Hindustan Copper – Breakout, Retest & Bullish Continuation SetupNSE:HINDCOPPER

Hindustan Copper has delivered a powerful breakout followed by healthy consolidation near highs — indicating strength rather than exhaustion.

Technical Observations

Breakout zone: ₹570–₹590 area (now acting as support)

Current structure: Flag-type consolidation near highs

Volume:

Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

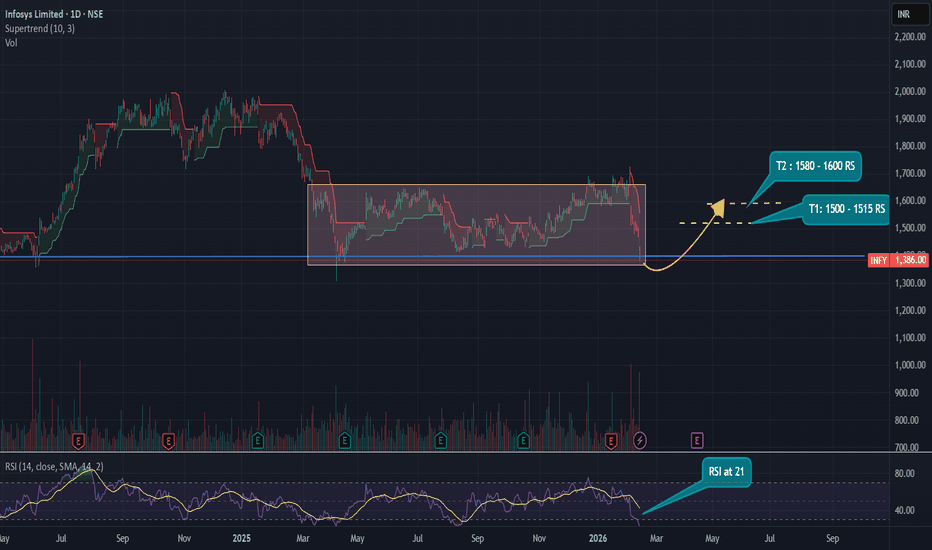

Positional View for Infyosys Ltd.Wrap up:-

As per chart of Infosys Ltd., it seems that correction in the stock is now over with a abc pattern in major wave 4. Now, major wave 5 is started of which inner wave 1 is completed at 1649 and wave 2 is expected to be completed in the range 1433-1307.

What I’m Watching for 🔍

Low Risk

BIOCON: Compression Before ExpansionBIOCON is trading inside a rising broad channel while currently forming a short-term falling channel.

Price is now near the lower support of the larger ascending structure. If it breaks above the falling channel resistance, we may see momentum toward the upper trendline zone.

But if it loses the r

Breakout from Rounding Base after Long Consolidation in VoltasNSE:VOLTAS

📈Pattern & Setup:

Voltas has formed a large rounding base over many months after staying under pressure from the prior decline. Price has now pushed into the major horizontal resistance zone near 1,520–1,540, where supply had repeatedly emerged earlier.

