HSCL — Technically shaping up for a 20% short term run # HSCL a short-term bullish setup on daily chart, trading above its EMA support zone around 460–465 with improving momentum. RSI near 59 indicates strength without being overbought.

A sustained move above the 495–500 resistance can trigger upside towards 520-535 and next 580-600...while a close b

Himadri Speciality Chemical Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.25 INR

5.56 B INR

46.09 B INR

185.35 M

About Himadri Speciality Chemical Ltd.

Sector

Industry

CEO

Anurag Choudhary

Website

Headquarters

Kolkata

Founded

1987

IPO date

Nov 11, 1992

Identifiers

2

ISIN INE019C01026

Himadri Speciality Chemical Ltd. engages in the provision of carbon products. It operates through the Carbon Materials and Chemicals, and Power segments. The Carbon Materials and Chemicals focuses on the manufacturing operations. The Power segment involves in the generation and distribution. The company was founded by Damodar Prasad Choudhary, Shyam Sundar Choudhary, Bankey Lal Choudhary, Vijay Kumar Choudhary, Anurag Choudhary, Amit Choudhary, and Tushar Choudhary on July 28, 1987 and is headquartered in Kolkata, India.

Related stocks

Stock in Support Zone ready to breakout: HSCL ?Himadri Speciality Chemical Ltd (HSCL) has been trading in a range for over three months between 440 amd 487.

There has been a marginal decrease in profit in the sept 2025 quarterly results.

The 440 support level was broken yesterdy.

However, the support was regained and gaining strength in terms

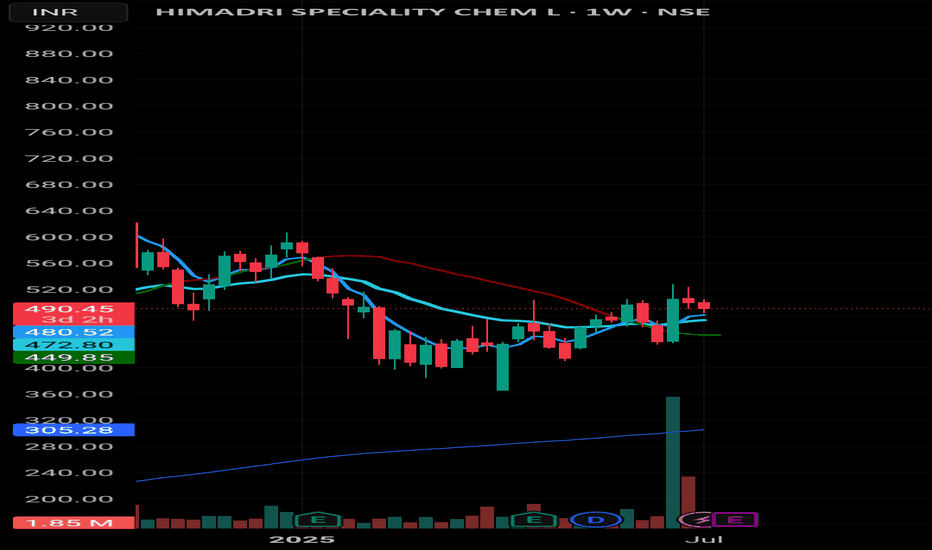

HSCL 1 Week Time Frame 📊 1-Week Technical Overview

Price Change: HSCL has gained approximately 3.35% over the past week.

Day Range: ₹458.60 – ₹469.55

52-Week Range: ₹365.35 – ₹676.20

Volume: 535,912 shares traded

📈 Technical Indicators

Relative Strength Index (RSI): 36.75, suggesting a neutral to slightly overs

HSCL | EV‑Battery Tech Catalyst Strong Buy Breakout ⚡

🔹 *Technical:* Strong Buy across Daily/Weekly/Monthly timeframes. RSI ~72, MACD/ADX/CCI/Stoch bullish — breakout above ₹545–550 zone :contentReference {index=24}.

🔹 *Support Levels: * ₹500 pivot; ₹462 (Supertrend/PSAR).

