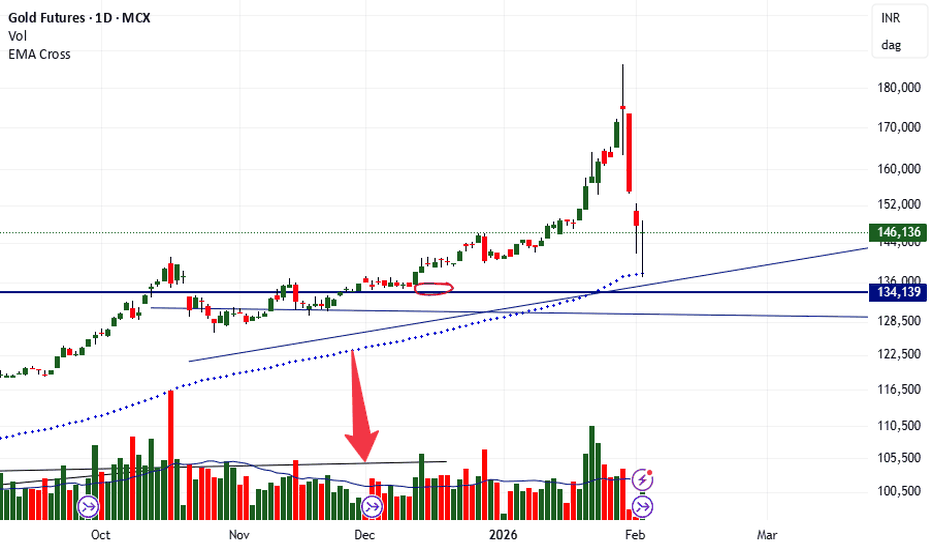

GOLD FUTURERS :Shooting star Candle shows exhaustion Buy on DipsGOLD Futurers : It has formed a Shooting Star at resistance shows exhaustion at higher levels. Expect a pullback towards 158000-151000.

Trend for Gold MCX remains bullish, but a Shooting Star at resistance signals a short-term pullback

As per Fib retracement and EMA Levels i will be a buyer at the f

Gold Futures

No trades

About Gold Futures

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a fiat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

Related commodities

Possibility of some cooldown on GOLD for few months.Possibility of some cooldown on GOLD for few months.

Gold after Rally to ATH of 165000+ looks reached on top end of the Channel ... Possibilities are it can consolidate near 170-175K Level for few weeks before providing new direction to the commodity.

LTP - 164K

Range 150K to 175K.

View - Cautio

GOLD PRICE$ forecastgold huge discount price central banks still buying gold.dollar index is still weak.japanese yen is more weaker one of the big player of U$ BOND holder incase japan sells U$ bond dollar more bearish. only safe heaven asset in the entire world. the geopolitical tension is more chaos. #epstinfiles

How ₹2 Lakh Can Be Invested in Gold & Silver Using SIP + GTTLet’s take a simple example of an investor who wants to invest ₹2,00,000 in Gold and Silver, but does not want to invest everything at one price.

Instead of predicting the bottom, the investor follows a rule-based SIP + GTT (dip buying) strategy.

📉 Market Context (At the Time of Planning)

Gold h

Role of FII and DII in the Indian Stock MarketIntroduction

The Indian stock market is one of the fastest-growing capital markets in the world and attracts investments from both domestic and global participants. Among the most influential players in this ecosystem are Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (

Part 1 Ride The Big Moves What Are Options?

Options are financial derivatives—meaning their value is derived from an underlying asset such as stock, index, commodity, etc. They are contracts between two parties: the option buyer and the option seller (writer).

There are two types of options:

Call Option (CE) – Right to bu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Gold Futures is 4,979.8 USD / APZ — it has risen 1.85% in the past 24 hours. Watch Gold Futures price in more detail on the chart.

The volume of Gold Futures is 171.80 K. Track more important stats on the Gold Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures this number is 280.89 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures technicals for a more comprehensive analysis.