DAX TECHNICAL UPDATE DAX is showing signs of bullish reversal after reacting strongly from a major demand/support zone (24,300–24,350). Price has broken the descending trendline, indicating a potential trend shift.

🔹 Market Structure:

• BOS (Break of Structure) on the upside

• Higher low formation confirms bullish intent

🔹 Technical Patterns:

• Trendline breakout

• FVG (Fair Value Gap) fill & reaction

• Fibonacci retracement holding above 0.618 support

• Strong bullish engulfing / impulsive candles from support

📈 Trade Setup:

• BUY STOP: 24,537

• TP1: 24,624

• TP2: 24,724

• SL: 24,409

➡️ Bias stays bullish above 24,500. Acceptance above breakout level can push price toward upper liquidity zones.

What traders are saying

GER40 Holds Key Fibonacci Support – Upside Continuation LikelyThe GER40 chart indicates that a larger A-B-C corrective structure has been completed at the recent low, marked as (C), after which the index began a fresh impulsive upward move. From that bottom, price has formed a clean five-wave advance, confirming the start of a new bullish cycle. The recent pullback appears to be a typical Wave 2 correction, which has respected the 0.5–0.618 Fibonacci support zone, a common area where corrections typically end. This suggests the correction is likely complete and the market is preparing for Wave 3, which is usually the strongest and fastest upward wave. As long as price holds above the Wave 2 low, the bullish Elliott Wave structure remains valid. Overall, the setup favours continued upside, with potential for higher highs in the coming sessions.

Stay tuned!

@Money_Dictators

Thank you :)

DAX breaking 7-month consolidationDAX Weekly Outlook – Consolidation Breakdown in Progress

The DAX has been moving in a broad 7-month consolidation range, showing neither a clear uptrend nor a downtrend. Such long consolidations often act as distribution zones, where smart money gradually exits positions before a larger move begins.

Consolidation Breaking on the Downside

This week, the index is attempting to break below the lower boundary of this consolidation range. A downside break after months of sideways action is usually a strong bearish signal, especially on higher timeframes like the weekly chart.

Key Level – 23,000

The 23,000 zone is the critical level to watch:

If the DAX gives a weekly close below 23,000,

And we see follow-up selling next week,

…then it would strongly suggest that the distribution phase is complete, and the index may begin a sustained downward journey.

What This Means

A confirmed breakdown from multi-month consolidation often leads to:

Increased volatility

Trend acceleration

Deeper corrections toward the next major demand zones

For now, the weekly close will be crucial. A weak closing would confirm bearish sentiment and open the path for further downside.

DAX Breaks H&S Pattern – Eyes 22,300–22,200🔎 Chart Setup

DAX has given a breakdown of the Head & Shoulders pattern on the daily chart. This is a strong bearish reversal pattern, usually signaling further downside.

⚖️ Downside Targets

With the breakdown confirmed, the pattern target lies in the 22,300–22,200 zone.

As long as 24,000 (on a closing basis) is not reclaimed, the bearish bias remains intact.

🔄 Retest Scenario

After such breakdowns, it’s common for the index to retest the neckline.

In this case, a pullback up to 23,700 is possible before resuming the downward move.

✅ Summary

DAX has entered a bearish phase after breaking down from the Head & Shoulders pattern. Unless it closes back above 24,000, the path of least resistance remains down toward 22,300–22,200.

Head & Shoulders on DAX Daily Chart – Watch for BreakdownThe DAX index is currently forming a Head and Shoulders pattern on the daily chart, a well-known bearish reversal formation. This pattern typically signals a potential shift in trend from bullish to bearish if the breakdown occurs.

Left Shoulder – Formed when prices peaked, followed by a correction.

Head – A higher peak, marking the top of the uptrend, followed by another decline.

Right Shoulder – A lower high compared to the head, showing weakening bullish momentum.

Neckline – The key support line connecting the lows between the shoulders and the head.

⚖️ Implications

If the DAX breaks below the neckline with strong volume, it will confirm the pattern.

This breakdown could trigger further downward momentum, with potential targets calculated by measuring the distance from the head to the neckline and projecting it downward.

✅ Summary

Pattern: Head & Shoulders (bearish) on daily chart.

Trigger: Breakdown below the neckline.

Outcome: Increased probability of further decline, with downside targets extending to lower support zones.

