Wave Analysis

Kalyan Jewellers – Symmetrical Triangle Breakout (1-Day)Kalyan Jewellers is currently forming a symmetrical triangle pattern on the daily chart, indicating a period of consolidation as buyers and sellers balance out. A confirmed breakout above the upper trendline could signal the start of a new upward move, while a break below support may lead to further weakness.

At the current market price (CMP) around ₹500,

The key levels to watch are:

• Support: ₹446, ₹393

• Resistance: ₹530, ₹575

Company Overview

Kalyan Jewellers is one of India’s leading organized jewelry retailers, known for its extensive network of showrooms across the country and strong brand presence. The company operates in the high-growth consumer discretionary segment, benefiting from rising income levels, wedding demand, and festive purchases. Its fundamentals are supported by a diversified geographic footprint, consistent same-store sales growth, and a focus on customer trust and quality assurance.

A sustained breakout with higher-than-average volume could confirm trend direction and attract further buying interest.

For analysis of any stock, feel free to comment the stock name below.

This analysis is for educational and informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security. Market investments are subject to risk, and past performance does not guarantee future results. Please consult a SEBI-registered financial advisor before making any investment decisions. The author is not responsible for any losses or gains arising from the use of this information.

End of ABC correction - Only for long term investorsThe correction in Solar Industries is complete

1) A(impulse) - B (triangle) - C (Impulse)

2) Wave C is exactly 0.618% of wave A extended from the end of wave B.

3) The entire correction has lasted for 26 weeks , which is an Ichimoku Time (Actual time is 27, but +1/1 is permissible)

4) Wave C rests exactly at the middle line for the ABC channel.

5) Wave C ends exactly at 0,618 of the impulse it is correcting

Buy a pullback for a target of 14765 and a SL of 11616.

EURUSD | HTF Demand Reaction After Liquidity SweepTrade Idea Overview

EURUSD is currently trading in a clear bearish structure, making lower highs and lower lows. Price has recently swept sell-side liquidity, tapped into a higher timeframe demand zone in discount, and reacted strongly from equilibrium — indicating potential mean reversion to the upside.

This setup aligns with Smart Money Concepts, where institutions accumulate positions after liquidity is taken and price trades below fair value.

Technical Confluence

HTF bearish structure with controlled pullback

Sell-side liquidity sweep below recent lows

Price entering HTF demand / discount zone

Reaction near equilibrium (50%), confirming imbalance

Previous internal structure support acting as demand

Trade Plan

Bias: Short-term bullish (counter-trend mean reversion)

Entry: From demand zone after liquidity sweep

Stop Loss: Below demand (invalidation level)

Targets:

TP1: Internal liquidity / imbalance fill

TP2: Previous structure high / premium zone

Risk-to-reward remains favorable, making this setup valid even with a modest win rate.

Invalidation

A strong candle close below the demand zone will invalidate the setup and signal continuation of the bearish trend.

Nifty Analysis for Jan 06, 2026Wrap up:-

As updated earlier, Nifty has fallen before achieving 26421 so it is not a Ending diagonal formation in wave c. It is an impulse wave with wave 1 at 26057, wave 2 at 25878, wave 3 at 26373 and wave 4 is expected to be completed in the range of 26212-26113. Thereafter, heading towards wave 5.

Buy Nifty @26212-26113 sl 26113 (75 min./1 hr candle closing basis) for a target of 26630-26890.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Bank of Maharashtra trade for 18-20% upside.**Bank of Maharashtra (Weekly Chart – NSE)**

The stock has **completed its Wave-4 corrective phase** and subsequently formed a **clear Inverse Head & Shoulders (iH&S) pattern**, signalling the start of a **fresh impulsive move (Wave-5)**.

