Silver

Silver’s Breakdown Points to Much Lower LevelsSilver’s recent price action is not showing signs of strength or accumulation.

Instead, it reflects a clean structural breakdown followed by weak, corrective consolidation — the kind of behavior that usually precedes another leg lower.

After losing the key $84 level, silver didn’t stabilize or reclaim lost territory. It simply drifted into a lower range, suggesting that the move down was not just a temporary flush, but the start of a broader repricing phase.

What the market is doing now looks less like accumulation and more like post-breakdown exhaustion.

The $84 zone: where structure changed

The $84 area was a major structural level.

It acted as a balance zone where price previously found support and built value.

Once that level broke:

Buyers lost control of the structure

The market shifted from balance to imbalance

Liquidity started moving downward

Strong markets defend key levels.

Weak markets lose them and never look back.

So far, silver is behaving like the latter.

The inability to reclaim $84 suggests that the market is now operating in a lower value regime, where rallies are likely to be sold into, not chased higher.

Current price action: drift, not recovery

After the sharp drop, price entered a sideways range. But this range lacks the characteristics of real accumulation.

There is:

No strong impulsive buying

No reclaim of broken structure

No sustained upward expansion

Instead, the market is:

Printing lower highs

Moving sideways to slightly down

Showing reactive buying, not aggressive accumulation

This type of behavior is typical in markets that are pausing before the next leg lower.

The downside path: where liquidity sits

Below the current price, multiple untested liquidity zones remain.

These areas represent prior consolidation, psychological levels, and structural supports.

First major target: $56.52

This is the nearest meaningful support zone.

It represents:

A prior demand area

A structural pause in the previous trend

A natural magnet after the $84 breakdown

A move to this level would be a logical continuation, not a panic move.

Secondary target: $49.78

If $56 fails to hold, the next liquidity pocket sits near $49.78.

This level aligns with:

Deeper structural support

A prior consolidation region

A zone where longer-term buyers may begin to re-enter

This would represent a full structural correction from the $84 breakdown.

Deeper flush zones: $44.13 → $37.48 → $34.82

If the market enters a true risk-off phase or broad commodity weakness:

$44 becomes the next major structural test

$37 acts as a deeper psychological and technical level

$34 represents a full-cycle liquidity reset zone

These levels are where:

Long-term positioning resets

Weak hands are fully cleared out

Real accumulation could begin

Why the bearish scenario makes structural sense

Several factors support the downside path:

1) Clean structural breakdown

The loss of $84 shifted the entire market regime.

2) Lack of impulsive recovery

Strong markets bounce fast. Weak markets drift.

3) Overhead supply above current price

Every rally now runs into trapped longs from higher levels.

4) Untested liquidity below

Multiple clean targets sit beneath the current range.

Markets naturally move toward unfilled liquidity zones.

The likely sequence from here

The higher-probability path:

Continued sideways-to-lower drift below $84

Gradual breakdown of the current range

First major test around $56.52

If that fails, extension toward $49.78

Deeper flush possible toward $44 → $37 → $34 zones

Real accumulation is more likely after these levels are tested, not at current prices.

Bottom line

Silver is not showing signs of a bottom.

It’s showing signs of a market adjusting to a lower price regime.

The $84 breakdown changed the structure.

Since then, price has only drifted — not recovered.

That usually means the move isn’t over.

The structure currently favors:

First major downside target: $56.52

Secondary level: $49.78

Deeper reset zones: $44 → $37 → $34

This isn’t a base in silver.

It’s a pause before the next move.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Bullish Structure Rebuild as Precious Metals Surge | Lana ✨

Precious metals are back in focus as silver surges sharply, adding momentum to the broader metals complex. In this context, gold is showing signs of structure rebuilding after a healthy correction, setting the stage for potential continuation.

📈 Market Structure & Technical Context

After a strong impulsive drop, gold successfully defended the 4,420–4,450 strong support zone, where buyers stepped in decisively. Since then, price has been forming higher lows along an ascending trendline, signalling a shift from distribution into recovery.

The current price action suggests this move is corrective-to-bullish, not just a short-lived bounce.

