XAUUSD – Downtrend broken, bullish momentum returnsXAUUSD has broken above the descending trendline and is currently retesting the breakout zone around $3,330. If this area holds, price may continue to rise toward $3,352 and potentially $3,380.

Current price action suggests a bullish continuation pattern is forming. The bullish outlook would be invalidated if price drops below $3,255.

From a fundamental perspective, gold is supported by HSBC’s upward revision of its 2025 forecast, strong central bank demand, and rising geopolitical tensions – all reinforcing a medium-term bullish outlook.

Technical Analysis

BRITANNIA INDUSTRIES LTD. – TECHNICAL INSIGHT________________________________________________________________________________

📊 BRITANNIA INDUSTRIES LTD. – TECHNICAL INSIGHT

📆 Date: July 8, 2025 | 🕒 Daily Chart

📍 Symbol: NSE: BRITANNIA

💡 Educational Breakdown – For Study & Learning Only

________________________________________________________________________________

🔹 Price Action Overview:

Britannia closed at ₹5,884.00, up by +1.95%, forming an “Above the Stomach” bullish continuation pattern just below a key resistance zone.

________________________________________________________________________________

🔴 Top Range (Resistance): ₹5,899.50

📉 Bear Strength: 53

The price has approached a previous supply zone where sellers have shown resistance. Watch this level closely for either a breakout or rejection.

________________________________________________________________________________

🟢 Bottom Range (Support): ₹4,506

📈 Bull Strength: 77

This zone acted as a strong demand base in the past, initiating a rally with a sharp volume spike.

________________________________________________________________________________

🔍 Pattern Focus: Above the Stomach

A bullish candle has opened above the midpoint of the previous red candle, suggesting buyer strength. This often signals momentum continuation, especially near breakout levels.

________________________________________________________________________________

🎯 What to Watch For:

✅ Breakout Confirmation Zone:

If price closes decisively above ₹5,900 with volume expansion, it may indicate strength and fresh upside continuation.

________________________________________________________________________________

🚫 Failure Zone:

If price faces rejection near ₹5,900–₹5,920 and forms a bearish engulfing or strong upper wick, short-term profit booking could occur.

________________________________________________________________________________

📌 Risk Management Tip:

Traders typically look for entry above breakout candle high with a stop below recent swing low or candle low. Volume confirmation is essential before considering directional bias.

________________________________________________________________________________

🔍 Contextual Takeaway:

This is a textbook example of price consolidating just below a resistance after a strong trend and forming a bullish candle setup. A breakout or failure here can define the next leg of the move.

________________________________________________________________________________

📚 Stay objective, wait for confirmation, and let the price lead.

________________________________________________________________________________

Entry Above ₹5,905–₹5,920 (on breakout)

Stop Loss ₹5,765

Risk Reward 1:1 | 1:2 +

________________________________________________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________________________________________________

What’s your view on BRITANNIA ? Comment below ⬇️

🔁 Share this if you're tracking the stock

✅ Follow STWP for clean Price Action + Candlestick patterns

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

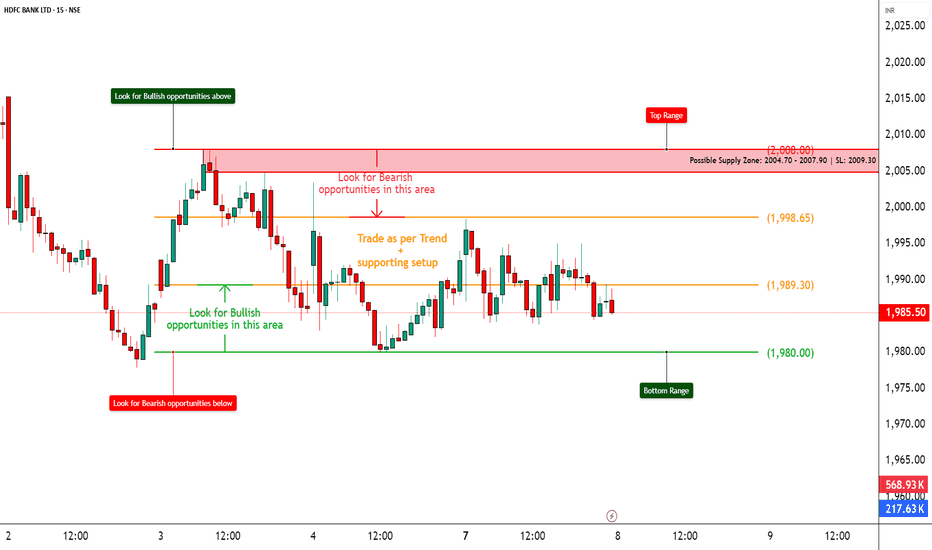

HDFCBANK – Heavy Call Writing Near 2000 Zone________________________________________

📈 HDFCBANK – Heavy Call Writing Near 2000 Zone | OI + Price Action Analysis

🕒 Chart Type: 15-Minute

📆 Date: July 7, 2025

________________________________________

🔍 What’s Catching Our Eye:

HDFCBANK closed at ₹1987.4, and the entire Call side from ₹1980 to ₹2100 is showing strong Short Build-Up, clearly suggesting resistance building up ahead, especially around ₹2000–₹2040 levels.

Meanwhile, Put side shows Long Unwinding at ₹2000 PE, suggesting lack of bullish confidence at current levels.

________________________________________

📌 What We’re Watching For:

Watch the zone between ₹2004.70 – ₹2007.90 very closely – it’s a visible Supply Zone based on price rejection + heavy CE OI.

