Gold Next Target 2800 and What Next Trump's tariffs?🔍 Chart Context (1H and 15M Combined View)

Trend: Bearish overall structure on the 1H timeframe, with lower highs and lower lows.

Trendline: Clearly respected and just recently tested again (price rejected at the trendline on 1H).

POI (Point of Interest): 3,030 – 3,040 zone acting as a strong supply/resistance zone.

📈 Support Levels:

2,978.949 (key demand/support zone).

2,956.129 (major support level).

📉 Resistance Zones:

✅3,020 area (15M minor supply zone, shaded red).

✅3,030–3,040 (POI level on 1H, shaded blue).

✅3,058.437 (major resistance).

🧠 Price Action Insights-1H Chart:

Price attempted to break the descending trendline but was quickly rejected (marked with a circle).

Multiple rejections from POI level suggest strong seller presence.

Strong bearish candle followed that rejection (confirmation of trend continuation).

15M Chart:

Price bounced from support at 2,978

Quick rally back to ~3,004, stalling below the minor supply at 3,020.

Could be forming a lower high (ideal short setup zone).

📌 Trade Setup Idea:

✅ Trade Type: Short (Sell)

🔽 Entry Zones (Sell Limit Ideas):

Aggressive: 3,020 (near the 15M minor supply zone)

Conservative: 3,030–3,040 (POI level on 1H chart)

🛑 Stop Loss:

Above 3,045 (well above POI and trendline breakout level)

🎯 Targets:

TP1: 2,978.949 (recent support, also previous bounce level)

TP2: 2,956.129 (major support level from 1H chart)

TP3 (Optional Swing): Below 2,950 if momentum continues

⚠️ Risk Management Tip (Beginner-Friendly):

Use position sizing based on your risk appetite (e.g., 1–2% of your account per trade).

Avoid entering late if price already breaks past POI or trendline with strong volume.

📌 Key Beginner Takeaways:

You're identifying liquidity zones, trendlines, and structure: excellent progress!

Use confluence (multiple factors aligning) to enter with higher probability.

Practice this setup in a demo account to gain confidence.

👉 Always follow TP/SL to protect your capital and maximize profits!

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

Xauusdanalysis

Gold hits important support. Is the downtrend over?

📊 Trump's "reciprocal tariffs" policy is affecting the entire financial market in general and gold prices in particular. The trade war is approaching and the market continued to fall sharply on Monday. Not staying out of the game, OANDA:XAUUSD is also inevitable to sell off when market volatility increases. Let's analyze the next developments of gold from the perspective of **Technical Analysis:** and the opportunity to find profits at this time:

🔹 **Frame D**: After 3 consecutive days of decline, FOREXCOM:XAUUSD prices have temporarily maintained the upward price trend. And currently the price is at an important support area, the old peak area 1 month ago. Whether the correction ends here or not, we will need to consider further in the next time frames

🔹 **H4 frame**: The important key zone has been broken, the bearish price structure has not changed, it is not yet possible to confirm that this downtrend has ended.

🔹 **H1 frame**: The bearish price structure is very clear, however, the selling force is not as strong as before. The support area still brings a cautious mentality to the bears, plus the profit-taking action for SELL positions after the past 3 days.

✅**Trading plan:*

Looking at the price structure, although the price is at an important support area, we are still not sure that this downtrend has ended, so the BUY option will not be considered. However, the current area is no longer suitable for setting up a SELL position. The priority at the moment is to wait for the price to return to the marked resistance area to TRADE WITH THE MEDIUM TERM TREND. The market volatility is very high at the moment so pay attention to reduce the corresponding Volume and Stoploss with the loss you can accept.

💪 **Wishing you success in achieving profits!**

XAUUSD 1H SELL PROJECTION 08.04.25Instrument: Gold Spot / U.S. Dollar (XAUUSD)

Timeframe: 1 Hour (1H)

Current Price: ~$2,995.25

Projection Date: April 8, 2025

Analysis Type: Bearish/Sell Projection

📊 Technical Elements:

🔹 Trend Analysis:

A 1H downtrend is marked with a descending trendline.

Price previously broke a key support zone, retested it (now acting as resistance), and is expected to drop again.

🔹 Trade Setup:

Entry: Near current price ($2,995.25)

Stop Loss: Above Resistance R1 at $3,010.27

Take Profit Targets:

TP1: At Support S1 (~$2,980)

TP2: At Support S2 (~$2,957)

📈 Indicators:

📍 Stochastic Oscillator (5, 3, 3):

Reading: 79.61 (green) and 80.17 (red)

Interpretation: Just above 80 → Overbought Zone

Signal: Potential reversal downwards

📍 Relative Strength Index (RSI - 14):

Value: 44.84

Interpretation: Below neutral 50, not oversold

Signal: Bearish momentum building

🧠 Conclusion / Strategy:

The chart suggests a short/sell setup for XAUUSD.

The price has retested the broken support (now resistance) and formed a rejection candle at the trendline.

Indicators support a potential downward move (Stochastic overbought + RSI weak).

Targeting lower supports for potential exit points.

GOLD FACES MAJOR PULLBACK: WILL IT BOUNCE BACK OR BREAK DOWN?Symbol - XAUUSD

CMP - 3032

Gold is currently undergoing a significant liquidation phase, primarily driven by profit taking following last week's favorable market news. The market sentiment has been further pressured by the robust Non-Farm Payroll (NFP) report released on Friday. The economic risk landscape is showing signs of divergence.

