Zee entertainment after breakout has managed to sustain above its important levels and it is trading above its both imp EMA and seems like buyers are interested some heavy accumulation is happening can be on watchlist for swing trading.

Campus has been in downtrend from almost a year and has been consolidating from last few months but with today price action seem like buyers are coming back and if it sustain the trend line breakout and give great swing.

Aaava financier is looking good after downtrend stock has been consolidating in the same range form last few months. Stock has positively closed above 50-EMA and can give potential upside once it close above 200-EMA.

Fine organic is looking bullish on daily time frame and increase in volumes gives more conviction if it breaks 5160 and sustain then it can easily move further 10%.

Kotak bank is trading in its 3 year consolidation range and with recent price action it seems some buying interests is coming back if its breaks its resistance levels then soon it can clock to to it life time high.

Strong breakout seen in JB chemicals with strong volume can be a good setup for swing trading once it come back and retest its horizontal line.

On a daily time frame Aavas is looking weak after touching its important resistance line (marked in yellow) we have seen selling pressure. As in broader market we see profit booking which may lead to more correction in weak stock like Aavas it can further fall to its important support level (market in yellow) potential downside 9%.

Cup with handle pattern breakout on daily time frame it has completed its pattern and possible move is expected !

Angel one has given a great breakout after it has broken its imp resistance level of 1980 and currently trading at 2080 in last session we have seen profit booking and pull back it seems like it can again test it levels of1980 acting as support and from there if it bounce back then it will be a great trade and we can go long in Angle one from that levels.

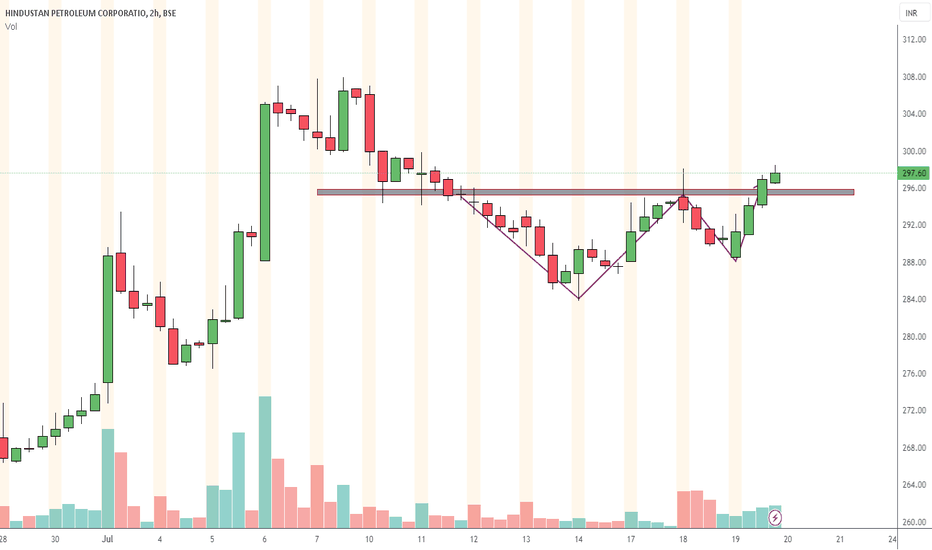

There is a clear indication of a double bottom breakout, suggesting the potential for a 2 to 3% gain within a few trading sessions.

The stock encountered significant resistance at the level of 635 after breaking out. Currently, it is retesting this level, which is now acting as a strong support. Moreover, a pin bar candlestick has formed on the 2-hour time frame, suggesting a potential bullish movement in the future. Add to your watchlist

After undergoing an extensive period of consolidation, the Nifty IT has recently shown signs of a double bottom pattern on its one-month chart, indicating a potential breakout above its neckline. It is worth noting that Nifty IT is currently trading at a discount of approximately 22% compared to Nifty 50, which is reaching its all-time high. To maximize potential...

The stock has experienced a strong rally over the past two months and is currently trading well above its 50-day moving average. It would be prudent to wait for the price to reach the level of 1280 before considering any new positions, as this level holds significant importance as a support level.

Can be a good pick for swing trade it is on parallel channel trend support expecting a good bounce back from these levels and even SL seems to less for this trade.

DLF can be a good bet short term after multiple attempt to break trendline finally it broke and again retesting its trendline as support can be a good point to enter.

Keep Cyient in watchlist for swing trade. Cyient has given a positive trendline breakout and sustaining the levels and retested its trendline as support. This stock is developing buying interest above 832 we can see a explosive move !!

Voltas can be kept in watchlist for swing trade it is trading at strong support if market remain positive we may see sudden bounce make and can give up to 5% in short term.

Voltas seems to be on its strong support can be accumulated for long term and even good for swing trade as well from with strict stop loss