JINDALSTEL trade ideas

JSPL: 16% ROI in 15 daysOn Jan 27, when the stock was at 376,

this is what was suggested

The stock gave ample opportunity to buy.

Today JSPL has made a high of 444.80

That is 18% ROI in about 15 days.

CMP 438 (16.5% approx)

Profit booking can be considered

Just following SImple Technical Analysis and results are in front of you

Happy trading....!!!

(P.S: The credit here goes to Krishna ji for highlighting this set up😀)

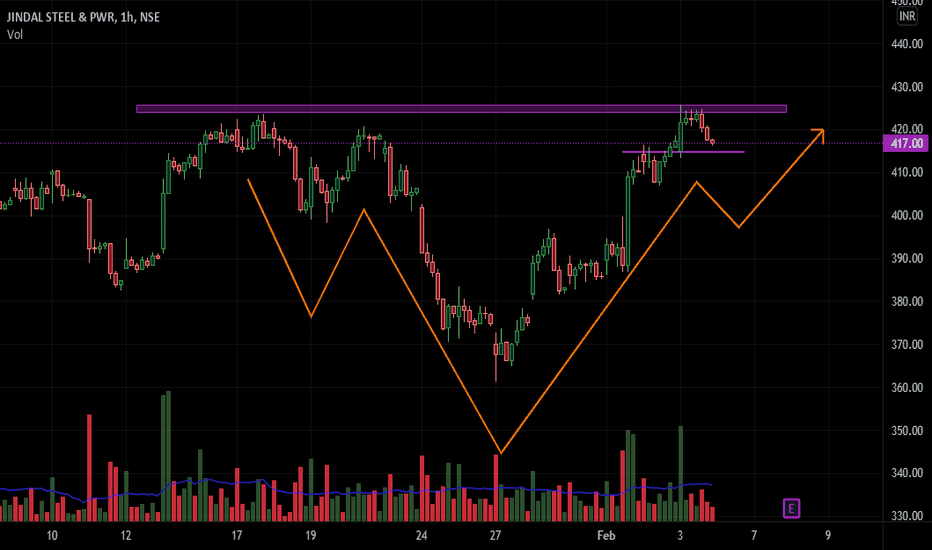

JSPL: Near Support levelsJSPL

- the stock is currently trading below it's 50 day

- The stock is currently near it's 200 day EMA (a tad below to be precise)

If 200 day EMA is withheld and the stock goes above 50 day EMA, then Target for the set up 418 / 447

- Given the volatility, consider buying in 2 tranches - one at current levels and have provisions to buy on dips towards 340-350 zone in case if that comes

Ignore if you are looking for short term quick gains.

Take care & safe trading...!!!

Disclaimer

- The view expressed here is my personal view

- Past performance is not a guarantee for future predictions

- Use this for educational purpose

- Any decision you take, you need to take responsibility for the same

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

- if trading in F&O, understand that F&O trading involves risk

- Do take proper risk management measures

- Do your own analysis and consult your financial adviser if need be

Jindal Steel and Power Massive breakoutA massive breakout rally should begin in Jindal Steel and Power soon. It is a triangle pattern breakout and even horizontal trendlines are broken. Keep a strict stop loss at Rs.420 for targets of Rs.500-545-605 in the short to medium term. A decisive and strict stop loss is necessary in metal stocks as they tend to reverse sharply and are very cyclical in nature. Please do follow your stop losses.

Trendline Breakout in JINDALSTELDON'T HAVE TIME TO MANAGE YOUR TRADES? | Trendline Breakout in JINDALSTEL

- Take BTST trades at 3:25 pm everyday

- Book profits within first 30 minutes of the market opening

- Try to exit taking 3-5% profit of each trade

- SL can be taken when 5/15 min candle close below 44EMA

- SL can also be maintained as 1% or closing below the low of breakout candle

Levels mentioned on the chart are calculated using Breakout Indicator

Now why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Buy Today, Sell Tomorrow: JINDALSTEL for more than 5%

JSW Steel trading in trendline..!!Metal sector doing well.. Its Time for JSW steel now, trading in the trendline and give targets of Rs 470/- from here in short term..!!

Disclaimer: I am not SEBI registered and all the analysis is purely for educational purposes. Not a buy or sell recommendation. consult your financial adviser before entering any trade.

JINDALSTEL 460 +10% UPSIDE POSSIBLE SWING TRADENSE:JINDALSTEL

Trade Logic | UPTRENDING MOVING AVERAGE. BREAKOUT SWING HIGH BUY

Entry 420

Stop 380

Target 460

RR 2.0+ 2nd Target Open

Details on chart as always

1 FREE trade idea Daily/Weekly.

Trade Size 5%- 10% Max

Max Trades 10-20/ Month

Time Frame 1 WEEK - 1 MONTH. Max

Diversify Bet Small Lose less. | Our Motto.

#TRADEWORLD | #MARKET_MAGIC

----**All Stocks Shared are in My Personal Trade Portfolio***----

TEST FIRST / THEN TRADE

Inverse H/S---🤑🤑An inverse head and shoulders, also called a "head and shoulders bottom", is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends. This pattern is identified when the price action of a security meets the following characteristics: the price falls to a trough and then rises; the price falls below the former trough and then rises again; finally, the price falls again but not as far as the second trough. Once the final trough is made, the price heads upward, toward the resistance found near the top of the previous troughs