🔹 *Targets: * ₹597–600 next key resistance.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

HSCL to Fly Very Sooon!So here's another chart that’s quietly showing signs of strength — NSE:HSCL just kissed its falling trendline drawn from September 2024 highs.

After almost 10 months of lower highs, the stock is now trying to push above the trendline with volume backing it. That giant green candle on June 27 wit

HSCL: A Classic Breakout Story in the MakingNSE:HSCL : A Classic Breakout Story in the Making

Price Action Analysis:

- Stock has formed a strong uptrend from September 2024 lows around 365 levels

- Current price of 517.80 represents a significant +41% move from the base

- Recent breakout above the 500 resistance level with strong volume c

Himadri Speciality Chem – Weekly Chart Update📊 Himadri Speciality Chem – Weekly Chart Update

• Strong volume breakout recently, with price hovering around 480–490 zone

• Price facing resistance near 200 EMA (red line) at ~487.70

• Support zones:

– 472.55 (20 EMA)

– 449.70 (50 EMA)

• Weekly candle formation hints at indecision. Watch next move

Himadri Speciality Chemical Limited (Technical Outlook)Key Observations

Price Levels: The stock is currently near the "Major Resistance" level at ₹505.15, with a potential upside toward ₹676.10 if it breaks through. The "Last Hope" level at ₹459.60 and a deeper retracement level at ₹417.85 are notable support zones.

Moving Averages: The 50 EMA (red lin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.96%

Market value

796.94 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of HSCL is 450.35 INR — it has decreased by −0.42% in the past 24 hours. Watch Himadri Speciality Chemical Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Himadri Speciality Chemical Ltd. stocks are traded under the ticker HSCL.

HSCL stock has fallen by −0.97% compared to the previous week, the month change is a −4.97% fall, over the last year Himadri Speciality Chemical Ltd. has showed a 3.05% increase.

We've gathered analysts' opinions on Himadri Speciality Chemical Ltd. future price: according to them, HSCL price has a max estimate of 470.00 INR and a min estimate of 470.00 INR. Watch HSCL chart and read a more detailed Himadri Speciality Chemical Ltd. stock forecast: see what analysts think of Himadri Speciality Chemical Ltd. and suggest that you do with its stocks.

HSCL reached its all-time high on Sep 18, 2024 with the price of 688.70 INR, and its all-time low was 6.80 INR and was reached on Mar 12, 2009. View more price dynamics on HSCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HSCL stock is 2.34% volatile and has beta coefficient of 1.95. Track Himadri Speciality Chemical Ltd. stock price on the chart and check out the list of the most volatile stocks — is Himadri Speciality Chemical Ltd. there?

Today Himadri Speciality Chemical Ltd. has the market capitalization of 227.00 B, it has decreased by −1.04% over the last week.

Yes, you can track Himadri Speciality Chemical Ltd. financials in yearly and quarterly reports right on TradingView.

Himadri Speciality Chemical Ltd. is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

HSCL net income for the last quarter is 1.92 B INR, while the quarter before that showed 1.77 B INR of net income which accounts for 8.80% change. Track more Himadri Speciality Chemical Ltd. financial stats to get the full picture.

Yes, HSCL dividends are paid annually. The last dividend per share was 0.60 INR. As of today, Dividend Yield (TTM)% is 0.13%. Tracking Himadri Speciality Chemical Ltd. dividends might help you take more informed decisions.

Himadri Speciality Chemical Ltd. dividend yield was 0.14% in 2024, and payout ratio reached 5.33%. The year before the numbers were 0.17% and 5.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 2.48 K employees. See our rating of the largest employees — is Himadri Speciality Chemical Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Himadri Speciality Chemical Ltd. EBITDA is 9.51 B INR, and current EBITDA margin is 18.44%. See more stats in Himadri Speciality Chemical Ltd. financial statements.

Like other stocks, HSCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Himadri Speciality Chemical Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Himadri Speciality Chemical Ltd. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Himadri Speciality Chemical Ltd. stock shows the neutral signal. See more of Himadri Speciality Chemical Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.