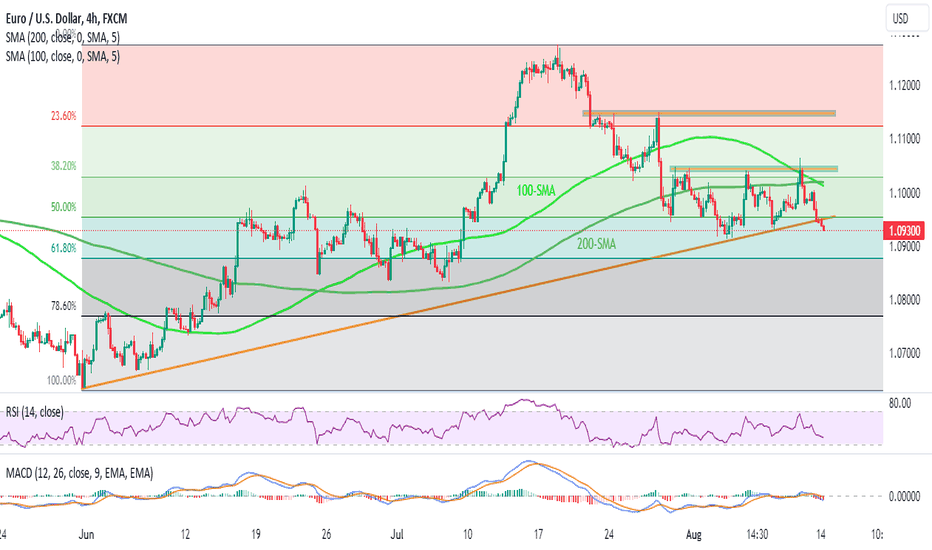

EURUSD sellers tighten grips ahead of a busy weekIn addition to posting the fourth consecutive weekly losses, the EURUSD also ended the week on a negative note while piercing a 10-week-old rising support line, now immediate resistance around 1.0950. Also keeping the Euro sellers hopeful are the bearish MACD signals. However, the RSI (14) line is below 50.0 and suggests bottom-picking, which in turn highlights the monthly low of around 1.0910 as short-term key support. Following that, July’s bottom surrounding 1.0830 and the 78.6% Fibonacci retracement of May-July upside, near 1.0770, can check the downside moves targeting May’s trough close to 1.0635.

Meanwhile, a corrective bounce needs to cross a convergence of the 100-SMA and the 200-SMA to convince the intraday buyers of the EURUSD pair. Even so, a fortnight-old horizontal resistance area surrounding 1.1045-50 could test the bulls before giving them control. Even so, the tops marked during late July may offer breathing space to the buyers near 1.1150. In a case where the Euro pair remains firmer past 1.1150, the odds of witnessing a run-up towards challenging the yearly top marked in July around 1.1275 can’t be ruled out.

Overall, EURUSD is on the bear’s radar as traders await more details of EU/US growth and inflation.

Supportandresistancezones

GBPUSD bulls need 1.2870 breakout and strong UK GDPA bullish triangle joins Thursday’s rebound to lure GBPUSD buyers as markets await the first estimates of the UK Q2 GDP. However, fears of recession and the 1.2815-25 resistance confluence restrict Cable prices. That said, a convergence of the 100-SMA and top line of a six-week-old descending triangle together constitute the 1.2800-05 key hurdle for the buyers. Even if the Pound Sterling bulls manage to cross the 1.2805 resistance, the 200-SMA level of near 1.2825 and previous support line stretched from late May, close to 1.2870 will act as the final defenses of the sellers.

On the contrary, a softer UK GDP outcome could quickly fetch the GBPUSD price towards the one-week-old horizontal support of around 1.2680. Following that, a broad support zone comprising multiple levels marked since late June, around 1.2620-2590, will be a tough nut to crack for the Cable bears. In a case where the Pound Sterling keeps the reins past 1.2590, the 1.2500 round figure and late May’s swing high near 1.2480 will be buffers during the south run towards May’s low of 1.2308.

Overall, GBPUSD teases buyers but they have a tough task on hand to retake control.

EURUSD sellers prepare for entry, 1.0930 and US inflation eyedEURUSD bears appear running out of steam during the fourth weekly loss as it grinds near the key support confluence within a five-month-old bullish channel ahead of the US inflation. In doing so, the Euro pair seesaws between a three-week-old falling resistance line and a confluence of the 100-DMA and a rising support line from November 2022, respectively near 1.0970 and 1.0930. It’s worth noting that the MACD and RSI signal the return of the buyers but a clear downside break of 1.0930 could quickly challenge the bullish channel by poking the 1.0760 mark comprising the stated channel’s support line. In a case where the Euro bears ignore oscillators and break the 1.0760 support, May’s low of 1.0688 may act as an intermediate halt before dragging the quote toward the lows marked in February and January of 2023, close to 1.0515 and 1.0480 in that order.

