Tradinglessons

Domestic Equity Market Trends: A Comprehensive Overview1. Structural Shift in the Domestic Equity Market

One of the most prominent trends in recent years has been the structural strengthening of the equity market. India has moved from being a savings-driven economy dominated by physical assets (gold and real estate) to an increasingly financialized economy.

Key drivers of this shift include:

Expansion of mutual funds and SIP culture

Digital trading platforms and mobile apps

Regulatory reforms by SEBI

Greater financial literacy and awareness

This structural transformation has made equity markets deeper, more liquid, and more resilient to shocks.

2. Rise of Retail and Domestic Institutional Investors

A defining trend in the domestic equity market is the surge in retail participation. Millions of new demat accounts have been added over the last few years, particularly after 2020.

Retail Investors

Retail investors are no longer short-term speculators alone. A growing segment participates through:

Systematic Investment Plans (SIPs)

Direct equity investments

ETFs and index funds

This has created steady domestic inflows, reducing dependence on volatile foreign capital.

Domestic Institutional Investors (DIIs)

Domestic institutions such as:

Mutual funds

Insurance companies

Pension funds

have emerged as market stabilizers, often counterbalancing Foreign Institutional Investor (FII) selling during global risk-off periods.

3. Sectoral Rotation and Thematic Trends

Domestic equity markets are increasingly characterized by sectoral rotation, where leadership shifts based on economic cycles, policy support, and earnings visibility.

Cyclical Sectors

Banking and financial services

Capital goods

Infrastructure

Metals and energy

These sectors tend to outperform during economic expansion, government capex cycles, and credit growth phases.

Defensive Sectors

FMCG

Pharmaceuticals

IT services

These sectors attract capital during periods of uncertainty, inflationary pressure, or global slowdown.

Emerging Themes

Recent domestic equity trends show growing interest in:

Manufacturing and “Make in India”

Defense and railways

Renewable energy and EV ecosystem

Digital platforms and fintech

4. Banking and Financial Services as Market Leaders

The banking and financial sector remains the backbone of the domestic equity market. Strong balance sheets, improving asset quality, and robust credit growth have made banks market leaders.

Key trends include:

Declining NPAs and improved capital adequacy

Strong performance by private sector banks

Gradual recovery in PSU banks

Expansion of NBFCs and fintech collaboration

Because financials hold significant index weight, their performance largely determines broader market direction.

5. Earnings Growth and Corporate Profitability

A sustainable equity market trend depends on earnings growth, not just valuation expansion. In recent years, Indian corporates have shown:

Improved operating margins

Better cost efficiency

Lower debt levels

Strong cash flows

Sectors aligned with domestic consumption and infrastructure spending have reported consistent earnings growth, reinforcing long-term investor confidence.

6. Valuation Expansion and Market Maturity

India’s domestic equity market often trades at a premium valuation compared to other emerging markets. This trend is supported by:

Political stability

Predictable policy framework

Strong demographic dividend

Long-term GDP growth prospects

However, high valuations also mean:

Increased sensitivity to earnings disappointments

Selective stock picking becomes crucial

Midcap and small-cap segments face sharper corrections during risk-off phases

7. Midcap and Small-Cap Market Dynamics

The midcap and small-cap segments have become key areas of interest in domestic equity markets.

Trends Observed:

Higher volatility compared to large caps

Strong participation from retail investors

Periodic sharp rallies followed by corrections

Growing scrutiny on corporate governance and balance sheet quality

While these segments offer higher growth potential, they demand disciplined risk management.

8. Influence of Macroeconomic Factors

Domestic equity market trends are closely linked to macroeconomic variables such as:

Inflation and interest rates

RBI monetary policy stance

Fiscal deficit and government spending

Currency movements

A stable inflation environment and supportive monetary policy typically boost equity valuations, while tightening cycles introduce volatility.

9. Impact of Global Factors on Domestic Markets

Although domestic equity markets are increasingly self-reliant, global factors still play a role:

US Federal Reserve policy

Global liquidity conditions

Geopolitical tensions

Commodity price movements

However, strong domestic flows have reduced the shock impact of FII outflows, making Indian markets relatively resilient compared to the past.

10. Regulatory and Policy Support

SEBI reforms have enhanced transparency, investor protection, and market efficiency. Measures such as:

T+1 settlement

Enhanced disclosure norms

Stronger corporate governance rules

have boosted confidence in domestic equity markets and encouraged long-term participation.

11. Technology and Market Accessibility

Technology has transformed equity market participation:

Algorithmic and quantitative trading

Online research and analytics

Low-cost brokerage models

Real-time data access

This has democratized investing but also increased short-term volatility due to faster information flow.

12. Long-Term Outlook of Domestic Equity Markets

The long-term trend of the domestic equity market remains structurally bullish, supported by:

Rising household financial savings

Expanding middle class and consumption

Infrastructure-led growth

Manufacturing revival

Digital and technological adoption

Short-term corrections are a natural part of market cycles, but the underlying growth story remains intact.

Conclusion

Domestic equity market trends reflect a powerful transformation—from liquidity-driven rallies to earnings-backed, structurally supported growth. The rise of domestic investors, sectoral diversification, strong regulatory oversight, and improving corporate fundamentals have made the market more mature and resilient.

For investors, the key lies in understanding these trends, aligning strategies with economic cycles, and maintaining a long-term perspective. While volatility is inevitable, the domestic equity market continues to offer compelling opportunities for wealth creation in a growing economy like India.

Part 2 Support and ResistanceMoneyness of Options

Options are classified based on their relationship with the underlying price:

In-the-Money (ITM)

Call: Spot > Strike

Put: Spot < Strike

At-the-Money (ATM)

Spot ≈ Strike

Out-of-the-Money (OTM)

Call: Spot < Strike

Put: Spot > Strike

Moneyness affects premium value, probability of profit, and risk.

How One Quant Giant Quietly Reshaped Global MarketsJane Street Impact

Jane Street is not a household name like Goldman Sachs or JPMorgan, yet its impact on modern financial markets is enormous. Founded in 2000, Jane Street is a quantitative trading firm and liquidity provider that operates across equities, ETFs, bonds, options, and cryptocurrencies in markets around the world. Its influence is subtle but powerful: tighter spreads, faster markets, changing trading strategies, and a new reality for both institutions and retail traders.

