DXY Breaks a Multi-Year SPT — A Structural Shift in the Dollar📉 Why the U.S. Dollar Is Falling – The Bigger Picture Behind DXY

The recent weakness in the U.S. Dollar (DXY) is not a random move or just a short-term reaction. It’s a result of a deeper shift in market expectations and global capital flows.

Markets are now pricing in a slower U.S. economy and a softer Federal Reserve stance ahead. As inflation pressures ease and rate cut expectations rise, U.S. bond yields have started losing momentum. Since global money always moves toward better relative returns, this has reduced the attractiveness of holding U.S. dollar assets.

At the same time, capital is gradually rotating toward emerging markets, commodities, and risk assets — areas that typically benefit when the dollar weakens. This flow shift is also being accelerated by hedge fund positioning and technical unwinding, making the decline sharper and faster.

A weaker dollar often supports:

• Emerging market equities and currencies (including India)

• Commodities like oil, metals, and gold

• Export-oriented companies

This is not about one news event — it’s about markets repricing the future path of money, interest rates, and growth.

If U.S. yields continue to soften and risk appetite remains strong, DXY may stay under pressure. A reversal would likely need either rising yields again or a renewed hawkish shift from the Fed.

👉 In simple terms:

The dollar is falling because the world is adjusting to a future where U.S. money is no longer becoming more expensive — and global capital is flowing accordingly.

Trend Analysis

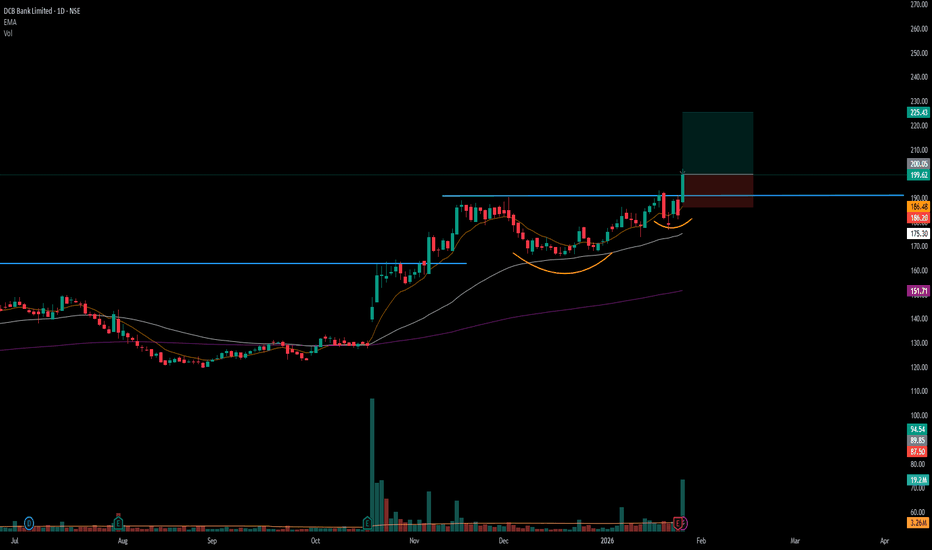

#DCBBANK - BreakOut in DTF with Volume Script: DCBBANK

Key highlights: 💡⚡

📈 C&H BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Base BreakOut

📈 RS Line making 52WH

📈 MACD Crossover

BUY ONLY ABOVE 200 DCB

⏱️ C.M.P 📑💰- 199.62

🟢 Target 🎯🏆 – 12%

⚠️ Stoploss ☠️🚫 – 6%

⚠️ Important: Market conditions are BAD, Avoid entering any Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅ Boost and Follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes. Not a BUY or SELL recommendation.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Dynamic Price & Time Calculations ( Logical approach) One can see the change in the Price % during Positive Movement in the Market

it also show the No of days consumed in the directional move which are ideally known as

motive waves in technical approach

The Speed of Rate of change one must calculate related to No of days

I have made some efforts in Explaining putting the both % tool & No of days Tool on the chart

what you can notice is when speed is moderate

1st Phase Dynamic CAGR is 123.68 % Per Year

2Nd Phase increase in time & increase in Price Movement which results in Dynamic CAGR 170.70%

