18/07 Gold Outlook – Final Friday Liquidity Moves Ahead!🟡 Gold Outlook – Final Friday Liquidity Moves Ahead!

Will Gold maintain its bullish pace or face weekend volatility? Stay ahead of the market!Why Gold is Moving – Key Macro Drivers

Gold bounced back sharply after a dip caused by stronger-than-expected US economic data. Here’s what Indian traders need to keep in mind:

📊 Rate cut hopes remain high as US core inflation remains sticky.

💣 Middle East tensions continue, with Israel launching more airstrikes on Syria.

🌐 Trade war risks increase as EU threatens $84B in tariffs on US goods.

🟡 Gold is acting as a safe haven in times of inflation concerns and global uncertainty.

👉 All of these factors support gold’s upside — especially heading into the weekend when low liquidity can cause price swings.

📉 Technical Picture – Zones in Play

Gold reversed from FLZ H2 (3310) — a key liquidity and demand zone. Sellers took profits, triggering a surge in buy volume. The price has since tested the OBS Sell Zone + Continuation Pattern (CP) around 334x with strong resistance.

Today, we expect price to revisit lower liquidity pools on the M30–H2 timeframe before the next breakout.

🧭 Key Levels for Friday – Watch Closely

✅ Buy Zone: 3318 – 3316

SL: 3312

TP Targets: 3322 – 3326 – 3330 – 3335 – 3340 – 3345 – 3350 – 3360

💼 Scalp Buy Zone: 3326 – 3324

SL: 3320

TP: 3330 – 3335 – 3340 – 3345 – 3350 – 3360

⚠️ Sell Zone: 3363 – 3365

SL: 3370

TP: 3360 – 3355 – 3350 – 3346 – 3342 – 3338 – 3335 – 3330

🔔 Important Notes for Indian Traders

Today is Friday, and even though there’s no major economic news, the risk of liquidity sweeps and volatility is high. Protect your capital with solid risk management and stick to your TP/SL strategy.

📌 Plan your entries from strong technical zones and don’t chase price — let the market come to you.

Smartmoney

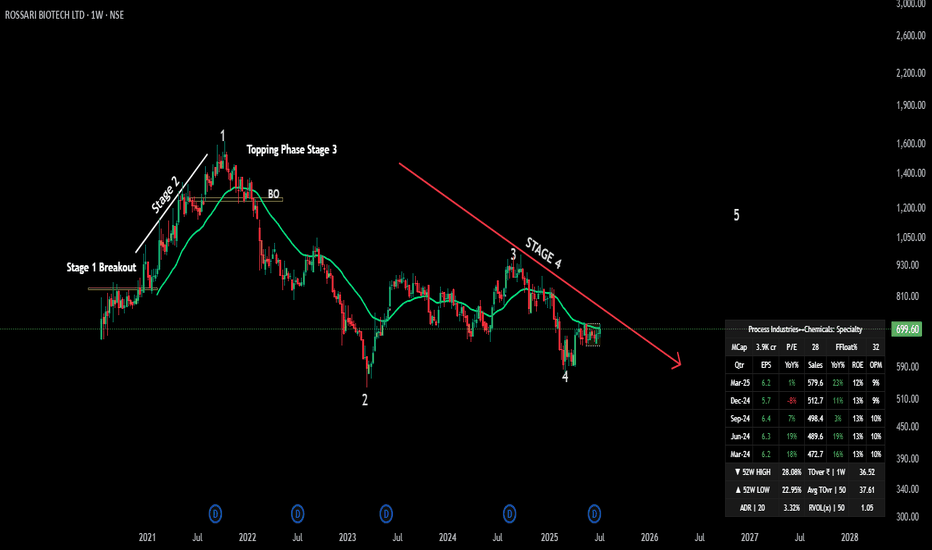

Rossari Biotech – Stage 4 Ending? Stage 1 Base in Play!🧪 NSE:ROSSARI – 📉 Stage 4 Ending? Stage 1 Base in Play!

🕵️♂️ Technical Context

Rossari has been in a Stage 4 decline since its 2021 peak. But now it’s forming a solid Stage 1 base between ₹650–720, with signs of smart accumulation emerging.

🧩 Business Model Snapshot

🧵 Segments: Textile Chemicals, HPPC, Animal Nutrition

🛒 New Growth: Institutional & B2C (₹299 Cr, +67% YoY)

🌍 Markets: Strong domestic base, expanding in Middle East & SE Asia

🤝 Client Spread: Diversified, no over-reliance

🎙️ Management Commentary

⚙️ Focus on margin normalization across verticals

📊 Base EBITDA margin ~15% (excl. new segments)

🌐 FX risk control via new geographies (Egypt, Turkey, SE Asia)

🧱 Scaling up I&B2C as a future margin driver

📈 Trend Overview

📆 Monthly: Ending Stage 4 — beginning Stage 1 base

📉 Weekly: Consolidating in a tight rectangle ₹650–750

📅 Daily: Sideways movement; price hugging EMA — coiled for move

🔄 Volume: Subtle uptick — early sign of institutional interest

🧭 Indicators: MACD crossover possible, RSI turning positive

🎯 Trade Plan

💼 Accumulation Zone: ₹650–720

🔓 Breakout Buy: ₹750+ (weekly close + volume)

⛔ Stop-loss: ₹640

🎯 Targets: ₹900 → ₹1,100

📈 Risk-Reward: Up to 1:4.5 🚀

📊 Fundamental Edge

💰 FY25 Revenue: ₹2,080 Cr

🧼 Expanding B2C + Institutional verticals

🏗️ ₹192 Cr CapEx in progress

💹 ROE: ~13%, OPM: ~10%

🧾 Clean governance, no pledges

🟢 Momentum Score: 7/10

📉 Stage 1 base + rising volume

📊 Solid growth fundamentals

🧠 FX/geography risk being managed

📍 NSE: ROSSARI | Sector: Specialty Chemicals

⏳ Watch ₹720 breakout zone – Big move may be coming!