1. Market Liquidity: Making Markets “Always On”

One of Jane Street’s biggest contributions is liquidity provision. The firm acts as a market maker, constantly posting buy and sell quotes. This ensures that traders can enter or exit positions quickly without massive price slippage.

Before firms like Jane Street dominated market making:

Spreads were wider

Liquidity was inconsistent

Large trades caused sharp price moves

Jane Street changed this by using sophisticated algorithms that continuously adjust prices based on real-time supply, demand, and risk. The result is:

Narrower bid–ask spreads

Deeper order books

More stable short-term pricing

For investors, this reduces transaction costs. For traders, it means faster fills—but also tougher competition.

2. ETFs and Price Efficiency

Jane Street is one of the largest ETF market makers in the world. ETFs rely on a mechanism where prices stay close to their underlying assets through arbitrage. Jane Street plays a key role in this process.

Their impact includes:

Keeping ETF prices aligned with net asset value (NAV)

Enabling massive ETF growth globally

Making passive investing cheaper and more reliable

Without firms like Jane Street, ETFs would trade with larger discounts or premiums, reducing trust in the product. Their efficiency helped fuel the explosion of ETFs across equities, commodities, bonds, and thematic strategies.

3. Volatility: Reduced on Average, Sharper in Extremes

Jane Street’s presence generally reduces everyday volatility. Constant liquidity smooths price movement during normal conditions. However, in extreme events, the picture changes.

During market stress:

Algorithms widen spreads

Liquidity can temporarily vanish

Prices can move suddenly and violently

This doesn’t mean Jane Street causes crashes, but it highlights a new reality: modern markets are stable—until they aren’t. When risk models flip to “defensive,” liquidity providers step back simultaneously, amplifying sudden moves.

4. Speed and the Rise of Microstructure Trading

Jane Street operates at ultra-high speed, reacting to market signals in microseconds. This reshaped market microstructure in several ways:

Price discovery happens faster

Arbitrage opportunities disappear quickly

Traditional discretionary trading edges shrink

For slower participants, this creates frustration. Patterns that once worked for minutes now work for seconds—or not at all. This is why many retail traders feel markets have become “harder” or “unfair,” even though they are technically more efficient.

5. Impact on Retail Traders

Jane Street doesn’t trade against retail traders directly in a predatory sense, but its presence changes the game:

Positive impacts

Lower spreads

Better execution prices

Easier entry and exit

Negative impacts

Fake breakouts due to liquidity probing

Stops hunted in low-liquidity zones

Retail strategies losing edge faster

Many retail traders unknowingly trade against sophisticated liquidity models. This is why modern trading education increasingly emphasizes:

Market structure

Liquidity zones

Institutional footprints

6. Institutional Trading and Strategy Evolution

Jane Street forced traditional institutions to evolve. Old-school floor trading and manual arbitrage could not compete with algorithmic precision.

As a result:

Banks adopted quant desks

Hedge funds invested heavily in data science

Trading shifted from intuition to probability models

Risk management also improved. Jane Street is known for strict risk controls, scenario testing, and disciplined capital allocation. This professionalized trading across the industry.

7. Cultural Impact: Redefining What a Trader Is

Jane Street changed the identity of a “trader.” Today, traders are often:

Mathematicians

Engineers

Physicists

Data scientists

The firm’s culture emphasizes:

Collaboration over ego

Continuous learning

Intellectual honesty

This influenced the broader finance world, making quantitative skills more valuable than aggressive personalities or gut instinct.

8. Regulatory and Ethical Implications

Jane Street operates within regulations, but its scale raises questions:

Should ultra-fast firms have speed advantages?

Is liquidity real if it disappears during crises?

Do algorithms create unequal access?

Regulators worldwide now focus more on:

Market fairness

Order-to-trade ratios

Algorithmic risk controls

Jane Street’s success indirectly pushed regulators to modernize frameworks designed for a pre-algorithm era.

9. Global Impact, Including Emerging Markets

Jane Street trades globally, including emerging markets through derivatives, ETFs, and arbitrage links. This has several effects:

Faster price transmission from global cues

Increased correlation across markets

Reduced inefficiencies

For countries like India, this means domestic markets respond more quickly to global flows. While this increases efficiency, it also reduces insulation from global shocks.

10. The Bigger Picture: Markets as Machines

Jane Street symbolizes a broader shift: markets are no longer human-driven arenas—they are machine ecosystems. Prices move not because of stories alone, but because of models reacting to probabilities, correlations, and risk constraints.

This doesn’t eliminate opportunity—it changes it. Traders who understand liquidity, structure, and behavior thrive. Those relying only on indicators struggle.

Conclusion

Jane Street’s impact on financial markets is profound yet understated. It improved liquidity, tightened spreads, enhanced ETF efficiency, and pushed trading into a new quantitative era. At the same time, it raised the bar for participation, forcing traders and institutions alike to adapt.

Jane Street did not “break” the markets—it rewired them. Understanding its role helps explain why modern price action behaves the way it does: fast, efficient, occasionally ruthless, and deeply structural.

In today’s world, trading is no longer about beating the market emotionally—it’s about understanding the systems that move it. Jane Street is one of the architects of that system.

Derivatives Explained in Detail (Imply & Describe)Introduction to Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset. That underlying asset can be anything that has a measurable price—stocks, stock indices, commodities, currencies, interest rates, bonds, or even weather and volatility. The derivative itself has no independent value; its worth implies and reflects movements in the price of the underlying asset.

In simple terms:

If the underlying asset moves, the derivative moves.

Derivatives are widely used in modern financial markets for risk management (hedging), price discovery, speculation, and arbitrage. They are essential tools for institutions, traders, corporations, and even governments.

Meaning and Implication of Derivatives

The word derivative comes from the idea that the instrument “derives” its value from something else. For example, a futures contract on crude oil derives its price from the spot price of crude oil. If crude oil prices rise, the value of that futures contract generally rises as well.

