#NIFTY Intraday Support and Resistance Levels - 12/02/2026Nifty is expected to open flat today, with price trading near 25945–25950 and no major gap compared to yesterday’s close. The structure clearly shows consolidation just below the psychological 26000 level. The market is currently moving in a tight range, indicating indecision and reduced volatility in the opening phase.

The immediate resistance is placed around 26000–26050, with a major resistance zone near 26250. A strong breakout and sustained move above 26000 can trigger fresh bullish momentum. If Nifty gives a clean 15-minute candle close above 26000, long positions can be considered for targets around 26150, 26200, and 26250+. However, traders should wait for proper confirmation because false breakouts are common in flat openings.

On the downside, 25900 is acting as an important intraday support. If price breaks and sustains below 25900, selling pressure may increase. In that case, short positions can be considered for targets around 25850, 25800, and 25750. A breakdown below 25750 would further weaken the intraday structure and may extend the fall toward the 25650 zone.

Overall, with a flat opening and clear consolidation zone between 25900 and 26000, the market is likely to remain range-bound initially. Traders should focus on breakout levels instead of entering trades in the middle of the range. Proper stop loss and trailing strategy will be important until the index gives a decisive directional move.

Technicalindicators

Jindal Steel & Power Limited - Breakout Setup, Move is ON...#JINDALSTEL trading above Resistance of 1157

Next Resistance is at 1567

Support is at 892

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases rarely resolve in a straight line and typically evolve into consolidation, base-building, or deeper corrective structures.

At current levels, Silver is hovering near an immediate demand zone around the 80–85 region, which now acts as a crucial decision area. This zone represents the first major area where buyers are expected to defend aggressively. The way price behaves here will define the next medium-term trend.

Scenario A – Range / Base Formation (High Probability):

The most probable outcome at this stage is sideways consolidation. After a vertical fall, markets often need time to absorb supply and rebuild demand. If Silver manages to hold above the immediate demand zone and starts forming higher lows on lower timeframes, it would indicate base formation rather than trend failure. This scenario favors range traders and patient positional participants, as price may oscillate between support and overhead resistance for several weeks or months.

Scenario B – Breakdown Continuation (Moderate Probability):

If the current support zone fails decisively with strong weekly closes below it, Silver could enter a deeper corrective phase. In such a case, price may gravitate toward the next major demand zone near 73–75, which aligns with prior consolidation and breakout structure. This move would likely be driven by broader risk-off sentiment or macro pressure rather than technical weakness alone. Traders should avoid aggressive longs if this breakdown structure develops.

Scenario C – Bullish Reclaim and Bounce (Low Probability, Needs Confirmation):

A less likely but still possible outcome is a bullish reclaim, where Silver holds current levels, absorbs selling pressure, and reclaims the 90+ zone with strong weekly confirmation. For this scenario to gain credibility, price must show acceptance above resistance with volume and structure. Until then, any bounce should be treated as reactive and corrective, not a confirmed trend reversal.

From a structural perspective, the major resistance remains far above near the 115–120 zone, which was the distribution area before the sharp reversal. This level will act as a long-term supply cap unless Silver builds a strong base over time.

In summary, Silver is no longer in a trending phase but in a transition zone. Patience is critical here. Traders should focus less on prediction and more on reaction to price behavior at key demand levels. Let structure, confirmation, and risk management guide decisions, as this phase can easily trap both early bulls and aggressive bears if approached without discipline.

Advanced Technical Analysis: A Comprehensive Guide1. Principles of Advanced Technical Analysis

At its core, technical analysis is based on three main principles:

Price Discounts Everything: All information — news, fundamentals, market sentiment — is reflected in the price. Advanced TA accepts this as a foundation, emphasizing price action over external factors.

Price Moves in Trends: Markets trend in three ways — uptrend, downtrend, and sideways. Advanced analysis focuses on identifying the start and end of these trends with precision using sophisticated tools.

History Repeats Itself: Patterns, behaviors, and psychology tend to repeat due to human nature. Advanced TA uses pattern recognition and statistical methods to capitalize on these repetitive behaviors.

Advanced TA combines these principles with quantitative methods and behavioral insights to increase accuracy.

2. Advanced Chart Patterns

While basic patterns include head and shoulders, double tops, and triangles, advanced patterns are more nuanced:

Harmonic Patterns: These patterns, like the Gartley, Butterfly, Bat, and Crab, use Fibonacci ratios to identify precise reversal zones. Unlike basic patterns, harmonic patterns offer a mathematically-defined framework for entry and exit.

Elliott Wave Theory: Developed by Ralph Nelson Elliott, this theory identifies recurring waves in price movement — impulsive (trend-following) and corrective (counter-trend) waves. Advanced traders use Elliott Wave to forecast multi-timeframe trends and market cycles.

Market Profile: This tool analyzes the distribution of traded volume at different price levels to identify value areas, points of control, and price acceptance zones. Market Profile is highly useful for intraday and institutional trading strategies.

3. Advanced Technical Indicators

Beyond moving averages and RSI, advanced traders rely on more sophisticated indicators:

Ichimoku Kinko Hyo: Often called the “one-glance indicator,” it provides support, resistance, trend direction, and momentum in one chart. The Kumo (cloud) identifies trend strength and potential reversals.

Fibonacci Extensions & Retracements: Advanced traders use Fibonacci levels not just for retracements, but for projecting price targets and stop-loss levels. Confluences with other indicators improve accuracy.

MACD with Histogram Divergence: While the basic MACD identifies trend and momentum, analyzing divergences between MACD and price uncovers early reversal signals.

Volume-based Indicators: Tools like On-Balance Volume (OBV), Chaikin Money Flow (CMF), and Volume Price Trend (VPT) help identify accumulation or distribution phases, indicating potential breakouts or breakdowns.

Adaptive Indicators: Indicators like Adaptive Moving Average (AMA) and Kaufman’s Efficiency Ratio adjust to market volatility, providing a more responsive approach than static indicators.