#Rossari #BreakoutStocks #StageAnalysis #SwingTrade #SmartMoney #TechFundamentals #TradingView #SpecialtyChemicals #IndiaEquity #finchoicebiz #markethunt

UNO MINDA – Ready to Revisit All-Time Highs?UNO Minda is showing strength after breaking out of a falling trendline channel. The stock is now hovering near the ₹1038–1044 supply zone with a strong volume base at ₹1018.

Observations:

Multiple trendline breakouts

Price holding above POC at ₹1018

Minor consolidation below resistance

If it sustains above ₹1044, the next logical target is ₹1130+. Support remains strong at ₹1018 and ₹980. As long as price holds above these levels, the structure remains bullish.

Like, comment your thoughts, and share this post

Explore more stock ideas on the right hand side your feedback means a lot to me!

Disclaimer: This post is for educational purposes only and should not be considered a buy/sell recommendation.

Golden Rejection Candle Strategy–Catch Explosive Intraday Moves!Golden Rejection Candle Strategy – Catch Explosive Intraday Moves Like a Pro!

Hello Traders!

Are you tired of buying options and watching premiums die slowly?

Or chasing breakouts that reverse the moment you enter?

Here’s your solution – the Golden Rejection Candle Strategy , designed especially for option buyers who want timed entries, fast momentum, and defined risk .

What is a Golden Rejection Candle?

A special candlestick that forms when price hits a strong level (like VWAP, trendline, or demand/supply zone) and gets instantly rejected.

It leaves behind a long wick (shadow), showing that buyers or sellers stepped in with force .

This candle often marks the start of a sharp intraday reversal .

It's not just a random wick — it’s a smart money footprint .

Live Chart Example – Nifty Spot vs Option Premium (23950 CE)

Date: 9th May 2025

Timeframe: 1 min (Spot), 1 min (Options)

Spot Chart Setup: Nifty approached a marked green support zone and created a strong wick rejection with a small body candle — classic sign of buyers defending the level.

Confirmation Candle: The next candle broke above the rejection candle’s high, confirming the reversal setup.

Premium Reaction: On the 1-min ATM Option chart (23950 CE), premiums jumped from 270 to 344 – a clean 26% gain within minutes.

Risk-Reward Snapshot: Entry was at breakout, SL just below rejection wick, and target hit in a single momentum burst — the kind of move option buyers live for.

How to Trade It as an Option Buyer

Choose the Right Strike: Use ATM or slightly ITM options to get faster movement when price reverses.

Entry Strategy: Wait for the next candle to break the rejection candle’s high/low. No break = No trade.

SL Placement: Keep it just beyond the wick. Small loss if wrong, big reward if right.

Exit Plan: Aim for intraday resistance/support or spike-based exits — option premiums often give quick moves post-rejection.

What NOT to Do:

Don’t enter on the rejection candle itself — wait for confirmation.

Avoid trading this pattern in low volume or middle of the range.

Don’t hold blindly — if premium spikes, take the money and run!

Rahul’s Tip:

“Sudden reversals are where option buyers make money — not slow trends. The rejection candle shows intent. The breakout shows confirmation. Combine both.”

Conclusion:

The Golden Rejection Candle Strategy gives you an edge that most random trades lack — timing, context, and structure.

If you're an option buyer, this can be your go-to setup to avoid traps and enter only when smart money steps in.

No more guessing. No more fear.

Just clean, price-action-based entries that make sense.

👇 Have you ever used rejection-based setups? Drop your favorite trade below! Let’s learn together.

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies , and learning-focused content — all from real trading experience , not theory. Stay connected if you're serious about growing as a trader!

Retail vs Smart Money: Learn to Spot the Real Market Movers!Hello Traders!

Today, we’re diving into one of the most important yet least talked about market dynamics — the constant battle between Retail Traders vs. Smart Money . Every chart hides a silent war where emotions meet strategy, and it’s time you learn how to spot it!

What is Smart Money vs Retail Behavior?

Retail traders often follow price, news, and momentum. Smart money (institutions, big players) create the setups that retail ends up chasing.They accumulate silently during fear, distribute during euphoria — and use chart patterns, volume, and sentiment to their advantage.

Key Signs You’re Competing Against Smart Money

False Breakouts Near Highs: Smart money sells into breakout buying volume as retail jumps in too late.

Volume Divergence: Price rises but volume fades — big players aren’t buying anymore.

Traps Around Support/Resistance: Retail stops get hunted just before big reversals.

Sudden Wicks & Spikes: Quick candle spikes in low liquidity zones often indicate manipulation.

VWAP & Order Flow Conflicts: Price trades above VWAP but fails to sustain — institutions are likely offloading.

How to Avoid Being the Liquidity for Smart Money

Don’t Chase Moves: Always wait for confirmation. Avoid impulsive entries.

Track Volume + Context: High volume at breakout = strength. Low volume = trap.

Observe VWAP and Institutional Zones: Use tools like VWAP, anchored VWAP, and order blocks to detect smart accumulation/distribution.

Think Like a Trap Setter: Ask — where are people trapped? That’s where smart money will act.

Rahul’s Tip If you feel excited to buy, ask yourself — who’s selling to you? If you feel panic to sell, who’s buying from you?That’s how smart money survives — by playing the opposite side of your emotion.

Conclusion Markets are less about technicals and more about psychology. The faster you learn how smart money uses charts to influence emotions, the faster you’ll level up as a trader.

Have you ever fallen into a smart money trap? Share your experience in the comments — let’s all learn together!