The implied meaning of derivatives is forward-looking. Unlike spot market transactions, derivatives often represent expectations about future prices. When traders buy or sell derivatives, they are expressing a view—bullish, bearish, or neutral—on how the underlying asset will behave in the future.

Thus, derivatives markets often act as a mirror of market sentiment, reflecting expectations, fear, confidence, volatility, and institutional positioning.

Key Characteristics of Derivatives

No Physical Ownership

Most derivatives do not involve ownership of the underlying asset. You can trade derivatives on gold without owning gold, or on stocks without owning shares.

Leverage

Derivatives allow traders to control a large value of assets with relatively small capital. This magnifies both profits and losses.

Contract-Based

Derivatives are legal contracts that specify terms such as price, quantity, expiration date, and settlement method.

Time-Bound

Most derivatives have an expiry date. Their value decays or changes as time passes, especially in options.

Risk Transfer

Derivatives shift risk from one party to another. Hedgers transfer risk; speculators absorb it for potential profit.

Types of Derivatives

1. Futures Contracts

A futures contract is an agreement to buy or sell an asset at a predetermined price on a future date.

Traded on exchanges (NSE, BSE, CME)

Standardized contracts

Daily mark-to-market settlement

Widely used in commodities, indices, and currencies

Implication:

Futures reflect collective expectations of future prices and institutional positioning.

2. Options Contracts

An option gives the buyer the right but not the obligation to buy or sell an underlying asset at a fixed price before or on expiry.

Call Option: Right to buy

Put Option: Right to sell

Options involve a premium, which is the cost of the contract.

Implication:

Options imply market expectations of volatility, not just direction. Concepts like implied volatility are derived directly from option prices.

3. Forwards Contracts

Forwards are private, customized agreements between two parties to trade an asset at a future date.

Not traded on exchanges

High counterparty risk

Common in corporate hedging (FX, interest rates)

Implication:

Forwards reflect negotiated future price expectations between specific parties.

4. Swaps

Swaps involve the exchange of cash flows between two parties.

Interest rate swaps

Currency swaps

Commodity swaps

Implication:

Swaps help institutions manage long-term financial risks and funding costs.

Why Derivatives Exist

1. Hedging Risk

Producers, exporters, investors, and institutions use derivatives to protect against adverse price movements.

Example:

A farmer hedges crop prices using futures

An airline hedges fuel costs

An exporter hedges currency risk

Here, derivatives imply risk insurance rather than speculation.

2. Speculation

Traders use derivatives to profit from price movements without owning the asset.

Lower capital required

Faster returns (and losses)

High risk, high reward

Implication:

Speculation adds liquidity but increases volatility if unmanaged.

3. Arbitrage

Arbitrageurs exploit price differences between markets.

Example:

Spot vs futures mispricing

Index vs constituent stocks

Derivatives help enforce price efficiency in financial markets.

Role of Derivatives in Price Discovery

Derivatives markets often react faster than cash markets because:

Lower transaction costs

Higher leverage

Institutional dominance

As a result, futures and options prices often lead spot prices. This makes derivatives a crucial tool for understanding:

Market trend direction

Institutional activity

Volatility expectations

In this sense, derivatives imply where “smart money” is positioned.

Risks Associated with Derivatives

Leverage Risk – Small moves can cause large losses

Liquidity Risk – Wide spreads during volatile periods

Time Decay – Especially harmful for option buyers

Complexity Risk – Misunderstanding contract behavior

Counterparty Risk – In OTC derivatives

Derivatives are powerful tools, but misuse can lead to catastrophic losses, as seen in multiple global financial crises.

Derivatives in the Indian Market

In India, derivatives are actively traded on NSE and BSE, mainly in:

Index derivatives (NIFTY, BANK NIFTY)

Stock futures and options

Currency derivatives

India’s derivatives market often has higher volumes than the cash market, highlighting its importance in price discovery and institutional trading.

Economic Importance of Derivatives

From a macroeconomic perspective, derivatives:

Improve market efficiency

Allow better risk distribution

Enhance capital allocation

Support global trade and investment

However, excessive speculative use can amplify systemic risk, making regulation essential.

Conclusion

Derivatives are not merely trading instruments; they are the backbone of modern financial markets. Their value is implied by the movement of underlying assets, expectations of future prices, and market psychology. When used responsibly, derivatives provide stability, efficiency, and risk management. When misused, they can magnify losses and destabilize entire economies.

Understanding derivatives is crucial for anyone involved in finance, trading, economics, or investment strategy. They are neither good nor bad by nature—their impact depends entirely on how intelligently they are used.

Sub-Broker in India: Role, Regulation, Business Model, FutureMeaning of a Sub-Broker

A sub-broker is an individual or entity that acts as an agent of a SEBI-registered stockbroker. The sub-broker assists clients in trading securities such as equities, derivatives, commodities, and currencies through the trading infrastructure of the main broker. Importantly, a sub-broker cannot trade independently on stock exchanges; all transactions must be routed through the principal broker.

In simple terms, if a stockbroker is the backbone of trading operations, the sub-broker is the business development arm, responsible for client acquisition, relationship management, and localized market presence.

Regulatory Framework in India

Earlier, sub-brokers were registered directly with SEBI (Securities and Exchange Board of India). However, after regulatory changes introduced around 2018, SEBI discontinued fresh sub-broker registrations. Instead, individuals now operate as Authorized Persons (APs) of stockbrokers. Despite this change in terminology, the core functions remain largely similar.

Key regulatory points include:

Sub-brokers/APs must be affiliated with a SEBI-registered broker.

They must comply with KYC norms, Anti-Money Laundering (AML) guidelines, and investor protection rules.

All client funds and securities are held by the main broker, not the sub-broker.

Misconduct by a sub-broker can attract penalties for both the sub-broker and the principal broker.

This regulatory structure ensures investor safety while allowing brokers to scale efficiently.

Role and Responsibilities of a Sub-Broker

The primary role of a sub-broker is client servicing and business expansion. Their responsibilities include:

Client Acquisition

Sub-brokers identify potential investors, explain trading products, and onboard clients by completing KYC documentation.

Market Guidance and Support

While they cannot provide unauthorized investment advice, sub-brokers often guide clients on market processes, trading platforms, and basic strategies.

