Trump speaks tonight — Gold at decision point.Market Context (H1–H4)

Gold remains in a broader bullish structure, but short-term price action has shifted into a decision phase after rejecting ATH. The sharp drop created a displacement leg, followed by a corrective bounce — typical post-event behavior.

Structurally:

HTF trend is still upward (ascending channel intact)

No confirmed HTF bearish reversal yet

Current move looks like rebalancing, not trend failure

Fundamental Context

Trump’s speech tonight is the key volatility trigger

Any geopolitical / USD-impacting rhetoric can cause:

A liquidity sweep before direction

Or a direct continuation if risk-off sentiment returns

Market is likely positioning → expect fake moves before clarity

Technical Breakdown

ATH: recent distribution, not yet reclaimed

FVG (upper): potential reaction zone for sellers if price rallies

Mid Zone (~5090–5120): short-term decision / balance area

Strong Demand (~4980–5000): HTF buy zone, aligns with trendline & prior BOS base

Trading Scenarios (If–Then)

If price holds above 5090–5120 → look for continuation into FVG, then ATH test

If price sweeps below 5090 but reclaims → classic liquidity grab → BUY continuation

If price breaks and holds below 5000 (H1 close) → deeper pullback, bullish bias pauses (not flips yet)

Key Takeaway

This is not the place to chase.

Trade reactions, not headlines.

Let Trump speak → let liquidity show → then follow structure.

Bias: Bullish continuation unless strong demand fails.

Trend Analysis

Gold Rejected at High – Sellers Take Control🔴 What the chart is saying NOW

Big rejection from 5600

Sharp breakdown below 5500

Structure shifted from bullish flag → bearish continuation

Current price ~5196

Lower high + lower low = trend flip intraday

This is distribution → breakdown, not a dip-buy anymore.

🧠 Market Bias (important)

Below 5250 = Sell on rise

Bulls invalidated for intraday

Only bounce trades, no blind buys

✅ If you want a FRESH TRADE idea (optional)

Sell below 5230

Targets: 5150 → 5080

SL: 5285

Entry setup11Before Trade Entry Follow the Step:-(check list)

Step 1:- Identify the Trend

Step 2:- Bullish Trend Wait for Support Price & Reversal Candlestick(Take Buy)

Step 3:- Bearish Trend Wait for Resistance & Reversal Candlestick(Take Sell)

Step 4:- Fibonacci retracement confirm

Step 5:- Wait for Reversal candlestick

My Trading Role:-

1. Don't Lose capital

2. Trade less Earn More

Focus On:-

1. Quality Trades

2. Risk Management

3. Self - Discipline

RISK WARNING:- All trading involves risk. Only risk capital you're prepared to lose. This chart has not given any investment advice, only for educational purposes

Part 1 Institutional VS. Technical

Key Components of Options- Underlying Asset: The security (stock, index, etc.) the option is based on.

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiry Date: The last day the option can be exercised.

- Premium: The price of the option contract.

VEDL 1 Day Time Frame 📊 Key Daily Price Levels (NSE)

(Current price context — road-tested from multiple live feeds)

⛳ Pivot & Intraday Reference (Daily pivot is the key bias level)

• Daily Pivot: ~₹685 – ₹719 region (major pivot range varies by source)

📈 Resistances (Upside Levels)

• R1: ~₹725 – ₹730 zone — initial resistance for bulls today

• R2: ~₹738 – ₹751 — stronger barrier area where sellers may step in

• R3: ~₹760 – ₹803 (higher overhead zone) — breakout target if momentum is strong

📉 Supports (Downside / Bounce Zones)

• Immediate Support: ~₹700 – ₹710 (near today’s intraday low mid-range)

• Next Support: ~₹689 – ₹690 (lower circuit boundary / near recent low)

• Deeper Support Zones: ₹665-₹660 cluster — a demand zone if price slips further

📌 What Today’s Price Action Looks Like

• Currently trading in a wide intraday range ~₹695–₹755 today on NSE — volatile with a broadened circuit range of ₹689.75 (LC) to ₹842.95 (UC).

• The stock has been in strong short-term uptrend, but faces selling pressure near upper resistances — this suggests cautious profit-booking near R1-R2 unless breakout with volume confirms strength.

