Crude buy near support sell near resistance recent low re-test How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Trade ideas

[MCX] Crudeoil Buy IdeaNote -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives

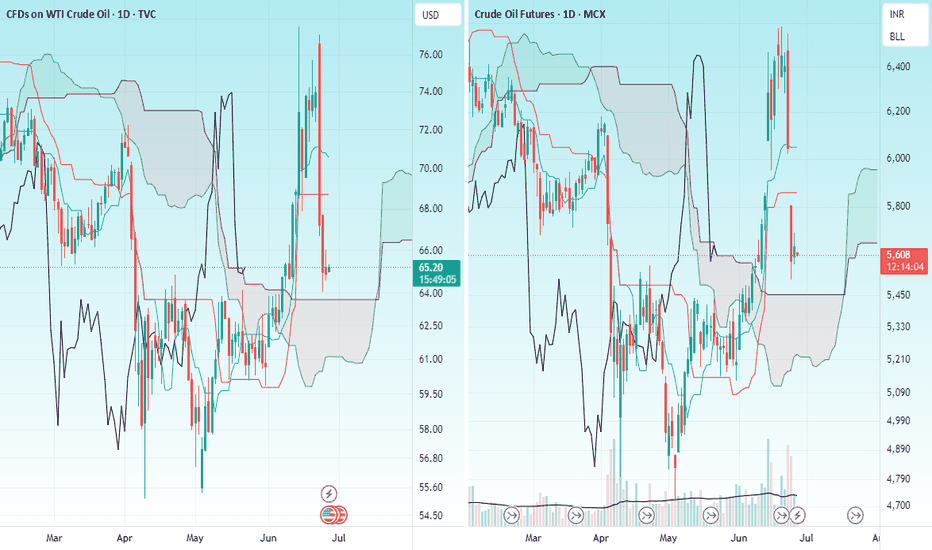

CRUDEHello & welcome to this analysis

USOIL / CRUDE (MCX) after a very sharp rally till the slanting channel have now retraced to very strong support levels as per the ICHIMOKU indicator in daily time frame.

One could look for a 4hrs reversal candle confirmation between $64.50 - 63.75 / INR 5625 - 5450 for a resumption of rally till $77 / INR 6900 with resistance on its path at $68.50 & $74 / INR 5825 & INR 6400

Remember enter only after you get a bullish candle confirmation from lower time frame.

All the best

Crude buy on dip recommended ,5800 target trail sl to 5650 How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Crude oil holdbuy trade 5820, 1st upside target SL 5570 now How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Crude buy on dip until 5550 not break 5700,5820,5980 target How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Crude buy given at 5550 near today booked profit at 5685 buy dipHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Learn Institutional Trading Pros and Cons

Pros: Early signals, useful for reversals.

Cons: Requires confirmation, may produce false signals.

Technical Trading

What is Technical Trading?

Technical trading focuses on using historical price data, volume, and technical indicators to predict future price movements. Traders use charts and patterns instead of company fundamentals.

Key Tools in Technical Trading

Price Charts: Candlestick, line, bar charts.

Indicators: Moving averages, RSI, MACD, Bollinger Bands.

Chart Patterns: Head and Shoulders, Triangles, Double Tops, Flags.

Support and Resistance Levels: Key price points where stocks reverse.

Crude now buy on dip near 5550 to 5500 ,5980,6100 Target sl 5350How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Crude Oil Weekly predictions All detail for chat. good entry at mark price only. and must stoploss minimum risk and good profit. risk ratio 1:1 to manage modified SL.

📌 This is not a buy/sell recommendation, just an educational trading idea.

📌 Market conditions can change; always conduct your own research.

📌 Understand risks before investing and take full responsibility for decisions.

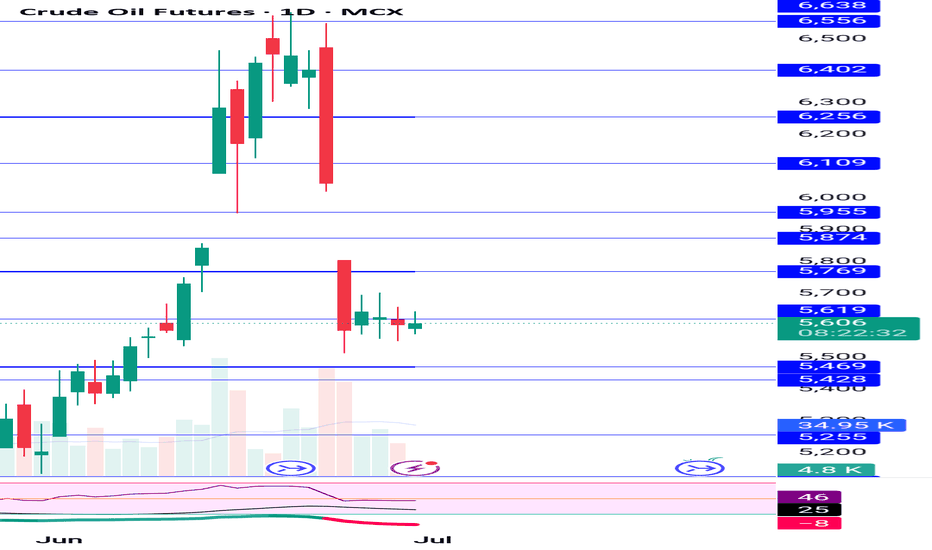

Mcx crudeoil crudeoil with gap down today is protecting gap down low and is near rising trendline support and near demand area 5500-5700 zone look good to enter long if hold above 5500 on closing bases can bounce towards 6400-6500 levels in coming week . if start closing below 5500 the positive view will fail .

