A Classic Case of Accumulation Turning into Momentum📈 SUPREME INDUSTRIES LTD – TECHNICAL ANALYSIS

📆 Date: May 27, 2025

🔍 Timeframe: Daily

Price Action:

Supreme Industries surged over 4% today and delivered a clean breakout after forming a consolidation triangle. The strong bullish candle closed near the day’s high with significant volume, confirming momentum on the upside.

Chart Pattern / Candlestick Pattern:

Symmetrical Triangle Breakout

Pullback Entry Zone Tested

Breakout Candle – wide range, strong body

Volume Surge – institutional interest visible

Technical Indicators:

RSI (Daily): 77 – strong bullish zone

MACD: Bullish crossover active

Stochastic: 98 – overbought but confirming strength

CCI: Above 200 – high momentum phase

Volume: 791.75K – supportive of breakout

Support & Resistance Levels:

Immediate Resistance: 4277.93

Next Resistance: 4355.47

Major Resistance: 4490.43

Immediate Support: 4065.43

Secondary Support: 3930.47

Major Support: 3852.93

Possible Fresh Demand Zone: 3837.60 – 3750.90

Chart Overview:

This visual clearly shows:

🔸 The symmetrical triangle pattern

🔸 Breakout + retest zone

🔸 Marked fresh demand zone for potential pullback opportunity

Educational Breakdown:

This setup combines:

Price Action: Triangle + Breakout

Volume Confirmation: Institutional participation

Momentum Indicators: Strong alignment

Demand Zone Mapping: Pre-breakout base

This is a classic trend continuation setup with clearly defined zones of interest. Risk control is key as price enters overbought territory.

Over the past few months, Supreme Industries displayed classic signs of an accumulation zone — a period marked by sideways movement, controlled volatility, and relatively stable volumes. This range-bound behavior typically indicates that long-term investors are quietly building positions while retail participation remains low. Recently, a strong bullish move supported by a significant rise in volume suggests the stock may have exited accumulation and entered the mark-up phase. This phase is often characterized by increased demand, higher price swings, and a clear shift in sentiment from neutral to bullish. The sharp breakout from the range, along with volume confirmation, signals the possible beginning of a new directional trend — where price tends to move swiftly as broader market participants join in.

How to Trade Supreme Industries (for learning purpose):

Entry Example: 4220.50

Stop Loss: 3781.50 (Risk: 439.00)

Target Example: 4659.50 (Reward: 439)

Sample Quantity: 50 shares

RR Ratio: ~1:1/1:2 etc.

Aggressive Traders: May consider riding the trend with trailing stop

Conservative Traders: Can wait for a pullback into the fresh demand zone (3837.60–3750.90)

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

Technical Analysis

Price Action, Demand Zones, and Low-Risk Entry Areas📊 Tata Chemicals – Technical Chart Study

🗓️ Date: May 22, 2025 | NSE: TATACHEM | Chart Type: Daily

**Price Action:**

Since mid-April 2025, the stock has exhibited an uptrend characterized by higher lows and higher highs, which is generally considered a positive sign of market strength. The current price stands at 900.40, supported by a strong green candle that closed near its daily high. This recent price movement suggests buying interest in the stock, indicating potential for further upward movement. However, investors are advised to conduct their own analysis and consider market conditions before making any decisions.

**Chart Pattern Analysis:**

TATACHEM is showing a Volatility Contraction Pattern (VCP), with several contraction phases visible since March. The price has been trading within a tightening range of approximately 860 to 900, forming a recognizable pattern handle. During this period, volume declined gradually, which is typical in a VCP setup and may indicate absorption by stronger hands. The last few sessions before the breakout showed tight-range candles with lower volumes and mildly positive delta, often seen as a sign of accumulation. The breakout on May 27 came with approximately double the average volume, suggesting increased participation. While this pattern can indicate a higher probability of continuation, traders should evaluate risk carefully and not rely solely on any single pattern.