📊 Technical Indicator Context (Daily)

⚡ RSI/oscillators on some providers show overbought conditions on short timeframe, indicating possible pullbacks if resistance holds.

Key Levels to Use for Stops/Entries:

Stop-loss (for long trades): below ₹689 (intraday structural support).

Aggressive breakout entry: above ₹738-₹750 (for momentum play).

Support test entry: near ₹700-₹690 (with tight stop).

GOLD FUTURERS :Shooting star Candle shows exhaustion Buy on DipsGOLD Futurers : It has formed a Shooting Star at resistance shows exhaustion at higher levels. Expect a pullback towards 158000-151000.

Trend for Gold MCX remains bullish, but a Shooting Star at resistance signals a short-term pullback

As per Fib retracement and EMA Levels i will be a buyer at the following levels 1. At Between 10 EMA: 157,735-20 EMA: 150,960 zone -part

2.At 50% Fib retracement levels of around 1,39,000-Aggressive buy

For educational purpose only)

Two Very Different Futures for Bitcoin Two Very Different Futures for Bitcoin 🔥

Don’t skip this one - the monthly chart decides

Bitcoin is approaching a critical decision zone on the monthly timeframe — one that could shape market behaviour well beyond short-term volatility.

From a structural and macro lens, a few developments stand out clearly:

1. Major supply has been swept, suggesting late-stage participation at higher levels

2. The long-term monthly trendline has been decisively broken

3. Price retested the broken trendline and has since started to roll over — a classic structural shift

4. A clearly defined demand zone between 48K–64K now sits below current price

5. This zone aligns with the 50-period EMA, strengthening it as a potential reaction area

Two macro-consistent paths emerge from here:

Scenario 1 (Higher probability):

Bitcoin retraces into the 48K–64K demand zone, finds support near the 50 EMA, and then resumes its broader bullish trajectory — eventually targeting liquidity above prior all-time highs (~125K).

This would represent a structural reset within a larger bullish cycle, consistent with historical behaviour during expansionary phases.

Scenario 2 (Lower probability, higher impact):

Bitcoin tests the same demand zone but fails to hold, leading to continued downside and a deeper move toward the long-term trendline low near ~18K.

This outcome would likely require a material macro trigger — tighter global liquidity, regulatory shocks, or a broader risk-off event. Less probable, but not dismissible.

Sharing this as a macro-structural study, not a directional call.

Analysis only. Not investment advice.

KOTAKBANK Level Analysis: Till Budget DayKOTAKBANK Level Analysis: Till Budget Day

Screen Shot: LEVELS for Positional Trading Published heading

"KOTAKBANSK: BUDGET Special Level Analysis for 30th JAN 2026+"

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

KOTAKBASNK: BUDGET Special Level Analysis for 30th JAN 2026+KOTAKBANK: BUDGET Special Level Analysis for 30th JAN 2026+

Screenshot of "KOTAKBANK Level Analysis: Till Budget Day" Watch Live Post (published Later)

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

BEL : High-Quality Setup Despite Market Weakness📊 Technical Catalysts :

This is a perfect VCP structure with a clean breakout supported by strong volume, clearly indicating institutional interest. The stop loss is well placed below the basing formation, keeping risk structurally defined. The 20 EMA crossing above the 50 EMA further confirms a bullish trend shift.

EPS and Sales are continuously increasing for the past few quarter. The only dip was in June and this is not a stock specific event but a market wide scenario.

🏭 Fundamental Catalysts :

Good Results ; EPS and Sales are continuously increasing for the past few quarter. The only dip was in June and this is not a stock specific event but a market wide scenario.

Q3 Beat: Net profit grew 20.4% YoY (₹1,590 Cr), comfortably beating street estimates. Revenue execution is at an all-time high.

The EU FTA Factor: The "Mother of All Deals" signed on Jan 27 opens up a $750B market for Indian defense electronics. BEL is the primary beneficiary as it scales up exports to European nations looking to de-risk from China/Russia.

Budget 2026 Speculation: With the Union Budget on Feb 1, the market is front-running a likely increase in defense capital outlay.

