Swingtrading

Swing Trade - SOLEX BUYTechnical Trade Set up

1) Sorted Ema's shows Higher timeframe Bullish sentiment

2) Price Bounced from strong Demand Zone

3) Aggresive trade active / Conservative entry wait for Price action

4) RSI in Oversold zone

Tgts wld be 1152 / 1297 / 1786

Stoploss 865 / 630 on candle closing Basis

Disclaimer: Educational purposes only. Not financial advice. DYOR and consult a professional before investing.

TMB : VCP Short Base BreakoutTMB has just completed a textbook VCP (Volatility Contraction Pattern) consolidation. We observed three clear rejections accompanied by consistent higher lows, along with a noticeable volume dry-up — all classic signs of tightening supply.

This was followed by a clean breakout backed by strong volume expansion, confirming demand stepping in. Fundamentally, both EPS and sales are improving QoQ, which adds further conviction to the setup. Overall, it checks all the boxes for a high-quality VCP trade.

I initiated the position with a conservative 0.1% risk, as I’m currently collecting more data and validating this setup type. Once I gain more confidence in the price action and consistency, I plan to gradually scale up the risk.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

BNBUSDT – Daily Timeframe AnalysisBNB is reacting from a strong support zone around 770 after a sharp sell-off. I’m looking for a bounce from this demand area for a possible short-term recovery.

Plan:

📍 Entry zone: 770–780

🎯 Target: 950–1000 (previous resistance area)

🛑 Stop-loss: Below 700

Bias: Cautious bullish while price holds above support.

If support fails, bearish continuation toward lower levels is possible.

Not financial advice. Trade with proper risk management.

Updater Services (UDS) – Wave (B) Exhaustion | Wave (C) Counter-Timeframe: Weekly

Market: NSE

Method: Elliott Wave + Fibonacci Projection

Updater Services appears to be completing a higher-degree corrective Wave (B) after a full ABC advance into 438.

The entire decline from the top has been overlapping, channelized, and time-consuming, confirming a corrective structure rather than an impulse.

Wave Structure Overview

Wave (A): Corrective rise into ~438

Wave (B): a–b–c decline, now near the lower boundary of the long-term falling channel

Wave (C): Expected counter-trend rally once Wave (B) exhaustion confirms

🎯 Wave (C) Target Zones (Projected Using Wave A)

Targets are derived using Trend-Based Fibonacci Extension

(Start of A → End of A → End of B)

0.382 Fib: ~225–230 → First reaction / partial booking

0.618 Fib: ~270–280 → Normal Wave (C)

1.0 Fib: ~330–360 → Only if price turns impulsive

⚠️ This is a corrective Wave (C), not a trend reversal unless momentum and structure confirm.

🛑 Invalidation

A sustained weekly close below the Wave (B) low (~145–150) invalidates the Wave (C) thesis.