Following a decline in the Asian trading session, gold prices have rebounded, consolidating the earlier drop precipitated by the escalating trade tensions between the United States and China. Comments from Trump rejecting potential trade deals with China have heightened recession concerns, which, in turn, have increased expectations of a potential Federal Reserve rate cut.

In this environment, gold has gained traction as a safe-haven asset, even amid rising dollar strength and climbing bond yields. However, the sustainability of gold's upward momentum remains uncertain due to ongoing profit-taking and the absence of new economic data from the United States.

From a technical perspective, gold is consolidating under pressure near the support levels of 3017-3013, with a descending triangle pattern forming on the local timeframe.

Resistance Levels: 3033, 3057

Support Levels: 3017, 3013, 2981

Given the current market dynamics and the strong pressure exerted on prices, two scenarios appear plausible:

A breakdown below the support range of 3017-3013, should the descending triangle structure on the local timeframe persist. In this case, the next targets for support are 3000 and 2981

Alternatively, the price could consolidate within the range, with potential targets of 3057, 3033, and 3013, reflecting a phase of consolidation following the sharp decline and liquidation.

GOLD WEEKLY OPEN – Sellers Hit Early, But Market Psychology🟡 GOLD WEEKLY OPEN – Sellers Hit Early, But Market Psychology Will Lead the Way

Gold kicked off the new week with a sharp drop during the Asian session, falling over 40 points from the previous highs (around 3018) down into the 297x zone. This reflects lingering sell pressure from the previous week’s volume.

However, gold quickly bounced back by nearly 40 points, confirming strong buy interest around 297x — a key level on the higher timeframes.

📌 This 297x zone is a critical support on H4/D1. A confirmed break below it could open the door for a deeper sell-off into 295x and beyond.

🔍 Technical Overview:

The broader trend on H4 and D1 still leans bullish.

However, psychological reactions from market participants are currently stronger than clean technical patterns.

On H1 and H2, price is now reacting to the 0.5 Fibonacci retracement.

A close below 3030 could trigger a renewed bearish move toward the 295x target.

🧠 Sentiment Will Drive Direction:

So far, only Asian and Australian sessions have participated.

We’ll need to monitor the London & US sessions closely to confirm directional conviction.

This is a sentiment-led market, not one purely ruled by structure → only trade from key zones with clean reaction signals.

🧭 KEY PRICE LEVELS:

🔺 Resistance:

3055 – 3076 – 3107

🔻 Support:

3024 – 3005 – 2970 – 2952

🎯 TRADE PLAN

🟢 BUY ZONE: 2980 – 2978

SL: 2974

TP: 2984 – 2988 – 2992 – 2996 – 3000

🔴 SELL ZONE: 3076 – 3078

SL: 3082

TP: 3072 – 3068 – 3064 – 3060 – 3056 – 3050

📅 Important this week:

Major data coming: CPI – PPI – FOMC Speeches → Expect potential spikes midweek. Stay alert, and I’ll update key reaction zones as the sessions unfold.

Stick to clear plans and always use TP/SL — capital protection comes first.

Good luck team,

— AD | Money Market Flow

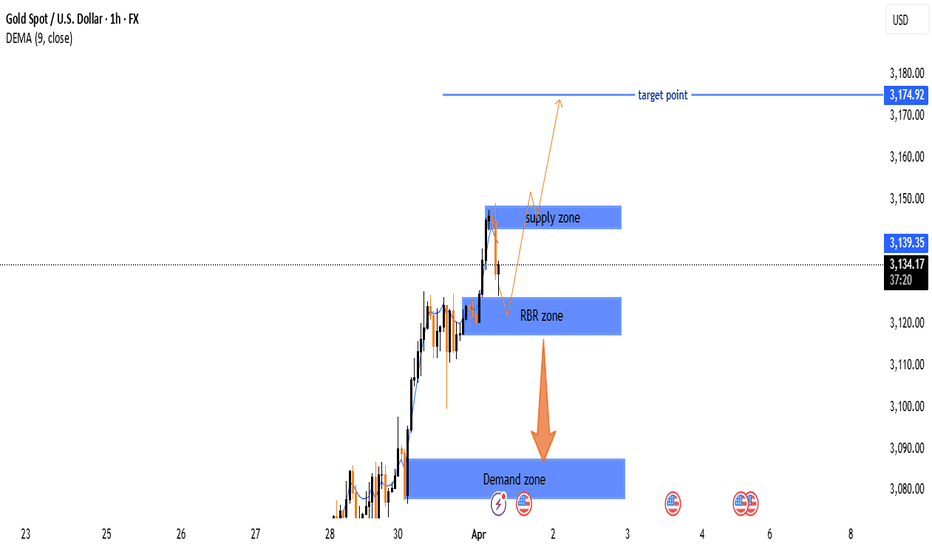

Gold Price Analysis:Key Supply & Demand Zones with Potential Bkl🔥 Key Levels & Zones

🔵 Supply Zone (3,135-3,140 USD) 📉

Acts as resistance where selling pressure increases.

If price reaches here, expect a potential pullback.

🟢 Demand Zone (3,085-3,095 USD) 📈

Strong support area with buying interest.

Price has tested this zone multiple times = accumulation.

🎯 Target Point (~3,167 USD) 🚀

If price breaks out, it may rally towards this level!