How War Headlines Trap Retail Traders – The Smart Money Way!Hello Traders!

Every time war or geopolitical tension makes headlines, the market reacts sharply — but not always logically. These emotional moves often trap retail traders, while smart money patiently waits to exploit the chaos . Let’s break down how war headlines create traps and how you can avoid being a victim of them.

Why Retail Traders Get Trapped During War News

Emotional Panic Selling: Negative headlines lead to fear-based selling, especially from retail participants who lack a plan. Institutions use this to buy at discounted prices.

Fake Breakdowns and Traps: Price may break key levels during war news, only to reverse sharply as soon as stops are taken out. This is a classic liquidity grab.

Overreaction to News Events: Headlines exaggerate potential impact. But smart money knows the difference between short-term noise and long-term fundamentals.

Sudden Volatility Spikes: Algos create wild intraday swings to trigger both sides of liquidity before real direction is decided.

How Smart Money Handles War-Based Market Moves

They Wait for Extremes: Institutions don’t chase panic — they wait for price to hit demand/supply zones before entering.

They Observe Volume Behavior: Smart money watches for volume spikes with weak price moves to detect exhaustion and potential reversals.

They Buy When Fear Peaks: When retail is most fearful, institutions begin accumulating quietly — this is why markets often rally after bad news.

Rahul’s Tip

“War headlines create emotional volatility. Smart traders don’t react, they observe. The trap is in the panic — the profit is in the patience.”

Conclusion

In times of war or crisis, stay grounded in structure, not emotion . Avoid reacting to every headline and focus on price action, volume, and zones. What appears like the end is often just a setup by smart money.

Have you ever taken a panic trade on a war headline and regretted it? Share your experience below — we learn together!

Premium Trap in Option Buying – Learn the Game of IV Crush!Hello Traders!

If you’ve ever bought an option thinking it will explode — only to see the premium barely move or even drop — you’ve likely been a victim of the IV manipulation trap . Let’s understand how this “Premium Trap” works and how Implied Volatility (IV) can be silently killing your trades.

What is the Premium Trap?

The premium trap happens when IV drops significantly after you enter an options trade , especially during high-impact news events, earnings, or sudden market moves . Even if the stock moves in your direction, the option premium doesn’t rise as expected due to IV Crush .

How IV Manipulation Hurts Option Buyers

IV Builds Up Before Events: Before events like results or budget announcements, IV rises, inflating premiums.

Post-Event IV Crush: Once the event is over, even with expected moves, IV drops rapidly — causing premiums to deflate.

Flat Premiums in Trending Markets: Sometimes, the price moves gradually, but IV keeps falling, keeping premiums flat.

Theta Decay + IV Crush Combo: This deadly combo eats up your premium even if the market is moving in your favor.

How to Avoid the Trap

Check IV Before Entry: Avoid buying when IV is already high unless you expect a very large move.

Buy Deep ITM Options: They have less Vega and are less sensitive to IV drops.

Trade After IV Settles: Instead of trading before news, wait until after IV cools down and direction becomes clear.

Track IV Trend: Use IV percentile or IV rank to understand whether the current IV is high or low compared to its range.

Conclusion:

Option buying is not just about direction — timing and volatility are key . Don’t get trapped by inflated premiums and IV manipulation. Learn to read volatility before taking trades, and always manage your risk and expectations like a pro!

Have you ever been trapped by IV crush? Share your experience in the comments below!

Why Market Moves Against You After Entry–It’s Not a Coincidence!Hello Traders!

Ever felt like the moment you enter a trade, the market just turns against you? You’re not alone. Today, we’ll break down why this happens and how you can avoid getting trapped. This common phenomenon is not just bad luck — it’s often a result of liquidity hunting, stop-loss triggering, and retail behavior predictability .

The Real Reason Behind Entry Reversals:

Liquidity Zones Near Obvious Entry Areas: Most traders enter at breakout or breakdown levels with tight stop-losses. Market makers and institutions know this and target these zones to fill their large orders.

Stop-Loss Clusters = Opportunity: When many traders place SLs at the same level, it creates a liquidity pool. Big players trigger these to generate volatility and enter at better prices.

Retail Predictability: Most traders use similar strategies – entering on breakout candles, using fixed SLs, or chasing momentum. Algos are trained to identify these patterns and act accordingly.

No Confirmation Entry: Entering without waiting for confirmation — like candle close, volume spike, or retest — increases the chances of being trapped.

How to Avoid Getting Trapped:

Don’t Enter at Obvious Levels: Instead of breakout candle entry, wait for retest or structure confirmation.

Use Liquidity Awareness: Identify where other traders may be placing SLs — avoid entering right before those levels.

Watch Volume and Price Behavior: Sharp moves on low volume are often traps. Entry should align with volume strength.

Wait for Retests: A retest after breakout/breakdown gives better R:R and filters out fakeouts.

Conclusion:

The market isn’t random — it’s designed to hunt the predictable. If you want to stay ahead, start thinking like the smart money. Avoid entering at the obvious point, understand where liquidity lies, and build a habit of confirmation-based trading.

Have you ever faced a market reversal just after your entry? Let’s talk about your experience and how you manage such traps in the comments below!

Adani energy Solution is on bullish breakout.Adani energy Solution is in bullish Momentum mode.

It gave marubozo candle with higher volume on dated 27.03.2025.

It also traps the retail investors with operator candle on date 07.04.2025.

Stock is in Demand zone as per chart It may test 1090 (20%) and 1255(36%) gain soon.

Fake News Rally Setup – The Smart Money Trap Explained!Hello Traders!

Today, we’re diving into one of the most dangerous traps in the market — the Fake News Rally Setup . Ever seen a stock or index suddenly spike after a “positive” news headline, only to crash minutes or hours later? That’s not by accident — it's often a coordinated move by smart money and institutions to lure retail traders into buying high before dumping their own positions. Let's break it down.

