Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instead of breaking below the neckline, price action failed to confirm the bearish reversal. The right shoulder did not lead to downside continuation. Instead, price reversed strongly and has now given a decisive breakout above the right shoulder high, closing above that level.

This failure of a bearish Head & Shoulders pattern indicates a potential bullish reversal. Failed patterns often lead to strong moves in the opposite direction, as trapped short sellers exit their positions.

Target Measurement:

The projected upside target is calculated by measuring the vertical distance from the Head (highest point) down to the neckline low. This distance is then projected upward from the breakout point above the right shoulder.

Price has already given a confirmed daily close above the right shoulder resistance, validating the breakout.

As long as price sustains above the breakout level, the measured move target remains active.

Positional View for Infyosys Ltd.Wrap up:-

As per chart of Infosys Ltd., it seems that correction in the stock is now over with a abc pattern in major wave 4. Now, major wave 5 is started of which inner wave 1 is completed at 1649 and wave 2 is expected to be completed in the range 1433-1307.

What I’m Watching for 🔍

Low Risk Entry Range is 1433-1307 for a Probable target of 1897-2053 with a stoploss of 1307.

Disclaimer: Sharing my personal view — only for educational purpose not financial advice.

"Don't predict the market. Decode them."

Hindustan Copper – Breakout, Retest & Bullish Continuation SetupNSE:HINDCOPPER

Hindustan Copper has delivered a powerful breakout followed by healthy consolidation near highs — indicating strength rather than exhaustion.

Technical Observations

Breakout zone: ₹570–₹590 area (now acting as support)

Current structure: Flag-type consolidation near highs

Volume: Expansion during breakout, contraction during pullback (healthy)

EMA alignment: 21 EMA > 50 EMA (bullish structure intact)

Momentum is cooling slightly but price is not breaking down — this indicates accumulation.

Bullish Continuation:

If price sustains above ₹590–₹600 zone → Possible move towards ₹650–₹680 and beyond.

Invalidation:

Daily close below ₹560 weakens structure.

BIOCON: Compression Before ExpansionBIOCON is trading inside a rising broad channel while currently forming a short-term falling channel.

Price is now near the lower support of the larger ascending structure. If it breaks above the falling channel resistance, we may see momentum toward the upper trendline zone.

But if it loses the rising support, the structure weakens.

This is a decision zone — watch for breakout confirmation, not prediction.

Clean structure. Clear levels. Let price speak. 🚀

Breakout from Rounding Base after Long Consolidation in VoltasNSE:VOLTAS

📈Pattern & Setup:

Voltas has formed a large rounding base over many months after staying under pressure from the prior decline. Price has now pushed into the major horizontal resistance zone near 1,520–1,540, where supply had repeatedly emerged earlier.

Today’s move shows a decisive breakout attempt backed by momentum, suggesting demand is finally overpowering sellers. Such long consolidation breakouts often lead to fast expansion legs.

📝 Trade Plan:

Entry: Fresh entry can be considered above 1,540–1,550 on sustained strength.

🚩Stop-Loss: 1,470 (below breakout base).

🎯Targets:

Target 1 → 1,700 (intermediate resistance).

Target 2 → 1,930–1,950 (measured move projection, ~25% upside).

💡Pyramiding Strategy:

1. Enter first lot above 1,550.

2. Add on continuation above 1,620, trail SL to 1,520.

3. Add final lot above 1,700, trail SL to 1,600.

Hold the position as long as price sustains above the breakout zone.

🧠Logic Behind Selecting this Trade:

Rounding bases indicate gradual accumulation. When price finally clears the neckline after months of compression, it usually attracts momentum traders and forces short covering. Acceptance above 1,550 can open the path toward the 1,900 zone.

Keep Learning. Keep Earning.

Let’s grow together 📚🎯

🔴Disclaimer:

This is not an investment advice. Always do your own due diligence before making any trading or investment decision.