Relationship Management

Maintaining long-term relationships with clients is a key strength of sub-brokers, especially in regions where trust and personal interaction matter.

Order Assistance

Some clients, particularly traditional investors, rely on sub-brokers for placing trades or resolving order-related issues.

Education and Awareness

Conducting seminars, workshops, and one-to-one sessions to educate investors about stock markets is an important value addition.

Business Model and Revenue Structure

The income of a sub-broker comes from commission sharing with the main broker. This commission is a percentage of the brokerage generated by the clients introduced by the sub-broker.

Common revenue models include:

Revenue Sharing Model: The sub-broker earns 30%–70% of the brokerage charged to clients.

Hybrid Model: Fixed income plus variable incentives based on volume or client activity.

Performance-Linked Model: Higher revenue share for achieving targets such as active clients or turnover.

Sub-brokers dealing with full-service brokers generally earn higher commissions, while those tied to discount brokers rely on volume rather than per-trade revenue.

Capital and Infrastructure Requirements

One of the major advantages of becoming a sub-broker is the low entry barrier. Unlike stockbrokers, sub-brokers do not need exchange memberships or large capital investments.

Basic requirements include:

Office space (physical or virtual)

Internet connectivity and computer systems

Sales and support staff (optional but helpful)

Initial security deposit payable to the broker (varies by broker)

This makes sub-broking an attractive entrepreneurial opportunity for finance professionals, relationship managers, and local business owners.

Advantages of Becoming a Sub-Broker

Low Risk Business

Since trading infrastructure, compliance, and settlement are handled by the main broker, operational risk is minimal.

Scalable Income

Earnings grow with the client base and trading volume, offering long-term passive income potential.

Local Market Trust

Sub-brokers leverage personal relationships and regional familiarity, which large brokers often lack.

Brand Support

Association with a reputed broker provides credibility, research support, and advanced trading platforms.

Challenges Faced by Sub-Brokers

Despite its benefits, sub-broking also comes with challenges:

Margin Pressure: Discount brokers offer very low brokerage, reducing commission income.

Regulatory Compliance: Continuous adherence to SEBI and broker guidelines is mandatory.

Client Expectations: Investors increasingly demand real-time service, advanced tools, and market insights.

Technology Shift: Online platforms and DIY trading apps have reduced dependency on intermediaries.

To survive, modern sub-brokers must adapt by offering value-added services rather than just trade execution.

Sub-Broker vs Stockbroker

Aspect Sub-Broker Stockbroker

Exchange Membership No Yes

SEBI Registration Through Broker Direct

Capital Requirement Low High

Client Funds Handling No Yes

Risk Exposure Low High

This comparison highlights why sub-broking is suitable for individuals seeking market participation without heavy compliance burden.

Future of Sub-Brokers in India

The future of sub-brokers in India is transformational rather than extinct. While traditional commission-based models are under pressure, new opportunities are emerging in:

Financial literacy and advisory support

Regional investor onboarding

HNI relationship management

Hybrid online-offline service models

Sub-brokers who embrace technology, build trust, and focus on long-term client value will continue to play a vital role in India’s expanding capital markets.

Conclusion

A sub-broker in India serves as a vital link between investors and stockbrokers, enabling market access, education, and personalized service. Though regulatory frameworks and technology have reshaped the role, sub-broking remains a powerful business model when approached with professionalism and adaptability. In a country like India—where financial inclusion is still growing—sub-brokers will continue to be an important pillar of the securities ecosystem.

Nifty & Bank Nifty Options: Smart Trading StrategiesIntroduction

Nifty 50 and Bank Nifty options are the most actively traded derivatives in India, offering high liquidity, tight bid-ask spreads, and multiple weekly expiries. These characteristics make them attractive to traders—but also dangerous for those without a structured approach. Smart options trading is not about predicting the market every day; it’s about probability, risk control, and discipline.

This guide explains smart, repeatable strategies used by professional and experienced retail traders across different market conditions—ranging from intraday momentum to non-directional income setups.

Understanding Nifty vs Bank Nifty Behavior

Before strategies, it’s critical to understand how these indices behave.

Nifty 50

Broader market representation

Lower volatility compared to Bank Nifty

Better for positional options selling, spreads, and calm intraday trades

Moves smoothly and respects technical levels

Bank Nifty

Highly volatile and momentum-driven

Sensitive to RBI policy, bond yields, and banking stocks

Ideal for intraday option buying, scalping, and fast spreads

Requires strict risk management due to sharp swings

Smart traders choose the index based on market conditions, not habit.

Core Principles of Smart Options Trading

1. Trade Probability, Not Prediction

Most professional options traders focus on high-probability setups (60–80%) instead of directional certainty.

2. Risk Defined First

Every trade must have:

Fixed maximum loss

Pre-decided exit

Position size based on capital, not confidence

3. Time Decay Is a Weapon

Theta (time decay) works against buyers and for sellers, especially in weekly options.

Smart Intraday Strategies

1. Opening Range Breakout (ORB) – Option Buying

Best for: Bank Nifty & Nifty (high volatility days)

Setup

Mark high and low of first 15 minutes

Buy Call if price breaks above range

Buy Put if price breaks below range

Choose ATM or slightly ITM options

Why it works

Institutions establish direction early

Volatility expansion favors buyers

Risk management

Stop-loss: 30–40% premium

Partial profit booking recommended

2. VWAP Trend Following

Best for: Trending intraday markets

Rules

Price above VWAP → buy Calls on pullbacks

Price below VWAP → buy Puts on pullbacks

Avoid counter-trend trades

Smart tip

Trade only when VWAP is sloping clearly—flat VWAP = no trade.

Smart Positional Strategies

3. Bull Call Spread / Bear Put Spread

Best for: Directional view with limited risk

Example (Bull Call Spread)

Buy ATM Call

Sell OTM Call (same expiry)

Advantages

Lower cost than naked buying

Reduced time decay impact

Defined risk and reward

Ideal for

Breakouts

News-based positional trades

Budget day, RBI policy days

4. Calendar Spread

Best for: Low volatility → expected volatility expansion

Setup

Sell near-expiry option

Buy same strike next-expiry option

Why it’s smart

Takes advantage of faster decay in weekly options

Lower directional risk

Used by

Experienced traders before events like RBI policy or CPI data.