❌ Stop Loss (~3,080 USD) ⛔

Marked below demand zone to limit risk.

---

📊 Trend Analysis

🔹 Trend Line Break ⚡

The price broke the previous uptrend = potential reversal or deeper correction.

🔹 Market Structure 🏗️

Price consolidating inside the demand zone = possible bullish move ahead.

🔹 Double Bottom Formation (DBF) at Supply Zone 🔄

Shows failed breakout attempts = strong resistance.

---

🔍 Indicators & Insights

📌 DEMA (9 close) at 3,099 USD 📈

Price hovering around this moving average = market indecision.

---

🚦 Possible Scenarios

✅ Bullish Scenario:

If price holds the demand zone & breaks above 3,110 USD, it could rally to supply zone (~3,135 USD).

A breakout above 3,140 USD could lead to the target zone (~3,167 USD) 🚀.

❌ Bearish Scenario:

If price breaks below 3,085 USD, it may hit stop loss (3,080 USD) and continue lower.

---

🎯 Trading Plan

🟩 Long Entry ➡️ Around 3,090-3,100 USD 📊

🛑 Stop Loss ➡️ Below 3,080 USD 🚨

🎯 Target ➡️ 3,135-3,167 USD 🎉

TRADE WAR STORM BREWING – IS A GLOBAL BIGSHORT COMING?🚨 TRADE WAR STORM BREWING – IS A GLOBAL BIGSHORT COMING?

In the past 24 hours, global financial markets have been rocked by the shock announcement of Trump’s aggressive global tariff policy. This isn’t just a geopolitical maneuver — it’s a potential trigger for massive systemic volatility, affecting everything from U.S. equities to Gold, DXY, crypto, and major global indices in Asia and Europe.

🔍 What Just Happened?

We saw Gold crash over 100 points, a move that caught many traders off guard. Under normal circumstances, a weakening USD would be bullish for Gold. But here’s the twist: the Dollar also dropped sharply, yet Gold was still aggressively sold off.

Why?

👉 A plausible explanation is that major funds and investors liquidated their Gold positions to cover equity losses or to meet margin calls from collapsing positions across other markets.

This is no ordinary move — it may well be the beginning of a “BIGSHORT” phase across global assets.

🧨 This Is Just the Beginning

The market reaction suggests that we are not in a routine correction. Instead, we may be witnessing the early stages of a coordinated risk-off movement — one sparked by fears of a new global trade war with far-reaching implications.

Tariffs on aluminum, steel, manufacturing goods, and industrial inputs have already disrupted entire supply chains. Industry-specific disruptions (e.g. construction, healthcare, utilities, wholesale) are beginning to show — this is not a drill.

📉 U.S. Macro Data Is Getting Worse

The headline inflation data in the U.S. continues to fall, but other economic indicators are flashing red:

ISM Services PMI (Mar): 50.8 (vs. 53.0 expected)

Employment: 46.2 (prev: 53.9) — a sharp drop

New Orders: 50.4

Export Orders & Backlogs: Both declined significantly

👉 The ISM Services sector represents more than 70% of U.S. GDP. A reading this weak suggests that the U.S. economy may be slowing faster than expected.

🧠 Market Sentiment Is Shaky

Fear is back. And worse: FOMO and panic are driving decisions, not logic.

Retail and institutional traders alike are struggling to digest the overlapping risks: tariffs, inflation uncertainty, interest rates, and recession fears.

Tonight brings another major catalyst:

📆 Nonfarm Payrolls (NFP) — a key employment report that could reinforce or break the current narrative.

🏦 Will the Fed Cut Rates Earlier Than Expected?

Here’s what markets are now pricing in:

Rate cuts may start as early as May or June 2025

Probabilities have risen for 2–4 rate cuts this year, compared to 2 cuts expected previously

Odds of a summer pivot are now well above 50%

If the Fed sees continued weakness in labor and services, it may have no choice but to cut earlier — regardless of inflation progress.

⚠️ Strategic Takeaway: Watch, Don’t Chase

Before looking for entries, take a breath.

This is a time when doing nothing might be the smartest trade.

“Sometimes, staying on the sidelines is how you survive the storm.”

Let the volatility play out — and prepare for high-probability setups, not emotional trades.

📊 TECHNICAL LEVELS TO WATCH

🔺 Resistance Levels:

3110 – 3119 – 3136 – 3148 – 3167

🔻 Support Levels:

3086 – 3075 – 3055 – 3040 – 3024

BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080

SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

💬 Final Thoughts

The combination of geopolitical tariffs, recession fears, and Fed policy uncertainty has created a perfect storm across global markets.

We’re entering a phase where any careless trade can wipe out weeks of progress. Be cautious. Stay informed. Wait for clarity before going big.

📌 As for Gold:

Are we seeing just a pullback — or is this the calm before an ATH breakout?

Stay sharp. Set clear SL/TP. Follow the macro, respect the chart — and most importantly, don’t trade scared.

🧠 Patience is profit. Let the market come to you.

XAU/USD: 5th Wave Rally After CorrectionOn the 1-hour timeframe, XAU/USD has formed an Elliott Wave corrective structure. This is an expanded flat correction, typically seen in the 4th wave. The correction seems to have been completed at 3,054, suggesting that the 5th wave may be in progress.

For bullish traders, a potential long position can be considered around the 0.236 retracement level as a pullback entry point.