**Footprint Analysis:**

Footprint data for TATACHEM leading up to the breakout shows signs of increased buyer activity. The session on May 27 recorded total volume near 1.75 million and a positive delta of +174,050, suggesting buyers were more aggressive than sellers. Previous sessions showed fluctuating delta values, indicating a gradual shift from selling pressure to buying control. This trend may reflect a period of accumulation, with sellers becoming less dominant. Despite these observations, it is important to note that past volume and delta patterns do not guarantee future price movements.

**Demand Zones:**

Potential demand zones have been identified at key price levels: between 886.70 and 871.05, 863.90 and 851.50, and 842.85 and 834.55. These areas could act as support where buying interest may emerge if the stock experiences a pullback. Monitoring these zones can help investors plan entries, but it is essential to consider overall market dynamics and perform due diligence before trading.

**Low-Risk Entry Zone:**

TATACHEM recently entered a zone between 895 and 900 that may offer a lower-risk entry opportunity, with a brief intraday breach observed. For additional confirmation, a sustained close above 900 to 905 accompanied by above-average volume could suggest continuation strength. A potential stop loss could be placed below the handle low near 860, implying a risk of roughly 4.5%. This setup may offer a favorable risk-reward balance, but traders should assess their risk tolerance and market conditions before making decisions.

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

GOLD TRADING INSIDE COMPRESSION ZONE WAITING FOR A CLEAR BREAK XAUUSD PLAN – MAY 27 | GOLD TRADING INSIDE A COMPRESSION ZONE – WAITING FOR A CLEAR BREAKOUT

Gold continues to consolidate below the 3,364 resistance zone after a rejection late last week. The market is currently trading within a compression range, preparing for a breakout – but direction still depends heavily on macro triggers and technical structure.

🌍 MACRO CONTEXT:

U.S. 10-year yields remain above 4.5%, keeping the dollar stable and applying short-term pressure on precious metals.

The Fed’s cost-cutting moves and operational losses are raising deeper concerns about long-term monetary stability.

Risk sentiment is mixed, and institutional money continues to flow cautiously into gold as a long-term value hedge, especially with equities showing signs of exhaustion.

📈 TECHNICAL OUTLOOK (H1):

Price failed to break through the 3,345–3,364 resistance zone, triggering a pullback toward the mid-range.

Key support around 3,311 is now being tested – a decisive level that could determine whether bulls can regain momentum or bears take control.

If price breaks below 3,311, we could see a deeper dip toward the 3,298–3,288 demand zone, which may offer a better re-entry for buyers.

On the upside, a confirmed break above 3,364 could open the door for a move into the Fair Value Gap toward 3,407.

🔹 TRADE SETUPS:

🔵 BUY SCALP

Entry: 3,314 – 3,312

Stop Loss: 3,308

Take Profit Targets:

3,318 – 3,322 – 3,326 – 3,330 – 3,340 – 3,350

🔵 BUY ZONE

Entry: 3,298 – 3,296

Stop Loss: 3,292

Take Profit Targets:

3,302 – 3,306 – 3,310 – 3,314 – 3,320 – 3,330

🔻 SELL SCALP

Entry: 3,346 – 3,348

Stop Loss: 3,350

Take Profit Targets:

3,342 – 3,338 – 3,334 – 3,330 – 3,320 – 3,310

🔻 SELL ZONE

Entry: 3,364 – 3,366

Stop Loss: 3,370

Take Profit Targets:

3,360 – 3,356 – 3,352 – 3,348 – 3,344 – 3,340 – 3,330

📌 Note:

Price is trading in the mid-range of a larger structure. Best opportunities remain near the edges of support/resistance with confirmation. Avoid overtrading in the middle zone. Let the market come to your areas of value.

💬 If you found this plan helpful, Like + Comment + Follow for daily GOLD strategies from the MMF Team.

