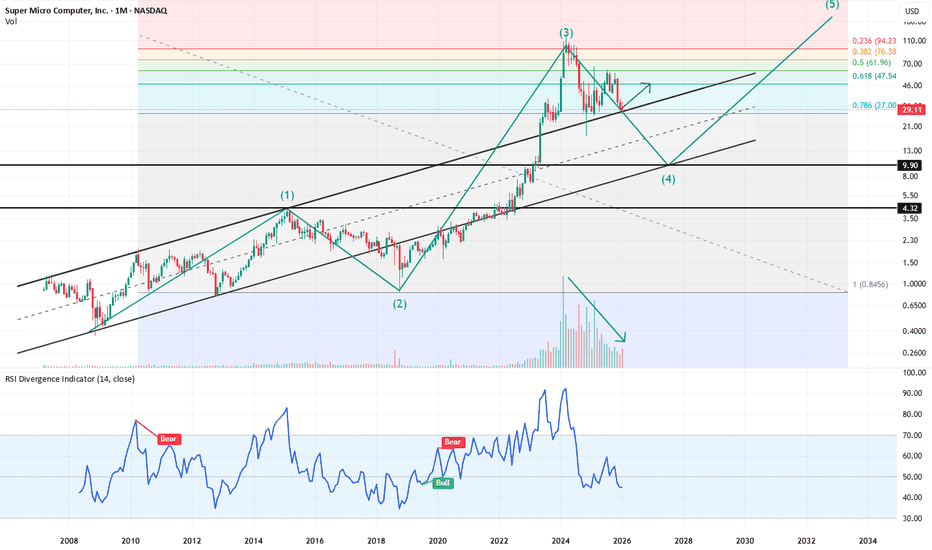

Navigating the Correction and Targeting the Next HurdleSMCI appears to be in the final stages of a significant corrective phase on the monthly and daily charts, following a strong impulse move. This analysis suggests we are working within a larger corrective structure, potentially a flat pattern that began in early 2025

Current Position: The stock pric

Super Micro Computer, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.24 EUR

890.38 M EUR

18.65 B EUR

514.94 M

About Super Micro Computer, Inc.

Sector

Industry

CEO

Charles Liang

Website

Headquarters

San Jose

Founded

1993

IPO date

Mar 29, 2007

Identifiers

3

ISIN US86800U3023

Super Micro Computer, Inc. engages in the distribution and manufacture of information technology solutions and other computer products. Its products include twin solutions, MP servers, GPU and coprocessor, MicroCloud, AMD solutions, power supplies, SuperServer, storage, motherboards, chassis, super workstations, accessories, SuperRack and server management products. The company was founded by Charles Liang, Yih-Shyan Liaw, Sara Liu, and Chiu-Chu Liu Liang in September 1993 and is headquartered in San Jose, CA.

Related stocks

SMCI - Symmetrical Triangle Breakout SetupSMCI is at a major decision point. Wait for breakout confirmation above $57.78, use the triangle structure and Fibonacci extensions as your target zones, and manage risk via the marked stop levels. This technical setup combines classical charting with quantitative projections, providing a clear fram

SMCI short term Target of 54SMCI has been correcting in a complex zig-zag correction.

It has completed triple Zig-Zag, correction seems over as per Wave-3 max pull back and seems to be headed towards 54 in short time, provided some conditions are met.

Conditions:

a) Correction should stop at around this level or can go max t

SMCI at Key Technical Juncture Post-EarningsThe stock has experienced significant volatility recently, influenced by broader market dynamics and company-specific developments.

Key Support Levels:

$39.02: This intraday low serves as immediate support. A decline below this level could signal further downside potential.

$37.90: Aligning with

SMCI's technical point potential bullish phase CMP $36 Key resistance levels to monitor include $46, where selling pressure may emerge, aligning with the 200-day moving average. A decisive move above these levels could lead to a rally toward $64. Conversely, support is observed around $35.50, which may serve as a potential entry point for investors.

Th

Super Micro Computer (SMCI) – Testing Key Resistance, Breakout 📈 NASDAQ: SMCI | CMP: $40.28 | Target: $50 - $69 | SL: $30

🔍 Analysis:

Super Micro Computer (SMCI) is showing a strong recovery from its recent lows near $18.76. The stock has been in an uptrend and is now testing the key resistance level at $50.02. A breakout above this level could trigger a stron

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMCI6021416

Super Micro Computer, Inc. 0.0% 01-MAR-2029Yield to maturity

—

Maturity date

Mar 1, 2029

SMCI6004752

Super Micro Computer, Inc. 2.25% 15-JUL-2028Yield to maturity

—

Maturity date

Jul 15, 2028

See all MS51 bonds

Frequently Asked Questions

The current price of MS51 is 25.55 EUR — it has increased by 1.01% in the past 24 hours. Watch Super Micro Computer, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Super Micro Computer, Inc. stocks are traded under the ticker MS51.

MS51 stock has risen by 1.64% compared to the previous week, the month change is a 6.30% rise, over the last year Super Micro Computer, Inc. has showed a −37.33% decrease.

We've gathered analysts' opinions on Super Micro Computer, Inc. future price: according to them, MS51 price has a max estimate of 53.37 EUR and a min estimate of 12.71 EUR. Watch MS51 chart and read a more detailed Super Micro Computer, Inc. stock forecast: see what analysts think of Super Micro Computer, Inc. and suggest that you do with its stocks.

MS51 reached its all-time high on Mar 8, 2024 with the price of 112.00 EUR, and its all-time low was 0.60 EUR and was reached on Nov 1, 2012. View more price dynamics on MS51 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MS51 stock is 2.04% volatile and has beta coefficient of 2.31. Track Super Micro Computer, Inc. stock price on the chart and check out the list of the most volatile stocks — is Super Micro Computer, Inc. there?

Today Super Micro Computer, Inc. has the market capitalization of 15.42 B, it has increased by 12.08% over the last week.

Yes, you can track Super Micro Computer, Inc. financials in yearly and quarterly reports right on TradingView.

Super Micro Computer, Inc. is going to release the next earnings report on May 5, 2026. Keep track of upcoming events with our Earnings Calendar.

MS51 earnings for the last quarter are 0.59 EUR per share, whereas the estimation was 0.42 EUR resulting in a 40.90% surprise. The estimated earnings for the next quarter are 0.51 EUR per share. See more details about Super Micro Computer, Inc. earnings.

Super Micro Computer, Inc. revenue for the last quarter amounts to 10.80 B EUR, despite the estimated figure of 8.87 B EUR. In the next quarter, revenue is expected to reach 10.34 B EUR.

MS51 net income for the last quarter is 341.05 M EUR, while the quarter before that showed 143.41 M EUR of net income which accounts for 137.81% change. Track more Super Micro Computer, Inc. financial stats to get the full picture.

No, MS51 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 16, 2026, the company has 6.24 K employees. See our rating of the largest employees — is Super Micro Computer, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Super Micro Computer, Inc. EBITDA is 940.08 M EUR, and current EBITDA margin is 5.97%. See more stats in Super Micro Computer, Inc. financial statements.

Like other stocks, MS51 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Super Micro Computer, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Super Micro Computer, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Super Micro Computer, Inc. stock shows the sell signal. See more of Super Micro Computer, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.