Crude updated levels buying avoid recommended near 6500 How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Learn Institutional Option Trading Part-10Popular Option Strategies in India:

Buying Call Options: Profit when the market rises.

Buying Put Options: Profit when the market falls.

Covered Call: Holding a stock and selling a call option to earn premiums.

Protective Put: Buying a put option to safeguard stock holdings.

Iron Condor: Earning from a range-bound market using multiple options.

Straddle and Strangle: Benefiting from high volatility.

CrudeOil in major resistance area may give breakout*$$CrudeOil is trading near major resistance area with positive news around the world for it. If Iran block Strait of Hormuz then it will give breakout from this area for target of 6655-6722 area & then 6988, 7301, 7500,7750.

If Iran problem solved with USA then it may fall also from this resistance area with fast momentum for target of 6033, 5633, 5155, 4733.

Please consult your advisor before taking any trade & with proper risk management.

Thank You

Crude mcx updated levels better to avoid buying at current priceHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Institutions Option Database Trading Part-6Deep Dive into Options Basics (For Data Traders)

Options are contracts giving the right but not the obligation to buy or sell an asset at a certain price before a set date. They are used for hedging, speculation, and generating income.

🛠️ Two Types:

Call Option: Right to buy an asset.

Put Option: Right to sell an asset.

Backtesting means testing a strategy using past data to check performance. Key for data-driven option trading.

Example:

Load 1-year option chain data for BANKNIFTY.

Apply rules: Buy Call when IV drops by 10% & PCR < 0.8.

Check PnL for each trade.

Filter for success rate > 65%.

MCX Crude Oil: Complex Correction Complete?Big Picture Structure — Daily Timeframe

After peaking at 9996, Crude Oil entered a prolonged complex corrective phase, unfolding as a W-X-Y-X-Z structure, reflecting a Elliott Wave complex correction pattern.

Wave W formed via an initial abc decline.

Wave X delivered a corrective bounce.

Wave Y unfolded into another abc leg down.

A second X followed, creating further complexity.

Finally, Wave Z completed with a terminating abc decline, bottoming near 4724.

With this, the entire larger degree Wave 4 correction appears to have completed, setting the stage for a potential higher-degree advance.

Zoom In — 4H Timeframe Analysis

Zooming into the rally from 4724, price action unfolds very cleanly:

A strong 5-wave impulsive advance has developed.

Wave 3 displayed strong extension — a healthy sign of impulsive strength.

Wave 5 pushed to a higher high near 6585, completing a likely Wave (1) at smaller degree.

Notably, the final leg of this upmove developed with RSI bearish divergence, often an early warning of short-term exhaustion, suggesting a corrective Wave (2) pullback may now be developing.

Outlook Ahead

With higher degree Wave 4 likely behind us, attention shifts to the ongoing development of the larger degree Wave 5.

A corrective Wave (2) pullback may offer attractive entry zones for the next bullish impulsive leg.

As long as price maintains structural integrity above the 4724 low, the broader bullish outlook remains intact.

Summary

Complex W-X-Y-X-Z correction likely complete.

New bullish sequence underway.

Short-term corrective pullback (Wave 2) anticipated.

RSI divergence signals caution for immediate upside, but larger bullish trend remains intact.

Chart will be updated as price action evolves.

Disclaimer :

This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Crude showing some negative pattern avoid buying near 6530 How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early traders can make fresh reversals trade after breaking 1st D 15.1% safe traders can reversal trade after breaking Point D 22.5.4% to 24.5% range

Targets :

Target T1 : 36.1% to 38.3%

Target T3 : 49.1% to 52.5%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection ).

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 15.1% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Advanced Institutions Option Trading - Part 8Institutional Option Trading Strategies

Let’s dive deeper into how big players operate:

🔶 Volatility Arbitrage:

Take advantage of IV mispricing across strikes/months.

Long low IV, short high IV – Net neutral delta.

🔶 Dispersion Trading:

Buy individual stock options, short index options.

Profit from correlation divergence.

🔶 Box Spread (Synthetic Arbitrage):

Arbitrage between synthetic long/short positions.

Very low risk, used by HFT desks.

Institutions use algorithms to run thousands of such strategies in real time.

Crude oil updated levels buy on dip at support How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early traders can make fresh reversals trade after breaking 1st D 15.1% safe traders can reversal trade after breaking Point D 22.5.4% to 24.5% range

Targets :

Target T1 : 36.1% to 38.3%

Target T3 : 49.1% to 52.5%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection ).

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 15.1% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Crude updated levels 6650, 6810 , 7050 upside next Target How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early traders can make fresh reversals trade after breaking 1st D 15.1% safe traders can reversal trade after breaking Point D 22.5.4% to 24.5% range

Targets :

Target T1 : 36.1% to 38.3%

Target T3 : 49.1% to 52.5%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection ).

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 15.1% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

CRUDE OIL 4HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

CRUDE OIL Looking good for upside..

When it break level 5551 and sustain.. it will go upside...

BUY@ 5551

Target

1st 5836

2nd 6145

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome to join the ride ..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..