4. Multi-Timeframe Analysis

Advanced traders rarely rely on a single timeframe. Multi-timeframe analysis involves examining multiple chart intervals — from monthly to intraday — to identify trends and align trades with higher-probability setups. Key principles include:

Top-Down Approach: Start with a higher timeframe to identify the major trend, then use lower timeframes to refine entries and exits.

Timeframe Confluence: Trades are stronger when multiple timeframes agree on trend direction, support/resistance, and momentum.

Fractal Patterns: Price movements repeat across timeframes, allowing traders to anticipate behavior in smaller or larger scales using fractal analysis.

5. Advanced Price Action Techniques

Price action analysis is the study of raw price behavior without relying heavily on indicators. Advanced techniques include:

Order Flow Analysis: Examining the flow of buy and sell orders in real-time markets to understand institutional activity and anticipate price moves.

Candlestick Confluence: Combining multiple candlestick patterns across higher and lower timeframes to validate reversals or continuation signals.

Support/Resistance with Precision: Using historical highs/lows, pivot points, Fibonacci levels, and volume clusters to identify high-probability zones for entries and exits.

Trend Exhaustion Signals: Recognizing signs of overextension, like long wicks, shrinking volume, or divergence in oscillators, to anticipate reversals.

6. Quantitative and Statistical Methods

Professional technical analysis increasingly incorporates quantitative methods:

Statistical Indicators: Bollinger Bands, Standard Deviation Channels, and Keltner Channels help identify volatility, mean reversion, and breakout points.

Correlation Analysis: Examining how assets or indices move in relation to each other to hedge or amplify trades.

Backtesting and Algorithmic Validation: Advanced traders validate strategies using historical data, Monte Carlo simulations, and statistical models to measure risk and probability of success.

7. Risk Management and Trade Psychology

Advanced technical analysis is incomplete without rigorous risk management:

Position Sizing: Using volatility, ATR, or percentage-based methods to determine trade size.

Stop-Loss Placement: Placing stops beyond key support/resistance, volatility levels, or pattern invalidation points.

Reward-to-Risk Optimization: Targeting trades with at least a 2:1 or 3:1 reward-to-risk ratio ensures long-term profitability.

Psychological Discipline: Advanced traders maintain emotional control, avoid overtrading, and adhere strictly to plan-based trading.

8. Integration with Fundamental and Sentiment Analysis

Though TA focuses on price, advanced practitioners often combine it with fundamental and sentiment insights:

Macro Events: Interest rates, earnings, or geopolitical developments can amplify technical setups.

Market Sentiment Indicators: Commitment of Traders (COT) reports, VIX index, and news sentiment can provide context to technical signals.

Confluence Approach: Trades with alignment between technical setups, fundamental catalysts, and market sentiment tend to have the highest probability.

9. Algorithmic and Machine Learning Approaches

Modern advanced technical analysis increasingly incorporates algorithmic trading and AI:

Pattern Recognition AI: Machine learning models can detect complex chart patterns faster and more accurately than humans.

Predictive Analytics: Using historical price, volume, and alternative data to predict probabilities of trend continuation or reversal.

Automated Execution: Advanced traders often use bots and automated scripts to execute trades when conditions are met, reducing emotional bias and ensuring precision.

10. Key Takeaways

Advanced technical analysis is more than chart reading; it is an integrated science of price, volume, momentum, and psychology. Key principles for mastery include:

Understanding multi-timeframe trends.

Combining advanced indicators, harmonic patterns, and Elliott Wave.

Using quantitative validation and backtesting for strategy reliability.

Integrating price action with institutional order flow and sentiment data.

Implementing strict risk management and psychological discipline.

By combining these tools, techniques, and analytical frameworks, traders can increase the probability of success, adapt to changing market conditions, and make informed decisions beyond simple guesswork. Advanced technical analysis is not about finding “guaranteed” trades but about stacking probabilities in your favor.

Technical vs. Fundamental AnalysisIntroduction

In the world of investing and trading, understanding the value and timing of financial instruments is crucial. Investors and traders often rely on two primary methods to guide their decisions: technical analysis and fundamental analysis. While both aim to inform decisions about buying, holding, or selling securities, they differ fundamentally in approach, methodology, and application. Understanding the strengths, limitations, and appropriate use cases of each is vital for anyone participating in financial markets.

1. Fundamental Analysis

Fundamental analysis focuses on evaluating a security’s intrinsic value. It attempts to determine whether a stock, bond, or other asset is overvalued, undervalued, or fairly priced based on the underlying economic and financial factors.

1.1 Core Principles

At its core, fundamental analysis is about understanding the “health” of a company or asset. Analysts examine various factors, including:

Financial Statements: Income statements, balance sheets, and cash flow statements are analyzed to assess profitability, liquidity, solvency, and efficiency. Key metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE).

Industry Conditions: The sector in which a company operates affects its potential. Market share, competitive advantages, regulatory environment, and industry growth trends are critical considerations.

Macroeconomic Factors: Interest rates, inflation, GDP growth, and fiscal policies can significantly influence asset prices.

Management Quality: Leadership decisions, corporate governance, and strategic vision often determine long-term success.

1.2 Methods

There are two primary approaches to fundamental analysis:

Top-Down Approach: Analysts first study macroeconomic conditions, then industry trends, and finally specific companies.

Bottom-Up Approach: Focuses on analyzing individual companies, often ignoring broader economic conditions, to identify investment opportunities.

1.3 Example

Suppose an investor evaluates Company X, a technology firm. By analyzing its revenue growth, profit margins, R&D spending, and competitive position, the investor determines the intrinsic value of the stock to be $150. If the current market price is $120, the stock may be considered undervalued, presenting a potential buying opportunity.

1.4 Advantages of Fundamental Analysis

Long-Term Perspective: Helps investors identify securities that may generate sustainable returns over years.

Value Identification: Can reveal undervalued or overvalued assets relative to intrinsic value.

Economic Insight: Offers a comprehensive understanding of industry and macroeconomic impacts on investments.

1.5 Limitations of Fundamental Analysis

Time-Consuming: Requires deep research, data collection, and analysis.