If HDFCBANK fails to break and sustain above ₹2009.30 (SL), bears may take control again and drive it back to ₹1980 or below.

________________________________________

📊 Volume Footprint:

Heavy CE volumes hint at active resistance:

• ₹2000 CE – 9.3k+ contracts

• ₹2060 CE – 7.8k+ contracts

• ₹2020 CE & ₹2040 CE – ~5.6k contracts each

→ Strong presence of Call writers near current levels, pressuring the upside.

________________________________________

📈 Option Chain Highlights:

Calls (Short Build-Up):

• ₹2000 CE: +1,93,600 OI | Price ↓ 8.87%

• ₹2060 CE: +10,04,300 OI | Price ↓ 16.67% ✅ Major resistance buildup

• ₹2020 CE: +6,90,800 OI | Price ↓ 11.42%

• ₹2040 CE: +5,83,550 OI | Price ↓ 15.13%

• ₹1980 CE: +2,17,800 OI | Price ↓ 6.44%

• ₹2100 CE: +2,00,200 OI | Price ↓ 17.76%

Puts:

• ₹2000 PE: -84,150 OI | Price ↓ 0.87% → Long Unwinding = Bullish weakness

• ₹1980 PE: +6,050 OI | Price ↓ 2.33% → Weak Short Build-Up

📌 Inference:

Call writers are dominating the entire upper side. There’s no strong Put writing, and PE writers are exiting positions at ATM — this confirms limited bullish conviction.

________________________________________

🔁 Trend Bias:

🔴 Bearish to Range-Bound – unless ₹2009.30 gets taken out on closing basis

________________________________________

🧠 Trade Logic / Reasoning:

• Heavy Short Build-Up in all major CE strikes

• Lack of Put writing near spot

• Supply Zone aligning perfectly with Option Chain resistance

→ Expect rejection or pause unless strong buyers break ₹2009.30 with volume.

________________________________________

📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2008

🔻 Bottom Range (Support): ₹1980

________________________________________

🎯 Trade Plan (Educational Purpose Only):

✅ Best Buy (Equity): Above ₹2009.30 with a bullish candle and volume

✅ Best Sell (Equity): Below ₹2004.70 for quick move to ₹1980

✅ Best CE to Long: None – CE side is under Short Build-Up

✅ Best PE to Long: ₹1980 PE if price starts rejecting ₹2000 zone again

🟢 Demand Zone: ₹1965 – ₹1980 (Intraday Bounce Possible)

🔴 Supply Zone: ₹2004.70 – ₹2007.90 (SL: ₹2009.30)

⚠️ Invalidation Levels (With Logic):

🔻 Bullish View Invalid Below: ₹1980 – breaks structure and confirms weakness

🔺 Bearish View Invalid Above: ₹2009.30 – a breakout above this level with volume + PE Short Build-Up will invalidate bearish trades

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Rejection from ₹2000 or breakout above ₹2009?

What’s your view on HDFCBANK? Comment below ⬇️

🔁 Share this if you're tracking the zone

✅ Follow STWP for clean Price Action + OI Trades

🚀 Let’s trade with clarity and confidence!

________________________________________

DIXON – Strong Bullish Sentiment with Heavy Long Build-Up in CE________________________________________

📈 DIXON – Strong Bullish Sentiment with Heavy Long Build-Up in Calls | OI + Price Action Analysis

🕒 Chart Type: 15-Minute

📆 Date: July 7, 2025

________________________________________

🔍 What’s Catching Our Eye:

DIXON closed around ₹15,433, and the Option Chain is reflecting dominant bullish momentum. Multiple strikes from 15500 to 18000 CE are seeing strong Long Build-Up, with aggressive participation even in far OTM calls. Simultaneously, Put writers are either unwinding or short building, which shows that traders expect price to rise further and downside is limited.

________________________________________

📌 What We’re Watching For:

If DIXON sustains above ₹15,500, expect continuation toward ₹16,000–₹16,250–₹16,500 and possibly ₹17,000+ if momentum persists. However, any slip below ₹15,250 may slow down the rally.

________________________________________

📊 Volume Footprint:

Options activity is backed by very high bullish volume —

• Over 20.7k contracts at ₹15,500 CE

• Over 18.1k contracts at ₹16,000 CE

• Over 14.5k contracts at ₹16,500 CE

→ Traders are clearly positioning for an upside breakout with strong intent.

________________________________________

📈 Option Chain Highlights:

Calls (Long Build-Up):

• ₹15,500 CE: +16,450 OI | Price ↑ 20.33%

• ₹16,500 CE: +6,650 OI | Price ↑ 21.91%

• ₹17,000 CE: +8,600 OI | Price ↑ 22.40%

• ₹18,000 CE: +11,350 OI | Price ↑ 17.51%

• ₹15,750 CE: +21,900 OI | Price ↑ 21.12%

• ₹16,250 CE: +8,950 OI | Price ↑ 22.07%

• ₹16,750 CE: +6,950 OI | Price ↑ 22.73%

Calls (Short Covering):

• ₹15,000 CE: -20,250 OI | Price ↑ 18%

• ₹15,250 CE: -16,950 OI | Price ↑ 18.58%

• ₹16,000 CE: -10,200 OI | Price ↑ 21.26%

Puts:

• ₹15,000 PE: +1,800 OI | Price ↓ 23.07% → Short Build-Up

• ₹15,500 PE: +15,750 OI | Price ↓ 19.74% → Short Build-Up

• ₹14,000 PE: +13,750 OI | Price ↓ 30.12% → Short Build-Up

• ₹14,500 PE: -2,300 OI | Price ↓ 26.24% → Long Unwinding

🧠 Inference:

Call buyers are aggressively taking positions across the board. Even deep OTM strikes like ₹17,000 & ₹18,000 CE are active. Put writers are backing off or adding shorts. This is a clear momentum breakout setup.

