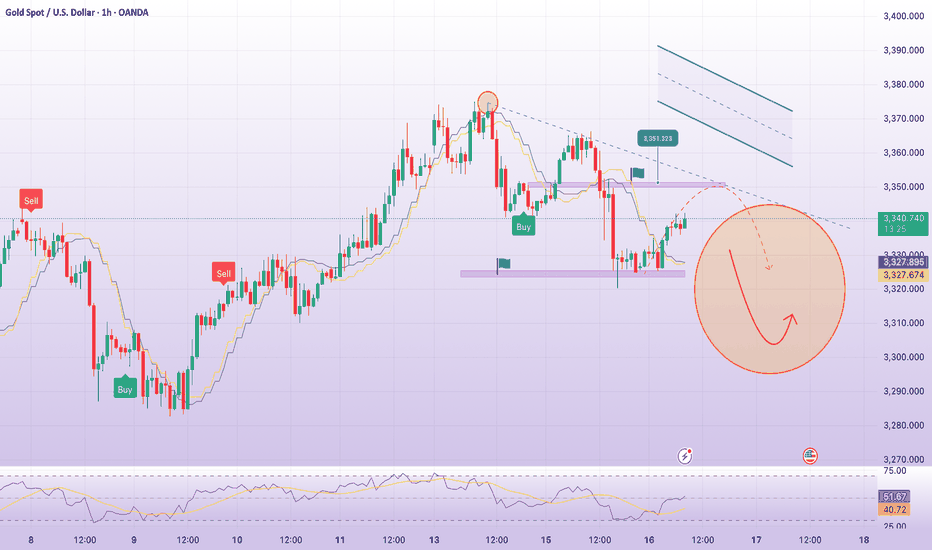

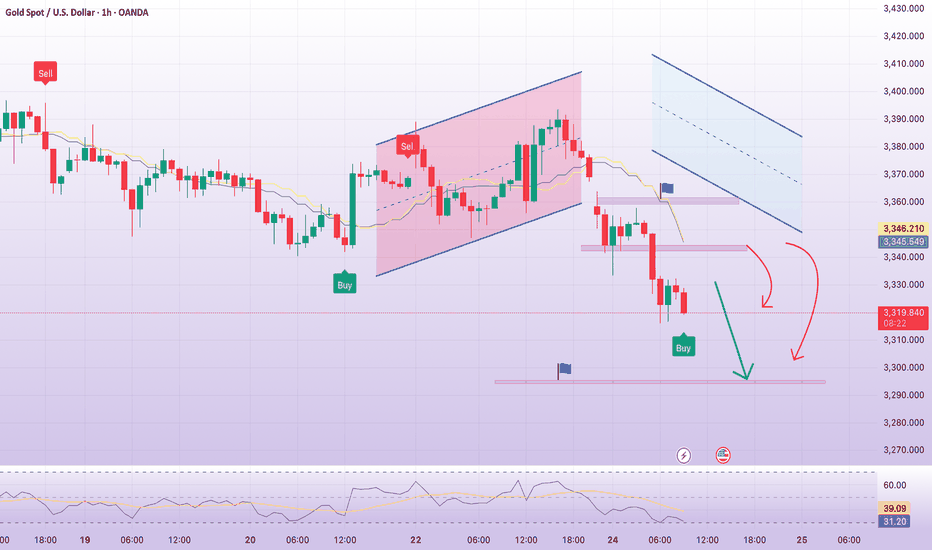

Gold price drops with FOMC today: 3342Plan XAU day: 30 July 2025

Related Information:!!!

Gold prices (XAU/USD) remain confined within a narrow range around the $3,325 level during the Asian session on Wednesday, struggling to extend the previous day's modest gains. Persistent market caution ahead of a pivotal central bank event lends some support to the safe-haven precious metal. In addition, a slight retreat in the US Dollar (USD) from a more than one-month high reached on Tuesday could provide an added boost to gold prices.

That said, upside potential appears limited, as investors exhibit restraint and await further clarity on the Federal Reserve's (Fed) monetary policy trajectory before making directional commitments. Meanwhile, the prevailing consensus that the Fed will maintain higher interest rates for an extended period is likely to prevent a significant USD pullback. Coupled with renewed trade optimism, these factors may continue to cap any meaningful gains in the XAU/USD pair

personal opinion:!!!

Gold price accumulated and compressed since the beginning of the week. Waiting for today's interest rate announcement. Decreased back to 3300.

