UPDATE: $BTC Breakdown Playing OutUPDATE: CRYPTOCAP:BTC Breakdown Playing Out

Bitcoin dumped below $85k, now trading near $84.4k.

We called shorts at $95k–$98k, and price rejected from ~$98k, delivering nearly 12% downside already.

The bear flag breakdown remains active, downside continuation favored.

Targets: $75k → $70k

Invalidation: HTF close above $90,600

Until then: sell rallies, respect the trend.

Not financial advice. DYOR.

Xbt

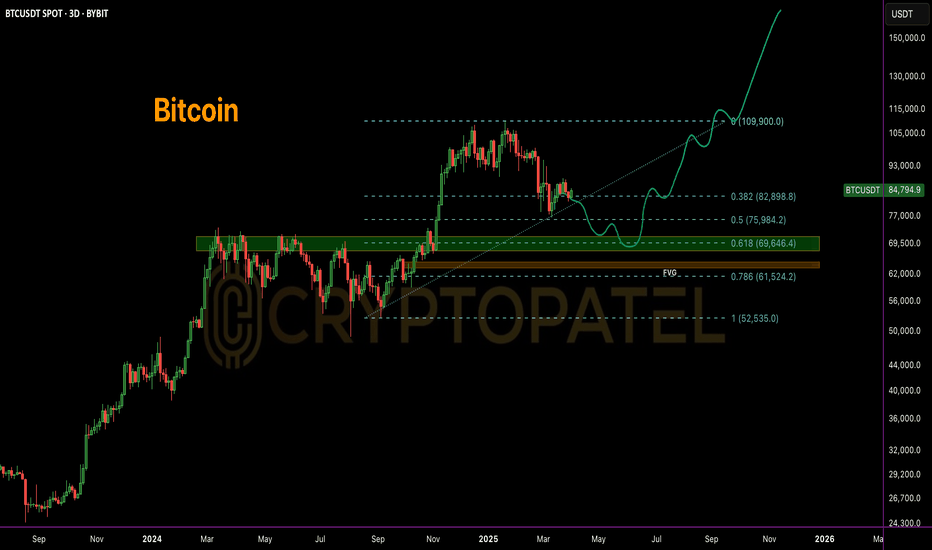

Bitcoin Next move?#Bitcoin reclaimed $85,000, but structurally a deeper retrace remains possible.

Classic TA suggests sustainable rallies often revisit key Fib levels:

1⃣ 0.618 Fib: $69,646

▪️ FVG: $75,582 – $69,916

2⃣ 0.786 Fib: $61,524

▪️ FVG: $64,789 – $63,435

A sweep of these zones could fuel the next leg toward $150K–$180K.

#BTC CRYPTOCAP:BTC

Bitcoin need Short term Retracement 🔹 #Bitcoin LTF Update 🔹

CRYPTOCAP:BTC has formed a double top on the LTF, signaling bearish potential below $90,000. This could mean a short-term retracement.

If #BTC fails to break the $90,000 resistance, we may see it drop to the $81,000 level soon, with LTF OB around $81,000.

However, if BTC breaks above $90,000, next stop could be over $100k 🚀

Important Liquidation Levels for Bitcoin: $50k - $73kImportant Liquidation Levels for Bitcoin: $50k - FWB:73K

#Bitcoin Liquidation Heat Map:

Approximately $3 billion can be liquidated up to $71,715. Key levels to watch:

➡ $67,420: $2.75 Billion in potential liquidations.

➡ $50,000: $5 Billion waiting to be liquidated.

Key Areas to Monitor:

➡ $56.9k - $52.1k: Weaker liquidations.

➡ $59.5k - $58.5k: Heavy liquidation zone.

➡ $52.1k - $50k: Another heavy liquidation zone.

Scenarios:

➡ Below $50k: ~$5+ billion could be liquidated.

➡ Above $74k: $6.1 billion might get liquidated.

Current price is around $63k!

Stay alert!

What's Next for Bitcoin? Understanding Its Current Price MovesWhat's Next for Bitcoin? Understanding Its Current Price Moves

#Bitcoin Market Brief

Current Status: CRYPTOCAP:BTC is trading near $64,000 amid recent declines. Bearish trends dominate due to global uncertainties affecting crypto markets.