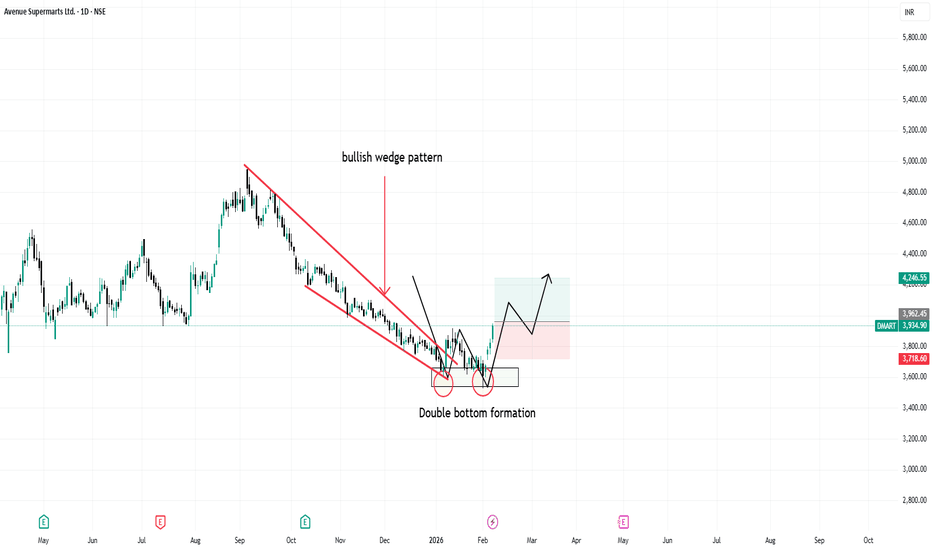

Nifty 50 : The “Trump–Modi” Rally Meets Budget Reality 🇮🇳🇺🇸Right now, the Indian market feels like it’s standing at a very interesting crossroads — both technically and fundamentally. After the wild start to February 2026, what we’re seeing looks more like a relief rally trying to fight against stretched valuations.

From Budget Shock to Trade Deal Pop

Just a few days back, sentiment was terrible.

The Union Budget’s surprise hike in STT on Futures and Options (0.05% and 0.15%) caught traders completely off guard. That one move alone wiped out nearly ₹10 lakh crore in market cap in a single session. The market was in full panic mode.

But then came the twist.

The “Trump–Modi” trade deal on Feb 2 flipped the script overnight.

The U.S. cut reciprocal tariffs on Indian goods from a brutal 50% to 18%, and in return, India agreed to shift energy imports toward the U.S., committing nearly $500 billion in energy and tech deals.

That was enough to light a fire under the market. Nifty responded with one of its strongest single-day moves, jumping 2.55% and reclaiming the 25,700 zone. Pure relief rally.

But I’m Not Chasing This Move Yet

Even with all the excitement, I don’t think this is the time to blindly chase green candles.

The chart still suggests we might need some time-wise consolidation before any serious attempt at new all-time highs.

Key points of concern :

IT is dragging badly. While textiles and gems are flying, Nifty IT is down almost 5% thanks to H-1B fee hikes and weakness in U.S. tech. That’s a heavy index weight to ignore.

Valuations are stretched. Without stronger earnings support, this rally could easily lose steam near the 26,000–26,100 supply zone.

RBI risk ahead. The Feb 6 MPC meeting is key. A rate cut is unlikely, but the tone matters. If the RBI isn’t dovish enough, sentiment can cool quickly.

My Take

For now, I’d rather stay patient.

This move still feels more like a relief bounce than the beginning of a clean, sustainable breakout. I’d rather see some stability and a proper base form before getting aggressive with fresh positions. We can even expect a move to fill the gap formed during the relief rally.

Right now, the moving averages are still in a bearish crossover, which tells me the broader structure hasn’t fully turned bullish yet. Ideally, I want to see the 20-day EMA cross back above the 50-day EMA and, more importantly, the index sustaining above those levels. That kind of strength would give more confidence that the bullish momentum is real and not just a short-term pullback rally.

Until that happens, it’s better to step back, stay patient, and reassess rather than forcing trades.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