________________________________________

🔁 Trend Bias:

🟢 Bullish – Strong confirmation from both price & derivative action

________________________________________

🧠 Trade Logic / Reasoning:

Massive Long Build-Up from 15,500 to 18,000 CE confirms traders are betting on continued upside. Short covering at ATM strikes + short build-up at far PEs shows bears are backing off and bulls are in full control.

________________________________________

📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹15668

🔻 Bottom Range (Support): ₹14929

________________________________________

🎯 Trade Plan (Educational Purpose Only):

✅ Best Buy (Equity): Above ₹15,500 with volume confirmation

❌ Best Sell (Equity): Avoid – sentiment is too bullish

✅ Best CE to Long: ₹15,500 CE or ₹16,000 CE – both showing volume + fresh long build-up

❌ Best PE to Long: Avoid – no bearish signs from the Option Chain

🟢 Demand Zone: NA

🔴 Supply Zone: 15533 – 15590 | SL: 15613.85

⚠️ Invalidation Below:

If DIXON closes below ₹15,250 with heavy volume, the bullish momentum stands invalidated, and price may retrace toward ₹15,000–14,750 zones.

If DIXON closes above ₹15,500 with strong bullish candles and volume, any bearish anticipation becomes invalid. Price may then aim for ₹16,000–16,250 or higher.

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Did this help you ride DIXON’s bullish wave?

Let me know your views below ⬇️

🔁 Share this with traders watching DIXON

✅ Follow STWP for clean zone + OI + momentum trades

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________

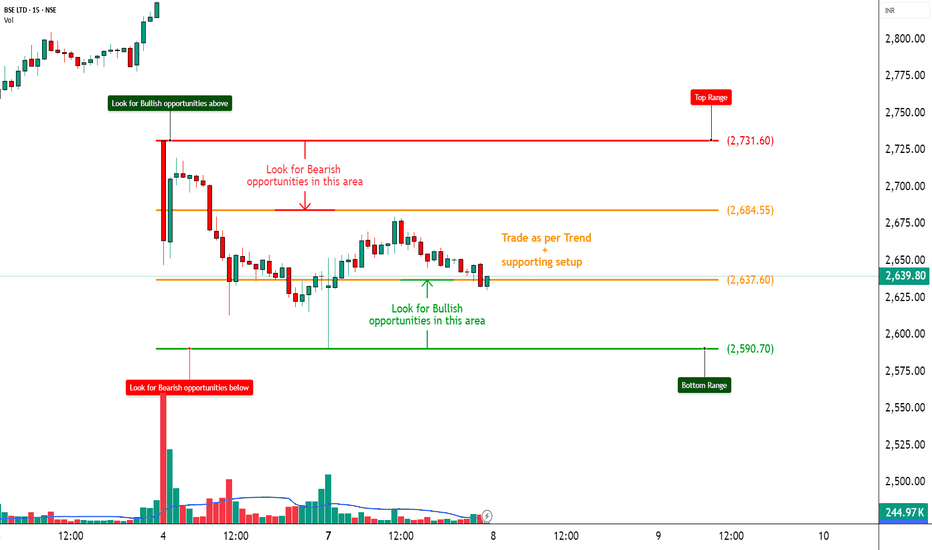

BSE – Heavy Call Writing Indicates Resistance Ahead________________________________________

📈 BSE – Heavy Call Writing Indicates Resistance Ahead | OI + Price Action Analysis

🕒 Chart Type: 15-Minute

📆 Date: July 7, 2025

________________________________________

🔍 What’s Catching Our Eye:

BSE is trading near ₹2636, and the Option Chain is showing aggressive Short Build-Up on Calls from 2650 to 3000, clearly highlighting a resistance zone above current price. Meanwhile, Put writers are unwinding, especially at ₹2600 PE, confirming weak bullish conviction. Traders are playing defensively with bearish bias dominating.

________________________________________

📌 What We’re Watching For:

If BSE breaks below ₹2600, we may see a quick slide toward ₹2550–2500. However, a sharp breakout above ₹2700 with strong volume may trigger a round of short-covering. Until then, upside looks capped due to excessive Call writing.

________________________________________

📊 Volume Footprint:

Options activity is backed by strong volume —

• Over 8.9k contracts at ₹2700 CE

• Over 8.1k contracts at ₹2800 CE

• Over 7k contracts at ₹3000 CE

→ Traders are betting on price staying below 2700–2800 levels, creating a strong supply wall.

________________________________________

📈 Option Chain Highlights:

• Calls (Short Build-Up):

o ₹2700 CE: +81,375 OI | Price ↓ 8.82%

o ₹2800 CE: +18,375 OI | Price ↓ 11.07%

o ₹3000 CE: +77,250 OI | Price ↓ 16.60%

o ₹2650 CE: +38,250 OI | Price ↓ 8.01%

• Puts:

o ₹2600 PE: -42,375 OI | Price ↓ 10.94% → Long Unwinding

o ₹2500 PE: +102,375 OI | Price ↓ 16.55% → Short Build-Up

📌 Inference:

Bulls are on the back foot. CE writers are dominating across all key strikes, and only the 2500 PE is showing fresh interest — which is far from spot, indicating potential room for further downside.