What is a Fake News Rally?

It’s a short-lived price surge triggered by news headlines, press releases, or media buzz — but without real institutional buying to support it. These setups are used to create emotional buying frenzies among retail traders, followed by a fast reversal as institutions offload their positions at inflated prices.

Key Signs of a Fake News Rally

Sharp Spike on News Without Volume: Price rises quickly, but volume doesn’t support the move — a big red flag.

Overextended Move into Resistance: The rally happens near a supply zone or resistance area where smart money waits to sell.

No Follow-Through in Next Candle: After the news candle, if price stalls or reverses quickly — it’s likely a trap.

Absence of Broad Market Support: The rest of the market isn’t moving — only the stock or sector affected by the news.

Sudden Volume Spike on Down Candle: Institutions often dump in bulk after trapping retail traders, causing a sharp reversal.

How to Trade Smart Around Fake News Rallies

Wait for Confirmation: Don’t chase the first candle. Let price action confirm whether it’s real momentum or a trap.

Use VWAP or Trendlines: If price stays above VWAP and breaks trendlines with volume, it may be real. Otherwise, stay alert.

Look for Bearish Engulfing or Reversal Candles: These are strong signs that the move was fake and reversal is coming.

Go Short After Confirmation: Once you spot signs of weakness and a breakdown below support — it’s time to ride the dump.

Rahul’s Tip

Don’t react to headlines — respond to price action. News creates noise. Learn to spot the footprints of smart money, not just what the media wants you to see.

Conclusion

Fake news rallies are designed to trigger your emotions — especially FOMO. Stay grounded in data and structure. Let the charts confirm the story , not the headline.

Have you ever been trapped in a fake rally before? Share your experience and let’s learn together!

How Brokers, Market Makers & Algos Trigger Your Stop-Loss!

Hello Traders!

Ever felt like the market hits your stop-loss and then flies in your direction? You’re not alone. It’s not always a coincidence. Today, let’s decode how brokers, market makers, and algorithms hunt retail stop-losses and how you can protect yourself by trading smarter.

The Hidden Game Behind Stop-Loss Hunting

Liquidity Pools Below Swing Lows/Highs:

Retail traders often place stop-losses near obvious support and resistance. Smart money knows this — they create a quick fake move to trigger these levels and grab liquidity.

Algos Detect Retail Patterns:

Algorithms scan chart structures, volume profiles, and order book imbalances. If too many stop orders sit below a zone, algos exploit it with a quick flush.

Market Makers Need Orders:

They profit from spreads and volume. By triggering stops, they fill larger institutional orders or create better entry zones for big players.

How to Avoid Getting Trapped

Avoid Obvious SL Placement

→ Don’t place stops right at swing low/high or support/resistance — give it a little buffer.

Use Structure-Based Stops

→ Place SL where your trade idea is invalidated, not just where price might come.

Wait for Confirmation, Not Impulse

→ Enter after a strong confirmation candle or retest. Don’t jump in just because price touches a zone.

Watch for Liquidity Grabs

→ If price quickly breaks support and reverses — it’s likely a trap. Mark that level as a future opportunity zone.

Rahul’s Tip

“Algos aren’t evil — they’re just smarter. So be smarter too. Stop-loss hunting is real — but if you trade with structure and logic, they can’t touch you.”

Conclusion

The market isn’t always random. There are systems, patterns, and traps designed to shake out weak hands. Understanding how stop-loss hunting works can help you survive longer and trade smarter . Trade like a sniper, not like bait.

Have you ever been stop-hunted? Share your story in the comments — let’s help each other grow!

If you found this post valuable, don't forget to LIKE and FOLLOW !

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience, not theory. Stay connected if you're serious about growing as a trader!

How Institutions Trap Retail Traders & The Blueprint to Outsmart✍️ Intro:

You’re not losing trades because you're unlucky.

You're losing because you’re playing in someone else’s trap.

This post reveals the actual game behind price movement — one that 95% of retail traders don’t even know exists.

Welcome to Liquidity Hunting — the psychological and structural method smart money uses to take your stop, steal your position, and use your exit to fund their entry.

🔍 What is Liquidity in Real Terms?

Most people throw around the word “liquidity” without really getting it.

Let’s define it clearly:

Liquidity = Clusters of pending orders (mostly stop-losses and pending breakouts).

Whenever a lot of traders are positioned in the same direction — their stop-losses naturally pool together. This forms a liquidity pocket that smart money can use.

Now ask yourself:

Where do most retail SLs sit?

Just below recent support.

Just above recent resistance.

Exactly where the wick comes before reversing, right?

That’s not coincidence.

That’s intentional.

🎯 The True Intent of Smart Money

Institutions can’t enter markets like you do. They're trading massive volumes.

They need:

Liquidity to get filled

Retail to take the opposite side

A reason to justify the move

So they create a false narrative.

They build chart patterns that scream “Buy now!” or “Sell breakout!”

They get retail to commit.

Then they run price into your SL — collect it — and move the opposite direction.

They use your exit…

As their entry.

⚙️ The Mechanics of a Liquidity Hunt (With Sequence)

Step 1: Build the Trap

Smart money allows price to form:

Multiple equal highs/lows

Clean support and resistance

A trendline with touches

A breakout zone with “fake pressure”

Retail traders get sucked into this illusion.

They start buying support. Selling resistance. Placing SLs behind the obvious.

That’s where liquidity builds up.

Step 2: The Sweep

Once enough liquidity is sitting there, the trap is activated.

Price makes a sharp move into that zone

Takes out every SL or triggers breakout orders

Retail thinks it’s a breakout or trend continuation

But it’s just a liquidity grab

This is the sweep.