The 5th wave has the potential to reach the following upside targets: 3,110, 3,145, 3,165

However, this bullish outlook remains valid only if the low of Wave IV holds. A breakdown below this level would invalidate the bullish scenario.

Gold (XAU/USD) Bullish trend Demand Zone – Trend Analysis🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

Gold (XAU/USD) : Bullish Setup with Key Demand Zone🔹 Trend Line & Demand Zone 📈

* The trend line shows an upward trend. 🚀

* The demand zone 🟦 acts as strong support, where buyers are likely to step in.

🔹 Price Action 🔍

* Price is bouncing off the demand zone ➡️ Bullish Signal 📊🔥

* Higher lows forming, indicating potential upward momentum.

🔹 Trade Setup 🎯

✅ Entry Point: Near the demand zone 🟦

❌ Stop Loss: 🔽 3,099.26 (Below demand zone)

🎯 Target Point: ⬆️ 3,148.58 (Key resistance area)

🔹 Expected Movement 🏆

* A slight pullback 📉 before a strong push up 📈💪

* If price holds the demand zone, 🚀 potential rally ahead!

🔹 Risk-to-Reward Ratio ⚖️

* Favorable trade setup ✅ High reward, controlled risk 🎯

🔹 Final Verdict 🔥

📊 Bullish Bias ✅ As long as demand zone holds!

🚨 Warning: If price breaks below 3,099.26, expect further downside!

GOLD ANALYSIS – NEW ATH AFTER TRADE TARIFF SHOCK!📊 GOLD ANALYSIS – NEW ATH AFTER TRADE TARIFF SHOCK!

Former U.S. President Donald Trump has officially announced a comprehensive global tariff policy, targeting multiple countries and regions. This unexpected move triggered strong risk-off sentiment, resulting in:

📉 Massive asset sell-offs

💵 A sharp decline in USD strength

🪙 And another all-time high (ATH) for GOLD

Gold broke out aggressively from a long-standing sideways triangle pattern, confirming strong bullish momentum. The counter-tariff reactions from other countries were far more aggressive than forecast, further fueling gold’s safe-haven appeal.

🔍 Technical Perspective

Yesterday, we successfully identified and traded within the triangle pattern by connecting recent highs and lows. The breakout came exactly as expected, especially nearing the end of the consolidation range — a classic price behavior traders should always watch for!

Now that the breakout has occurred, our focus shifts to BUYING on a retest of the breakout zone. Early entries during the Asian and European sessions are preferred, while we’ll reassess during the U.S. session due to upcoming economic data.

🔔 Note: With major events like Nonfarm Payrolls (NFP) coming soon, stay alert for volatility and unexpected moves.

📌 Key Resistance Levels:

3167 (ATH) - 3175 - 3185 - 3198 - 3206 (psychological/Fibonacci extensions – wait for candle confirmation)

📌 Key Support Levels:

3140 - 3132 - 3120

🎯 Trade Setups

BUY ZONE: 3132 – 3130

Stop Loss: 3126

Take Profits: 3136 – 3140 – 3144 – 3148 – 3152 – 3156 – 3160

SELL ZONE: 3185 – 3187

Stop Loss: 3191

Take Profits: 3180 – 3176 – 3172 – 3168 – 3160

⚠️ Final Notes:

The uptrend is clearly dominant — no need to FOMO sell at current highs. Be patient, wait for the market to reach key resistance zones (psychological or Fibonacci-based), then reassess.

📌 Avoid overtrading or aggressive selling — the tariff announcement is a global macro driver with deep market impact.

We’ll wait for Friday’s NFP to reassess broader sentiment.

As always: Respect your TP/SL levels to protect your capital.

Stay safe & trade smart! 💼📈

Gold Hits Another Record II U.S. Tariff Plan II Daily Analysis🔥 Fundamental Analysis :

⚡Gold rose to $3,164 per ounce, a new record high as risk aversion increased following President Trump's tariff announcement.

⚡Trump outlined a 10% baseline tariff on imports from all countries, with higher rates for nations with trade surpluses, including China (34%), the EU (20%), and Japan (24%), and a 25% tariff on foreign-made automobiles.

⚡ All eyes are on the U.S. non-farm payrolls report, due Friday, for further clues on the Federal Reserve's monetary policy path.

Technical Analysis:

1. New All-Time High:

The price reached 3,168 USD, marking a new all-time high.

However, the price has slightly retraced after hitting this level.

2. Fibonacci Levels:

• 1st Fib Level: 3,183 USD – Potential resistance.

• 2nd Fib Level: 3,206 USD – Further resistance if the bullish momentum continues.

3. Support & Resistance Zones:

• Green Zone (~3,135 - 3,138 USD): Previously a resistance, now acting as support.

• Another support near 3,124 USD.

• Resistance Levels:

• 3,168 USD: (All-time high) – If broken, could push the price towards the Fibonacci targets.

4. Moving Averages:

• Red Line (Likely 50 EMA): Trending upwards, supporting price action.

• Blue Line (Likely 200 EMA): Positioned lower, indicating that the trend remains bullish as long as price stays above.

5. Trend Analysis:

• Bullish Breakout: The price broke out of a previous range and surged to a new high.

• Potential Retest: Price might revisit the 3,135 - 3,138 support zone before another leg up.

Trading Considerations:

• Bullish Case: If price consolidates above 3,135-3,138, it could retest 3,168 and move towards 3,183 or 3,206.