Key Levels:

Support: Watch $63,800. Falling below could lead us to $51,000.

Resistance: Key resistance at $67,600. Below this, expect continued bearishness.

Observations: Recent charts show a trendline breakout and retest, suggesting a possible further drop. Stay alert to these patterns for trading cues.

Action Points: Maintain strict stop-losses to minimize risks. A break above $71,000 could shift momentum to bullish, signaling a potential new ATH.

Suggestion: Focus on technical analysis and update strategies with market changes. Keep an eye on global news that could sway crypto prices.

Looking Ahead: A climb over $71,000 might set the stage for new record highs.

Keep tuned for updates.

#BTC #Cryptocrash

Bitcoin Inverted Head & Shoulder Pattern #Bitcoin Inverse H&S Spotted

▪️ CRYPTOCAP:BTC Inverted H&S potential building

▪️ Clear breakout level to watch

▪️ Attractive upside targets if triggered

▪️ No confirmation yet, so caution is still advised

While traders are buzzing about a potential inverted head and shoulders forming on the BTC charts, caution is still warranted until we get CONFIRMATION.

The breakout point to watch is $43,700 - only a decisive 4 Hour CLOSE above that level would trigger the bullish pattern targeting:

▫️ 1st Target: $47,090

▫️ 2nd Target: $49,225

CRUCIAL: Below the neckline at $43700 Bitcoin remains Bearish territory.

Disciplined traders will await a confirmed breakout before getting too bullish here!

Patience pays with chart patterns.

BTC Breaks Long Term Trend As Tesla Ditches It-BTC has fallen to a two month low as Tesla announces suspension of BTC payments

-150 MA has held BTC from a further downfall

-Bullish divergence spotted on RSI

Bitcoin has broken out of a long 3 month range of $10,000. After Elon Musk announced Tesla will no longer be accepting BTC due to environmental reasons, BTC broke its major support of $55,000 and quickly fell over 15%. BTC is now is now in scary waters.

While looking at the chart, BTC has broken a long term trend that has been held for nearly 6 months. This is not a good sign as there is much FUD spreading about Bitcoins environmental impact. BTC must hold major support range of $46,500-$48,000 or we can experience a large fall to $40,000. As of now, the 150MA has held the price of BTC as it touched this moving average for the first time in 6 months.

If BTC can break above $48,000 and hold, there will be a decent revival to $51,400. In the case that BTC holds this resistance, next up is $54,400. BTC has grown over 1000% in a year. With this being said, there is a good chance more downside might occur before BTC resumes a bullish uptrend.

Whil looking at the Stochastic RSI, we can see that strength has reset to oversold levels. If the strength can bound above 30, expect a revival to minimum $51,400. The regular RSI also confirms a small bullish upswing as it has printed a bullish divergence. This occurs when price makes a Lowe low but RSI makes a higher low.

BTC intraday levels

Spot rate: $48,100

Trend: Bearish

Volatility: High

Support: $46,400

Resistance: $48,000

Bitcoin 4hr analysis 3-14-2021Good morning Ladies and gentlemen and welcome back to my daily analysis of Bitcoin. Today I have the 4 hour time frame pulled up after holding onto 60 K more or less throughout the day yesterday. I guess we can pat ourselves on the back for that. Meanwhile we do have some bearish news that I will address through this analysis. I also have some good news as well so we can focus on both and you can make your own mind up. I am fresh off of a 3 day ban via Facebook so I am happy to be able to finally post again. I have missed you all dearly. Anyways let's take a look at the chart and see what we can see.

So we are just below 60k at the moment. Nothing to get freaked out about. We have been floating above and below 60k the entire time I have been looking at the chart this a.m. As you probably all know the weekend is typically lower volume when compared to the Monday through Friday work week. More people tend to trade during the week and exchanges like CME flat out close on the weekend. This is where the bearish news comes into play. I guess we can focus on the bear news first. That way we can have a happy ending.