Even though the broader market is showing signs of weakness, the confluence of strong technical structure, volume-backed breakout, moving-average crossover, and improving fundamentals provides enough confidence to take this trade, while still maintaining disciplined risk management with a standard 1% risk per trade.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

The U.S. Tech Sector’s Engagement With The Indian Market1. Introduction: U.S. Tech in India — A Strategic Presence

The United States technology sector plays a central role in India’s digital and economic transformation. American tech companies, from platform giants like Amazon, Microsoft, and Google to niche cloud and AI providers, are investing heavily in India — not just in revenue generation, but also in infrastructure, innovation, skill development and supply chain diversification. These movements reflect a deepening integration between the two largest democracies’ economies, specifically in advanced technologies like cloud computing, artificial intelligence (AI), SaaS, and semiconductors.

2. Scale of Investment: Billions Committed

In recent years, U.S. tech giants have announced multi‑billion‑dollar investments focused on India’s future tech stack:

Amazon has committed more than $35 billion through 2030 to grow AI capabilities, exports, logistics, and jobs in India — part of a larger history of $40 billion in investments since 2010. This push is aimed at making India a major AI and e‑commerce hub, with a target of creating 1 million jobs by the end of the decade.

Microsoft plans to invest around $17.5 billion over approximately four years to expand cloud, AI, and digital infrastructure. A major part of this is enhancing AI skills — having doubled its commitments to train millions of Indians in AI technologies.

Google is investing $15 billion to establish what it calls its largest AI hub outside the U.S. in Visakhapatnam, complete with data centers, fiber‑optic networks, and subsea connectivity that will accelerate AI development and digital services across the region.

Together, these demonstrate how U.S. tech capital is flowing into India’s infrastructure layer, not just in customer‑facing products but in foundational compute and AI resources.

3. Market Drivers: Why U.S. Tech Is Betting on India

Several compelling factors make India attractive to U.S. technology companies:

a. Huge and Growing Digital Economy

India is one of the fastest‑growing digital markets in the world, with increasing internet penetration, mobile usage, and consumer tech adoption. Domestic IT spending, including cloud and AI subscriptions, has been rising rapidly (with forecasts indicating enterprise IT spending crossing over $176 billion in 2026).

b. Talent and Capabilities

India’s large pool of software developers, engineers, and digital professionals is a key asset. India accounts for over 50% of global global capability centers (GCCs) — specialized tech and engineering hubs set up by multinationals to serve global operations. These centers allow U.S. firms to innovate and deliver services worldwide from India.

c. Strategic Regulatory Environment

India’s business environment permits 100% foreign direct investment (FDI) in software, cloud services, and technology platforms through automatic routes — making entry and operations smoother for U.S. companies. Policies like the Digital Personal Data Protection Act and bilateral frameworks like the United States–India Initiative on Critical and Emerging Technology (iCET) further support cooperation in AI, quantum computing, semiconductors, and more.

4. Partnerships and Collaborative Innovation

Beyond large capital outlays, U.S. tech firms are partnering with Indian organizations in several strategic ways:

Many companies are linking with local partners on infrastructure projects — for example, Google’s Visakhapatnam AI hub is developed in collaboration with India’s Adani Group.

U.S. firms are increasingly integrating with India’s “digital public infrastructure” — including systems like Aadhaar, UPI, and other digital frameworks that streamline payments, identity management, and cloud‑native services.

Venture capital and private equity firms (e.g., Accel) continue to fund Indian startup ecosystems, aligning U.S. capital with India’s burgeoning SaaS, edtech, and fintech companies.

These collaborations not only help U.S. companies localize their offerings but also stimulate innovation within India’s tech ecosystem itself.

5. Workforce Dynamics: Migration and Skill Exchange

The tech workforce interplay between the U.S. and India is complex and evolving:

Longstanding trends saw Indian professionals taking up tech roles in the U.S., especially through the H‑1B visa program. New policy changes and uncertainty around visas have contributed to a reverse flow, with more tech workers relocating to India — a shift captured in recent LinkedIn data showing a 40 % rise in U.S. tech professionals moving to India.

Conversely, Indian IT companies historically employed hundreds of thousands of Americans, contributing significantly to the U.S. economy through jobs and revenue.

This dynamic reflects a maturing global tech labor market, where India is emerging not only as a talent supplier but also as a destination for global tech careers.