**Technical Observations**

* Wave-4 correction has ended near ₹45–46, respecting Elliott Wave rules

* iH&S neckline breakout confirms trend reversal

* Momentum indicators (RSI & MACD) support bullish continuation

* Price is holding above the breakout zone with healthy structure

**Strategy**

* **Accumulation Zone:** ₹60 – ₹65

* **Upside Target:** ₹75 – ₹80

* **Potential Upside:** ~18–20% from current levels

As long as the price sustains above the accumulation range, the structure remains constructive for further upside in the ongoing **Wave-5**.

This setup favours **accumulate-on-dips** rather than chasing extended candles.

---

Nibe Ltd – Elliott Wave UpdateNibe Ltd – Elliott Wave Update

Nibe Ltd has reversed decisively from the 78.6% Fibonacci retracement, completing a textbook ABC corrective structure. The reversal was accompanied by clear bullish divergence on RSI and MACD, confirming exhaustion of the corrective phase.

Following the reversal:

Wave 1 of the new impulsive structure is complete

Wave 2 has unfolded as a shallow, time-wise correction

Price is now trading in Wave 3, supported by expanding momentum and rising volume

As long as price holds above the recent swing low (~₹1,030), the impulsive structure remains valid. Momentum indicators continue to support further upside, suggesting the trend is in an acceleration phase rather than exhaustion.

Trend Bias: Bullish

Structure: Impulsive (Wave 3 in progress)

Minimum Target: ₹1,700

Invalidation Level: Below the Wave-2 low

Divergence Secrets Leverage: Control Big Value With Small Capital

Options are inherently leveraged instruments, meaning you control a large contract value by paying only a small premium.

Example:

Suppose Bank Nifty is at 49,500.

Buying the index in futures may require a margin of ₹1.5–2 lakh.

But buying a 49,500 CE may cost only ₹200–₹300 per lot.

This means a trader can participate in the same price move with:

10x–50x lower capital

Better capital efficiency

More flexibility in managing risk

Leverage is a double-edged sword, but when used with discipline and structure, it can generate powerful results.

Elliott Wave Analysis XAUUSD – 06/01/2026

1. Momentum

D1 Timeframe

– D1 momentum is currently rising

– It may take another 1–2 D1 candles for momentum to enter the overbought zone

– This suggests the current bullish move still has room to extend and may last another 1–2 days before a clear reversal signal appears

H4 Timeframe

– H4 momentum is currently in the overbought zone and preparing for a bearish reversal

– In the near term, H4 is likely to form a corrective move / bearish reversal

– This downside move is expected to last at least several H4 candles once the momentum reversal is confirmed

H1 Timeframe

– H1 momentum is still rising

– However, only 1–2 more H1 candles are needed for momentum to enter the overbought zone

– Therefore, a short-term bearish reversal on H1 is highly likely

2. Elliott Wave Structure

D1 Timeframe

– The D1 structure remains within the purple wave Y

– Price is likely forming wave 1 or wave A of the bearish leg within wave Y

– The completion of wave 2 or wave B is likely to coincide with the next bearish reversal of D1 momentum

H4 Timeframe

– The structure of purple wave Y is more clearly visible on H4

– H4 momentum is currently preparing for a bearish reversal, suggesting a downside move ahead

– Confirmation requires at least one bearish H4 candle

– Once confirmed, the Sell scenario will continue to be prioritized

H1 Timeframe

– The current recovery move is forming a 3-wave ABC structure

– Price has already exceeded the Fibonacci target zone outlined in yesterday’s plan

– Price is now approaching a major liquidity zone at 4471

3. Liquidity Zones & Price Scenarios

– The major liquidity zone is highlighted by the red box on the chart

– This zone is located between 4471 – 4521

Primary Scenario

– When price first approaches the outer edge at 4471, a bearish reaction is highly likely

– This area is considered a preferred zone to look for a potential top

Bullish Continuation Scenario

– If H4 momentum reverses lower and moves into oversold territory

– While the corrective decline does not close below 4398

– Then we should prepare for another bullish continuation toward the 4471 – 4521 liquidity zone

Strong Bearish Scenario

– If price closes below the 4398 level

– Or even moves into the lower liquidity zone at 4348 – 4317

– Then the market is likely to enter a strong bearish phase toward deeper targets of wave Y

4. Trading Plan

– Sell Zone: 4470 – 4472

– Stop Loss: 4490

– TP1: 4405

– TP2: 4348

– TP3: 4072

➡️ Overall Strategy

– Continue to prioritize Sell setups around the 4471 area as planned

– Wait for additional confirmation from H4 and H1 momentum to enter trades with higher probability

PCJEWELLER 1 Month time Frame 📊 📌 Current Price Snapshot

Approx current price: ~₹10.14–₹10.30 per share (Jan 5–6, 2026) based on live market data.