The bear news isn't devastating or anything but it does signal that a drop could be in order on Monday. We will just have to wait and see how it plays out. We all know that we experienced a rise over the weekend of a few thousand dollars. This typically results in a bearish gap. These gaps form on the CME during the weekend when the price rises. The CME closes Friday at whatever the price is at the close {This past Friday the close was close to 57250 according to the CME chart } and the price right this second is 60k approximately. That makes a nearly 3k gap below us which may cause quite a dip Monday morning. Let me say this.. Not all dips are created equal so do with this information what you will. This is just a warning to watch the charts. Those gaps fill more often than not within 24 hours.

Okay enough about gaps. Especially the bear gaps. Lets talk bull. We are above the set up on my chart. As my buddy Ernie Villz would say, "The path of least resistance seems to be up." That means there is a lot more evident support than resistance. This alone can give traders the confidence to long an already overbought market. That is what fomo does. I saw it in 2017 and this pump seems different. I guess due to the fact that it was a perfect storm really. Let me explain.

1 year ago almost to the day we dropped. HARD. We fell from 10500 USD to 3800 in a matter of 48 hours. Quite the dip. If you took that dip {percentage wise} and applied it to the price today we would drop from 60k to 24k respectively. That would be a blow to morale lol. Just want to give you an idea of what it was like to be in the market 1 year ago. Watching a wallet lose 65% over the course of 2 days was not easy... Let me tell you. But look at it now. I bought more around 4k. Best investment I have ever made. But since that drop volume came roaring back. The halving occurred less than a year ago and that assisted the pump. Couple that with stimulus payments and inflation along with breaking 20k and other key resistance along the way and you have a recipe for an explosive market. Proof is in the pudding!

The gap I drew on the chart is conditional. If the weekend closes around 57800 there likely wont be a gap. Anything can and usually does happen in this market so be prepared for anything folks. Set a stop loss. There is no excuse not to. Unless you are long term holding and in that case you need to find some cold storage. Bybit is great and so is Ledger. Cold storage is safer than an exchange wallet by miles. A little security can go a long way. Problem is most people dont care about security til its too late.

I missed you guys over the last 3 days.. But Im back today and I will be sharing my analysis again as usual. Stimulus checks are hitting US citizens accounts as I type and that could provide a pump to the BTC market. That is why I would be careful with that gap. Maybe we will fill it right away. Maybe not. I see gaps that have been on the chart for years. So not all gaps fill like their brothers. Some fill in minutes and some take years apparently. Maybe it will never be filled? Anyways I hope you all have a great day! Make good choices my friends and always remember WTFDIK???

TLDR: Bulls are fighting to keep 60k. We may have a bearish gap to start Monday... {Closed Friday around 57800 and current price is 60 so that is a few thousand dollar gap} Just keep an eye on things. If that gap does fill its a great opportunity to make a quick profitable trade to start off your Monday!

Bitcoin 4hr analysis 3-7-2021Good morning again ladies and gentlemen and welcome back to my daily analysis of Bitcoin. Today I am looking at the 4 hr time frame pulled up again after a decent bounce. We are in much better shape than yesterday and things look prime for another possible higher high. Anyways lets take a look at the charts this a.m. and see what we can see.

The bulls woke up early today apparently and they decided the 4hr 200 MA was the time for a pivot and climb above support. The very same support that was resistance yesterday. The 4hr 50 MA is below us now along with the 4hr cloud. All bullish occurrences. But the real test is on at the moment. We poked out of the top of the triangle on the chart but we really need that confirmation candle to close to ensure the break is legit. And the current 4hr candle has 30 mins left its life so lets see if it can remain above the cloud and the triangle.

One can clearly see that the 4hr 200 MA is strong support as the last 2 times we approached the indicator you had a real shot at entering a profitable long position. This is something you should take notice of in case we end up in a situation where we test other indicators such as the daily 50 MA and the daily 200 MA. With the reliability of the 4hr 200 MA very evident I imagine the daily will be even stronger. The daily time frame is the most important of all time frames imo.

So now that we broke above the triangle (and the cloud to boot) We have clear skies above us. That is if we can manage to stay above support and 50k. I see a bearish gap on Monday due to the recent rise But that will be more clear to me in the morning. Things are looking really good to start the week.

With the stimulus bill passing through the govt passing we can expect some of that money to enter the crypto market. I am not saying we should expect a trillion dollars in new volume but I will say I do expect some people to throw their money into the market. We see directly after approval of the stimulus the market responds positively. One reason could be due to the influx of new volume or the fact that inflation will almost surely cause the price of BTC to rise while the USD loses value.