🔍 Key Levels to Watch

Strong Support: 4,420 – 4,450

This zone remains the structural base. As long as price holds above it, bullish scenarios stay valid.

Mid Resistance / Reaction Zone: ~5,050 – 5,080

Price is currently consolidating here, absorbing supply after the rebound.

Next Resistance: ~5,135

A clean break and acceptance above this level would confirm continuation strength.

Upper Targets: ~5,300 – 5,350

Aligned with Fibonacci extensions and prior supply zones.

Higher Objective: ~5,580

Only in play if bullish momentum accelerates across the metals market.

🎯 Bullish Scenarios

If gold continues to respect the upper trendline and holds above the 5,000 psychological level:

A brief pullback into 5,000–5,050 could offer structure for continuation.

Acceptance above 5,135 opens the path toward 5,300+.

Strong momentum, supported by silver’s breakout, could extend moves toward 5,580.

Any pullbacks toward support are currently viewed as constructive corrections, not weakness.

🌍 Intermarket Insight

Silver’s sharp rally highlights renewed demand across precious metals, often acting as a leading signal for broader sector strength. This backdrop supports the idea that gold’s recent correction was a reset, not a reversal.

🧠 Lana’s View

Gold is rebuilding its bullish structure step by step. The focus is not on chasing price, but on how price reacts at key levels. As long as structure and momentum remain aligned, the broader trend stays constructive.

✨ Stay patient, respect the zones, and let the market confirm the next expansion.

SILVER1! : Volatility Contraction & Mean Reversion Analysis1. Context & Review (Linking the Past) In our previous analysis Silver Futures: Parabolic Breakdown , we correctly identified the "Bearish Liquidation" event that led to a -17% correction. As predicted, the parabolic arc was violated, and price sought liquidity lower.

2. Current Market Structure: The Snap-Back We are witnessing the aftermath. The market stabilized at the ~265k zone and is reacting with a strong +5% bounce. This aligns with standard Mean Reversion mechanics:

Oversold Conditions: The selling intensity stretched price too far from the average ("rubber band" effect).

Short Covering: Early bears are booking profits, fueling the initial bounce.

3. Technical Roadmap (The "New" Path)

The Gap Fill: The rapid drop left a liquidity void (Fair Value Gap) between 290k - 300k. Price naturally gravitates toward this magnet to "repair" inefficient price action.

The 0.382 Test: As mentioned in our previous "Dead Cat Bounce" scenario, we are watching the Fibonacci retracement levels. The current move is approaching the 0.382 resistance.

4. Technical Setup (Visible on Chart)

The "Orange Box" (Supply Zone): We have highlighted the 290k-300k zone as the "Line in the Sand."

Bullish Case: A daily close above 300k suggests this is more than just a dead cat bounce and opens the door to the Golden Pocket (0.618).

Bearish Case: Rejection at this Orange Box confirms the "Lower High" thesis, likely inviting a second leg down.

5. Volatility Analysis (TradeX View) Historical data confirms that after a >15% crash, volatility remains elevated for 2-3 weeks. We expect wide trading ranges rather than a straight V-shape recovery.

Strategy: Fade the extremes. Buy deep supports, sell the rip into resistance.

6. Conclusion The panic phase is over; the "reconstruction" phase has begun. We are currently neutral-bullish for a tactical bounce to the ~300,000 resistance area, but we remain cautious of the macro trend until that level is reclaimed.

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases rarely resolve in a straight line and typically evolve into consolidation, base-building, or deeper corrective structures.

At current levels, Silver is hovering near an immediate demand zone around the 80–85 region, which now acts as a crucial decision area. This zone represents the first major area where buyers are expected to defend aggressively. The way price behaves here will define the next medium-term trend.

Scenario A – Range / Base Formation (High Probability):

The most probable outcome at this stage is sideways consolidation. After a vertical fall, markets often need time to absorb supply and rebuild demand. If Silver manages to hold above the immediate demand zone and starts forming higher lows on lower timeframes, it would indicate base formation rather than trend failure. This scenario favors range traders and patient positional participants, as price may oscillate between support and overhead resistance for several weeks or months.