52‑week range: ₹8.67 low → ₹19.65 high.

Recent trend: Up from late‑Dec lows but still below major longer moving averages.

📈 1‑Month Technical Levels

🛑 Resistance (Upside)

These are levels where sellers might step in:

₹10.55–10.60: 1st resistance area (near recent daily pivots).

₹10.85–11.25: Next resistance cluster from pivot calculations.

Above ₹11.30: More structural resistance — recent EMA/SMA levels (50‑100 day) lie around this broader zone.

💡 A break above ~₹10.85–11.25 with strong volume would be needed to shift momentum more bullishly in the next few weeks.

🧱 Support (Downside)

Key floors where buyers might appear:

₹9.85–9.96: Immediate support, including pivot support and volume accumulation zone.

₹9.45–9.50: Secondary support below near recent lows.

₹8.80–8.70: Strong broader support near 52‑week range lows (bearish fallback).

📌 Trading Range Summary (1‑Month View)

Scenario Level

Immediate Support Zone ₹9.85–₹9.96

Bearish Break Support ₹9.45 → ₹8.80

Resistance Zone ₹10.55–₹10.85

Bullish Break Target Above ₹11.25

CANDLESTICK PATTERNSCandlestick patterns originated in Japan in the 1700s for analyzing rice markets. Today, they are used worldwide in stocks, forex, commodities, and crypto. Each candle represents four values – Open, High, Low, Close (OHLC) – and reflects market sentiment, strength, and trader behavior.

Candlestick patterns are divided into:

A. Reversal Patterns

B. Continuation Patterns

C. Indecision Patterns

D. Complex Multi-Candle Patterns

XAUUSD (H2) – Buying priority todayGold holds above 4,400 on safe-haven flows | Trade liquidity, don’t chase

Quick summary

Gold started the week with strong momentum and pushed above 4,400 during the Asian session as global markets rotated into safe-haven assets. Geopolitical risk is the key driver after reports of US ground strikes in Venezuela and the detention of President Nicolás Maduro and his wife. With that backdrop, my plan today is simple: prioritize BUY setups at liquidity zones, and avoid FOMO while the price is elevated.

1) Macro context: Why gold is supported

When geopolitical risk escalates, capital typically flows into gold.

Headline-driven sessions often bring:

✅ fast pumps, ✅ liquidity sweeps, ✅ larger wicks/spreads.

➡️ The safest execution is waiting for pullbacks into predefined buy zones, not chasing highs.

2) Technical view (based on your chart)

On H2, gold has bounced sharply and your chart highlights clear execution areas:

Key levels for today

✅ Buy zone: 4340 – 4345 (trend/structure pullback zone)

✅ Strong Liquidity: lower support band (marked on chart)

✅ Sell zone: 4436 – 4440 (near-term supply / reaction area)

✅ Sell swing / target: 4515 – 4520 (higher objective / profit-taking zone)

3) Trading plan (Liam style: trade the level)

Scenario A (priority): BUY the pullback into 4340–4345

✅ Buy: 4340 – 4345

SL (guide): below the zone (adjust to spread / lower TF structure)

TP1: 4400 – 4410

TP2: 4436 – 4440

TP3: 4515 – 4520 (if momentum continues with headlines)

Logic: 4340–4345 offers a cleaner R:R than chasing above 4,400.

Scenario B: If the price holds above 4,400 and only dips lightly

Look for a buy only on clear holding signals near the closest support/strong liquidity (M15–H1).

