Trend Analysis

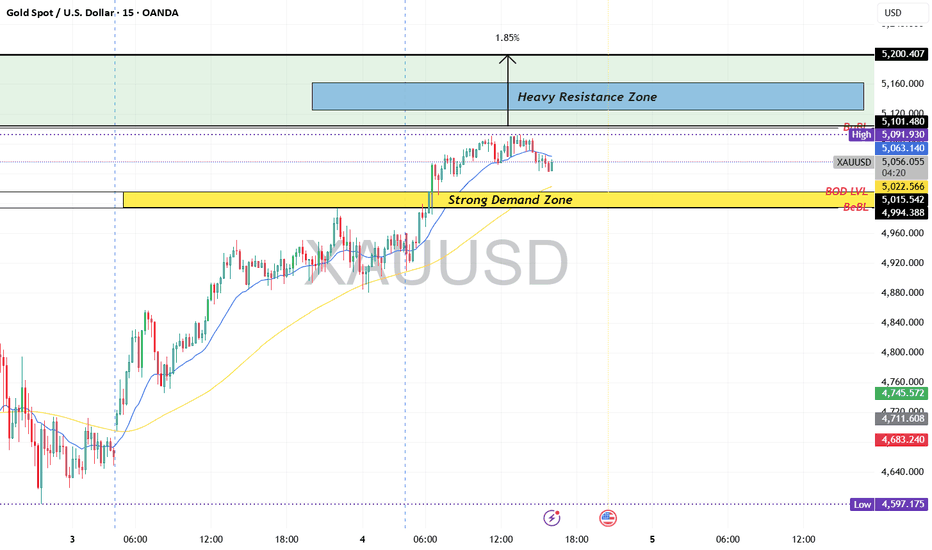

XAU/USD – Bullish Continuation Above Key POI, Targeting Range 🔍 Technical Analysis (45M)

🟢 Market Structure

After a strong bearish impulse, Gold formed a solid base and shifted structure to bullish.

A sequence of higher highs & higher lows is now respected along the upward trendline ✔️

Multiple pivot points confirm buyers are defending higher price levels.

📦 POI & Key Zones

Extreme POI Point (Demand Zone): Major accumulation area that triggered the reversal 🟩

High POI Point (Supply → Mitigation Zone): Price broke above and is now holding as support — bullish sign.

As long as price remains above this High POI zone, continuation is favored.

📈 Breakout & Price Action

Earlier bearish breakouts to the downside failed, followed by strong bullish displacement.

Current structure shows bullish consolidation above the High POI, suggesting continuation rather than reversal.

Pullbacks into the High POI / trendline area are viewed as buy-the-dip opportunities.

🎯 Targets

🎯 Primary Target:

5,120 – 5,150 (Range High / Liquidity Grab Zone)

🎯 Extended Target (if momentum accelerates):

5,180 – 5,220

🛑 Invalidation Level:

Sustained close below 4,950 would weaken the bullish continuation scenario.

✅ Conclusion

Gold remains structurally bullish, supported by strong demand and trendline respect. Holding above the High POI keeps the path open toward the range high target. Expect shallow pullbacks before continuation 📊✨XAU/USD – Bullish Continuation Above Key POI, Targeting Range High

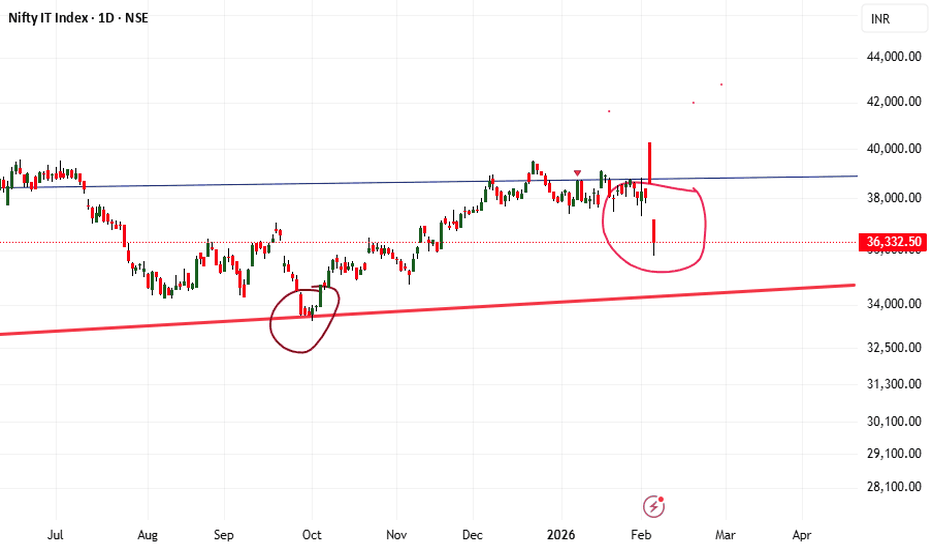

When Broader Market Held the Gap… Why Is NiftyIT the Outlier?When Broader Market Held the Gap… Why Is NiftyIT the Outlier?