I really hope we can hold onto this bullish break this morning and as people decide to exit their slumber and look at the charts they may fomo into the market seeing this break. But this is pure speculation at this point. What we do know is we broke above the 4hr 50 MA, the 4hr cloud, and the triangle pattern we were stuck in for weeks. All bullish! So lets make this week a good one! Make good choices yall! And always remember... WTFDIK???

TLDR: Sunny skies, no clouds. Bears sleeping in. Life is good

Bitcoin 4hr analysis 3-6-2021Good morning again ladies and gentlemen and welcome back to my daily analysis of Bitcoin. Today I am looking at the 4 hr and things are going like I assumed they would since I recognized this pattern. Support and resistance are clearly defined and now its just a matter of escaping this consolidation! I am going to try something a a bit different today and accompany this analysis with a video analysis. So I may not type as much. I know that will break some hearts LOL :) Anyways lets take a look at what is happening.

The consolidation is real! We are stuck in the cloud as I type and this has been the case for 4 days now. That shows how reliable of an indicator the "ichimoku cloud" can be. When you enter the cloud its not so easy to escape and that is what we are seeing here. If we can exit the top of the cloud the bull market should be alive and well but if we fall out of the bottom... Well all I will say is set a stop loss.

This week has been pretty flat in terms of price movement. I guess we are spoiled as investors and are used to several thousand dollar swings in this market. But a little breather may be what the market needed? Only time will tell. Stimulus talks are going on as I type and that could add more capitol to the market. Along with devaluing the USD through a massive printing effort. I mean if they are going to inflate our currency we may as well buy BTC and benefit from their short sightedness.

We broke out of the 4hr cloud this week but the support didnt hold unfortunately sending us right back into the clutches of the 4hr cloud and we have been stuck there for the majority of this week. Right now the saving grace happens to be the fact the 4hr 200 MA (blue line) is right at the bottom of the cloud. This means double support which should remain strong through the weekend I imagine. That is if this strong support holds. If we lose the support all that stands between us and a real dip is the support of the former ATH at 42k...

I will say this, I really hope the bulls have a few giant green candles up their sleeves. But I will not be greedy. I will stick to my plan and if I decide to enter a long you better believe I am entering my stop loss right after. Right now is not the time to be cute with your bags. If a dip is coming you should be ready. Another thing I should mention is get cold storage. If you plan to sit on BTC long term start thinking more about security. Cold storage is so much safer than storing in a hot wallet (exchange or wallet app off the playstore that looks sketch af) Learn to protect your investment. If you lose your $$ you want it to be because of your awful trading, not because some jerk phished your pw away... I hope you all have a great day and make good choices! WTFDIK??

TLDR: Bears suck. Cmon Bulls lets roundhouse kick these bears back into their hibernation caves

Bitcoin 4hr analysis 3-2-2021Good morning again ladies and gentlemen and welcome back to my daily analysis of Bitcoin. Today I have the 4hr pulled up after a nice little bounce from support. Can the bulls keep the momentum going though? We have retaken some lost support so things definitely look better today than yesterday in my opinion. Anyways lets take a look at the charts.

I can see that since I fell asleep last night the bulls led the charge and retook the 4hr 50 MA. Nice work bulls! That was a big step towards extending the bull run. Although we are not quite out of the woods yet. The 4hr cloud is current resistance and if we cannot muscle our way above the 4hr cloud this mornings recovery may be short lived.

So we are sitting just below 50k and things look decent. The resistance of the 4hr cloud vs the support of the 4hr 50 MA. I can tell you that if you plan to long this set a stop loss. This is the most important time to set a stop loss as the market truly could go either way and you should be prepared for that.

Taking a closer look at the 4hr and a number of candles back we had a nice bounce from the 4hr 200 MA. This is why I enjoy using the indicator. The 50 MA and the 200 MA have always been quite reliable in my trades. So after seeing that bounce from the 200 MA and seeing us retake the 4hr 50 MA this may give traders the confidence needed to go long. Confidence is always abundant when support is abundant and right now we have a nice amount of support directly below us (on the daily and the 4hr)

So if we can muscle our way up above the 4hr cloud we have a real shot at another pump to a possible new ATH. Only time will tell for sure. I will be watching the charts today to see what the bulls do with this new found support. I hope you all have a great day folks! Make good choices! And always remember WTFDIK???