6. Economic Impact on Indian Market Players

American tech investments affect Indian companies in both competitive and complementary ways:

Indian IT services firms (such as TCS, Infosys, Wipro, HCL) still derive a sizable portion of their revenues from the U.S. market — often through outsourcing contracts and enterprise services. Stocks of these companies can be sensitive to U.S. policy shifts and macroeconomic trends. Recent visa policy changes have at times triggered volatility in Indian IT shares, highlighting their dependence on U.S. demand.

U.S. cloud platforms (AWS, Azure, Google Cloud) are expanding services to Indian enterprises, increasing competition with domestic cloud players but also raising the overall tech spending pie through digital transformation.

7. Challenges and Risks Facing U.S. Tech in India

Despite strong growth prospects, several challenges persist:

a. Regulatory and Policy Risks

Data localization, cross‑border flow restrictions, and evolving digital regulation can create uncertainty for foreign tech firms balancing compliance and innovation.

b. Geopolitical Shifts

U.S.–China trade tensions and shifting visa policies in the U.S. can indirectly impact strategy and workforce planning for tech companies in India.

c. Infrastructure and Talent Gaps

While India’s talent base is deep, there are skills mismatches in areas like advanced AI research and semiconductor fabrication capacity — which U.S. firms are trying to address through training initiatives and collaborations.

8. Looking Ahead: Strategic Future Opportunities

The trajectory of U.S. tech in India points toward deepening involvement in core technological domains, including:

AI and machine learning infrastructure development

Cloud and edge computing expansion

Semiconductor partnerships and manufacturing ecosystems

Joint research in quantum, cybersecurity, and digital infrastructure

Both countries’ governments are also strengthening tech ties through initiatives like iCET, which aim to institutionalize cooperation in emerging technologies — potentially accelerating innovation hubs, talent exchange and joint R&D on a global scale.

9. Conclusion: U.S. Tech as a Pillar of India’s Digital Growth

In summary, the U.S. tech sector’s engagement with the Indian market has matured from services‑oriented outsourcing to deep strategic investment across cloud, AI, infrastructure, and talent development. This evolving partnership is transforming India into a global tech hub, driven by massive capital commitments from U.S. firms and supported by India’s regulatory reforms, digital initiatives, and talent base. As technologies such as AI and cloud computing reshape global markets, the U.S.–India tech linkage is likely to become even more central to global innovation ecosystems in the coming decade.

AI and Technology Stocks: A Comprehensive Overview1. Understanding AI and Technology Stocks

Technology stocks broadly include companies engaged in software development, hardware manufacturing, cloud computing, semiconductors, networking, and IT services. Within this sector, AI stocks are a subset focused on companies that develop artificial intelligence solutions, including machine learning, natural language processing, computer vision, and robotics. Leading AI stocks are often also technology companies but with a significant focus on AI-enabled products or services.

Major players in AI and technology include companies such as Microsoft, NVIDIA, Alphabet (Google), Amazon, Meta Platforms, Tesla, and Intel. Each of these companies leverages AI differently: NVIDIA through AI chipsets, Microsoft and Google via AI cloud services and software, Amazon through AI-driven logistics and recommendation engines, and Tesla with AI for autonomous vehicles.

2. Drivers of Growth in AI and Technology Stocks

Several macro and microeconomic factors have driven the growth of AI and technology stocks:

Cloud Computing and Big Data: The adoption of cloud infrastructure has expanded rapidly, with AI algorithms requiring massive computational power and storage. Companies providing cloud solutions, like Amazon Web Services, Microsoft Azure, and Google Cloud, benefit from both AI and broader technology trends.

AI Integration Across Industries: AI is no longer confined to tech companies. Financial services, healthcare, automotive, retail, and manufacturing increasingly implement AI for efficiency, predictive analytics, and automation. This cross-industry adoption fuels revenue growth for AI technology providers.

Semiconductor Demand: AI applications rely heavily on GPUs and specialized AI chips. Companies like NVIDIA and AMD have become central to AI development, as their processors are critical for training large language models and running complex AI workloads.

Automation and Productivity: AI enhances operational efficiency by automating repetitive tasks, improving decision-making through predictive analytics, and reducing costs. This value proposition makes AI investments appealing both to enterprises and investors.

Research and Innovation: AI research, including breakthroughs in natural language processing (NLP), computer vision, reinforcement learning, and generative AI, has accelerated. Investment in R&D strengthens competitive moats for technology companies, which is reflected in stock valuations.

