Weekly CT Breakout + 200EMA Flip | GALAXYSURF Structure📉 Main CT Line (Dotted White)

A well-defined counter-trendline finally gave way after weeks of price compression. The breakout was clean, with a strong bullish candle closing decisively above it.

📊 Volume Confirmation

Breakout candle posted a solid spike in volume — the highest weekly volume in months. 💥

📈 200 EMA Broken (Blue Line)

Price has also cleared the 200-week EMA, a key dynamic resistance, now potentially flipping to support. 📉

🟧 Higher Timeframe Supply (Orange Line) / ⚪ (White Lines)

The breakout candle has also stepped into a tight zone between Weekly + Monthly supply, marked by the orange line.

📌 As always, the chart tells the story. No predictions. No assumptions, just structure.

Stocks!

Styrenix Performance Materials Ltd - Breakout Setup, Move is ON.#STYRENIX trading above Resistance of 2485

Next Resistance is at 3295

Support is at 1675

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Breakout in Madhya Bharat Agro Products Ltd...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Nifty Bank Intraday levels(For Education Purpose)20.05.2025📉 Bearish (Sell) Setup:

Sell Below: ₹55,480 (confirmed breakdown)

Targets:

🎯 Target 1: ₹55,400

🎯 Target 2: ₹55,300

🎯 Target 3: ₹55,180 (if heavy selling continues)

Stop Loss: ₹55,580 (or ₹55,600 for conservative SL)

///📈 Bullish (Buy) Setup – Only if Reversal Happens:

Buy Above: ₹55,600 (strong reversal with volume & green candles)

Targets:

🎯 Target 1: ₹55,700

🎯 Target 2: ₹55,800

🎯 Target 3: ₹55,900

Stop Loss: ₹55,480

TCS Strong Support at ₹3360 | Breakout Above ₹3700ata Consultancy Services (TCS) is showing strong support near ₹3360 levels. A potential breakout will be confirmed if the price sustains above ₹3700.

Currently, the stock is facing key resistance zones between ₹3512 and ₹3525. A successful close above these levels may lead to strong bullish momentum.

📌 Key Levels:

Support: ₹3360

Resistance Zones: ₹3512 – ₹3525

Breakout Confirmation: Above ₹3700

Traders should watch these levels closely for directional cues. Volume confirmation and price action around resistance will be crucial.

#TCS #TCSshare #NSEStocks #StockAnalysis #BreakoutStocks #TradingViewIndia #TCSBreakout #IndianStocks #TechnicalAnalysis #SwingTrade

🔔 Disclaimer:

This analysis is for educational and informational purposes only. It is not a buy or sell recommendation. Please do your own research or consult a financial advisor before making any trading decisions. Trading and investing involve risk.

Technical Development on Weekly Chart – Birla Cable📈 BIRLA CABLE – Chart Talking Loud Now!

✅ 200 DEMA crossed

200 Dema was providing solid resistance and now taken out marked with blue line.

❌ At Counter-Trendline

Solid CT thrown from the top of the pattern, dotted white line shows that.

✅ Demand Zone Holding Strong

Clearly shown a solid supply zone which got converted into a Demand only after the Breakout some months back.

After months of consolidation and rejection from the same supply zone… price is now attacking with volume 🔥

🧠 “When structure aligns with emotionless patience, conviction follows.”

CT Breakout Live on GOKULAGRO! Supply Zone Just Ahead 📌 CT Breakout In Play | GOKULAGRO

A strong breakout just happened on the Daily chart of GOKULAGRO.

🟢 The Active CT (green) has been cleanly broken today with a strong bullish candle.

🟢 Multiple hidden resistances were also taken out during the breakout – marked in green as they’ve now turned into potential support.

🟢 A healthy volume spike confirms strong participation – not massive, but convincing enough to validate the move.

🔴 The next major supply lies just ahead – a combined Weekly + Monthly resistance zone (marked in red). This could act as a temporary pause or reversal zone if not cleared with momentum.

This is not a forecast or a buy/sell recommendation — just a structured observation of price action and context.

Watching how it behaves near the higher timeframe supply. Will it reject or absorb?

Technical Analysis (TITAN - Daily Chart):📊 Trend and Candle Pattern:

• The stock showed strong recovery between March and April.

• There was a bullish rally from April to May, reaching highs above 3600.

• After hitting resistance, it has seen a minor correction and is now trading around 3436.40.

🔴 Moving Average (Likely 200-DMA):

• The red line on the chart appears to be the 200-day moving average (DMA), which is currently at 3385.91.

• The current price is above the 200-DMA, indicating that the stock remains in a bullish zone.

• If the price falls below 3385, it may signal weakness or a trend reversal.

🧱 Support and Resistance:

• Immediate Support: 3385 (200 DMA)

• Major Support: Around 3300

• Resistance Zone: 3600–3650 (recent highs)

📈 Performance:

• The stock has shown a 5.80% gain, indicating positive momentum over the recent period.

⸻

📌 Conclusion:

• As long as the price remains above the 200-DMA (3385), the trend is bullish, and traders can consider a “buy on dips” strategy.

• A close below 3385 could trigger further downside.

• The current trend appears to be sideways to mildly bullish.