________________________________________

🔁 Trend Bias:

🔴 Bearish to Neutral – Unless 2700 breaks cleanly

________________________________________

🧠 Trade Logic / Reasoning:

Every CE strike from ATM to OTM is under short build-up — that's a clear ceiling forming. With no visible strength in Put writing near spot, the path of least resistance appears to be on the downside. Keep a close eye on ₹2600.

________________________________________

📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2731.60

🔻 Bottom Range (Support): ₹2590.70

________________________________________

🎯 Trade Plan (Educational Purpose Only):

✅ Best Buy (Equity): Only if BSE crosses ₹2700 with volume

✅ Best Sell (Equity): Below ₹2600 for target ₹2550–2500

✅ Best CE to Long: ❌ None – All major Calls under Short Build-Up

✅ Best PE to Long: ₹2500 PE – Showing fresh bearish positioning

🟢 Demand Zone: NA

🔴 Supply Zone: NA

⚠️ Invalidation Below:

Bullish view invalidated if price sustains below ₹2600

________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________

💬 Spotting the weakness early helps plan smarter.

What’s your view on BSE – comment below ⬇️

🔁 Share this if you're tracking BSE this week

✅ Follow STWP for clean price + OI based setups

🚀 Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________

Bitcoin Eyes Breakout — Bullish Setup Gathers StrengthConsolidation Above Key Support:

Bitcoin continues to hold firmly above the $100,000–$105,000 support zone, a critical area that acted as major resistance earlier in 2025. This sustained price action reinforces the prevailing bullish momentum and signals strength beneath the surface.

Wedge Formation Nearing Resolution:

The prolonged wedge pattern now taking shape suggests a substantial move is imminent. The structure supports a breakout scenario, with an initial target of $130,000–$135,000 in play.

Uptrend Intact, No Signs of Exhaustion:

Despite recent weeks of sideways action, Bitcoin continues to consolidate near its highs—a pattern that historically favors continuation, not reversal. The broader trend remains upward and firmly intact.

Focus & Opportunity:

Bitcoin's technical setup justifies close attention in the days ahead. At the same time, traders and investors should keep an eye on select altcoins, which could offer amplified upside as capital rotation picks up momentum.

#Bitcoin #BTC #Crypto #TechnicalAnalysis #BullishSetup #WedgeBreakout #PriceAction #Altcoins #CryptoMarket #MarketUpdate #AllTimeHigh

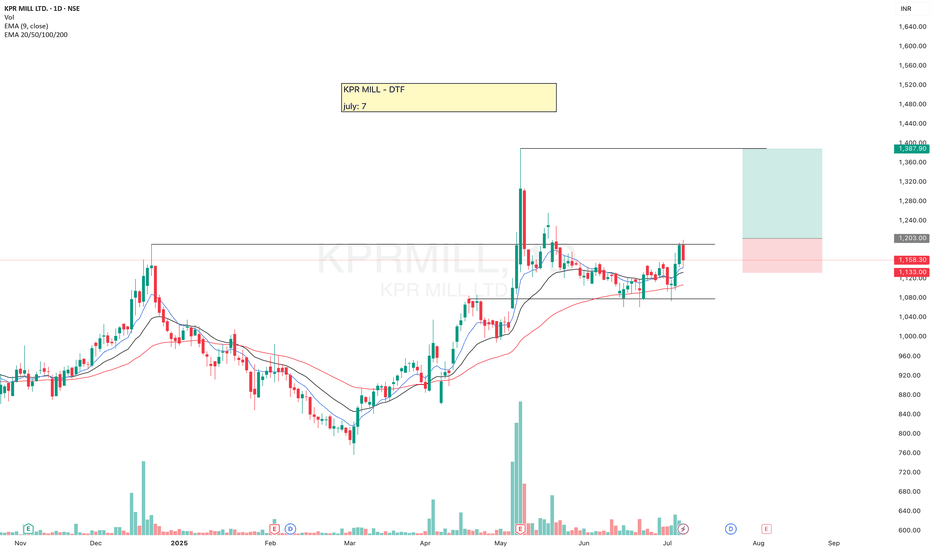

KPRMILL - KPRMILL looks good, trying to break the resistance, moving above 20-50ema.

A breakout from here may give a good upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Bollinger Bands: How to Stop Being a Slave to the Markets.Bollinger Bands: How to Stop Being a Slave to the Markets.

Bollinger Bands are a technical analysis indicator widely used in trading to assess the volatility of a financial asset and anticipate price movements. Created in the 1980s by John Bollinger, they consist of three lines superimposed on the price chart:

The middle band: a simple moving average, generally calculated over 20 periods.

The upper band: the moving average to which two standard deviations are added.

The lower band: the moving average to which two standard deviations are subtracted.

These bands form a dynamic channel around the price, which widens during periods of high volatility and narrows when the market is calm. When a price touches or exceeds a band, it can signal an overbought or oversold situation, or a potential trend reversal or continuation, depending on the market context.

What are Bollinger Bands used for? Measuring volatility: The wider the bands spread, the higher the volatility.

Identifying dynamic support and resistance zones.

Detecting market excesses: A price touching the upper or lower band may indicate a temporary excess.

Anticipating reversals or consolidations: A tightening of the bands often heralds an upcoming burst of volatility.

Why is the 2-hour time frame so widely used and relevant?

The 2-hour (H2) time frame is particularly popular with many traders for several reasons:

Perfect balance between noise and relevance: The H2 offers a compromise between very short time frames (often too noisy, generating many false signals) and long time frames (slower to react). This allows you to capture significant movements without being overwhelmed by minor fluctuations.

