by learning.

Please feel free to contact me for further clarification.

Tata Motors - Can it be Hat trick with Bearish Harmonic from 425Last Price@421.50 - 25th Oct2017 15:25 Hrs

As suggested last night - had bullish harmonic & got the move from 415 to 423 & prior to that from 434-438 to 416 - can it be hatrick from 425 to 410 - Let us wait & watch.

Any move above 427 - invalidates the pattern.

Bullish Harmonic from 415-416 to 423-425 - Why I closed the update at 423-425

Incomplete H&S with Right Shoulder & Fall to 410

Tata Motors - Fly & Fall with the Cypher Above 486L-S Long First & Short Later is the opportunity I shall be looking from the Tata Motors counter.

Trading Strategy for Bulls

484-486 is the zone of importance as upside & downside reversals has been seen in that zone quiet frequent shown by thumb, so moving above 486 on sustained basis we will look for 515-525 as Target Zone for bulls.

Trading Strategy for Bears

Once the Cypher completes & faces resistance in the zone 515-525 - taking care of 552 not to be breached upside, otherwise this pattern fails but if we see any weakness in the desired zone as mentioned then we will look for targets 485 back & below 475 it can retest 400-420 zone.

Previous Analysis - Hitting the Top@485 - Are you dreaming -drive it.

Tata Motors - Importance of Reverse Gear @307 - 300 Reverse gears are equally important as normal gears like 1-2-3-4 & 5. If you don't have space upside or room in front in that case we know how reverse gears become boon for drivers.

Last Update Review - Bearish Shark@320-325 - Let us enjoy motor's ride

In technical analysis - the term called polarity reversal is important which is support turning into resistance & resistance turning into support which was the case with 307 level as motors broke that level & retested that level back but this time there was a spike@307.65 as it always need fuel to move next (stops kept exactly above 307) so I suggested we wait for few minutes to see whether it holds 307 - I was not surprised that it did not hold above 307 & I suggested -we are not interested to buy below 307 levels.

Dropped to 304 level - we booked partial & below 304 - suggested to book close to 300 - Bingo!

Finally, taking reverse gear@300-301 zone as suggested - to zoom at day high@311 - 18th June 2018 finally closing at 308.75 for the day - All this was updated as Plan -4 -additional update

Trading Strategy - What Next ?

Plan 1 - Look to go long / buy if 306 -307 provides next support for targets 311 -314 -320-325

Plan 2 - Look to go long / buy if 303 - 304 provides support below 306 for same targets upside - 311 -314 - 320-325

Plan 3 - Look to long if crosses above 311 & holds above 311 for target 314 - 320

Plan 4 = Plan 3 (Last Update - Selling in 320-325 - In the bearish shark zone)