Still not recommending FOMO entries in headline volatility.

Scenario C: SELL reaction (scalp) at supply

✅ If price tags 4436–4440 and shows weakness:

Sell scalp: 4436 – 4440

SL: above the zone

TP: back toward 4400–4380

Logic: This is a near-term supply area — good for quick profit-taking, not a long-term reversal call.

4) Notes (avoid getting swept)

The Asian session can spike hard on headlines → wait for pullback confirmations.

Reduce size if spreads widen.

Only execute when price hits the level and prints a clear reaction (rejection / engulf / MSS).

What’s your plan today: buying the 4340–4345 pullback, or waiting for price to push into 4515–4520 before reassessing?

XAUUSD Smart Money Levels: Demand 4325, Supply 4494🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, but current price action reflects a premium-side liquidity operation rather than clean continuation. After a strong upside leg, price is now rotating inside premium where Smart Money typically distributes positions before initiating corrective delivery.

Today’s focus revolves around USD strength, U.S. yield sensitivity, and ongoing Fed rate path speculation, with traders positioning ahead of upcoming U.S. macro releases and Fed commentary. As real yields fluctuate and risk sentiment remains fragile, Gold continues to attract safe-haven flows — but not without engineered pullbacks.

This environment favors liquidity sweeps, false continuation, and inducement above highs, rather than impulsive breakout buying.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish structure with an active short-term corrective leg from premium.

Key Idea:

Expect Smart Money interaction either at internal supply (4492–4494) for distribution, or HTF demand (4327–4325) for re-accumulation before the next expansion.

Structural Notes:

• HTF bullish structure remains valid

• Recent CHoCH confirms corrective rotation

• Buy-side liquidity above highs has been partially tapped

• Supply cluster at 4492–4494 acts as distribution zone

• Demand zone at 4327–4325 aligns with OB + liquidity pool

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4327 – 4325 | SL 4317

• 🔴 SELL GOLD 4492 – 4494 | SL 4500

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4327 – 4325 | SL 4317

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Strong upside BOS with impulsive candles

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4390 — initial displacement

• 4450 — internal liquidity

• 4490+ — premium retest if USD weakens

🔴 SELL GOLD 4492 – 4494 | SL 4500

Rules:

✔ Reaction into premium supply zone

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4455 — first imbalance fill

• 4395 — internal discount

• 4327 — HTF demand sweep

⚠️ Risk Notes

• Premium zones favor fake breakouts and stop hunts

• Volatility may spike around U.S. data and Fed remarks

• No entries without MSS + BOS confirmation

• Stops often triggered before real displacement

📍 Summary

Gold remains structurally bullish, but today’s edge lies in trading Smart Money’s range:

• A sweep into 4327–4325 may reload longs toward 4450–4490, or

• A reaction at 4492–4494 offers a sell opportunity back into discount.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

Advanced Trading Methods1. Market Structure and Microstructure-Based Trading

One of the most advanced approaches in trading involves understanding market structure and microstructure. This includes studying how orders flow through the market, how liquidity is created and removed, bid-ask spreads, order book dynamics, and the behavior of market participants such as institutions, high-frequency traders, and market makers. Traders use tools like Level II data, time-and-sales, volume profile, and footprint charts to identify where large players are active. By aligning trades with institutional order flow, traders aim to reduce randomness and increase probability.

2. Quantitative and Algorithmic Trading

Quantitative trading relies on mathematical models, statistical analysis, and computer algorithms to identify trading opportunities. Instead of subjective decision-making, rules are coded based on historical data, probabilities, correlations, and patterns. Algorithms can execute trades automatically based on predefined conditions, removing emotional bias. Advanced quantitative strategies include mean reversion models, trend-following systems, statistical arbitrage, pair trading, and factor-based investing. These methods often involve backtesting, optimization, and continuous refinement to adapt to changing market conditions.

