Learn Institution Trading Part -6Introduction to Institutional Option Trading

Institutional option trading refers to the sophisticated strategies used by hedge funds, mutual funds, insurance companies, proprietary trading firms, and foreign institutional investors (FIIs) to manage portfolios, hedge risks, and generate consistent alpha from the derivatives market. Unlike retail traders, institutions operate with large capital, access to advanced technology, and deep market insights, allowing them to structure complex trades.

2. Why Institutions Trade Options

Institutions don’t usually trade options for quick profits. Their trades are designed to meet broader objectives:

Hedging Equity Portfolios

Volatility Trading

Generating Yield on Holdings

Market Making and Arbitrage

Directional or Non-directional Speculation

3. Core Institutional Option Strategies

Let’s explore the most popular strategies that institutions use with real-world logic behind them.

A. Covered Call (Buy-Write)

Use: Income generation from long-term stock holdings

Structure: Buy stock + Sell Call Option (OTM or ATM)

Institutional Use Case:

A mutual fund holding Reliance shares might sell monthly call options against its holdings to generate monthly income (premium), enhancing total returns.

Wave Analysis

Advanced Institutions Option Trading - Part 3Why Trade Options?

Hedging against portfolio loss

Leverage with limited capital

Income generation through strategies like covered calls

Directional trading using strategies like long calls or puts

Investment Strategy using Options

LEAPS (Long-Term Equity Anticipation Securities): Investing in long-term call options

Covered Calls: Generate income while holding stocks

Cash-Secured Puts: Earn premium while waiting to buy a stock at lower price

These are often used by investors to add flexibility and income to portfolios.

Learn institutional Trading Part -5Option Buying vs Selling

Option Buyers

Pay premium

Unlimited profit, limited risk

Need strong directional movement

Option Sellers (Writers)

Receive premium

Limited profit, unlimited risk

Thrive in sideways or range-bound markets

Need deep knowledge of Greeks and risk management

6. Popular Option Trading Strategies

Beginner Strategies

Long Call/Put – Directional trades

Protective Put – Hedge stock losses

Covered Call – Generate income from holdings

Intermediate Strategies

Bull Call Spread – Buy and sell calls of different strikes

Bear Put Spread – Buy and sell puts

Straddle – Buy both call and put at same strike (high volatility)

Strangle – Buy OTM call and put (cheaper than straddle)

Advanced Strategies

Iron Condor – Neutral strategy with 4 legs

Butterfly Spread – Limited risk range strategy

Calendar Spread – Exploiting time decay differences

Ratio Spread – More contracts sold than bought

Learn institution Trading Part -3How Option Prices Move – The Greeks

Delta: Sensitivity to price change in the underlying

Gamma: Rate of change of Delta

Theta: Time decay – loss in value as expiry nears

Vega: Sensitivity to Implied Volatility (IV)

Rho: Interest rate sensitivity

Understanding Greeks helps manage risk, adjust positions, and time trades better.

4. Why Traders Choose Options

Leverage: Control large positions with limited capital

Risk Control: Limited loss in buying options

Flexibility: Multiple strategies (bullish, bearish, neutral)

Hedging: Protect existing stock portfolios

Income Generation: Through writing options like covered calls

Master class 9. Introduction to Option Trading

Options are powerful derivative instruments that give buyers the right (not obligation) to buy or sell an underlying asset at a predetermined price within a specific time. They are commonly used for hedging, speculation, and income strategies.

There are two basic types:

Call Options: Right to buy

Put Options: Right to sell

Options derive value from stocks, indices (Nifty, Bank Nifty), commodities, or currencies and are traded on platforms like NSE in India.

2. Key Terminology in Option Trading

Strike Price: Price at which the option can be exercised

Premium: Cost of buying the option

Expiry: Last day the option is valid

Lot Size: Fixed number of underlying units (e.g., 50 for Nifty)

Intrinsic Value: Real value of an option if exercised now

Time Value: Portion of premium linked to time left before expiry

ATM/ITM/OTM: At The Money, In The Money, Out of The Money – defines moneyness of options

Advanced Technical Master classMulti-Timeframe Analysis involves analyzing multiple chart timeframes (Monthly, Weekly, Daily, 4H, 1H) to confirm trend direction and improve timing accuracy.

Application:

Identify long-term trend (Monthly/Weekly)

Use Daily/4H for entry signals

Filter noise with lower timeframes

Key Tools: Moving Averages, Trendlines, MACD

Module 2: Advanced Chart Patterns

Key Patterns Covered:

Harmonic Patterns (Gartley, Bat, Crab)

Elliott Waves (Impulse & Corrective Waves)

Wyckoff Method (Accumulation/Distribution Phases)

Practical Use:

Pattern + Volume = Strong Entry

Combine with Fib levels for reversal confirmation

Module 3: Volume Price Analysis (VPA)

Core Principle:

Volume precedes price. Learn to read volume spikes, absorption, and exhaustion.