You see a massive wick or a sudden engulfing move into the zone.

Retail thinks:

“It’s breaking out!” → But really, it’s sucking them in.

Step 3: The Shift (MSS/BOS)

Immediately after the sweep, smart money:

Exits their fake move

Reverses direction

Breaks recent structure

This Market Structure Shift (MSS) or Break of Structure (BOS) is your real signal.

This is where retail gets trapped and frozen.

Stopped out. Missed the reversal.

Or worse — still holding the wrong side.

Step 4: Entry Opportunity (FVG / OB Zones)

Price now pulls back to:

A Fair Value Gap (FVG) — a sudden imbalance caused by fast moves

A Bullish/Bearish Order Block — the last candle before the impulse

This pullback is where smart money re-enters to scale.

This is your sniper entry zone.

Low risk

High RR

Emotionally clean (because you waited, not chased)

📚 Real-World Chart Example

Let’s say Gold is trading at 1980.

You see clean resistance at 2000 — multiple rejections.

Retail thinks:

“When 2000 breaks, I’m buying. Target 2010. SL below 1995.”

Price pushes to 2000. Breaks 2002.

Everyone enters long.

Then — sudden drop to 1987, stops out all entries.

Then price shoots to 2020 without them.

Classic sweep.

You see it daily.

🚨 Common Retail Mistakes That Get Hunted

Blind Breakout Trading – Entering without thinking who’s on the other side

Fixed SLs below structures – Same spot as everyone = easy to trap

Emotionally Chasing – No plan, just FOMO entries

Lack of Patience – Not waiting for confirmation

🧭 How to Flip the Script: Be the Hunter

Here’s the method to become a sniper, not a victim:

✅ 1. Identify Liquidity Zones

Equal highs/lows

Clean retail structures

Obvious trendlines

That’s where SLs pile up.

✅ 2. Wait for the Sweep

Don’t jump early. Let the market:

Take out those zones

Show impulsive wick or move

Look like a breakout

✅ 3. Watch for Market Structure Shift

Break of recent structure confirms trap

Look for BOS + FVG or OB

✅ 4. Enter on the Pullback

Entry at OB or FVG = sniper.

Keep tight SL below the sweep candle or OB.

✅ 5. Ride With Confidence

You’re now in a position where:

Retail is trapped

Smart money is scaling

RR is high

Emotion is dead

🔥 Final Mindset Shift

Stop thinking like a retail trader.

Start thinking:

“If I were a bank, where would I trap people?”

Because that’s what institutions do — every single day.

They don’t chase. They trap.

They don’t trade signals. They build them.

They don’t follow trends. They reverse them.

Now that you know the game…

Trade the trap. Not the bait.

BRIGADE – Falling Wedge at Demand Zone, Waiting for BOSSetup Type: Reversal + Breakout Play | Conviction: Medium-High (Needs Confirmation)

Chart Framework: Smart Money + Classic TA

BRIGADE is showing signs of a potential trend reversal, but we’re not jumping in yet. Here's what the chart tells us:

🟡 Falling Wedge Formation – A bullish reversal pattern that typically resolves to the upside.

🟢 Tapped into a Strong Order Block – Smart money territory where previous accumulation took place.

🧲 Liquidity Grab Below Prior Lows, but... Volume on Bounce is Weak – Sign of caution.

📢 Analyst Rating: STRONG BUY – Adds institutional bias to the bullish setup.

🔐 No Confirmed Break of Structure Yet – Enter only after a clean breakout above ₹1050.

📈 Trade Plan:

Wait for a strong BOS (Break of Structure) and price closing above ₹1050 with volume.

Target zone near ₹1440+ aligns with measured move of wedge and previous supply.

⚠️ This is a setup with potential, but it’s not “ready” yet. Don't front-run smart money — let price confirm before jumping in. Risk management is a must.

How Algo Bots Target Retail SL – Learn to Beat Them!Hello Traders!

Have you ever seen your stop-loss get hit by just a few points and then the market moves in the direction you expected? That’s not a coincidence — it’s often the work of Algo Bots and big players trying to trap retail traders . These bots are designed to trick traders by moving prices to hit SLs before starting the real move.

Let’s understand how these bots work — and how you can avoid getting trapped.

How Algos Hunt Retail Stop-Losses

They Target Common SL Zones:

Algo bots look for areas where many traders place their stop-loss — like just below support or above resistance.

They Trick with Fake Breakouts:

You may see a fast move above or below a level — but it’s just to hit SLs and then reverse. This is called a stop hunt .

They React Fast:

Bots can place thousands of trades in a second. They use their speed to catch traders off guard.

How to Beat the Bots – Pro Tips

Avoid Obvious SL Levels:

Don’t keep SL right at support or resistance. Place it a little beyond where bots won’t expect it.

Use Structure-Based SLs:

Look at price structure and place SLs based on key swing highs/lows — not just round numbers.

Wait for Confirmation:

Don’t enter as soon as a level breaks. Wait for retest or a strong candle signal.

Mark Smart Zones:

Learn to spot liquidity areas and imbalance zones — that’s where big players usually trade after bots do their job.

Rahul’s Tip

The market isn’t cheating you — it’s just smarter. Learn how it works and you’ll trade with more confidence and better results.

Conclusion

Algo bots are fast and smart — but not unbeatable. If you place SLs wisely, trade with structure, and wait for confirmation, you’ll stop being trapped and start trading like the smart money.

Has your SL ever been hunted like this? Let’s talk in the comments and help each other grow!

How I Use Relative Volume (RVOL) to Find Intraday Movers!Hello Traders!

If you're looking for stocks that actually move during the day — not those that sit flat and waste your time — Relative Volume (RVOL) is your best friend. It helps you spot where the action is, where smart money is flowing, and where momentum is building.

