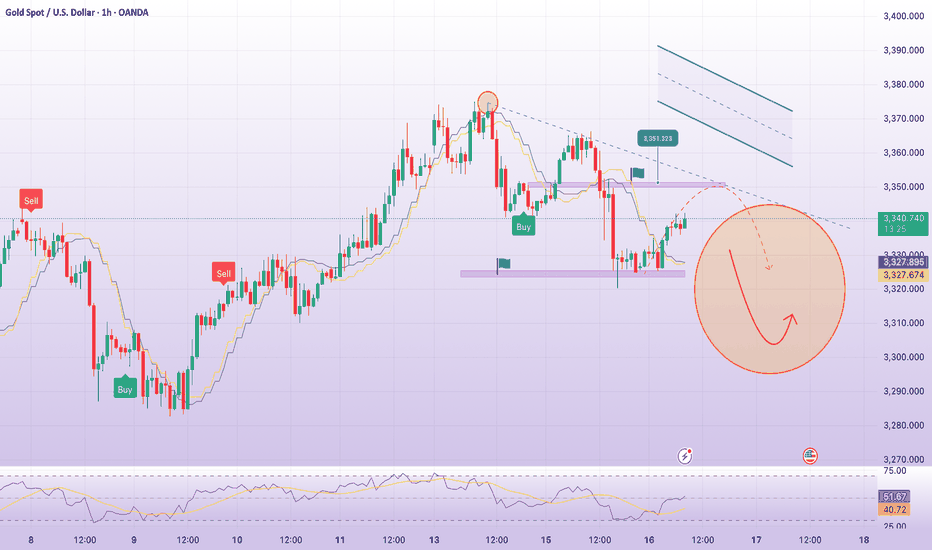

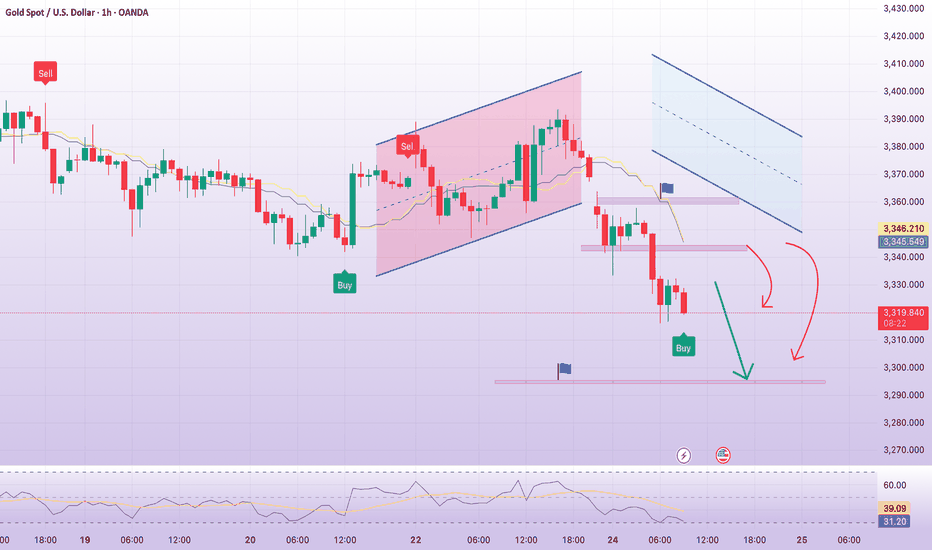

Gold price drops with FOMC today: 3342Plan XAU day: 30 July 2025

Related Information:!!!

Gold prices (XAU/USD) remain confined within a narrow range around the $3,325 level during the Asian session on Wednesday, struggling to extend the previous day's modest gains. Persistent market caution ahead of a pivotal central bank event lends some support to the safe-haven precious metal. In addition, a slight retreat in the US Dollar (USD) from a more than one-month high reached on Tuesday could provide an added boost to gold prices.

That said, upside potential appears limited, as investors exhibit restraint and await further clarity on the Federal Reserve's (Fed) monetary policy trajectory before making directional commitments. Meanwhile, the prevailing consensus that the Fed will maintain higher interest rates for an extended period is likely to prevent a significant USD pullback. Coupled with renewed trade optimism, these factors may continue to cap any meaningful gains in the XAU/USD pair

personal opinion:!!!

Gold price accumulated and compressed since the beginning of the week. Waiting for today's interest rate announcement. Decreased back to 3300.

Important price zone to consider : !!!

resistance zone point: 3342 zone

Sustainable trading to beat the market

Sellxauusd

Gold price accumulation, price reduction rangePlan XAU day: 28 July 2025

Related Information:!!!