Smart Non-Directional Strategies (Option Selling)

5. Short Strangle

Best for: Sideways markets, low VIX

Setup

Sell OTM Call

Sell OTM Put

Same expiry

Profit source

Time decay

Range-bound price action

Risk control

Always hedge with far OTM options

Exit if spot breaches sold strike

Works best

In Nifty more than Bank Nifty

When India VIX < 14–15

6. Iron Condor (Hedged Income Strategy)

Best for: Consistent weekly income

Structure

Sell OTM Call + Buy higher Call

Sell OTM Put + Buy lower Put

Advantages

Defined maximum loss

Lower margin requirement

Stress-free compared to naked selling

Professional insight

Iron Condors outperform aggressive selling over long periods.

Expiry Day Smart Strategies

7. Intraday Short Straddle (Advanced)

Best for: Weekly expiry, post 1 PM

Logic

Volatility collapses rapidly on expiry

ATM options lose value quickly

Rules

Only when index is range-bound

Strict stop-loss on combined premium

Not for beginners

8. Directional Expiry Scalping

Best for: Bank Nifty expiry

Setup

Trade ATM options

Quick 5–15 point moves

High frequency, low holding time

Golden rule

One bad trade can wipe 5 good ones—size small.

Risk Management: The Real Edge

Capital Allocation

Risk max 1–2% of capital per trade

Never deploy full margin on one idea

Stop-Loss Discipline

Pre-defined SL beats mental SL

Exit without emotion

Avoid Overtrading

No trade is also a trade

Most losses happen due to boredom trades

Common Mistakes to Avoid

Buying weekly OTM options without momentum

Holding losing positions hoping for reversal

Trading during low-volume midday hours

Ignoring India VIX

Trading every expiry aggressively

Smart Trader’s Checklist (Before Every Trade)

Is the market trending or sideways?

What is India VIX doing?

Am I a buyer or seller today?

Is my risk predefined?

Is this trade worth taking?

If any answer is unclear—skip the trade.

Conclusion

Smart Nifty and Bank Nifty options trading is not about high returns every day, but about survival, consistency, and compounding. The market rewards patience, structure, and risk control far more than excitement.

Successful traders:

Adapt strategies to volatility

Prefer probability over prediction

Protect capital first, profits second

Part 5 Advance Trading Strategies How Institutions Manipulate Premiums

Push underlying price to premium-rich zones.

IV crush after event.

Quick whipsaws to trigger SL of retailers.

Short covering traps.

Events Affecting Options

Budget announcements.

RBI MPC.

Fed decisions.

US inflation & jobs data.

Elections.

Geopolitical events.

IPO listing days.

Part 4 Institutional Option Trading Vs. Techncal AnalysisLot Size

Options trade in lots, not single units.

Lot size varies by instrument.

Why Are Options Popular?

Low upfront premium.

Leverage.

Sophisticated hedging.

High liquidity.

European vs American Options

Indian index options are European — can only be exercised on expiry.

Stock options are American — can be exercised any time (but rarely done).

Behavioral Finance & Trading Psychology1. Traditional Finance vs Behavioral Finance

Traditional finance theory assumes that investors are rational, markets are efficient, and prices always reflect all available information. In reality, markets frequently experience bubbles, crashes, overreactions, and panic selling—events that cannot be fully explained by logic alone.

Behavioral finance challenges this assumption by recognizing that:

Investors are emotionally driven

Decisions are influenced by cognitive biases

Market prices can deviate from intrinsic value for long periods

Understanding behavioral finance helps traders identify why mistakes happen and how to reduce their impact.

2. Core Psychological Forces in Trading

a) Fear

Fear is one of the strongest emotions in trading. It appears in different forms:

Fear of losing money

Fear of missing out (FOMO)

Fear of being wrong

Fear often causes traders to:

Exit profitable trades too early

Avoid valid setups

Panic sell during market corrections

b) Greed

Greed pushes traders to:

Overtrade

Take oversized positions

Ignore stop-losses

Hold losing trades hoping for reversal

Greed usually appears after a series of winning trades, leading to overconfidence and risk mismanagement.

c) Hope

Hope is dangerous in trading. Traders often hold losing positions hoping the market will turn in their favor. Hope replaces discipline and prevents logical decision-making.

d) Regret

Regret arises after missed trades or losses. It often leads to revenge trading—entering poor trades to “recover” losses quickly.

3. Common Cognitive Biases in Trading

a) Loss Aversion

People feel the pain of losses more strongly than the pleasure of gains. Traders may:

Hold losing trades too long

Cut winning trades too quickly

This leads to an unfavorable risk-reward ratio.

b) Overconfidence Bias

After a few successful trades, traders may believe they have “figured out” the market. This often results in:

Ignoring rules

Increasing position size

Taking low-quality setups

Overconfidence is one of the biggest reasons for sudden account drawdowns.

c) Confirmation Bias

Traders tend to seek information that supports their existing view and ignore opposing signals. For example, a bullish trader may ignore bearish indicators and news.

d) Anchoring Bias

Anchoring occurs when traders fixate on a specific price (buy price, previous high, or analyst target) and make decisions based on it rather than current market conditions.

e) Herd Mentality

Many traders follow the crowd instead of independent analysis. This leads to buying at tops and selling at bottoms—classic bubble behavior.

4. Emotional Cycle of a Trader

Most traders experience a repeated emotional cycle:

Optimism – Confidence after a few wins

Excitement – Increasing trade size

Euphoria – Peak confidence, maximum risk

Anxiety – First loss appears

Denial – Ignoring signals

Fear – Losses increase

Panic – Emotional exits

Despair – Loss of confidence

Hope – Waiting for recovery

Relief – Small recovery, cycle restarts

Successful traders learn to break this cycle through discipline and systems.

5. Trading Psychology and Performance

Trading psychology directly affects:

Entry timing

Exit discipline

Position sizing

Consistency

Two traders using the same strategy can have very different results due to psychological differences. Discipline, patience, and emotional control matter more than finding a “perfect” strategy.