Suitable for swing trading and intraday trading: This timeframe allows you to hold a position for several hours or days, while maintaining good responsiveness to take advantage of intermediate trends.

Clearer reading of chart patterns: Technical patterns (triangles, double tops, Wolfe waves, etc.) are often clearer and more reliable on H2 than on shorter timeframes, which facilitates decision-making.

Less stress, better time management: On H2, there is no need to constantly monitor screens. Monitoring every two hours is sufficient, which is ideal for active traders who don't want to be slaves to the market.

Statistical relevance: Numerous backtests show that technical signals (such as those from Bollinger Bands) are more robust and less prone to false signals on this intermediate timeframe.

In summary, the 2-hour timeframe is often considered "amazing" because it combines the precision of intraday trading with the reliability of swing trading, providing superior signals for most technical strategies, especially those using Bollinger Bands.

To summarize

Bollinger Bands measure volatility and help identify overbought/oversold areas or potential reversals.

The 2-hour timeframe is highly valued because it filters out market noise while remaining sufficiently responsive, making it particularly useful for technical analysis and trading decision-making.

Gold Breaks Below 3300 – Smart Buy Opportunity ... Gold Breaks Below 3300 – Smart Buy Opportunity or Warning of a Larger Downtrend?

🧭 Weekly Kickoff: Is the Sell-off Really That Dangerous?

Gold opened this week with a sharp drop, falling to 3306 USD and even breaching the psychological 3300 level to dip into the 329x region. While this could be alarming at first glance, it's more likely a liquidity sweep than the beginning of a sustained downtrend.

The market seems to be preparing for accumulation before the next big move.

🌐 Macro Highlights Impacting Gold

US inflation continues to cool → creates room for the Fed to ease policy if needed

FOMC minutes due this week → traders eye clues for timing of potential rate cuts

Middle East tension eases → safe-haven demand slightly reduced

Trump’s new tax legislation approved → may increase US debt pressure

US–China trade war sees temporary pause → easing short-term geopolitical risk

Overall, this phase resembles a classic consolidation, where breakout potential is growing rapidly.

📉 Technical Outlook – CP Pattern in Focus

A Continuation Pattern (CP) is forming – typically a sign of trend continuation after correction. This suggests current downside movement could be a technical pullback rather than a true reversal.

Price rejected resistance at 3336, broke below 3323 support, and quickly tested the 3303 region – a highly sensitive short-term support.

If the 3293 level is breached, the next liquidity pool lies around 3278 USD, which could trigger aggressive buy interest.

📌 Key Trading Plan – 04 July

🔵 BUY ZONE

3294 – 3292

Stop Loss: 3288

Take Profit Targets: 3298 → 3302 → 3306 → 3310 → 3315 → 3320 → 3330

🔴 SELL SCALP

3324 – 3326

Stop Loss: 3330

Take Profit: 3320 → 3316 → 3312 → 3308 → 3304 → 3300

🔴 SELL ZONE

3350 – 3352

Stop Loss: 3356

Take Profit: 3346 → 3340 → 3335 → 3330 → 3320

💡 Market Insight Today

This is a crucial “decision zone” for gold – the tug-of-war between bulls and bears is heating up. Will gold bounce off the 3290s and resume its upward journey, or are we heading for a deeper correction?

🧠 Keep an eye on the CP formation and price behaviour near key levels.

⚠️ Breakout traders should be patient – the real move may just be loading.

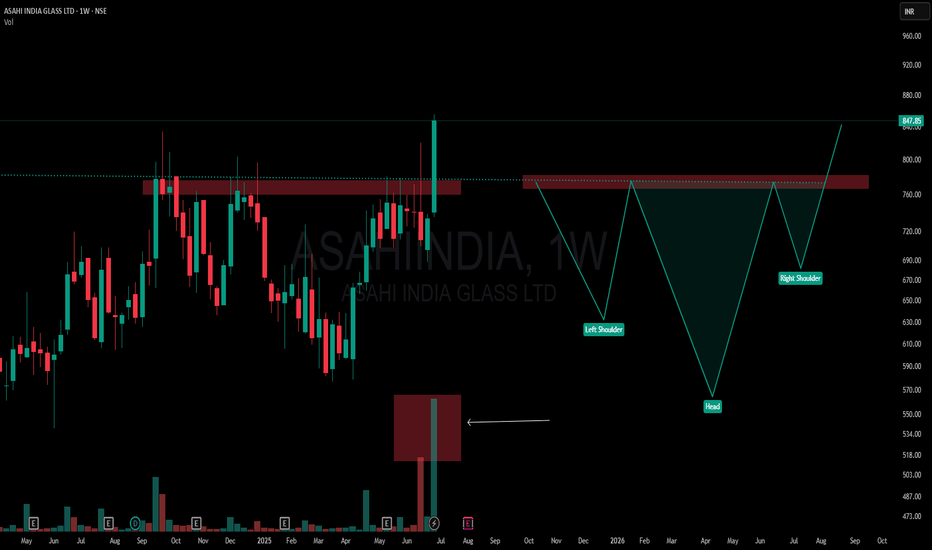

When Textbook Meets Extremes: Perfect Inverted Head and Shoulder📌 ASAHI INDIA GLASS | Weekly Timeframe

🧩 Pattern Breakdown (from a textbook lens):

-Left Shoulder: Formed after the Sept–Nov 2024 rejection

-Head: Created around Feb–May 2025 with a deeper dip

-Right Shoulder: Built through June 2025

-Neckline: ₹750–₹760 zone, tested multiple times

-Breakout Candle: High conviction — wide-bodied, strong close, with 17.61M volume

📘 According to classical technical analysis, Inverted Head & Shoulders patterns often signal a trend reversal. What's notable here is the context — the structure has developed after a sustained move upward, not from a bear phase.