On the flip side, a clear upside break of the aforementioned three-week-old descending resistance line, close to 1.0970 at the latest, becomes necessary for the EURUSD bull’s return. Following that, the tops marked in February and April, near 1.1035 and 1.1095 in that order will gain the market’s attention. In a case where the Euro buyers dominate past 1.1095, the yearly high marked in July around 1.1275 and the previously stated bullish channel’s top line, close to 1.1285, should lure the bids.

Overall, EURUSD is hitting strong support ahead of the key event that’s likely to underpin the US Dollar pullback, which in turn requires sellers to remain cautious before taking a fresh short position.

Banknifty ( Mostly Bullish )Banknifty . Trying to form ( H&S ).

Enter after " Breakout and Retracement ".

.

.

For " long "

entry: 44580 / 45120

target: 45250 - 45760

stoploss: 44900 / 45030

.

.

For " Short"

entry: 44550

target: 44250, 44030

stoploss: 44580

.

Enter only if market Breaks

"Yellow box" mentioned.

.

Wait for proper reversal and conformation.

.

Don't make complicated trade set-up.📈📉

Keep it " Simple, Focus on Consistency "💹 .

Refer our old ideas for accuracy rate🧑💻.

Valuable comments are welcomed-✌️

.

refer old ideas attached below

AUDUSD downside hinges on 0.6470 breakdown and Aussie/US dataA clear downside break of the 10-month-old rising support line teases the AUDUSD bears as China releases mixed inflation data from July. Even so, an ascending trend line from early November 2022, close to 0.6470, could join the nearly oversold RSI to challenge the Aussie bears. Following that, a 78.6% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6375, may act as the final defense of the bulls before the late 2022 low of 0.6170 gains attention.

Meanwhile, AUDUSD needs to provide a daily closing beyond the support-turned-resistance line, near 0.6540 at the latest, to recall buyers. Following that, a three-week-old falling resistance line, around 0.6650, could check the upside momentum ahead of targeting May’s peak of around 0.6820. It’s worth noting, however, that the double tops surrounding 0.6900 become the key hurdle to the north for the pair buyers to crack for conviction.

Overall, AUDUSD slips into the bear’s radar but the road towards the south is long. That said, Thursday’s Australia Consumer Inflation Expectations for August and the all-important US Consumer Price Index (CPI) will be crucial for the pair traders to watch for clear directions.

Kotak Bank Near Support ZoneKotak Bank is trading in sideways channel and is currently near a support zone of the channel. This presents a potentially good opportunity for a swing trade.

Entry:

For entry, it is recommended to go long after close of strong bullish candle near support zone.

Stoploss:

To minimize risk, a stop loss should be placed below the support zone, with some buffer to avoid stop loss hunting.

Target:

As for the target, it is advised to aim for the next resistance level as indicated on the chart.

Thank you for considering this analysis, and feel free to follow for more insights.

Rain might Make it HailRain industries is currently in a symmetrical triangle pattern resting on the 200EMA and is on a strong area of confluence which is acting like a support zone, it is also supported by a moving average right below which is the 50EMA which gives us 3 major support zones.

Looking deep into the volume of the consolidation, you can see that the consolidation was on low volume and a good green candle has formed with good volume showing buying at that level.

Normally when the market breaks out, we miss the best entry, to prevent that, we indulge in a riskier trade with the help of position sizing giving us maximum gain and minimum loss.

What is position sizing?

It is when you first add half your position to check If the market is saying you are right or wrong, if the market moves in your direction, you will add your second half and tighten your stop loss. This way you add two positions but one only when the market shows you that you are correct.

Example: Suppose your risk is 100 per trade, You first buy enough Qt to risk only 50 ( Typically with a larger stop) and if the market forms a green candle or another bullish sign, you add another Qt to risk 50 more ( Total risk 100) and your second stop loss becomes tighter ( most probably at the breakeven of the first position) this way you minimise your loss but ur reward is the same and even more. If your first stop gets hit, you accept your mistake and move on.