Let me share how I personally use RVOL to filter intraday trades with high potential — and how you can use it too.

What is Relative Volume (RVOL)?

RVOL measures today’s volume vs. its average volume:

It tells you whether a stock is trading with more or less activity than usual.

Formula:

RVOL = Current Volume / Average Volume (typically 10 or 20-day average)

Why it matters:

Higher RVOL = Higher interest = More volatility = More opportunity

How I Use RVOL in My Intraday Setup

Look for RVOL above 2.0 before 10 AM:

This shows early momentum and strong interest — a great sign for day trading setups.

Combine RVOL with price action at key levels:

If a stock is breaking resistance/support with high RVOL, it’s more likely to follow through.

Avoid low RVOL stocks:

If RVOL is below 1.0, I usually skip the trade — the move might be too slow or fake.

Watch for spikes on news-based RVOL:

Earnings, upgrades/downgrades, or big headlines often fuel big RVOL spikes — prime for breakout scalps.

Rahul’s Tip

Volume validates price. No matter how beautiful the setup looks, if there’s no volume — it’s just noise. Use RVOL as your momentum filter.

Conclusion

RVOL is a simple yet powerful tool to find real intraday movers . It helps you trade stocks where participation is high and moves are clean. Add it to your pre-market watchlist routine and you’ll notice the difference in your trade quality.

Do you use RVOL in your strategy? Or do you rely on scanners only? Let’s chat in the comments!

AUD/USD: Bullish Momentum Builds from Strong DemandIn the 4-hour AUD/USD chart, strong supply and demand zones are visible. A significant demand zone is observed around the 0.62269 level. Within the chart, a Change of Character (ChoCh) is identified from the 0.6323 level, and a Break of Structure (BoS) is noted at the 0.63211 level. A strong selling reaction has been observed from the supply zone, and the market has retested that level again.

On the demand side, the market has touched the strong demand zone twice and showed a bullish formation each time. Currently, the price is forming a strong bullish candle again.

Based on the Fibonacci levels, potential upside targets could be seen at 0.62717, 0.63128, and 0.63312, provided the market holds above the demand zone. However, if the demand zone is broken, there is a possibility of the market dropping down to 0.61901 .

Smart Money Trendline Liquidity Trap Strategy!Hello Traders!

Ever been stopped out right after a trendline breakout — only to watch the price reverse in your direction later? That’s not bad luck — that’s a Smart Money Liquidity Trap in action. Today, let’s uncover how big players use trendlines to trap retail traders and how you can flip the script using this powerful strategy.

What Is a Trendline Liquidity Trap?

The Setup:

Smart Money knows retail traders love clean trendlines. So, they allow price to break above or below these lines, creating the illusion of a breakout.

The Trap:

Once breakout traders enter, Smart Money triggers liquidity grabs (stop hunts) to fill large orders at premium prices. The market then quickly reverses direction.

The Confirmation:

True move begins after fake breakout fails and price reclaims the trendline or breaks structure in the opposite direction — that’s your signal.

How to Trade the Trap (Smartly)

Mark the Trendline:

Draw trendlines that connect at least 2–3 swing points. Watch for liquidity build-up above/below them.

Wait for the Fakeout:

Don’t jump in on first breakout. Let price break the trendline and observe for fast rejection or imbalance zone re-entry .

Enter on Confirmation:

Once the trap is clear, look for engulfing candles, FVG reactions, or BOS (break of structure) in the opposite direction.

Risk Management:

Keep SL above the trap high/low. Target liquidity zones on the other side — often you’ll get 1:2 or 1:3 RR setups .

Rahul’s Tip

Smart Money needs retail traders to enter first. Don’t be their liquidity. Instead, wait, watch, and enter when they’ve shown their cards.

Conclusion

The Smart Money Trendline Trap Strategy helps you stop trading like the crowd and start trading like the pros. By recognizing fakeouts and understanding liquidity manipulation, you’ll position yourself on the right side of the market moves .

Have you experienced fakeouts on trendlines? Let’s talk in the comments and grow together!

How Foreign Investors Manipulate Indian MarketsHello Traders!

Have you ever wondered why the market suddenly falls on a good news day? Or why Nifty rallies when retail traders are bearish? Welcome to the hidden world of FII (Foreign Institutional Investors) activity . Today, let’s uncover how foreign investors can influence and sometimes manipulate the Indian stock market .

Understanding this flow can help you avoid traps and trade smarter with the big players — not against them.

How FIIs Influence the Market

Massive Buying/Selling Power:

FIIs bring in huge capital. Their bulk orders can drive up or drag down prices in minutes, especially in index-heavy stocks.

Volume & Volatility Triggers:

Sudden large orders create volatility. This can trigger stop losses of retail traders and cause panic moves — which FIIs use to build better positions.

Fake Breakouts or Breakdowns:

FIIs often create false moves near key technical levels to trap breakout traders — only to reverse and move in the opposite direction.

Derivative Game:

Through futures & options, FIIs often hedge or create pressure in Nifty/Bank Nifty, giving them leverage to distort short-term price action .

Why FIIs Manipulate (and What They Want)

Better Entry/Exit Prices:

Creating temporary fear or euphoria helps them enter at lower prices or book profits near tops.

Controlling Sentiment:

Big players understand retail psychology. They use media, market moves, and timing to control sentiment and positioning .

Liquidity Advantage:

They need volume to exit large positions — so they often create the volume by triggering retail orders .

Rahul’s Tip

Track FII data daily — not blindly, but with structure. Look at cash flow, derivatives positioning, and sectors being rotated. And remember: The smart money enters when retail panic or celebrates.

Conclusion

Foreign investors have the power to move markets — but not randomly. They act with logic, timing, and structure. By aligning yourself with their footprints instead of fighting them, you can trade with higher accuracy and confidence.