3ed Phase Speed increase in price displacement but % remain Lower then Previous Two Movements resulting Dynamic CAGR 83.80 %

Now by this time I am not completely agreeing on market trend termination

but if markets turns then it will Give very less revenue in all of the Motive Movements

This is education Content

Goodluck

Daily 1:30 PM IST Crude Oil Trend Setup StrategyPrice action traders on MCX WTI Crude Oil can capture reliable intraday trends by focusing on setups around 1:30 PM IST, using 15-minute - 1hr charts with support/resistance levels and a 10-20 EMA crossover confirmation. This timing aligns with active MCX sessions when momentum builds post-initial volatility.

Chart Analysis

The attached TradingView chart shows CFD WTI Crude Oil on a hourly timeframe.

Core Setup Rules

Monitor price action at exactly 1:30 PM IST for candlestick reversals (e.g., hammers or engulfing) at drawn support/resistance zones.

Confirm entry with 10 EMA crossing above 20 EMA for longs (or reverse for shorts), ensuring alignment with higher timeframe trend.

Target 20 points profit with 15-point stop-loss from entry, as seen in similar crude strategies.

Risk Management Tips

Risk 0.5-1% of capital per trade, trailing stops to breakeven after 10 points. Avoid setups during major news like EIA reports (~8 PM IST). Backtest on TradingView for Nifty/MCX consistency, given your intraday focus. This yields high-probability daily trades in volatile commodities like crude.

0/0, 1/0, 0/1 Explained: MARAL Liquidity Conditions Liquidity Isn’t an Entry — It’s a Test (XAUUSD Case Study)

This XAUUSD chart is a textbook example of why most traders misunderstand liquidity in live markets.

Price moved strongly higher over multiple sessions, creating a clear bullish structure. Many traders see this and immediately think:

“Trend is up → buy pullbacks.”

That assumption is exactly where execution errors begin.

What This Chart Actually Shows (Objectively)

Strong directional move

Price advanced cleanly from the 4700s into the 5100s.

Momentum expansion is obvious.

Structure remains intact.

Price now stalling near prior highs

The market is no longer impulsive.

Candles compress.

Wicks increase.

Range tightens

This is no longer a trend-entry environment.

This is a liquidity decision zone.

Liquidity Reality on This Chart

Liquidity is not something you predict.

It is something price either takes or doesn’t take.

On this chart:

Buy-side liquidity sits above recent highs.

Sell-side liquidity sits below recent higher lows.

At the current price:

Buy-side liquidity is not yet clearly accepted.

Sell-side liquidity is not yet clearly taken.

Meaning:

Price is between liquidity pools.

This is the most dangerous zone for live trading.

Why the “Middle” Is Where Accounts Get Damaged

When price is between liquidity pools:

Risk-to-reward becomes asymmetric.

Breakouts lack confirmation.

Reversals lack fuel.

Entries become emotional, not structural.

Most losing trades happen here, not at extremes.

This is why MARAL treats the middle as a WAIT zone, not an opportunity.

What MARAL Waits for on This Chart

MARAL does not ask:

“Is gold bullish?”

It asks:

“Has liquidity been resolved in a way that permits execution?”

There are only two valid next steps:

1) Buy-Side Liquidity Taken + Acceptance

Price takes the highs.

Holds above them.

Builds acceptance (not just a wick).

Only then does continuation become executable.

2) Buy-Side Liquidity Taken + Rejection

Price takes the highs.

Fails to hold.

Closes back into range.

Only then does mean reversion or pullback logic activate.

Until one of these happens, MARAL stays inactive.

Why This Protects Live Traders

Without liquidity rules, traders:

Buy into resistance.

Sell into support.

Chase candles.

Tighten stops randomly.

Overtrade ranges.

With liquidity rules:

Trades are earned, not guessed.

Entries happen after information, not before.

Risk is defined by structure, not emotion.

MARAL’s job is not to find more trades.

It is to block bad ones.

Key Takeaway from This XAUUSD Chart

This chart is not saying “buy” or “sell.”