• Bearish Case: A break below 3,135 could push price back towards 3,124 or lower.

• Risk Management: Place stop losses below key support zones if entering long positions.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

📢Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

XAUUSD 13 POINTS STRONG INTRADAY ABOVE 3137.10 TARGET UPTO 3150XAUUSD strong zone intraday wise if active above 3137.10

current mkt price 3133.40

there is no resistance upto 3141.50 next 3150

wait for active

Buy above 3137.10

Stoploss..............3131....6 points

Target1.............3141.50....4.50 points

Target2.............3150........13 points

Disclaimer- This level only for educational purpose only . Do ur own analysis

GOLD MARKET – Early Asian Spike Meets Resistance Ahead of ADP🟡 GOLD MARKET UPDATE – Early Asian Spike Meets Resistance Ahead of ADP

Gold saw a strong early move during the Asian session, rallying back into the 313x zone — largely supported by consistent buying flow from Asian and Middle Eastern investors, as seen in the bullish momentum early in recent Asian sessions.

However, price quickly reacted to the key resistance zone at 3130–3135, which was highlighted in yesterday’s plan. With selling pressure reappearing at this level, my view remains to look for sell setups in both the Asian and London sessions if price retraces upward again.

📉 Technical Structure:

Gold is approaching the tip of a symmetrical triangle pattern, suggesting an imminent breakout.

→ As always: wait for the breakout, then trade the retest in the breakout direction.

📰 Fundamental Watch:

All eyes will be on tonight’s ADP Non-Farm Employment data from the U.S.

Expectations are fairly optimistic — if the data comes in near or better than forecast, this could strengthen the USD and push gold lower, aligning with my bearish view toward the 308x–307x target zone.

🧭 Key Levels to Watch:

🔺 Resistance: 3128 – 3135 – 3142 – 3148

🔻 Support: 3110 – 3100 – 3080 – 3070

🎯 Trade Setup:

🟢 BUY ZONE: 3102 – 3100

SL: 3096

TP: 3106 – 3110 – 3114 – 3118 – 3122 – 3126 – 3130

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

📌 Caution: Watch out for increased volatility during the US session with ADP release.

In Asia and Europe, stick to the technical zones above and always manage your TP/SL properly to protect your capital.

Good luck, stay sharp.

— AD | Money Market Flow

GOLD - BULLISH STRUCTURE INTACT II Trump's tariff plansFundamental Key points:

⚡Gold hangs near record high on safe-haven flows

⚡Currency market muted ahead of reciprocal tariffs

⚡Investors brace for Trump's levies

🔎 Technical Analysis:

Key Observations:

1. Market Structure:

o The price is in an uptrend overall, following a parallel channel (1H chart).

o Short-term retracement after testing a resistance level (~$3,138 - $3,149).

2. Support & Resistance Levels:

o Resistance Levels (Sell Zone):

$3,138.87 → Previous high/resistance.

$3,149.05 → Major resistance, potential reversal zone.

o Support Levels (Buy Zone):

$3,122.61 - $3,114.86 (Order Block - OB) → Strong demand zone.

$3,100.93 → Strong support level, potential bounce area.

$3,065.23 - $3,058.33 → Major support on the 1H chart.

3. POI (Point of Interest) Level:

o The price is currently at the POI level (~$3,130-$3,132), which is acting as a temporary resistance.

4. Moving Averages & Trend Confirmation:

o 50 EMA (Red Line) on 1H chart is acting as support (~$3,114).

o 200 EMA (Blue Line) below, confirming a strong bullish trend.

________________________________________

Trade Plan:

🔹 Buy (Long) Setups:

1. Entry Zone:

o $3,122 - $3,114 (OB Zone)

o $3,100 - $3,110 (Major Support)

o $3,065 - $3,058 (Strong Support, 1H Chart)

2. ⭐ Confirmation:

o Price showing bullish rejection at support levels.

o 50 EMA Holding Support

3.🎯Target:

🎯TP1: $3,138

🎯TP2: $3,149

4. ❌Stop Loss (SL):

o Below $3,100 (to avoid deeper pullback risks).

________________________________________

🔹 Sell (Short) Setups:

1. ✔Entry Zone:

o $3,138 - $3,149 (Major Resistance Zone)

o If price struggles to break above $3,138 and shows reversal patterns, it’s a potential short.

2. 📌Confirmation:

o Rejection wicks at resistance

o Break below POI Level ($3,130)

3. Target:🎯

🎯 TP1: $3,122

🎯 TP2: $3,114

4. Stop Loss (SL):

o Above $3,150 (to avoid fake breakouts).

________________________________________

📢 Conclusion:

• Bullish Bias: Until price breaks below $3,114.

• Ideal Buy Zone: $3,122 - $3,114

• Sell Only Near Resistance: $3,138 - $3,149

Gold short-term analysis: a new round of rise beginsPrecious metals benefited significantly from a sudden surge in risk aversion this week. U.S. President Donald Trump confirmed that reciprocal tariffs would be imposed on all countries on Tuesday, after hopes for a possible last-minute easing were dashed. Market tensions have risen significantly as the deadline approaches. Meanwhile, major banks remain bullish on the outlook for precious metals. Goldman Sachs Group Inc. sharply raised its gold forecast, predicting it will reach $4,500 by the end of the year.