Indicators to Use:

On Balance Volume (OBV)

Volume Profile

VWAP

Institution Option Trading Part-7Regulatory & Risk Considerations

SEBI (India) & SEC (US) regulations limit speculative exposure.

Institutions must report Open Interest, Position Limits, Margin Usage.

Must adhere to VaR (Value at Risk) frameworks and internal risk policies.

Institutional Trading during Events

Earnings Seasons: Institutions use straddles/strangles for earnings plays.

Budget or RBI Policy: Protective collars/volatility trades.

Global Crisis (e.g. COVID): Use of massive protective puts (SPX, NIFTY).

VIX & Institutional Behavior

India VIX plays a vital role in determining institutional option strategies.

High VIX = buying protection, long gamma strategies.

Low VIX = selling premium, income strategies.

Institution Option Trading Part-1Role of Market Makers & Liquidity Providers

Institutions often rely on market makers for tight bid-ask spreads.

Market makers hedge every trade using delta-neutral strategies.

Their presence helps institutions build or unwind large positions without disrupting prices.

Institutional Examples in Option Trading

Hedge Funds: Use volatility arbitrage, gamma scalping, dispersion trading.

Insurance Firms: Use long-dated puts to hedge annuity products.

Banks: Write structured products with option-like features (e.g., equity-linked notes).

Asset Managers: Use protective puts or collars on core portfolios.

Institution Option Trading Part-2.0Institutional Order Flow – Market Impact

Option Flow as Signal: Large trades in options market may indicate upcoming moves in underlying assets.

Unusual Options Activity (UOA): Tracked by smart money traders to anticipate institutional moves.

Dark Pools: Institutions often use off-exchange mechanisms to avoid price impact.

Tools & Analytics Used by Institutions

Volatility Surface Analysis

Greeks Sensitivity Scans (Delta, Gamma, Vega, Theta)

Skew Charts & Term Structure

Trade Cost Analysis (TCA)

Liquidity Heatmaps

Algo Execution Strategies (TWAP, VWAP)

Institution Option Trading Part-6Introduction to Institutional Option Trading

Institutional option trading refers to the use of options by large financial institutions such as hedge funds, pension funds, insurance companies, mutual funds, and proprietary trading desks to manage risk, enhance returns, or speculate on price movements. Unlike retail traders, institutions bring scale, research, and complex strategies to the options market.

Slide 2: Key Characteristics of Institutional Traders

Large Capital Base: Institutions trade in bulk with millions or billions of dollars.

Data Advantage: Access to premium data, analytics, and predictive algorithms.

Advanced Infrastructure: High-frequency execution systems, smart order routing.

Risk Management Focus: Use options for hedging equity, credit, FX, or commodity exposure.

Regulatory Boundaries: Subject to risk limits, compliance, and disclosures

Institution Option Trading Part-5Popular Strategies Tested via Option Database

IV Crush Earnings Strategy

Buy/sell options before earnings when IV is high, expecting post-earnings IV drop.

High OI Breakouts

Trade breakouts from strikes with high OI using price+OI correlation.

Skew Arbitrage

Analyze IV skew and trade underpriced/overpriced strikes accordingly.

Time Decay Capture (Theta)

Sell options with high Theta before expiry using historical decay rates.

💡 Advantages of Option Database Trading

Quantitative Edge: Allows logic-based decisions over emotion-driven trades.

Backtesting Confidence: Know the probability of success before risking capital.

Scalability: Can analyze hundreds of symbols and expiry combinations.

Automation Ready: Can link with brokers to run fully algorithmic systems.

Power of India VixWhy India VIX Matters?

✅ Predicts Market Sentiment: Spikes in VIX often precede sharp market moves.

✅ Option Pricing Insight: High VIX = Expensive Options; Low VIX = Cheaper Options.

✅ Helps Strategy Selection:

High VIX: Favor credit strategies (Iron Condor, Strangle Sell).

Low VIX: Favor debit strategies (Buy Call/Put, Spread Buy).

✅ Risk Management Tool: Helps gauge when to reduce exposure or go aggressive.

Option trading is a financial strategy where traders buy and sell options contracts — financial instruments that derive value from underlying assets like stocks or indices. Each option gives the buyer the right (not obligation) to buy (Call) or sell (Put) at a specified price before expiry.