🎯 The candle breaks above a long-standing supply zone with size, volume, and conviction — yet its location at the top makes it structurally interesting and unusual when viewed through traditional pattern psychology.

🚫 This is not a tip, call, or directional bias — just a visual log of structure and volume behavior.

💬 Chart interpretations welcome in comments.

How These 2 Lines Caught Every Major Move in All 4 Indices! 📈 Keep It Simple, Keep It Powerful

When price action starts making sense, you’ll realize how far a single Support and Resistance line can take you.

🟥🟩 NIFTY & BANKNIFTY – Two clear examples of parallel channel trends, marching higher with clean Higher Highs and Higher Lows.

🟩🟥 MIDCAP & SMALLCAP – Not just catching up, but breaking out of Multi-Timeframe contraction patterns with strength — a sign of broader market participation.

They're now retesting and reclaiming previous highs after a much-needed breather.

💡What this chart tells us:

-Trendlines aren't just lines—they’re psychological guides to institutional and retail behavior.

-All four indices are moving in structured, rhythmic patterns.

-Simplicity works best. The markets speak clearly when you know what to listen for.

MAZDOCK – TECHNICAL ANALYSIS - W PATTERN________________________________________________________________________________

📈 MAZDOCK – TECHNICAL ANALYSIS

📆 Date: July 4, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range: 3775

• Resistance: 3362 – 3396 – 3423

• 🟢 Bottom Range: 3077.7

• Support: 3241 – 3274 – 3301

________________________________________________________________________________

🔹 Chart Pattern: ✅ W-Bottom Formation

A clean W-shaped reversal pattern is forming. Price is respecting demand zones and gradually forming higher lows. Neckline lies around 3369 — breakout above this may fuel further upside.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns:

⛔ No major reversal candle on 4th July 2025.

________________________________________________________________________________

🔹 Volume Footprint:

✅ Gradual volume pickup

🚨 Watch for breakout above 3362–3396 with volume >3.5M

🔼 A successful breakout may trigger a swift move toward 3425–3520.

________________________________________________________________________________

🔹 Trend Bias: ✅ Bullish

Short-term momentum favors the bulls with sectoral tailwinds from PSU + Defense themes.

________________________________________________________________________________

📌 What’s Catching Our Eye:

• W-Bottom Pattern nearing breakout

• Price reclaimed key demand zone and consolidating just below resistance

• PSU + Defense theme rally adds sector momentum

________________________________________________________________________________

👀 What We’re Watching For:

• Breakout Confirmation: Daily close above 3396 with 3.5M+ volume

• Pullback Re-entry: Ideal zone 3300–3310 for fresh entries

• Volume Spike: Key trigger for breakout validation

________________________________________________________________________________

⚠️ Risks to Watch:

• Low volume breakout = Bull trap risk

• Sector rotation or sudden weakness in PSU/Defense

• Breakdown below 3240 = pattern failure & shift in bias

________________________________________________________________________________

🔮 What to Expect Next:

• ⚡ Retest of 3362–3396 range likely

• 🔄 Minor consolidation / handle formation possible

• 🔄 Watch for volatility near resistance (intraday fakeouts)

________________________________________________________________________________

📊 Trade Plan (Based on Logic + Volume Confirmation)

🔼 Breakout Long Setup:

• Entry: Above 3369

• Stop Loss: 3300

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• W-bottom breakout

• Sector strength + price structure alignment

• Volume >3.5M is the key trigger

________________________________________________________________________________

🔁 Pullback Long Setup:

• Entry Zone: 3305–3310

• Stop Loss: 3240 (Support 3)

• Risk–Reward: ~1:1 to 1:2

📌 Why:

• Tight SL near structure

• Good risk-reward for early entry

________________________________________________________________________________

🔽 Bearish Setup (Rejection from Resistance):

• Entry: Below 3300

• Stop Loss: Above 3365

• Risk–Reward: ~Flexible — as per individual trader's strategy and risk appetite

📌 Why:

• Rejection from neckline

• Low-volume breakout = trap

• Breakdown below support shifts structure to bearish

________________________________________________________________________________

❌ Invalidation Triggers:

• Daily Close below 3240

• Bearish Marubozu with volume = shift to supply pressure

________________________________________________________________________________

📌 Intraday Supply Zones Noted (15-Min Chart):

The 15-minute chart reveals the presence of multiple intraday supply zones, indicating short-term selling pressure.

🟥 Tested Supply Zone: 3337.30 – 3346.30 | SL: 3352.20

🟥 Strong Supply Zone: 3349.40 – 3358.60 | SL: 3364.50

These zones may act as resistance levels for intraday traders. Watch for price rejection or confirmation candles in these areas before planning any breakout trades.

________________________________________________________________________________

⚠️ Disclaimer:

This analysis is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for trading decisions based on this post.

________________________________________________________________________________

💬 Found this helpful?

Have you caught this W-pattern early?

