Silver holding buy trade from 148350, target 153400, 155700Silver holding buy trade from 148350 target 153400, 155700 levels given on chart

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early / Risky entry) : D 13.2% -D 16.1 % is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone (Safe entry ) : SL 23.1% and SL 25.5% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Any Upside or downside level will activate only if break 1st level then 2nd will be active if break 2nd then 3rd will be active.

Total we have 7 important level which are support and resistance area

Until , 16% not break uptrend will continue if break then profit booking will start.

If break 25% then fresh downtrend will start then T1, T2,T3 will activate

1,3,5,10,15,20 minutes are short term levels.

30 minutes 60 minutes , 2 hours,3 hours, ... 1 day and 1 week chart positional and long term levels

Silver Micro Futures

Trade ideas

Silver 5000-5500 points upmove from previous buy given hold buySilver upmove will continue next target 49.80 to 49.90 on comex , mcx levels given on chart but fallow comex levels

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early / Risky entry) : D 13.2% -D 16.1 % is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone (Safe entry ) : SL 23.1% and SL 25.5% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Any Upside or downside level will activate only if break 1st level then 2nd will be active if break 2nd then 3rd will be active.

Total we have 7 important level which are support and resistance area

Until , 16% not break uptrend will continue if break then profit booking will start.

If break 25% then fresh downtrend will start then T1, T2,T3 will activate

1,3,5,10,15,20 minutes are short term levels.

30 minutes 60 minutes , 2 hours,3 hours, ... 1 day and 1 week chart positional and long term levels

Silver Brewing a fall soon?

Sell Silver Futures

Rationale:

Silver has formed a rising wedge pattern on the 4-hour chart, indicating exhaustion in the recent uptrend. Price action shows multiple rejections near $48.40–$48.50, while the CCI momentum indicator is flattening after reaching overbought territory, hinting at a potential reversal. A breakdown below $48.00 could trigger a corrective wave toward $45.70.

Macro Headwinds:

• US Dollar Strength: The Dollar Index continues to hold firm above 105 amid hawkish Fed commentary, limiting upside for precious metals.

• Rising US Yields: The US 10-year yield remains elevated, making non-yielding assets like Silver less attractive in the short term.

• Cooling Industrial Demand: Recent Chinese PMI data points to a softening recovery in the manufacturing sector, a key demand driver for Silver.

• Fed Rate Outlook: Markets are now pricing in the possibility of delayed rate cuts, keeping real rates higher for longer that is a negative for Silver.

Key Levels:

• Entry Zone: Below $48.05

• Stop Loss: $49.47

• Target: $45.70

• Risk–Reward Ratio: ~1:2.5

Technical View:

Trendline breakdown confirmation on the 4-hour timeframe would validate the short setup. Sustained trade below $48.00 may invite further selling pressure, with supports seen near $47.00 and $45.70. A decisive close above $49.50 would invalidate the bearish structure.

Silver holding buynfrom 144000 , target 145600Silver holding buy from 144000, target 145600 , upside target big but mcx closed tomorrow so will book profit.

Yesterday also bought at 141500 and booked today at 144100

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early / Risky entry) : D 12.3% -D 16.1 % is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone (Safe entry ) : SL 23.1% and SL 25.5% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Any Upside or downside level will activate only if break 1st level then 2nd will be active if break 2nd then 3rd will be active.

Total we have 7 important level which are support and resistance area

Until , 16% not break uptrend will continue if break then profit booking will start.

If break 25% then fresh downtrend will start then T1, T2,T3 will activate

1,3,5,10,15,20 minutes are short term levels.

30 minutes 60 minutes , 2 hours,3 hours, ... 1 day and 1 week chart positional and long term levels

Silver mcx updated levels buy near support 50$ 1st on comex comeSilver mcx updated levels given on chart,silver mcx 10-12 % upside still possible, silver will try to break previous ATH and make fresh ATH

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early / Risky entry) : D 12.3% -D 16.1 % is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone (Safe entry ) : SL 23.1% and SL 25.5% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Any Upside or downside level will activate only if break 1st level then 2nd will be active if break 2nd then 3rd will be active.

Total we have 7 important level which are support and resistance area

Until , 16% not break uptrend will continue if break then profit booking will start.

If break 25% then fresh downtrend will start then T1, T2,T3 will activate

1,3,5,10,15,20 minutes are short term levels.

30 minutes 60 minutes , 2 hours,3 hours, ... 1 day and 1 week chart positional and long term levels

Silver Re Entry After booking partial profits at 12R, I am re-entering the MCX:SILVERM1! trade with a fresh position. The setup continues to align with my trend-following and risk parameters, and the market structure supports further upside potential.

Partial exit: 12R booked ✅

New entry: Initiated as per strategy rules

Risk management: Strict stop in place, position sizing aligned with capital

Targets: Following original R-multiple framework

Staying disciplined and letting the trade run with the trend.

Silver – Riding the WaveMCX:SILVERMIC1! is trending strong, and we are already surfing at 5R.

Our system’s strength lies in catching mean reversals early and riding the momentum that follows.