Subjectivity: Estimating intrinsic value involves assumptions that may differ among analysts.

Less Effective for Short-Term Trading: Market prices may diverge from fundamental values for extended periods.

2. Technical Analysis

Technical analysis, on the other hand, focuses on price movements and trading patterns rather than the underlying business. It assumes that all relevant information is already reflected in the asset’s price, and that historical patterns tend to repeat over time.

2.1 Core Principles

Technical analysis is based on three key assumptions:

Market Action Discounts Everything: Prices reflect all available information, including fundamentals, market sentiment, and news.

Prices Move in Trends: Once established, trends are more likely to continue than reverse, at least until proven otherwise.

History Tends to Repeat Itself: Human psychology leads to recurring price patterns.

2.2 Tools and Techniques

Technical analysts use charts, patterns, and indicators to forecast price movements:

Charts: Line charts, bar charts, and candlestick charts visualize price action over different time frames.

Indicators: Moving averages, relative strength index (RSI), MACD, Bollinger Bands, and Fibonacci retracement levels help identify trends and momentum.

Patterns: Head-and-shoulders, double tops/bottoms, triangles, and flags signal potential reversals or continuations.

Volume Analysis: Helps confirm trends or warn of potential reversals.

2.3 Example

A trader observes that Stock Y has formed a “double bottom” pattern on its daily chart, signaling a potential upward reversal. Using this information, the trader may enter a long position, anticipating a price increase based on historical pattern behavior rather than the company’s earnings or fundamentals.

2.4 Advantages of Technical Analysis

Timing and Short-Term Opportunities: Helps traders make decisions based on market trends and entry/exit points.

Quantitative Approach: Uses measurable price data and mathematical indicators.

Market Sentiment Insight: Captures emotions and behaviors that drive short-term price movements.

2.5 Limitations of Technical Analysis

Does Not Measure Intrinsic Value: Focuses purely on price action without regard to a company’s financial health.

False Signals: Patterns and indicators can fail, leading to losses.

Short-Term Focus: Often unsuitable for long-term investment strategies.

3. Fundamental vs. Technical Analysis: Key Differences

Feature Fundamental Analysis Technical Analysis

Focus Intrinsic value of the asset Price movements and trends

Time Horizon Long-term Short- to medium-term

Basis Financial statements, economic indicators, industry trends Price charts, volume, technical indicators

Assumption Market prices eventually reflect true value History tends to repeat; price trends continue

Tools Ratios, financial models, macroeconomic data Charts, trend lines, moving averages, oscillators

Decision Making Buy undervalued, sell overvalued Buy when patterns signal upward trend, sell on reversal signals

Use Case Investment (long-term) Trading (short-term or swing trading)

4. Integrating Both Approaches

Many successful investors and traders combine both fundamental and technical analysis:

Long-Term Investors: Use fundamental analysis to identify undervalued stocks, then apply technical analysis to optimize entry points.

Swing Traders: May rely primarily on technical analysis but consider fundamental news (earnings, economic data) to anticipate volatility.

Portfolio Management: Combining both can improve risk management and timing of trades.

Example of Integration

Consider a tech company showing strong earnings growth (fundamental analysis). A technical analyst may wait for a price breakout above a resistance level before entering a trade. By combining both approaches, the investor aligns value with optimal timing.

5. Market Psychology and Behavioral Insights

Fundamental Analysis: Relies on rational evaluation of financial health, assuming markets are logical over the long term.

Technical Analysis: Captures human psychology, fear, and greed, which often dominate short-term market behavior.

This difference reflects the broader tension between value investing and trend trading. Technical analysis often thrives in volatile, sentiment-driven markets, whereas fundamental analysis provides a grounded assessment during stable, growth-oriented periods.

6. Conclusion

Both fundamental and technical analysis offer valuable insights, but they serve different purposes. Fundamental analysis is ideal for long-term investors seeking intrinsic value, focusing on company performance, industry trends, and economic conditions. Technical analysis suits short-term traders aiming to exploit market trends and price patterns, focusing on timing and market sentiment.

While some purists favor one approach over the other, the most successful market participants often blend the two. Fundamental analysis provides the “why” behind an investment, while technical analysis provides the “when.” By understanding the strengths and limitations of each method, investors and traders can make more informed, strategic, and disciplined financial decisions.

In today’s dynamic financial markets, a holistic approach that considers both fundamentals and technical signals can enhance profitability, reduce risk, and provide a robust framework for navigating complexity. Knowledge of both allows market participants to adapt to changing conditions, combine long-term insight with short-term strategy, and ultimately make more confident decisions in the face of uncertainty.

#NIFTY Intraday Support and Resistance Levels - 29/01/2026Nifty is expected to open on a flat to mildly positive note, indicating stability after the recent recovery from lower levels. The index is currently trading around the 25340–25350 zone, which is an important intraday pivot. A flat opening near this level suggests that the market is waiting for fresh cues before committing to a directional move. Volatility may remain moderate in the initial phase, with price action largely driven by how Nifty behaves around key support and resistance zones.

From a technical structure point of view, Nifty has shown a decent pullback from the 25000 support area, where strong buying interest was seen earlier. This bounce indicates that buyers are still active at lower levels. However, the upside is capped near the 25450–25500 resistance zone, which has repeatedly acted as a supply area. Until this zone is decisively broken, the index may continue to trade in a defined range, offering selective intraday opportunities rather than trending moves.

On the bullish side, if Nifty manages to sustain above 25250 on a 15-minute closing basis, it would indicate strength and continuation of the short-term upmove. In this scenario, long positions can be considered above 25250 with an initial target of 25350. If momentum builds further, the index can move toward 25400 and then 25450+, where partial profit booking is advisable due to expected selling pressure. A strong close above 25450 would further improve the bullish outlook for the coming sessions.

On the downside, failure to hold above 25200 would weaken the immediate structure. If Nifty breaks and sustains below 25200, it may trigger a short-term correction. In such a case, downside targets of 25100 and 25050 come into play, followed by the psychological 25000 level. The 25000–25050 zone remains a crucial support area, where fresh buying or a reversal attempt can be expected. A clean breakdown below 25000 would increase bearish momentum and may lead to deeper correction, though that seems less likely without strong negative cues.