3. Investment Characteristics of AI and Technology Stocks

Investing in AI and technology stocks has distinct characteristics:

High Growth Potential: AI and tech stocks often outperform traditional sectors due to their growth-oriented nature. Revenue growth rates in AI-focused companies can be exponential, driven by adoption of AI tools, cloud computing, and SaaS (Software as a Service) solutions.

Volatility: High growth comes with high volatility. AI and technology stocks are sensitive to market sentiment, technological shifts, regulatory changes, and macroeconomic conditions like interest rates. Short-term price swings can be significant, requiring investors to have a long-term perspective.

Valuation Challenges: Many AI and tech stocks trade at premium valuations relative to earnings, reflecting expected future growth rather than current profitability. Metrics such as price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-revenue (EV/R) are often higher than the broader market, reflecting investor optimism.

Network Effects: Many AI and tech companies benefit from network effects. For example, social media platforms like Meta gain value as user engagement increases, while cloud platforms become more entrenched as enterprises build ecosystems on them.

Recurring Revenue Models: AI and software companies often rely on subscription-based models, providing predictable and recurring revenue streams. SaaS and AI-as-a-Service offerings contribute to long-term profitability and valuation stability.

4. Key Sectors within AI and Technology

AI and technology stocks span multiple sub-sectors:

Semiconductors: The backbone of AI computing, companies like NVIDIA, Intel, AMD, and Qualcomm dominate chip production for AI, data centers, and edge computing.

Cloud Computing and SaaS: AI-driven cloud services are essential for enterprise digital transformation. Microsoft, Amazon, Salesforce, and Snowflake exemplify this sector.

Autonomous Vehicles and Robotics: AI powers autonomous driving, drones, and industrial robotics. Tesla, Waymo, Boston Dynamics, and ABB leverage AI for automation, which opens new revenue streams.

Cybersecurity: AI is crucial in threat detection, anomaly detection, and automated response systems. Companies like Palo Alto Networks, CrowdStrike, and Fortinet integrate AI into their cybersecurity solutions.

Consumer Technology and Platforms: AI enables recommendation systems, personalization, and smart devices. Apple, Alphabet, and Meta integrate AI into consumer products and services to enhance engagement and monetization.

5. Trends Shaping AI and Technology Stocks

Several trends are shaping the AI and technology sector:

Generative AI: Generative AI models like ChatGPT, DALL-E, and other large language models have opened new commercial applications, from content creation to automated coding, fueling investor enthusiasm.

AI Democratization: Cloud-based AI platforms enable smaller companies to adopt AI without heavy infrastructure investment, broadening market adoption and creating new investment opportunities.

Edge Computing and IoT: AI integration in Internet of Things (IoT) devices allows real-time processing at the edge, expanding applications in smart homes, industrial automation, and healthcare monitoring.

Mergers and Acquisitions: Large tech companies are acquiring AI startups to accelerate innovation, expand capabilities, and secure talent, impacting stock valuations and sector dynamics.

Regulatory Focus: Governments worldwide are exploring AI regulation to address ethical concerns, data privacy, and job displacement. While regulation can limit certain practices, clear rules may also enhance investor confidence in sustainable AI adoption.

6. Risks and Challenges

Investing in AI and technology stocks carries risks:

Market Volatility: High-growth AI and tech stocks are sensitive to interest rate changes, inflation, and market cycles, which can create sharp declines during downturns.

Competition: Rapid innovation attracts competition. Startups can disrupt established players, while large firms must continually innovate to maintain dominance.

Regulatory Risks: AI-specific regulations, antitrust concerns, and data privacy laws may affect profitability and business models.

Ethical and Social Implications: AI adoption raises questions about job displacement, algorithmic bias, and misuse, which could impact public perception and lead to policy intervention.

Valuation Risk: High valuations mean that even minor setbacks or earnings misses can trigger large corrections in stock prices.

7. Investment Strategies

Investors approach AI and technology stocks differently based on risk tolerance and objectives:

Growth Investing: Focused on high-growth AI and tech leaders, anticipating long-term revenue and market expansion.

Diversification: Using ETFs or mutual funds like the Global X Artificial Intelligence & Technology ETF (AIQ) to mitigate company-specific risks while gaining exposure to the sector.