Add to more on break of triangle

Target with a good risk to reward

Stop loss below 50EMA

Keep It Simple

Gold sellers need to break $1,925 support for further downsideGold Price fades bounce off an upward-sloping support line from late February by retreating from the 50-DMA hurdle, around $1,945 by the press time. Adding strength to the downside bias are the bearish MACD signals and a downward-sloping RSI (14), not oversold. With this, the XAUUSD is likely to break the stated support line, around $1,925 by the press time. Following that, a quick fall toward the $1,900 round figure can’t be ruled out. However, a six-month-long horizontal support zone around $1,890 and the 78.6% Fibonacci retracement of February-May upside, near $1,860 may test the metal’s further downside before challenging the yearly low marked in March around $1,804.

On the contrary, a daily closing beyond the 50-DMA hurdle of around $1,945 may allow the Gold buyers to aim for the 38.2% Fibonacci retracement level of around $1,967. However, an area comprising multiple levels marked since May 19, close to $1,985, will challenge the XAUUSD bulls afterward. In a case where the bullion price rally crosses the $1,985 resistance, the $2,000 round figure may give a final fight to the optimists before giving them control.

Overall, the Gold Price remains on the back foot but a clear downside break of $1,925 becomes necessary for the bears to take control.

USDJPY pares weekly gains with eyes on sub-140.00 zoneUSDJPY extended a pullback from a five-week-old horizontal resistance by slipping beneath monthly horizontal support and 200-SMA, despite the latest rebound, as markets sensed the Bank of Japan’s (BoJ) exit from the loose monetary policy and unimpressive US employment report. Also keeping the Yen sellers hopeful are the bearish MACD signals and downward-sloping RSI (14) line. With this, the bears are all set to challenge the 141.00 round figure comprising the 50% Fibonacci retracement of the June-July downturn. Following that, the 38.2% Fibonacci retracement level of 140.30 and the 140.00 psychological magnet may test the downside move. It’s worth observing that a three-week-old rising support line, close to 139.55 at the latest, acts as the last defense of the buyers.

On the flip side, the aforementioned support-turned-resistance zone and the 200-SMA, around 141.85-142.00, challenge the USDJPY buyers before directing them to the five-week-old horizontal hurdle surrounding 144.00. In a case where the Yen pair rises past 144.00, the yearly peak marked in June around 145.10, will be in the spotlight. It should be noted that the quote’s strength past 145.10 could direct bulls toward the 150.00 round figure ahead of highlighting the next year’s top of around 152.00.

Overall, the talks of a looming BoJ rate hike or an alteration into the Yield Curve Control (YCC) policy exert downside pressure on the USDJPY pair but the US inflation is on the cards and can help the pair register another positive week. Hence, it's advisable to be cautious while trading the Yen pair.

What makes a Resistance Potential OneResistance and support are faces of a same coin the concept is same , if price reverses its direction after getting closer to a particular level or zone we call it resistance or support level or zone.

When you start learning about it more you will find that it is the most basic approach to analyze a price action, then you mix it up with trend line which is again nothing but a tilted support and resistances, concept is same.

Trading such levels & zone require an approach where you can benefit maximum from the upcoming move and the trade you take should have the potential to give you a good risk to reward ratio.

If you see, resistance and support are everyday happenings , they occurs so much times that taking a bet on every setup will make our trading random ,so filtering those blurry , OK-ok, less potential setup is very very important .

---------------------

Here I am giving you some of my observation over filtering such setups.

First do not try to make support and resistance everywhere , try to avoid making inside a range , can only make such resistances and support if they form on a large time frame or over a long period. This will filter out your 40% setups.

Second Let the support and resistance test 3 or more touches , when price behaves in an ideal way more than three times the level or zone become very crucial and price can tend to give you a big and sharp rally (see the direction still can be any side as it is not always breakdown it can also be a big reversal).

Third See the overall trend and recent price pattern , better if the setup is in order to the overall trend, reversals should also be in sync with overall trend as in this USD/INR chart the overall trend is bullish & the pattern is a bullish flag which is again a bullish one.

Fourth Volume formation when price reaches to a support or resistance if a spike in volume is there then you can say a big players is also betting on those levels or zones in big quantity (note : they betting in which direction you can't guess like that).

You can take entry at breakout and make your stop loss at the support simple....

Gold bears approach key support ahead of US NFPFailure to cross a nine-week-old horizontal resistance drags the Gold price back an upward-sloping support line from late February, close to $1,920 at the latest. Adding strength to the downside bias is the falling RSI line and bearish MACD signals. However, the RSI line is below 50.0 and suggests bottom-picking, which in turn highlights the stated trend line support. Even if the metal breaks the $1,920 support, the 200-EMA level of around $1,905 and the $1,900, as well as June’s bottom of around $1,895, can challenge the XAUUSD bears. Following that, a slump towards the 78.6% Fibonacci retracement of February-May upside, near $1,860, can’t be ruled out.