For intraday traders, the zone between 25200 and 25250 should be treated as a wait-and-watch area, as price action here can be choppy and directionless. The best trades are expected only after a clear breakout above resistance or a confirmed breakdown below support. Strict stop-loss, partial profit booking, and disciplined position sizing are essential, as the market is still in a consolidation-to-reversal phase rather than a strong trend.

Overall, Nifty is positioned at a crucial juncture. Holding above 25250 keeps the bias mildly positive, while a break below 25200 shifts the bias toward a short-term corrective move. The session is likely to reward traders who focus on levels, confirmation, and risk management rather than aggressive directional bets.

#BANKNIFTY PE & CE Levels(29/01/2026)Bank Nifty is expected to open flat, indicating a pause in momentum after the recent sharp recovery from lower levels. Such flat openings generally signal indecision in the market, especially when the index is trading close to an important resistance zone. At present, Bank Nifty is hovering near the 59550–59600 area, which has acted as a strong supply zone in recent sessions. This makes today’s trade more level-driven, with higher chances of range-bound movement and sudden volatility around key levels.

From a broader structure perspective, the index has bounced strongly from the sub-58500 region, mainly due to short covering. However, as price approaches higher resistance zones, fresh buying strength needs confirmation. Until that happens, the market may either consolidate in a narrow range or show false breakouts followed by quick reversals. Traders should avoid anticipating moves and instead react to confirmed price action.

On the bullish side, if Bank Nifty manages to sustain above 59550 on a 15-minute closing basis, it would indicate that buyers are gaining control despite the overhead supply. In such a scenario, call options can be considered above 59550. The first upside target would be around 59750, which is a minor resistance and a good zone for partial profit booking. If momentum continues, the next levels to watch are 59850 and then 59950 or higher. Near the 60000 psychological level, strong profit booking is expected, so trailing stop-loss becomes crucial for long positions.

On the bearish side, failure to hold above 59550 followed by a breakdown below the 59450–59400 zone would indicate rejection from higher levels. This would open the door for a corrective move. In that case, put options can be considered around 59450–59400. The immediate downside targets would be 59250 and then 59150. If selling pressure increases, the index could drift toward the 59050–59000 support zone. A clear break below 59050 would weaken the structure further, though such a move would likely require negative global cues or heavy institutional selling.

For intraday traders, the zone between 59450 and 59550 should be treated as a no-trade area, as price action here can be choppy and misleading. The best trades are expected only after the market shows clear acceptance above resistance or below support. Partial profit booking at every target and strict risk management are essential due to the possibility of sudden spikes on either side.

Overall, Bank Nifty is at a crucial decision point. Sustained trade above 59550 favors bullish continuation, while rejection and breakdown below 59400 may lead to a pullback. The session is likely to be volatile but structured, rewarding traders who stick to levels, wait for confirmation, and avoid emotional or over-leveraged positions.

Part 1 Institutional vs. Technical What Is an Option?

An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price before a specific time.

There are two types:

• Call Options

A call gives you the right to buy the asset at a predetermined price.

You buy calls when you expect the market to go up.

• Put Options

A put gives you the right to sell the asset at a predetermined price.

You buy puts when you expect the market to go down.

The price at which the transaction occurs is called the strike price, and the last date the option is valid is the expiry.

Mastering Technical Analysis1. Understanding the Foundation of Technical Analysis

Technical analysis is based on three core assumptions:

Price discounts everything – All known information, including fundamentals, news, and market sentiment, is already reflected in the price.

Prices move in trends – Markets tend to trend, and once a trend is established, it is more likely to continue than reverse.

History tends to repeat itself – Human behavior in markets is consistent, leading to recurring patterns.

Mastering technical analysis starts with internalizing these principles and learning to trust price behavior over opinions or predictions.

2. Market Structure and Price Action

At the heart of technical analysis lies price action—the direct study of price movement without excessive indicators. Understanding market structure involves identifying:

Higher highs and higher lows (uptrend)

Lower highs and lower lows (downtrend)

Sideways or range-bound markets

Support and resistance levels are crucial. Support is where demand overcomes supply, while resistance is where selling pressure dominates. These levels often act as decision zones where price reacts sharply.

Candlestick analysis enhances price action reading. Patterns such as doji, engulfing, hammer, and shooting star reveal shifts in market sentiment. Mastery comes from observing these candles in context—not in isolation.

3. Chart Patterns and Their Psychology

Chart patterns visually represent market psychology. Some of the most powerful patterns include:

Trend continuation patterns: flags, pennants, rectangles

Reversal patterns: head and shoulders, double top/bottom, rounding formations

Consolidation patterns: triangles and ranges

Each pattern reflects a battle between buyers and sellers. For example, a head and shoulders pattern signals weakening buying pressure after repeated attempts to push price higher. Mastery lies in recognizing these patterns early and confirming them with volume and price behavior.

4. Technical Indicators: Tools, Not Crutches

Indicators are mathematical calculations derived from price and volume. While useful, over-reliance can create confusion. Mastery means choosing a few complementary indicators:

Trend indicators: Moving averages, ADX

Momentum indicators: RSI, MACD, Stochastic

Volume indicators: Volume profile, OBV

Volatility indicators: Bollinger Bands, ATR

For example, RSI helps identify overbought and oversold conditions, but it works best when aligned with trend direction. Indicators should confirm what price action already suggests, not contradict it.

5. Time Frame Analysis and Top-Down Approach

Professional traders analyze multiple time frames. This top-down approach begins with higher time frames to identify trend direction and key levels, then moves to lower time frames for precise entries.

Higher time frames show trend and structure

Lower time frames show entry and exit precision

This alignment reduces false signals and improves consistency. Mastery involves respecting the dominant trend while timing trades efficiently.

6. Volume and Market Participation

Volume validates price movement. A breakout supported by strong volume has higher reliability than one without participation. Key volume concepts include:

Volume expansion during breakouts

Volume divergence during trend exhaustion

Accumulation and distribution phases

Understanding volume reveals whether institutions are entering or exiting positions. Master traders follow volume because it reflects real commitment, not just price fluctuations.