6. Importance of Self-Awareness

Every trader has a unique psychological profile. Some are risk-averse, others are aggressive. Understanding personal tendencies helps in:

Selecting the right trading style (intraday, swing, positional)

Choosing appropriate risk levels

Designing realistic trading rules

Self-awareness turns weaknesses into controlled variables.

7. Developing a Strong Trading Mindset

a) Accepting Uncertainty

Markets are probabilistic. No trade is guaranteed. Successful traders accept losses as a cost of doing business rather than personal failure.

b) Process Over Profits

Focusing on execution quality instead of daily profits reduces emotional pressure. Profits become a by-product of consistency.

c) Discipline and Routine

A disciplined routine includes:

Pre-market planning

Defined entry and exit rules

Fixed risk per trade

Post-market review

Routine reduces impulsive decisions.

d) Risk Management as Psychological Protection

Proper risk management lowers emotional stress. When losses are controlled, fear and panic reduce significantly.

8. Role of Trading Journal

A trading journal is one of the most powerful psychological tools. It helps:

Identify emotional mistakes

Track behavioral patterns

Improve discipline

Build confidence based on data

Journaling transforms subjective feelings into objective analysis.

9. Behavioral Finance in Market Movements

Market phenomena explained by behavioral finance include:

Bubbles (excessive optimism and herd behavior)

Crashes (panic selling and fear)

Overreaction to news

Underreaction to fundamentals

Smart traders use these behavioral inefficiencies to their advantage.

10. Long-Term Psychological Edge

The real edge in trading is not speed, indicators, or predictions—it is emotional stability and consistency. Over time:

Strategies change

Markets evolve

Psychology remains constant

Traders who master their emotions outperform those who constantly search for new systems.

Conclusion

Behavioral finance and trading psychology reveal a critical truth: markets move because people make emotional decisions. Fear, greed, bias, and overconfidence influence not only individual traders but the entire market structure. While technical and fundamental analysis tell you what the market is doing, psychology explains why traders fail or succeed.

Mastering trading psychology requires self-awareness, discipline, and acceptance of uncertainty. Traders who control their behavior can survive market volatility, maintain consistency, and achieve long-term success. In trading, the biggest battle is not against the market—it is against one’s own mind.

VTL 1 Day View 📍 Latest Price Context (Daily Close)

Approx. share price: ~₹432 – ₹433 on NSE (close of last session).

Today’s range (recent session): High ~₹468, Low ~₹407.45.

52-week range: Low ~₹361.10, High ~₹539.90.

📊 Key Daily Levels (1-Day Time Frame)

🔑 Pivot & Intraday Levels

(Based on pivot point calculations for the daily session)

Central Pivot (Daily): ~₹412.33 – baseline pivot for directional bias.

📈 Resistance Levels

R1 ~₹418 – ₹423 – first near-term resistance zone.

R2 ~₹423 – ₹429 – next resistance above pivot.

R3 ~₹429 – ₹446 (or higher intraday) – notable upper resistance zone if price strengthens.

👉 Bullish scenario: Daily close above ~₹429-₹435 could trigger further upside momentum toward higher resistance zones (based on recent highs).

📉 Support Levels

S1 ~₹407 – ₹410 – short-term support near today’s low zone.

S2 ~₹401 – ₹405 – secondary support if price declines below S1.

S3 ~₹396 – ₹399 – deeper support on a pullback.

👉 Bearish scenario: A daily close below ~₹401-₹396 may open further decline toward lower support clusters.

📌 Simple Interpretation (Daily TF)

📍 Above Pivot (~₹412): Slightly bullish / range control.

📍 Holding Support (~₹407 – ₹401): Helps limit downside.

📍 Break above ~₹429: Potential for continuation to next resistance area.

📍 Break below ~₹396: Bearish momentum intensifies.

⚠️ Notes

Levels are based on standard pivot and support/resistance derivations — actual intraday price action may vary with market volatility.

For live charts and real-time plotting, it’s best to check TradingView, your broker’s charting tool, or other live market platforms.

AUROPHARMA 1 Month View📌 Current Price Context

Last traded / current price: ~₹1,207–₹1,208 on NSE.

📊 Key Technical Levels (1-Month View)

🔹 Pivot Point

Pivot (daily): ~₹1,200 – centre of recent price action.

📈 Resistance Levels

R1: ~₹1,226–₹1,228 — first meaningful resistance above current price.

R2: ~₹1,245–₹1,247 — higher resistance zone from classic pivot analysis.

R3: ~₹1,271–₹1,275+ — extended resistance from upper pivot range.

These resistances correspond to areas where price has previously found sellers or consolidation over the last few weeks.

📉 Support Levels

S1: ~₹1,181–₹1,182 — first support just below pivot region.

S2: ~₹1,155–₹1,156 — secondary support from recent swing lows.

S3: ~₹1,136–₹1,138 — deeper support area if market weakens further.

These support zones align with recent range lows and moving average clusters over a monthly period.

📊 Moving Averages & Trend

20-day / 50-day / 100-day EMAs and SMAs are currently around ₹1,164–₹1,192 range — near price but showing neutral-to-slightly bullish bias on daily charts.

Price trading above most short and mid-term moving averages suggests short-term strength if levels hold.

📈 Oscillators / Momentum (Short-term indication)

RSI near mid-to-bullish levels (~58–68) indicating no extreme overbought condition yet.

Momentum suggests neutral-to-slightly uptrend in the recent 1-month timeframe.