Meanwhile, the Gold price recovery needs to cross the late July swing low of around $1,945 to convince the buyers. However, the metal’s further upside remains elusive unless crossing the previously mentioned multi-week-old horizontal hurdle surrounding $1,985. In a case where the XAUUSD buyers manage to keep the reins past $1,985, the $2,000 round figure and March’s high of around $2,010 will act as the final defense of the sellers.

Overall, Gold sellers are likely to witness a bumpy road ahead but may continue to occupy the driver’s seat.

Expiry Day Special Analysis 03/Aug/23 || Nifty Hero & Zero TradeGood Morning Traders, i hope you had a good day yesterday, as we have captured huge move in nifty. Well i have brought again analysis on Nifty on Expiry Day. So let's start.

Guy's yesterday we have seen sharp selling in all indian indices, even in whole world exchanges were down more than 1% in intraday. The reason was that US Credit downgraded. Anyway we have captured good move that is important as trader right.

For today's scenario, Global market still looking bearish, i have seen, it's everywhere red showing. But nifty is on support let's see are we gonna to hold yesterday's low or not. Chances are high we can see some upside in first half and then sailing pressure can come in 2nd half, well predicting now is impossible, that what exactly gonna to happen, but we will trade according to levels or price action.

IMPORTANT LEVELS FOR NIFTY TODAY:-

Best buy will be when nifty cross above 19632 and sustains at least for 30 mints.

Targets we can see in upside 19699/19766++

Keep stop loss at 19561

Best sale levels will be, once nifty breaks 19410 and sustains at least for 30 mints.

Target we can see in downside 19335/19277--

Keep stop loss at 19561

Note:- Hero Zero Trade will be in 2nd half somewhere 1:15pm. So, we will update in afternoon according to price action, so stick with us and follow us to get notity at right time. Till then enjoy but don't overtrade and Always wait for the best entry or levels to execute trades. And always follow strict stop loss to save your capital from unexpected market direction.

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.

NZDUSD challenges two-month-long bullish trendNZDUSD slides beneath a two-month-old rising support line, extending late July’s downside break of the 200-EMA, as New Zealand released mixed second-quarter (Q2) employment data but the sentiment remains sour on US credit rating downgrade. With this, the Kiwi bears are all set to visit March’s low of around 0.6085. However, the late June swing low of around 0.6050 and the 0.6000 psychological magnet could test the pair sellers as the RSI (14) is below 50.0. If not, then May’s bottom of around 0.5985 will act as the last defense of buyers ahead of highlighting a convergence of the five-month-old descending support line and 61.8% Fibonacci retracement of October 2022 to March 2023 upside, near 0.5910.

Meanwhile, a daily closing beyond the 200-EMA level of around 0.6225 becomes necessary for the NZDUSD buyers to retake control, at least for the short term. Following that, the 23.6% Fibonacci retracement level of around 0.6300 will be in the spotlight. However, an area comprising multiple levels marked since early February, close to 0.6380-90, quickly followed by July’s high of around 0.6415, should probe the Kiwi pair’s further upside ahead of enabling it to target the yearly top marked in February around 0.6535-40.

Expiry Day Special analysis || FinNifty Hero Zero Trade 01/08/23Hello Traders, Good Morning, i hope you will be doing good in your trading and your life as well as. I have done analysis on Finance nifty as today is weekly expiry. So let's start,,

We have seen some pull back in all indian indices in yesterday's session, i think this should continue, as global market also supporting. Finance nifty also done same, let's see what is going to happen today.

If i talk about support and resistance for Finance nifty, then There is support in the zone of 20175-20200 in downside and i think Finance nifty will give respect for this today's session. Guy's try to buy in support zone also, if you see any price reversal pattern on downside and keep stop loss at 20125.

For Resistance we can see in the range of 20358-20375, and if Finance nifty will break above these levels and trade at least for 30 mints then our buying order should triggered, as then we can see bullishness in Finance Nifty and that momentum will lead the rally towards 20450-20500 levels.

Important Levels for Finance Nifty:-

Buy above 20358, if levels got sustained at least for 30 mints.

Target we can see in upside 20441/20481/20537.

Keep stop loss at 20200.

Sale below 20200, if levels got sustained at least for 30 mints.

Target we can see in downside 20125/20065/20011.

Keep stop loss at 20358.

Note:- Hero Zero Trade will be in 2nd half somewhere 1:15pm. So, we will update in afternoon according to price action, so stick with us and follow us to get notity at right time. Till then enjoy but don't overtrade and Always wait for the best entry or levels to execute trades. And always follow strict stop loss to save your capital from unexpected market direction.

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.