7. Risk Management: The Core of Mastery

No technical analysis system works without solid risk management. This includes:

Defining risk per trade (usually 1–2% of capital)

Using stop-loss orders logically (below support or above resistance)

Maintaining favorable risk-reward ratios (minimum 1:2)

Mastering technical analysis is less about winning every trade and more about controlling losses. Consistency in risk management separates professionals from amateurs.

8. Trading Psychology and Discipline

Even the best analysis fails without emotional control. Fear, greed, and impatience distort decision-making. Master traders develop:

Discipline to follow rules

Patience to wait for confirmation

Emotional neutrality after wins and losses

A trading journal is a powerful tool. Recording setups, emotions, and outcomes helps identify behavioral patterns and refine strategy over time.

9. Backtesting and Continuous Improvement

Technical mastery requires constant refinement. Backtesting strategies on historical data builds confidence and highlights weaknesses. Markets evolve, and strategies must adapt.

Learning from losses, adjusting parameters, and staying aligned with market conditions ensure long-term growth. Mastery is not a destination—it is a continuous learning process.

10. Integrating Technical Analysis with Market Context

While technical analysis focuses on charts, awareness of broader market context enhances accuracy. Economic events, sector trends, and inter-market correlations influence price behavior. A technically strong setup aligned with favorable market conditions carries higher probability.

Conclusion

Mastering technical analysis is a blend of art and science. It requires deep understanding of price behavior, disciplined risk management, emotional control, and continuous learning. There is no perfect indicator or pattern, but there is consistency in approach. Traders who respect probability, manage risk, and stay adaptable ultimately succeed. Technical analysis is not about predicting markets—it is about preparing for them with clarity, structure, and confidence.

Part 3 Institutional Option Trading Vs. Technical Analysis What Are Options?

Options are derivative contracts whose value is derived from an underlying asset like index (Nifty, Bank Nifty), stocks, commodities, currencies, etc.

They give you the right, but not the obligation, to buy or sell the underlying at a fixed price before a specific date.

Options are mainly of two types:

Call Option (CE): Right to BUY

Put Option (PE): Right to SELL

They are widely used by traders for hedging, speculation, income generation, and risk management.

RBL Bank Shows a Powerful Cup Pattern Breakout on Weekly ChartRBL Bank has completed a textbook Cup & Handle pattern on the weekly timeframe, signaling a meaningful shift from a long consolidation phase into a fresh bullish trend. The rounded base formation highlights a gradual transition from distribution to accumulation, indicating growing confidence among long-term market participants.

The most critical development is the decisive breakout above the handle resistance zone, which had previously acted as a strong supply area. This breakout is supported by strong price expansion and follow-through candles, confirming that buyers are in control. Such breakouts from multi-month bases often lead to sustained trending moves rather than short-lived rallies.

From a price projection standpoint, the measured move of the cup suggests an initial upside target around 380+, followed by an extended projected target near 440+ if momentum continues to build. The current structure also shows healthy consolidation above the breakout level, which is a positive sign and often acts as a base for the next leg higher.

Risk management remains clearly defined in this setup. As long as the price holds above the breakout support zone near 280–290, the bullish structure stays intact. Any sustained breakdown below this area would invalidate the pattern and shift the outlook back to neutral or corrective.

Overall, RBL Bank appears to be transitioning into a new medium-to-long-term uptrend, backed by a strong chart structure and favorable risk–reward dynamics. This makes it a compelling setup for positional traders and investors who prefer structurally confirmed breakouts with clear targets and controlled downside risk.

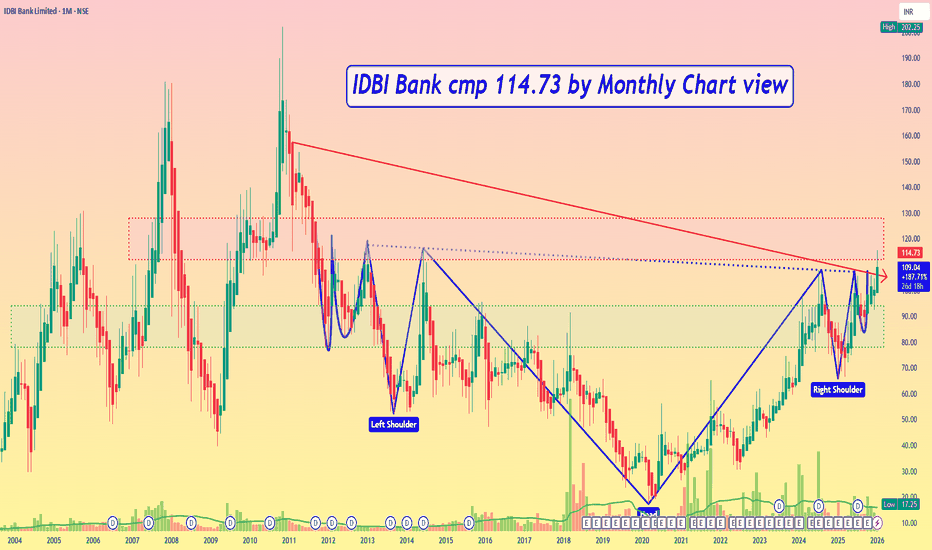

IDBI Bank cmp 114.73 by Monthly Chart view - UpdateIDBI Bank cmp 114.73 by Monthly Chart view

* Support Zone 74 to 94 Price Band

* Resistance Zone 112 to 128 Price Band

* Bullish Head & Shoulders by Resistance Zone Neckline

* Stock headed for probable major breakout above 11 ½ years old price level of 116.40 done in June 2014

[INTRADAY] #BANKNIFTY PE & CE Levels(30/12/2025)A flat opening is expected in Bank Nifty, with the index trading near the 59,000 zone, which continues to act as a short-term balance area. Price action over the last few sessions shows sustained selling pressure from higher levels, followed by a mild pullback and sideways movement. This indicates that the market is still in a consolidation-to-weak structure, where buyers are attempting to defend lower supports while sellers remain active near resistance.