📍 Summary (1-Month Technical View)

Bullish breakout zone:

• Above ~₹1,226 → may accelerate toward ₹1,245 / ₹1,270+

Key neutral range:

• ₹1,181–₹1,226 — consolidation band to watch intra-month

Bearish trigger (pullback):

• Below ~₹1,155 → risk of deeper test of ₹1,136+ support

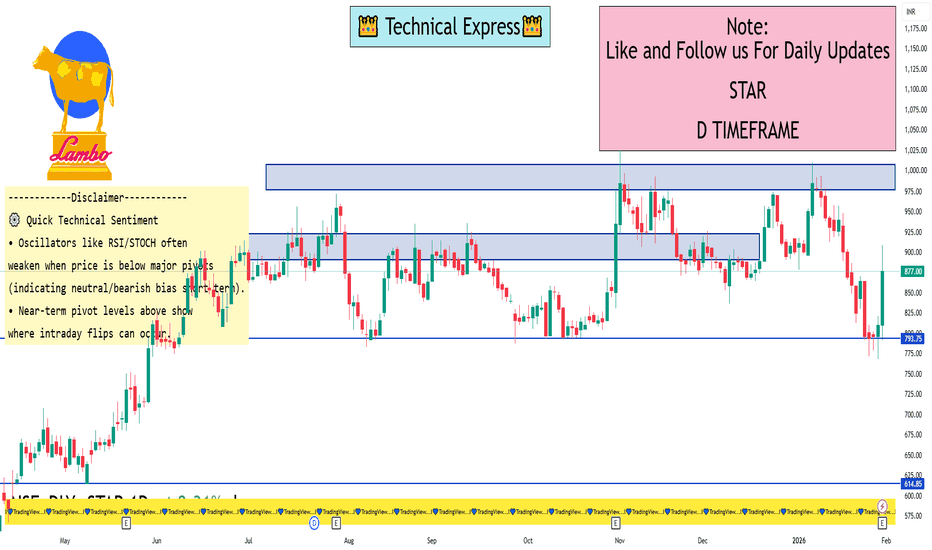

STAR 1 Day View 📌 Live Price Snapshot

• Current price: ~₹877.00 on NSE (Last traded)

• Today’s range: ₹791 – ₹908.40

• 52-Week range: ₹513.05 – ₹1,025.00

📊 Daily Pivot & Key Levels (1-Day Timeframe)

These are approximate pivot, support and resistance levels based on the most recent pivot analysis published today:

📍 Pivot Point

Central Pivot: ~ ₹850.8

🛑 Resistance Levels

R1: ~ ₹868.1

R2: ~ ₹891.0

R3: ~ ₹908.3

(These are short-term upside barriers where price may slow/reverse)

🟩 Support Levels

S1: ~ ₹827.9

S2: ~ ₹810.6

S3: ~ ₹787.7

(These are immediate downside zones where price could find buying interest)

📌 How to Use These Levels Today

✔ Bullish view:

• Above Pivot ₹850.8 → watch for closing above R1 (~₹868) to strengthen upside bias.

• Breaking and holding above R2 (~₹891) could extend toward R3 (~₹908).

✔ Bearish/Range view:

• Failure below Pivot ₹850.8 or S1 (~₹827.9) increases odds of deeper correction toward S2/S3.

• Intraday rejections at R1/R2 can signal short-term sellers.

SWIGGY 1 Day View 📊 SWIGGY – 1-Day Time Frame Key Levels (Daily Technical View)

📍 Latest Price Context (Approx)

Current/Live price range (recent session): ~₹305–₹315 (trading range today)

🔑 Daily Support Levels

These are price zones where buying interest could emerge if the stock dips:

📌 S1 (Immediate Support): ~₹313–₹315

📌 S2: ~₹307–₹310

📌 S3 (Deeper support): ~₹295–₹300

(levels help define where the stock may stabilize on a pullback)

📈 Daily Resistance Levels

These are zones where price may face selling pressure:

🔹 R1: ~₹329–₹330

🔹 R2: ~₹335–₹336

🔹 R3: ~₹345–₹346

(above these, the stock needs strong momentum to continue higher)

📊 Daily Pivot Levels

Pivot levels often act as reference for thematic direction:

📍 Pivot (Central daily level): ~₹326–₹327

(Above this = mildly bullish bias for the day; below this = bearish bias)

📌 Based on Technical Indicators

Short-term indicators show mixed to bearish bias in daily trend, with several oscillators and moving average signals leaning sell/oversold — reflecting current selling pressure in the market.

DATAPATTNS 1 Week time Frame 📌 Current Price Snapshot (Live / Latest Data)

Data Patterns (India) Ltd price (approx): ~ ₹2,592 — ₹2,620 per share (NSE) based on latest trading session updates.

52‑Week Range:

• High: ₹3,268.80

• Low: ₹1,351.15

📈 Weekly Pivot & Levels (classic method)

Level Price (Approx)

Weekly Pivot (central) ₹2,943.7

Weekly R1 ₹3,277.0

Weekly R2 ₹3,453.4

Weekly R3 ₹3,786.7

Weekly S1 ₹2,767.3

Weekly S2 ₹2,433.9

Weekly S3 ₹2,257.6

🔁 Weekly Fibonacci Pivot Levels (Alternate)

Level Price (Approx)

Weekly Pivot (Fibo) ₹2,943.7

R1 (Fib) ₹3,138.4

R2 (Fib) ₹3,258.7

R3 (Fib) ₹3,453.4

S1 (Fib) ₹2,748.9

S2 (Fib) ₹2,628.7

S3 (Fib) ₹2,433.9

📌 Quick Weekly Levels Summary

Current level (approx): ₹2,592 – ₹2,620

Weekly Pivot: ~₹2,943

Weekly Resistance 1: ~₹3,277

Weekly Resistance 2: ~₹3,453

Weekly Support 1: ~₹2,767

Weekly Support 2: ~₹2,433

Weekly Support 3: ~₹2,258

Part 1 Technical Analysis Vs Institution Option Trading What Are Options?

Options are contracts, not shares.

They give you a right (not an obligation) to buy or sell an underlying asset—usually a stock or index—at a predetermined price.

You do not own the stock, you only trade the contract.

Options derive their value from something else → an index (Nifty, Bank Nifty), stock (Reliance, TCS), or commodities (gold).

Therefore, they are called “derivatives.”

Two basic types:

Call Option (CE) → Right to buy

Put Option (PE) → Right to sell

You can either Buy or Sell (Write) both types.

Option trading allows profits in up, down, and sideways markets.

Part 4 Institutional vs. TechnicalWhy Trade Options?

Retail traders, institutions, and hedgers use options for different reasons:

1. Hedging

Institutions hedge large positions using options to protect risk.

Example:

A mutual fund buys NIFTY PEs to protect its long equity portfolio.

2. Speculation

Small traders use options to generate returns with limited capital.