3. High-Frequency Trading (HFT)

High-frequency trading is one of the most technologically advanced trading methods. It involves executing a large number of trades at extremely high speeds, often in microseconds. HFT strategies exploit tiny price inefficiencies, latency advantages, and short-term liquidity imbalances. These traders rely on colocated servers, direct market access, and ultra-low-latency infrastructure. While HFT is largely inaccessible to retail traders, understanding its impact helps advanced traders recognize sudden volatility spikes, false breakouts, and rapid liquidity shifts.

4. Options and Derivatives Strategies

Advanced trading frequently incorporates derivatives such as options, futures, and swaps. Options trading, in particular, allows traders to structure positions based on volatility, time decay, and directional bias. Advanced strategies include spreads, straddles, strangles, iron condors, butterflies, calendar spreads, and ratio spreads. These methods enable traders to profit in sideways, volatile, or trending markets while defining risk. Futures and options are also used for hedging portfolios, managing exposure, and leveraging capital efficiently.

5. Volatility-Based Trading

Volatility is a core component of advanced trading. Instead of focusing only on price direction, traders analyze implied volatility, historical volatility, and volatility skew. Volatility trading strategies aim to profit from changes in volatility rather than price movement itself. For example, traders may buy options when volatility is low and expected to rise, or sell options when volatility is high and expected to fall. Instruments like VIX futures, volatility ETFs, and variance swaps are often used in advanced volatility trading frameworks.

6. Global Macro and Intermarket Trading

Global macro trading involves analyzing macroeconomic trends, interest rates, inflation, central bank policies, geopolitical events, and cross-border capital flows. Advanced traders study how different asset classes—equities, bonds, currencies, and commodities—interact with each other. Intermarket analysis helps traders identify correlations and divergences, such as equity markets reacting to bond yields or currencies responding to interest rate differentials. This method allows traders to position themselves ahead of major economic shifts rather than reacting to short-term price movements.

7. Smart Money and Institutional Trading Concepts

Smart money trading focuses on identifying the actions of institutional participants who control large volumes of capital. These traders study accumulation and distribution phases, liquidity zones, stop-hunting behavior, and market manipulation patterns. Concepts such as order blocks, fair value gaps, liquidity pools, and imbalance zones are used to anticipate price movement. Advanced traders aim to enter trades where institutions are likely to defend positions, thereby increasing the probability of success.

8. Sentiment and Behavioral Trading

Advanced trading methods incorporate market psychology and behavioral finance. Traders analyze sentiment indicators such as put-call ratios, commitment of traders (COT) reports, volatility indexes, social media sentiment, and fund flow data. Extreme optimism or pessimism often signals potential reversals. By understanding crowd behavior, fear, greed, and cognitive biases, advanced traders position themselves contrarian to emotional market participants.

9. Risk Management and Portfolio Optimization

At the advanced level, risk management is as important as strategy selection. Traders use position sizing models, value-at-risk (VaR), expected shortfall, drawdown analysis, and correlation-based diversification. Portfolio optimization techniques help balance risk across multiple instruments and strategies. Advanced traders focus on consistency, capital preservation, and long-term performance rather than chasing short-term gains.

10. Adaptive and Machine Learning-Based Trading

Modern advanced trading increasingly integrates machine learning and artificial intelligence. These systems analyze vast amounts of data to detect non-linear relationships and evolving patterns. Adaptive strategies adjust parameters automatically based on market conditions. While complex, these methods allow traders to respond dynamically to changing volatility, liquidity, and regime shifts, making them highly powerful when implemented correctly.

Conclusion

Advanced trading methods represent a holistic and professional approach to financial markets. They combine technical expertise, quantitative analysis, market psychology, technology, and disciplined risk management. Unlike basic trading, advanced methods focus on probability, structure, and adaptability rather than prediction. While they require significant learning, practice, and capital discipline, advanced trading methods provide traders with the tools to navigate complex markets, manage uncertainty, and pursue sustainable long-term profitability.