Do you track FII data in your analysis? Share your views below — let’s decode their strategy together!

Joel Greenblatt: The Genius Behind Magic Formula Investing

Hello Traders & Investors!

Today, let’s explore the incredible journey and wisdom of Joel Greenblatt , one of the most respected value investors in modern history. Known for his bestselling book “ The Little Book That Beats the Market ,” Greenblatt introduced the revolutionary Magic Formula —a systematic way to find undervalued companies with high returns on capital. His strategies are simple, yet powerful, and have consistently delivered outstanding results.

Who is Joel Greenblatt?

Joel Greenblatt is the founder of Gotham Capital , where he generated an annualized return of over 40% for two decades . He believes that investing should be logical, disciplined, and backed by strong fundamentals —not based on hype or speculation.

Key Principles from Joel Greenblatt's Investing Style

Use the Magic Formula: Focus on companies with high earnings yield and high return on capital —this filters out fundamentally strong yet undervalued businesses.

Stay Rational, Not Emotional: Ignore market noise. Stick to your strategy even when the market seems irrational.

Long-Term Patience: His formula doesn’t work overnight—but over time, it consistently beats the market.

Simple is Powerful: Greenblatt believes in simple metrics and systematic investing to remove emotional decision-making.

Focus on Fundamentals: Buy businesses, not stocks. Evaluate them based on their financial strength, consistency, and potential for growth .

What We Can Learn from Joel Greenblatt

Stick to the Process: Greenblatt’s biggest success came from trusting his system—not market noise.

Invest in Quality at a Fair Price: A great company doesn’t always mean a great investment— valuation matters.

Don’t Chase the Crowd: His strategy is often contrarian. Buy when others fear, and hold with conviction.

Conclusion

Joel Greenblatt has shown that you don’t need a complex system to succeed—just a logical, disciplined, and repeatable strategy. If you’re serious about value investing, his Magic Formula can be a game-changer .

Have you tried Magic Formula Investing? Or read Greenblatt’s books?

Share your views in the comments! Let’s learn together and grow our investing mindset.

The Ultimate Guide to Building Wealth Through Smart Investing!Hello Traders & Investors!

Are you wondering which investment method can build the largest corpus over the long term? With so many options— Stocks, ETFs, Mutual Funds, Gold, Bonds, Fixed Deposits, and even Options Writing, it’s crucial to know which one offers the best returns while managing risk effectively. Let’s dive into a detailed comparison to find the best strategy for long-term wealth creation!

1. Equity (Stocks) – The Ultimate Wealth Creator

Average Returns: 12-18% CAGR (historically for strong companies).

Why It’s Powerful: Equity investments compound over time and provide the highest long-term returns.

Best For: Investors who can handle volatility and have a long investment horizon.

Pros:

✔ Compounding Effect – Small investments grow into massive wealth over time.

✔ Beats Inflation – Equity is the best asset class for long-term wealth preservation.

Cons:

❌ High volatility in the short term.

❌ Requires research & patience.

2. ETFs & Mutual Funds – Passive Investing for Consistency

Average Returns: 10-15% CAGR (depending on market performance).

Why It’s Powerful: Diversification and professional management make it a safer alternative to direct stock investing.

Best For: Investors who want steady returns without active stock picking.

Pros:

✔ Low Risk Compared to Stocks – Reduces exposure to single-stock failures.

✔ Great for Long-Term Investors – Set & forget approach.

Cons:

❌ Returns are slightly lower than individual stocks.

❌ Expense ratios reduce overall profitability.

3. Gold – The Safe-Haven Asset

Average Returns: 8-12% CAGR (historically).

Why It’s Powerful: Gold holds value during market crashes and economic uncertainty.

Best For: Investors looking for portfolio diversification and inflation protection.

Pros:

✔ Hedge Against Inflation & Crashes.

✔ Highly Liquid – Easily Buy & Sell.

Cons:

❌ Lower long-term returns than stocks & ETFs.

❌ No compounding effect.

4. Bonds & Fixed Deposits – Safety but Low Growth

Average Returns: 6-8% CAGR (historically).

Why It’s Powerful: Provides stability and guaranteed returns, making it a good option for conservative investors.

Best For: Those seeking low-risk, fixed returns over time.

Pros:

✔ Principal Protection – No Market Risk.

✔ Fixed Income Source.

Cons:

❌ Returns barely beat inflation.

❌ Not ideal for wealth creation.

5. Option Writing – High Risk, High Reward

Average Returns: 15-30% CAGR (if done correctly).

Why It’s Powerful: Generates consistent income through premium collection.

Best For: Experienced traders who understand risk management and capital allocation.

Pros:

✔ Consistent Income Through Premiums.

✔ Can Profit in Any Market Condition.

Cons:

❌ High capital requirement.

❌ Risk of significant losses in volatile markets.

6. The Best Long-Term Investment Strategy?

For Maximum Growth: Equity (Stocks) + ETFs – The best for compounding wealth.

For Balanced Growth & Safety: Equity + ETFs + Gold – A mix of high returns & stability.

For Conservative Investors: ETFs + Bonds + Fixed Deposits – Low risk, but lower returns.

For Passive Income Seekers: Dividend Stocks + Bonds – Steady returns with income.

For Experienced Traders: Stocks + ETFs + Option Writing – High returns, requires skill.

Conclusion

There’s no single best investment, but if you want huge wealth creation, equities & ETFs outperform all other asset classes in the long run. Add gold & bonds for stability, and if experienced, option writing can generate extra income.

What’s your preferred investment strategy for long-term wealth creation? Let’s discuss below! 👇

How ETF Investing Can Make You Rich in the Long Term!Hello Traders & Investors!