On the upside, the 59,050–59,100 zone is the immediate resistance and a crucial trigger for bullish momentum. If Bank Nifty manages to hold above this zone, buying opportunities in buying can be considered, with upside targets at 59,250, 59,350, and 59,450+. A sustained move above this resistance may lead to short covering and a recovery toward higher levels.

On the downside, failure to hold the 58,950–58,900 zone can invite renewed selling pressure. In such a scenario, selling positions may be considered with downside targets at 58,750, 58,650, and 58,550-, where stronger demand is expected to emerge. Until a clear breakout or breakdown occurs, traders should continue to trade range to range, avoid aggressive positions, and strictly follow risk management in this consolidation-driven setup.

[INTRADAY] #BANKNIFTY PE & CE Levels(29/12/2025)A flat opening is expected in Bank Nifty, with the index trading near 59,000, indicating continuation of the recent weak-to-range-bound structure. Price action shows Bank Nifty drifting lower from higher levels and now stabilizing near a key demand zone, suggesting that sellers are slowing down but buyers are still cautious. Overall sentiment remains neutral, and the index needs a decisive move to establish fresh direction.

On the upside, the 59,050–59,100 zone is the immediate resistance and a crucial trigger for bullish momentum. If Bank Nifty sustains above this zone, long trades can be considered with upside targets at 59,250, 59,350, and 59,450+. A breakout above this resistance may lead to short-covering and intraday buying interest toward higher levels.

On the downside, the 58,950–58,900 range remains a critical support. A breakdown below this zone may accelerate selling pressure, opening the path for short trades with downside targets at 58,750, 58,650, and 58,550-. Until a clear breakout or breakdown occurs, traders are advised to focus on level-based trading, maintain strict stop losses, and avoid aggressive positions in this consolidating and mildly bearish setup.

#NIFTY Intraday Support and Resistance Levels - 24/12/2025A flat opening is expected in Nifty 50, with the index trading near 26,150–26,200, indicating consolidation after the recent upside move. Price is currently holding above the short-term support zone, but lack of strong follow-through suggests the market is in a pause-and-consolidate phase, waiting for a decisive trigger to define the next direction.

On the upside, a sustained move above 26,250 will be crucial to resume bullish momentum. If Nifty holds above this level, long positions can be considered with upside targets at 26,350, 26,400, and 26,450+. A breakout above this resistance zone may attract fresh buying interest and extend the upward move.

On the downside, failure to sustain above 26,200–26,180 may lead to a reversal-based selling opportunity. In such a scenario, short positions can be considered with downside targets at 26,150, 26,100, and 26,050-, where strong intraday support is placed. Until a clear breakout or breakdown occurs, traders are advised to continue focusing on level-based trades, maintain strict risk management, and avoid aggressive directional positions.

BANKNIFTY at a Make-or-Break ZoneNIFTYBANK is currently trading at a critical confluence zone where a downward-sloping resistance trendline is meeting a well-defined rising support area on the 1-hour timeframe. This price compression indicates indecision and typically precedes a sharp directional move. The index has repeatedly respected both these levels, confirming their importance in the current structure.

On the upside, the falling resistance zone near 59,300–59,500 remains the key hurdle. A sustained breakout and close above this trendline would signal a shift in short-term momentum, opening the door for a recovery move toward 59,800 initially, followed by a potential extension toward the 60,400–60,600 zone. Such a breakout would also indicate that buyers are regaining control after the recent corrective phase.

On the downside, the green support zone around 58,700–58,850 is the immediate demand area to watch. This zone has acted as a base multiple times, and as long as Bank Nifty holds above it, pullbacks may continue to attract buyers. However, a decisive breakdown below this support would invalidate the bullish bounce scenario and could accelerate selling pressure toward 58,300 first, with a deeper downside extension possible toward the 57,200 region.

Overall, BANKNIFTY is trading inside a tightening range, signaling an imminent volatility expansion. Directional clarity will emerge only after a confirmed breakout or breakdown. Traders should remain cautious at current levels and wait for confirmation, as this is a classic decision zone where false moves are also common.

Price hits FVG: Get ready for Market Maker's next move!In the current market context, the price structure is clearly showing the regulation of Smart Money as it continuously creates new liquidity zones, breaks structures, and leaves important footprints like OB – FVG – BOS. Below is a trading plan built based on the observed price zones on the chart:

🟥 1. Market Context – Role of OB Sell

Price has reacted strongly at the Order Block Sell in the 4,237 – 4,256 zone.

This is where a strong push down occurred (accompanied by a structure break – BOS), confirming this as an active supply zone.

➡️ This will be the key level to monitor all pullbacks in the coming time.

🟩 2. Current Market Structure – Market Structure

After the OB Sell is activated, the market creates a bearish BOS.

Price is moving down to approach the Liquidity Buy below in the 4,154 – 4,161 zone.

On the way, price leaves a Fair Value Gap (FVG) – a zone that can be used as a retracement point to continue selling.

➡️ Overall bias: Bearish intraday – favor sell on pullback.

🟨 3. Main Trading Plan – SELL SETUP

🎯 Area of Interest

FVG: 4,197 – 4,214

This is the ideal price zone for price to return to balance before continuing the downtrend.

📌 Entry SELL:

Preferred scenario: Price retraces to fill FVG → reacts → creates a small bearish structure (BOS M1–M5) → Sell.

🎯 Targets:

TP1: 4,170 — intermediate support zone

TP2: Liquidity Buy: 4,154 – 4,161

TP3 (extended): 4,144 if liquidity below continues to be swept

🛑 Stop Loss:

Above the FVG peak or above the nearest OB zone: 4,214 – 4,227

➡️ High probability when price fails to break 4,214–4,227 and continues to create lower highs.

