The Truth About Overnight Riches What Influencers Won’t Tell YouHello Traders!

You’ve seen it everywhere, screenshots of massive profits, luxury cars, and captions like “I made this in one trade.”

The illusion of overnight riches sells fast, but what you don’t see is the reality behind it.

Let’s uncover what most influencers never talk about, the truth behind quick money in trading.

1. The Reality Behind the Screenshot

That big profit post doesn’t show how many losses came before it.

Many traders show one winning trade out of dozens of failed ones.

You never see the emotional stress, sleepless nights, and blown accounts behind that single success.

2. Overnight Riches Come with Overnight Risk

The faster you try to make money, the faster you can lose it.

Trading with oversized lots or without stop losses may look exciting, until one bad move wipes you out.

Wealth that lasts is built on consistency, not chaos.

3. The Boring Stuff Makes You Rich

Proper risk management, discipline, and patience are not flashy, but they’re what actually make traders successful.

While others chase quick money, real traders master control over emotions and capital.

Slow growth feels boring, but it’s the only path that’s sustainable.

4. The Hidden Cost of “Fast” Success

Chasing overnight profits creates mental pressure and greed.

Even if you win once, you’ll keep gambling to repeat it, until luck runs out.

True freedom in trading comes when you stop forcing success and start following process

Rahul’s Tip:

Don’t compare your beginning to someone else’s highlight reel. The real traders you admire have spent years learning, failing, and improving before they started winning.

Conclusion:

The idea of overnight riches is a dream sold to those who don’t know better.

But once you understand trading is a skill, not a lottery, you’ll stop rushing and start growing steadily.

The best traders don’t chase money; they chase mastery, and money follows naturally.

If this post gave you clarity about the real journey of trading, like it, share your thoughts in comments, and follow for more honest trading insights!

Traderlifestyle

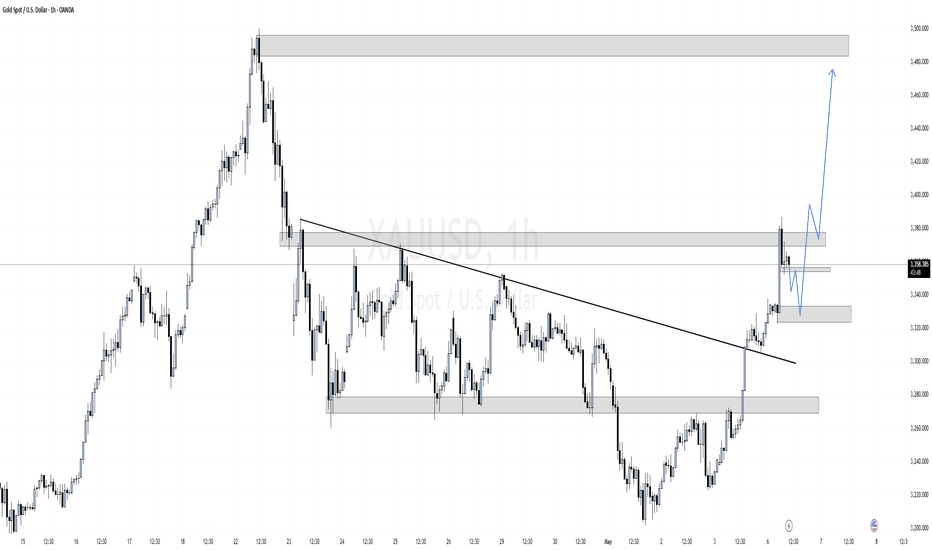

XAUUSD Bullish Breakout with Retest & Rally Setup (1H Chart) Pair: XAUUSD (Gold vs US Dollar)

Timeframe: 1 Hour (1H)

Market Bias: Bullish

Strategy Type: Trendline Breakout + Order Block Retest + Liquidity Sweep + Momentum Continuation

📊 Technical Analysis:

🔹 1. Trendline Breakout:

A major descending trendline (bearish structure) was cleanly broken with strong bullish momentum.

This is a market structure shift and indicates potential trend reversal or at least a short-term bullish rally.

🔹 2. Break of Structure & Demand Zones:

Price broke above a key resistance zone (previous supply) around 3360, turning it into support/demand.

A new bullish order block (OB) is visible just below current price (~3340–3350), now acting as an entry zone.

A lower OB zone (~3300–3320) has been left unmitigated, which could act as a second deeper entry point if price retraces further.

🔹 3. Imbalance/Fair Value Gap (FVG):

There is a clean imbalance left between the current price and the lower OB. Price may wick into this zone before rallying.

This imbalance is acting like a magnet and could invite a retracement into the 3340–3320 zone.

🔹 4. Liquidity Engineering:

Buy-side liquidity was likely swept above the trendline break and recent highs.

Sellers trapped above the trendline may give fuel for a deeper push toward the next supply zone.

🔹 5. Target Supply Zone:

A clean and unmitigated supply zone lies between 3480–3500, the ultimate target for bulls if momentum sustains.