Scenario B – Breakdown Continuation (Moderate Probability):

If the current support zone fails decisively with strong weekly closes below it, Silver could enter a deeper corrective phase. In such a case, price may gravitate toward the next major demand zone near 73–75, which aligns with prior consolidation and breakout structure. This move would likely be driven by broader risk-off sentiment or macro pressure rather than technical weakness alone. Traders should avoid aggressive longs if this breakdown structure develops.

Scenario C – Bullish Reclaim and Bounce (Low Probability, Needs Confirmation):

A less likely but still possible outcome is a bullish reclaim, where Silver holds current levels, absorbs selling pressure, and reclaims the 90+ zone with strong weekly confirmation. For this scenario to gain credibility, price must show acceptance above resistance with volume and structure. Until then, any bounce should be treated as reactive and corrective, not a confirmed trend reversal.

From a structural perspective, the major resistance remains far above near the 115–120 zone, which was the distribution area before the sharp reversal. This level will act as a long-term supply cap unless Silver builds a strong base over time.

In summary, Silver is no longer in a trending phase but in a transition zone. Patience is critical here. Traders should focus less on prediction and more on reaction to price behavior at key demand levels. Let structure, confirmation, and risk management guide decisions, as this phase can easily trap both early bulls and aggressive bears if approached without discipline.

Silver Futures: Parabolic Breakdown & Bearish LiquidationSilver Futures: Parabolic Breakdown & Bearish Liquidation (Analysis)

Part 1: Historical Context (The "Why") To understand this violent -17% move, we must look at Silver's distinct "personality" compared to Gold.

1. The "Beta" Factor (Silver vs. Gold) Silver is often called "Gold on steroids." While Gold is a monetary metal held by Central Banks for stability, Silver is 50% industrial and 50% speculative. It has a much smaller market cap, meaning it takes less liquidity to push the price up or down violently.

Historical Rule of Thumb: When Gold drops 5%, Silver often drops 10-15%. This chart confirms a classic high-beta liquidation event.

2. Historical Comparisons

The 2011 Crash: In April 2011, Silver went parabolic to nearly $50/oz before crashing ~17.7% in a single day (the "Sunday Night Massacre"). This was caused by exchange margin hikes, forcing leveraged longs to liquidate.

The 2020 Covid Crash: In March 2020, Silver fell ~30% in weeks due to a liquidity crisis where traders sold precious metals to cover equity losses.

Part 2: Visual & Technical Analysis

A. Daily Timeframe (The "Map")

Step 1: The Parabolic Arc Break: The rally followed a steep, unsustainable curve (Blue Arc on chart). When price cuts vertically through such an arc—as the recent Red Candle has done—the bullish momentum is technically broken.

Step 2: The "Supply Zone" Rejection: The long wick at the top (near 422,000) represents a "concrete ceiling." Buyers were exhausted, and trapped longs at this level will likely sell into any recovery to break even.

Step 3: Bearish Engulfing Candle: The massive red candle has "engulfed" (wiped out) the gains of the previous 7-10 trading sessions. This shifts market psychology from "Buy the Dip" to "Sell the Rally."

Step 4: Momentum Warning (RSI Divergence): Before this drop, while price was making Higher Highs, the RSI likely failed to confirm with a Higher High (Bearish Divergence). This signaled buyer exhaustion before the crash occurred.

B. Intraday / Short-Term Strategy (The "Path") Since the daily trend is broken, the strategy shifts to defensive management.

1. The "Dead Cat Bounce" Scenario: After a vertical drop, the RSI is oversold. A bounce is expected, but it is often a trap. We use Fibonacci Retracement levels from the Swing High to Low to identify resistance:

0.382 Level: The first zone where aggressive bears often reload shorts.

0.5 - 0.618 (Golden Pocket): Historically the highest probability area for a "Lower High" to form.

2. The "Bear Flag" Pattern: In strong liquidations, price rarely recovers in a V-shape. Watch for a "Flag" pattern (slow drift upward on low volume). A break below the flag's support triggers the next leg down.

Part 3: Trading Strategy Summary & Risk Management

Volume Confirmation: Check the volume on the breakdown candle. If it is the highest of the year, it indicates "Capitulation" (potential temporary bottom). If volume is average, the "real" panic selling may still be ahead.

