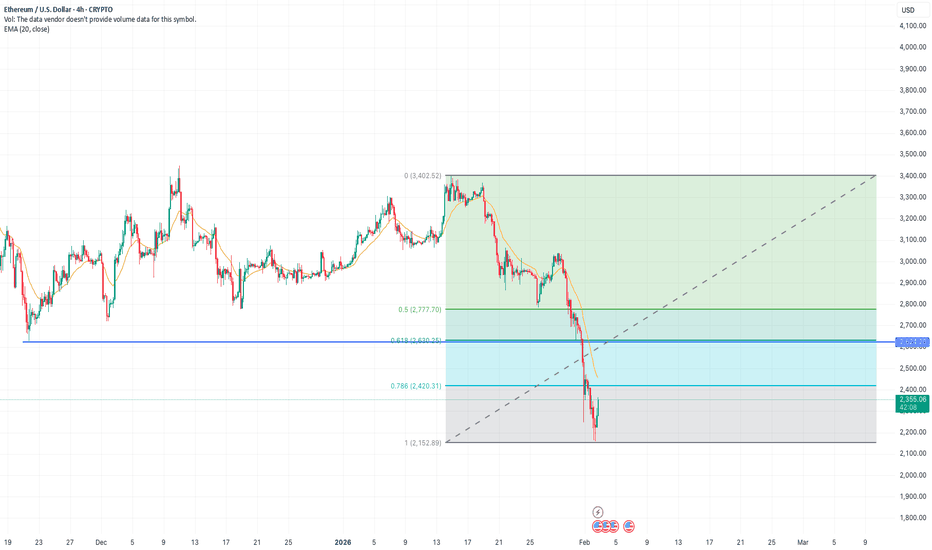

ETH/USD Daily — Support Bounce Setup in a Strong Downtrend

Chart Analysis:

Market Structure:

ETH is clearly in a bearish trend on the daily timeframe. Lower highs and lower lows are intact after a sharp rejection from the major supply zone around 3,300–3,400 (yellow zone).

Impulsive Sell-Off:

The recent move down is strong and aggressive, suggesting capi

ETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARDETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the mark

ETH Reversal or just a pullback?CRYPTO:ETHUSD

Looking at the 4hr TF of ETH. it looks taking a minor pullback from the downward trend.

Yet it has to close Above $2620 to break the character of the current downtrend.

Highly likely it will chase this number successfully as more people are coming in with sentiment of buying the

The Bearish take on EthereumETH’s price action isn’t resilience — it’s structural weakness.

• ETH failed to lead while BTC stabilized

• No rotation narrative — capital isn’t choosing ETH

• Underperformance is a signal, not noise

Ethereum doesn’t benefit from “digital scarcity.”

• Supply is policy-driven, not fixed

• Monetar

#ETH Risker than beforeWatch for these levels. ETH can head back to $900 to $1000 again.

This chart/indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible

Will it rhyme again?What do you think would happen?

This indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible for any financial losses resulting from th

Indicators & Oscillators (Technical Analysis) – Complete GuideIntroduction

In technical analysis, Indicators and Oscillators are mathematical tools derived from price, volume, or open interest data. Traders use them to analyze market behavior, identify trends, measure momentum, spot reversals, and improve trade timing.

While price action shows what the marke

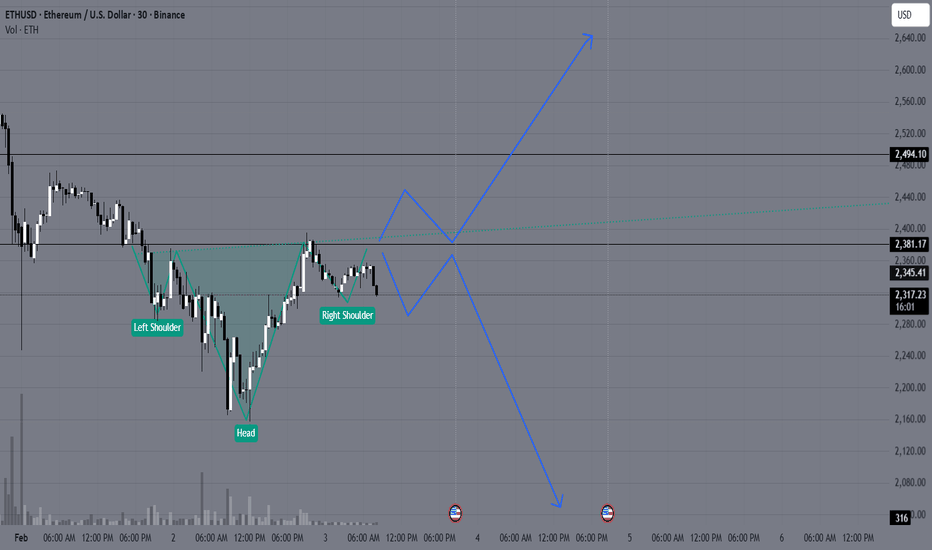

ETHUSD at a crucial support Forming Head and shoulder pattern✅ Pattern Forming: Inverse Head & Shoulders (Early Stage)

Look closely:

Left Shoulder → ~2300

Head (lowest point) → ~2180–2200

Right Shoulder → ~2250–2270

Price now pushing upward again

This is a classic bullish reversal structure.

✅ Key Resistance / Neckline Zone

Marked level around:

2380–

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.