Trade ideas

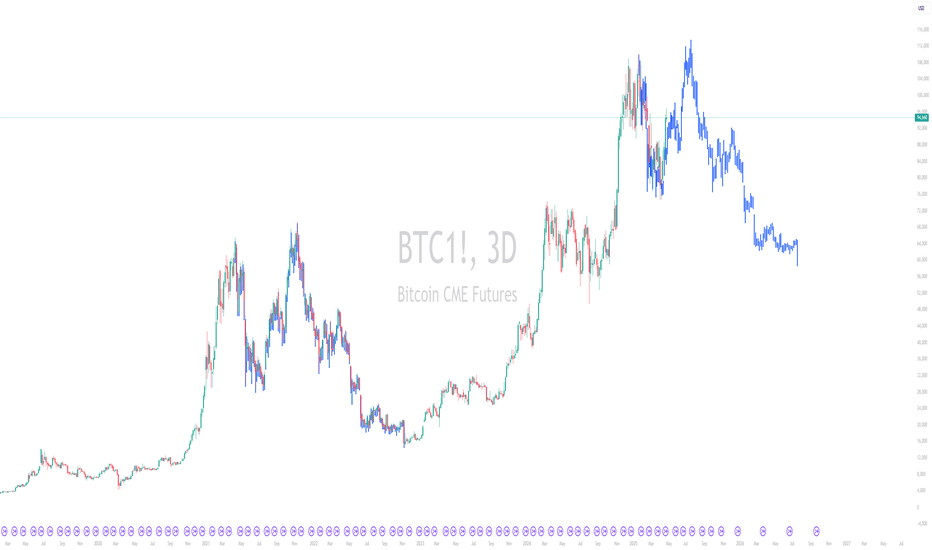

Bitcoin Next move $70k or $120k?CRYPTOCAP:BTC Is About to Bounce From the Level Everyone Is Ignoring

CME Gap 👉 $91,170

FVG below 👉 $89,020

Both zones = liquidity magnets.

No upside CME gaps left… only 1 upside FVG at $120,370

My view:

Fill → Sweep → Strong bounce expected from $89K–$91K range.

Next major draw = $120K FVG.

NFa & DYOR

BITCOIN CME Gap Alert: CME GAP around $91000BITCOIN CME Gap Alert:

As per CME chart, Bitcoin still has an unfilled gap between $91,970 – $92,730.

In my opinion, BTC must revisit around $91,970 to fully close this gap.

Price usually returns to CME gaps because they act as liquidity zones and market inefficiencies, the market tends to fill them before continuing the main trend.

NFa & DYOR

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t want to change. It believed that strength meant standing still, no matter how hard the current pulled.

But slowly, almost without noticing, the stone began to wear down. The river wasn’t trying to destroy it. The water wasn’t cruel. It was simply doing what rivers do - moving, shifting, carving its own path.

One day, the stone realised it wasn’t the same shape anymore. It was smoother now, smaller in places. It hadn’t won by resisting. It had survived by adapting. It had learned to let the river shape it without breaking it apart.

The stone couldn’t control the river. All it could do was endure without letting itself be shattered.

Trading is NOT so different.

The market moves like a river. It doesn’t care if you want it to go left or right. It doesn’t reward those who stand rigid against its flow. It rewards those who learn when to hold their ground, when to let go, and how to survive the constant pull of forces bigger than themselves.

This is NOT a story about rivers and stones. It’s a story about YOU.

About learning to endure without breaking. About understanding that survival comes not from fighting the current, but from learning how to live within it.

Much like the stone, every trader begins with the same illusion, that strength means control, that certainty can be conquered with enough knowledge or willpower.

But time in the markets teaches you otherwise. It shows you, again and again, that survival isn’t about resisting the flow. It’s about learning to move with it, to protect yourself from the inevitable storms without being broken by them.

And so, this is where the real story of trading begins.

Trading often appears simple from a distance. You buy, you sell, you make a profit, and then you repeat the process.