Thematic Investing: Targeting AI, cloud computing, robotics, or cybersecurity themes within the broader technology space.

Long-Term Horizon: Many AI technologies require years to reach maturity, so patient capital tends to benefit from the compounding growth of leaders in the space.

8. Outlook

The outlook for AI and technology stocks remains bullish, driven by continuous innovation, expanding applications, and increasing global digitalization. However, volatility, regulatory developments, and competitive pressures will shape the trajectory. Investors who focus on high-quality companies with strong AI integration, robust balance sheets, and scalable business models are likely to capture the sector's long-term growth.

AI and technology stocks are more than just market trends—they represent a paradigm shift in the global economy, influencing productivity, business models, and societal interaction. While the ride can be volatile, the potential rewards are significant for investors willing to embrace innovation and understand the transformative impact of AI and technology.

GODREJPROP Level Analysis: Intraswing for 30th JAN 2026+GODREJPROP Level Analysis: Intraswing for 30th JAN 2026+

Pause after Perfect H&S Correction.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

XAUUSD – Brian | 30M – Value Shift AfterXAUUSD – Brian | 30M – Value Shift After a Sharp Volatility Move

Gold has just experienced a significant volatility event, with price selling off aggressively from the highs before rebounding sharply. The market is now trading around a newly formed value area, a typical behavior when price transitions from expansion into a rebalancing phase. In this environment, value and POC levels tend to guide price more effectively than individual candles.

Macro Context (Brief)

Market sentiment remains sensitive to macro risks, including commodity volatility, geopolitical tensions, and monetary policy expectations. Gold ETF holdings have shown no meaningful change recently, suggesting no clear signs of institutional liquidation. The current volatility therefore appears more consistent with a positioning adjustment rather than a broader trend reversal.

Technical Analysis from the Chart (30M)

Following the sharp sell-off, price is now forming a well-defined trading range, with value areas acting as key reference points:

1) Upper Supply / Reaction Zones

POC – SELL: 5,531–5,526

The previous high-value zone, where selling pressure may re-emerge if price retraces higher.

Sell VAH: 5,365–5,369

The value area high, typically a reaction zone if distribution pressure remains present.

2) Current Balance Area

The 5,180–5,200 region is currently acting as a balancing zone after the volatility. Acceptance and consolidation above this area would increase the probability of a move back towards the VAH.

3) Lower Demand / Support Zones

POC Buy (scalping): 5,187

A short-term support area for technical reactions.

Buy VAL – Support: 5,058–5,064

The most important lower support zone. If a deeper liquidity sweep occurs, this area is likely to attract attention for potential absorption and short-term reversal.

Price Scenarios (Structure-Based)

Scenario A (Preferred if value holds):

Price holds above 5,180–5,200 → recovery towards 5,365–5,369 (VAH).

Scenario B (Rejection from above):

Price retraces into the VAH zone but faces clear rejection → rotation back towards the 5,187 / 5,180 area.

Scenario C (Deeper liquidation):

Loss of 5,180 → liquidity sweep into 5,058–5,064 (VAL) before attempting to rebuild.

Key Takeaway

In a rebalancing phase, value acceptance matters more than directional prediction. Focus on how price behaves around 5,180–5,200, the reaction at 5,365–5,369, and whether deeper support at 5,058–5,064 attracts meaningful buying interest.

Refer to the chart for detailed POC, VAH and VAL levels.

Follow the TradingView channel to receive early structure insights and join the discussion.

Premium Chart Pattern Limitations

No Guarantees: Patterns only indicate probabilities, not certainties.

False Signals: Markets can generate fake breakouts or pattern failures.

Subjectivity: Interpretation can vary among traders.

Context Matters: Patterns work best with trend confirmation and other technical indicators like RSI, MACD, and moving averages.

XAUUSD – H1 volatility surge | liquidity reset ongoingMarket Context

Gold is entering a high-volatility phase after an extended bullish run. The recent sharp impulse down from the upper zone is not random — it reflects liquidity distribution and aggressive profit-taking near highs, amplified by fast USD flows and event-driven positioning.

In this environment, Gold is no longer trending smoothly. Instead, it is rotating between liquidity zones, creating two-way risk intraday.