Trading Road Map 1. Foundation Stage (Beginner Level)

Understand Markets: Equity, Commodity, Forex, Derivatives

Basic Concepts: What is a stock, index, option, futures

Learn Platforms: TradingView, Zerodha, Upstox

Risk Awareness: Avoid FOMO, control emotions, capital safety

🔹 2. Skill Building Stage (Intermediate Level)

Technical Analysis: Charts, Patterns, Indicators (MACD, RSI, Moving Averages)

Fundamental Analysis: Earnings, Balance Sheets, PE ratio

Paper Trading: Practice without risking money

Journaling: Track trades, wins/losses, and learn from mistakes

🔹 3. Strategy Development (Advanced Level)

Create Systems: Scalping, Swing, Positional

Options Mastery: Strategies like Iron Condor, Straddle, Spread

Risk Management: Position sizing, SL rules, R:R ratio

Backtesting: Validate your strategy on historical data

🔹 4. Execution & Scaling (Pro Level)

Discipline & Psychology: Stick to plans, stay unemotional

Automation & Tools: Algo Trading, Screeners

Capital Scaling: From ₹10K to ₹10L+ systematically

Diversification: Trade across assets, build passive income

BTC 3rd Wave Targeting $195,000! Are You Riding It?Bold, Attention-Grabbing:

🚀 BTC 3rd Wave Targeting $195,000! Are You Riding It?

🔥 Bitcoin Sniper Entry: Next Stop $195K

📈 3rd Wave in Play: BTC Bulls Eyeing $195,000

💣 Bitcoin Explosion Coming — 3rd Wave Toward $195K

🧠 Smart Money Sniping BTC to $195K — Join the Ride

Advanced Technical Trading Advanced Technical Trading: A Deep Dive

Introduction

Advanced technical trading goes beyond basic chart patterns and indicators. It blends quantitative analysis, risk management, algorithmic methods, and behavioral insights to make data-driven trading decisions. The goal is to create a structured trading framework that adapts to market dynamics with precision.

This guide covers advanced tools, methods, and strategies used by professional traders and hedge funds to navigate complex market conditions.

1. Market Structure Analysis

Understanding market structure is critical for timing entries and exits.

Market Phases: Accumulation → Mark-Up → Distribution → Mark-Down

Order Blocks: Institutional price levels where smart money enters (used in ICT and SMC).

Liquidity Pools: Zones of stop-loss clustering (above highs or below lows).

Break of Structure (BOS): A key signal that trend direction is shifting.

Change of Character (CHOCH): A microstructure shift that signals potential reversals.

Tools:

Volume Profile

VWAP (Volume-Weighted Average Price)

Footprint Charts (for order flow)

2. Multi-Timeframe Analysis (MTFA)

Advanced traders always align multiple timeframes:

HTF (High Time Frame): Weekly/Daily → Defines macro trend

MTF (Mid Time Frame): 4H/1H → Confirms setups

LTF (Low Time Frame): 15min/5min → Execution

Example: Look for a daily demand zone + 4H BOS + 5min bullish CHoCH to confirm long entry.

3. Advanced Indicators & Tools

A. ATR-Based Strategies

Average True Range (ATR): Measures volatility.

Use ATR to set dynamic stop losses and targets.

ATR Channels can be used to gauge overbought/oversold conditions.

B. Ichimoku Cloud

Gives a complete picture: trend, momentum, support/resistance.

Cloud twist (Kumo twist) indicates potential trend reversals.

C. RSI Advanced Usage

RSI Divergence: Price making new highs, RSI not confirming.

RSI Levels: Beyond 80/20—watch for failure swings.

D. Fibonacci Extensions

Combine with Elliott Wave for confluence in target projections.

4. Price Action + Liquidity Concepts

Price action trading at an advanced level involves understanding:

Fair Value Gaps (FVG): Imbalances where price moves aggressively without filling orders.

Liquidity Grabs: Price sweeping a high/low to trigger stop hunts, then reversing.

Mitigation Blocks: Areas where the market re-tests a previous imbalance before continuing.

Use in:

ICT (Inner Circle Trader) methodology

Smart Money Concepts (SMC)

5. Algorithmic & Quantitative Techniques

A. Statistical Edge

Backtest strategies using Python or Excel.

Metrics: Win rate, profit factor, Sharpe ratio, max drawdown.

B. Monte Carlo Simulations

Assess risk and variability in performance.

C. Correlation Analysis

Use tools like rolling correlation between assets (e.g., Nifty 50 vs. Bank Nifty).

6. Volume and Order Flow Trading

Volume tells the story behind price movement:

Footprint Charts: Show actual volume at each price level.

Delta Divergence: Difference between aggressive buyers and sellers.

Volume Clusters: Zones where high volume transactions occurred—often act as support/resistance.

Tools:

Bookmap

Sierra Chart

TradingView + Volume Profile plugins

7. Risk and Trade Management

Advanced trading isn't about always being right—it's about managing risk:

Kelly Criterion: Used to size trades based on edge.

