Indicators, Strategies and Libraries

The Ultra Moving Average is a versatile technical indicator that combines various types of moving averages to analyze trends, providing multi-timeframe insights for traders. It offers four customizable moving averages and a trend strength table for enhanced decision-making. Introduction The Ultra Moving Average indicator is a powerful tool designed to help...

The Dual SMA/EMA Bands indicator provides a clear view of market trends, combining Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) in one customizable tool. Designed for any timeframe, it features Aqua and Purple Bands for 50-period and 200-period averages , respectively, aiding in trend analysis and volatility insights. Features: Adaptive...

This is a very simple long-only strategy I've used since December 2022 to manage my Bitcoin position. I'm sharing it as an open-source script for other traders to learn from the code and adapt it to their liking if they find the system concept interesting. General Overview Always do your own research and backtesting - this script is not intended to be traded...

LNL Trend System is an ATR based day trading system specifically designed for intra-day traders and scalpers. The System works on any chart time frame & can be applied to any market. The study consist of two components - the Trend Line and the Stop Line. Trend System is based on a special ATR calculation that is achieved by combining the previous values of the 13...

This is a simple strategy that is working well on SPY but also well performing on Mini Futures SP500. The strategy is composed by the followin rules: 1. If RSI(2) is less than 15, then enter at the close. 2. Exit on close if today’s close is higher than yesterday’s high. If you backtest it on Mini Futures SP500 you will be able to track data from 1993. It is...

█ INTRODUCTION Nearly three years in the making, intermittently worked on in the few spare hours of weekends and time off, this is a passion project I undertook to flesh out my skills as a computer programmer. This script currently recognizes 85 different candlestick patterns ranging from one to five candles in length. It also performs statistical analysis on...

⚉ OVERVIEW ⚉ One of the best Systems for Backtesting your Strategies. Incredibly flexible, simple, fast and feature-rich system — will solve most of your queries without much effort. Many systems for setting StopLoss, TakeProfit, Risk Management and advanced Filters. All you need to do is plug in your indicator and start Backtesting . I intentionally left the...

EN: TradingView indicator for FBMA strategy People oftem ask: “Dmitry, BABA, TSLA, AAPL flies like a rocket! Well, what are we buying!?” - And I say no, the price does not act like a straight rocket upwards or downwards, instead it breathes, inhales moving away from the moving average and exhales returning to it, so we will wait for the first pullback and buy...

Extreme Volume Support Resistance Levels are S/R levels(zones, basically), based on extreme volume . Settings: Lookback -- number of bars, which algorithm will be using; Volume Threshold Period -- period of MA (Volume MA), which smoothers volume in order to find the extremes; Volume Threshold Multiplier -- multiplier for Volume MA, which "lift" Volume...

The script filters stocks on the basis of ATR. If the stock has moved above 7 times the ATR from the lows, the system generates buy signal and continues till the stock drops by 2 ATR. It is a good system in trending markets however in sideways consolidating markets, the system must be avoided. In trending markets it can generate good returns with significant Risk...

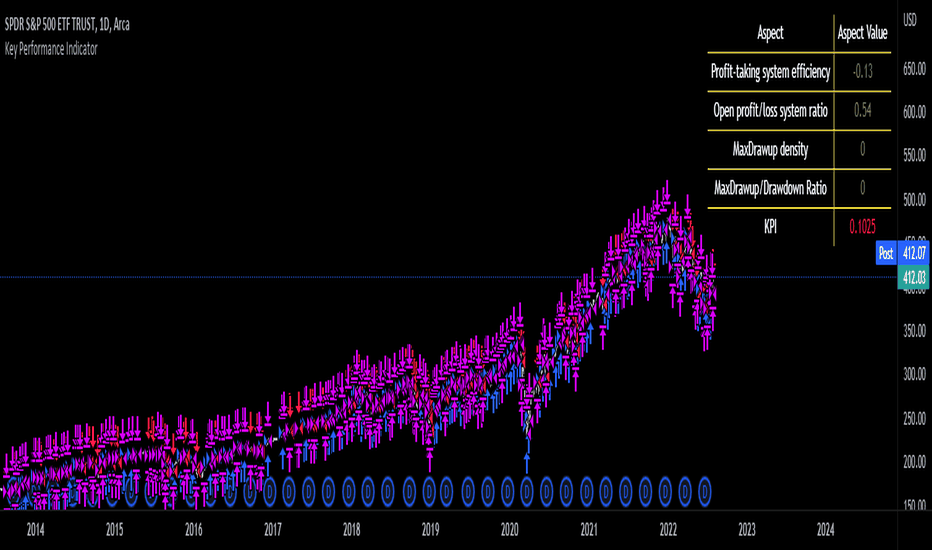

We are happy to introduce the Key Performance Indicator by Detlev Matthes. This is an amazing tool to quantify the efficiency of a trading system and identify potential spots of improvement. Abstract A key performance indicator with high explanatory value for the quality of trading systems is introduced. Quality is expressed as an indicator and comprises the...

We script this one for combining VWAP , EMA50 and EMA200. The tool is fantastic if traders know how VWAP , EMA work? Just adding this script in your favorite and work like charm: VWAP: How to trade with that - One of the simplest uses of the VWAP is gauging support and/or resistance. - A trader who is long a stock can use the VWAP as a target exit if its trading...

This indicator is based on Consensio strategy. Green = 100% Bullish, Yellow = 75%-90% Bullish, Orange = 30%-75% Bullish, Red = 100% Cash Position 1-4 Green candles = Bullish trend momentum (4 is stronger) 1-4 Red candles = Bearish trend momentum (4 is stronger)

INDIGO Cloud System © This script shows the monthly dip and peak zones and the daily highs & lows. The green zone is the dip zone. It's the place to enter a long position if you think there is or will be a reversal. The red zone is the peak zone. It's the place to enter a short position if you think there is or will be a reversal. The script uses the INDIGO...

This indicator combines the Supertrend (to determine the main trend direction) with two Keltner channels (used for add and take profit signals) to construct a trend trading system. These are the available settings: General UseTrendChange ➞ toggle trend change alerts and labels UseAdds ➞ toggle add to position alerts and labels UseTakeProfits ➞ toggle...

Function to convert unix time to a datestamp string.

The SMA 200 basic strategy will be more than familiar to most traders. This strategy is to stay with the programming language so to say the "Hello World" of trading. The SMA 200 basic strategy is also one of the simplest strategies in trading. All that is required is the price and a 200 period moving average. Usually the strategy is used in the daily chart....

Hey, I am glad to present you one of the strategies where I put a lot of time in it. This strategy can be adapted to all type of timecharts like scalping, daytrading or swing. The context is the next one : First we have the ATR to calculate our TP/SL points. At the same time we have another rule once we enter(we enter based on % risk from total equity, in this...