TLDR: Bulls woke up early and retook the 4hr 50 MA. We need to retake the 4hr cloud next to keep the momentum moving. Cmon bulls!

Bitcoin 1 day analysis 2-28-2021Good morning again everyone and welcome back to my daily look into the world of Bitcoin. Today I have the daily time frame pulled up and I can see we are holding on to 45 K by the hair on our chinny chin chin. Weekends are known for being low volume event so this doesn't surprise me too much. But will Monday result in a green candle or two? That's the question on my mind. Let's take a look at the chart...

I still say there is a lot of support between 42 and 45 k and that coupled with the 50 ma being below us I am still ultimately boys although I have made sure my stop-losses are set accordingly. We are currently just below 45k but with this in mind we may have a bullish gap above us Monday. Only time will tell if this results in a bullish start to the month of March but as you all know I do like playing gaps so I will be watching.

In my opinion if we were to lose the support of the daily 50 MA or 42k I would likely be bearish. Let's see how the daily, the weekly, and the monthly close tonight. Lots of big time frames ending cycles so it is certainly something we should watch.

The way we can turn back bullish In my opinion is to retake the 4hr 50 MA. I love the 4hr time frame and when I saw us lose the support of the 4hr 50 MA I was discouraged. Now I will be watching the 50 MA on that daily time frame. Of it holds I believe BTC is still bullish. If not we could see those lower highs that are so common in a bear market.

I would love another Bullish month (March) but I'm not holding my breath. The writing is on the wall for bulls and im not saying we are going down yet. But I am saying set a stop loss. Many alts took a hit overnight. But there is still a chance that the bulls can flip the script. I hope you all have a great day! Make good choices! And always remember WTFDIK?

TLDR: Wake up bulls and let's retake the 4hr 50MA. Someone wake Musk up and tell him to tweet something bullish lol

Bitcoin 1 day analysis 2-27-2021Good morning again ladies and gentlemen and welcome back to my daily look into the world of Bitcoin. Today I have the daily time frame pulled up as it is really doing well with my trading set up at the moment (50 MA, 200 MA, Cloud) The bears have made their presence known once again as the candles dropped from roughly 60k to 45k in a matter of days. I know that this price movement may be scary to you noobs but this is actually quite common with BTC. Anyways lets take a look at the charts.

We are currently cruising along right above some key support that really needs to hold if we expect this run to stay alive. The 4hr 50 MA was lost over this week and that is bearish in itself. But the daily is the real deal in my opinion and as long as we remain above the daily 50 MA there is hope for a pivot. But that doesnt mean you should depend on a pivot. Rather set a stop loss and hope for the best while preparing for the worst. If this daily 50 MA holds we have a real shot at a decent long.

So currently there is a lot of support between 42k and 45k. This could keep confidence high enough to keep the bull market alive. I would be even more confident if we make it to Monday above 45k. Weekends are known for lower volume (not always but more often than not) so Im not expecting too much. But I will be ready for anything and everything. Being a trader there is no other way to do it. Stay on top of them charts or you will get REKT.

Nothing goes straight up forever. Even if the bull market does continue after the recent dump from nearly 60k, that does not mean corrections wont be on the chart as well. Its the very nature of a cyclical market. If you truly believe in Bitcoin long term the recent 20%-25% drop we saw should not bother you. Even if you did buy at 58k. Yes you do hold the heavy bags at the moment but I was you 3 years ago. Buying at 18k and watching the profit dwindle into actual losses. I lost even more chasing alts. Really I was buying into the pumps. Not before the pumps. Which means I was left holding bags while early investors sold. But that is the nature of the beast. Gotta learn to earn and sometimes that means getting burned.