IOC – 7+ Years Mega Breakout in the MakingIOC is not setting up for a routine breakout. The stock is attempting to emerge from a massive 7–8 year consolidation phase, making this a potential multi-year structural breakout rather than a short-term move.

Since 2017, IOC has repeatedly faced selling pressure near the 180–190 resistance zone, keeping the stock range-bound for years. Now, price is back at this critical level — but this time with strong trend structure and visible volume expansion, suggesting a clear shift in market behavior.

The overall price action shows a transition from range mode to trend mode. Higher highs and higher lows are already in place, and pullbacks are becoming shallow — a classic sign of institutional accumulation. Price is also trading comfortably above its key moving averages, reinforcing the long-term bullish bias.

Momentum indicators support the setup as well. The Vortex Indicator shows clear buyer dominance, indicating that sellers are gradually losing control. Currently, the stock is consolidating in a tight 177–182 zone, which looks more like energy build-up than exhaustion.

A sustained move above the 185–190 zone, especially on a monthly closing basis, could confirm a major structural breakout and open the door for a strong trend continuation.

Key Levels to Watch

🚀 Breakout Zone: 185 – 192 (Sustaining above this is crucial)

🛡️ Immediate Support: 165

🛡️ Structural Support: 153

Final Take

IOC is standing at the edge of a long-term trend shift. Multi-year bases take time to resolve, but once the breakout is confirmed, the resulting move is often powerful and decisive. This setup is more about confirmation and patience than prediction.

Big bases don’t deliver fast moves — they deliver big moves.

— Ayushi Shrivastava

Independent Market Research | Technical & Structural Analysis

This research is my own work, supported by AI tools for data structuring and visualization.

Disclaimer: This analysis is for educational purposes only. Not investment advice.

Derivatives and Options TradingWhat Are Derivatives?

A derivative is a financial contract whose value is derived from an underlying asset. The underlying asset can be:

Stocks

Bonds

Commodities (gold, oil, wheat)

Currencies

Interest rates

Market indexes (like the S&P 500 or Nifty 50)

In simple terms, a derivative does not have independent value; its price depends on the value of something else.

Common Types of Derivatives

Futures Contracts

Options Contracts

Forwards Contracts

Swaps

Among these, futures and options are the most actively traded on exchanges.

Purpose of Derivatives

Derivatives serve three main purposes:

1. Hedging (Risk Management)

Hedging is used to reduce or eliminate financial risk. For example, a farmer expecting to harvest wheat in three months may use a futures contract to lock in a selling price today. This protects against the risk of falling prices.

Similarly, investors use options to protect stock portfolios from market downturns.

2. Speculation

Speculators use derivatives to profit from price movements. Because derivatives often require a smaller initial investment (called margin or premium), they provide leverage, allowing traders to control large positions with less capital.

However, leverage increases both potential profits and potential losses.

3. Arbitrage

Arbitrage involves exploiting price differences between markets. Traders buy an asset in one market and sell it in another where the price is higher, locking in a risk-free profit.

Understanding Options

An option is a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date.

There are two main types of options:

Call Option

Put Option

Call Option

A call option gives the buyer the right to buy an asset at a fixed price (called the strike price) before expiration.

Example:

Stock price: $100

Call option strike price: $105

Expiration: 1 month

If the stock rises to $120, the call option becomes valuable because the buyer can purchase at $105 and potentially sell at $120.

If the stock stays below $105, the option may expire worthless.

Put Option

A put option gives the buyer the right to sell an asset at a fixed price before expiration.

Example:

Stock price: $100

Put strike price: $95

If the stock falls to $70, the put increases in value because the holder can sell at $95 instead of the market price of $70.

If the stock stays above $95, the option may expire worthless.

Key Components of an Option

1. Strike Price

The predetermined price at which the asset can be bought or sold.

2. Expiration Date

The date on which the option contract expires.

3. Premium

The price paid to buy the option. This is the maximum loss for the buyer.

4. Intrinsic Value

The real value if exercised immediately.

5. Time Value

The extra value based on time remaining before expiration.

Option Buyers vs Option Sellers

Option Buyer (Holder)

Pays the premium

Has limited risk (loss = premium paid)

Has unlimited profit potential (for calls)

Option Seller (Writer)

Receives the premium

Has limited profit (premium received)

May face large or unlimited losses

Selling options can be riskier than buying them.

In-the-Money, At-the-Money, Out-of-the-Money

In-the-Money (ITM)

Call: Stock price > Strike price

Put: Stock price < Strike price

At-the-Money (ATM)

Stock price = Strike price

Out-of-the-Money (OTM)

Call: Stock price < Strike price

Put: Stock price > Strike price

Leverage in Options Trading

Options provide leverage because traders control large positions with smaller investments.

Example:

Buying 100 shares at $100 = $10,000 investment

Buying one call option might cost $300

If the stock rises significantly, the percentage return on the option can be much higher than owning the stock directly.

However, if the stock does not move as expected, the option can expire worthless.

Risks in Derivatives and Options Trading

While derivatives provide opportunities, they also involve risks:

1. Market Risk

Price movements can lead to losses.

2. Time Decay (Theta)

Options lose value as expiration approaches.

3. Volatility Risk

Changes in volatility affect option prices.

4. Leverage Risk

Losses can be magnified.

5. Liquidity Risk

Some contracts may be difficult to buy or sell.

Option Pricing Basics

Option prices are influenced by:

Current stock price

Strike price

Time until expiration

Volatility

Interest rates

The Black-Scholes model is commonly used to estimate theoretical option prices.

Popular Options Strategies

Traders use different strategies depending on their outlook.

1. Covered Call

Holding a stock and selling a call against it to earn income.

2. Protective Put

Buying a put to protect a stock position.

3. Straddle

Buying both a call and a put at the same strike price to profit from large moves in either direction.

4. Spread Strategies

Combining multiple options to reduce risk.

Futures vs Options

Feature Futures Options

Obligation Both parties obligated Buyer has right, not obligation

Risk Can be unlimited Buyer risk limited to premium

Upfront Cost Margin required Premium paid

Complexity Moderate More complex

Exchange-Traded vs OTC Derivatives

Exchange-Traded Derivatives

Standardized contracts

Regulated exchanges

Lower counterparty risk

Over-the-Counter (OTC)

Customized contracts

Private agreements

Higher counterparty risk

Importance in Financial Markets

Derivatives increase:

Market efficiency

Price discovery

Liquidity

Risk management capabilities

However, misuse or excessive speculation can cause instability, as seen during the 2008 financial crisis involving complex derivatives like credit default swaps.

Who Uses Derivatives?

Individual traders

Hedge funds

Banks

Corporations

Institutional investors

For example, airlines hedge fuel costs using oil futures, and multinational companies hedge currency risk using forex derivatives.

Conclusion

Derivatives and options trading are powerful financial tools that allow market participants to hedge risk, speculate on price movements, and enhance portfolio returns. Options, in particular, offer flexibility because they provide the right—but not the obligation—to buy or sell an asset at a fixed price.

However, these instruments involve complexity and significant risk, especially due to leverage and time decay. Successful derivatives trading requires strong knowledge, risk management, and disciplined strategy.

In summary, derivatives and options are essential parts of global financial markets. When used wisely, they can reduce risk and create opportunities. When misused, they can lead to substantial financial losses. Understanding their structure, purpose, and risks is the foundation for participating safely and effectively in derivatives markets.

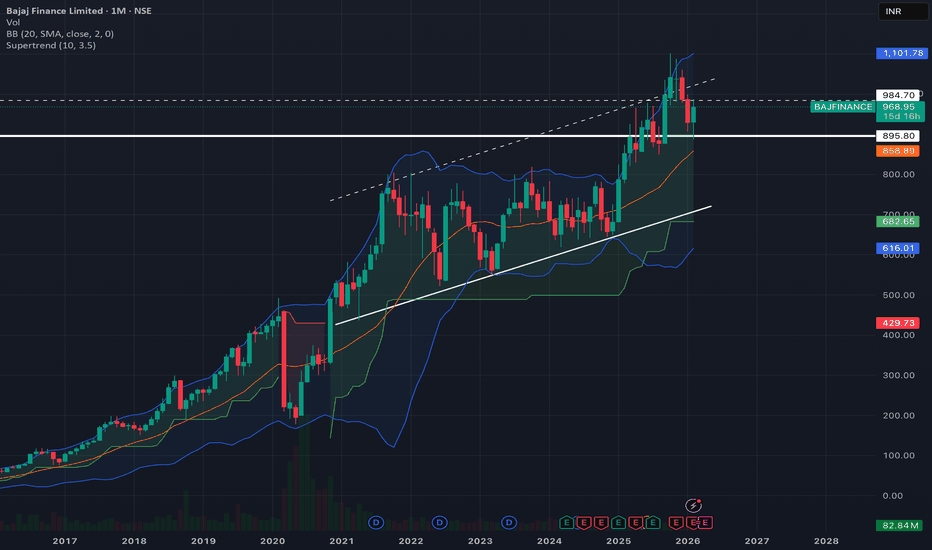

Bajaj finance: is retest done or pending?As per chart reading we can see that BAJFIN completed the retest in the market volatility of the last few weeks, be it in budget or US-INDIA trade deal.

it is gearing up for new rally.

have a 10% SL and it can give return more than 50%.

first tareget should be 25% then 38% and last target should be 50% of the current price.

current price : 967

SL: 870

Target 1: 1208

Target 2: 1334

Target 3 (Final target) :1450

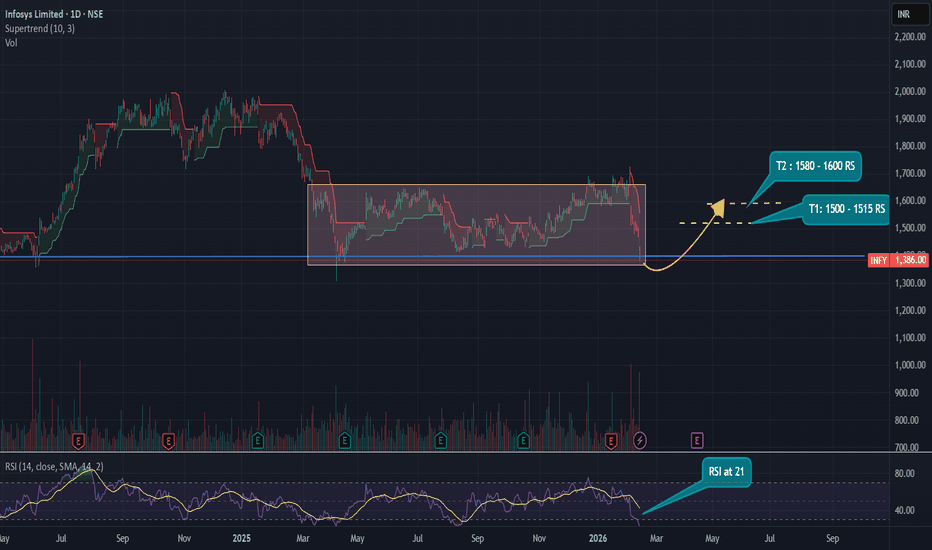

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500–₹1515

- Target 2: ₹1580–₹1600

This implies a potential return of 9–12% from current levels, provided the support holds.

Disclaimer : The Above shared Content is for information and education purposes only and should not be treated as investment or trading advice. Im not SEBI registered, Contact your financial advisor before any investment.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Cup & Handle Breakout in KPL

BUY TODAY SELL TOMORROW for 5%

Commodities and Alternative Assets1. Commodities

Definition

Commodities are raw materials or primary agricultural products that can be bought and sold. They are standardized and interchangeable, meaning one unit is essentially the same as another unit of the same grade. For example, one barrel of crude oil is equivalent to another barrel of the same type and quality.

Commodities are typically traded on exchanges such as the Chicago Mercantile Exchange (CME) or the London Metal Exchange (LME).

Types of Commodities

1. Energy Commodities

Crude oil

Natural gas

Coal

Gasoline

Energy commodities are highly sensitive to geopolitical events, supply disruptions, and global demand cycles.

2. Precious Metals

Gold

Silver

Platinum

Palladium

Gold is often viewed as a “safe haven” asset during economic uncertainty or inflationary periods.

3. Industrial Metals

Copper

Aluminum

Nickel

Zinc

These are closely tied to industrial production and infrastructure development.

4. Agricultural Commodities

Wheat

Corn

Soybeans

Coffee

Sugar

Cotton

Prices are affected by weather patterns, seasonal cycles, and global consumption trends.

Ways to Invest in Commodities

Physical Ownership

Buying physical gold, silver, or other tangible goods.

Futures Contracts

Agreements to buy or sell a commodity at a future date at a predetermined price. Futures are highly leveraged and commonly used by traders and hedgers.

Exchange-Traded Funds (ETFs)

Commodity-based ETFs track the price of a specific commodity or a basket of commodities.

Commodity Stocks

Investing in companies that produce commodities (e.g., oil companies, mining firms).

Mutual Funds and Index Funds

Provide diversified exposure to commodity markets.

Characteristics of Commodities

Inflation Hedge: Commodities often rise in price when inflation increases.

Low Correlation with Stocks/Bonds: They can reduce portfolio volatility.

High Volatility: Prices fluctuate due to global supply-demand imbalances.

Cyclical Nature: Prices move in long-term cycles tied to economic expansion and contraction.

Advantages of Commodities

Portfolio diversification

Protection against inflation

Opportunity for high returns during commodity booms

Hedge against currency depreciation

Risks of Commodities

Price volatility

Geopolitical risk

Weather risk (agriculture)

Storage and transportation costs (for physical commodities)

Leverage risk in futures trading

2. Alternative Assets

Definition

Alternative assets are financial assets that do not fall into traditional categories like stocks, bonds, or cash. They often require specialized knowledge and may be less liquid than conventional investments.

Alternative investments are commonly used by institutional investors, hedge funds, and high-net-worth individuals.

Major Types of Alternative Assets

1. Real Estate

Includes residential, commercial, and industrial properties. Investors may earn income through rent and capital appreciation.

Direct property ownership

Real Estate Investment Trusts (REITs)

Real estate funds

2. Private Equity

Investment in private companies or buyouts of public companies. Investors aim to improve operations and sell at a profit.

Venture capital

Growth capital

Leveraged buyouts

3. Hedge Funds

Actively managed investment funds using complex strategies:

Long/short equity

Arbitrage

Global macro

Event-driven strategies

4. Infrastructure

Investments in public assets such as:

Airports

Toll roads

Utilities

Renewable energy projects

These provide stable, long-term cash flows.

5. Commodities (as Alternatives)

Though commodities are their own asset class, they are often categorized under alternative investments.

6. Collectibles and Tangible Assets

Art

Rare coins

Wine

Classic cars

Antiques

Value depends on rarity, condition, and demand.

7. Cryptocurrencies

Digital assets like Bitcoin and Ethereum. Highly volatile but increasingly considered an alternative investment class.

Characteristics of Alternative Assets

Low Liquidity: Harder to buy and sell quickly.

Higher Return Potential: Often target above-market returns.

Higher Risk: Complexity and lack of regulation in some areas.

Less Transparency: Valuations may not be daily or publicly available.

Advantages of Alternative Assets

Diversification

Lower correlation with traditional markets.

Inflation Protection

Real estate and infrastructure often adjust with inflation.

Higher Yield Potential

Private equity and hedge funds can outperform public markets.

Access to Unique Opportunities

Investment in emerging industries and innovation.

Risks of Alternative Assets

Illiquidity risk

High fees (management and performance fees)

Valuation risk

Regulatory risk

Complexity and limited transparency

Role in Portfolio Management

Modern portfolio theory suggests diversification reduces overall risk. Commodities and alternative assets improve diversification because they behave differently from traditional equities and bonds.

Institutional investors such as pension funds often allocate:

5–15% to commodities

10–30% to alternative investments

The actual allocation depends on:

Risk tolerance

Investment horizon

Liquidity needs

Economic outlook

Conclusion

Commodities and alternative assets have become increasingly important components of modern investment portfolios. Commodities provide exposure to tangible goods essential to the global economy and offer inflation protection and diversification benefits. However, they are subject to high volatility and global economic forces.

Alternative assets encompass a wide range of investments including real estate, private equity, hedge funds, infrastructure, collectibles, and digital assets. These investments often provide opportunities for enhanced returns and risk diversification but come with challenges such as illiquidity, complexity, and higher fees.

For investors seeking to move beyond traditional stocks and bonds, commodities and alternative assets can enhance portfolio resilience and return potential. However, careful analysis, risk assessment, and strategic allocation are essential to successfully integrate them into a long-term investment strategy.

BAJFINANCE: At a Decisive Crossroads!The gap-up and volatility we're seeing today in BAJFINANCE are driven by two main factors:

India-US Trade Deal Euphoria: The broader market surged today after US President Donald Trump and PM Modi announced a historic trade deal. This sparked a massive rally across the Sensex and Nifty (up over 2.5%), with Bajaj Finance being one of the top gainers as foreign investors eye a return to Indian equities.

Q3 Earnings Report (Mixed Bag): Bajaj Finance released its Q3 results today post-market hours.

The Good: Net Interest Income (NII) surged 21% YoY to ₹11,318 crore, and Assets Under Management (AUM) grew 22%.

The Bad: Net profit fell 5.6% YoY to ₹4,066 crore, primarily due to a one-time charge from new labor codes and accelerated credit loss provisions.

Market Sentiment: While the profit dip looks "red" on paper, the underlying business growth (AUM and NII) is robust, which often keeps the bulls interested.

Key Technical Levels for the Next 2-3 Days:

🚧 The Decisive Zone (951–971): This is the battlefield. The stock is currently testing the 50-day EMA and a major sentimental barrier at 970.

📈 Bullish Case: If the stock sustains above 971, the next stop is 1005. A trade with volume above this could confirm the end of the long-term correction.

📉 Bearish Case: If it fails to hold the 951 level, expect a retracement toward the immediate support at 913.

💡 Strategy: Be extremely vigilant near the 970 mark. With Q3 results now public, the market will spend the next 48 hours "digesting" the data. High volatility is expected.

Watch for: Volume-backed breakout above 971 or a rejection candle at 970.

TCS – Heavy Breakdown | Key Support Under Threat Amid IT Sector TCS has witnessed a decisive breakdown, signaling a clear shift in market structure. The recent decline is not just a technical event but aligns closely with the broader weakness seen across the IT sector.

Ongoing pressure from global cues — including uncertainty around US interest-rate cuts, cautious enterprise IT spending, and weak sentiment in global tech stocks — has weighed heavily on Indian IT names. In this environment, TCS price action has firmly tilted in favor of sellers.

The stock has broken below its earlier base and is now trading at lower levels. Every minor recovery attempt is facing selling pressure, indicating that the market is currently selling rallies rather than buying dips.

Key Price Zones to Watch

₹2,650: This is a critical short-term support zone. Price behavior around this level will be crucial in deciding whether a temporary pause or further downside unfolds.

A decisive break below ₹2,650 could open the door for a deeper move towards the ₹2,400 demand zone, which acts as the next major support.