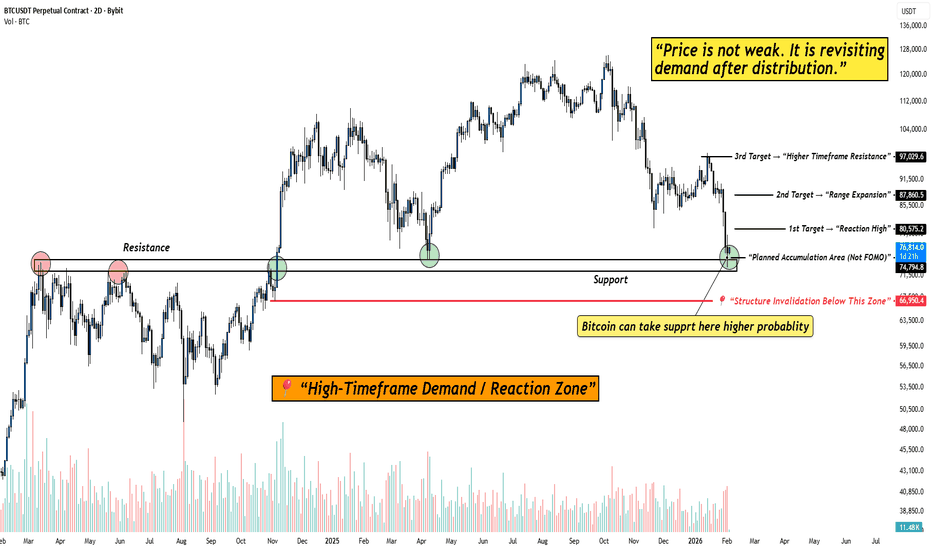

BITCOIN at High-Timeframe Demand: Reaction Zone in Play!When I look at this chart, I’m not seeing fear or structural damage.

I’m seeing price doing exactly what it should do after a distribution phase , revisiting demand and slowing down.

Bitcoin has come back into a clearly marked high-timeframe demand / reaction zone . This is not a random level. This is an area where price has previously flipped structure and attracted strong participation.

What stands out to me on the chart:

Price is holding above a major high-timeframe support , not slicing through it. That tells me sellers are no longer aggressive at these levels.

The current zone is labeled as a planned accumulation area (not FOMO) . Price is reacting here instead of accelerating lower, that’s important.

Downside risk is clearly defined with a structure invalidation level below demand. As long as that level holds, structure remains intact.

Upside targets are logical and sequential , starting from a reaction high, followed by range expansion, and then higher-timeframe resistance.

The psychology behind this phase:

This is the part of the market where most people feel uncomfortable.

Price isn’t exciting. It’s not trending fast. It’s just… sitting.

But that’s usually how strong moves begin.

If Bitcoin were truly weak, it wouldn’t pause here, it would break cleanly below demand.

So far, it hasn’t.

That tells me the market is evaluating value , not panicking.

My approach here is simple:

I don’t chase price away from demand.

I don’t panic inside support.

I observe how price behaves at this zone and let the market show its hand.

As long as price holds above the demand zone, reactions from here remain valid.

Only a clean acceptance below the invalidation level would change this view.

Until then, this is a patience zone .

And patience, more often than prediction, is what gets paid in this market.

Disclaimer:

This analysis is for educational purposes only. Not financial advice. Always manage risk and trade according to your own plan.

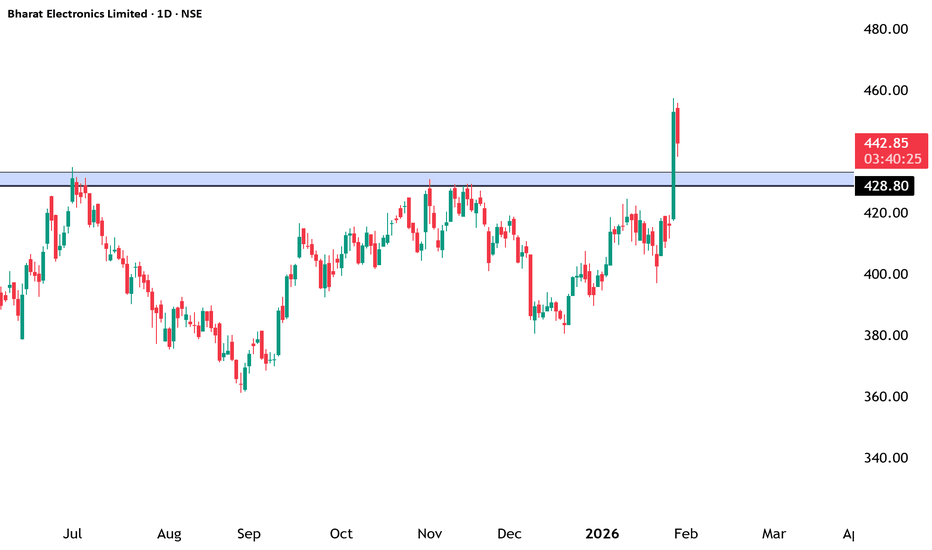

BEL : High-Quality Setup Despite Market Weakness📊 Technical Catalysts :

This is a perfect VCP structure with a clean breakout supported by strong volume, clearly indicating institutional interest. The stop loss is well placed below the basing formation, keeping risk structurally defined. The 20 EMA crossing above the 50 EMA further confirms a bullish trend shift.