But anyone who has spent enough time in the markets will tell you the truth. This isn’t a game of certainty. This is a game of survival.

The market humbles you early. It doesn’t care how much you know, how brilliant you think you are, or how much confidence you bring. The market doesn’t reward ego; it breaks it down piece by piece.

Almost everyone starts with the same mindset. You want to win. You want to make money. You believe you can figure it out if you study hard enough, work smart enough, hustle more than the next person.

But eventually, reality steps in. You begin to understand this game isn’t about knowing where the price will go next. It’s about knowing where you will stop, where you will cut a loss, where you will step aside and wait.

The traders who survive are not the ones who chase perfection or seek to predict every move. They are the ones who learn how to lose properly - small losses, controlled losses. Losses that don’t bleed into something bigger, mentally or financially.

Most people can’t do that. They fight the market. They fight themselves. They refuse to accept small losses, believing they can somehow force a different outcome.

Those small losses eventually snowball. Blowups rarely come from one bad trade. They come from ignoring the small signs over and over again. The market isn’t cruel. It’s just indifferent. It’s your responsibility to protect yourself.

Good trading isn’t loud. It isn’t exciting. It isn’t full of adrenaline and big calls.

Good trading is quiet, repetitive, and frankly, a little boring. It’s built on discipline, not drama. Your job is to manage risk, protect your capital, and let time do its work.

There is no holy grail. There is only process. A process you can repeat with a clear head, day after day, year after year, without losing yourself in the noise.

Wins will come. Losses will come. Neither defines who you are. What defines you is how you respond.

⦿ Can you stay calm after a red day?

⦿ Can you follow your plan even after a mistake?

⦿ Can you sit on your hands when there’s nothing to do and trust the work you’ve already done?

Patience, in the end, is the real edge. Most won’t have it.

They’ll bounce between strategies, searching for certainty where none exists. They’ll burn out chasing shortcuts. They’ll forget that progress comes through small, steady steps taken over years, not through chasing big wins.

Trading is a mirror. It reflects your fear, your greed, your impatience. It shows you who you really are. Ignore what it reveals and you’ll keep paying for the same lesson until you finally learn it.

In the end, this game isn’t about the market. It’s about YOU.

⦿ Learn to protect yourself.

⦿ Learn to sit with boredom.

⦿ Learn to lose well.

⦿ Learn to wait without losing faith.

If you can do that, the market has a way of rewarding you in time.

Short Bitcoin

### 📉 Micro Bitcoin Futures (MBT1!) - 4H Chart Analysis 🕵️♂️

**Current Price:** $83,725

**Chart Type:** 4H (CME Futures)

---

### 🔍 Market Context:

- MBT is currently facing resistance at the **200 EMA** and the marked **supply zone** around **$84,000–$86,300**.

- After failing to break this resistance, price has started a retracement.

---

### 🧠 Trade Idea:

We're watching for a **pullback into the demand zone** between **$80,000 – $80,950**, where buyers have previously shown strength.

---

### 🔧 Strategy Setup:

- **Entry Zone:** $80,000 – $80,950 (Demand Area)

- **Stop Loss:** Below $79,920 (Structure invalidation)

- **Target 1:** $83,700 (Previous high / 200 EMA area)

- **Target 2:** $86,300 (Top of supply zone)

---

### 📊 Indicators:

- **RSI** is cooling down from overbought levels.

- **MACD** showing early signs of a bearish crossover – supporting short-term retracement thesis.

- **Volume** appears to be decreasing on the drop – suggesting potential for buyer re-entry soon.

---

### ✅ Trade Bias:

**Bullish on pullback.**

Waiting for price to retest demand and form bullish confirmation before entering long.

---

🔔 **Note:** Patience is key. Let the price come to the zone. Enter only on confirmation (e.g. bullish engulfing, pin bar, or reversal divergence on RSI/MACD).

Target for Bear Market FVGs = Fair Value Gaps can hold as Liquidity Zone.