➡️ Key mindset: trade reactions at levels, not direction.

Structure & Price Action (H1)

The prior bullish structure has been temporarily broken by a strong bearish impulse.

Price failed to hold above 5,427 – 5,532, confirming this area as active supply / distribution.

The move down shows range expansion, typical after ATH phases.

Current price action suggests rebalancing and liquidity search, not a confirmed macro reversal yet.

Key read:

👉 Above supply = rejection

👉 Below supply = corrective / bearish bias until proven otherwise

Trading Plan – MMF Style

🔴 Primary Scenario – SELL on Pullback (Volatility Play)

While price remains below key supply, selling reactions is favored.

SELL Zone 1: 5,427 – 5,432

(Former demand → supply flip + trendline rejection)

SELL Zone 2: 5,301 – 5,315

(Mid-range supply / corrective retest)

Targets:

TP1: 5,215

TP2: 5,111

TP3: 5,060

Extension: 4,919 (major liquidity pool)

➡️ Only SELL after clear rejection / bearish confirmation.

➡️ No chasing breakdowns.

🟢 Alternative Scenario – BUY at Deep Liquidity

If price sweeps lower liquidity and shows absorption:

BUY Zone: 4,920 – 4,900

(Major demand + liquidity sweep zone)

Reaction targets:

5,060 → 5,215 → 5,300+

➡️ BUY only if structure stabilizes and bullish reaction appears.

Invalidation

A clean H1 close back above 5,432 invalidates the short-term bearish bias and shifts focus back to bullish continuation.

Summary

Gold is transitioning from trend extension to volatility expansion.

This is a market for discipline and level-based execution, not prediction.

MMF principle:

Volatility = opportunity, but only for those who wait for reaction.

Trade the levels. Control risk. Let price confirm.

XAUUSD/GOLD 15MIN SELL LIMIT PROJECTION 30.01.26XAUUSD (Gold) – 15 Minute Sell Limit Projection | 30-01-2026

Gold is currently moving in a higher-timeframe uptrend, but in the short term, price is showing signs of a pullback and potential rejection.

The marked sell limit zone is a strong resistance area formed by the 1-hour trendline and the 50% Fibonacci retracement level. This confluence increases the probability of a bearish reaction from this zone.

Trade Idea

Sell Entry: Near the 1H trendline + 50% retracement resistance

Stop Loss: Above the resistance zone (trendline break level)

Target: Previous demand / liquidity area around 5238

Market Expectation

Price may first move upward to test resistance, then reject and continue downward toward the target zone.

This setup is a retracement sell, not a trend reversal.

Risk Note

Always wait for price action confirmation on lower timeframes and manage risk properly, as gold volatility remains high.

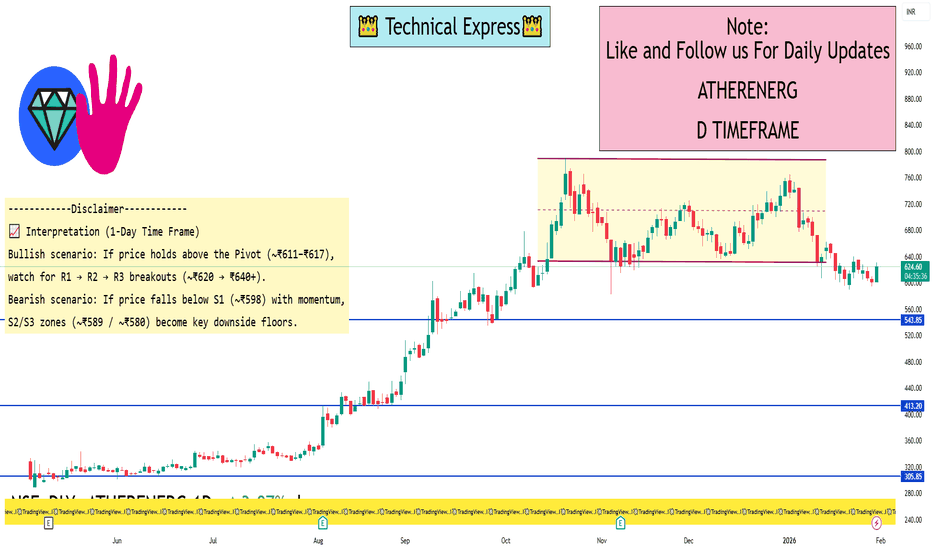

ATHERENERG 1 Day View 📌 Live Price Snapshot

Current Price (approx): ~₹620–₹630 range in recent sessions (market data can vary intraday).