EPS and Sales are continuously increasing for the past few quarter. The only dip was in June and this is not a stock specific event but a market wide scenario.

🏭 Fundamental Catalysts :

Good Results ; EPS and Sales are continuously increasing for the past few quarter. The only dip was in June and this is not a stock specific event but a market wide scenario.

Q3 Beat: Net profit grew 20.4% YoY (₹1,590 Cr), comfortably beating street estimates. Revenue execution is at an all-time high.

The EU FTA Factor: The "Mother of All Deals" signed on Jan 27 opens up a $750B market for Indian defense electronics. BEL is the primary beneficiary as it scales up exports to European nations looking to de-risk from China/Russia.

Budget 2026 Speculation: With the Union Budget on Feb 1, the market is front-running a likely increase in defense capital outlay.

Even though the broader market is showing signs of weakness, the confluence of strong technical structure, volume-backed breakout, moving-average crossover, and improving fundamentals provides enough confidence to take this trade, while still maintaining disciplined risk management with a standard 1% risk per trade.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

APLAPOLLO : VCP Breakout with Fundamental ConfirmationInitiated a long position in APLAPOLLO following a high-conviction breakout from a multi-month Volatility Contraction Pattern (VCP). Although the price is currently extended from the 20- and 50-day EMAs, the structural strength of the breakout suggests the beginning of a fresh leg in the uptrend.

From a fundamentals perspective, the company continues to deliver strong and consistent sales and EPS growth, reinforcing its positioning as a proxy for India’s infrastructure-led growth cycle.

To manage the risk associated with being extended from the moving averages, I’ve opted for a wider stop-loss, allowing room for short-term volatility or a potential retest of the breakout zone. This approach gives the trade sufficient breathing space while the moving averages gradually catch up to price.

From a broader market standpoint, the recent ~10% correction in ITC following the government’s cigarette tax announcement has created temporary index-level pressure on the Nifty 50. However, this has triggered a clear sectoral rotation rather than broad-based weakness. Capital is rotating out of regulatory-impacted FMCG names and into high-growth industrial leaders like APL Apollo.

Given its insulation from regulatory shocks and its direct linkage to domestic capex growth, APL Apollo is exhibiting strong relative strength even as the broader market remains range-bound.

Initiated the position with 1% risk.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

Automotive Axles - ATH Breakout - Investment Ideas#Automotive Axles Limited - Technical Analysis

Current Price: 1,790.80

#Breakout & Retest = Opportunity

#Technical Setup

Strategy: Swing to Short Term Trade

✅ **ATH Breakout + Retest** - Successfully retested breakout zone

✅ **Higher High Formation** - Clear uptrend structure

✅ **EMAs Sorted** - Bullish alignment confirmed

✅ **Trendline Breakout** - Long-term resistance conquered

#Key Levels

Support: 1,520 (Tight SL) | 1,504 (Major support)

Swing Targets:

- T1: 2,078

- T2: 2,189

- T3: 2,284

Short-Term Targets:

- T1: 2,546

- T2: 2,800

- T3: 2,933

- Grand T4: 3,125

#tradesetup

Entry: Current levels (1,790 - 1,800)

Stop Loss: 1,520 (daily closing basis)

Risk-Reward: 1:3+ (excellent)

Timeframe: 2-6 months

Disclaimer: For educational purposes only. Not investment advice. Trading involves substantial risk. Consult a SEBI-registered financial advisor before making investment decisions. Past performance doesn't guarantee future results.

#AutomotiveAxles #SwingTrading #BreakoutTrading #TechnicalAnalysis #NSE #AutoStocks #ShortTermTrading #StockMarket #ATHBreakout #IndianStocks

BEL – Setting Up for a 5% Move-Swing TradeBEL – Setting Up for a 5% Upside Move 🚀

BEL has taken strong support near ₹385–388 and is now reclaiming key moving averages with improving momentum. With the upcoming Union Budget expected to favor Defence spending, sentiment & flows remain supportive.