I see the 4hr 50 MA (I know this is the daily chart but I drew the 4hr 50 MA for your convenience) is the current line in the sand for the bulls. If we can retake that 4hr 50 MA that could be the start of another pump. Of course only time will tell. We got rejected already one time this week trying to retake the 4hr 50 MA. But not all hope is lost yet as we still managed to hold onto 45k as support. That coupled with the fact we are above the 50 MA on the daily shows there is still hope. Although I would not enter a long without a strict stop loss. I hope you all have a great weekend and make smart choices folks! WTFDIK???

TLDR: 42k - 45k shows promise as strong support. 4hr 50 MA (green line) is (IMO) what we need to conquer to keep the bull run moving.

bitcoin 4hr analysis 2-14-2021Good morning ladies and gentlemen and welcome back to my daily analysis of Bitcoin. Today I have the four hour time frame pulled up after a new all-time high overnight. We hit around 49700 + and things still look good from the Bulls perspective. I do have a few things I want to cover so let's get this party started y'all.

First of all I want to keep it simple and look at the indicators on the chart. The 50m a is ascending with the candles and as long as we are above the 50 and made things look really solid. But being above the 50 MA and the cloud and the 200 ma is definitely a bullish scenario. We are still above these key indicators on the daily and weekly as well. All of these factors makes a strong case for the bulls...

50k is probably going to show some resistance to the candle. Maybe not 50k on the money but somewhere close to that. The reason I say it is 50k is a nice round number. Seeing as how we have not put much data above 49 k we have to take what we can get. And I do know that Traders look for nice round numbers like 50k for instance to place sell orders and whatnot...

Bollinger bands look pretty tight on the 4hr time frame. Which could indicate that volatility is on the horizon. So it does look like a breakout is on the way. Go to Bollinger Bands really don't tell you which way it's going to go. You have to combine it with other indicators to get a gauge on the market. And right now things look pretty bullish but I would set a stop loss just in case. Also the MACD on the 4hr looks like it could turn back bullish any second. Something to keep an eye on.

Happy Valentine's day to each of you. I hope you all enjoy your Sunday! Its supposed to freeze here and people in SE Texas dont know how to cope with cold weather. So if my power goes out I will try my best to still share my analysis. In the mean time watch for a gap to form below us if these recent gains stick around til Monday. Only time will tell. Have a great day. Make good choices my friends... And always remember WTFDIK?

TLDR: New ATH (49800) We are knocking on 50k's door. Set a stop loss.

Bitcoin 4hr analysis 2-13-2021Good morning again everyone and welcome back to my daily look into the world of Bitcoin. Today I have the four hour time frame pulled up and I can see we have been in consolidation since early Friday and it looks to continue into the weekend and possibly even till Sunday. We will just have to see how it goes. There are reasons to be bullish and there are also reasons to expect maybe a short-term drop and I will touch on all of that during the analysis. So pull up a chair and let's get this party started.

Looking at the current situation $46,500 looks to be the support currently. It flipped to resistance just a few days ago but we flipped it back to support recently and we are still above it and that is a good thing. We hit a new all-time high of about $49,000 on the 11th of February. Things are looking very strong for Bitcoin and I would be very hesitant to drop a short and even though I do think a drop will come eventually.

The thing is I keep seeing bullish news come out for Bitcoin for instance they are talking about Visa and MasterCard possibly offering cryptocurrencies on their Network and allowing people to pay with them etc. That would be a huge deal for Bitcoin and altcoins alike. This news coupled with big news that we recently got about Elon Musk purchasing 1.5 billion dollars worth of bitcoin means the Bulls might be alive for a bit longer folks. But setting a stop loss is always recommended. Just in case those Bears surprise us.

If we do in fact lose the support at 46500 over the weekend I would expect a drop to around 44,000 as that is where former support and resistance slide not to mention before our 50 in May is showing up right about in that area as well which means there would likely be a bounce their due to multiple supports. Of course I only time will tell if that is true. The best recommendation is if you are going to go that route and play the charts set a stop loss like I always say. Limiting your losses will save a lot of profit.

We still have major support around 42,000 as well so since that was the previous all-time high back in January I am expecting that to hold up at least for a short period of time and possibly get a trade or two out of it. But setting a stop loss is always recommended and I cannot stress that enough.