Important price zone to consider : !!!

resistance zone point: 3342 zone

Sustainable trading to beat the market

Shortgold

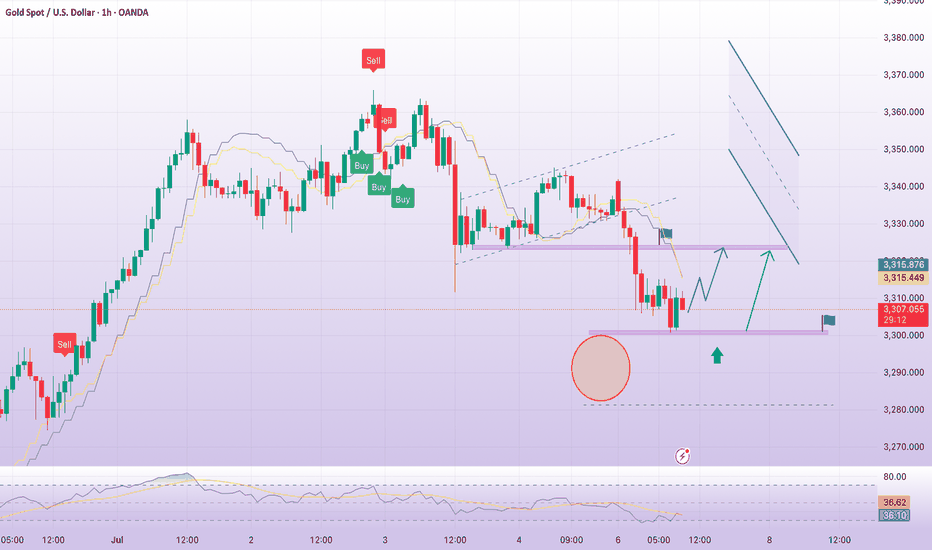

Gold price accumulation, price reduction rangePlan XAU day: 28 July 2025

Related Information:!!!

Gold prices (XAU/USD) have stalled their intraday rebound from a more than one-week low and are trading around the $3,335 level during the early European session on Monday, marking a decline for the third consecutive day. Renewed strength in the US Dollar (USD) continues to weigh on the precious metal, serving as a primary headwind. Additionally, a broadly positive market sentiment—supported by recent trade-related optimism—is further limiting the upside potential for the safe-haven asset.

That said, USD bulls may exercise caution and refrain from initiating aggressive positions ahead of further clarity on the Federal Reserve’s (Fed) monetary policy outlook. As such, market participants are expected to closely monitor the outcome of the upcoming two-day FOMC meeting concluding on Wednesday, which is likely to influence USD dynamics and provide fresh directional impetus for non-yielding gold. Moreover, this week’s key US macroeconomic data releases will be instrumental in determining the next leg of movement for the XAU/USD pair

personal opinion:!!!

Very important news this week, gold price is forecast to continue to fall sharply below 3300 with the almost certain result that the FED will continue to keep the current interest rate unchanged.

Important price zone to consider : !!!

resistance zone point: 3340, 3358 zone

Sustainable trading to beat the market

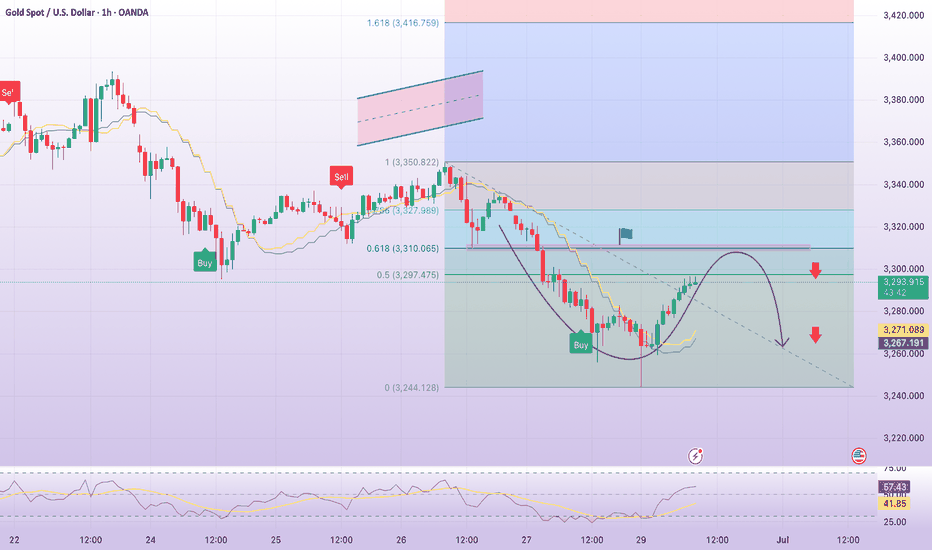

recovery 3352, signal SELL gold trendline todayPlan XAU day: 16 July 2025

Related Information:!!!

