Gold Spot / U.S. Dollar

No trades

About Gold Spot / U.S. Dollar

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a flat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

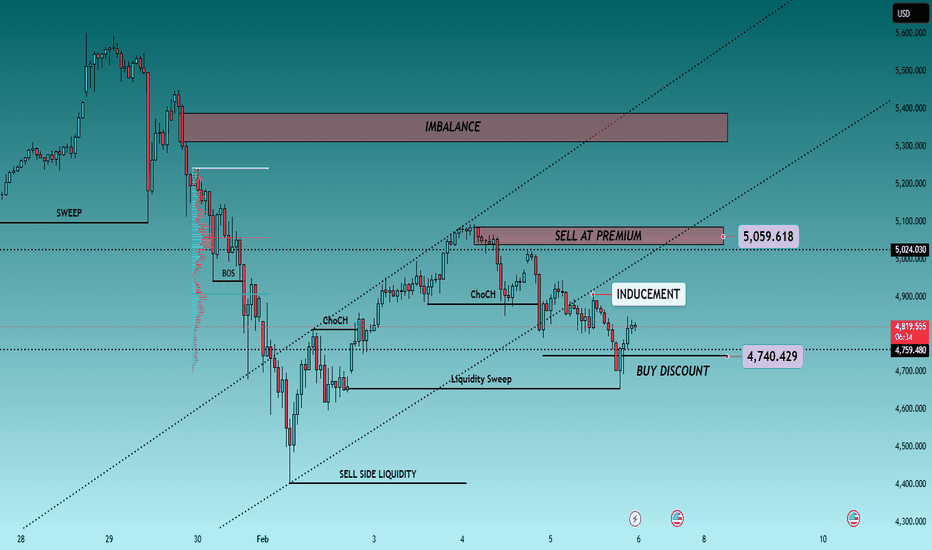

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 06.02.26XAUUSD – 1H Sell Limit Projection | 06.02.26

“In this one-hour XAUUSD analysis, gold is currently moving within a broader corrective structure after a strong bearish impulse.

Price is approaching a key descending trendline, where we can also observe a double top formation developing near the resis

Bearish Rejection From Supply, Targets Below

Market Structure

Price previously made a blow-off top (sharp impulsive high, marked by the red arrow), followed by a strong bearish reversal, breaking short-term structure.

The subsequent bounce formed a lower high, confirming a bearish market structure shift on the intraday timeframe.

Key Zones

Gold PA Scalping FrameworkScanning XAUUSD to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. Th

XAUUSD / GOLD – 1H SELL PROJECTION (05-02-2026)

Gold was moving inside a rising channel, respecting the uptrend line.

However, price failed to sustain bullish momentum and clearly broke the uptrend, indicating a market structure shift.

After the breakdown:

Price retraced back into a Fair Value Gap (FVG)

The retracement got rejected near Resi

GOLD INTRADAY LEVELS 📉 PRIMARY SETUP: SELL ON RISE (preferred)

✅ Entry

Sell zone: 4830 – 4860

Or sell on rejection candle in this zone

🎯 Targets

T1: 4765

T2: 4700

T3: 4655 (recent low)

🛑 Stop Loss

SL: 4920 (15-min close)

🟢 ALTERNATE SETUP: BUY ONLY IF REVERSAL CONFIRMS

✅ Condition

15-min close above 4920

Follo

Gold Trades the Extremes as News Fuels Liquidity Games🟡 XAUUSD – Intraday Smart Money Plan (H1)

📈 Market Context

Gold remains highly sensitive today as markets react to President Trump’s announcement, keeping USD flows unstable and risk sentiment mixed. This environment favors liquidity engineering, not trend chasing. Institutions are exploiting news

XAUUSD (H2) – Liam ViewXAUUSD (H2) – Liam View

USD strength continues to limit gold | Sell-side structure still active

Quick summary

Gold remains under pressure on the H2 timeframe as a firm US Dollar keeps weighing on precious metals. The recent rebound looks corrective and lacks solid acceptance above supply. With mark

Gold at a Make-or-Break Harmonic ZoneGold is approaching a critical harmonic completion area, where price action, Fibonacci geometry, and momentum structure are converging. This setup demands attention.

🧠 Market Structure Snapshot

Price has completed a well-defined X–A–B–C structure

The market is currently progressing through

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.