Invalidation Level (When is this view wrong?): This bearish outlook is negated ONLY if we get a Daily Candle close back above the 400,000 supply zone. Until then, the market structure remains corrective.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading futures involves significant risk.

Market Outlook & Trade Setup – Friday, 30th January 2025Major indices showed a sharp recovery yesterday and even crossed the opening day high. Silver and Gold has corrected by more than 6% overnight so some selling pressure could be seen.

We have the Budget on Sunday, 1st Feb, 2026, so heavy positions might not be build in the market today.

🔹 NIFTY

* Previous Close: 25,418

* Expected Range: 25,000 – 25,500

🔹 SENSEX

* Previous Close: 82,566

* Expected Range: 82,500 - 82,600

🌍 Global & Market Sentiment

* DJIA: +55 | S&P: -9

💰 Institutional Activity (Cash Market)

* FII: Net Sellers: - ₹ 394 Cr

* DII: Net Buyers: + ₹ 2639 Cr

🔥 Events this Week: US --- Trump Speech & FED Rate announcement

📌 Sectoral Focus

Metal, Energy

👉 Commodities in Focus: Gold, Silver, Copper, Crude, Natural Gas

💯 Important Quarterly Results: Cupid, GHCL, HUDCO, IEX, ITC,REC, Voltas

📈 Trade smart. Manage risk. Stay disciplined.

SILVER (XAGUSD) – Weekly Projection Analysis (24-01-26)

Overall Bias: 🔥 Strong Bullish

🔹 Market Structure

Price is clearly inside a bullish channel

Previous trendline break → clean retest

Retest aligns perfectly with 50% Fibonacci level

👉 This is a high-probability continuation zone

🔹 Key Levels

Support S2: ~96

Support S1: ~99–100

Entry Zone: Broken trendline + 50% Fibo (around 100)

Stop Loss: Below ~96 (structure protection)

Resistance R1: ~112–114

Target Zone: 115 – 120+ (New ATH zone) 🚀

🔹 Candle Strength

Strong bullish impulse candle confirms buyers’ dominance

No major rejection wick → momentum intact

🔹 Projection Logic

Trend continuation inside channel

Higher highs & higher lows

Retest confirmation + momentum breakout = buy-on-dips strategy

🧠 Trading Plan Summary

✅ Buy on retracement

✅ SL below structure

✅ Partial booking near R1

✅ Hold runner for ATH expansion

SILVER - HEALTHY CONSOLIDATION LONGSSilver doing a healthy consolidation - momentum intact.

very strong support for momentum to continue is $90, belov that momentum vill be lost.

small resistance at $93.50

major resistance at $95.50 - $96

above $96 v should likely test 3digits - $100.

above that vill be a price discovery one can trail at ST 1.5 on 75m chart.

MCX Silver: Healthy Dip Before Next RallyMCX Silver is in a strong long-term uptrend on the daily chart. The market has already completed wave 1, 2, and a strong wave 3 upward. After this big rise, price is now expected to make a normal correction (wave 4). This pullback can come toward the 236,000 area, which is an important support zone. As long as price stays above this support, the overall trend remains bullish. After wave 4 is completed, Silver is expected to start wave 5, which can push prices to new highs. In short, the trend is up, and any dip is a healthy correction, not weakness.

Stay Tuned :)