Gold prices (XAU/USD) maintain a firm tone during the early European session on Wednesday, currently trading just below the $3,340 level. Investor sentiment remains cautious amid concerns over the potential economic repercussions of US President Donald Trump’s tariff policies, coupled with expectations that the Federal Reserve (Fed) will maintain elevated interest rates for an extended period. This risk-averse mood—reflected in the generally weaker performance of equity markets—is helping to revive demand for the safe-haven precious metal following two consecutive days of losses.

Additionally, a modest pullback in the US Dollar (USD) from its highest level since June 23—reached in response to slightly stronger-than-expected inflation data for June—provides further support to gold prices. Nevertheless, the growing consensus that the Fed is likely to postpone rate cuts amid persistent inflationary pressures should limit significant USD depreciation and cap upside potential for the non-yielding yellow metal. Consequently, a cautious approach remains advisable for XAU/USD bulls as market participants await the release of the US Producer Price Index (PPI) later in the North American session

personal opinion:!!!

Gold price recovers to gain liquidity in Asian and European trading sessions, inflation indicators increase, DXY recovers, gold price continues to be under selling pressure

Important price zone to consider : !!!

resistance zone point: 3352 zone

Sustainable trading to beat the market

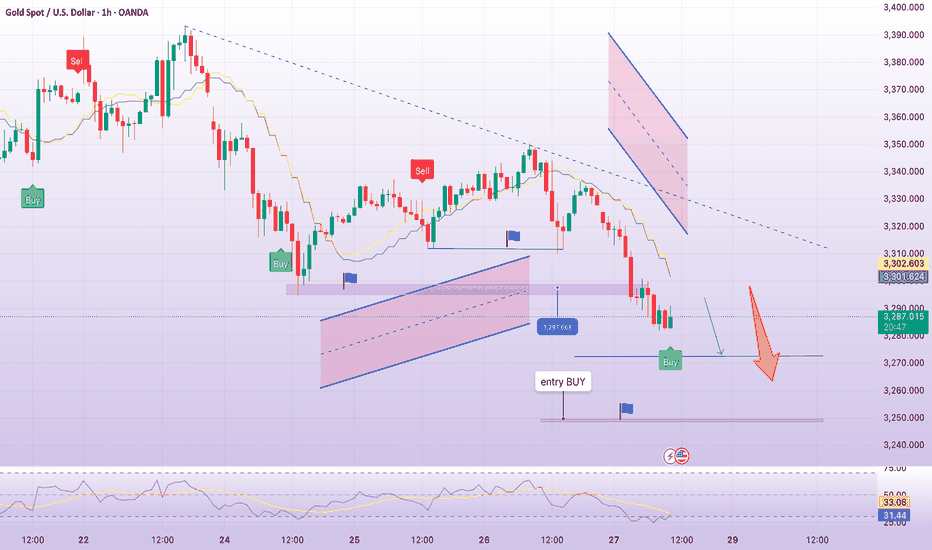

sell signal at the beginning of the week, downward pressurePlan XAU day: 07 July 2025

Related Information:!!!

Gold prices (XAU/USD) maintain an intraday bearish bias during the first half of the European session, although the precious metal has managed to rebound from the $3,300 level—its lowest point in a week, recorded earlier on Monday. A notable uptick in demand for the US Dollar (USD) has emerged as a primary factor diverting flows away from gold. However, increasing market consensus that the US Federal Reserve (Fed) is likely to implement further interest rate cuts this year may temper bullish sentiment toward the USD and offer some support to the non-yielding yellow metal.

Additionally, concerns surrounding former President Donald Trump’s substantial tax-cut and spending proposals—seen as potentially exacerbating the United States’ long-term debt challenges—may also act as a constraint on USD strength. Meanwhile, overall market sentiment remains fragile due to ongoing uncertainty linked to Trump's unpredictable trade policies. Furthermore, renewed Israeli airstrikes on Yemen—the first in nearly a month—have dampened investor appetite for riskier assets, further helping to limit downside pressure on gold and warranting a cautious approach from bearish traders.

personal opinion:!!!