Redington Ltd | Symmetrical Triangle – Breakout AwaitedRedington Ltd is a leading technology distribution and supply chain solutions company, operating across India, the Middle East, Africa, and South Asia. The company specializes in the distribution of IT products, mobility devices, cloud solutions, and emerging technologies, partnering with global brands to deliver end-to-end supply chain and value-added services. With a strong focus on digital transformation, scalability, and efficient logistics, Redington plays a crucial role in enabling technology adoption across multiple markets.

Redington Ltd is currently consolidating within a symmetrical triangle formation, indicating a phase of price contraction and equilibrium between buyers and sellers. The stock has been making lower highs and higher lows, reflecting reduced volatility and a potential build-up for a strong directional move. A decisive breakout with volume confirmation will be crucial to determine the next trend direction.

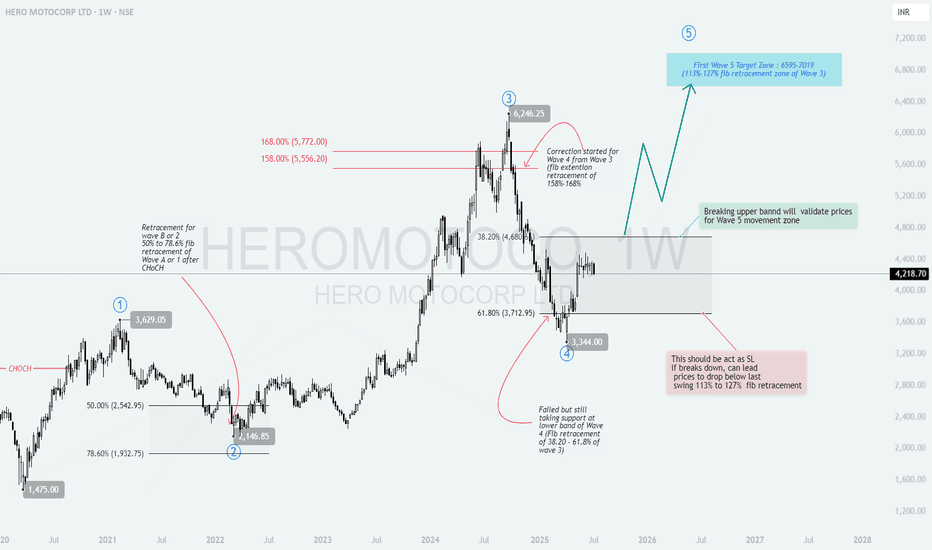

HEROMOTOCO – Wave 5 Setup Unfolding After Ideal Wave 4 📘 HERO MOTOCORP – Wave 5 Setup from Textbook Elliott Structure

Timeframe: Weekly

Structure: Impulsive (1–2–3–4 complete) → Preparing for Wave 5

Type: Positional Swing Setup | Elliott Wave Based

🔍 1. Elliott Wave Structure Breakdown:

Wave 1: ₹1,475 to ₹3,629

Wave 2: Retraced to ₹2,146.85 (between 50%–78.6% Fib of Wave 1)

Wave 3: Impulse to ₹6,246.25

Wave 4: Currently correcting between 38.2%–61.8% Fib of Wave 3 (₹4,680–₹3,712)

✅ Price found support near ₹3,344, which is just below 61.8% retracement – a common zone for Wave 4 completion.

🟫 2. Wave 4 Support Zone – ₹3,712 to ₹3,344:

This zone is acting as a potential reversal base with:

Fib retracement confluence: 38.2%–61.8% of Wave 3

Failed breakdown attempts followed by recovery candles

CHoCH observed in lower timeframes – suggests momentum shift

🟩 3. Breakout Confirmation Level – ₹4,680:

Breaking above ₹4,680–₹4,800 range would confirm Wave 5 activation

Indicates structure validation + bullish resumption

Close above this zone = strength & momentum breakout

📈 4. Wave 5 Target Projection – ₹6,595 to ₹7,019:

Calculated using:

113%–127% Fibonacci extension of Wave 3

Historical rally symmetry from Wave 1 and 3

Target zone offers positional upside potential of ~55%+

🛑 5. Stop Loss & Invalidation Level:

SL Zone: ₹3,344

Sustained breakdown below this invalidates Wave 4 base

Can lead to sharp drop toward ₹2,600–2,900 (next Fib cluster)

✅ 6. Trade Plan (Swing):

Accumulation Zone: ₹3,700 – ₹4,300 (if support structure holds)

Breakout Entry: Close above ₹4,680–4,800

Stop Loss: ₹3,344

Target: ₹6,595–7,019 (Wave 5 zone)

🧠 7. Why This Setup Matters:

Elliott Wave Confluence: Clean 1–2–3–4 formation

Textbook Fib Behavior: Wave 2 and Wave 4 within ideal retracement ranges

Defined R:R Structure: Tight invalidation + 1:2+ reward

Momentum Setup: Wave 5 can unfold rapidly once confirmed

📌 Conclusion:

HERO MOTOCORP is poised for a potential Wave 5 rally after a well-behaved corrective Wave 4.

A breakout above ₹4,680 could trigger bullish continuation toward ₹7,000+.

This is a classic trend continuation setup for wave-based swing traders.

XAUUSD Smart Money Levels: Demand 4312, Supply 4436XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalysts (Fed commentary, U.S. jobs data, Treasury yields), institutional participation is oscillating between liquidity hunts and controlled re-accumulation.

Global risk sentiment and safe-haven bids are intensifying as traders weigh inflation trajectory with central bank pivot expectations — leading Gold to exhibit rotational distribution behavior rather than clean continuation. Controlled swings and sweep-driven moves dominate price progression.

This environment favors engineered liquidity access and inducement, not blind breakout chasing.

Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish bias with short-term corrective displacement.

Key Idea:

Expect structural engagement near HTF demand (~4312–4314) or internal supply liquidity (~4434–4436) before meaningful displacement sequences.

Structural Notes:

• HTF bullish structure remains intact

• Recent CHoCH confirms corrective leg

• Buy-side liquidity above recent highs is targeted

• Supply cluster near 4436 acts as engineered lure

• Demand confluence aligns with institutional accumulation

Liquidity Zones & Triggers

• BUY GOLD 4314 – 4312 | SL 4304

• SELL GOLD 4434 – 4436 | SL 4444

Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → internal supply retest → expansion

Execution Rules

BUY GOLD 4314 – 4312 | SL 4304

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Clear upside BOS with impulse candles

✔ Entry via refined demand OB or FVG fill

Targets:

• 4370 — initial displacement

• 4410 — internal supply test

• 4440+ — extended run if USD weakens

SELL GOLD 4434 – 4436 | SL 4444

Rules:

✔ Reaction into internal supply cluster

✔ Bearish MSS / CHoCH confluence

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4390 — first discount zone

• 4350 — deeper pullback

• 4314 — HTF demand scan

Risk Notes

• False breaks favored near thin Asian session volume

• Macro catalysts (U.S. data, Fed speakers) may spike volatility

• Avoid entries without MSS + BOS confirmations

• Stops triggered by engineered liquidity hunts

Summary

Gold remains structurally bullish, but today’s edge lies in disciplined entries and liquidity awareness:

• A sweep into 4312–4314 may reload longs with targets up to 4410–4440, or

• A reaction near 4434–4436 provides a fade opportunity back into discount.

Let liquidity initiate the move. Let structure confirm.

Smart Money sets traps — retail chases them.

Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

NIFTY : Trading levels and Plan for 06-Jan-2026📘 NIFTY Trading Plan for 6-Jan-2026

(Timeframe: 15-min | Gap consideration: 100+ points)

Key Levels to Track (from chart)

Upper Resistance / Extension: 26,483

Last Intraday Resistance Zone: 26,386 – 26,412

Opening Resistance: 26,316

Opening Support / Resistance Zone: 26,202 – 26,244

Lower Support: 26,041

🧠 Market Context: NIFTY has recently shown strong upside momentum, but price is now reacting near a major supply zone. Expect volatility, false breakouts, and profit booking unless levels are clearly accepted.