It is saying:

“Wait until liquidity makes the decision for you.”

Liquidity tells you where stops were hit.

Execution permission comes from what price does after that.

Until then:

No prediction.

No anticipation.

No forced entries.

MARAL Liquidity Conditions (0/1) — Execution Rules

In MARAL, liquidity isn’t “concept.” It’s a binary event gate. 0.00 = not triggered. 1.00 = triggered.

Reference pools:

PDH = Prev Day High → Buy-side liquidity

PDL = Prev Day Low → Sell-side liquidity

1) 0.00 / 0.00 → “NO LIQUIDITY EVENT” Price is between pools:

Candle High < PDH

Candle Low > PDL

✅ Meaning: No sweep happened. You’re in the middle zone. MARAL prefers WAIT / reduce size / demand extra confirmation.

2) 1.00 / 0.00 → “BUY-SIDE SWEEP EVENT” Triggered when price tags / wicks above PDH (or a defined swing high).

✅ Meaning: stops above highs were likely harvested. Next decision is NOT “buy.” Next decision is “accept or reject above PDH.”

3) 0.00 / 1.00 → “SELL-SIDE SWEEP EVENT” Triggered when price tags / wicks below PDL (or a defined swing low).

✅ Meaning: stops below lows were likely harvested. Next decision is NOT “sell.” Next decision is “accept or reject below PDL.”

4) 1.00 / 1.00 → “DUAL SWEEP / RANGE LIQUIDITY” Both sides got taken in the same session/window:

A push above highs AND a push below lows

✅ Meaning: stop-hunt environment / expansion trap risk. MARAL demands structure reclaim + volatility control before any entry.

Post-sweep MARAL decision gates (the real edge)

After any sweep (Buy-side or Sell-side), MARAL waits for one of two outcomes:

A) Acceptance (Continuation permitted)

Price holds beyond the swept level

Follow-through candles confirm

✅ Interpretation: the sweep was breakout fuel, not a trap.

B) Rejection (Reversal / pullback permitted)

Price wicks beyond the level then closes back inside

Reclaim confirms

✅ Interpretation: the sweep was liquidity grab, not real continuation.

Golden rule

Liquidity flag = “where stops got hit.” Entry permission = “what price did AFTER stops got hit.”

MARAL Liquidity: How It Helps Live Trading (Not Theory)

Most traders know liquidity.

They still lose live — because they trade it too early or in the middle.

MARAL turns liquidity into execution gates so you don’t “guess.”

You wait for the event, then trade the reaction.

1) MARAL converts liquidity into a binary live signal (0/1)

Liquidity becomes usable when it’s measurable:

Buy-side Liquidity (High) = stops above highs (PDH / swing highs)

Sell-side Liquidity (Low) = stops below lows (PDL / swing lows)

0.00 = not triggered on this bar/window

1.00 = triggered on this bar/window

This is huge live, because it kills imagination:

“Did price actually take the pool, yes or no?”

2) 0/0 is NOT “nothing” — it’s a warning

Buy = 0.00 and Sell = 0.00

means: price is between pools.

Live meaning:

you are in mid-range

RR becomes random

both directions can wick you out

How it helps traders:

MARAL stops you from trading the worst zone where most retail accounts get chopped.

3) 1/0 or 0/1 tells you: “Liquidity event just happened”

When you see:

1/0 → buy-side liquidity taken (stops above highs hit)

0/1 → sell-side liquidity taken (stops below lows hit)

Live meaning:

the market just did its “stop run”

now the real question is acceptance vs rejection

How it helps traders:

You stop entering into the sweep.

You wait for what price does after the sweep.

4) The real edge is post-sweep behavior (MARAL live rule)

After a liquidity grab, MARAL expects only 2 outcomes:

A) Acceptance (continuation allowed)

price holds beyond the swept level

follow-through candles confirm

✅ Meaning: sweep acted as fuel

B) Rejection (reversal/pullback allowed)

wick beyond level then closes back inside

reclaim confirms

✅ Meaning: sweep was a trap collection

How it helps traders:

This is how you avoid the #1 mistake:

“I bought the wick.” / “I sold the wick.”