Unexpected central bank demand and strong inflows into gold ETFs are the main factors supporting prices. U.S. Treasury yields gapped lower on Monday, approaching the March low of 4.172%. Market data shows that gold pricing has not only not become more expensive, but has become cheaper, suggesting that the market expects the current high to become the new normal and there is still room for upside in the future.

The 1-hour moving average of gold continues to cross upward and diverge. The support of the 1-hour moving average of gold has moved up to 3096, but gold is now far away from the moving average. So wait patiently for the adjustment and then continue to go long after stepping back. The 1-hour gold price fell to 3100 yesterday and stabilized again. So today, gold continues to go long on dips above 3100.

Don't guess the top of gold in a bull market. This is the best reflection of this year's market. The current market has hit a new high. For our intraday gold investment, I think we should continue to be bullish, because in the general direction, gold has completely broken through and stabilized above the 3100 mark. The trend in the first quarter showed a trend of exceeding strong rise, and the market continued to attack higher points above!

After gold stepped back, it hit a new high again. Gold bulls continued to be strong. Gold broke through 3127 again, so bulls were better and gold fell back to continue to be bullish. From the one-hour chart, gold broke through the new high in the morning and continued to rise, and the intraday 3127 line has turned into a support level. If it falls back to 3127 again, we will buy directly!

Key points:

First support: 3125, second support: 3113, third support: 3102

First resistance: 3148, second resistance: 3159, third resistance: 3170

Operation ideas:

Buy: 3120-3123, SL: 3112, TP: 3140-3150;

Gold Kicks Off April with a New ATH – Bulls Remain in Control Gold continued its explosive rally during the early Asian session today, printing yet another All-Time High (ATH) after retesting the 3,12x zone overnight.

The U.S. stock market reversed sharply higher in the New York session, and if this bullish momentum continues, gold could see a short-term pullback near current resistance before heading higher again.

However, if equities fail to hold and roll over, gold may push further into uncharted territory, eyeing extended targets around 315x – 317x.

📰 Macro Focus:

Investors seem to have interpreted Trump’s latest trade stance as more "measured" than previously feared.

In his latest comments, he signaled that “tariffs may play a smaller role in the overall economic strategy.”

This has calmed markets slightly but hasn’t slowed down the gold rush.

📈 Price Action & Outlook:

With current momentum and sentiment, gold still looks likely to print fresh ATHs this week.

The next major upside target sits around 316x – 318x, where we may finally see a significant pullback as FOMO cools down.

For now, watch the 312x – 311x zones for potential short setups at local resistance — as marked in AD’s key levels.

🧭 Key Technical Levels:

🔻 Support: 3133 – 3122 – 3111 – 3100

🔺 Resistance: 3158 – 3166 – 3172 – 3180

🎯 Trade Zones:

🟢 BUY ZONE: 3122 – 3120

SL: 3116

TP: 3126 – 3130 – 3134 – 3138 – 3142 – 3146 – 3150

🔴 SELL ZONE: 3170 – 3172

SL: 3176

TP: 3166 – 3162 – 3158 – 3152 – 3148 – 3144 – 3140

📊 What to Watch Today:

Investors will be closely watching ISM Manufacturing PMI and JOLTS Job Openings during the US session — expect volatility spikes.

As gold hovers near new ATHs, stay disciplined:

✅ Respect SL/TP

✅ Manage risk according to your account size

✅ Don’t get caught up in emotional trades

Wishing you a powerful and profitable start to the new month. Let’s flow smart.

— AD | Money Market Flow

Gold Spot (XAU/USD) Price Analysis –Key Zones & Potential Movemt🔵 Key Price Levels:

Current price: 🟠 $3,130.99

DEMA (9): 🔵 $3,138.21

Target price: 🎯 $3,174.92

📌 Zones Identified:

🟢 Demand Zone (Support) ⬇️: Strong buying interest, potential bounce area. If price falls here, buyers may step in.

🟡 RBR Zone (Rally-Base-Rally) 🔄: A mid-level area where price could consolidate before moving up.

🔴 Supply Zone (Resistance) ⬆️: Sellers might emerge, causing a reversal or slowdown in price movement.

📈 Potential Price Action:

🔹 Scenario 1 (Bullish 🐂): A retrace to the RBR Zone 🟡 could lead to a bounce 📈 toward the Target 🎯 at $3,174.92.

🔹 Scenario 2 (Bearish 🐻): If price drops below the Demand Zone 🟢, it may signal a trend reversal 📉.

🔹 Breakout Confirmation: If price breaks above the Supply Zone 🔴, it may continue rallying 🚀 toward the target point.

Gold Next Move 3200?🔎 15-Minute Chart (Intraday Analysis)

50 EMA as Dynamic Support:

Price is respecting the 50 EMA (red line), indicating bullish strength.

📈 Support Levels:

$3,099 & $3,087 - Strong support zones for a possible bounce.

$3,071 - Deeper support if price pulls back further.

• Current Price Action:

• Price is pushing higher but approaching resistance.

📌 Conclusion: If the 50 EMA holds, price could continue its upward move. If it breaks, we may see a pullback toward $3,099 or lower.

🔎 1-Hour Chart (Short-Term Targets & Ranging Market)

⚠️ Breakout from Ranging Market:

• Price was consolidating in a range around $3,098 - $3,120 before breaking out.

Fibonacci Targets:

• 1st Target: $3,141 (already reached).

• 2nd Target: $3,162 (next potential level).

Support & Resistance Levels:

📉 Resistance: Near $3,141 - $3,162 (Fib targets).