Arkade Developers IPO breakoutAfter ipo promoter promised in concall about 10000cr revenue till 2029 in next 5 years. so aprox considering 27% pat margin they will deliver 2700cr profit. which is current networth of company. very stong fundamental plus technical bet

in this market fall promoter bought very huge quantity of shares, which also shows that they bealive in their commitment and actions forward. track

SWING/POSITIONAL PICKTechnical View

Stock Has Effectively Broken Previous Support. Support Acts As Resistance And Gives Breakout With Retest. Buy At CMP 480. TGT 520/598/700+++. SL Below 450 Closing Basis.

Fundamental

EBITDA Highest In History. PAT Is Also Highest In History. Positive Cashflow. FII And DII Increase Stake By Last Qtr.

I Am Not SEBI Registered Research Analyst. It Is Giving Only Educational Purpose. Trade In BBOX After Discussing With Your Financial Advisor.

SBI Life Ltd moving on to next new level of 1875.SBI life moving on to next level of 1875 as for now it is facing resistance at 1811-1818 level but once it crosses and closes above the given level it will likely continue its upside movement.

MACD indicator is on the positive momentum and along with it ADX indicator also signals strength in upside momentum as it is as 29.09.

Lastly 50 DAY SMA has crossed above 200 Day SMA which shows that upside long term targets may be higher once the momentum starts.

Kindly note This is for Educational Purpose only and Not any recommondation . I am not a Registed Aalayst.

Triangle Breakout is expected in REDINGTON.Elliott wave analysis:-

Running Flat took place with B wave as triangle. now an upside move is expected.

i am not a SEBI registered advisor. Before taking a trade do your own analysis or consult a financial advisor. I share chart for education purpose only. I share my trade setup.

Long Correction is expected to take place in INDRAPRASATH GAS!Elliott Wave Analysis:-

In Correction wave a) wave took place and for retracement b) wave and still a little more correction was pending it seems to be. and the fall is expected from there.

i am not a SEBI registered advisor.

Before taking a trade do your own analysis or consult a financial advisor.

I share chart for education purpose only. I share my trade setup.

IRCTC , Looking good ; min 25% Roi ; swing For short term investment ;

Leave a " Like If you agree ".👍

.

Wait for small retracement & daily candle to close above - "785".

Trade carefully untill ENTRY level.

.

Entry: 785

Target: 850-917-991

sl: 745

major stoploss/ support: 700.

.

Enter only if market Breaks

"Yellow box" mentioned.

.

.

Don't make complicated trade set-up.📈📉

Keep it " simple, focus on consistency "💹

Refer our old ideas for accuracy rate🧑💻

Follow for daily updates👍

.

Refer old posted idea attached below.

Will Gold Break Through 3366 or Pull Back Before NFP Week?XAUUSD PLAN – 26/05 | Will Gold Break Through 3366 or Pull Back Before NFP Week?

Gold is currently trading near a major resistance zone after a sharp rebound last week. With Fed policies still hawkish and trade tensions between the US and EU on hold, the market is entering a wait-and-see phase — ideal for structured trades.

🌍 MACRO CONTEXT:

Trump Delays 50% Tariffs on EU Until July 9: This cooled market tension temporarily but doesn’t eliminate the risk long term.

US 10-Year Yields Surge Back Above 4.55% right after, showing bond markets are still pricing in tighter conditions.

The Fed Faces Strategic Losses: As rate hikes increase reserve interest payments, the Fed is trimming 10% of its workforce — a rare signal of operational pressure.

➡️ Investors should brace for volatility ahead of NFP and watch closely for central bank reactions.

🔍 TECHNICAL OUTLOOK – H1/H4 View:

Gold is respecting a rising channel while consolidating near the 3360–3366 region — a key sell zone with potential for reversal.

The chart also shows clear Fair Value Gaps (FVGs) above and below current price, signaling pending liquidity sweeps.