5) 1/1 is a live “danger mode”

Both sides taken (in same session/window) = stop-hunt environment.

Live meaning:

range expansion

fakeouts increase

structure becomes unreliable

How it helps traders:

MARAL forces extra confirmation or reduces trade frequency.

You stop treating volatility as opportunity when it’s actually noise risk.

MARAL Liquidity Summary (Live Trading)

Liquidity is not a setup. It’s a test.

0/0 → middle zone → WAIT

1/0 or 0/1 → sweep happened → trade only after acceptance/rejection

1/1 → stop-hunt regime → high confirmation needed.

Final Note

This analysis is educational, focused on execution behavior, not signals or financial advice.

Use it to improve decision quality, not to chase outcomes.

#Trading #Liquidity #SMC #PriceAction #RiskManagement #Forex #Crypto #XAUUSD #NAS100 #ICT #Liquidity #Engineering

MFSL at Channel Support — Bounce or Breakdown?MFSL is moving inside a well-defined rising channel, showing a healthy and controlled uptrend.

The stock has respected this structure multiple times, with buyers stepping in near the lower support and selling pressure appearing near the upper resistance.

Currently, price is approaching the lower boundary of the channel — a crucial zone where trend continuation usually happens if buyers defend it.

As long as this support holds, the overall trend remains positive.

A clear breakdown below the channel could signal further weakness.

TCS Forming a Classic Bullish Flag — Pause Before the Next Move?TCS witnessed a strong impulsive rally, indicating solid buying momentum.

After the sharp move, the price has entered a controlled downward-sloping channel — a classic bullish flag pattern.

This consolidation phase suggests that the market is taking a healthy pause rather than showing weakness. Sellers are not aggressive, and price is respecting the flag boundaries well.

A decisive breakout above the upper trendline could signal continuation of the previous uptrend with renewed momentum.

However, a breakdown below the lower boundary would invalidate the pattern and may invite further downside.

For now, structure favors a bullish continuation as long as the flag holds.

📌 Key focus: Watch for volume expansion on breakout for confirmation.

RELIANCE Set for 2026 Catalysts-Intraswing for 28th JAN 2026🔥Reliance Industries Set for 2026 Catalysts.

💯ARPU Skyrockets, and Mahakal New Energy Domination – 💥 ₹1,800 Target Locked!"

SCreenshot: Reliance Industries Ignites 2026 Boom - RELIANCE Positional Level Analysis

++++++++$$$$$$$$$$$++++++++

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correction looks weak and corrective, suggesting sellers are still in control. As long as price remains below the invalidation level around 2.0050 , the bearish bias stays valid. The expectation is for the correction to finish soon, followed by Wave 5 to the downside, targeting the lower channel area and the 1.96–1.95 zone. Overall, the trend remains bearish, and any short-term bounce is likely a selling opportunity before the next leg lower.

Stay tuned!

@Money_Dictators

Thank you :)