📈 Support: Around $3,098 and $3,087 (marked with red and green lines).

📌 Conclusion: The breakout is bullish, and if price holds above $3,141, it may push toward $3,162. A break below $3,098 could signal a retracement.

🔎 4-Hour Chart (Trend & Key Levels)

Trend: Strong uptrend inside an ascending channel.

Buy Entry & Exit Points:

• A Buy was placed near the lower trendline.

• Buy Exit was taken at a key resistance level before a pullback.

• POI (Point of Interest) Level:

• A demand zone (light blue area) around $2,980 - $3,000, where price previously reacted.

Moving Averages:

• The 50 EMA (red line) is acting as a dynamic support.

• The 200 EMA (blue line) is providing long-term support.

Resistance & Support Levels:

📉 Resistance: Near $3,150 (upper trendline).

📈 Support: Around $3,059 and $2,980 (marked green lines).

📌 Conclusion: Price is moving towards the upper trendline. If it breaks, we could see more bullish momentum. If rejected, a pullback toward POI is likely.

🔹 Overall Market Summary & Trading Plan

✅ Bullish Bias: Price is in an uptrend on multiple timeframes.

✅ Next Resistance: $3,150 - $3,162 (watch for rejection or breakout).

✅ Pullback Zone: $3,098 - $3,087 (potential buy area).

🚨 Risk Management: If price breaks below $3,087, a deeper retracement may occur.

📌 Trade Idea:

🟢 Long Entry: On pullbacks to $3,098 - $3,087.

🎯 Target: $3,150 - $3,162.

❌ Stop Loss: Below $3,071 for risk control.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

📢 Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

Next Gold Move To 3500 ?📰 Fundametal news:

Key points:

⚡Gold hits record high at $3,128.06

⚡Trump expected to announce reciprocal tariffs on April 2

⚡Silver, platinum, palladium set for monthly gains

Trump is expected to announce reciprocal tariffs on April 2, while automobile tariffs will take effect on April 3

🚨 Technical Analysis

4-Hour Chart Analysis

Trend: Strong bullish channel (marked by red trendlines).

📈 Support Levels:

3,057 (key level in case of correction).

3,007 (next major support below).

📉 Resistance Levels:

🔸Upper boundary of the bullish channel near 3,140-3,150.

The price is respecting the trend channel.

🔸If gold remains inside this channel, it may continue rising towards the upper boundary (around 3,140-3,150).

🔸A breakdown of the channel could signal a correction.

1-Hour Chart Analysis

🔸Trend: Strong bullish momentum with a new all-time high at 3,127.962.

📈 Support Levels:

🔸3,057 (previous resistance turned support).

🔸2,999 (major historical support).

📉 Resistance Levels:

🔸No historical resistance beyond the all-time high, meaning price discovery mode.

🔸Gold is in a price discovery phase after breaking above previous highs.

🔸A possible pullback to 3,057 could provide a buying opportunity if bullish momentum continues.

15-Minute Chart Analysis

Trend: Short-term uptrend but facing resistance near 3,128.

📈 Support Levels:

🔸Minor support at 3,109 (highlighted blue zone).

🔸50 EMA (red line) acting as dynamic support.

📉 Resistance Levels:

💡3,128 is a strong resistance level where price is struggling to break out.

🔸The price gapped up and continued its bullish momentum.

🔸The price is hovering above support, indicating potential consolidation before another move.

Overall Trading Plan & Strategy:

Bullish Scenario:

🔸If price breaks 3,128 with strong momentum, we could see 3,140+ in the short term.

🔸Pullback to 3,109-3,057 could provide a buying opportunity if it holds support.

Bearish Scenario:

🔸If gold fails to hold 3,109, a drop to 3,057 or even 3,007 could be expected.

🔸Breaking below the trend channel would signal a deeper correction.

💡 Conclusion: The trend is bullish, but resistance at 3,128 needs to be broken for further upside. Watch for support at 3,109 and 3,057 for potential buy opportunities.

👉 Always follow TP/SL to protect your capital and maximize profits!

Stay tuned for updates once the confirmations are in place!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

📢 Best Regards , Silver Wolf Traders Community

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

GOLD SURGE CONTINUES – FEAR, WAR & END-OF-MONTH VOLATILITYGold opened this week with a strong upside gap, once again reminding us of how unpredictable Mondays can be following highly volatile weekends.

As always, when the market gaps significantly after the weekend, it's best to wait for price to absorb the remaining volume before locking into new setups.

As mentioned in previous outlooks, the current BUY pressure is still high, driven by a global wave of FOMO and fear, caused by:

Rising geopolitical tensions,

Global economic instability,

And even natural disasters now hitting parts of Asia.

Asian stock markets dropped sharply this morning after weekend developments escalated — with the Russia–Ukraine war showing no signs of de-escalation. In fact, new reports suggest a broader regional impact, further boosting risk-off sentiment.

💡 Safe Haven Flows Are Back in Full Force

Right now, gold is the #1 asset investors are paying attention to.

It's being treated as the ultimate flight-to-safety amid global panic and uncertainty.

And with this momentum, new ATHs may still be ahead.

📅 End-of-Month Candle Close – Expect Whipsaws

Today also marks the final trading day of the month, meaning we could see aggressive stop hunts and liquidity sweeps as large players look to close their monthly books.

➡️ Be extra cautious today — sharp moves up or down may occur due to end-of-month positioning.