🔑 KEY TECHNICAL LEVELS

🔺 Resistance Zones:

3364 – 3366 → Local top and key reversal zone

3406 – 3408 → FVG upper bound, potential blow-off target if breakout occurs

🔻 Support Zones:

3324 – 3326 → 20 EMA retest, potential bullish bounce

3310 – 3308 → Trendline + EMA89 confluence

3304 → Break below this area could invalidate short-term bull bias

🎯 TRADE SETUPS

🟢 BUY SCALP:

Entry: 3326 – 3324

Stop-Loss: 3320

Take-Profit: 3330 → 3334 → 3338 → 3342 → 3346 → 3350

🟢 BUY ZONE:

Entry: 3310 – 3308

Stop-Loss: 3304

Take-Profit: 3314 → 3318 → 3322 → 3326 → 3330 → 3340

🔴 SELL SCALP:

Entry: 3364 – 3366

Stop-Loss: 3370

Take-Profit: 3360 → 3356 → 3352 → 3348 → 3344 → 3340

🔴 SELL ZONE:

Entry: 3406 – 3408

Stop-Loss: 3412

Take-Profit: 3400 → 3396 → 3392 → 3388 → 3385 → 3380

⚠️ STRATEGY RECOMMENDATION:

If price breaks above 3366 with momentum, expect a run to 3408 and possibly 3450.

If price rejects 3366 or fails to hold above 3320, scalpers can look for quick shorts with tight stops.

📌 Avoid chasing price in the middle of the range. Wait for strong rejection or breakout confirmation to enter.

Banknifty 2025-2026 (Expected level)Banknifty. (Only for Experienced traders" )

Enter after " Breakout and Retracement ".

Leave a " Like If you agree ".✌.

Follow for regular updates 👍

.

For " long "

entry: 56000 / 56500

target: 60000- 62350

stoploss: 54800

Enter only if market Breaks

"Yellow box" mentioned.

.

.

For " Short"

entry: 54000

target:51000- 49500

stoploss: 54600

Enter only if market Breaks

"Yellow box" mentioned.

.

Wait for proper reversal and conformation.

.

Don't make complicated trade set-up.📈📉

Keep it " Simple, Focus on Consistency "💹.

Refer our old ideas for accuracy rate🧑💻.

Valuable comments are welcomed-✌️

.

.

Disclaimer:

Our Trading style is not to capture "10-20" points per trade.📊

We take entry only for min "200-300" points without any distractions.💹

So, our ideas may not be preferable for small traders, who just focusing on too much of support and resistance.📈📉📈

So, please consider others ideas.

This is for educational purposes.🧑💻

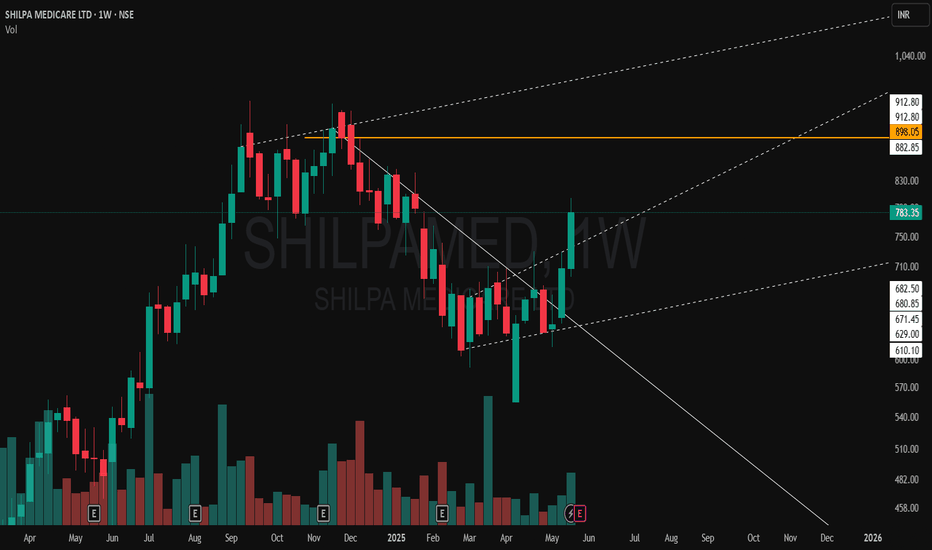

Hidden Channel SHATTERED – Explosive Breakout on SHILPA MEDICARE✅ Breakout from a well-defined Weekly Counter Trendline (white thick line) with strong bullish candle.