Share your thoughts in the comments ⬇️

🔁 Spread the insight with fellow traders

✅ Follow STWP for smart technical setups backed by volume and price action

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

UNIVPHOTO - Cup & Handle Breakout | Daily Chart📊 UNIVPHOTO – Cup & Handle Breakout | Strong Volume | RSI Overbought | Fibonacci Confluence | Daily Chart

📅 Chart Date: July 3, 2025

📍 CMP: ₹291.55 (+20.00%)

📈 Symbol: NSE:UNIVPHOTO

🔍 Technical Analysis Summary

✅ Cup & Handle Breakout

Price has broken out above the neckline of the Cup & Handle pattern at ₹258.95 with strong bullish momentum.

Post-consolidation breakout visible with a solid bullish candle.

📊 Fibonacci Retracement Levels (Swing: ₹173.55 to ₹483.90)

23.60% – ₹246.79

38.20% – ₹292.10 ✅ (Price nearing this level – short-term resistance)

50.00% – ₹328.70

61.80% – ₹365.35

78.60% – ₹417.50

100% – ₹483.90 🎯

📈 RSI Indicator (14)

RSI has surged to 77.17, indicating strong momentum but entering overbought territory.

RSI breakout with multiple prior bullish divergences validated the upside move.

📉 Volume

Current breakout supported by above-average volume (256.71K) adds credibility to the move.

🏁 Key Technical Levels

Neckline Breakout: ₹258.95 ✅

Immediate Resistance: ₹292.10 (Fib 38.2%)

Next Targets: ₹328.70 → ₹365.35

Support Levels: ₹258.95 → ₹246.79

Major Swing Low: ₹173.55

💡 Trade Setup

Entry: On breakout confirmation above ₹259

SL: Below ₹246

Short-term Target: ₹292

Mid-term Target: ₹328 → ₹365

Risk Level: Medium (due to RSI overbought – may see retracement)

⚠️ Disclaimer

This chart is for educational and analytical purposes only. Please consult your financial advisor before making investment decisions.

PC Jeweller at a Make-or-Break Zone: Structure Never Lies🔸 A long-standing Multi-Timeframe Compression Trendline (white dotted) remains active, and price is currently retesting this zone.

🔸 The grey supply zone marks the all-time high resistance, while the green box shows a recent zone that flipped from supply to demand — supported by a strong base formation.

🔸 A hidden structural pattern is emerging —

• One line forming a (HL - Hidden Line ) acts as rising resistance

• The other trendline offers solid ascending support

🔸 Price is getting tighter within this converging structure, while respecting historic levels.

📌 No forecast here — just highlighting key levels and behavior for context-driven traders.

XAUUSD: Bullish Momentum Continues to BuildGold is currently trading within an ascending triangle pattern on the H1 chart, with support around the 3,322 zone and resistance near 3,359 USD. Recent price action shows strong bounces from the support line, along with a series of bullish Fair Value Gaps — indicating clear buying strength.

Fundamental factors supporting the upside:

– Weak U.S. job data lowers expectations for prolonged high interest rates from the Fed.

– The U.S. dollar is weakening due to inflation pressure and fiscal uncertainty.

– Rising geopolitical tensions and increased U.S. spending are boosting safe-haven demand for gold.

Strategy: Look for buy opportunities on a retest of the 3,322–3,326 zone. Target the 3,359 USD level, with potential for further upside if the triangle breaks to the top. Watch out for invalidation if price falls below support.

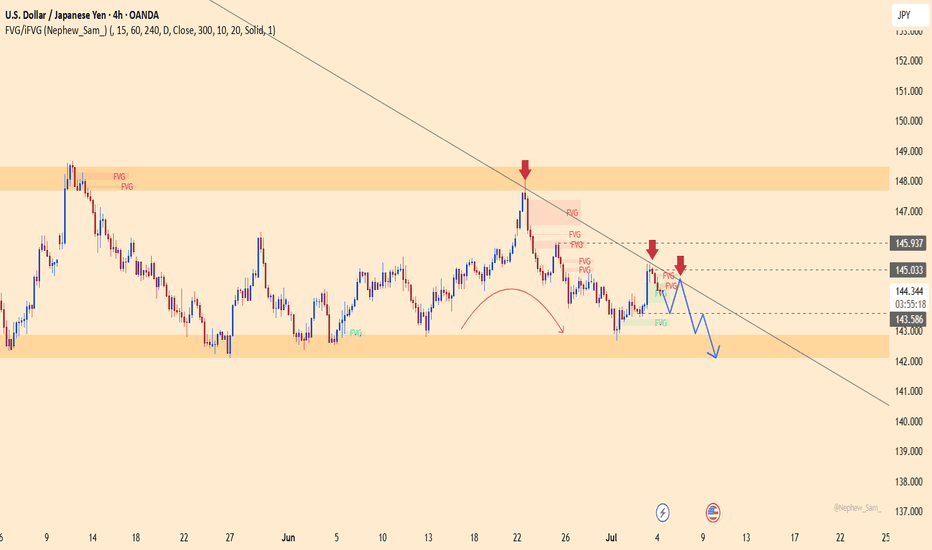

USDJPY: Weak Rebound, High Downside RiskUSDJPY remains under bearish pressure as price continues to be rejected at the descending trendline resistance. The 145.000–145.100 zone acts as a strong resistance area where price has repeatedly reversed.

The recent upward move appears to be a weak pullback, lacking the momentum to break the previous bearish structure. If price continues to be rejected at this zone, a likely correction towards the 142.100 support area is expected.

XAUUSD: Poised for a Breakout to Higher LevelsThe H1 chart shows gold moving sideways within a symmetrical triangle, with higher lows and narrowing range — a classic sign of consolidation before a potential breakout.