@Money_Dictators

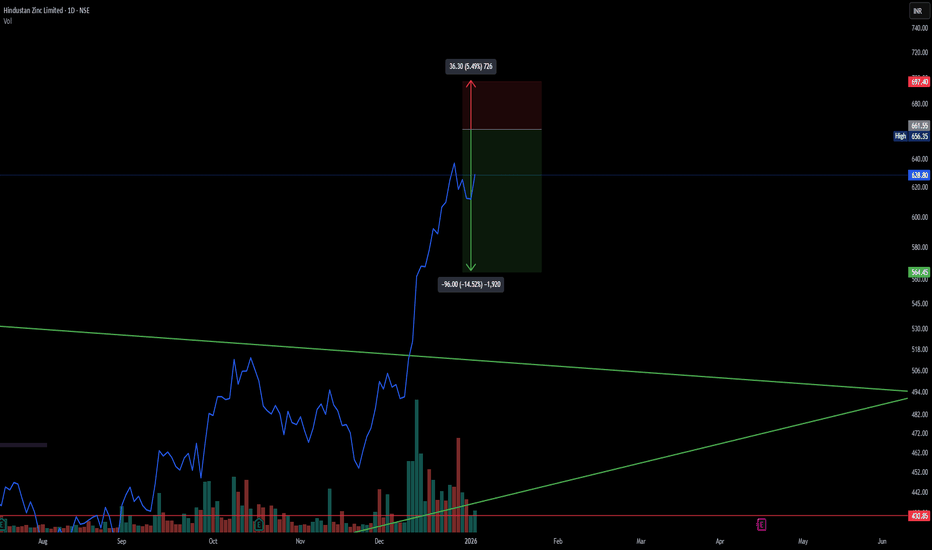

HIND ZINC SHORT TRADE -RISKYTechnical Analysis

Parabolic Extension: The stock has seen a massive, nearly vertical rally from the ~400 levels to highs near 670 in a very short span. Such parabolic moves are rarely sustainable without a significant correction or consolidation phase.

Rejection at Highs: The price action shows a sharp pullback from the recent high of 661.55, indicating that profit booking is kicking in and buyers are exhausted at these elevated levels.

Risk/Reward Ratio: The current setup offers a favorable Risk/Reward ratio for a short position. The stop loss is tight relative to the potential downside move as the stock attempts to revert to the mean.

Volume Profile: High volume during the ascent suggests strong participation, but upcoming sessions should be watched for distribution volume (selling pressure) to confirm the top.

Trade Setup (Short)

Entry Zone: 661 (Looking for rejection near the highs)

Stop Loss: 697.40 (Strict SL above recent swing high to protect against a "blow-off top")

Target: 564.45 (Targeting the gap fill/retracement to previous structure support)

Potential R:R: ~ 1:2.6

⚠️ Disclaimer: This chart analysis is shared for educational and informational purposes only. It does not constitute financial or investment advice. I am not a SEBI registered research analyst. Trading in the stock market involves a high degree of risk. Please consult with a certified financial advisor and perform your own due diligence before making any trading decisions.

SILVER | XAGUSD 1H Chart - Make or Break LevelsFX:XAGUSD MCX:SILVER1!

Silver is trading at a make-or-break support zone — this level will decide whether the broader uptrend survives or cracks.

🔹 Price is sitting near the 200 EMA, a level that historically acted as a launchpad

🔹 Last time Silver tested the 200 EMA (around $50), it marked the base before a multi-year breakout

🔹 Now, price has again pulled back to the same EMA near $70

📌 Key Observation:

As long as Silver holds above the 200 EMA, this move looks like a healthy retracement, not trend failure.

To Reduce the Noise switch to 4h Chart and see its forming 2 range candle just above 50EMA a break ot that will trigger the trade.

Need Confirmation from 4h chart then only go long

Keep Learning, Happy Trading.

GOLD/SILVER RatioChart is self explanatory. The price of the TVC:GOLD/TVC:SILVER ratio (XAU/XAG) as of January 1, 2026, is approximately 60.71. This indicates that one ounce of gold is worth roughly 60.71 ounces of silver. Over the past year, the ratio has seen a significant change, trading within a 52-week range of 54.19 to 107.27.

Recent trends

* Market Sentiment and Economic Conditions: When economic uncertainty is high, investors typically flock to gold as a safe-haven asset, which widens the ratio (increases the number).

* Industrial Demand for Silver: Silver has significant industrial applications (electronics, solar panels), so its price often correlates with economic growth and industrial demand, which can narrow the ratio.

* Relative Volatility: Silver is generally more volatile than gold ("high-beta" version of gold); in a bull market for precious metals, silver prices tend to rise faster, lowering the ratio, while in a bear market, gold prices tend to hold up better, increasing the ratio.

Key Insights

* Ratio Fluctuation: The gold-silver ratio is highly volatile. Historically, the all-time high was 125:1 in April 2020.