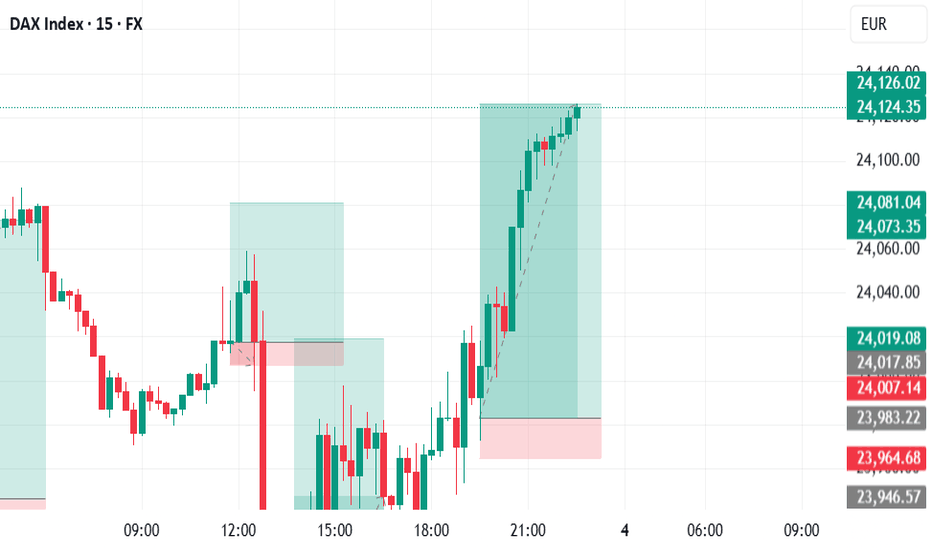

GER40 BUY TODAY RUNNING SMOOTHLYI saw a setup forming on the charts in 5 minutes. Took a Ger40 Buy according to my setup. I just entered another buy which I have shown on the charts. It is currently running around 1;3. my target in the second buy is 1;7 ish. I will hold 1st buy till my TP reaches. Sharing just to show you guys.

DAX40 Recovery Setup-Potential Upside to 24552After a significant intraday selloff, DAX40 shows signs of a potential recovery as price reclaims the earlier support zone with strength.

🔍 Key Observations:

✅ Yellow box marks a cluster of bars after a strong downtrend, hinting at accumulation or exhaustion.

⚠️ Support retest held — recent candles show signs of rejection from the lower bound near 24,077.

📈 Leola Lens SignalPro structure suggests a potential shift in bias — upside projection mapped to 24,552 as the next key level.

📊 Clean invalidation zone below recent wick lows.

💡 Educational Insight:

This setup emphasizes the importance of price structure, volume balance zones, and trend exhaustion for anticipating reversals. Traders can study how institutional-style tools like SignalPro help highlight such shift moments with visual clarity.

Global cuesDAX CMP 22272

Candlestick- the Index fell 17% from the highs during the month and then regained most of the fall. The size of the lower wick is a sign of warning. In Japanese candlestick pattern it is a long term reversal candlestick pattern called the Hanging Man . At times after a big fall the bears just test the bulls to see till where they can pull the mkt. So the bears say that if this what u can pull up to then ur hanged.

Elliott - This rally is the B wave and will go up no further. The C wave downfall will start from here.

Oscillators- RSI is back to the bear zone on the weekly charts and also below the MA cross. This is very bearish. Second the composite is below its MA cross.

Conclusion- We are a global mkt and we rise together and fall together. Hence cues from anywhere is most welcome. Both these are higher time frame charts and hence investors should keep an eye on them. In my view caution is the view for next two months.

21-08-2024, GERMAN 40 - SHORTS 1. for long term we are seeking premium (LONGS) targeting (18790.01) price level

2. during this perticular day (21-08-2024), we are going short to sweep 4hr Sellside Liq to go up

- looking for shorts in between the dealing range targeting 4hr low (monday low,19-08-2024)

25-07-2024_ Looking for shorts (GER 30) 1. Daily view

- as we are looking for bearishness in a weekly range (MON-FRI) perspective,from Monday to Tuesday NY session price gives us the Judas swing

- due to the Daily imbalance (BISI) a little confussion wether that BISI push price higher as we can see there are 4hr equal highs

- And yesterday we got the conformation is that the Daily imbalance is no longer holding price and it inversed and now we can look for shorts after a Liq sweep, (targeting FRIDAY'S low)

2. Weekly view

- we are looking for bearishness and if we continue the bearish OF we are most likely be reaching for the MAY and JULY low

GER30I am expecting a good bullish market from here. Use proper risk management. Lets Download Success

DAX Looks Supported todayYou can make an argument that the DAX is very overextended, as we have rallied quite drastically.

The German DAX initially pulled back a bit during the trading session on Friday, but it does look as if there are buyers underneath, especially near the €16,600 level.

This is an area that has offered support recently, and the fact that we have bounced from that bottom does suggest that we probably have further to go to the upside.

Overextended?

You can make an argument that the DAX is very overextended, as we have rallied quite drastically. The 16,000 level is an area that a lot of people have paid close attention to, and of course, it is a large, round, psychologically significant figure. Furthermore, the 50-day EMA is crossing the general vicinity, so I would be especially interested in buying the DAX on a pullback to that area. However, I also recognize that we may not pull back, rather we could just go sideways. Either way, we need to work off some of the excess froth, which is because we have gone straight up in the air since the end of October. Stocks are overbought worldwide, and the DAX of course is not going to be any different.

If we were to simply rally from here, the €17,000 level is an area that a lot of people will pay attention to as potential resistance, as we have sold off from that area. It’ll be interesting to see how this plays out, because we are either going to see a pullback that buyers will take advantage of due to value, or we will go sideways. I will be watching the €16,500 level very closely because it is a short-term support level. If we break down below there, then we find even more value. During this time of year, I tend to put on small positions, and then build those positions up as the trade proves itself to be correct. This allows me to essentially “dollar cost average” on the pullback. With this, as exactly how I’m going to trade the DAX going forward over the next several weeks.

GER 40 - for 6.11.2023

As seen in the previous few sessions, the index has significantly moved up breaking all the resistances. Now it has arrived at an important daily resistance range of 15280 - 15300 (20 points).

If it Breaks the support level of 15120, we can look for a good short opportunity with a range till 15030 (approx 100 points) or the index could experience periods of consolidation, with volatile fluctuations in both upward and downward directions.