R-Multiple Tracking: Risk-to-reward measurement on every trade.

Position Sizing Models:

Volatility-based sizing (using ATR)

Equity curve-based sizing

8. Strategy Building & Optimization

Build a Rules-Based Strategy

Setup (Entry Criteria): Structure + Indicator confluence

Trigger: Candlestick or microstructure confirmation

Risk Management: Fixed % or volatility-based

Exit Plan: Partial profit-taking, trailing stop, or time-based exit

Optimize Your Edge

Forward test in live but small positions

Maintain a trading journal

9. Psychological Edge

Advanced trading requires emotional discipline:

Avoid Overtrading: High-quality setups only.

Process Over Outcome: Focus on execution, not money.

Meditation and Mindfulness: Helps manage stress and improve decision-making.

Pre/Post-Market Routines: Review trades, plan ahead.

Books like "Trading in the Zone" by Mark Douglas are highly recommended.

10. Specialized Strategies

A. Options Flow Analysis

Track institutional options activity.

Option Trading with Option chain part -3Example of an Option. Suppose that Microsoft (MFST) shares trade at $108 per share and you believe they will increase in value. You decide to buy a call option to benefit from an increase in the stock's price. You purchase one call option with a strike price of $115 for one month in the future for 37 cents per contract ...

Ans: Options contracts are of two types; Call options and Put options. However, they can differ based on their underlying assets and expiration date.

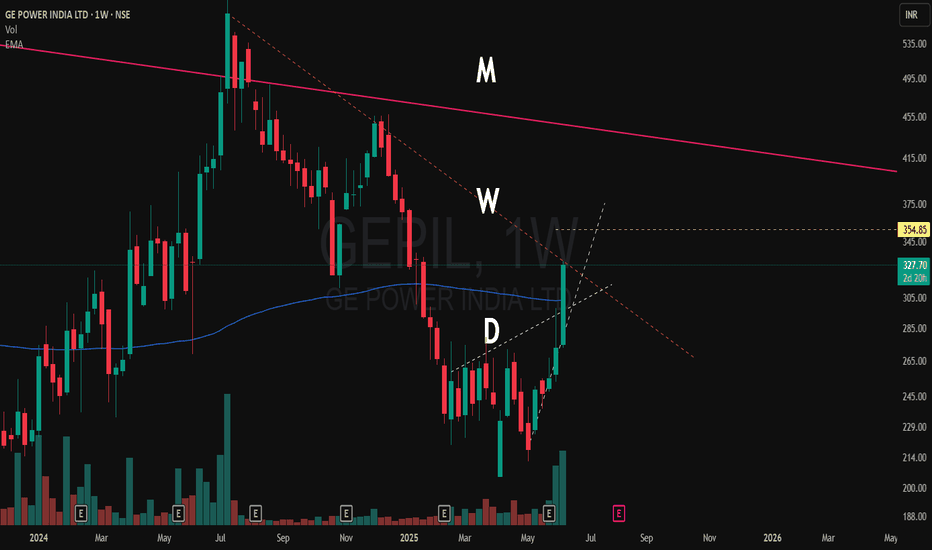

Multi time frame charting explained in GEPILI make educational content videos for swing / positional trading

Option trading Who is the youngest successful stock trader in the world? 5 Youngest Stock Traders Ashu Sehrawat At only 22 years old, the self-made millionaire has created a name for himself as one of India's top stock traders.

Selling options spreads is one such strategy that fits the bill. It's often seen as one of the lowest risk option strategies because it allows you to have a pre-determined capped loss risk when trading. This way, you're not only minimizing risk but also generating income.

Database TradingIf you're looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security on or by a specific date at a specific price. An option is a contract that's linked to an underlying asset, such as a stock or another security.

The long straddle is the best strategy for option trading that consists of purchasing an In-The-Money call and putting options with the same underlying asset, strike price, and expiration date. Profit potential is infinite in this method, while loss potential is limited.

Option Trading Part-7If you're looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security on or by a specific date at a specific price. An option is a contract that's linked to an underlying asset, such as a stock or another security.

The Indian stock market has witnessed significant growth in recent decades, transforming from a manually operated environment to a digital, highly regulated, and globally integrated system. Among the many financial instruments available, options trading has emerged as one of the most dynamic and potentially rewarding strategies for traders and investors.

Advance Institutions Option Trading - Lecture 5When it comes to low risk options strategies, selling a call spread and selling a put spread are techniques that traders often utilize. These strategies are characterized by a high probability of profit due to the low probability of loss, and they limit risk in case the trade doesn't go as planned.

While day traders look at minute-to-minute price changes, swing traders look at trends that play out over several days. This is considered one of the most profitable trading types that allows more flexibility, as you don't need to be glued to your computer screen all day.