RELIANCE Level Analysis: Intraswing for 23rd JAN 2026Contd...... of 18 Jan 2026 Post.

RELIANCE Level Analysis: Intraswing for 23rd JAN 2026 _____________^^^^^^^^^^_____________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Trend Analysis

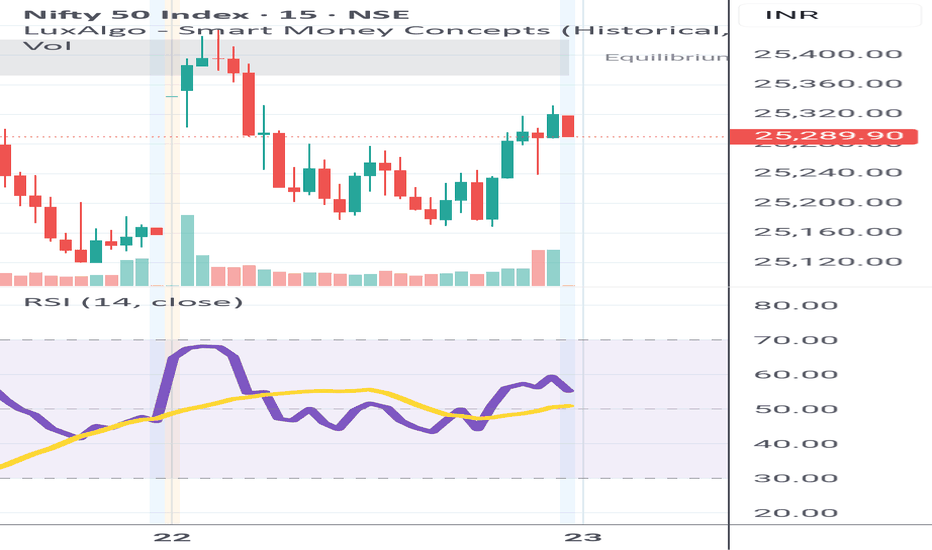

Nifty Intraday Analysis for 22nd January 2026NSE:NIFTY

Index has resistance near 25325 – 25375 range and if index crosses and sustains above this level then may reach near 25550 – 26600 range.

Nifty has immediate support near 24975 – 24925 range and if this support is broken then index may tank near 24750 – 24700 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 25500 level.

Banknifty Intraday Analysis for 22nd January 2026NSE:BANKNIFTY

Index has resistance near 59200 – 59300 range and if index crosses and sustains above this level then may reach near 59800 – 59900 range.

Banknifty has immediate support near 57800 - 57700 range and if this support is broken then index may tank near 57300 - 57200 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 59800 level.

NIFTY Analysis for 23d JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 23d JAN 2026: IntraSwing Spot levels

👇🏼Screenshot of NIFTY Spot All-day(22nd Jan 2026) in 5 min TF.

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of GIFTNIFTY Feb 2026 EXP. as of now (22nd Jan 2026) in 5 min TF.

____________^^^^^^^^^^__________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Finnifty Intraday Analysis for 22nd January 2026 NSE:CNXFINANCE

Index has resistance near 27175 - 27225 range and if index crosses and sustains above this level then may reach near 27450 - 27500 range.

Finnifty has immediate support near 26725 – 26675 range and if this support is broken then index may tank near 26550 – 26500 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 27600 level.

Midnifty Intraday Analysis for 22nd January 2026NSE:NIFTY_MID_SELECT

Index has immediate resistance near 13275 – 13300 range and if index crosses and sustains above this level then may reach 13425 – 13450 range.

Midnifty has immediate support near 13025 – 13000 range and if this support is broken then index may tank near 12875 – 12850 range.

The market is expected to react to the US President Trump’s speech tonight on conflict with European countries over Greenland and other related issues at WEF, Davos. Short term uptrend will be confirmed only if the index sustains and closes above 13400 level.

XAUUSD (Gold) | Technical Outlook | 22nd Jan'2026Gold continues to trade near 4,831, maintaining a strong bullish structure across all major timeframes. Price remains firmly above key moving averages (20/50/100/200), signaling sustained buyer control and trend continuation.

Momentum indicators support the upside, with RSI in bullish territory, MACD positive, and ADX above 35, confirming strong trend strength. Volatility remains elevated, suggesting sharp and directional price moves.

Key Levels to Watch

Support: 4,800–4,790 | 4,770–4,760 | 4,740–4,730

Resistance: 4,838–4,845 | 4,870–4,888

Major Breakout: Above 4,900

Bullish Bias

As long as Gold holds above 4,770–4,780, the trend remains bullish. A break and close above 4,845 could trigger momentum buying toward 4,870 → 4,900+. Pullbacks are expected to remain corrective.

Bearish / Correction

Bearish pressure emerges only below 4,770, with downside levels at 4,740 → 4,700 → 4,660. Trend reversal only if 4,630 breaks on a daily close.