Headlines point to explanations like AI bubble fears, US tech weakness, or currency moves.

But are these the real drivers — or just narratives assigned after the move ?

Price leads. News follows.

The weekly price structure appears to have been signaling this divergence well in advance, as price continued to respect higher-timeframe supply while the broader market held firm.

At the same time, the daily Ichimoku structure reflects this conflict . It repeatedly toggled between kumo breakout and kumo breakdown highlighting unresolved higher-timeframe pressure

XAUUSD (Gold) | BULLISH VS BEARISH LEVEL | 4th Feb'2026Gold remains bullish above 5,015–4,995, which is the major demand zone and key trend support. Intraday pullbacks toward 5,030–5,050 can offer buy-on-dips opportunities as long as price holds above this base.

On the upside, 5,090–5,100 is the immediate supply zone. A sustained breakout above 5,100 can accelerate momentum toward 5,125–5,160 and further to 5,200. Only a decisive hourly close below 4,995 would weaken the bullish structure and open downside toward 4,960–4,920.

Market Bias: Bullish above 5,015 | Neutral 5,015–5,050 | Bearish below 4,995

GBPUSD looks bearish for the next few sessions!!ICT Concepts:

- Price swept BSL in Daily timestamp

- IFVG creation on daily showing bearish sentiment

- Daily candle delivering out of CE of the IFVG

- FVG sitting in discount should attract price lower

- Previous breakout region and OB should be the next price targets as mentioned in the chart

Oil India – SMC-Based Trading Outlook (Daily)According to the Smart Money Concepts (SMC) framework, Oil India has delivered a clear bullish Break of Structure (BOS) above ₹494.05, which earlier acted as a strong supply zone. The decisive close above this level confirms that demand has absorbed supply, shifting market control to buyers.

With the BOS confirmed, price has expanded sharply towards the ₹508–₹510 zone, validating bullish intent

Bullish Continuation Scenario (Primary)

BOS Level: ₹494.05 (now flipped into support)

Immediate Upside Target: ₹579

Extended Swing Target: ₹740 (as marked on the chart)

After the impulsive move, a healthy pullback towards the 50% retracement zone (₹495–₹500) would be considered structurally bullish and may offer a high-probability re-entry opportunity for trend continuation.

Alternate Bullish Setup (Support-Based)

If price retraces deeper, the demand zone near ₹448.25 remains a strong institutional support area.

A bullish reversal signal or momentum confirmation from this zone can present a secondary buying opportunity with favorable risk–reward.

Bearish / Risk Scenario

-Failure to hold above ₹448.25 would weaken the bullish structure.

In such a case:

-Breakdown below ₹448.25 → opens downside risk towards ₹420

-This would shift the bias to bearish-to-sideways, with ₹420 acting as a critical decision zone (breakdown vs reversal).

Bullish

-BOS above ₹494.05 → Target ₹579

-Swing extension → ₹740

-Re-entry zone → ₹495–₹500

-Alternate buy → ₹448.25 (on bullish confirmation)

Bearish

-Breakdown below ₹448.25 → ₹420

-Below ₹420 → structure turns weak/sideways

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

The Bearish take on EthereumETH’s price action isn’t resilience — it’s structural weakness.

• ETH failed to lead while BTC stabilized

• No rotation narrative — capital isn’t choosing ETH

• Underperformance is a signal, not noise

Ethereum doesn’t benefit from “digital scarcity.”

• Supply is policy-driven, not fixed

• Monetary credibility depends on human decisions

• In tightening cycles, that’s a liability

The “ETH = tech beta” story is now working against it.

• Risk-off hits growth assets first

• Fees down → activity down → narrative breaks

• Layer-2s dilute value capture, not enhance it

$2,000 isn’t just a round number — it’s structural.

• Prior demand zone

• Psychological anchor

• Forced positioning reset area

A move to $2K wouldn’t be capitulation — it would be repair.

If liquidity tightens, ETH likely overshoots downside first…

then finds real buyers near $2,000.

Weak hands exit above.

Strong hands step in below.

HUDCO: LONG IDEAHUDCO is currently sitting in a high-conviction Demand Zone (₹180–₹185) with the Union Budget 2026 significantly increasing urban infra capex to ₹12.2 lakh crore, the fundamental floor for this PSU remains rock solid.

Support: Strong buyer presence at the ₹180 horizontal pivot

Goal: Targeting a move back toward ₹220 (Initial) and ₹245 (Supply)

Entry: ₹180 - ₹186

Target: ₹220 / ₹245+

Stop Loss: ₹174 (Daily Close)

Sentiment: Bullish Reversal

Risk: High

This is for educational purposes only. Please conduct your own due diligence or consult a financial advisor before trading.