With all of these big names throwing their hat in the ring Bitcoin can really go off this year. Possibly even hitting six figures. And tell me about And tell me how you feel about possibly having to get on a waiting list one of these days to buy Bitcoin? It sounds like it may end up going that route if Bitcoin stays mainstream like this and all these rich people want to buy some. Not to mention institutions. I could definitely see a waiting list being a real possibility in the future for Bitcoin and I know that would suck but we need to be prepared for anything as there are only 21 million Bitcoin...

So if we want to keep moving up we need to break 49,000 and we need to hold 46500 at the same time which is simply minor support but it is holding up nicely and hopefully we can see a bounce from it this weekend. If not we will likely Fall to around 44,000 I imagine. The weekend is typically low volume. So i'm not expecting a lot.

The market cap for BTC eclipses 1 trillion again. It's amazing to see the growth. I remember when the market cap was nowhere near 1 trillion. You could spend 1 million a day for 2000 years and not spend 1 trillion dollars. Boggles the mind it does. I hope you all have a great weekend. Stay warm. I know a winter storm is crashing through the US right now so if you guys don't hear from me Monday morning my power might be out so just FYI. I have all sorts of devices to stay warm with so I should be okay but still. I hope you all stay warm and have a good weekend. Make good choices and always remember WTFDIK...

TLDR: 46500 is current support. 49k is resistance. The bulls are still alive and well. Set a stop loss! 44k shows promise of support along with 42k if we do drop.

Bitcoin 4hr analysis 2-7-2021Good morning again ladies and gentlemen and welcome back to my daily look into the charts of Bitcoin. Today I have the 4hr time frame pulled up after a nice little run to start the weekend off. We have cooled off a bit since the $40850 high we saw yesterday but there is still reason to be bullish. I will explain... So pull up a seat and lets get this party started.

I see we nearly hit 41k yesterday. Very close to the ATH we hit last month. Ive been saying it for days but 42k is obviously the line in the sand at this point. We had trouble crossing 41k yesterday which shows that breaking the line at 42k may be easier said than done. I think if we can make it to 42k out chances will definitely increase with a possible injection of fomo. Fomo is such a wild card as it can make a simple green candle into a massive pump. The crypto market is notorious for pump chasers.

I was looking for a possible gap on the chart or at least evidence that a gap may or may not be on the charts Monday and for now it does not look like there will be much of a gap. Of course there is sill 9-10 hours before the daily and weekly close. So only time will tell for sure. I like to trade gaps on Monday mornings if they are worth trading that is. Sometimes the gaps are just too minor or non existent to worry about. But when they are on the chart I try to take advantage. Although it is always recommended to exercise risk management and set a stop loss.

So we broke the resistance that was evident at around 38500ish yesterday and peaked around $40,850 now we are retesting the $38,500 resistance we broke yesterday which is now support. But we are really testing it hard so if it fails we may drop a bit. I see support around $34,500ish but it doesnt look like the strongest of supports Ive ever seen. Lets hope that $38,500 holds and we can advance to 42k. If we can break that resistance we have a real shot at 45k or maybe even 50k depending on how hot the fomo can get.

This week we pretty crazy. We had the Elon pump. A huge 4hr candle that was over 5k was the result. But the gains did not stick. Thats to be expected from a fabricated pump such as this one. There was no real rhyme or reason for the pump. But if you did catch the wave congratulations. Alt coins deserve a little mention as they have been really performing great. It sort of reminds me of 2018. Right after the BTC pump to 20k profits left BTC and flowed into many alts. Of course I want to say alts were hotter in 2017 than they are today. Although I may just have my head too far up BTC's %$$ to pay anything else too much attention. I will say that this alt season seems more streamlined. Not every alt is pumping. In 2017 you could throw a dart at a computer screen and pick a winner. Either way the crypto market as a whole seems to be impervious to the FUD of India possibly banning BTC and other crypto and also Nigeria. Both are huge hubs for crypto use.

Lets start this week off right. Even if we dip a bit before the weekly close tonight we should have gap above us as a result and that could help me start the week off right with a profitable trade. Like I said before set a stop loss if you want to play that game. We made the higher high traders want to see yesterday but the momentum must continue or it will all be for nothing. Sundays are notorious for low volume but maybe it will be a repeat of yesterday? We will have to wait and see. Have a great Sunday and enjoy the Super Bowl if you are into that kind of thing. Make good choices my friends and always remember WTFDIK????