📌 Trade View

CMP: ~₹400

Targets: ₹420 (near-term), ₹431 (extendable)

Support: ₹388

Stoploss: ₹382 (strict)

💡 Why?

Strong bounce from key demand zone

Reclaiming trend levels + improving structure

Budget tailwinds + Defence sector strength

Trend intact. Dips buying. Ride the move! 🐊🔥

Bharat Electronics Ltd (BEL) – Bullish Structure BreakoutNSE:BEL

🔹 Technical View

Price has decisively broken above a major supply / resistance zone (~₹428–432) after multiple rejections in the past.

Strong bullish momentum candle indicates institutional participation and demand dominance.

Previous resistance now likely to act as strong support on any pullback.

Structure shows higher highs & higher lows, confirming an ongoing uptrend.

Immediate levels to watch:

Support: ₹428–420

Upside potential: ₹460 → ₹480 (positional)

🔹 Volume & Price Action

Breakout supported by healthy volume expansion, validating the move.

No major selling pressure visible near breakout zone so far.

🔹 Fundamental View

BEL is a Navratna PSU and a key player in defence electronics.

Strong order book driven by:

Defence modernization

Indigenous manufacturing (Make in India / Atmanirbhar Bharat)

Consistent revenue visibility, healthy margins, and improving ROE.

Virtually debt-free balance sheet adds financial stability.

🔹 Future Growth Prospects

Long-term beneficiary of India’s rising defence spending.

Increasing focus on:

Radar systems

Electronic warfare

Missile & naval electronics

Export opportunities and private-defence collaboration act as additional growth triggers.

Well-positioned for sustainable compounding over the next few years.

🔹 Conclusion

Technically strong breakout + fundamentally robust business.

Suitable for positional & long-term investors on dips near support.

Trend remains bullish as long as price sustains above ₹420–428 zone.

==============

⚠️ Disclaimer:

==============

This content is shared strictly for educational and informational purposes.

We are not SEBI-registered investment advisors or analysts.

The views expressed are personal opinions, based on publicly available data and market observations.

Please consult a SEBI-registered investment advisor before taking any investment or trading decisions.

Any actions taken based on this content are entirely at your own risk and responsibility.

========================

Trade Secrets By Pratik

========================

#BEL - VCP BreakOut in Daily Time Frame Script: BEL

Key highlights: 💡⚡

📈 VCP BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Base BreakOut

📈 RS Line making 52WH

📈 MACD Crossover

⚠️ Important: Market conditions are BAD, Avoid entering any Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅ Boost and Follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes. Not a BUY or SELL recommendation.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