Plus, this market looks exactly like the Dotcom. Any project that includes crypto, blockchain, layer,.... just shoot the sky with billions upon billions of dollars.

With all the hypes, they die out eventually. Pepe: billions of MC, Doge, Shib....

that is not healthy market.

People throw money recklessly at any project without real life applications.

So I am soon will stay out of this super speculative market.

The future is there, but for real projects only.

Bitcoin Mini Future Bearish Price ActionAfter the accelerated fall post breakdown of horizontal channel, the price dropped to fill the gap and bounced back.

The bounce took price back into the horizontal channel but the price slid out of it.

Then price dropped towards the gap and bouncing just above it.

The price tried to enter the horizontal channel but took resistance, further confirming bearish price action.

As it remains outside the channel, it seems bearish.

Price of the Bitcoine is Refelection of the World LiquidityThe best part of the Bitcoine price movement is show in the What is the liquidity of the world, If the liquidity increase the price of bitcoine is goes up and When liquidity is shrink the price of the bitcoine is down this is very important for the trader and investor.

The price of bitcoine most of the time give go return when the Nesdaq give good return.

"No Matter You Are Trader or Investor, You Love or Hate Cryptocurrency, But you can't ignor the Bitcoine"

Btc CME gap is still pending As a BTC chart analyst, I observed a recent CME gap at **79,000**. Currently, BTC is approaching **91,000**. Historical data suggests a high probability of the CME gap being filled, as gaps often get filled over time. The likelihood of BTC reaching the gap level is significant, given past trends. Traders should monitor this closely, as gap fills can present profitable opportunities. It's crucial to stay updated with market movements and consider risk management strategies to capitalize on potential price movements.

THE IMPORTANT BTC GAPS ARE GOING TO FILLBitcoin ( CRYPTOCAP:BTC ) recently plummeted to $49,000 due to rising US unemployment rates and a fall in the Japanese stock market. However, BTC is now recovering, bouncing back from the oversold area.

This recovery indicates it's time to fill the gaps between the $58,500 and $62,600 levels. In the crypto market, gaps tend to fill quickly, suggesting an imminent bullish movement for Bitcoin.

Next targets are 62600 & 69000 , if breaks we are going to see new all time high. Mostly ATH will come in November.

BITCOIN BTC on CUP & Handle Pattern | Target 1,21,00 $As per Technical analysis on weekly timeframe on BTC. I think BTC might go in an upward direction CUP & Handle pattern formation found.

Now, BTC at 70000$

Also, Check my previous BTC target at $70,000

Keep Using SL and always remember below points

Imp. Note: This analysis is provided for informational purposes only and does not constitute a direct recommendation to buy or sell stocks. Investors should conduct their own research and consult with financial advisors before making any investment decisions, as market conditions and individual circumstances may vary.

Market Risk: However, it's important to acknowledge the inherent risks associated with investing in the stock market, including but not limited to volatility, economic downturns, regulatory changes, and unforeseen events that can impact stock prices. It's crucial for investors to remain vigilant and diversify their portfolios to mitigate potential losses.

BTC Update I have opened long positions at 60k, 61k, 62k, and 63k. Now, I expect a slight dip to fill the CME gap. I am closing 50% of my position to book some profit and will add more if the price comes down. The prices I am looking to add long positions at are 64411 and 63501.

There is no new CME gap formed between 64405 and 64495; it will fill sooner or later.

BTC UpdateA new CME gap has formed around $67,630. Currently, there are two nearby gaps at $67,630 and $63,550.

It's worth noting that approximately 90% of CME gaps tend to be filled sooner or later, whether it's within a week or a month. Keep this in mind.

Regarding BTC, I anticipate it will touch the upper trendline of this symmetrical triangle or even surpass it, but it could be a fake out. There's a possibility of rejection around $74k or $75k, at which point I'll be looking for short trades.

Following that, BTC may proceed to fill both CME gaps entirely and prepare for new all-time highs within the next six months.