Commodities and Alternative Assets1. Commodities

Definition

Commodities are raw materials or primary agricultural products that can be bought and sold. They are standardized and interchangeable, meaning one unit is essentially the same as another unit of the same grade. For example, one barrel of crude oil is equivalent to another

State Bank of India Sponsored GDR RegS

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.6 USD

9.17 B USD

77.85 B USD

About State Bank of India

Sector

Industry

CEO

Rana Ashutosh Kumar Singh

Website

Headquarters

Mumbai

Founded

1921

IPO date

Nov 3, 1994

Identifiers

3

ISIN US8565522039

State Bank of India engages in the provision of public sector banking, and financial services statutory body. It operates through the following segments: Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business. The Treasury segment includes the investment portfolio and trading in foreign exchange contracts and derivative contracts. The Corporate/Wholesale Banking segment consists of lending activities of Corporate Accounts Group, Commercial Clients Group, and Stressed Assets Resolution Group that provides loans and transaction services to corporate and institutional clients and further include non-treasury operations of foreign offices. The Retail Banking segment refers to the retail branches, which primarily includes personal banking activities including lending activities to corporate customers. The Other Banking business segment focuses on the operations of all the non-banking subsidiaries and joint ventures of the group. The company was founded on January 27, 1921 and is headquartered in Mumbai, India.

Related stocks

What Are Leveraged Hedge Funds?Understanding Leverage in Simple Terms

Leverage means using borrowed capital to increase investment exposure.

For example:

A fund has $100 million in investor capital.

It borrows $200 million from a prime broker.

It now controls $300 million in investments.

Its leverage ratio is 3:1.

If the p

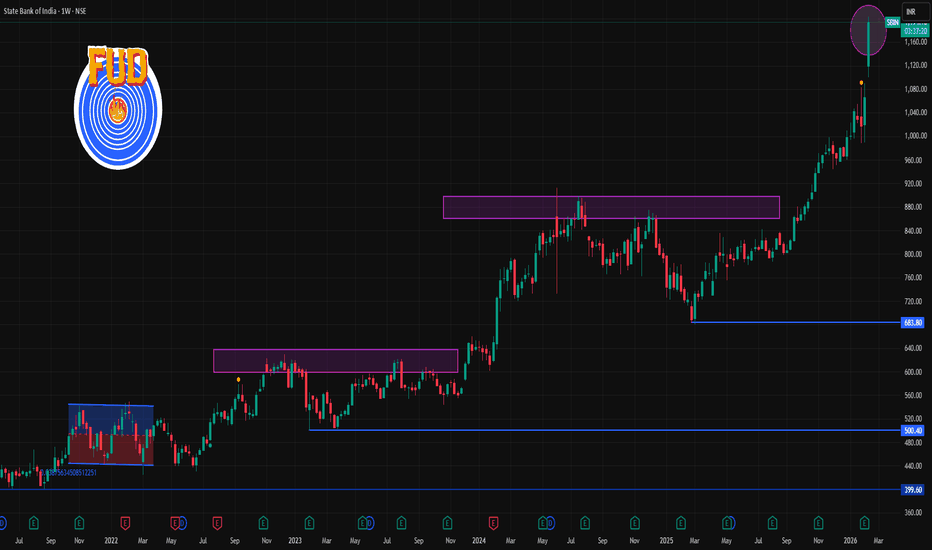

SBIN 1 Week Time Frame 📈 Current Trend & Price Context

Last traded price: ~₹1,192 – ₹1,195 on NSE.

Price is near its 52-week high around ~₹1,203.

Moving averages from technical services show a generally bullish bias with many Buy signals (*note: these are mostly daily / medium-term).

📊 Weekly Pivot & Key Levels (Approx)

BRICS Thriving: The Rise of a New Global Power Origins and Evolution of BRICS

The term “BRIC” was originally coined in 2001 by economist Jim O’Neill to describe fast-growing economies with the potential to reshape global growth. What began as an economic classification soon transformed into a political and strategic alliance. South Africa joine

The AI Revolution & Tech Sector Leadership: Impact on EquitiesThe Rise of AI-Centric Market Leadership

The AI boom has accelerated leadership concentration within mega-cap technology companies. Firms such as NVIDIA, Microsoft, Alphabet, and Amazon have become central pillars of equity index performance due to their direct exposure to AI infrastructure, cloud

Reserve Currency Dominance: Meaning, Mechanisms, and ImplicationWhat Makes a Currency a Reserve Currency?

For a currency to become dominant, several structural conditions must exist:

Economic Size and Trade Influence

The issuing country must have a large, productive, and globally integrated economy. Nations prefer holding reserves in currencies linked to econo

Bonds and Fixed Income InstrumentsIntroduction to Bonds and Fixed-Income Instruments

Bonds and fixed-income instruments are debt securities issued by governments, corporations, and financial institutions to raise capital. When an investor purchases a bond, they are effectively lending money to the issuer in exchange for periodic in

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

770SBI38

State Bank of India 7.7% 19-JAN-2038Yield to maturity

8.34%

Maturity date

Jan 19, 2038

834SBIPERP

State Bank of India 8.34% PERPYield to maturity

7.92%

Maturity date

—

772SBIPER

State Bank of India 7.72% PERPYield to maturity

7.57%

Maturity date

—

751SBI32

State Bank of India 7.51% 06-DEC-2032Yield to maturity

7.32%

Maturity date

Dec 6, 2032

772SBI31

State Bank of India 7.72% PERPYield to maturity

7.30%

Maturity date

—

798SBIPERP

State Bank of India 7.98% PERPYield to maturity

7.26%

Maturity date

—

733SBI39

State Bank of India 7.33% 20-SEP-2039Yield to maturity

7.20%

Maturity date

Sep 20, 2039

755SBIPERP

State Bank of India 7.55% PERPYield to maturity

7.20%

Maturity date

—

775SBIPER

State Bank of India 7.75% PERPYield to maturity

7.15%

Maturity date

—

754SBI38

State Bank of India 7.54% 01-AUG-2038Yield to maturity

7.07%

Maturity date

Aug 1, 2038

680SBI35

State Bank of India 6.8% 21-AUG-2035Yield to maturity

6.07%

Maturity date

Aug 21, 2035

See all SBID bonds