Gold prices (XAU/USD) have stalled their intraday rebound from a more than one-week low and are trading around the $3,335 level during the early European session on Monday, marking a decline for the third consecutive day. Renewed strength in the US Dollar (USD) continues to weigh on the precious metal, serving as a primary headwind. Additionally, a broadly positive market sentiment—supported by recent trade-related optimism—is further limiting the upside potential for the safe-haven asset.

That said, USD bulls may exercise caution and refrain from initiating aggressive positions ahead of further clarity on the Federal Reserve’s (Fed) monetary policy outlook. As such, market participants are expected to closely monitor the outcome of the upcoming two-day FOMC meeting concluding on Wednesday, which is likely to influence USD dynamics and provide fresh directional impetus for non-yielding gold. Moreover, this week’s key US macroeconomic data releases will be instrumental in determining the next leg of movement for the XAU/USD pair

personal opinion:!!!

Very important news this week, gold price is forecast to continue to fall sharply below 3300 with the almost certain result that the FED will continue to keep the current interest rate unchanged.

Important price zone to consider : !!!

resistance zone point: 3340, 3358 zone

Sustainable trading to beat the market

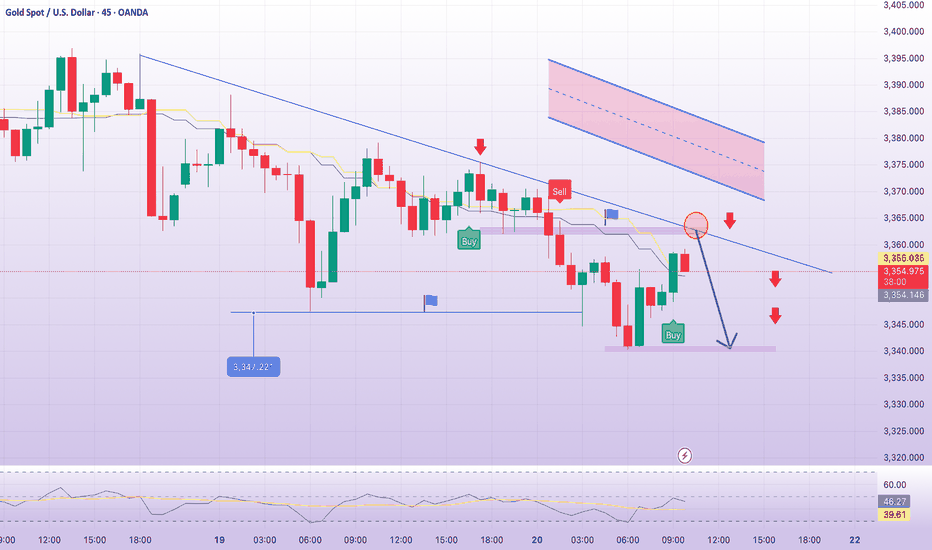

recovery 3352, signal SELL gold trendline todayPlan XAU day: 16 July 2025

Related Information:!!!

Gold prices (XAU/USD) maintain a firm tone during the early European session on Wednesday, currently trading just below the $3,340 level. Investor sentiment remains cautious amid concerns over the potential economic repercussions of US President Donald Trump’s tariff policies, coupled with expectations that the Federal Reserve (Fed) will maintain elevated interest rates for an extended period. This risk-averse mood—reflected in the generally weaker performance of equity markets—is helping to revive demand for the safe-haven precious metal following two consecutive days of losses.

Additionally, a modest pullback in the US Dollar (USD) from its highest level since June 23—reached in response to slightly stronger-than-expected inflation data for June—provides further support to gold prices. Nevertheless, the growing consensus that the Fed is likely to postpone rate cuts amid persistent inflationary pressures should limit significant USD depreciation and cap upside potential for the non-yielding yellow metal. Consequently, a cautious approach remains advisable for XAU/USD bulls as market participants await the release of the US Producer Price Index (PPI) later in the North American session

personal opinion:!!!