Disciplined risk, precise trailing, no second-guessing.

This approach has delivered consistent double-digit “R” trades in the past.

Now, the trend is in motion — and we stay with it as long as it runs.

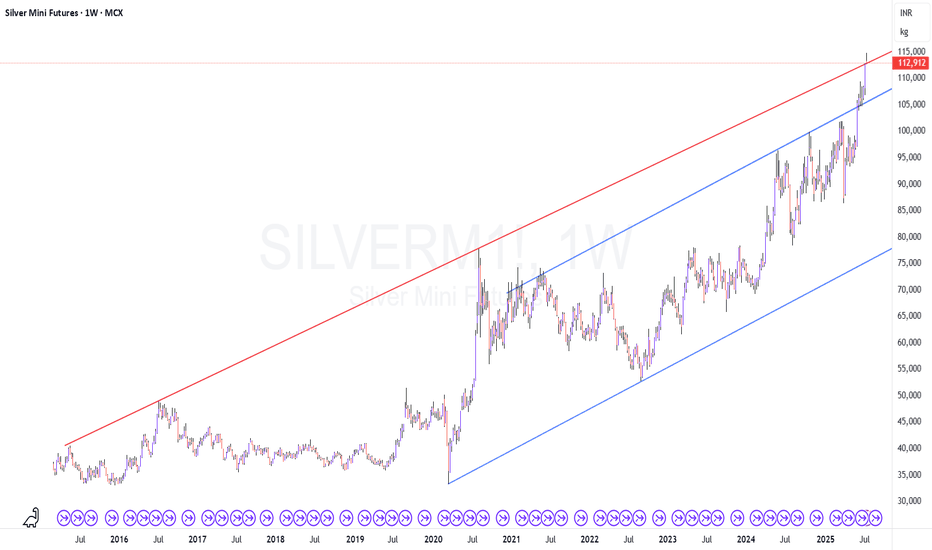

SILVERM1! - At the ResistanceCMP: 112800

TF: Weekly

Price is hitting the resistance on weekly chart, and the breakout from here might be a challenging task for the bulls. Let's see how this week progresses

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Silver goes to the moon

Silver is entering a strong upcycle, indicating that the broader script remains firmly in the bullish zone. After consolidating around the $41.20–41.40 support range, the price has not only absorbed selling pressure but also broken above a well-defined descending trendline, which had previously acted as a cap on the upside.

This breakout has occurred just above a key resistance zone (~$41.50), confirming strength and suggesting the start of a fresh upward leg. Volume expansion on breakout candles further validates buyer participation.

• Entry Zone: $41.50–41.55 (post trendline breakout confirmation)

• Stop Loss: $41.20 (below recent support block)

• Target 1: $41.80

• Target 2: $42.00–42.20 (upper resistance and measured move from breakout)

Confluences:

• Upcycle strength: Higher lows from the $41.20 base reflect demand absorption.

• Trendline breakout: Clean break above the descending resistance trendline signals trend reversal.

• Key zone retest: Breakout happened above $41.50, a zone of prior supply, turning it into fresh support.

• Momentum indicator (bottom panel): Rebounding sharply from oversold, confirming bullish momentum.

Bias: Strongly bullish as long as $41.20 support holds. Sustained trade above $41.55 can accelerate the move toward $42+.

Silver Futures (4H) – Zigzag Correction in ProgressThe decline from 116,641 → 109,080 unfolded in 5 waves, confirming an impulse. This sets the stage for a 5-3-5 zigzag correction . With Wave A complete, the market is now advancing in Wave B, expected to resolve as a zigzag.

A strict bearish invalidation level is marked at 116,641 . As long as prices remain below this level, the expectation is for Wave C down to follow and complete the zigzag sequence.

📌 Key Levels:

Invalidation (SL): 116,641

Wave B unfolding as zigzag

Wave C down expected next

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

12R locked in on $MCX:SILVERMIC1!12R locked in on MCX:SILVERMIC1!

I entered with conviction, managed with discipline.

Risk was tight, exits were clear, emotions silent.

Price moved, I trailed. Trend built, I rose with it.

No rush, no greed — just system and patience.

This is sigma trading: controlled risk, amplified reward.

Silver holding sell trade from 113550-113600 , sl 114500Silver we are holding sell trade from 113550 .

Until 114500 not break sell on rise will continue.

Downside target 112800, 112100, 111500, 110900

How My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone ( Early / Risky entry) : D 11.8% -D 16.1 % is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone (Safe entry ) : SL 23% and SL 25% is reversal zone if break then trend reverse and we can take reverse trade

Target : T1, T2, T3, T4 and .

Are our Target zone

Any Upside or downside level will activate only if break 1st level then 2nd will be active if break 2nd then 3rd will be active.

Total we have 7 important level which are support and resistance area

Until , 16% not break uptrend will continue if break then profit booking will start.

If break 25% then fresh downtrend will start then T1, T2,T3 will activate

1,3,5,10,15,20 minutes are short term levels.

30 minutes 60 minutes , 2 hours,3 hours, ... 1 day and 1 week chart positional and long term levels