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in HOMEFIRST

BUY TODAY SELL TOMORROW for 5%

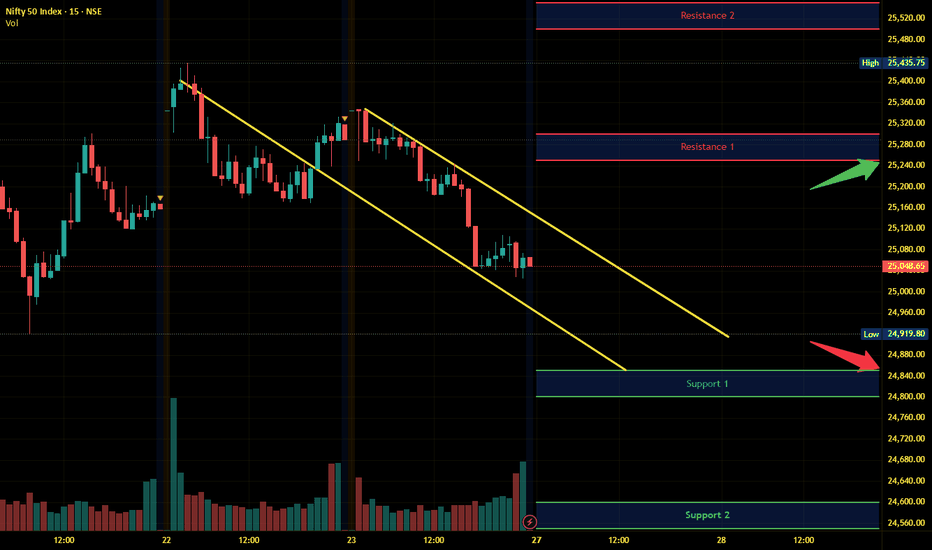

Nifty Intraday Analysis for 27th January 2026NSE:NIFTY

Index has resistance near 25250 – 25300 range and if index crosses and sustains above this level then may reach near 25500 – 26550 range.

Nifty has immediate support near 24850 – 24800 range and if this support is broken then index may tank near 24600 – 24550 range.

The index is expected to move and remain in the positive zone in anticipation of a positive outcome from India EU trade deal scheduled on 27th January’26. However, volatility expected with unwinding of January’26 Month F&O contract expiry.

Banknifty Intraday Analysis for 27th January 2026NSE:BANKNIFTY

Index has resistance near 58850 – 58950 range and if index crosses and sustains above this level then may reach near 59350 – 59450 range.

Banknifty has immediate support near 58050 - 57950 range and if this support is broken then index may tank near 57550 - 57450 range.

The index is expected to move and remain in the positive zone in anticipation of a positive outcome from India EU trade deal scheduled on 27th January’26. However, volatility expected with unwinding of January’26 Month F&O contract expiry.

Finnifty Intraday Analysis for 27th January 2026 NSE:CNXFINANCE

Index has resistance near 27050 - 27100 range and if index crosses and sustains above this level then may reach near 27325 - 27375 range.

Finnifty has immediate support near 26600 – 26550 range and if this support is broken then index may tank near 26325 – 26275 range.

The index is expected to move and remain in the positive zone in anticipation of a positive outcome from India EU trade deal scheduled on 27th January’26. However, volatility expected with unwinding of January’26 Month F&O contract expiry.

Midnifty Intraday Analysis for 27th January 2026NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13200 – 13225 range and if index crosses and sustains above this level then may reach 13350 – 13375 range.

Midnifty has immediate support near 12950 – 12925 range and if this support is broken then index may tank near 12800 – 12775 range.

The index is expected to move and remain in the positive zone in anticipation of a positive outcome from India EU trade deal scheduled on 27th January’26. However, volatility expected with unwinding of January’26 Month F&O contract expiry.

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in APLAPOLLO

BUY TODAY SELL TOMORROW for 5%

Candle Patterns in Technical AnalysisCandle patterns are formations created by Japanese candlesticks on a chart, indicating market sentiment and potential price movements. Here are some common ones:

Bullish Patterns- Hammer: Indicates potential reversal from bearish to bullish.

- Bullish Engulfing: Indicates reversal from bearish to bullish.

- Morning Star: Indicates reversal from bearish to bullish.

Bearish Patterns- Shooting Star: Indicates potential reversal from bullish to bearish.

- Bearish Engulfing: Indicates reversal from bullish to bearish.

- Evening Star: Indicates reversal from bullish to bearish.

Indecision Patterns- Doji: Indicates indecision in market.

- Spinning Top: Indicates indecision.

Chart Patterns in Technical AnalysisChart patterns are formations created by price movements on a chart, helping traders predict future price movements. Here are some common ones:

Reversal Patterns- Head and Shoulders: Indicates a reversal from bullish to bearish.

- Inverse Head and Shoulders: Indicates a reversal from bearish to bullish.

- Double Top: Bearish reversal pattern.

- Double Bottom: Bullish reversal pattern.

Continuation Patterns- Triangle: Can be bullish or bearish, indicates continuation.

- Pennant: Indicates continuation of trend.

- Flag: Indicates continuation of trend.

Other Patterns- Cup and Handle: Bullish pattern indicating continuation.

- Wedge: Can indicate reversal or continuation.