Gold price recovers to gain liquidity in Asian and European trading sessions, inflation indicators increase, DXY recovers, gold price continues to be under selling pressure

Important price zone to consider : !!!

resistance zone point: 3352 zone

Sustainable trading to beat the market

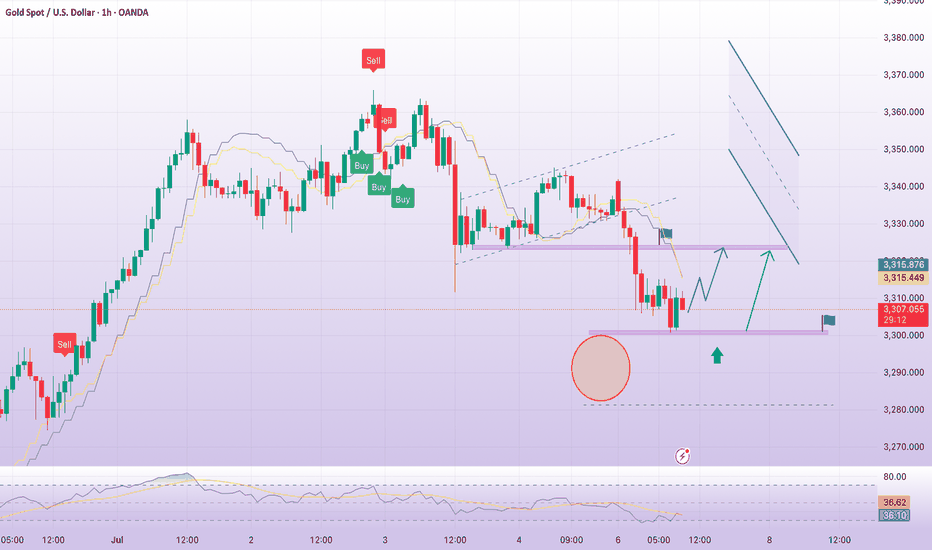

sell signal at the beginning of the week, downward pressurePlan XAU day: 07 July 2025

Related Information:!!!

Gold prices (XAU/USD) maintain an intraday bearish bias during the first half of the European session, although the precious metal has managed to rebound from the $3,300 level—its lowest point in a week, recorded earlier on Monday. A notable uptick in demand for the US Dollar (USD) has emerged as a primary factor diverting flows away from gold. However, increasing market consensus that the US Federal Reserve (Fed) is likely to implement further interest rate cuts this year may temper bullish sentiment toward the USD and offer some support to the non-yielding yellow metal.

Additionally, concerns surrounding former President Donald Trump’s substantial tax-cut and spending proposals—seen as potentially exacerbating the United States’ long-term debt challenges—may also act as a constraint on USD strength. Meanwhile, overall market sentiment remains fragile due to ongoing uncertainty linked to Trump's unpredictable trade policies. Furthermore, renewed Israeli airstrikes on Yemen—the first in nearly a month—have dampened investor appetite for riskier assets, further helping to limit downside pressure on gold and warranting a cautious approach from bearish traders.

personal opinion:!!!

Gold price adjusts and accumulates around 3300 before tariff policies this week, gold recovery opportunity

Important price zone to consider : !!!

Resistance point: 3324 zone

Sustainable trading to beat the market

Gold price recovers 3310, accumulates MondayPlan XAU day: 30 June 2025

Related Information:!!!

Gold prices (XAU/USD) regained some lost ground during the early European trading hours on Monday. Increasing expectations that the US Federal Reserve (Fed) will implement additional interest rate cuts this year—and potentially sooner than previously anticipated—may weigh on the US Dollar and, in turn, provide support for the USD-denominated commodity, as a weaker dollar makes gold more affordable for foreign investors.

However, improved risk sentiment stemming from the US-China trade agreement, as well as the ceasefire reached between Israel and Iran, may reduce the appeal of gold as a traditional safe-haven asset. Market participants now turn their attention to upcoming remarks from Federal Reserve officials later on Monday, with scheduled speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee.

personal opinion:!!!

Gold price recovers to gain liquidity at the beginning of the week, using fibonacci to find potential resistance: 3310

Important price zone to consider : !!!