🟢 1. GAP-UP OPENING (100+ Points)

If NIFTY opens above 26,316, it indicates bullish intent but inside a heavy resistance cluster.

🎓 Educational Explanation:

Gap-ups near resistance often attract smart money selling. True continuation happens only if price accepts above resistance, not just spikes.

Plan of Action:

Avoid trades in the first 10–15 minutes; let volatility settle.

Sustaining above 26,316 keeps price biased toward 26,386–26,412.

Acceptance above 26,412 opens path toward 26,483.

Repeated rejection from 26,386–26,412 signals profit booking / pullback.

Options traders: Prefer Bull Call Spread or ATM Call with trailing SL near resistance.

🟡 2. FLAT OPENING

If NIFTY opens around 26,202–26,316, expect a range-bound and tricky session initially.

🎓 Educational Explanation:

Flat opens inside a broad zone reflect indecision. Direction emerges only after a range expansion.

Plan of Action:

Above 26,316 → bullish bias toward 26,386–26,412.

Failure near 26,316 keeps market sideways.

Break below 26,202 shifts bias toward 26,041.

Wait for 15-min candle close + volume confirmation before entering.

Options traders: Iron Fly / Short Strangle (light quantity) works well if range persists.

🔴 3. GAP-DOWN OPENING (100+ Points)

If NIFTY opens below 26,202, sentiment turns cautious.

🎓 Educational Explanation:

Gap-downs into support often cause panic selling early, followed by either short covering or continuation. Confirmation is key.

Plan of Action:

First level to watch: 26,202–26,244 zone.

Sustaining below 26,202 increases downside probability toward 26,041.

Strong bullish reaction near 26,041 may give intraday bounce trades.

Avoid aggressive shorts near support without confirmation.

Options traders: Prefer Bear Put Spread over naked puts to manage risk.

⚙️ Risk Management Tips for Options Trading 🛡️

Limit risk to 1–2% of capital per trade.

Avoid over-trading near major resistance zones.

Use time-based exits if premium stops moving for 15–20 mins.

Book partial profits early; trail the remainder.

Prefer ATM options or spreads in volatile sessions.

No revenge trades after SL hit.

🧾 Summary & Conclusion

Above 26,316: Bulls active, but expect resistance near 26,386–26,412

Between 26,202–26,316: Choppy zone → patience required

Below 26,202: Weakness toward 26,041 possible

Trade price reaction, not prediction 🚦

Discipline > aggression in resistance-heavy markets.

⚠️ Disclaimer

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Markets involve risk; please consult your financial advisor before taking any trade.

Updated Positional View for Nifty from January to March, 2026Wrap up:-

After breaking ATH of 26277 dated 27.09.2024, Major wave X has been shifted further and pattern counts has been changed at major level. Now, wave w of major wave x has been completed at 26277 and wave x is in progress.

In wave x, a is completed at 23263 and b is expected to be completed in the range of 26630-26890. Thereafter, Nifty will head towards wave c for a min. target of 23635.

Now, we have to check internal pattern of Nifty which is currently in progress i.e. wave 5 from 24337. In this pattern, Nifty is forming a wxy pattern. Wave w has been completed at 25448 and wave x at 25318 and wave y is expected to be completed in the range of 26630-26890.

In wave y, wave a is completed at 26010 and b is completed at 25693 and heading towards wave c through impulse wave.

In wave c of y of 5, wave 1 was completed at 26057, wave 2 at 25878, wave 3 at 26373 and wave 4 is expected to be completed in the range of 26212-26113. Thereafter, wave 5 is expected to be completed in the range of 26630-26890.

What I’m Watching for 🔍

Short Nifty in the range of 26630-26890 sl 26890 (daily closing basis) for a target of 25220-25031-24772-23635-23200.

Disclaimer: Sharing my personal market view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."