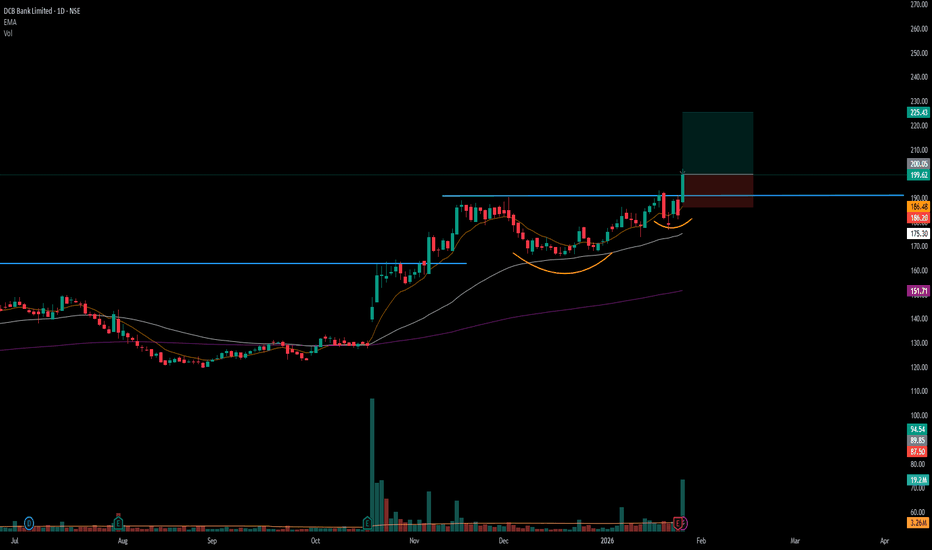

#DCBBANK - BreakOut in DTF with Volume Script: DCBBANK

Key highlights: 💡⚡

📈 C&H BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Base BreakOut

📈 RS Line making 52WH

📈 MACD Crossover

BUY ONLY ABOVE 200 DCB

⏱️ C.M.P 📑💰- 199.62

🟢 Target 🎯🏆 – 12%

⚠️ Stoploss ☠️🚫 – 6%

⚠️ Important: Market conditions are BAD, Avoid entering any Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅ Boost and Follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes. Not a BUY or SELL recommendation.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Triangle Contraction Symphony: Hidden Supports, Inverted H&SWitness the mesmerizing dance of price action in this chart masterpiece. A pristine triangle contraction pattern emerges, bounded by a supportive yellow trendline below and a red counter-trendline above, perfectly channeling price within tightening bounds.

Layered hidden dotted support/resistance lines add depth, illustrating how price meticulously respects each level—time and again.

Culminating in a textbook inverted head and shoulders formation, this setup showcases contraction elegance at its finest.

Purely educational: Reliving how these levels held in the past. No directional bias here—just the raw beauty of price action precision.

Disclaimer: This post is for educational purposes only, demonstrating historical price action behavior and level interactions. No directional bias or trading recommendations are implied. Past performance is not indicative of future results. Trade at your own risk.

Intraday Trading vs. Swing Trading: A Detailed Comparison1. What Is Intraday Trading?

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading session. All positions are closed before the market closes, and no trades are carried overnight.

Intraday traders profit from small price fluctuations using high volume, leverage, and precise timing. The focus is on short-term momentum, liquidity, and volatility.

Key Characteristics of Intraday Trading

Trades last from a few seconds to a few hours

No overnight risk

High frequency of trades

Requires continuous screen monitoring

Strong dependence on technical indicators

Sensitive to news and market sentiment

2. What Is Swing Trading?

Swing trading aims to capture short- to medium-term price swings over several days to a few weeks. Positions are held overnight and sometimes across market cycles.

Swing traders rely on trend analysis, support and resistance levels, and market structure rather than minute-to-minute price action.

Key Characteristics of Swing Trading

Trades last from 2 days to several weeks

Positions are held overnight

Lower trade frequency

Less screen time required

Combination of technical and fundamental analysis

Focus on broader market trends

3. Time Frame and Trade Duration

Intraday Trading

Time frames used: 1-minute, 5-minute, 15-minute charts

Trades aim to capture quick price movements

High pressure due to fast decision-making

Traders must act instantly on signals

Swing Trading

Time frames used: Daily, 4-hour, and weekly charts

Trades allow time for trends to develop

More patience required

Decisions can be planned after market hours

4. Capital Requirement and Leverage

Intraday Trading

Often requires higher capital

Leverage is commonly used

Brokers offer margin benefits for intraday trades

Small adverse moves can cause quick losses

Swing Trading

Lower leverage compared to intraday

Less dependence on margin

Suitable for traders with moderate capital

Lower risk of forced liquidation

5. Risk Exposure and Volatility

Intraday Trading Risks

Sudden price spikes

Slippage during high volatility

Emotional stress due to rapid price movement

Overtrading risk

Swing Trading Risks

Overnight gap risk

News and earnings impact

Broader market risk

Requires wider stop-losses

Despite overnight risk, swing trading often has better risk-to-reward ratios than intraday trading.

6. Profit Potential and Consistency

Intraday Trading

Smaller profits per trade

Requires many successful trades for consistency

High transaction costs (brokerage, taxes)

Suitable for traders seeking daily income

Swing Trading

Larger profit targets

Fewer trades, higher quality setups

Lower transaction costs

Better suited for wealth building

7. Technical Analysis Tools Used

Common Intraday Indicators

VWAP (Volume Weighted Average Price)

Moving Averages (9, 20 EMA)

RSI (short-period)

MACD (fast settings)

Order flow and volume profile

Common Swing Trading Indicators

Support and resistance

Fibonacci retracement

Trendlines and channels

RSI (14-period)

Moving averages (50, 100, 200)

Swing traders rely more on price action and structure, while intraday traders focus on speed and momentum.

8. Psychological Demands

Intraday Trading Psychology

High stress and pressure

Requires emotional discipline

Fear and greed act faster

Quick recovery from losses is essential

Swing Trading Psychology

Requires patience and trust in analysis

Managing uncertainty overnight

Avoiding panic due to short-term noise

More suitable for calm personalities

Psychology often determines success more than strategy.

9. Lifestyle and Time Commitment

Intraday Trading

Full-time commitment

Requires presence during market hours

Not suitable for working professionals

Highly demanding mentally

Swing Trading

Part-time friendly

Ideal for professionals and students

Analysis can be done after market hours

Better work-life balance

10. Market Conditions Suitability

Intraday Trading Works Best When:

Market is highly volatile

Strong intraday trends exist

Liquidity is high

News-driven moves occur

Swing Trading Works Best When:

Clear trends are present

Markets are stable

Volatility is moderate

Broader market direction is defined

11. Taxation and Costs (General View)

Intraday trading usually attracts higher taxes and transaction costs

Frequent trading increases brokerage expenses

Swing trading is more tax-efficient due to lower turnover

(Tax rules vary by country and should be checked locally.)

12. Who Should Choose Intraday Trading?

Intraday trading is suitable for traders who:

Can dedicate full market hours

Handle high stress and fast decisions

Have strong discipline and execution skills

Prefer daily profit opportunities

13. Who Should Choose Swing Trading?

Swing trading is suitable for traders who:

Prefer planned trades

Have limited time during market hours

Aim for higher risk-reward trades

Want consistent growth with lower stress

14. Intraday vs. Swing Trading: Key Differences Summary

Aspect Intraday Trading Swing Trading

Holding Period Same day Days to weeks

Risk High, fast Moderate

Screen Time Very high Low

Leverage High Low

Stress Level High Moderate

Suitable For Full-time traders Part-time traders

Conclusion

Both intraday trading and swing trading are effective trading styles when practiced with discipline, proper risk management, and a clear strategy. Intraday trading offers faster feedback and daily opportunities but comes with higher stress and execution risk. Swing trading provides more flexibility, better risk-reward potential, and a balanced lifestyle but requires patience and the ability to handle overnight uncertainty.

There is no universally superior trading style. The best approach is the one that matches your personality, capital, time availability, and psychological comfort. Many successful traders even combine both styles, using intraday trades for short-term opportunities and swing trades for broader market moves.

INDIANB (Indian Bank)INDIAN BANK is showing a strong and constructive setup.

The stock recently made a fresh all-time high near 894, followed by a healthy pullback, which is a positive sign and often helps in building a stronger base for the next move. Importantly, the pullback was well-controlled, indicating limited selling pressure.

Price has now resumed its upward move and is trading above all key EMAs, reflecting continued strength and bullish momentum. The overall structure remains intact with higher highs and higher lows.

A decisive breakout from the current consolidation zone could open the door for a fresh upside move in the coming sessions.

Keep it in your watchlist.

✅ If you like my analysis, please follow me here as a token of appreciation :) in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

BPCL : Trading the Confluence of Price Action & Macro TailwindsThe stock has been consolidating within a defined range over the past few weeks and has recently started forming a solid base. While the breakout volume isn’t a classic “God-candle,” price action continues to hold firmly above key moving averages, which is a constructive sign. That said, the price is somewhat extended from the EMAs, increasing the probability of a mean-reversion move. Hence, the stop loss needs to be placed wider rather than just below the basing structure.

The conviction behind this trade comes largely from the current Goldilocks macro environment we’re witnessing in early 2026. With global crude prices remaining comfortably low, BPCL is benefiting from strong marketing margins across petrol and diesel, supporting near-term earnings visibility.

On the fundamental side, a major catalyst is the Government’s LPG compensation package. BPCL is expected to receive a significant share of the ₹30,000 crore payout allocated to OMCs, which materially improves cash flows in H2 FY26. This inflow also acts as a strong deleveraging trigger, further strengthening an already improving balance sheet that has seen a steady decline in debt-equity levels over recent quarters.

So took this position with 1% risk on the net capital.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

NIFTY – Bearish Structure Playing Out as AnticipatedIn my previous posts, I had clearly highlighted the possibility of a trend shift and warned that the ongoing price action could resolve to the downside. Over the last few sessions, price has started to play out exactly along those lines.

1. Bearish crossover (mini death cross)

A bearish crossover between the short-term and medium-term moving averages has now occurred. This was already anticipated and mentioned in earlier posts, and it marks a loss of bullish momentum after the ATH zone.

2. Clean breakdown below key support

Price has decisively broken below an important support and trendline structure. This confirms the bearish bias and strengthens the view that the broader market is under distribution rather than accumulation.

3. Next immediate support zone

The marked zone below acts as the next immediate support, where we may expect temporary consolidation or a technical bounce. However, unless there is strong follow-through buying, this should be treated cautiously.

4. Caution on bullish moves

Any signs of bullishness from here are likely to be temporary retracements, which may eventually trigger further sell-offs.

➡️ Avoid fresh swing longs until overall market sentiment turns favorable.

➡️ Existing positions should be managed with strict stop-losses and disciplined risk management.

The market is behaving in line with what was discussed earlier. Until structure changes and strength is proven, the risk remains on the downside. Patience and capital protection are more important than chasing trades in such phases.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

JK TYREJK TYRE is consolidating near the previous Swing High Supply zone around 500–510 after a strong uptrend from lower levels. Instead of a sharp rejection, price is holding near resistance and contracting, while sustaining above the weekly 9 EMA. This price behaviour often points to supply absorption rather than distribution.

The stock continues to show leadership strength, with a high RS Rating (92 on the daily chart), indicating strong relative performance versus the broader market.

From a probability perspective:

> Sustained acceptance above the supply zone with expansion could support trend continuation.

> Failure to hold above key EMAs and acceptance below the range would suggest supply is still active.

On the fundamental side , the company has outlined a ₹5,000 crore capex plan over the next few years, focused on capacity expansion and long-term growth, which adds supportive context to the technical structure.

Keep it in your watchlist.

✅ If you like my analysis, please follow me here as a token of appreciation :) in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Hidden Channels & Fib Golden Zone : Beauty of Price ActionObservational Post only Showcasing how price action works using historical price points only

Observe how price elegantly respects this counter trendline on the weekly chart (red line), forging consistent lower highs through precise rejections. A subtle parallel channel lurks beneath, acting as a hidden guardian. Channels like these shield against fakeouts, confirming pure breakouts only when breached alongside key lines.

Shifting to the monthly view, the Fib retracement from swing low to high highlights the golden zone (50 to 61%, white shaded), a magnet for retracements where price often pauses or reverses with stunning symmetry.

This interplay reveals price action's beauty: layers of structure working in harmony, rewarding patient observers.

Disclaimer: This is for educational purposes only, showcasing historical price action observations. Not financial advice. Always conduct your own analysis and manage risk appropriately.

BANK NIFTY - Technical Analysis Bank Nifty is showing an interesting setup on the weekly chart.

After breaking out above its previous all-time high, the index has started contracting in a tight range, indicating healthy consolidation.

On the daily timeframe, it continues to take support near the 9 EMA, and during minor dips, it has also reversed from the 20 EMA, reflecting strong buying interest.

If Bank Nifty breaks out of this range with momentum, the upside potential remains open, sky’s the limit.

In case of a pullback, watch these key support zones:

🟩 57,500 – first immediate support

🟩 57,160 – secondary support

🟩 56,600 – third support

🟩 56,000 – major support zone if deeper retracement occurs

Overall market structure is Bullish, and a bit more consolidation or a short pullback will only strengthen the base for a sustained breakout.

✅ If you like my analysis, please follow me here as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.