📊 Daily Levels (1 Day Time Frame)

📍 Pivot & Key Levels

(Based on most recent technical calculations from current price action)

Central Pivot (PP): ~ ₹611–₹617

Resistance Levels:

R1: ~ ₹620–₹630

R2: ~ ₹632–₹643

R3: ~ ₹653–₹654

Support Levels:

S1: ~ ₹606–₹598

S2: ~ ₹594–₹589

S3: ~ ₹582–₹576

(Daily pivot and S/R are based on previous session ranges)

🧠 Notes

These levels are typically used for intraday or very short‑term trading and shift daily based on price action. Harsh deviations can occur on high volatility.

Always check a live chart or broker feed for minute‑by‑minute exact pivot/S/R values — the ones here are approximate based on latest calculated pivot data.

Price data is subject to real‑time movement and can differ slightly if markets are open.

XAUUSD Full Technical Analysis (Multi-Timeframe View)Market Structure:

Gold has shifted from a strong bullish impulse into a corrective bearish phase on the lower timeframes. After rejecting from the 5600–5580 supply zone, price formed a clear Change of Character (ChoCH) followed by multiple Bearish Breaks of Structure (BOS), confirming short-term trend weakness. The impulsive selloff toward 5110 indicates aggressive profit booking and institutional distribution from higher levels.

Trend & Momentum:

On the 5-minute chart, price remains below key dynamic resistances (EMA cluster & VWAP), which keeps the intraday bias bearish. Momentum has slowed near 5230–5240, where price is consolidating inside a demand zone with visible volume support, suggesting short-term stabilization but not yet a confirmed reversal. Any bullish move from here is currently corrective unless structure changes.

Key Levels:

Immediate Resistance: 5280 → 5320 → 5415

Major Supply Zone: 5450–5500

Immediate Support: 5230 → 5200

Major Demand: 5110–5050

Scenarios:

Bullish Case: A sustained break and acceptance above 5280–5300, followed by a BOS, could open a recovery toward 5415 and possibly 5450. This would signal buyers regaining short-term control.

Bearish Case (Preferred): Failure to reclaim 5280 keeps price vulnerable to another selloff toward 5200, and a breakdown below 5110 would expose 5050–5000 next.

Conclusion:

Overall bias remains bearish to neutral in the short term, with current price action suggesting a pause or corrective bounce rather than trend reversal. Traders should wait for structure confirmation—either a bullish BOS above resistance for longs or rejection from resistance to continue selling rallies. Patience is key until the market shows clear intent.

SWIGGY 1 Day View 📊 SWIGGY – 1-Day Time Frame Key Levels (Daily Technical View)

📍 Latest Price Context (Approx)

Current/Live price range (recent session): ~₹305–₹315 (trading range today)

🔑 Daily Support Levels

These are price zones where buying interest could emerge if the stock dips:

📌 S1 (Immediate Support): ~₹313–₹315

📌 S2: ~₹307–₹310

📌 S3 (Deeper support): ~₹295–₹300

(levels help define where the stock may stabilize on a pullback)

📈 Daily Resistance Levels

These are zones where price may face selling pressure:

🔹 R1: ~₹329–₹330

🔹 R2: ~₹335–₹336

🔹 R3: ~₹345–₹346

(above these, the stock needs strong momentum to continue higher)

📊 Daily Pivot Levels

Pivot levels often act as reference for thematic direction:

📍 Pivot (Central daily level): ~₹326–₹327

(Above this = mildly bullish bias for the day; below this = bearish bias)

📌 Based on Technical Indicators

Short-term indicators show mixed to bearish bias in daily trend, with several oscillators and moving average signals leaning sell/oversold — reflecting current selling pressure in the market.

Nifty 50 - 30.01.2026Nifty hovering in small zone as marked by the yellow line keeping buyers hanging suggesting indecisiveness or state of confusion. Any movements either upside or downside will fetch some good money. Else it’s looking like put writers day.

Stay focused and watch but do not take action till yellow line is passed.