Whether BUY or SELL, it’s best to trade tight, scalp smart, and respect your SL/TP.

Key Levels for 01/04:

🔺 Resistance: 3116 – 3132

🔻 Support: 3092 – 3085 – 3076 – 3066

🎯 Trade Plan:

SELL ZONE: 3130 – 3132

SL: 3136

TP: 3125 – 3120 – 3115 – 3110 – 3105 – 3100

BUY ZONE: 3066 – 3064

SL: 3060

TP: 3070 – 3075 – 3080 – 3085 – 3090 – 3095 – 3100

Stay sharp and trade with discipline.

End-of-month volatility is not for the weak hands.

— AD | Money Market Flow

GOLD – Unshaken Through Chaos - 50 new all-time highs🟡 GOLD – Unshaken Through Chaos | A Structural Bull Run Backed by Global Repricing

Gold isn’t just rallying — it’s sending a message.

Over the past 12 months, gold has set over 50 new all-time highs, a breakout sequence unmatched in over a decade. This is now officially the longest bullish streak in 12 years, and the third longest in modern history, only behind the volatile 1979–1980 period — a time when the global economy was grappling with runaway inflation, stagnant growth, and widespread unemployment.

But what makes this current bull cycle unique is not just the price action, but the structural shift behind the move.

📈 The Numbers Speak for Themselves:

YTD 2024 performance: +16%

12-month gain: +39%

Price range: From ~$1,200 to nearly $1,600/oz

3rd consecutive bullish year

These gains are not speculative pumps — they are a response to systemic instability. The macro backdrop is screaming uncertainty:

Sticky, structural inflation

Slowing global economic growth

Real interest rates still hovering around zero or negative

Geopolitical risk escalating in nearly every region of the world

This isn’t a short squeeze. It’s a capital migration.

🏦 The Central Bank Bid: The Silent Giant

What separates this rally from past cycles is who’s buying.

Unlike the 2011 gold run — driven heavily by retail FOMO and speculative ETF flows — today’s surge is institutionally anchored.

The strongest force in the current trend? Central banks.

Led by China, Russia, Turkey, and several BRICS nations, central banks have been accumulating gold at a record pace, shifting reserves away from USD exposure and hedging long-term geopolitical and economic risks. This isn't just diversification — it's a statement of monetary sovereignty.

Their consistent demand is forming a strong floor under price, insulating gold from violent retracements even during short-term corrections.

🔍 The Psychology of this Bull Market

This isn’t the kind of rally that fades on CPI noise.

The capital flow is defensive, not aggressive.

Funds are rotating into gold not to chase yield, but to preserve value. In times when fiat devaluation, sovereign debt instability, and political fragmentation are on the rise — gold doesn’t just shine, it leads.

The market is re-pricing systemic risk.

Investors are no longer reacting to inflation headlines. They are positioning for longer-term fragility in global monetary policy. That’s why even when inflation prints soften temporarily, gold still holds ground.

📌 What Comes Next?

Yes, technically, a pullback is healthy — even expected.

Extended breakouts are often followed by short-term consolidations. But the medium- to long-term structure remains intact.

Gold is not in a bubble. It’s in rotation.

In a world full of uncertainty, inflation volatility, and central bank crossfire — gold remains the most trusted asset for capital protection. And this rally? It’s not the end of something.

It’s just the beginning of a new monetary cycle.

— AD | Money Market Flow

📢 Join our community of serious traders.

Let’s grow, learn, and win together inside the MMFlow Trading Channel.

Tap in and be part of the flow.

Gold Rallies Ahead of Critical PCE Report – Is a Reversal ComingAs expected, Gold reached a new all-time high (ATH) following the bullish momentum we anticipated yesterday.

However, this upside move seems to have arrived earlier than projected — potentially a pre-positioning move before a major correction triggered by tonight’s PCE inflation data and profit-taking ahead of the weekend.

With current momentum, Gold could easily target $3100 as global stock markets — from the US to Asia — are sharply declining.

This reflects rising concerns over a global economic slowdown, and highlights the growing demand for safe haven assets like Gold.

📰 Tonight’s PCE data will offer key insights into inflation in the current macro context.

If PCE inflation decreases, Gold is likely to continue its rally.

However, if PCE shows higher inflation, we could see heavy sell pressure enter the market — leading to a sharp drop in XAUUSD.

That said, recent CPI and PPI data suggest that inflation may already be easing, supporting the bullish case — or at least explaining the early price surge.

🟡 Strategy for Today:

Look for early BUY entries during Asia & London sessions at key lower supports.

Avoid SELL positions for now — wait for price to reach major psychological resistance levels like $3100 before considering a short setup.

🧭 Key Levels:

🔻 Support: 3064 – 3055 – 3048 – 3040 – 3032

🔺 Psychological Resistance: 3090 – 3100 – 3106 – 3110

🎯 Trade Zones – 29/03:

BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080 – ???

🔴 SELL ZONE: 3100 – 3102

SL: 3107

TP: 3096 – 3090 – 3086 – 3082 – 3078 – 3074 – 3070

🧠 Final Reminder:

It’s Friday — and PCE inflation data tonight is crucial.

If you feel unsure or your trading psychology is shaky, stay out and wait for clarity post-news.

As always, respect your SL/TP levels and protect your capital at all costs.

Good luck, homies! Let’s trade smart.

— AD | Money Market Flow