🟦 4. Secondary Scenario – SHORT-TERM BUY (Countertrend)

Only activated when price hits Liquidity Buy and a clear reversal signal appears:

📌 Entry BUY:

After sweeping liquidity in the 4,154–4,161 zone

Wait for bullish BOS confirmation on a lower timeframe

🎯 Targets:

4,184

4,197

4,214 (maximum – hit FVG and exit)

➡️ This is just a retracement trade, not trend-following, so risk management is crucial.

⭐ 5. Summary View

The market is moving in line with Smart Money behavior:

Sweep liquidity above (Sell-side Liquidity) → Create OB → Push price down

Leave FVG → Attract price back → Continue distribution

Main goal: Sweep Liquidity below

👉 The main trend remains SELL until the Liquidity Buy below is hit and a strong reversal structure is created.

XAU/USD: Buy Gold on Support Retest, Bullish StructureGold continues to fluctuate within a compression model + ascending support, indicating that selling pressure is weakening and the market wants to accumulate before bouncing to the upper supply zones.

Recent data shows USD cooling as the market increases expectations that the FED will be more dovish → creating a support base for XAU/USD's short-term rise.

📊 Technical Analysis – H1 Frame (MMF Flow)

1️⃣ Key Support:

4,187 – 4,188: BUY zone + lower trendline + strong price reaction.

Price just retested and bounced → confirming active buying remains.

2️⃣ Near Resistance:

4,211 – 4,212: mid-liquidity zone → expected to create HL before breaking the downtrend line.

3️⃣ Main Target Zone:

4,236 → strong resistance, confluence multiple times from the market.

Further: 4,254 → large supply zone, is an extended target if price breaks out.

🧭 Trading Scenario According to MMF

Main Scenario – BUY with Trend

BUY again when price retests 4,187 – 4,188 or

BUY when price breaks 4,212 then retests.

TP Targets:

TP1: 4,212

TP2: 4,236

TP3: 4,254

SL: below 4,182.

Idea: price creates an absorption model + HL on trendline → potential to pull up to the upper liquidity zones.

Secondary Scenario – SELL Reaction

Only for scalp traders:

SELL reaction at 4,236 – 4,238

TP: 4,212

SL: 4,243

🎯 Daily Bias Summary

Bias: Bullish on H1 when price holds 4,187.

Priority: BUY at the bottom – SELL at the top only for scalp.

Wait for the downtrend line to break to extend the target to 4,254.

XAUUSD –| watch reaction at POC – VAL – VAH according to VolumeXAUUSD – Brian | watch reaction at POC – VAL – VAH according to Volume Profile

1. Market snapshot

Gold is entering a redistribution phase in the high price range, with fluctuations mainly revolving around large volume clusters on the Volume Profile. In this context, Brian's current priority scenario is to watch for a Sell when the price approaches the POC / VAL / VAH areas – where the market previously traded heavily.

2. Volume Profile – Notable price areas

POC – VAH area 4.217 is the price area where buyers/sellers previously "struggled" strongly, suitable for looking for sell signals if there is a rejection reaction.

VAL & the support area below around 4.134 is where short-term buying force may appear, suitable for a technical rebound buy scenario.

3. Trading plan (this week)

Scenario 1 – Sell according to Volume Profile (priority)

Sell: 4.217

SL: 4.125

TP: 4.200 – 4.182 – 4.150

Idea: wait for the price to rebound to the POC/VAH area around 4.217, observe the H1/M30 candle reaction. If a clear rejection signal appears (long upper tail, reversal candle...), the sell order can be activated according to the plan.

Scenario 2 – Short buy at VAL/support area

Buy: 4.134

SL: 4.125

TP: 4.155 – 4.180 – 4.200

Idea: if the price adjusts deeply near the VAL area and holds above 4.125, a technical rebound may occur. This is a short buy, not going too far against the trend, prioritizing partial profit-taking when the price returns to the upper POC area.

4. News to watch – Unemployment Claims

Today there are US Unemployment Claims figures, which are quite sensitive data for gold because:

The market will assess the strength/weakness of the US labor market.

Worse-than-expected figures → increase the likelihood of Fed easing → positive for gold.

Better-than-expected figures → support USD, may cause gold to face adjustment pressure.

Therefore, it is advisable to limit new orders close to the news release time, wait for the post-news candle to stabilize, and then reassess the structure.

5. Risk management (user-friendly for phone users)

Sell is the priority scenario but do not overlook SL 4.125, to avoid the case of a strong breakout above the current volume cluster.

With the Buy 4.134 scenario, it is advisable to split TP, move SL to breakeven when the price hits TP1 to reduce the pressure of having to "watch the chart" continuously on the phone.

If D1/H4 closes below the 4.125 area with large volume, Brian will consider it a signal to reduce short-term buying expectations and wait for a clearer new structure.

Gold Holds Strong Inside Trend Channel,Prepares for New ATH PushGold continues to maintain impressive bullish momentum, trading steadily within its rising trend channel. With structure firmly supported and macro sentiment leaning dovish, the market appears to be positioning for a new short-term ATH if liquidity aligns.

📊 Technical Outlook (M30 – MMF Flow)

Gold has respected the ascending channel perfectly, with each corrective leg finding buyers along channel midline and lower boundary.

The most recent impulse broke through the 4,23x region before pulling back into local liquidity.

Key Liquidity Zones

4,236 – 4,254 → Short-term supply reacting

4,218 – 4,220 → Minor demand zone

4,196 – 4,199 → Major BUY Zone (channel support + imbalance fill)

Market structure remains bullish as long as price holds above 4,196, the confluence level where:

✔️ Demand zone

✔️ Trend channel support

✔️ Fibonacci retracement

all align.

A clean bounce from this zone could trigger the next expansion leg.

🎯 MMF Trading Plan – BUY Priority

Scenario 1 – Continuation Bounce

Entry (Buy): 4,218 – 4,220

SL: 4,210

TP: 4,254 → 4,272 → 4,281

Scenario 2 – Strong Liquidity Sweep BUY (Preferred for RR)

Entry (Buy): 4,196 – 4,199

SL: 4,188

TP: 4,236 → 4,254 → 4,281

SELL Trades

Only scalp sells at supply zones

(4,254–4,257 / 4,281–4,283)

→ Not a main strategy while trend remains bullish.