#HUDCO #StockMarketIndia #TechnicalAnalysis #SwingTrade #NiftyPSE #HousingFinance #Budget2026 #PriceAction #TradingIdeas #PSUStocks

Multi Commodity Exchange of India Limited✔ Price trading above 20-day SMA, indicating short-term trend strength.

✔ Recent pullback has found support above breakout zone (~2550).

✔ Clear sequence of higher highs and higher lows.

Setup:

-Entry Zone: on pullback or consolidation above 2550–2575 (your chart’s breakout region).

-Stop-Loss: below recent support and 20-SMA area (~2380–2400).

-Primary Target: 2700 — aligns with near-term analyst targets.

-Extended Target: 2870+ on strong continuation.

Reason To Buy

Volume & Participation: Rising open interest and recent strong closes suggest conviction, not just short-covering.

Macro tailwinds: Elevated precious metals futures activity typically lifts exchange transaction volumes, benefiting MCX’s core business.

Sentiment improvement: Removal of a key legal overhang on MCX improves institutional and retail sentiment.

Risks to watch:

⚠ Broader market weakness or metal price collapses could dampen trading volumes.

⚠ Near–term resistance at 2704 may cap rallies if global risk appetite falters.

Disclaimer: aliceblueonline.com/legal-documentation/disclaimer/

BITCOIN FORECAST BITCOIN still bearish wait for perfect entry ,still institutions accumulating .

but fundamental show still bearish so wait.

discount areas 49000$ - 65000

TP 1 - 98000$

TP 2 - 104000$

TP 3 - 116344$

TP 4 - 126108$

once all take profits are completed . next bull run more surprise for world

long term expected bitcoin price is = 162755 $ - 222734 $

XAUUSD – Brian | H4 Technical AnalysisXAUUSD – Brian | H4 Technical Outlook – Selling Bias After Exhaustion Rally

Gold has completed a strong upside expansion and is now showing clear signs of trend exhaustion on the H4 timeframe. After printing a sharp impulse leg higher, price failed to sustain acceptance above the recent highs and quickly transitioned into a deep corrective move, signalling a shift in short-term market control.

From a structural perspective, the market has moved from impulse → distribution → correction, favouring a selling bias while price remains capped below key resistance.

Market Structure & Fibonacci Context

The recent rally stalled near the upper resistance zone, followed by an aggressive rejection.

Price has retraced deeply into the Fibonacci 0.618–0.75 area, confirming that the move lower is not a minor pullback but a meaningful correction.

Current price action suggests lower highs are forming, keeping selling pressure active on rebounds.

As long as price fails to reclaim and accept above the prior breakdown levels, the bearish structure remains valid.

Key Zones to Watch

Primary SELL Zone

5,716 – 5,866

This is the major supply and sell-liquidity zone on H4. Any corrective rally into this area is likely to attract sellers, especially if price shows hesitation or rejection.

Intermediate Reaction Zone

Around the 0.5–0.618 Fibonacci retracement area, where short-term rebounds may stall before continuation lower.

Downside Targets / Demand

The lower support zone near 4,800–4,850 remains the first key downside area to monitor.

Deeper continuation would expose the 4,600–4,500 region, where broader demand may attempt to absorb selling pressure.

Macro Context (Brief)

Fundamentally, gold is facing headwinds from persistent uncertainty around interest rate expectations. Recent central bank commentary continues to signal caution toward near-term rate cuts, keeping real yields supported and limiting gold’s upside in the short term. This backdrop aligns with the current technical correction and distribution phase.

Trading Outlook

Bias: Selling / sell-on-rallies

Focus: Selling corrective rebounds into resistance zones

Risk note: Avoid chasing price at lows; let structure and levels guide entries

In this phase, patience is key. Selling strength at predefined zones offers higher probability than predicting bottoms.

Refer to the chart for Fibonacci levels, structure shift, and highlighted sell zones.

✅ Follow the TradingView channel to receive early updates on market structure, liquidity shifts, and high-probability zones.

Bandhan Bank Ka Biggest Breakout We may see the biggest breakout in NSE:BANDHANBNK as both technical and financial both showing positive outcome.

As you can see in the chart price is at the supply zone but if it crosses the supply zone, We are about to see the big breakout so lets wait for few conformations before planning trade.

Note : This is not any financial advice NSE:BANDHANBNK #bandhanbank #nse #trend #breakout

The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction⚠️ The Ugly Truth Behind Cathie Wood's $1.5M Bitcoin Prediction Nobody Talks About (The $1M Bitcoin Trap Exposed)

Cathie Wood Just Predicted $1.5M Bitcoin By 2030. Before You Get Excited, Let Me Show You Something Important.