Trading Focus

Buy on dips near 4,800–4,790

Sell only on breakdown below 4,770

Watch US PMI, GDP, Jobless Claims, Fed commentary & DXY for volatility

Conclusion

Gold remains firmly bullish, with the path of least resistance pointing higher unless key supports fail.

Part 11 Trading Master Class With Experts Time Decay (Theta)

Theta represents how much value option will lose per day even if price doesn’t move.

Sellers LOVE Theta

Buyers FEAR Theta

Near expiry:

A ₹200 premium may fall to ₹20 even with little change in spot.

This is how sellers make money consistently.

NIFTY – Short-term & Long-term Outlook from Demand ZoneNifty has shown a strong rejection from the 24,900–24,500 historical demand zone.

On the 4H chart:

Long lower wick near 24,900 indicates aggressive buyer participation.

RSI exhaustion and reversal suggests selling pressure has weakened.

Trendline and EMAs remain intact.

Short-term View:

Above 24,900 → upside possible towards 25,600 – 25,900

Below 24,900 (sustained) → downside towards 24,500

Long-term View:

24,500 is the major invalidation level.

Above 24,700–24,900, bias remains bullish on dips.

Upside targets: 26,000 – 26,400+

Disclaimer:

I am not a SEBI registered advisor. This analysis is for educational purposes only. Please do your own research before taking any trades.

Part 12 Trading Master Class With Experts Why Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

This flexibility makes options superior to normal equity trading.

Part 5 Advance Trading Knowledge Introduction to Option Trading

Option trading is a sophisticated financial market activity that allows traders and investors to manage risk, speculate on price movements, and generate income using derivative instruments known as options. Unlike traditional equity trading—where an investor buys or sells shares outright—options derive their value from an underlying asset such as stocks, indices, commodities, currencies, or cryptocurrencies.

An option contract gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. The seller (writer) of the option, on the other hand, has the obligation to fulfill the contract if the buyer chooses to exercise it.

Option trading is widely used in global financial markets due to its flexibility, leverage, and ability to profit in rising, falling, or even sideways markets.

BANK Of India weekly chart1. Pattern identification: The weekly Bank of India chart shows a rounding bottom marked with a white arc, indicating a potential long‑term reversal from downtrend to uptrend.

2. Current price action:

Price is ₹166.75 (close) with a 5.98% gain.

The stock is approaching the rim of the saucer near ₹170.

3. Breakout analysis:

A clean break above ₹170 on strong volume will confirm the rounding‑bottom completion and trigger a bullish move.

Target can be estimated by measuring the depth of the saucer, rise from bottom to rim.

4. Volume & momentum:

Volume spikes are seen during the bottom formation and recent rise, supporting accumulation.

5. The View :

Initiate a long position on a decisive breakout above ₹170 with a noticeable volume surge (preferably > average volume).

Stop‑loss: Place a protective stop below the lower support, around ₹160, to limit loss if the pattern fails.

The pattern suggests buyers are gaining control; risk‑reward is favorable if the breakout holds.

Bitcoin Bybit chart analysis JENUARY 21Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq has been acting up lately.

As the Nasdaq is undergoing forced coupling,

please pay close attention to its movements.

*Long Position Strategy:

1. Confirm the touch of the purple finger at the top,

and then switch to a long position at $88,784 at the red finger at the bottom.

/ If the purple support line is broken, set a stop loss.

2. $91,612.7 long position initial target -> Top, then Good in that order.

If the strategy is successful, $90,566.3 is the long position re-entry point.

If the upper level falls immediately without touching the first point,

wait for a final long position at point 2. / If the green support line is broken, set a stop loss.

Today's bottom -> $86,977.3

is a major rebound point on the daily Bollinger Band chart.

Also, the orange resistance line at the top is the center line of the 4-hour Bollinger Band chart.

A strong breakout of this area is necessary for a true rebound.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

MedPlus: Rising Channel Accumulation – Swing Opportunity StudyOn the daily chart, MedPlus Health Services is trading within a well-defined rising channel, indicating controlled accumulation after a prior decline. Price action shows higher lows and stable demand, while upside progress remains capped by a major resistance band.

🔸 Key Support Levels

₹740–760 → Primary channel support & accumulation zone

₹780–800 → Mid-channel support / short-term decision area

Holding above these zones keeps the bullish swing structure intact.

🔸 Key Resistance Levels

₹845–850 → Major horizontal resistance & breakout trigger

₹880–900 → First expansion zone after breakout

₹940–960 → Upper swing projection / prior rejection area

A decisive daily close above ₹850 with volume would indicate trend continuation, while failure to hold channel support would weaken the structure.

🔸 Invalidation Level (Structure Failure)

Below ₹740 (daily close)

Channel breakdown would invalidate the current swing thesis and suggest further consolidation or downside.

🔹 Swing Study Summary

Structure: Higher lows inside rising channel

Bias: Neutral-to-positive while above ₹740

Decision zone: ₹845–850

⚠️ Note

This analysis is for educational and chart-study purposes only.

It is not a buy/sell recommendation.