SELL point: 3310 zone

Sustainable trading to beat the market

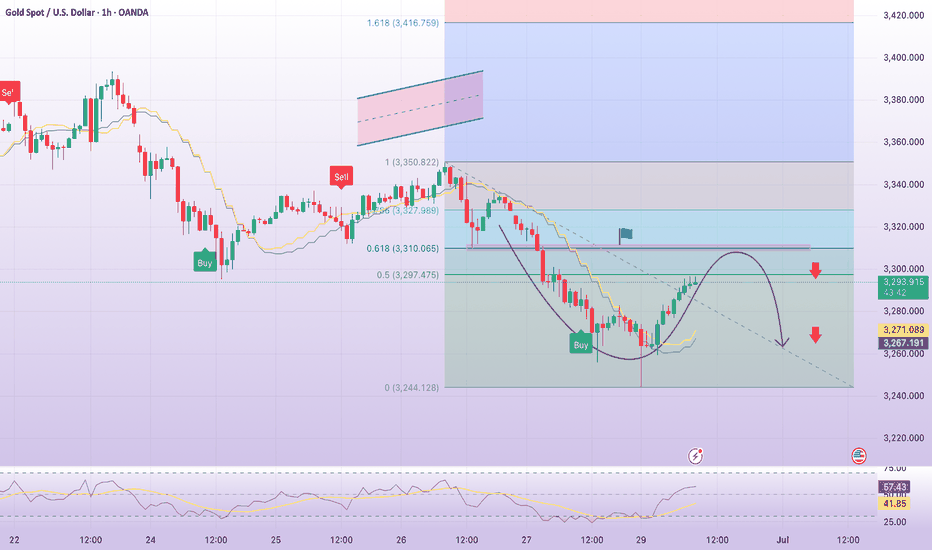

bears active, gold price below 3300Plan XAU day: 27 June 2025

Related Information:!!!

In fact, Powell reiterated this week that the Fed is well-positioned to wait before cutting interest rates until it has a clearer understanding of the impact of steep tariffs on consumer prices. His comments sparked fresh criticism from US President Donald Trump, who has been calling for lower interest rates. Furthermore, reports indicate that Trump is considering naming Powell's successor by September or October.

This development raises concerns about a potential erosion of the Fed’s independence, which should limit any immediate positive reaction in the USD to the upcoming inflation data. In turn, this suggests that the path of least resistance for the XAU/USD pair remains to the upside, and any further decline may still be viewed as a buying opportunity.

personal opinion:!!!

Gold prices are consolidating around 3280 - 3290 in the European trading session, accumulating for selling pressure to prevail.

Important price zone to consider : !!!

BUY point: 3272; 3248 zone

Sustainable trading to beat the market

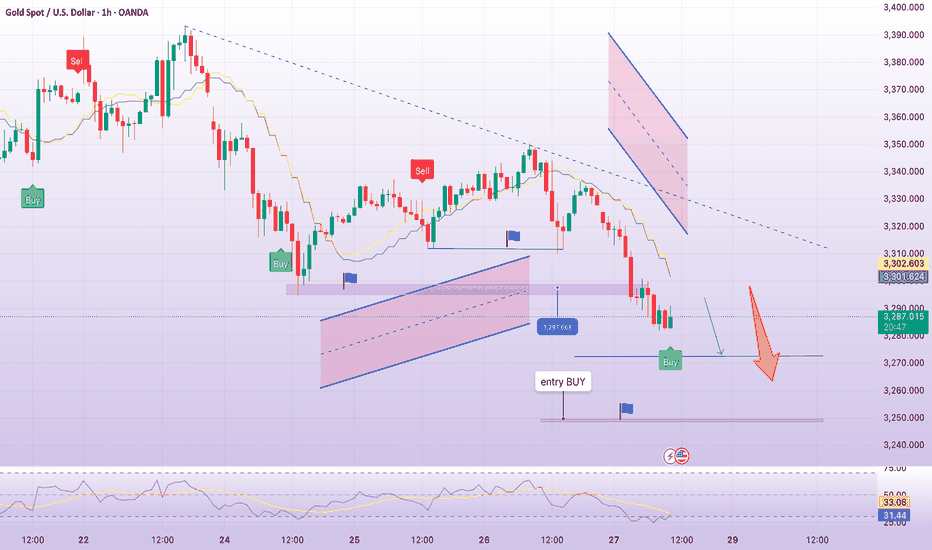

Selling pressure, gold price falls below 3300Plan XAU day: 24 June 2025

Related Information:!!!

Gold price (XAU/USD) maintains a heavily bearish tone during the first half of the European session and is currently trading just above the nearly two-week low reached earlier this Tuesday. News of a ceasefire between Iran and Israel has boosted investor confidence and triggered a fresh wave of global risk-on sentiment, which is seen as a key factor driving funds away from the safe-haven precious metal.

Meanwhile, the intraday decline appears largely unaffected by continued US Dollar (USD) selling, which would typically support gold prices. Mixed US PMI data and dovish comments from Federal Reserve officials have fueled speculation about a possible rate cut in July. As a result, the USD has fallen to a more than one-week low, which could offer some support to gold ahead of Fed Chair Jerome Powell’s upcoming testimony.

personal opinion:!!!

Strong selling pressure, gold price continues to be under downward pressure. War negotiation information is becoming an obstacle causing gold price to drop sharply.

Important price zone to consider : !!!

BUY point: 3304; 3293 zone

Sustainable trading to beat the market

Gold price returns to 3363 price zone, gold selling pointPlan XAU day: 20 June 2025

Related Information:!!!