Note : not a buying or selling recommendation only for education purposes

GM BREWERIES – A Classic CT Breakout with Strong Demand Flip🔍 A solid Weekly Time Frame (WTF) structure is visible here on GMBREW:

-The red-green zone highlights a classic supply turning into demand, supporting the structure.

-A clear Counter Trendline (CT) breakout (white line) is now visible, showing strength with increasing momentum.

-Notice the strong spike in volume – this breakout isn't silent. Participation has significantly picked up.

-Yellow line represents the MTF supply, which could act as the next area of interest.

-Price is currently showing a wick, so weekly closing behavior will be key from here.

-No predictions – just a technical snapshot. Structure, volume, and zones are aligning well here. Let’s see how it unfolds. 📊

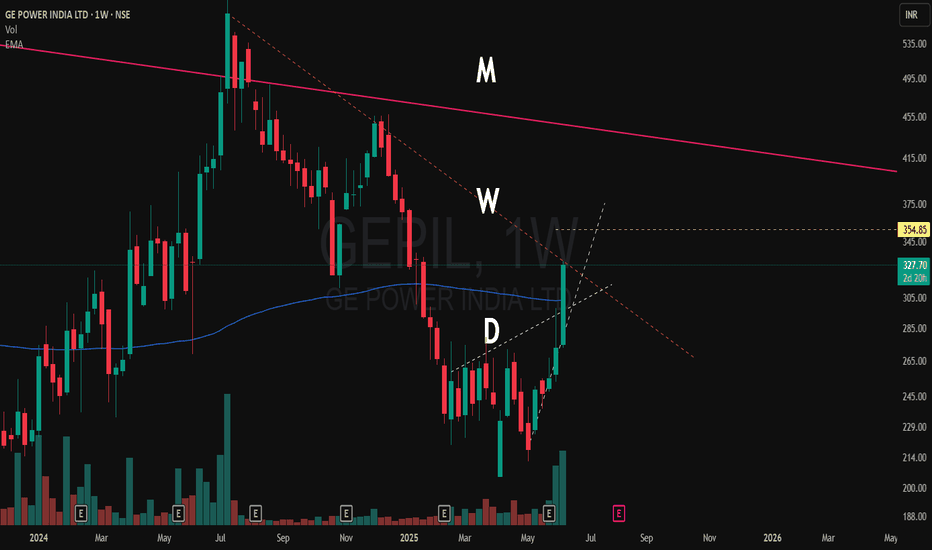

Multi time frame charting explained in GEPILI make educational content videos for swing / positional trading

BEPL Breakout soonBEPL about to breakout with 16% profit in short term with triangle pattern and also 55 ema has crossed 8,13,21 ema which shows strong uptrend on moving average

Hold duration around 1-2 month

Entry - 117

Target -138

Stock has good fundamentals

So I suggest to buy BEPL Bhansali eng. Polymers LTD

PURVAPURVA has given breakout of resistance after a consolidation.

Moving above 20ema. Now there is probability of an upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

NDR Auto Components Ltd - Breakout Setup, Move is ON...#NDRAUTO trading above Resistance of 1476

Next Resistance is at 1938

Support is at 1094

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Fiem Industries - Long Setup, Move is ON...#FIEMIND trading above Resistance of 2317

Next Resistance is at 3624

Support is at 1510

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Inside Bars After High Volume – CERA Setting Up Near Key CT📌 Timeframe: Weekly (WTF)

📌 Type: Technical Observation / Swing Structure

📌 Concept: Counter Trendline Breakout Setup

CERA is currently navigating a highly constructive zone from a swing trading lens. Here's what's developing technically:

🔹 Higher Low Formation:

The stock has established a higher low structure, with the white internal trendline offering visible support across recent weeks. Interestingly, this aligns perfectly with the 200-period EMA on the weekly timeframe, enhancing its significance as a dynamic support layer.

🔹 Volume Clues:

Two of the highest volume candles on the weekly chart have now been followed by inside bars, a potential sign of absorption or base building. This tightening within volume zones signals institutional interest and a possible buildup phase.

🔹 Supply Zone Identified:

An overhead supply (marked in orange)

🔹 EMA Context: The blue 200 EMA further reinforces the idea of Supportive price behavior around this line validates its role.

🔍 This post is for educational discussion only. No recommendation or forecast is implied. Please conduct your own due diligence.

Support Flips, Trendline Snaps — Weekly Chart Speaks!A counter-trendline breakout (white line) is underway on the Weekly Time Frame (WTF), supported by strong structural confluences:

🔹 Pattern size is substantial, with price consolidating for several months before breakout.

🔹 The yellow zone represents a prior support, which later broke down — now acting as a resistance-turned-breakout zone, a classic supply flip.

🔹 Recent breakout candle shows strength, emerging after taking support from the 200 DEMA, reinforcing the base.

🔹 MTF resistance (dashed yellow line) is marked — remains the next significant obstacle on higher timeframes.

No trading/investment advice. Purely educational .

Welspun Corp - Breakout Setup, Move is ON...#WELCORP trading above Resistance of 750

Next Resistance is at 916

Support is at 614

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Hitachi Energy (PowerIndia) - Breakout Setup, Move is ON...#POWERINDIA trading above Resistance of 12845

Next Resistance is at 17702

Support is at 9481

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.