⚡ Hidden Broadening Channel Formation (dotted white lines) was also broken in the same move—double breakout confirmation!

💥 Volume spike — first major surge in weeks, indicating institutional participation.

📌 Consolidation just below major resistance (MTF orange line) played out perfectly. Price broke above previous swing highs.

🧱 Next Resistance: ₹898.05 (Monthly TF resistance). With current momentum, a clean test is highly probable.

HDFCLIFE positional trading ideasThe trend is bullish.

Breakout already done. Breakout candle is a large candle with high volume.

Price is above 20SMA.

Disclaimer: All information provided here is for educational purposes and not a recommendation, advice, research report, or stock tip of any nature. Analysis Posted here is just our view/personal study method on the stocks, commodities or other instruments and assets. Do your own analysis or consult your financial advisor before making any investment decision.

Will Gold Surge with a Gap Up as US-China Trade War Heats Up?XAU/USD Analysis: Will Gold Surge with a Gap Up? (26/5 - 30/5)

Fundamental Outlook

US-China Trade War: China's halt on US goods imports weakens the USD, boosting gold (inverse USD correlation).

Trump’s 50% EU Tariff Threat: Potential EU retaliation could spike global uncertainty, driving investors to gold as a safe haven.

Gold Demand: Rising trade tensions and inflation fears are pushing capital into gold, especially in India and China with upcoming festivals.

Macro Drivers

Monetary Policy:

US Fed: Trade war fallout may pressure rate cuts, reducing USD appeal and supporting gold.

China’s PBOC: Possible Yuan devaluation could lift gold prices in USD terms.

Market Sentiment:

Expect VIX spikes from trade uncertainties, favoring gold.

Strong physical gold demand in Asia supports prices.

Key Events:

US PCE inflation and consumer confidence data (watch for high inflation boosting gold).

Monitor EU/China trade retaliation statements.

Technical Analysis (H4 Chart)

Trend: Gold is in a strong ascending channel with support (3,325) and resistance (3,407 - 3,444).

Current Price: 3,407.554, testing key resistance (3,407 - 3,444).

Support Levels: 3,361.648 (mid-channel), 3,325.347 (channel support).

Resistance: 3,444.436 (all-time high).

Price Action: Recent Doji candle at resistance suggests possible pullback before continuation.

Fair Value Gaps (FVG):

3,325 - 3,340

3,361 - 3,407

Scenarios:

Bullish: Break above 3,444 with momentum could trigger a gap up, targeting 3,500

Bearish: Failure at 3,444 may lead to a pullback to 3,361 or 3,325.

Gap Up Probability: 60% chance at market open (26/5), driven by bullish sentiment.

Trading Plan

Buy Strategy

Entry: 3,361 - 3,370 (pullback to FVG or mid-channel).

Take Profit: 3,444 (resistance), 3,500 (breakout target).

Stop Loss: Below 3,325 (channel support).

Sell Strategy

Entry: Sell on rejection at 3,444 with bearish confirmation (e.g., strong bearish candle or head-and-shoulders).

Take Profit: 3,361 (FVG zone).

Stop Loss: Above 3,444.

Best Trading Times

Monitor market open (26/5) for gap-up confirmation.

Trade during London/New York sessions for optimal liquidity.

Key Takeaways

Gold is poised for potential upside due to trade war escalation and USD weakness. Watch for a breakout above 3,444 for a possible gap up or a pullback to 3,361 for buying opportunities. Stay updated on US inflation data and trade policy news.

XAUUSD in a Daily Channel — Bears Eyeing a Break at Trendline Re📊 Cycle Structure:

HWC (Higher Wave Cycle): Bearish with a mild slope 🔽

MWC (Middle Wave Cycle): Bullish 🔼

LWC (Lower Wave Cycle): Bullish 🔼

While both the mid and short-term cycles are pushing upward, the dominant bearish trend in the higher timeframe still weighs heavier, tilting the bias toward short setups.