* Recent Volatility: Both gold and silver have experienced significant price movements in 2025, driven by factors such as interest rate expectations, geopolitical tensions, and industrial demand for silver.

* Price Influences: Domestic gold and silver prices in India are influenced by international market trends, currency exchange rates, local demand, taxes, and import duties.

Gold-Silver Ratio and Future Price Predictions

The gold-silver ratio (calculated by dividing the gold price by the silver price) indicates which metal may be undervalued or overvalued compared to the other and helps anticipate potential out performance.

* High Ratio (e.g., above 80:1 or 90:1): Historically suggests that silver is undervalued relative to gold. This often signals a potential buying opportunity for silver, with expectations that silver's price may rise faster than gold's, causing the ratio to decrease (revert to its mean). A high ratio can also indicate economic uncertainty or a flight to gold's safe-haven appeal.

* Low Ratio (e.g., below 50:1 or 60:1): Historically suggests that silver is overvalued relative to gold. This may signal a potential buying opportunity for gold, with expectations that gold may outperform silver, causing the ratio to increase. A low ratio often coincides with periods of economic optimism and stronger industrial demand for silver.

Current Market Insights

As of late December 2025/early January 2026, the gold-silver ratio has recently fluctuated, with reports placing it around 60.53 to 64:1, down from highs earlier in 2025 that exceeded 100:1. The sharp drop in the ratio during 2025 signaled a strong out performance by silver.

* Silver Out performance Expected: Many analysts believe silver is still cheap relative to its long-term historical average ratio (around 40-60:1 or 60-80:1) and could continue to outperform gold.

* Key Drivers: Silver's strong industrial demand (especially in solar panels and electronics), coupled with persistent supply deficits, provides fundamental support for its price to potentially reach higher levels like $85-$100 per ounce in the medium to long term.

* Volatility and Risk: Silver is generally more volatile than gold, which means it has the potential for higher percentage gains but also larger pullbacks. Investors use the ratio as one of several tools to balance their portfolios, rather than relying on it as a sole predictor.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

SELL SILVER - everyone says this, but i say only when i'm sureMarkets that run too far from their statistical/structural mean tend to revert back — especially after parabolic rallies. Classic studies show prices can overshoot by large factors before pulling back toward long-term averages.

arXiv

Silver in 2025 experienced extraordinary gains (~150–170%+), which is well beyond typical historical norms relative to commodities or industrial metals.

Trading Economics

When a rally of that magnitude climaxes, mean-reversion theory suggests:

Prices overshoot the “fair value band”

Sellers (especially momentum traders) begin taking profits

Volatility spikes increase backwardation/short squeezes

This is exactly what has been happening recently — sharp pullbacks, volatility, and aggressive liquidation.

SILVER | Monthly TA – High-Risk ZoneSILVER | Monthly TA – High-Risk Zone

#Silver is in a vertical Expansion Phase and Trading far above Long-Term Trend Support.

Price is testing a macro Supply / Distribution Zone after a Parabolic advance.

If Distribution Confirms:

→ Mean Reversion Toward 0.382–0.5 Fib ($39–$31)

→ Extended Correction into 0.618 Fib (~$24) Possible

Momentum is Climactic — Risk > Reward at Highs.

This is a Decision Zone, not a Chase Zone.

Monthly Timeframe | Structure > Noise

⚠️ Disclaimer: This is Pure TA. Markets involve Risk. NFA & DYOR Before Making any Trading or Investment Decisions.

Breakout in Silver (Ag)...Chart is self explanatory. Levels of breakout, possible up-moves (where silver may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Litecoin Super potential toward $300?Real Silver is Up +180% YTD 2025 & Digital Silver ( CRYPTOCAP:LTC ) is Down -44% YTD 2025

That Gap is Getting Impossible to Ignore.

When Real Silver is Pumping Hard but Digital Silver is Sleeping, it Usually Doesn’t Last Forever.

If the Rotation Happens in 2026, CRYPTOCAP:LTC at $250–$300 is Very Realistic.

Now Litecoin has One Job: Prove it Truly is Digital Silver.

NFA & DYOR