Ever wondered how ETFs (Exchange-Traded Funds) can help you build massive wealth over time? Unlike stock picking, ETFs offer a simple, diversified, and low-cost way to grow your money steadily. If you’re looking for consistent returns without active trading, this post is for you! Let’s explore how ETF investing can create long-term financial success!

1. Why ETFs Are a Wealth-Building Machine?

Diversification with One Investment: ETFs hold multiple stocks, bonds, or assets, reducing the risk of a single stock crash.

Passive Investing with Compounding Growth: ETFs let your money grow effortlessly over years with minimal effort.

Lower Costs, Higher Returns: ETFs have lower expense ratios than mutual funds, saving you money over time.

Reinvested Dividends Boost Wealth: Many ETFs offer dividend reinvestment (DRIP), letting your gains compound.

Better Risk Management: Since ETFs spread investments across different sectors and asset classes, they offer stability in market downturns.

2. How to Choose the Right ETFs for Long-Term Wealth?

Broad Market ETFs (S&P 500, Nifty 50, Nasdaq-100): These track major indexes and provide steady growth over time.

Sector-Specific ETFs: If you believe in tech, healthcare, or energy, sector ETFs let you invest in growing industries.

Dividend ETFs for Passive Income: High-yield dividend ETFs provide stable income while growing your capital.

Bond & Gold ETFs for Safety: These add stability and protection during market volatility.

Low-Cost ETFs with High Liquidity: Look for ETFs with low expense ratios & high trading volume.

3. The Magic of Compounding with ETFs

Long-Term Investing Always Wins: ETFs benefit from compounding returns, where small gains snowball into large wealth.

Automate Your Investments: Use Systematic Investment Plans (SIP) to invest regularly without worrying about market timing.

Stay Invested in Market Crashes: The best gains happen when the market recovers. Never panic-sell!

Reinvest Dividends for Faster Growth: A small dividend can turn into massive returns over decades.

Think in Decades, Not Days: ETF investing is about long-term wealth accumulation, not short-term trading.

4. How to Start ETF Investing Today?

Open a Brokerage Account: Choose a platform that offers commission-free ETF investing.

Pick Your ETFs Based on Goals: Want growth? Choose ** index ETFs. Want safety? Go for bond ETFs.

Start Small & Increase Over Time: Even small investments grow exponentially with time.

Stay Consistent: Invest monthly or quarterly, regardless of market conditions.

Rebalance When Needed: Once a year, adjust your ETF holdings to stay aligned with your financial goals.

Conclusion

ETFs are a powerful, simple, and low-cost way to build long-term wealth. They offer diversification, passive income, and compound growth without the stress of stock picking. If you’re serious about financial freedom, ETF investing is one of the best paths to get there!

Are you investing in ETFs? Share your thoughts and favorite ETFs in the comments!👇

How to Spot the Market Bottom Before Everyone Else!Hello Traders!

Catching the exact market bottom feels like finding a needle in a haystack. Many traders jump in too early and get trapped in false recoveries, while others wait too long and miss the best buying opportunities. So, how do we know when the market has truly bottomed out? Let’s break it down!

1. Key Signs That a Market Bottom is Forming

Extreme Fear & Capitulation: When panic selling accelerates, weak hands get flushed out, and volume spikes—this is often the final shakeout before a reversal.

Divergence in Indicators: If price is making lower lows, but indicators like RSI, MACD, or OBV are making higher lows, this signals weakening selling pressure.

Institutional Buying (Smart Money Inflow): Look for large volume spikes at key support zones— institutions accumulate when retail traders panic sell.

VIX & Fear Index Peaking: A spike in volatility (VIX) and extreme fear readings indicate that the market is near capitulation.

Market Structure Shift: A higher high after a long downtrend signals a potential reversal and confirms a bottom formation.

2. Confirmation That the Bottom is In!

Breakout Above Key Resistance: If the price successfully reclaims a major resistance zone and holds above it, this confirms a shift in momentum.

Higher Highs & Higher Lows: A classic uptrend structure forms when the market starts making higher highs and higher lows.

Sector Rotation & Strength in Leading Stocks: Watch for growth stocks, tech, or financials gaining strength before the broader market recovers.

Positive Economic Triggers: Market bottoms often align with central bank policy shifts, interest rate pauses, or strong earnings reports.

Volume Confirmation: The strongest bottoms are confirmed by high buying volume on up days and low selling volume on down days.

3. Common Traps to Avoid When Predicting Market Bottoms

Catching the Falling Knife: Just because an asset has dropped significantly doesn’t mean it can’t go lower! Always wait for confirmation.

Fake Breakouts & Dead Cat Bounces: A sharp rally during a bear market doesn’t always mean the bottom is in. Watch for volume and trend confirmations.

Ignoring Macro Trends: If the Fed is still raising rates, inflation is high, or economic data is weak, the market could stay in a downtrend longer than expected.

Not Managing Risk Properly: Always use stop-losses, proper position sizing, and avoid going all-in at once!

4. How to Trade a Market Bottom Effectively

Look for Leading Stocks in Strong Sectors: The first stocks to recover often outperform the entire market.

Use Scaling Entries: Instead of buying all at once, scale in with multiple entries as confirmation builds.

Monitor Sentiment Indicators: Extreme bearishness in news and social media often signals a turning point.

Trade with Trend Confirmation: Wait for the first higher high & pullback retest to confirm an uptrend.

Have an Exit Plan: If the trend fails, cut losses quickly. If it works, let winners run!

Conclusion

Finding a market bottom isn’t about guessing—it’s about using data, price action, and sentiment indicators to confirm a shift in momentum. The best traders don’t try to buy the lowest price, they buy when the trend is shifting in their favor!

Do you think the market has bottomed out yet? Let’s discuss below!👇