📐 Market Structure:

Price is moving within a descending daily channel.

There's a 1H ascending trendline that has been tested four times already — currently heading into a fifth test.

The previous (fourth) reaction was weak, which statistically increases the chance of a breakout on the fifth touch.

The 3290 zone remains a strong resistance and a good target for short-term profit-taking on short positions.

📈 Alternate Long Scenario:

If buying pressure intensifies and price breaks above the 3345 key resistance, it could trigger a shift toward a bullish bias and challenge the integrity of the descending channel. This would invite breakout traders to join the move. However, this remains a secondary scenario, not the primary focus right now.

📌 Main focus remains on identifying short opportunities near resistance with proper risk management in place.

📌 If you'd like a specific pair or coin analyzed, drop it in the comments — I’ll choose from there.

⚠️ Without proper risk management, you're just a ticking time bomb.

— PXA

GOLD PLAN 23/05–YIELD CURVE FLIPS Will Gold Breakout or Sell Off🔥 GOLD PLAN 23/05 – YIELD CURVE FLIPS | Will Gold Breakout or Sell Off at 3360?

Global markets are heating up again as risk sentiment shifts. A major alert comes from the U.S. bond market:

For the first time since October 2021, the yield curve between the 5-year and 30-year treasuries inverted to +1.00%, signaling strong expectations for inflation and future growth concerns.

🌍 MACRO CATALYSTS DRIVING GOLD:

Iran warns the U.S.: “Leash your mad dog!” – escalating rhetoric as Israel is rumored to be preparing a strike on Iran's nuclear sites. Tehran vows to retaliate and holds the U.S. accountable.

Goldman Sachs says: “Only one way – BUY GOLD!”

Following the failed 20-year bond auction, rising deficits, and fiscal stress, GS urges investors to move into gold and crypto.

The return of risk-off sentiment makes Gold the #1 safe haven asset, attracting global institutional flow.

📈 TECHNICAL OUTLOOK (H1 Chart):

Critical resistance at 3358–3360 is a key decision zone.

A breakout here may trigger a strong move toward previous highs (ATH zone: 3390–3400).

Major support lies around 3276–3274.

A breakdown here may expose gold to deeper pullbacks below the 3200 handle, revisiting the FVG zone.

📌 TRADE PLAN FOR TODAY:

🔵 BUY ZONE:

Entry: 3276 – 3274

SL: 3270

TP: 3280 – 3284 – 3288 – 3292 – 3296 – 3300

🔵 BUY SCALP:

Entry: 3304 – 3302

SL: 3298

TP: 3308 – 3312 – 3316 – 3320 – 3325 – 3330 – 3340

🔻 SELL ZONE:

Entry: 3376 – 3378

SL: 3382

TP: 3372 – 3368 – 3364 – 3360 – 3350

🔻 SELL SCALP:

Entry: 3344 – 3346

SL: 3350

TP: 3340 – 3336 – 3332 – 3328 – 3324 – 3320

⚠️ Caution:

With geopolitical risk and bond market stress rising, volatility is expected to spike. Be patient and trade only on confirmation from key zones.

🎯 Stick to the plan. Don't chase the price. Protect your capital.

Supply & Retested Demand Zone in Play!🟣 Bank Nifty Index – Supply & Retested Demand Zone in Play! | 15-Min Chart Breakdown

📅 Date: May 21, 2025 | 🕒 Timeframe: 15-Minute

Hello Traders 👋

Today's Bank Nifty chart presents a textbook scenario of supply rejection and demand zone defense. These key zones could drive the next directional move, especially as price hovers in a narrow intraday range after sharp volatility earlier in the session.

🔲 Possible Supply Zone: 55,599 – 55,676.50

This zone formed after a strong rally got rejected with aggressive selling. The wick rejections and follow-up red candles confirm the presence of institutional sellers. If price revisits this level, look for shorting opportunities only with confirmation like bearish engulfing or volume spike.