Her Prediction Track Record:

1️⃣ November 2020: Target: $400K-$500K

2️⃣ May 2021: Target: $500K By 2026

3️⃣ September 2021: Target: $500K by 2026

4️⃣ January 2022: Target: $1M+ by 2030

5️⃣ February 2023: Target: $1M-$1.48M by 2030

6️⃣ January 2024: Target: $1.5M by 2030 (Raised 50%)

6️⃣ November 2024: Target: Base $650K, Bull $1.5M by 2030

7️⃣ February 2025: Target: Bull $1.5M, Base $710K, Bear $300K

8️⃣ April 2025: Target: Up to $2.4M by 2030

9️⃣ November 2025: Target: $1.2M by 2030 (Reduced from $1.5M)

Notice The Pattern? The Target Year Keeps Shifting But The Big Numbers Stay In Headlines.

🔰 Ask Yourself This:

If Institutions Truly Believed Bitcoin Will 15x From Here, Why Would They Tell You?

Why Reveal Their “Secret” To Millions Of Retail Investors?

Think About It. When They Announce Massive Targets, Retail Holds Expecting $1M While Institutions Quietly Take Profits. Then They Buy Back Cheaper When You Panic Sell The Dip.

This Is How Exit Liquidity Works.

🔰 The Reality Check:

I Am Not Against Bitcoin Reaching $1M. It Absolutely Can Happen.

But Here Is What Nobody Tells You: Bitcoin Is Not Magic. It Does Not 10x Overnight Because Someone On TV Said So.

$1M Bitcoin Is Possible But Realistic Timeframe Is 5–10 Years Of Holding Through Multiple Cycles, Crashes And Recoveries.

🔰 My Honest Take:

➡️ Institutions Are Not Your Friends. They Are Not Sharing Alpha, They Are Creating Liquidity.

➡️ When ARK Says Buy, Ask Yourself: Who Are They Selling To?

➡️ Big Targets Make Great Headlines But Terrible Trading Strategies.

🔰 What You Should Do Instead:

👉 Never Make Financial Decisions Based On Influencer Predictions.

👉 Do Your Own Research With Proper Calculations.

👉 Have Your Own Entry And Exit Strategy.

👉 Understand That Wealth Building Takes Time Not Tweets.

CryptoPatel Summary:

🔹 Yes Bitcoin Can Reach $1M. I Support That Long Term Vision.

🔹 But It Will Take Years Of Patience, Not Months Of Hopium.

🔹 The Difference Between Retail And Institutions? They Have A Plan. Do You?

🔹 Stop Being Exit Liquidity. Start Being Strategic.

Save This Post. Your Future Self Will Thank You.

Follow @CryptoPatel For Real Talk, Not Hype.

NFA & DYOR

Part 3 Institutional Vs. Technical AnalysisMax Pain Theory

Price gravitates toward the strike where option writers lose the least.

Works well near expiry.

Building an Option Trading System

Identify trend with market structure.

Use volume profile for levels.

Use OI for confirmation.

Use Greeks for probability.

Execute with discipline.

IOC – Classic IHNS Pattern Showing Accumulation Before BreakoutThis chart is a textbook example of an Inverse Head and Shoulders pattern forming after a decline.

First, price made a low (left shoulder).

Then it dropped deeper and formed the head.

After that, it made a higher low (right shoulder), showing selling pressure is weakening.

Now price is consolidating near the neckline, which means buyers are absorbing supply.

This structure usually appears when smart money is accumulating and preparing for a trend reversal.

No indicators.

No noise.

Just pure market structure and human behavior.

Rounding price action + higher low + tight consolidation = strength building.

If price holds above this zone and breaks the neckline, it often leads to a strong upward move.

Markets repeat these patterns again and again — because psychology never changes.

Feel free to comment if you want a deeper explanation.

Part 2 Institutional Vs. Technical AnalysisGamma Scalping

Involves hedging delta during fast markets.

Mostly used by institutions.

Put-Call Ratio (PCR)

Extreme PCR < 0.7 → oversold.

PCR > 1.3 → overbought.

Helps identify reversal zones.

Impact of News

Options react instantly to news.

High IV before news, low IV after.

Nifty IT down by 6%A company called Anthropic released a new set of AI tools that surprised global markets.

One of these tools helps with work like reading documents and automating routine office tasks.

Investors worried that this AI could replace old software and services many companies sell.

Because of this fear, people started selling shares in big software companies.

Big Indian IT companies like Infosys, TCS and Wipro were affected.

The market reaction showed that investors fear AI might cut into profits of traditional tech businesses.

Anthropic’s new tools are meant to save time, but for stock markets it sparked uncertainty.

This event highlighted how powerful and fast AI changes are happening in technology today.

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective