Bitcoin needs to Close above 85,300 on Hourly or Daily chartsBitcoin (BTCUSDT) Price Analysis: Key Levels to Watch

Since March 9, 2025, Bitcoin (BTCUSDT) has struggled to close above the critical $85,000 mark, keeping traders and investors on edge. The market is looking for signs of renewed bullish momentum, and Bitcoin must break specific resistance levels to continue its upward trajectory.

Key Resistance Levels and Price Action

For Bitcoin to regain its bullish momentum, it needs to achieve at least an hourly close above $85,300. This level serves as a short-term breakout point, indicating potential strength among buyers. However, for a more significant confirmation of bullish dominance, Bitcoin must close above $85,300 on the daily chart. If this happens, the likelihood of further downside will diminish considerably, paving the way for a sustained uptrend.

Important Resistance Zones to Watch

Even if Bitcoin clears the $85,300 level, it will encounter resistance at multiple key levels:

$86,200 – A minor resistance level that could create short-term selling pressure.

$90,600 – A stronger resistance zone that may require higher trading volume to break.

$93,400 – The ultimate challenge for Bitcoin. A successful breakout above this level could signal the start of a more aggressive bullish run.

Market Outlook

If Bitcoin fails to close above $85,300, bearish sentiment may persist, leading to increased volatility. On the other hand, a sustained close above this level—especially on the daily chart—could trigger fresh buying momentum and set the stage for a push toward higher resistance zones.

Traders and investors should closely monitor these levels while considering macroeconomic factors and overall market sentiment to gauge Bitcoin's next major move.

BITCOIN trade ideas

Bitcoin Bybit chart analysis March 19 Hello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

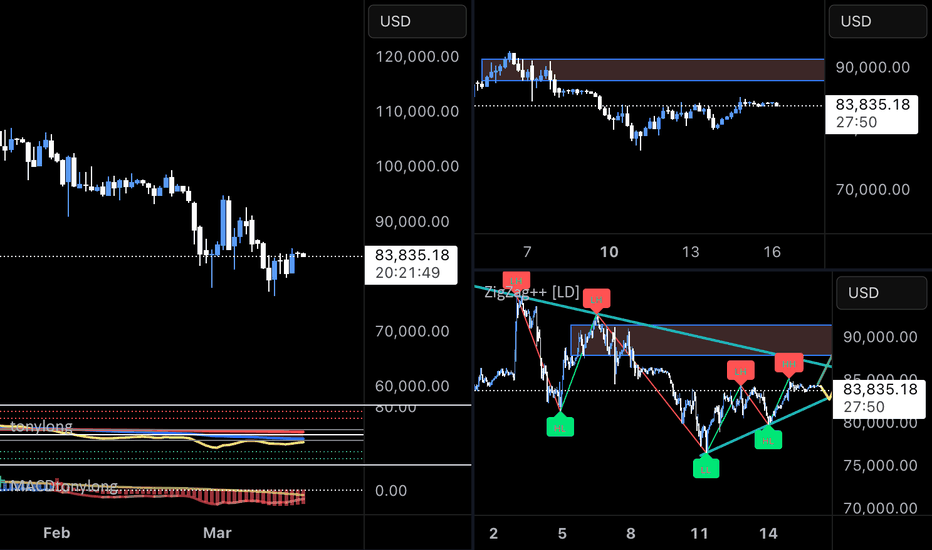

Here is the Bitcoin 30-minute chart.

There will be a Nasdaq index announcement (FOMC interest rate announcement) at 3 AM soon.

I created today's strategy based on Nasdaq.

*When the red finger moves,

One-way long position strategy

1. 83,451.4 dollars long position entry point / green support line breakaway stop loss price

2. 85,233.8 dollars long position 1st target and after autonomous short -> Top autonomous long

-> Good to up to 94,179.7 dollars long position final target price

(You can check the price if you drag the chart.)

The purple finger section at the top

is the place where you should touch first to have a high chance of success in the strategy. This is a section for autonomous shorts and rising waves,

(If it comes down right away, the safe section in the short-term rising trend is number 2)

If it breaks the 3rd sky blue support line at the bottom,

the rising trend line may break,

and since the previous low is broken from the bottom,

you should open it up to $79,712.8 by the weekend.

(Major rebound section)

Please use my analysis articles for reference only,

and I hope you operate safely with principle trading and stop loss prices.

I will see you next Monday due to personal reasons.

Thank you.

Cut down on ur shortsBTC CMP 82950

Elliott- The previous abc correction is a bullish zig zag. Hence a rally is on the cards now. The crypto can come down to 80700 again, but it will be preparing for a rally to some 89K odd levels. The correction will again set from there. So will say dont be too aggressive on ur shorts.

BTCUSD 8H: Trendline Pressure and Key Support Test🔥 BTCUSD 8H Deep Dive

1️⃣ Trendline Pressure: Bears controlling the market with a strong descending trendline.

2️⃣ Support Zone Strength: $77,500-$80,000 is a key demand area. Previous bounce shows buyers stepping in.

3️⃣ Liquidity Hunt? Price might sweep the support zone before reversal.

4️⃣ Volume Check Needed: Low volume = fakeout risk. High volume = potential breakout.

🎯 Targets

Bullish Breakout: $85,000-$87,500

Bearish Breakdown: $77,500-$75,000

📍 Eyes on next 8H close.

Bitcoin buy on dip near support upside Target 88100-89000How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

BTC#21: Fear Index Rising. Will BTC Continue to Fall? 💎 💎 💎 BINANCE:BTCUSDT BTC's decline has somewhat slowed down in recent days with a recovery from 78k. We will plan for BINANCE:BTCUSD next 💎 💎 💎

1️⃣ **Fundamental Analysis:**

📊 The Fear and Greed Index dropped to 30 today, and the level is still fear

🚀 Cumulative net inflows into US spot Bitcoin ETFs have dropped to their lowest level since January 2

📌 The market is still in a pessimistic phase about BTC's bullish outlook. The outflow of money from the market is not only due to BTC's decline but also due to concerns about an economic recession due to Trump's unstable policies.

2️⃣ **Technical analysis:**

🔹 **D frame**: BTC's downtrend has shown signs of slowing down, but the main trend in frame D is still down. We will still need to wait for the price reaction in the resistance area to confirm.

🔹 **H4 frame**: The price trend is still down. The price reaction in the support area of 78K is not as strong as before, showing that market sentiment is still leaning towards the bears.

🔹 **H1 frame**: we are in a short-term correction. The target for this correction is the resistance area of 88-91K as you can see on the chart

3️⃣ **Trading plan:*

As you can see from the multi-frame perspective, the main trend is still down, but we are in a short-term correction. We can choose to wait for the price to return to the resistance area to trade in line with the main trend or if the price has a slight recovery, set up BUY to seek profit. However, because the main trend is down, we need to stop loss fully and not be greedy when the price hits resistance because the price can return to the main trend at any time.

💪 **Wish you success in achieving profits!**

### **"Mastering the Downtrend: A Professional Short Strategy ### Professional Short Analysis and Trading Plan for Bitcoin (BTC/USD)

**Market Overview:**

The current trend of Bitcoin (BTC/USD) on the daily chart shows a **clear downtrend**, as the price remains below the **BB 104 0.1 (lower)**. Additionally, the slope of **SMA 104** is significantly declining, confirming a **strong bearish trend**.

**Bollinger Bands Analysis:**

- The **BB 20 1** (Upper Band 1 - UB1) at **$89,587.18** and **Lower Band 1 - LB1** at **$82,326.86** mark the short-term volatility range.

- The **Channel LB12** zone between **LB1** and **LB2** indicates that the market is in a **short-term downtrend**.

- The price currently resides within the **Channel LB12**, indicating a weak buying momentum with no confirmed reversal signals.

**Trend Confirmation:**

- **BB 104 0.1 (lower)** at **$95,532.52** acts as a major resistance level, confirming that the market is in a **downtrend**.

- **SMA 104** slope is significantly negative, emphasizing the continuation of the bearish trend.

---

#### **Short Trading Plan:**

**1. Entry Strategy:**

- Look for short entry when the price retraces upward and approaches the **Upper Band 1 (UB1)** around **$89,587.18**.

- An additional entry point can be considered if the price fails to break above the **BB 104 0.1 (lower)** at **$95,532.52**.

**2. Position Sizing:**

- Open **1/3 (33.33%)** of the full position size due to the confirmed downtrend and strong bearish momentum.

- Increase to **1/2 (50%)** if the price fails to break UB1 and shows bearish signals like long upper wicks or bearish engulfing patterns.

**3. Stop Loss:**

- Place the initial stop loss slightly above **BB 104 0.1 (lower)** at **$96,000** to account for false breakouts.

- Adjust the stop loss dynamically based on the slope of **SMA 104** and **ADX** strength.

**4. Take Profit:**

- First target: **$82,326.86** (LB1) to capture initial momentum.

- Second target: **$75,000** as a psychological support level and previous consolidation zone.

- Trail the stop using the **BB 20 0.2 (Upper)** to lock in profits as the trend continues.

---

#### **Risk Management:**

- Maintain a **Risk-to-Reward Ratio (RRR) of 1:3** or better.

- Avoid excessive position sizing to minimize the impact of sudden volatility.

- Continuously monitor trend strength using **ADX** and slope analysis of **SMA 104**.

---

#### **Professional Insight:**

The market shows strong bearish characteristics with no significant bullish reversal signals at this time. The short strategy aims to capitalize on downward momentum while minimizing risk through calculated position sizing and adaptive stop loss placement.

Prepare for sudden price swings and volatility, especially around **major resistance levels**. Regularly reassess the trade as the market dynamics evolve.

Bitcoin holding buy @80200 , Target 88200-89000How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

BTCUSD GANN VIBRATIONS 15 MIN TIME FRAME.....15 MARCH 2025Gann Trading System is a very disciplined trading system if you know what you want to achieve while executing your trades. Chart shows Gann swings on smaller timeframe. Possible trades within the two dates are marked on chart. The time for trading is nearly 7 days. Possible trades were 10 in numbers. Swing trading is done on 4 min timeframe. But due to minimum 15 min tf required here to put the idea across to the users is used on chart.

Happy Trading !!!

BTC update- next move the downside about started.BTC has completed Major move down and than corrected

Correction started from 76576 low and made high around 82k as a W wave and took abc correction

to the downside & correction completed at. 79k around and price bounced in Y wave,which is a ABC

correction and completed around 83.5K and next wave to the downside completed at. 81.3K and completed

X1 there and price went for next upside and completed triple zigzag pattern to the upside at

84.4K and broke to the downside.

Now if I am correct this move to the downside has to break the low of 76K.

BTCBTC appears to be forming a bullish AB=CD pattern. The key support level is at **$79,940**, while resistance is seen at **$81,765**. If BTC remains above **$79,940**, it could continue its bullish momentum. However, a break below this support may trigger further declines.

In the event of a downside move, the next targets could be **$78,724**, **$77,772**, **$76,560**, and **$73,059**. Traders should monitor price action around support and resistance levels to confirm potential trends. A sustained move above resistance could indicate further bullish strength, while a breakdown below support may lead to deeper corrections.

Risk management is crucial, as volatility remains high. Setting stop-loss orders and watching for confirmation signals can help in making informed trading decisions. Keep an eye on market sentiment and external factors, such as macroeconomic events, which could influence BTC's price movement.BTC appears to be forming a bullish AB=CD pattern. The key support level is at **$79,940**, while resistance is seen at **$81,765**. If BTC remains above **$79,940**, it could continue its bullish momentum. However, a break below this support may trigger further declines.

In the event of a downside move, the next targets could be **$78,724**, **$77,772**, **$76,560**, and **$73,059**. Traders should monitor price action around support and resistance levels to confirm potential trends. A sustained move above resistance could indicate further bullish strength, while a breakdown below support may lead to deeper corrections.

Risk management is crucial, as volatility remains high. Setting stop-loss orders and watching for confirmation signals can help in making informed trading decisions. Keep an eye on market sentiment and external factors, such as macroeconomic events, which could influence BTC's price movement.

Very good shorting opportunity in BTC. Trade setup explainedBtc is getting rejection from 1hour supply zone. We can short btc with sl of 89840. We can target level of 83650. Risk reward ratio of the trade is very good i.e 1:8. Below at 83000 levels We have a demand zone which will be our target for the trade.

Bitcoin Bybit chart analysis March 6Hello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

This is the Bitcoin 30-minute chart.

There will be a Nasdaq index announcement at 10:30 in a little while.

At the bottom left is the long position entry point on March 5th.

The purple finger is connected to $88,407.

*Red finger movement path

One-way long position strategy

First wave check in section 1 at the top

1. Long position entry section of $90,698 / Stop loss price when purple support line is broken

2. Long position 1st target of $94,236.5 -> Gap8 2nd target

(Today's 4-hour chart, 12-hour chart resistance line section is $94,236.5

Since we don't know how much the adjustment will come out, it's okay to use a short position.)

3. After long profit cut, section 1, $91,884.5 long position utilization section

After that, long position target price in order of Top -> Good section.

Section 1 at the top

If there is an adjustment after the touch, a short->long movement will occur in NASDAQ

and it is more advantageous to wait for a long than a short,

and Section 2 at the bottom is a safe long position entry section where a short-term pattern is maintained.

From Section 3, there may be an additional decline,

so it would be good to check Bottom -> $83449.5 as indicated.

My waist and shoulders are not so good

I will enter early here today

Please use my analysis article as a reference only

Don't forget the 6 principles of trading and the essential stop loss price

and operate safely

Thank you.

Bitcoin showing weakness. It may test 76076Bitcoin chart is weak now. weakly RSI below 60 MACD also negative. Double top pattern form and correction showing. As per chart it may test 76076 soon. It can short on any bounce up to 92000.

These is Neckline place near 76076 of Inverse H&S pattern. It would be retest of neckline.

BTCUSD: Trendline Support vs. Key Resistance - What's Next ?Previous Support Turned Resistance: The 91,000-93,000 range that previously acted as support has now flipped to resistance, confirming a classic price action principle.

Diagonal Trendline Support: Currently, price is respecting an upward diagonal trendline (marked by the red lines on the chart), providing short-term support.

Market Structure:

Bitcoin experienced a sharp drop from the 96,000 level in late February

Price found a bottom around the 80,000 mark before forming the current ascending trendline

Recent price action shows a series of higher lows along this trendline, suggesting potential bullish momentum building

Trading Outlook:

As long as price remains above the diagonal trendline support, we can expect a continued move higher

Immediate target would be a retest of the 91,000-93,000 resistance zone and if price sustain above this then more upisde possible.

A successful break above this resistance could signal a resumption of the larger bullish trend

However, a break below (Close on daily) the trendline support would invalidate this bullish scenario

Bullish Position on BTC: Double Bottom on 5-Minute Chart and SPXAs Bitcoin (BTC) forms a double bottom pattern on the 5-minute chart, traders are eyeing a bullish position. This technical analysis pattern, often seen as a reversal signal, indicates potential upward momentum. Additionally, BTC's correlation with the SPX index further supports the bullish sentiment. Stay updated with the latest market trends and capitalize on this promising trading opportunity.