Today’s move shows a decisive

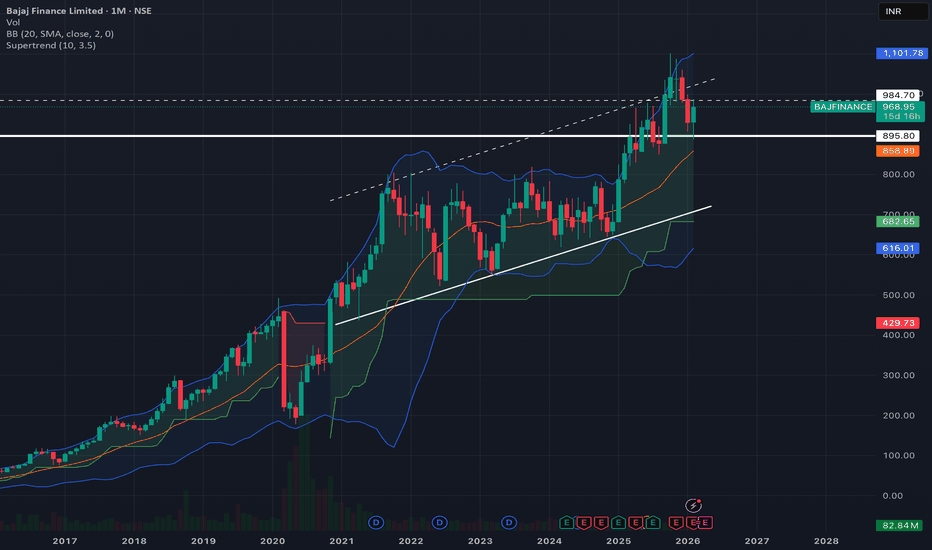

Bajaj finance: is retest done or pending?As per chart reading we can see that BAJFIN completed the retest in the market volatility of the last few weeks, be it in budget or US-INDIA trade deal.

it is gearing up for new rally.

have a 10% SL and it can give return more than 50%.

first tareget should be 25% then 38% and last target should be

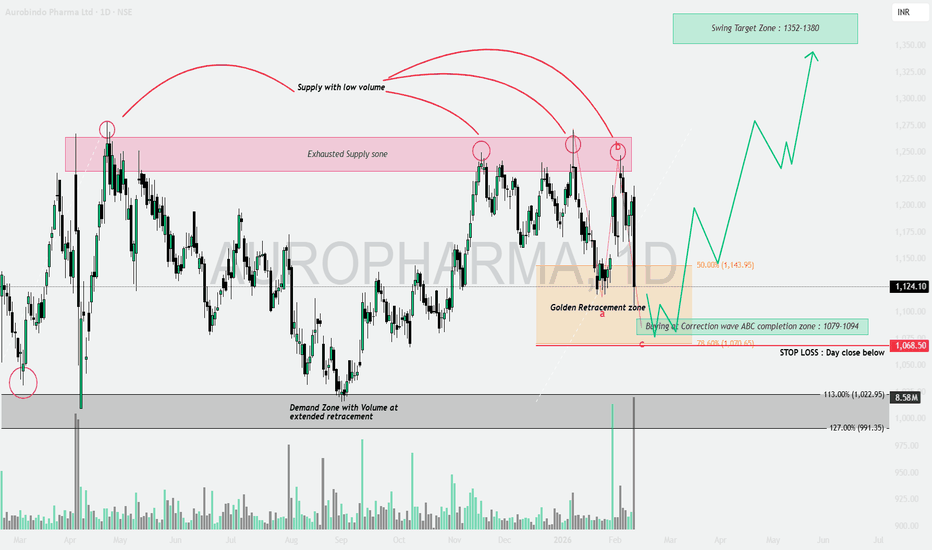

AUROPHARMA: Supply Exhaustion & The Golden Retracement📝 The Technical Breakdown (Educational Guide)

This chart is a masterclass in understanding Volume Price Analysis + Fibonacci Confluence. Let’s decode the setup through 4 key educational pillars:

1️⃣ Supply Exhaustion Zone 🔴

Observe the pink box marked as “Exhausted Supply Zone.”

Price has tested

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500

See all popular ideas

World biggest companies

SymbolPrice & chgMarket cap

SymbolMarket cap / Price

SymbolPrice & chgEmployees

SymbolEmployees / Price

Stock collections

Today

SB1NOSPAREBANK 1 SOR-NORGE ASA

Actual

0.41

USD

Estimate

0.41

USD

Today

035720Kakao Corp.

Actual

0.06

USD

Estimate

0.17

USD

Today

5105Toyo Tire Corporation

Actual

0.44

USD

Estimate

0.68

USD

Today

2270MEGMILK SNOW BRAND Co., Ltd.

Actual

1.11

USD

Estimate

0.54

USD

Today

COINCoinbase Global, Inc. - 3

Actual

−2.49

USD

Estimate

1.00

USD

Today

6460Sega Sammy Holdings Inc.

Actual

−0.59

USD

Estimate

0.24

USD

Today

8795T&D Holdings, Inc.

Actual

0.58

USD

Estimate

0.58

USD

Today

3197Skylark Holdings Co., Ltd.

Actual

0.09

USD

Estimate

0.10

USD

See more events