⚜️ MMF View

Gold is showing healthy bullish structure, with clear liquidity engineering and controlled corrections.

As long as price stays within the trend channel and above 4,196, the path of least resistance remains up.

A breakout toward 4,281+ is highly likely before any deeper correction.

“In bullish markets, the best trades come from buying the dip—never chasing the pump.”XAU/USD – Gold Holds Strong Inside Trend Channel, Prepares for New ATH Push

Gold continues to maintain impressive bullish momentum, trading steadily within its rising trend channel. With structure firmly supported and macro sentiment leaning dovish, the market appears to be positioning for a new short-term ATH if liquidity aligns.

📊 Technical Outlook (M30 – MMF Flow)

Gold has respected the ascending channel perfectly, with each corrective leg finding buyers along channel midline and lower boundary.

The most recent impulse broke through the 4,23x region before pulling back into local liquidity.

Key Liquidity Zones

4,236 – 4,254 → Short-term supply reacting

4,218 – 4,220 → Minor demand zone

4,196 – 4,199 → Major BUY Zone (channel support + imbalance fill)

Market structure remains bullish as long as price holds above 4,196, the confluence level where:

✔️ Demand zone

✔️ Trend channel support

✔️ Fibonacci retracement

all align.

A clean bounce from this zone could trigger the next expansion leg.

🎯 MMF Trading Plan – BUY Priority

Scenario 1 – Continuation Bounce

Entry (Buy): 4,218 – 4,220

SL: 4,210

TP: 4,254 → 4,272 → 4,281

Scenario 2 – Strong Liquidity Sweep BUY (Preferred for RR)

Entry (Buy): 4,196 – 4,199

SL: 4,188

TP: 4,236 → 4,254 → 4,281

SELL Trades

Only scalp sells at supply zones

(4,254–4,257 / 4,281–4,283)

→ Not a main strategy while trend remains bullish.

⚜️ MMF View

Gold is showing healthy bullish structure, with clear liquidity engineering and controlled corrections.

As long as price stays within the trend channel and above 4,196, the path of least resistance remains up.

A breakout toward 4,281+ is highly likely before any deeper correction.

“In bullish markets, the best trades come from buying the dip—never chasing the pump.”

[INTRADAY] #BANKNIFTY PE & CE Levels(28/11/2025)Bank Nifty is expected to open flat today, indicating a neutral start with no immediate directional push from buyers or sellers. If the index sustains above the 59550–59600 zone, the buying setup becomes active with upside targets of 59750, 59850, and 59950+. A further breakout above 60050–60100 can continue the bullish momentum toward 60250, 60350, and 60450+.

On the downside, any weakness will be confirmed only if Bank Nifty slips below the 59450–59400 level, which will activate the reversal setup with downside targets of 59250, 59150, and 59050-. Since the opening is flat, the initial movement may remain range-bound, and a decisive break above or below key levels will determine the intraday trend.

#NIFTY Intraday Support and Resistance Levels - 24/11/2025Nifty is expected to open with a gap-up today, indicating early strength after the recent decline and signalling that buyers may attempt a recovery from lower levels. If the index sustains above the 26050–26100 zone, the long setup becomes active with upside targets of 26150, 26200, and 26250+. A breakout above the major resistance at 26250 can further extend the bullish momentum toward 26350, 26400, and 26450+.

On the downside, any weakness or reversal will be confirmed only if the index rejects the 26250–26200 zone, activating the reversal short setup toward 26150, 26100, and 26050-. An additional short opportunity emerges only if Nifty breaks below 25950, which opens targets of 25850, 25800, and 25750-. With a gap-up opening, early price action around the key zones will determine whether the market continues upward or faces resistance-driven pullback.

LiamTrading – XAUUSD H4 | Gold accumulates on the trendlineLiamTrading – XAUUSD H4 | Gold accumulates on the trendline, waiting to break the structure for a breakout

After testing the upward trendline twice, gold bounced up and then moved sideways around the 4065 area. On H4, this price zone has accumulated for almost a week – indicating that the selling force is not liquid enough to push the price down deeply, while there is still plenty of price gap above according to Fibonacci. My preferred scenario: gold continues to "compress" within the triangle, then breaks out to create a new wave.

Macro – Fed context

Fed member Collins emphasized that there is still reason to be cautious about cutting rates in the December meeting. She stated:

This is a complex phase, and it's not unusual for internal disagreements within the Fed.

The Fed must balance between the two goals of employment and inflation, which are moving in opposite directions.

This makes it difficult for the market to clearly price the interest rate scenario, so gold continues to choose to accumulate around important technical zones instead of breaking out in one direction.

Technical Analysis – Trendline, Fibonacci, Volume Profile

The current H4 structure is a triangle model with:

A downward sloping trendline from the old peak 42xx.

An upward sloping trendline from the late October low, acting as dynamic support.

Zone 4060–4070: the "balance" price zone last week – where the price moved sideways the longest, serving as a reference point for the short-term trend.

Key levels: 4132: near resistance, coinciding with the VAH area of the current Volume Profile.

4171: higher resistance, near the Fibonacci 1.0 area of the recovery wave.

4242: Fibonacci extension confluence zone (1.618) + historical resistance – where strong profit-taking is likely.

4347: 2.618 expansion zone – reference target if the peak is successfully broken.

4022 and 3997: important support close to the lower trendline – main buy zone if there is a liquidity sweep.

When the price decisively breaks out of one of the trendlines, the new trend on H4 will be clearer; the trading plan will follow this breakout direction.

Risk management and invalidation

H4 closes below 3997: the triangle structure is broken downward, fully prioritizing sell orders to lower zones – at that point, medium-term buy orders should not be held.

H4 closes above 4245 with good volume: considered a successful triangle peak breakout, discard all sell orders in this area and focus on buying according to the new trend.

Which scenario are you leaning towards for next week: breaking up to test 4242–4347 or sweeping down to 4022–3997 before bouncing back? Leave a comment and follow the LiamTrading channel on TradingView for daily XAUUSD updates.