Gold price adjusts and accumulates around 3300 before tariff policies this week, gold recovery opportunity

Important price zone to consider : !!!

Resistance point: 3324 zone

Sustainable trading to beat the market

Gold price recovers 3310, accumulates MondayPlan XAU day: 30 June 2025

Related Information:!!!

Gold prices (XAU/USD) regained some lost ground during the early European trading hours on Monday. Increasing expectations that the US Federal Reserve (Fed) will implement additional interest rate cuts this year—and potentially sooner than previously anticipated—may weigh on the US Dollar and, in turn, provide support for the USD-denominated commodity, as a weaker dollar makes gold more affordable for foreign investors.

However, improved risk sentiment stemming from the US-China trade agreement, as well as the ceasefire reached between Israel and Iran, may reduce the appeal of gold as a traditional safe-haven asset. Market participants now turn their attention to upcoming remarks from Federal Reserve officials later on Monday, with scheduled speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee.

personal opinion:!!!

Gold price recovers to gain liquidity at the beginning of the week, using fibonacci to find potential resistance: 3310

Important price zone to consider : !!!

SELL point: 3310 zone

Sustainable trading to beat the market

bears active, gold price below 3300Plan XAU day: 27 June 2025

Related Information:!!!

In fact, Powell reiterated this week that the Fed is well-positioned to wait before cutting interest rates until it has a clearer understanding of the impact of steep tariffs on consumer prices. His comments sparked fresh criticism from US President Donald Trump, who has been calling for lower interest rates. Furthermore, reports indicate that Trump is considering naming Powell's successor by September or October.

This development raises concerns about a potential erosion of the Fed’s independence, which should limit any immediate positive reaction in the USD to the upcoming inflation data. In turn, this suggests that the path of least resistance for the XAU/USD pair remains to the upside, and any further decline may still be viewed as a buying opportunity.

personal opinion:!!!

Gold prices are consolidating around 3280 - 3290 in the European trading session, accumulating for selling pressure to prevail.

Important price zone to consider : !!!

BUY point: 3272; 3248 zone

Sustainable trading to beat the market

Selling pressure, gold price falls below 3300Plan XAU day: 24 June 2025

Related Information:!!!

Gold price (XAU/USD) maintains a heavily bearish tone during the first half of the European session and is currently trading just above the nearly two-week low reached earlier this Tuesday. News of a ceasefire between Iran and Israel has boosted investor confidence and triggered a fresh wave of global risk-on sentiment, which is seen as a key factor driving funds away from the safe-haven precious metal.

Meanwhile, the intraday decline appears largely unaffected by continued US Dollar (USD) selling, which would typically support gold prices. Mixed US PMI data and dovish comments from Federal Reserve officials have fueled speculation about a possible rate cut in July. As a result, the USD has fallen to a more than one-week low, which could offer some support to gold ahead of Fed Chair Jerome Powell’s upcoming testimony.

personal opinion:!!!

Strong selling pressure, gold price continues to be under downward pressure. War negotiation information is becoming an obstacle causing gold price to drop sharply.

Important price zone to consider : !!!

BUY point: 3304; 3293 zone

Sustainable trading to beat the market

short term downtrend! sell gold 3379Plan XAU day: 19 June 2025

Related Information:!!!

Gold prices show minimal gains as the Asian session begins, following the Fed’s decision to maintain rates while indicating they are still considering two rate cuts. Meanwhile, US President Donald Trump’s comments on Iran triggered a pullback toward a weekly low of $3,362 before settling at around current levels. XAU/USD is trading at $3,375, up 0.19%.

On Wednesday, the Fed kept rates unchanged as expected and updated its economic projections for the United States (US). The median forecasts suggest that Gross Domestic Product (GDP) will be lower than in March’s projections, while the unemployment rate is expected to rise slightly. Inflation is likely to end around the 3% level, and the Federal Funds Rate forecast indicates policymakers are anticipating 50 basis points of easing

personal opinion:!!!

Gold price confirms downtrend in Asian session, price zone 3379 following downtrend line

Important price zone to consider : !!!

SELL point: 3379 zone

Sustainable trading to beat the market

GDP - gold price continues to decrease⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to around $2,920 in early Asian trading on Thursday, supported by trade tensions and economic uncertainty that fuel demand for safe-haven assets.