Gold price (XAU/USD) is seen consolidating its intraday losses to over a one-week low and is trading just below the $3,350 level during the first half of the European session. Earlier this week, the US Federal Reserve (Fed) trimmed its outlook for rate cuts in 2026 and 2027, which is seen as a tailwind for the US Dollar (USD) and is weighing on demand for the non-yielding yellow metal.

In addition, a generally positive tone in European equity markets is another factor putting pressure on Gold prices. However, rising geopolitical tensions in the Middle East may cap market optimism amid ongoing trade-related uncertainties and help limit losses for the safe-haven XAU/USD, which remains on track for weekly losses

personal opinion:!!!

Gold price in sell zone, trend line 3362

Important price zone to consider : !!!

SELL point: 3362 zone

Sustainable trading to beat the market

short term downtrend! sell gold 3379Plan XAU day: 19 June 2025

Related Information:!!!

Gold prices show minimal gains as the Asian session begins, following the Fed’s decision to maintain rates while indicating they are still considering two rate cuts. Meanwhile, US President Donald Trump’s comments on Iran triggered a pullback toward a weekly low of $3,362 before settling at around current levels. XAU/USD is trading at $3,375, up 0.19%.

On Wednesday, the Fed kept rates unchanged as expected and updated its economic projections for the United States (US). The median forecasts suggest that Gross Domestic Product (GDP) will be lower than in March’s projections, while the unemployment rate is expected to rise slightly. Inflation is likely to end around the 3% level, and the Federal Funds Rate forecast indicates policymakers are anticipating 50 basis points of easing

personal opinion:!!!

Gold price confirms downtrend in Asian session, price zone 3379 following downtrend line

Important price zone to consider : !!!

SELL point: 3379 zone

Sustainable trading to beat the market

GDP - gold price continues to decrease⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to around $2,920 in early Asian trading on Thursday, supported by trade tensions and economic uncertainty that fuel demand for safe-haven assets.

On Wednesday, US President Donald Trump reaffirmed plans for 25% tariffs on Canada and Mexico and announced similar measures for the European Union. He added that tariffs on Canada and Mexico would take effect on April 2.

Investors remain focused on further developments in Trump’s trade policies, as uncertainty around tariffs could drive more safe-haven demand for gold.

⭐️ Personal comments NOVA:

Downtrend continues today, selling pressure adjusts to lower price zone: pay attention 2877

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2878 - $2876 SL $2871

TP1: $2885

TP2: $2892

TP3: $2900

🔥 SELL GOLD zone: $2939 - $2941 SL $2946

TP1: $2930

TP2: $2920

TP3: $2910

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD bank holiday!! slight recovery in gold price in early JulyThe current stance of central banks favoring tighter monetary policies is expected to hinder the rise of gold prices. Additionally, the likelihood of a 25 basis points rate hike at the upcoming FOMC meeting, coupled with a more aggressive approach taken by major central banks, is likely to continue exerting pressure on the non-yielding gold price. Furthermore, the recent surge in global equity markets, indicating a higher appetite for risk, is expected to further limit the upward potential for gold, which is typically seen as a safe-haven asset. Therefore, it would be wise to wait for significant buying momentum before confirming that the XAU/USD has reached a short-term bottom and considering any substantial upward movement.

This week, it is predicted that the gold price is still recovering slightly, sideways around the $1910 - $1950 mark

Set up SELL GOLD price zone at: $1930 - $1932 sl $1945

Based on technical analysis indicators EMA 34, EMA 89 , resistance at $1930

GOLD 3/7 !!! The bulls are having a slight recoveryThe Gold price is being affected by a slight increase in the US Dollar. After experiencing significant losses on Friday, the US Dollar is attracting some buyers and recovering. This is seen as a key factor that is putting pressure on the price of Gold. Recent data from the United States shows that the Personal Consumption Expenditures (PCE) Price Index decreased to 3.8% in May from 4.3% previously. Additionally, the Core PCE Price Index, which excludes volatile food and energy components, went down to 4.6% in May from 4.7% in April. Despite these decreases, both indices remain well above the Federal Reserve's target of 2% and support the possibility of further tightening of monetary policy.

Today, July 3, 2023, gold price is predicted to have a slight recovery around the $1925 -$1930 mark

Set up Price Gold at:

SELL GOLD at: 1920-1922 small lot

and SELL GOLD at: $1930 - $1932 small lot

and SELL GOLD at: $1937 - $1940 sl $1950

Based on technical indicators EMA 34, EMA 89 and resistance areas to sell at the above price zones.