🔲 Re-Tested Demand Zone: 54,599.55 – 54,442.30

A powerful base that sparked a strong reversal rally. The demand zone was successfully retested on May 21 with clear buying interest. Buyers defended this zone again, forming a bullish rejection wick on rising volume – indicating accumulation.

📊 Volume Context:

✅ Spike in volume seen during the bounce from the demand zone – bullish strength confirmed.

✅ Low volume chop as price consolidates near 55,000 – suggests a bigger move is brewing.

📌 Watch for a volume breakout above 3.5M to validate any directional move.

🧠 What Should Traders Watch For?

Short Trade Setup near 55,600–55,675: Look for rejection candles + selling volume.

Long Trade Setup near 54,600–54,450: Wait for bullish confirmation + rising volume.

Avoid entering mid-range without confirmation – it’s a trap zone.

Respect the supply and demand boundaries – this is a range-to-breakout transition phase.

📌 Note: Supply and demand zones are not magic levels—they are high-probability areas where past buyer/seller action can repeat. Combine with price action and volume for precision entries.

💬 Drop your thoughts, questions, or your zone levels below. Follow for more real-time chart education and actionable breakdowns!

Breakout Building Up from Falling Wedge PatternIndex: Nifty 50

Timeframe: 15-minute

Date: 21st May 2025

Price Action Insight

After a strong sell-off, NIFTY 50 formed a solid V-shaped recovery, followed by a series of higher lows, indicating a shift in momentum from sellers to buyers. Price is now consolidating near a key resistance level at 24,839.35, suggesting a potential breakout or rejection setup.

Chart Patterns in Focus

Falling Wedge (Bullish Reversal)

Breakout occurred after price compressed into the wedge.

A textbook reversal pattern signaling buying interest returning.

Bullish Flag / Pennant Formation

Post-wedge breakout, price is consolidating in a narrow range (flag).

Typically seen as a continuation pattern before another bullish leg.

Trendline Support

Price is holding above an ascending trendline, forming higher lows, reinforcing bullish bias.

Volume Analysis

Volume spiked during the wedge breakout – confirming buyer participation.

Current consolidation shows declining volume, indicating a possible volume expansion ahead.

Watch for a volume surge during breakout or breakdown for trade confirmation.

Educational Insight: How to Read This Setup

Why this matters for traders:

A falling wedge + bullish flag is a high-conviction combo.

Volume contraction during consolidation is healthy and often precedes explosive moves.

Price rejecting or sustaining above resistance gives traders directional edge.

Always wait for confirmation with price action + volume to avoid fakeouts.

Trade Scenarios

✅ Bullish Scenario (Long Trade)

Entry: Above 24,839.35

Target Zones: 24,900 / 24,950

Stop-Loss: Below 24,740.80 (below consolidation and trendline support)

Confirmation: Breakout candle with above-average volume

❌ Bearish Scenario (Short Trade)

Entry: Below 24,740.80

Target Zones: 24,650 / 24,580

Stop-Loss: Above 24,839.35

Confirmation: Breakdown from trendline support + rise in selling volume

Is Gold Set to Explode or Fake Out at 3400?GOLD PLAN 22/05 – TERROR ATTACK SHOCKS MARKETS | Is Gold Set to Explode or Fake Out at 3397?

Markets have just been hit by fresh geopolitical tension:

An Israeli diplomat was shot dead in Washington D.C. during a high-profile Jewish community event near the Holocaust Museum. The shooter allegedly shouted political slogans, and the FBI is now treating the case as a potential anti-Semitic terrorist act.

Former President Donald Trump called the event “disgusting” and urged the U.S. to stand strong against extremism.

🟡 This incident triggered a wave of risk aversion, pushing safe-haven assets like GOLD into the spotlight once again.

🌐 FUNDAMENTAL CONTEXT:

The USD remains under pressure due to weak U.S. economic data (housing, manufacturing, retail).