On Wednesday, US President Donald Trump reaffirmed plans for 25% tariffs on Canada and Mexico and announced similar measures for the European Union. He added that tariffs on Canada and Mexico would take effect on April 2.

Investors remain focused on further developments in Trump’s trade policies, as uncertainty around tariffs could drive more safe-haven demand for gold.

⭐️ Personal comments NOVA:

Downtrend continues today, selling pressure adjusts to lower price zone: pay attention 2877

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2878 - $2876 SL $2871

TP1: $2885

TP2: $2892

TP3: $2900

🔥 SELL GOLD zone: $2939 - $2941 SL $2946

TP1: $2930

TP2: $2920

TP3: $2910

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold MCX - Trade UpdateHey traders, here's an important update on our Gold MCX positions:

We've successfully booked our long position and are currently completely out of our short-term long trade.

In order to consider re-entering a long trade, we'll be closely monitoring the market for a break above the key level of 61,130 , and it's crucial that the price sustains above this level.

As of now, our focus is on initiating a short trade entry around 60,750 , while maintaining a disciplined stop loss at 61,150.

Stay tuned for more updates and trade responsibly. Happy trading, everyone!

Short Gold Based on the current scenario we can clearly identify that Gold is approaching a major breakdown as it has its downtrend resistance at 1950, considering that we can acknowledge 1944 as a reversal point and soon in upcoming time we can expect this bearish trend to test all the levels up to 1890.

The Best thing is to stay bearish with a stop loss 1950, and if it breaks the 1950 level and the next 1 hr candles survive over it we can consider it as a successful breakout and then be bullish again considering this as a minor pullback.

So right now it would be best if we sell gold, trade at your own risk.

GOLD Double Top Oportunity

Weekly chart - Strong buying pressure

Daily chart - Potential double short

Hourly chart - pushing back to tesst top resistance once more

If it rejects this top level again we are in a good way for Double top setup

We will have to wait and see how price reacts to the 143 price level, If you want you can play agressive with a shot pending order on the 143 level and a ver short stop loss right above this resistance. Price might bounce back really fast and you will miss this opportunity

Gold broke major support for more sell side direction XAUUSD Technical Overview:

Pivot: 1188.20

Key Resistance: 1184.55 - 1188.20 - 1192.89 - 1196.48

Key Support: 1180.23 - 1176.45 - 1174.88 - 1171.43

Technical Indicator:

RSI: The indicator having bullish divergence but moving under 50 level near to oversold condition.

Moving Average: CMP 1182 Price moving under Simple moving average 100 & 55, sign for more down trend ahead.

Technical Trade Idea:

Most Likely Scenario: short positions below 1188.20 with targets at 1182.55 & 1176.45 in extension.

Alternative scenario: above 1188.20 look for further upside with 1191.89 & 1194.66 as targets.

Overall, Gold markets broke down rather significantly during the day on Thursday, slicing through the $1200 level like it wasn’t even there. Furthermore, we broke below the hammer at the $1195 level, which is a further sign of weakness.

the US economy is running at full steam ahead, it was appropriate that the Fed removed that sentence from the statement - But what markets traded was the forward outlook - As the policy rate moves closer to estimates of neutral, members of the FOMC and observers, market participants, now forecast a modestly restrictive terminal FFTR while other Central Banks embark on their own normalization of policy, thus stripping some of the yield advantages out of the long end of the curve for the dollar.

However, in the near term, the dollar remains on top and following today's set of economic data,"Between Chairman Powell's comment yesterday the that the U.S. economy is in a particularly good spot and today's robust durable good orders and excellent business spending, despite the August pause the six months to July saw the strongest investment spending in five years, the dollar has room to run on the American economy alone."

US economic data

US: Pending home sales decline by 1.8% in August vs 0.4% expected.

US: Durable goods orders increased by 4.5% in August following July's 1.2% contraction.

US: Real GDP expanded at an annual rate of 4.2% in Q2 to match expectations.

FOMC outcome notes

As expected, the FOMC raised the FFTR and the IOER by 25bps at its September meeting.

‘Dot-plot’ distribution around three hikes in 2019 narrowed; FOMC still sees strong growth as cyclical.

2021 projections indicate a ‘soft landing’ through lower real growth and slightly higher unemployment.

The only significant change to the statement was the removal of the description of monetary policy stance as “accommodate”.

Thanks

YoCryptoManic