3. Income Generation

Option sellers earn premium by selling options that they believe will expire worthless.

4. Risk Management

Options allow you to define risk precisely.

Part 2 Institutional vs. TechnicalOption trading involves buying and selling contracts that give the right, but not the obligation, to buy or sell an underlying asset at a set price (strike price) before a certain date (expiry).

- Call Option: Right to buy the asset.

- Put Option: Right to sell the asset.

- Buying Options: Limited risk, potential for high returns.

- Selling Options: Higher risk, potential for income.

Bank Nifty 1 Week Time Frame 📊 Current Approx Level

Bank Nifty (NSEBANK): ~59,595 on 28 Jan 2026.

📈 Weekly Resistance Levels

1. Near-term resistance: ~₹59,600–59,700

– This zone has acted as a supply/resistance band on weekly charts.

2. Immediate overhead resistances: ~₹59,800–60,000

– Breaking and closing above this would signal stronger weekly bullish momentum.

3. Higher resistance cluster: ~₹60,000+

– Psychological/all‑time high areas — strong supply if price approaches.

📉 Weekly Support Levels

1. Key support band: ~₹58,300–58,100

– A critical weekly support zone aligned with trendlines/EMA zones.

2. Secondary support: ~₹57,000–57,500

– Important weekly structure support on pullbacks.

3. Deeper support zone: ~₹56,000 – major structure support

– Very strong demand area if broader correction deepens.

📌 Weekly Pivot Zones (Technical Reference)

From pivot analysis (classic/Fibonacci levels):

Support (S1): ~₹57,124–57,970 (depending on method)

Pivot middle: ~₹58,953

Resistance (R1−R3): ~₹59,627 – 60,780+

These can be used as reference points within the broader weekly structure.

🧠 Summary – Weekly Context

Bullish above: ~₹59,800–60,000 — breakout signals strength.

Neutral/consolidation range: ~₹57,500–59,600 — sideways trend.

Bearish below key support: <₹58,100 — risk of deeper pullback.

HINDZINC 1 Month View 📊 Current Price Context (as of late Jan 28, 2026)

Stock is trading near its recent highs around ₹720–₹730 on NSE.

📈 1-Month Key Levels (Support & Resistance)

🔁 Major Resistance Levels

1. ~₹730–₹735 — Immediate resistance around recent highs/upper range of the month (where price struggled on breakout)

2. ~₹750 — Psychological resistance zone above current levels (weekly/medium term trend)

3. ~₹770–₹780+ — Extended upside if breakout sustains (higher supply zone)

(Break above ~₹735 with strong volume can open room toward these higher targets.)

🔽 Immediate Support Levels

1. ~₹695–₹700 — First support pivot zone (near recent consolidation low)

2. ~₹675–₹680 — Next technical support from pivot and short-term averages

3. ~₹650–₹660 — Stronger 1-month base support if the stock pulls back further

4. ~₹620–₹630 — Major support zone if broader weakness emerges (coincides with longer moving averages)

📊 Moving Average Context

The 20/50/100/200-day SMAs/EMAs are generally positioned below the current price, showing positive slope — often interpreted as bullish momentum on the medium-term charts.

📌 Interpretation / Range Estimate (1-Month)

Based on recent trading dynamics and pivot analysis, a reasonable 1-month trading range could be approximately:

Bullish Scenario: ₹735 → ₹770+

Bearish / Pullback Range: ₹700 → ₹650

This gives a sense of where the stock may find near-term resistance and support around the current price action.

BIKAJI 1 Week View 📌 Current Price Snapshot (Weekly Context)

Current trading price: ~₹645 – ₹651 (NSE) — price has been trending lower recently.

1‑week return: down ~6–7% (indicating short‑term bearish momentum).

📊 Weekly Support & Resistance Levels (Key Zones)

🔹 Resistance (Upside)

These are levels where price may face selling pressure if it tries to rebound:

R1: ~₹680 – ₹686

R2: ~₹695 – ₹700

R3: ~₹710 – ₹722

(these are key weekly/week pivot‑type resistance zones)

🔸 Current Pivot / Short‑Term Reference

Pivot zone: ~₹668 – ₹670 (central bias level)

This is useful for gauging bullish vs bearish bias for the week.

🔻 Support (Downside)

These are levels where buyers could step in on weakness:

S1: ~₹650 – ₹642

S2: ~₹635 – ₹630

S3: ~₹620 – ₹619

(weekly support zones below current price)

📈 How to Interpret These Levels (1‑Week Lens)

🎯 Bearish scenario

If price closes below ~₹640–₹635 on weekly candles → next support around ₹620 becomes important. Continuous closes below that could see deeper pullbacks.

📈 Bullish/Recovery scenario

For a bullish shift at this 1‑week timeframe:

Break above ₹680–₹690 zone convincingly → next upside toward ₹700+

Weekly close above ₹700–₹710 strengthens the reversal thesis.

🟡 Neutral/Range scenario

Between approx ₹650–₹690, expect sideways movement / consolidation with likely choppy action.

AVL 1 Day View📅 Daily (1‑Day) Technical Levels – Aditya Vision Ltd

📌 Current Approx Price (Latest)

~₹474–₹483 range around current trading session (today’s intraday range seen) — price fluctuates in this band.

📊 Pivot / Reference

Pivot ~ ₹479–₹484 (central reference for bias — above = bullish, below = bearish).

🟩 Resistance Levels (Upside)

R1: ~ ₹484–₹485 – first upside barrier.

R2: ~ ₹489–₹492 – next target if momentum improves.

R3: ~ ₹495–₹500+ – higher resistance zone.

🔻 Support Levels (Downside)

S1: ~ ₹474–₹476 – immediate support.

S2: ~ ₹468–₹470 – intermediate support if S1 breaks.

S3: ~ ₹460–₹463 – deeper support zone.

📈 Interpretation (1‑Day View)

Bullish scenario:

✔️ Price holding above pivot ~₹480 strengthens short‑term bullish bias.

✔️ A break above ~₹490–₹492 can open up ~₹495–₹500+ region.

Bearish scenario:

❌ If price decisively drops below ~₹474–₹476, next supports ~₹468 and ~₹463 may be tested.