Despite the Fed’s “higher for longer” tone, markets are pricing in potential rate cuts by Q3.

Rising geopolitical tensions in the Middle East & U.S. soil may fuel further gold demand in the short term.

📈 TECHNICAL OUTLOOK (H1 Chart):

Price is nearing FVG resistance at 3395–3397, which could serve as a liquidity trap for breakout traders.

Key mid-zone resistance: 3344–3356, where price might stall or reverse if upward momentum weakens.

Strong support levels: 3303 – 3288 – 3277, aligned with previous structure and demand zones.

📌 TRADE PLAN:

Buy zone: 3296 - 3294

SL: 3290

TP: 3300 - 3304 - 3308 - 3315 - 3320 - 3330 - ???

Buy Scalp: 3316 - 3314

SL: 3310

TP: 3320 - 3324 - 3328 - 3332 - 3340 - 3350

Look for bullish reaction from the support zone and enter with proper risk management.

🔻 Sell zone: 3395 – 3397

SL: 3401

TP: 3390 - 3386 - 3380 - 3376 - 3370

🔻 Sell Scalp: 3358 - 3360

SL: 3364

TP: 3354 - 3350 - 3346 - 3342 - 3338 - 3330

If price spikes into FVG and shows exhaustion or bearish reversal, short setup is valid.

⚠️ Warning: Due to geopolitical headlines and gold trading near psychological resistance, expect high volatility and potential for traps.

🎯 Stick to your zones. Manage TP/SL properly. Do not chase price!

FED HAWKISHNESS VS TECHNICAL FAIR VALUE GAPS – BIG MOVE COMING?GOLD PLAN 21/05 – FOMC HAWKISHNESS VS TECHNICAL FAIR VALUE GAPS – BIG MOVE COMING?

The recent surge in gold has paused just as traders digest the latest Federal Reserve signals. Despite rising geopolitical risks and weakening U.S. economic data, Fed officials continue to project a “higher-for-longer” rate stance, keeping the dollar afloat and adding pressure on gold’s rally.

📉 However, the technical structure tells another side of the story.

⚙️ TECHNICAL OUTLOOK: Bearish Trap or Hidden Bullish Opportunity?

On the 1H timeframe, XAU/USD is showing signs of consolidation after tapping into a major Fair Value Gap (FVG) around the 3328–3356 area. We now observe two key FVG zones above and below current price, highlighting high volatility and potential liquidity grabs.

🔍 A short-term bullish scenario is forming if gold retraces towards 3250–3252 support, where trendline confluence and dynamic support suggest strong demand.

Conversely, any strong rejection from 3354–3356 SELL ZONE could activate a bearish play back towards the lower structure levels.

💹 TRADE SETUPS FOR TODAY:

🔵 BUY ZONE:

Entry: 3252–3250

Stop Loss: 3246

Take Profit Targets:

3256 – 3260 – 3264 – 3268 – 3272 – 3280 – 3300 – ???

🔵 BUY SCALP:

Entry: 3277–3275

Stop Loss: 3272

Take Profit Targets:

3280 – 3284 – 3288 – 3292 – 3296 – 3300

🔻 SELL ZONE:

Entry: 3354–3356

Stop Loss: 3360

Take Profit Targets:

3350 – 3346 – 3342 – 3338 – 3334 – 3330 – 3320

🔻 SELL SCALP:

Entry: 3328–3330

Stop Loss: 3334

Take Profit Targets:

3324 – 3320 – 3316 – 3310 – 3305 – 3300

🌍 MACRO INSIGHT:

Fed’s hawkish tone is weighing on precious metals, but gold remains attractive under geopolitical uncertainty and de-dollarization trends.

China and other central banks continue their accumulation, suggesting long-term bullish pressure is intact.

Watch for U.S. data this week – especially PMI and jobless claims – which could provide short-term catalysts.

📌 Stay cautious and disciplined. Stick to your zones and manage risk tightly – volatility is increasing.

👉 If you found this useful, don’t forget to like, comment and follow for daily gold insights!