TLDR: 38,500 is support/resistance. If we can hold the line above 38500 we have a real shot at a bounce to another possible higher high. But it doesnt look promising as we are currently below the support which makes it resistance. But I would wait for the candle to close.

Bitcoin 4hr analysis 2-6-2021Good morning again ladies and gentlemen and 40k as well! We have broken resistance and things are looking good for BTC at the moment. The bulls have put on a show over night and reminded everyone of us (including me) not to underestimate the bulls. The alt coin market has taken a lot of the recent glory in the crypto market but it looks as if BTC is attempting to take some dominance back. But can it last? Lets take a look at the charts.

First of all I want to point out that we have overcome the bears and broke up from the small bullish triangle overnight. It looks as if we have a confirmation candle that indicates that we have successfully broken the resistance. Former resistance becomes support. Technical Analysis 101. I love passing off little helpful hints in my analysis. Most vets already understand former support becomes resistance and vice versa. Learning how to identify support and resistance and understanding exactly how they work is better than any indicator you can turn on. Keep that in mind when you are looking at a chart. You can have a billion lines on the chart. In the end it looks like a bowl of spaghetti.

I do enjoy keeping a few indicators on the chart such as the 50 MA and the 200 MA and the cloud specifically. Bollinger bands and MACD are also helpful. But I can certainly read a chart without these indicators. But I will say that I can appreciate the usefulness of these indicators and I leave them on to make it even easier on me. Just keep it simple. Decide on a few key indicators and stick with them. Learn them. Understand them. Then check out the lesser used indicators. Maybe you will lay that golden egg.

So here we are back at 40k. I had a feeling we would break up from the right ascending triangle on the chart. We topped out on this triangle 2 times this week. I was hesitant to mention it looked like a double top to me when I saw it recently which led me to believe we may not break up from this. But after waking up this morning I was pleasantly surprised and I will walk my stop loss up to lock in that profit. Easy peasy...

So the next hurdle sits around 42k. That will be the real test. I do like the fact we have started creating higher highs once again. All of the bullish factors I am bringing up certainly gives traders confidence to long this. Especially with the abundance of support below us on multiple time frames. If we do in fact break 42k I think 45k - 50k would be a possibility. But WTFDIK??? Make good choices folks!

TLDR: Bulls are awake early. And they drank some espresso

Bitcoin 4hr analysis 2-2-2021Good morning again ladies and gentlemen and welcome back to my daily look into the world we call Bitcoin. Today I have the 4hr time frame pulled up after retaking some serious support. The question is will it last? The bulls have awoken early today and if the bears sleep in we could see some gains today. But only time will tell if that will be the case. So lets take a look at the chart and see what we can see.

The bulls pulled us out of a tight spot and now we are sitting pretty upon plenty of support. That will instill confidence and possibly entice more bulls to enter the fray. If I were going to long this recent development I would certainly not end my session at the computer without setting a stop loss. We saw the Elon candle broke up from the descending resistance only to fall right back below it less than 8 hours later so prepare for the worst and hope for the best.

Now we have 35k as support. That is if we can get some confirmation candles to close above the 35k support/resistance. If we do in fact sink back under 35k we still have the support of the 4hr 50 MA and the 4hr cloud and the 4hr 200 MA. So as I mentioned earlier there is a lot of support. If we drop back below 35k the bulls will likely relent due to knee jerk sellers bailing out of a failed pump.

30k way below us is also support. Im hoping we can avoid dropping that far for the time being but anything can and usually does happen. The 4hr MACD seems to be bullish but MACD can change pretty quickly so beware of the bears. We are clinging to 35k this morning and it very well may be fleeting. With that in mind set a stop loss and you should be okay.

I would like to see a higher high show up on the chart after this break above resistance but I guess I cant have everything. I will be keeping an eye on the charts today. Im not expecting a lot but you never really know for sure. I mean guys named Elon may put Bitcoin on his profile and boom! LOL. I wish there was an indicator made for that. I hope you all have a great day. Make good choices! And always remember WTFDIK???

TLDR: We broke above the resistance that has been plaguing us. We need to close a few candles above support (35k) if we expect these recent gains to stick. Finger crossed!