On the upside, the ₹2,900–3,000 zone is now a strong supply area. Unless price reclaims this zone with acceptance, upside attempts may continue to face resistance.

View

The overall structure remains negative, and broader IT sector sentiment does not yet support a sustainable reversal. Until higher levels are reclaimed, any bounce should be viewed with caution.

Price action around ₹2,650 will likely define the next directional move.

— Ayushi Shrivastava

Market structure & price-action focused analysis

This research is prepared with the assistance of AI tools for data structuring and presentation.

GODREJAGRO 1 Day Time Frame 📊 Current approximate price range: ~₹580 – ₹600+ (varies by data source & session)

📌 Daily Pivot & Support/Resistance Levels (Standard)

(based on common pivot formulas from technical data)

Pivot Point (Daily Reference): ~₹636 – ₹638

Resistance Levels

R1: ~₹601 – 602

R2: ~₹612 – 614

R3: ~₹622 – 624

Support Levels

S1: ~₹581 – 582

S2: ~₹571 – 573

S3: ~₹560 – 562

📍 Alternate intraday S/R from TradingView-type calculations (indicative)

(These are shorter-term pivot-based intraday levels that traders use for entry/exit)

Supports:

S1 ~₹642.9

S2 ~₹648.0

S3 ~₹653.2

S4 ~₹637.8

Resistances:

R1 ~₹658.2

R2 ~₹663.4

R3 ~₹668.4

R4 ~₹672.6

These figures vary slightly depending on calculation method (Classic pivot, Fibonacci, Camarilla, etc.). But the daily support range near ₹580–₹560 and resistance range near ₹600–₹620+ are consistent indicators.

📊 Important Levels to Watch

Near-term support zones (key floors):

₹580–₹575: First real intraday support

₹560–₹550: Secondary broader support (breakdown risk)

Near-term resistance zones:

₹600–₹612: Immediate resistance

₹620–₹630+: Higher resistance if bulls resume control

EICHERMOT-BUY LIMITView: Bullish continuation – Buy on retracement

Eicher Motors is maintaining a strong higher high – higher low structure, indicating a clear uptrend. After a sharp impulsive move upward, price is likely to retrace toward the previous breakout / demand zone before continuing higher.

The marked purple zone around ₹7,150 – ₹7,300 is a strong demand and previous resistance-turned-support area. This zone aligns with:

Prior consolidation base

Breakout level

Trendline support area

Strong bullish reaction previously

This makes it an ideal area to place a Buy Limit order, instead of chasing price at higher levels.

PREMIERENE: Bulls Defend 776 Support,Is 805 Next?PREMIERENE is currently showing a classic "volatile consolidation" pattern. After a strong bounce from the 766 level that peaked at 833, the stock faced significant selling pressure today, sliding back to test the strength of its recent recovery.

The price action has narrowed down to a decisive pivot zone between 772.50 and 776 . Today’s session confirmed the importance of this area as the stock managed to find intraday buyers right at this level with sentimental level at 782

Bullish Scenario: If the stock maintains its footing above 776, the immediate target remains 805. A sustained move above this could restart the further momentum towards the recent high of 833.

Bearish Scenario: A breakdown and trade below 772.50 would likely trigger a deeper correction. In this case, the next logical support sits at 738, which aligns with previous structural lows.

Joint Venture & Expansion: The company recently announced a JV with BA Prerna Renewables and has successfully commissioned a new 400 MW solar cell facility in Telangana. This brings their total cell capacity to 3.6 GW, supporting their aggressive ₹11,000 crore expansion plan.

Earnings Momentum: In the latest Q3 FY26 earnings (released Jan 23), Premier Energies reported EPS that exceeded analyst expectations, though revenue slightly lagged.

Institutional Interest: Despite recent volatility, 90% of analysts track the stock with a "BUY" rating, with institutional giants like Quant Mid Cap Fund holding significant stakes.