📍 Key Levels:

Type Price Range (Approx)

Current Price 3360.90

Entry Zone 1 (OB 1H) 3340 – 3350

Entry Zone 2 (OB 1H) 3300 – 3320

Target Supply Zone 3480 – 3500

Invalidation Below 3300

🎯 Trade Idea:

Entry: On bullish confirmation at 3340–3350 or deeper at 3300–3320

Stop Loss: Below 3300 (structure break + OB invalidation)

Target: 3480–3500 (clean supply zone above)

Risk-to-Reward (R:R): ~1:3 to 1:5 depending on entry zone

✅ Confluences Supporting This Setup:

✅ Trendline break + retest setup

✅ Price flipped previous resistance into support

✅ Strong bullish impulse breaking structure

✅ Bullish Order Block + Fair Value Gap (FVG) below price

✅ Clean upside liquidity pool in untested supply zone

✅ Momentum breakout candle confirms buyer strength

⚠️ Invalidation Criteria:

Breakdown and 1H close below 3300 invalidates the OB and bullish structure.

Be cautious around NFP or Fed-related news, which may spike volatility.

🔁 Potential Scenarios:

📈 Bullish Continuation:

Price retests OB (3340–3350), finds support, and rallies directly to 3480–3500.

🔁 Deeper Retracement:

Price may wick into the lower OB at 3300–3320 to grab liquidity, then rally.

❌ Invalidation:

Breakdown below 3300 = bearish reversal or deeper correction incoming.

📘 Summary Table:

Parameter Value

Bias Bullish

Entry Zone(s) 3340–3350 (primary), 3300–3320

Stop Loss Below 3300

Take Profit 3480–3500

Strategy Trendline Break + OB Retest + Imbalance

Confluences Break of Structure, Demand Zones, FVG, Trendline Break

XAU#5: Next trading plan for XAU

💎 💎 💎 Plan#4 OANDA:XAUUSD above helps you make a profit. Please leave a comment and tag your friends to share. 💎 💎 💎

In the previous post. I noted to everyone that the price is in the support area and we can look for opportunities to establish a position. Currently, the price is running according to plan. I have summarized the things to pay attention to in the article below:

1️⃣ **Fundamental analysis:**

📊 The US dollar continues to fall after Trump's inauguration speech. A series of executive orders were signed. Highlights: Trump threatens to impose 25% tariffs on Mexico and Canada, gold rises near two-month high

🔴 Limited expectations: Some officials have emphasized that any tariffs will be implemented "in a controlled manner," but Trump's new statement has increased uncertainty.

📌 The market is in a state of fear due to Trump's decisions, which has been the main driver of gold's increase in recent times.

2️⃣ **Technical analysis:**

🔹 **Frame D:** The uptrend continues to be promoted. Yesterday ended with a pinbar, so today's price push is also suitable from a technical perspective. The price approached the resistance zone but the reaction was weak. Therefore, the possibility of prices continuing to increase in the near future is high

🔹 **Frame H4:** The key zone has been broken in the H4 frame. The price continuously tested support to break higher, showing stability in market sentiment. There are no signs of a trend reversal yet.

🔹 **H1 frame:** The price structure is very clear. Although it is in the trendline area, the reaction is insignificant. The strong increase in the Asian session brings many possibilities of a sudden change in the US session and expanding the price channel.

3️⃣ **Trading plan:**

⛔ Absolutely do not block SELL in this area. Going against the trend when the news and the price line are supporting each other can lead to large losses and make trading psychology unstable

🚀If you already have a BUY position in the support area I marked yesterday, we can completely expect a higher profit. If you do not have one, you can refer to the yellow arrow plan.

💪 **Wishing you successful trading!**

📌 For any questions, please contact directly. I am ready to answer you for free

Relative Strength Index (RSI) IndicatorThe best RSI settings are typically a 14-period timeframe with 70 as the overbought level and 30 as the oversold level. These settings can be adjusted based on specific trading strategies.

The relative strength index (RSI) is an indicator used in technical analysis to determine overbought and oversold conditions, which provides traders with buy and sell signals (when to enter and exit positions). Values above 70 indicate overbought conditions and those below 30 indicate oversold conditions.

Low RSI levels, typically below 30 (red line), indicate oversold conditions—generating a potential buy signal. Conversely, high RSI levels, typically above 70 (green line), indicate overbought conditions—generating a potential sell signal.

ADX indicator in Trading The average directional index (ADX) is a technical indicator used by traders to determine the strength of a financial security's price trend. It helps them reduce risk and increase profit potential by trading in the direction of a strong trend.

The ADX identifies a strong trend when the ADX is over 25 and a weak trend when the ADX is below 20. Crossovers of the -DI and +DI lines can be used to generate trade signals. For example, if the +DI line crosses above the -DI line and the ADX is above 20, or ideally above 25, then that is a potential signal to buy.