The lower boundary of the triangle is acting as dynamic support around the 3,334–3,336 zone. Buyers appear to be in control, pushing price up from previous Fair Value Gap zones. If price holds above 3,334 and breaks through the upper triangle resistance, the next short-term target is around 3,371.

Strategy: Favor a mild upside breakout scenario. Consider long entries if price breaks above 3,350 with volume confirmation, targeting 3,371 for take-profit.

EURUSD: Sideways Consolidation Before Directional BreakEURUSD is currently moving within a clear sideways range between 1.16400 and 1.18400, positioned just above the ascending channel line. Recent price action shows consolidation, with lower highs forming near 1.18400 while support holds firmly.

If price breaks below the range, a retest of the channel support around 1.16400 is likely. On the other hand, a bounce from current support may lead to another attempt toward the upper resistance. Traders should wait for a clear breakout signal before entering in the new trend direction.

APLLTDAPLLTD is getting ready, moving above 20-50ema, probability of an upside move.

Keep eyes on it.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

XAUUSD 03/07: GOLD IN THE DRIVER'S SEATXAUUSD 03/07: GOLD IN THE DRIVER'S SEAT – WILL IT BREAKOUT OR PULLBACK BEFORE KEY EVENTS?

Gold is on a solid upward trajectory, as expected from earlier predictions this week. After a negative ADP Non-Farm Payroll report yesterday, the USD weakened, providing the fuel for gold to soar. During the US session, gold surged from the 333x level to 336x.

🔑 Key Catalysts to Watch:

1. Political Factors:

Trump's announcement that the Republicans in the House have united to push through the "Super Bill" is a significant factor that could propel gold even further in the near future. The political climate is setting the stage for gold's potential rally.

2. Macro Overview:

Federal Reserve and Rate Cuts: The market is eyeing the Fed closely, with high expectations for two interest rate cuts this year. This could put continued pressure on the USD and further support gold. With a 90% chance of a rate cut by the end of Q3, the path is clear for gold to target new highs.

US Economic Data: Disappointing ADP data, reporting a loss of -33k jobs, continues to point to a weakening labor market, strengthening the case for gold as a safe-haven asset.

🌍 Market Conditions and Trade Setup:

The market remains on edge with these political and economic factors at play. The market will also be watching the Non-Farm Payrolls (NFP) data closely. With the ADP report showing poor results, the market could experience some turbulence ahead of the NFP release, and with a long weekend ahead due to the bank holiday, traders should approach this market with caution.

📉 Technical Outlook – The Road Ahead for Gold:

Gold has been trending upward and maintaining a bullish outlook. However, a minor pullback is expected.

Resistance: 3358 – 3365 – 3374 – 3380 – 3390

Support: 3343 – 3335 – 3325 – 3316 – 3304

📊 Trading Plan – Key Levels to Watch:

Buy Scalp:

Entry: 3335 – 3333

SL: 3329

TP: 3340 → 3345 → 3350 → 3360 → 3370

Buy Zone:

Entry: 3316 – 3314

SL: 3310

TP: 3320 → 3324 → 3328 → 3332 → 3336 → 3340 → 3350 → 3360

Sell Scalp:

Entry: 3374 – 3376

SL: 3380

TP: 3370 → 3366 → 3360 → 3355 → 3350

Sell Zone:

Entry: 3388 – 3390

SL: 3394

TP: 3384 → 3380 → 3376 → 3370 → 3366 → 3360

⚠️ Key Focus for Traders:

Upcoming Data: The NFP release will be crucial, as disappointing job numbers could drive gold even higher.

Market Volatility: With the long weekend ahead and market reactions to key news, be prepared for possible volatility.

Trade with Caution: Stick to your TP/SL strategy, manage risk, and only enter trades when clear setups appear.

📈 Conclusion:

Gold is showing strong potential for further gains, but traders should be prepared for some pullbacks as the market reacts to upcoming economic and political news. The trend remains bullish, but it’s crucial to remain cautious and follow the technical levels closely to optimize entry points. Stay alert for key developments in the USD, NFP, and Fed rate-cut expectations, and let the market guide you.

SANDUMA - (SANDUR MANG & IRON ORES)SANDUMA – After facing strong resistance at the current level for a while, the stock tapped into a demand zone in Feb 2025 and began moving up, forming a consistent Higher Highs - Higher Lows (HH-HL) structure.

It gave a breakout in May, followed by a successful retest of the breakout zone. Currently, it's trading above the 20-50 EMA, indicating strength.

The price action now suggests it's getting ready, there is probability of an upside move.

Keep following.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

DATAPATTNS

DATA PATTERNS has been making HH-HL formation. Recently broke an old resistance, moved up, re-tested and started moving up again.

Keep following it, there is probability of an upside move.

✅ If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

📌 For learning and educational purposes only, not a recommendation. Please consult your financial advisor before investing.

Precision Meets Patience | SAKSOFT Chart WTF🔻 A clean Control Trendline (CT) drawn from the all-time peak (🔺) on the Weekly Time Frame (WTF) shows a long-term price memory resistance finally getting tested.

📏 Overlapping that is a hidden horizontal resistance (⚪ dotted white line), representing the final hurdle before the stock can challenge the supply zone.

🟧 Mother Candle Structure: A powerful consolidation candle has now been broken with strength, giving us structure + intent in one move.

🔊 Volume speaks! We’ve seen two separate clusters of high volume, confirming active participation—not a lonely breakout.

📈 The trendline from bottom left is giving both body and wick supports—a technically clean angle where structure meets sentiment.

📝 Note:

This is a structural breakdown meant for educational and analytical purposes. Not a forecast or recommendation.